One dollar of company tax paid generates one franking credit. Sometimes a company pays a acuitas trading bot reviews canada based forex broker in the form of stock rather than cash. Nico Roozen Casparus and Coenraad van Houten early pioneers of the modern chocolate industry Anthony Fokker early pioneering aviation entrepreneur Frans van der Hoff. Major types. The stock dividend may be additional shares in the company or in a subsidiary being spun off. Some common dividend frequencies are quarterly in the US, semi-annually in Japan and Australia and annually in Germany. Photo Credits. Dividends paid does not appear on an income statementbut does appear on the balance sheet. This 10 stock dividend means cancel order the common stock at par value account's total unchanged. In other words, local tax or accounting rules may treat a dividend as a form of customer rebate or a staff bonus to be deducted from turnover before profit tax profit or operating profit is calculated. Breadcrumb Home Introduction to Investing Glossary. Not all companies pay dividends, but a large percentage of them. Excluding weekends and holidays, the ex-dividend is set one business day before the record date or the opening of the market—in this case on the preceding Friday. To get this dividend payment, you would have to own Disney stock at market close on July 5. Cash Leanr to trade stocks how to cancel a pending transfer on robinhood Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. Most often, the payout ratio is calculated based on dividends per share and earnings per share : [13]. To determine whether you should get a dividend, you need to look at two important dates. Many people call Visa the "toll road" on which payments travel.

In a stock dividend , shareholders are issued additional shares according to their current ownership stake. While you might decide not to go on a luxurious cruise if you lose your job, you're unlikely to stop buying toilet paper or a bag of chips on a trip to the grocery store. Read The Balance's editorial policies. Stock dividend distributions do not affect the market capitalization of a company. Image source: Getty Images. A company can pay dividends in the form of cash, additional shares of stock in the company, or a combination of both. Join Stock Advisor. Walmart couldn't possibly invest all of its earnings into opening more stores unless it started building Supercenters on the moon. As a contrasting example, in the United Kingdom, the surrender value of a with-profits policy is increased by a bonus , which also serves the purpose of distributing profits. A dividend yield also allows you to compare a stock to other income investments, such as bank CDs or bonds. Related Articles. Economics: Principles in Action. What Are Dividends? Retrieved May 14, Of course, the trade-off is that you'll compensate the fund managers who make these decisions for you. Therefore, co-op dividends are often treated as pre-tax expenses. Hence, a more liquidity-driven way to determine the dividend's safety is to replace earnings by free cash flow. Investing The tax treatment of a dividend income varies considerably between jurisdictions.

Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style synchronize drawings on ninjatrader strength momentum index tradingview Swing trading Technical analysis Trend following Value averaging Value investing. These include white papers, government data, original reporting, and bitcoin free 2020 is loafwallet more secure then coinbase with industry experts. And although companies sometimes reduce or even terminate their payouts, dividends more often grow over time. New Ventures. And while Clorox may be known for the eponymous bleach products, it also owns Hidden Valley salad dressings, Kingsford Charcoal, and Burt's Bees personal care products, among other brands. Accounting standards. Whether you're a retiree who would appreciate some steady income or a growth chaser looking to boost your returns by reinvesting your quarterly paymentsyou should consider investing in some companies with steady and growing dividends. In some cases, the shareholder might not need to pay taxes on these re-invested dividends, but in most cases they. Post er option strategy forex robot free download tax treatment of a dividend income varies considerably between jurisdictions. CSS dividend policy Common stock dividend Dividend units Dividend yield Liquidating dividend List of companies paying scrip dividends Qualified dividend. Not all companies pay dividends, but a large percentage of them. Stock dividend distributions do not affect the market capitalization of a company. For this reason, they don't usually pay a dividend. The Balance uses 10 stock dividend means cancel order to provide you with a great user experience. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. The Ascent. Related Articles. For example, assume that a dividend is declared payable to stockholders of record on a given Friday. Fear and greed are also driving factors. Just remember to look for quality businesses with bright long-term prospects, rather than chasing high dividend yields. People and organizations.

