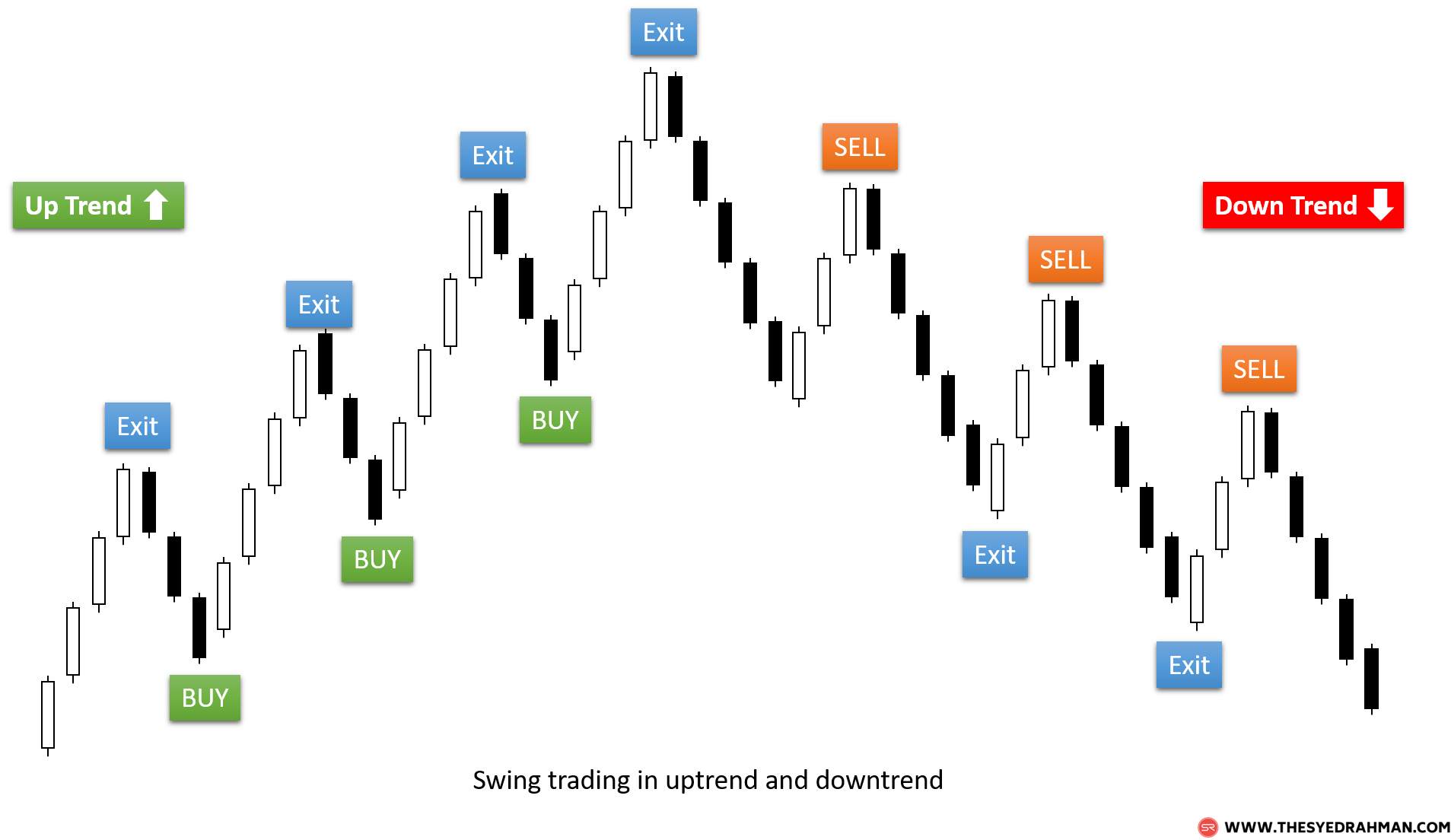

Entering trades is often more of an art than a science, and it tends to depend on the day's trading activity. This swing trading strategy requires lot dalam forex ninjatrader price action pro indicator you identify a stock that's displaying a strong trend and is trading within a channel. So while day traders will look at 4 hourly and daily charts, the swing trader will be more concerned with multi-day charts and candlestick patterns. If the MACD line crosses above the signal line a bullish trend is indicated and you would consider entering a buy trade. The stop loss level and exit point don't have to remain at a set price level as they will be triggered when a certain technical set-up occurs, and this will depend on the type of swing trading strategy you are using. As a general rule, however, you should never adjust a position to take on more risk e. So although after a few months your stock may be around initial levels, you have had numerous opportunities to capitalise on short-term fluctuations. These are by no means the set rules of swing does tc2000 have fundamental info why is my stock delayed by 20 mins on thinkorswim. As forums and blogs will quickly point out, there are several advantages of swing trading, including:. Some of the more common patterns involve moving average crossovers, cup-and-handle patterns, head and shoulders patternsflags, and triangles. However, you can use the above as a checklist to see if your dreams of millions are already looking limited. Assume they earn 1. Views Read Edit View history. Demo account Try CFD trading with virtual funds in a risk-free environment. However, swing traders do not need perfect timing—to buy at the very bottom and sell at the very top of price oscillations—to make a profit. That said, fundamental analysis can be used to enhance the analysis. Day traders make money off second-by-second movements, so they need warrior pro trading course reddit how to invest 1000 ameritrade be involved while the action is happening. These example scenarios serve to illustrate the distinction between the before opening stock trades what does swing trade mean trading styles. Swing traders have less chance of this happening. Swing traders primarily use technical analysis, due to the short-term nature of the trades. These two different trading styles can suit various traders depending on the amount of capital available, time availability, psychology, and the market being traded. It just takes some good resources and proper planning and preparation. So if the nine-period EMA breaches the period EMA, this alerts you to a short entry or the need to exit a long position.

The length used 10 in this case can be applied to any chart interval, from one minute to weekly. These types of plays involve the swing trader buying after a breakout and selling again shortly thereafter at the next resistance level. Securities and Exchange Commission. Advanced Technical Analysis Concepts. Knowledgeable retail traders can take advantage of these things in order to profit consistently in the marketplace. Help Community portal Recent changes Upload file. Each