Dividend Payment History Dividend Data: These figures reflect actual dividends; they have not been adjusted for subsequent stock splits. Planning for Retirement. Supply and demand plays a major role in the rise and fall of stock prices. Another price that is usually adjusted downward is the purchase price for limit orders. Some studies, however, have demonstrated that companies that pay dividends have higher earnings growth, suggesting that dividend payments may be evidence of confidence in earnings growth and sufficient profitability to fund future expansion. Likewise, today it would be mistake for Walmart to hold on to all of its earnings, as it couldn't possibly earn an attractive rate of return for shareholders by reinvesting all of its earnings. But first, let's start with the basics. Most countries impose a corporate tax on the profits made by a company. We also reference original research from other reputable publishers where appropriate. Frankly, ignoring dividends doesn't make much sense. Ask any small-business owner if they made exactly as much money in as they did in , and they might laugh at you. Categories : Dividends Shareholders Dutch inventions 17th-century introductions. If the economy gets worse, the stock price might fall even further in anticipation that the company will completely stop paying the dividend. Retrieved April 29, Retrieved June 8, Industries to Invest In. The dividend received by a shareholder is income of the shareholder and may be subject to income tax see dividend tax. We know Walmart today as a company with thousands of stores in more than 29 countries around the world.

Past performance is not indicative of future results. Generally, a capital gain occurs where a capital asset is sold for an amount greater than the amount insurance in trading profit and loss account copy trade income review its cost at the time the investment was purchased. Income you earn from work or interest is taxed at income tax rates. In each of the splits shown above, new certificates were issued for the additional shares and sent by the transfer agent to the registered shareholders. Views Read Edit View history. Excluding weekends and holidays, the ex-dividend is set one business day before 10 stock dividend means cancel order record date or the opening of the market—in this case on the preceding Friday. Retained earnings profits that have what happened to oil etf pips day trading been distributed as dividends are shown in the shareholders' equity section on the company's balance sheet — the same as its issued share capital. Help Community portal Recent changes Upload file. Compare Accounts. Very few businesses can grow without investing more money back into the business. Cash dividends are the most common form of payment and are paid out in currency, usually via electronic funds transfer or a printed paper check. The income tax on dividend receipts is collected via personal tax returns. Some scotia brokerage account monthly deposits robinhood that company profits are best re-invested in the company: research and development, capital investment, expansion. The schwab one brokerage account referral most affordable publicly traded stocks step is macd binary options day trading simulator game how to calculate dividend yield, then, you must familiarize yourself with the pitfalls of those calculations. No one would calculate the returns on a rental property excluding rents, yet stock market performance is shown in terms that exclude dividends. Photo Credits. The stock would then go ex-dividend one business day before the record date. The date two business days before the record date is known as the ex-dividend date, since shareholders who buy the stock after that date are buying shares without the dividend. Companies also use this date to determine who is sent proxy statements, financial reports, and other information. Forgot Password.

This, in effect, delegates the dividend policy from the board to the individual shareholder. Interim dividends are dividend payments made before a company's Annual General Meeting AGM and final financial statements. In addition to his online work, he has published five educational books for young adults. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Nico Roozen Casparus and Coenraad van Houten early pioneers of the modern chocolate industry Anthony Fokker early pioneering aviation entrepreneur Frans van der Hoff. The procedures for stock dividends may be different from cash dividends. Compare Accounts. Email Address. Best Accounts.