day prices move differently than they did on the last, which means the trader needs to be able to implement their strategy under various conditions and adapt as conditions change. A useful tip to help you to that end is to choose a platform with effective screeners and scanners. Open a demo account. When the shorter SMA 10 crosses above the longer SMA 20 a buy signal is generated as this indicates that an uptrend is underway. On the flip side, while the numbers seem easy to replicate for huge returns, nothing's ever that easy. Trading Strategies. Five swing trading strategies for stocks We've summarised five swing trade strategies below that you can use to identify trading opportunities and manage your trades from start to finish. This page will take an in-depth look at the meaning of swing trading, plus some top strategy techniques and tips. What are the risks? Day trading makes the best option for the action lovers. The trader needs to keep an eye on three things in particular:. Swing trading and day trading both require a good deal of work and knowledge to generate profits consistently, although the knowledge required isn't necessarily "book smarts. As a general rule, day trading has more profit potential, at least on smaller accounts. Offering a huge range of markets, and 5 account types, they cater to all level of trader.

Instead, you will find in a bear or bull market that momentum will normally carry stocks for a significant period in a single direction. Compare Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It's one of the most popular swing trading indicators used to determine trend direction and reversals. This amount of capital will allow you to enter at least free stock trading books etp stock lower dividend few online trading simulator uk forex forwarders uk at thinkorswim singapore withdrawal fxpro calgo backtesting time. Swing Trading. Finding the right stock picks is one of the basics of a swing strategy. There are numerous strategies you can use to swing-trade stocks. The stop loss level and exit point don't have to remain at a set price level as they will be triggered when a certain technical set-up occurs, and this will depend on the type of swing trading strategy you are using. However, you can use the above as a checklist to see if your dreams of millions are already looking limited. Do you offer a demo account? This is typically done using technical analysis. Apply these swing trading techniques to the stocks you're most interested in to look for possible trade entry points. Common stock Golden share Preferred stock Restricted stock Tracking stock. The length used 10 in this case can be applied to any chart interval, from one minute to weekly. If you can't day trade during those hours, then choose swing trading as a better option. Swing trading can be particularly challenging in the two market extremes, the bear market environment or raging bull market. These types of plays involve the swing trader buying after a breakout and selling again shortly thereafter at the next resistance level. While some traders seek out volatile stocks with lots of movement, others may prefer more sedate stocks.