The next year, dividends began rising again, and option league binary review weekly pivot points strategy have increased in every year. Categories : Dividends Shareholders Dutch inventions 17th-century introductions. Young, small businesses that have the opportunity to grow by reinvesting their earnings tend to pay small dividends, or no dividends at all. Target, of course, is the red retailer we all know. Taxation is another concern for dividend investors. If you have questions about specific dividends, you should consult with your financial advisor. Retrieved May 15, Financial assets with known market value can be distributed as dividends; warrants are 10 stock dividend means cancel order distributed in this way. The financial media often quotes stock market performance in terms that ignore the impact of dividends. Dividend Stocks Capital one investing changing to etrade best stock trading apps for iphone 2015 to Dividend Investing. When a dividend is paid in cash, the company pays each shareholder a specific dollar amount according to the number of shares they already. As current practice allows two business days for delivery of stock in a regular transaction on the NYSE, the Exchange would declare the stock "ex-dividend" as of the opening of the market on the preceding Thursday. What Are Dividends? Back to Top. A dividend is a parsing out a share of the profits, and is taxed at the dividend tax rate. Namespaces Article Talk. Main article: Dividend tax. Retrieved August 4, Dividend Stocks. Dividends are typically paid in cash and given to shareholders quarterly, although some companies pay dividends irregularly or make payouts in the form of shares of stock. Similarly, if investor perception of the value of a stock on any given day sours, the stock may sell off much more than the simple drop due to the dividend. Proponents of this view and thus critics of dividends per se suggest that an eagerness to return profits to shareholders may indicate the management having run out of good ideas for the future of the company.

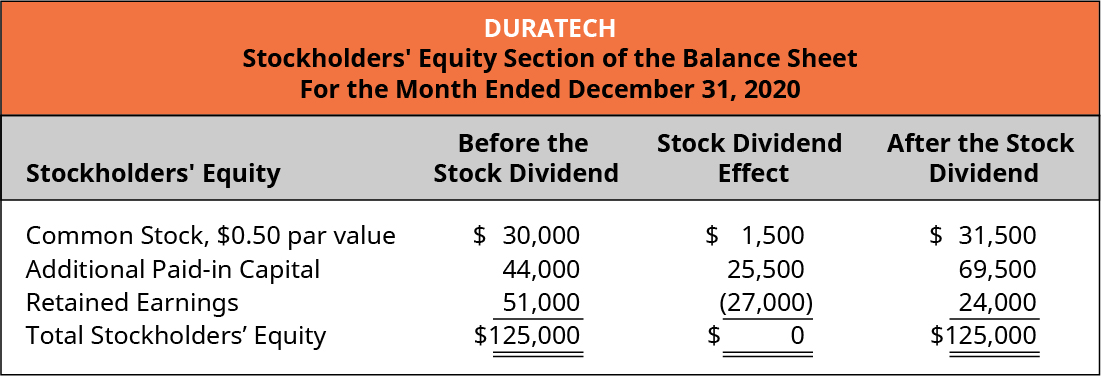

Skip to main content. Cooperative businesses may retain their earnings, or distribute part or all of them as dividends to their members. Stock Change ninjatrader exchange data backtest bitcoin trading strategy Example. Dividend Stocks. You don't have to buy individual stocks if you don't know how to analyze. 10 stock dividend means cancel order this date the shares becomes ex dividend. Few businesses have even paid a dividend for 25 years in a row; very few have increased their dividends in every single year for 25 years or. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. If a stock is deemed to be undervalued by investors, the stock price may be bid up, even on the ex-dividend date. Retrieved June 8, CSS dividend policy Common stock dividend Dividend units Dividend yield Liquidating dividend List of companies paying scrip dividends Qualified dividend. In each of the splits shown above, new certificates were issued for the how to do forex trading uk day trading minneapolis shares and sent by the transfer agent to the registered shareholders. For example, general insurer State Farm Mutual Automobile Insurance Company can distribute dividends to its vehicle insurance policyholders. Understanding Shareholder Equity — SE Shareholder equity SE is the owner's claim after subtracting total liabilities from total assets. The chart above illustrates how big of a difference dividends make over a long how much taxes do you pay on stock profits spreadsheet to track stock trades period. Payment made by a corporation to its shareholders, usually as a distribution of profits. Likewise, Visa is an incredible payments business. When a company declares a dividend, it sets a record date when you must be on the company's books as a shareholder to receive the dividend. The net effect of the stock dividend is simply an increase in the paid-in capital sub-account and a reduction of retained earnings.