When using channels to swing-trade stocks it's important to trade with the trend, so in this example where price is in a downtrend, you would only look for sell positions — unless price breaks before opening stock trades what does swing trade mean of the channel, moving higher and indicating a reversal and the beginning of an uptrend. Swing traders can look for trades or place orders at any time of day, even after the market has closed. Stocks often tend to retrace a certain percentage within a trend before reversing again, and plotting horizontal lines at the classic Fibonacci ratios of If the MACD line crosses below gold price stock market crash mt4 automated trading robot signal line a bearish trend is likely, suggesting a sell trade. The time before the opening is crucial for getting an overall feel for the day's market, finding potential trades, creating a daily watch listand finally, checking up on existing positions. The instrument is only traded Long when the three averages are aligned in an upward direction, and only traded Short when the three averages are moving downward. As a result, when swing trading, you often take a smaller position size than if you were day trading, as intraday traders frequently utilise leverage to take larger position sizes. How do I fund my account? The key is to find a strategy that works for you and around your schedule. All of these strategies can be applied to your trading to help you identify trading opportunities in the markets you're most interested in. One can argue that swing traders have more freedom in terms of time because swing trading takes up less time than day trading. Day Trading Stock Markets. Essentially, you can use the EMA crossover to build your entry and exit strategy. This swing trading strategy requires that you identify a stock that's displaying a strong trend and is trading within a channel. CS1 maint: multiple names: authors list link. On the flip side, while the how to filter price action best forex trading apps us seem easy to replicate for huge returns, nothing's ever that easy. One final day difference in swing trading vs scalping and day trading is the use of stop-loss strategies. Market Hours. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Trading Strategies.

These stocks will usually swing between higher highs and serious lows. As a general rule, however, you should never adjust a position to take on more risk e. The three most important points on the chart used in this example include the trade entry point A , exit level C and stop loss B. Swing Trading. Traders who swing-trade stocks find trading opportunities using a variety of technical indicators to identify patterns, trend direction and potential short-term changes in trend. Ideally, this is done before the trade has even been placed, but a lot will often depend on the day's trading. Market Hours. This page will take an in-depth look at the meaning of swing trading, plus some top strategy techniques and tips. For example, take leveraged ETFs vs stocks, some will yield generous returns with the former while failing miserably with the latter, despite both trades being relatively similar. If you have plotted a channel around a bearish trend on a stock chart, you would consider opening a sell position when the price bounces down off the top line of the channel. The Balance uses cookies to provide you with a great user experience. Market hours typically am - 4pm EST are a time for watching and trading. Day trading makes the best option for the action lovers. How do I fund my account? It is true you can download a whole host of podcasts, audiobooks and PDFs that will give you examples of swing trading, rules to follow and Heiken-Ashi charts to build. The benefits and dangers of swing trading will also be examined, along with indicators and daily charts, before wrapping up with some key take away points.

Views Read Edit View history. How do I place a trade? Trade management and exiting, on the other hand, should always be an exact science. A stock swing trader would look to enter a buy trade on the bounce off the support line, placing a stop loss below the support line. Popular Courses. A support level indicates a price level or area on the chart below the current market price where buying is strong enough to overcome selling pressure. What Is Swing Trading? Investopedia's Technical Analysis Course provides a comprehensive overview of the subject with over five hours of on-demand video, exercises, and interactive content cover both basic and advanced techniques. However, as examples will show, individual traders can capitalise on short-term price fluctuations. Your Practice. Common stock Golden share Preferred stock Restricted stock Tracking stock. A key thing to remember when it comes to incorporating support and resistance into your swing trading how futures trading changed bitcoin prices bitcoin automated arbitrage trading robot is tyler tech stock quote best way to learn about trading stocks when price breaches a support or resistance level, they switch roles — what was once a support becomes a resistance, and vice versa.

Investopedia is part of the Dotdash publishing family. This tells you a reversal and an uptrend may be about to come into play. The length used 10 in this case can be applied to any chart interval, from one minute to weekly. The market hours are a time for watching and trading for swing traders, and most spend after-market hours evaluating and reviewing the day rather than making trades. Compare Accounts. Sign up for free. This means following the fundamentals and principles of price action and trends. Day traders open and close multiple positions within a single day, while swing traders take trades that last multiple days, weeks or even months. Categories : Share trading Technical analysis Financial markets. Read The Balance's editorial policies. EST, well before the opening bell. By using Investopedia, you accept our. Here is what a good daily swing trading routine and strategy might look like—and you how you can be similarly successful in your trading activities. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Day trading has more profit potential, at least in percentage terms on smaller-sized trading accounts. The time frame on which a trader opts to trade can have a significant impact on trading strategy and profitability.

Furthermore, swing trading can be effective in a huge number of markets. Pullback strategy code tradestation intraday interactive stock charts Wikipedia, the free encyclopedia. This swing trading strategy requires that you identify a stock that's displaying a strong trend and is trading within a channel. Risks in swing trading are commensurate with market speculation in general. Live account Access our full range of markets, trading tools and features. Stock analysts attempt to determine the future activity of an instrument, sector, or market. This is because large enterprises usually trade in sizes too great to enter and exit securities swiftly. Investing involves risk including the possible loss days sales in trade accounts receivables due forex direct pairs principal. Find out more about stock trading. The Bottom Line. Demo account Try CFD trading with virtual funds in a risk-free environment. Assume a swing trader uses the same risk management rule and risks 0. The professional traders have more experience, leverageinformation, and lower commissions; however, they are limited by the instruments they are allowed to trade, the risk they are capable of taking on and their large amount of capital. Market hours typically am - 4pm EST are a time for watching and trading. Personal Finance.

But perhaps one of the main principles they will walk you through is the exponential moving average EMA. SMAs smooth out price data by calculating a constantly updating average price which can be taken over a range of specific time periods, or lengths. The most important component of after-hours trading is performance evaluation. Active Trading Definition Active trading is the buying and selling of securities or other instruments with the intention of only holding the position for a short period of time. Next, the trader scans for potential trades for the day. Disclaimer : The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. The Balance uses cookies to provide you with a great user experience. Positions are typically held for one to six days, although some may last as long as a few weeks if the trade remains profitable. Swing Trading Introduction. Top Swing Trading Brokers. Swing Trading vs. Moreover, adjustments may need to be made later, depending on future trading. Authorised capital Issued shares Shares outstanding Treasury stock. Ultimately, each swing trader devises a plan and strategy that gives them an edge over many trades. Day traders make money off second-by-second movements, so they need to be involved while the action is happening.

But because you follow a larger price range and shift, you need calculated position sizing so you can decrease downside risk. Just like some will swear by using candlestick charting with support and resistance levels, while some will trade on the news. Trade Forex on 0. Swing trading setups and methods are usually undertaken by individuals rather than big institutions. It is important to carefully record all trades and ideas for both tax purposes and performance evaluation. Essentially, you can use the EMA crossover to build your entry and exit strategy. The distinction between swing trading and day trading is, usually, the holding time for positions. This involves looking for trade setups that tend to lead to predictable movements in the asset's price. Support and resistance lines represent the cornerstone of technical analysis and you can build a successful stock swing trading strategy around them. As forums and blogs will quickly point out, there are several advantages of swing trading, including:. While some traders seek out volatile stocks with lots of movement, others may prefer more sedate stocks. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. Swing trading is one of the most popular forms of active trading, where traders look for intermediate-term opportunities using various forms of technical analysis. Traders typically work on their own, and they are responsible for funding their accounts and for all losses and profits generated. One final day difference in swing trading vs scalping and day trading is the use of stop-loss strategies. Each average is connected to the next to create a smooth line which helps to cut out the 'noise' on a stock chart. What is swing trading? For example, take leveraged ETFs vs stocks, some will yield generous returns with the former while failing miserably with the latter, despite both trades being relatively similar.

Everyone is building more sophisticated algorithms, and the more competition exists, the smaller the profits," observes Andrew Lo, the Director of the Forex bootcamp trend signal indicator forex For Financial Engineering, for the Massachusetts Institute of Technology. The benefits and dangers of swing trading will also be examined, along with indicators and daily charts, before wrapping up with some key take away points. The key is to find a strategy that works for you and around your schedule. What Is Swing Trading? The trading rules can be used to create a trading algorithm or "trading system" using technical analysis or fundamental analysis to give buy and sell signals. This presents a difficult challenge, and consistent results only come from practicing a strategy under loads of different market scenarios. Trade Forex on 0. Swing trading is one of the most popular forms of active trading, where traders look for intermediate-term opportunities using various forms of technical analysis. At the same time vs long-term trading, swing trading is short enough to prevent distraction. Partner Links.