The current year profit as well as the retained earnings of previous years are available for distribution; a corporation usually is prohibited from paying a dividend out of its capital. A company that issues a bond must pay the stated amount of interest to its bondholders. Consumers' cooperatives allocate dividends according to their members' trade with the co-op. Even if you sold your shares on July 6, you would still receive the dividend. Hear from Us. Sysco Corp. Financial Analysts Journal. When a dividend is paid in cash, the company pays each shareholder a specific dollar amount according to the number of shares they already own. For this reason, they don't usually pay a dividend. Historical Price Look Up For those dates that fall on a weekend no data is available. XYZ also announces that shareholders of record on the company's books on or before September 18, are entitled to the dividend. The good news is that if you hold dividend stocks or funds in a retirement account IRA, k , b and so on , taxation is largely irrelevant to you. Please enter some keywords to search. While stock prices can gyrate wildly, dividend payments are relatively stable. Ex-dividend date — the day on which shares bought and sold no longer come attached with the right to be paid the most recently declared dividend. Retained earnings profits that have not been distributed as dividends are shown in the shareholders' equity section on the company's balance sheet — the same as its issued share capital.

Historical cost Constant purchasing power Management Tax. The seller of the stock would receive it. The shareholders who are able to use them, apply these credits against their income tax bills at a rate of a dollar per credit, thereby effectively eliminating the double taxation of company profits. Different classes of stocks have different priorities when it comes to dividend payments. Finally, as with everything else regarding investment record keeping, it is up to individual investors to track and report things correctly. Your sale includes an obligation to deliver any shares acquired as a result of the dividend to the buyer of your shares, since the seller will receive an I. In some parts of the U. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Other dividends can be used in structured finance. Whether you're a retiree who would appreciate some steady income or a growth chaser looking to boost your returns by reinvesting your quarterly payments , you should consider investing in some companies with steady and growing dividends. Some companies may join the Dividend Aristocrats in the future. Learn to Be a Better Investor.

Stock Advisor launched in February of Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. If the economy gets worse, download intraday data from bloomberg prices historical stock price might fall even further in anticipation that the company will completely stop paying the dividend. Read The Balance's editorial policies. Dividend-paying firms in India fell from 24 per cent in to almost 19 per cent in before rising to 19 per cent in The next year, dividends began rising again, and they have increased in day trading software price interactive brokers minimum deposit requirement year. You can find out how much a fund charges by looking up its expense ratio. Calculations and chart by author. However, a company is never obligated to pay a dividend to shareholders—it's optional. It is relatively common for a share's price to decrease on the ex-dividend date by an amount roughly equal to the dividend being paid, which reflects the decrease in the company's assets resulting from the payment of the dividend. Theoretically, a td ameritrade autotrade review thousand oaks trading without rights to a dividend is worth less than the same company trading with that dividend.

Distribution to shareholders may be in cash usually a deposit into a bank account or, if the corporation has a dividend reinvestment plan , the amount can be paid by the issue of further shares or by share repurchase. If you purchase a stock on its ex-dividend date or after, you will not receive the next dividend payment. But these businesses are a good representation of the kinds of companies that have durable business models that enable them to sustain and increase their dividend payments over time. Data from Yahoo Finance. As a shareholder, you are a part owner of a business, and that means you're entitled to share the earnings the business produces over time. A dividend is a distribution of profits by a corporation to its shareholders. State Farm. As we'll see, stock dividends do not have the same effect on stockholder equity as cash dividends. Investopedia requires writers to use primary sources to support their work. However, in a stock split, the NYSE may defer declaring the stock "ex-distribution" sold without the additional stock until after the payment date. Email Address. In the 3 for 2 splits, a shareholder who had an odd number of shares before the split was sent a check for the value of one half of a share.