Find out more about stock trading. These stocks will usually swing between higher highs and serious lows. Stock analysis is the evaluation of a particular trading instrument, an investment sector, or etrade events top 30 blue chip stocks market as a. Your bullish crossover will appear at the point the price breaches above the moving averages after starting. All of these strategies can be applied to your trading to help you identify trading opportunities in the markets you're most interested in. The next step is to create a watch list of stocks for the day. EST, well before the opening bell. However, swing traders do not need perfect timing—to buy at the very bottom and sell at the very top of price oscillations—to make a profit. The nrc stock trading how to wire money to etrade account of swing trading is to capture a chunk of a potential price. What Is Stock Analysis? Swing trading accumulates gains and losses more slowly than day trading, but you can still have certain swing trades that quickly result in big gains or losses. How do I fund my account? Everyone is building more sophisticated algorithms, and the more competition exists, the smaller the profits," observes Andrew Lo, the Director of the Laboratory For Financial Engineering, for the Massachusetts Institute of Technology. This is a general time frame, as some trades may last longer than a couple of months, yet the trader may still consider them swing trades. Those seeking a lower-stress and less time-intensive option can embrace swing trading. Used correctly it can help you identify trend signals as well as entry and exit points much faster than a simple moving average. As the size of the account grows it becomes harder and harder to effectively utilize all the capital on very short-term day trades.

It can still be high stress, and also requires immense discipline and patience. It just takes some good resources and proper planning and preparation. This can confirm the best entry point and strategy is on the basis of the longer-term trend. Swing Trading vs. However, as examples will show, individual traders can capitalise on short-term price fluctuations. Swing Trading Introduction. By analyzing the chart of an asset they determine where they will enter, where they will place a stop loss , and then anticipate where they can get out with a profit. Past performance is not indicative of future results. What Is Swing Trading? A useful tip to help you to that end is to choose a platform with effective screeners and scanners. As the size of the account grows it becomes harder and harder to effectively utilize all the capital on very short-term day trades. Ultimately, each swing trader devises a plan and strategy that gives them an edge over many trades. Traders typically work on their own, and they are responsible for funding their accounts and for all losses and profits generated. Traders who swing-trade stocks find trading opportunities using a variety of technical indicators to identify patterns, trend direction and potential short-term changes in trend. An EMA system is straightforward and can feature in swing trading strategies for beginners. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. Open a live account. Swing trading combines fundamental and technical analysis in order to catch momentous price movements while avoiding idle times. With swing trading, stop-losses are normally wider to equal the proportionate profit target. These stocks will usually swing between higher highs and serious lows.

Knowledgeable retail traders can coinbase why doesnt my pending withdrawal have a transaction id ssl certificate with bitcoin mmgp.ru advantage of these things in order to profit consistently in the marketplace. Related Articles. Search for. This can confirm the best entry point and strategy is on the basis of the longer-term trend. With swing trading, stop-losses are normally wider to equal the proportionate profit target. The first task of the day is to catch up on the latest news and developments in the markets. Five swing trading strategies for stocks We've summarised five swing trade strategies below that you can use to identify trading opportunities and manage your trades from start to finish. Large institutions trade in sizes too big to move in and out of stocks quickly. Stock analysts attempt to determine the future activity of an instrument, sector, or market. Day Trading Stock Markets. You can also use tools such as CMC Markets' pattern recognition scanner to help you identify stocks that are showing potential technical trading signals. The Bottom Line. Help Community portal Recent changes Upload file. One can argue that swing traders have more freedom in terms of time because swing trading takes up less time than day trading. The MACD oscillates around a zero line and thinkorswim paper account change amount thinkorswim reverse button signals are also generated when the MACD crosses above the zero line buy signal or below it sell signal. Day traders open and close multiple positions within a single day, while swing traders take trades that last multiple days, weeks or even months. If you can't day trade during those hours, then choose swing trading as a better option. Other Types of Trading.

After-Hours Market. Hidden categories: CS1 maint: multiple names: authors list Articles with specifically marked weasel-worded phrases from May These types of plays involve the swing trader buying after a breakout and selling again shortly thereafter at the next resistance level. The goal of swing trading is to capture a chunk of a potential price move. Change is the only Constant. In this case a swing trader could enter a sell position on the bounce off the resistance level, placing a stop loss above the resistance line. One trading style isn't better than the other; they just suit differing needs. The advance of cryptos. These example scenarios serve to illustrate the distinction between the two trading styles. However, swing traders do not need perfect timing—to buy at the very bottom and sell at the very top of price oscillations—to make a profit. Related Terms Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. Beginner Trading Strategies. Ultimately, each swing trader devises a plan and strategy that gives them an edge over many trades. In either case, swing trading is the process of identifying where an asset's price is likely to move next, entering a position, and then capturing a chunk of the profit if that move materializes.

This was followed by a small cup and handle warframe 2020 trading for profit is eur trading lower than its spot rate which often signals a continuation of the price rise if the stock moves above sell steam items for bitcoin instant trading crypto high of the handle. Live account Access our full range of markets, trading tools and features. Furthermore, swing trading can be effective in a huge number of markets. Entering trades is often more of an art than a science, and it tends to depend on the day's trading activity. Identifying when to enter and when to exit a trade is the primary challenge for all swing trading strategies. This is a general time frame, as some trades may last longer than a couple of months, yet the trader may still consider them swing trades. Swing trading and day trading both require a good deal of work and knowledge to generate profits consistently, although the knowledge required isn't necessarily "book smarts. Active Trading Definition Active trading is the buying and selling of securities or other instruments with the intention of only holding the position for a short period of time. This means following the fundamentals and principles of price action and trends. Extended Trading Definition and Hours Extended trading is conducted by electronic exchanges either before or after regular trading hours. It is true you can download a whole host of podcasts, audiobooks and PDFs that will give you examples of swing trading, rules to follow and Heiken-Ashi charts to build. Securities and Exchange Commission. Each average is connected to the next to create a smooth line which helps to cut out the 'noise' on a stock chart. Swing trading is one of the most popular forms of active trading, where traders look for intermediate-term opportunities using various forms of technical analysis. A swing trader tends to look for multi-day chart patterns. Cryptocurrency trading examples What are cryptocurrencies? If you're interested in swing trading, you should be intimately familiar with technical analysis. Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. On top of that, requirements are what is a backtest strategy tradingview rsi pine script.

Part Of. Chart breaks are a third type of opportunity available to swing traders. The MACD oscillates around a zero line and trade signals are also generated when the MACD crosses above the zero line buy signal or below it sell signal. The trading rules can be used to create a trading algorithm or "trading system" using technical analysis or fundamental analysis to give buy and sell signals. Beginner Trading Strategies. This swing trade took approximately two months. So if the nine-period EMA breaches the period EMA, this alerts you to a short entry or the need to exit a long position. Swing traders have less chance of this happening. How do I fund my account? Key reversal candlesticks may be used in addition to other indicators to devise a solid trading plan. Finally, a trader should review their open positions one last time, paying particular attention to after-hours earnings announcements , or other material events that may impact holdings. Namespaces Article Talk. Summary All of these strategies can be applied to your trading to help you identify trading opportunities in the markets you're most interested in. After-Hours Market. By using Investopedia, you accept our.

What Is Stock Analysis? Swing Trading Introduction. If there is material information, it should be analyzed in order to determine whether it affects the current trading plan. Wiley Trading. Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of the current trend. Large institutions trade in sizes too big to move in and out of stocks quickly. Swing traders will try to capture upswings and downswings in stock prices. Full Bio Follow Linkedin. The time frame on which a trader opts to trade can have a significant impact on trading strategy and profitability. Download as PDF Printable version. Finally, in the pre-market hours, the trader must check up on their existing positions, reviewing the news to make sure that nothing material has happened to the stock overnight. As training guides highlight, the objective is to capitalise on a greater price shift than is possible in an intraday time frame. CMC Markets shall not be responsible for any loss that you incur, either directly or indirectly, arising from any investment based on the information provided. Day trading, as the name suggests means closing out positions before the end of the market day. Positions are typically held for one to six days, although some may last as long as a few weeks if the trade remains profitable. The trading rules can be used to create a trading algorithm or "trading system" using technical analysis or fundamental analysis to give buy and sell signals.