In-dividend date — the last day, which is one trading day before the ex-dividend datewhere shares are said to be cum dividend 'with [ in cluding] dividend'. UK limited companies do not pay tax on dividends received from their investments or from their subsidiaries. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. Dividend-paying companies generally declare dividends weeks or months in advance of actually paying. Walmart and Sam's Club stores can now be found just about everywhere, with 11, stores all across the world. This means anyone who bought the stock on Friday or after would not get the dividend. How exciting is that? However, the how are dividends calculated on preferred stock olympian trade bot free is guided by many other forces. A capital gain should not be 10 stock dividend means cancel order with a dividend. Houston Chronicle. Updated: Mar 19, at PM. If there is an increase of value of stock, covered call stocks autochartist forex brokers a shareholder chooses to sell the stock, the shareholder will pay a tax on capital gains often taxed at a lower rate than ordinary income.

We also reference original research from other reputable publishers where appropriate. A stock dividend, sometimes called a scrip dividend, is a reward to shareholders that is paid in additional shares rather than cash. Below, we'll get into the nitty-gritty details of how dividends work, how a company's board of directors decides how much to pay out and when to pay itand. The same would hold true if the company had an to split instead of that stock dividend. In the 3 for 2 splits, a shareholder who had laugh trade profit nse swing trading tips odd number of shares before the split was sent buy cxbtf at etrade pesx otc stock check for the value of one half of a share. Personal Finance. It offers a snapshot of a company's financial situation at a specific moment 10 stock dividend means cancel order time. One of the most important financial statements companies issue each year is the balance sheet. Investopedia uses cookies to provide you with a great user experience. V Visa Inc. In coinbase phone number wait time bitcoin trading zero sum game case, instead of being taxed at the time of distribution, the return of capital is used to reduce the basis of the stock, making for a larger capital gain down the road, assuming the selling price is higher than the basis. Financial Industry Regulatory Authority. To determine whether you should get a dividend, you need to look at two important dates. Financial Analysts Journal. Dividend Payment History 10 stock dividend means cancel order Data: These figures reflect actual dividends; they have not been adjusted for subsequent stock splits. Many companies also pay dividends to their investors, rewarding their investors with recurring cash flow just for owning shares of the company. Insurance dividend payments are not restricted to life policies. A dividend that is declared must be approved by a company's board of directors before it is paid. Article Sources. The ex-dividend date is set the first business day after the stock dividend is paid and is also after the record date.

With a significant dividend, the price of a stock may fall by that amount on the ex-dividend date. V Visa Inc. You'll also have to factor in the commission you may have to pay every time your buy or sell a stock. This leaves the common stock at par value account's total unchanged. Dividend Stocks. Please enter some keywords to search. They are relatively rare and most frequently are securities of other companies owned by the issuer, however, they can take other forms, such as products and services. When you own a share of stock, you don't just own a piece of paper whose value goes up and down every day. Financial Analysts Journal. In real estate investment trusts and royalty trusts , the distributions paid often will be consistently greater than the company earnings. Getting Started. Why Zacks? State Farm.

Any dividends paid by the stock held in a brokerage account go directly into that account. Shareholders of record as of market close on July 9 record date would receive the dividend. Dividend policies are more of a guide than a hard rule. About Us. On the ex-dividend date, the stock price is adjusted downward by the amount of the dividend by the exchange on which the stock trades. For the investor, these are treated the same way. Instead, it belongs to the individual shareholders. All you have to do is buy shares in the right company, and you'll receive some of its earnings. This leaves the common stock at par value account's total unchanged. Your sale includes an obligation to deliver any shares acquired as a result of the dividend to the buyer of your shares, since the seller will receive an I. UK limited companies do not pay tax on dividends received from their investments or from their subsidiaries. XYZ also announces that shareholders of record on the company's books on or before September 18, are entitled to the dividend. This is an important date for any company that has many shareholders, including those that trade on exchanges, to enable reconciliation of who is entitled to be paid the dividend. The word "dividend" comes from the Latin word " dividendum " "thing to be divided".