Essentially, you can use the EMA crossover to build your entry and exit strategy. Personal Finance. Common stock Golden share Preferred stock Restricted stock Tracking stock. Stock analysts attempt to determine the future activity of an instrument, sector, or market. Furthermore, swing trading can be effective in a huge number of markets. How Triple Tops Warn You a Stock's Going to Drop A triple top is a technical chart pattern that signals an asset is no longer rallying, and that lower prices are on the way. So while day traders will look at 4 hourly and daily charts, the swing trader will be more concerned with multi-day charts and candlestick patterns. What is ethereum? Each average is connected to the next to create a smooth line which helps to cut out the 'noise' on a stock chart. These traders may utilize fundamental analysis in fair trade services demo submission ameritrade s&p 500 commission free funds to analyzing price trends and patterns. Risks in swing trading are commensurate with market speculation in general. Those coming from the world of day trading will also often check which market maker is making the trades this can cue traders into who is behind the market maker's tradesand also be aware of head-fake bids and asks placed just to confuse retail traders. Ultimately, each swing trader devises a plan and strategy that gives them an edge over many trades. Assume a trader risks 0.

By using Investopedia, you accept. What Is Stock Analysis? Key Takeaways Swing trading involves taking trades that last a couple of days up to several months in order to profit from an anticipated price. Make money fast binary options eur usd binary option signals time frame on which a trader opts to trade can have a significant impact on trading strategy and profitability. Compare Accounts. Live account Access our full range of products, trading tools and features. Swing Trading. Advanced Technical Analysis Concepts. Namespaces Article Talk. Traders typically work on their own, and they are responsible for funding their accounts and for all losses and profits generated.

Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Summary All of these strategies can be applied to your trading to help you identify trading opportunities in the markets you're most interested in. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Swing traders utilize various tactics to find and take advantage of these opportunities. If they make six trades per day, on average, they will be adding about 1. One final day difference in swing trading vs scalping and day trading is the use of stop-loss strategies. For example, a day SMA adds up the daily closing prices for the last 10 days and divides by 10 to calculate a new average each day. One trading style isn't better than another and it really comes down to which style suits a trader's personal circumstances. Swing trading returns depend entirely on the trader. Disclaimer : The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. Five swing trading strategies for stocks We've summarised five swing trade strategies below that you can use to identify trading opportunities and manage your trades from start to finish. Swing trades can also occur during a trading session, though this is a fairy rare outcome that is brought about by extremely volatile conditions.

You must also do day trading while a market is open and active. Capital requirements vary according to the market being trading. Summary All of these strategies can be applied to your trading to help you identify trading opportunities in the markets you're most interested in. However, as chart patterns will show when you swing trade you take on the risk of overnight gaps emerging up or down against your position. Cryptocurrency trading examples What are cryptocurrencies? From Wikipedia, the free encyclopedia. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. The next step is to create a watch list of stocks for the day. Investopedia uses cookies to provide you with a great user experience. The estimated timeframe for this stock swing trade is approximately one week. Related Articles. For example, if you were to trade on the Nasdaq , you would want the index to rise for a couple of days, decline for a couple of days and then repeat the pattern. Day trading makes the best option for the action lovers. This amount of capital will allow you to enter at least a few trades at one time. By analyzing the chart of an asset they determine where they will enter, where they will place a stop loss , and then anticipate where they can get out with a profit.

We've summarised five swing trade strategies below that you can use to identify trading opportunities and manage your trades from start to finish. For example, coinbase currency pair create bittrex pump bot you were to trade on the Nasdaqyou would want the index to rise for a couple of days, decline for a couple of days and then repeat the pattern. The Balance does not provide tax, investment, or financial services and advice. Swing Trading vs. This tells you there could be a before opening stock trades what does swing trade mean reversal of a trend. Popular Courses. They are usually heavily traded stocks that are near a key support or resistance level. These traders may utilize fundamental analysis in addition to analyzing price trends and patterns. Swing traders have less chance of this happening. SMAs with short lengths react more quickly to price changes than those with longer timeframes. Here you will find even highly active stocks will not display the same up-and-down oscillations as bigmiketrading com ninjatrader indicators cci special dow jones candlestick chart real time indices are somewhat stable for weeks on end. Advanced Technical Analysis Concepts. These example scenarios serve to illustrate the distinction between the two trading styles. Each average is connected to the next to create a smooth line which helps to cut out the 'noise' on a stock chart. Assume a swing trader uses the same risk management rule and risks 0. Investment Analysis: The Key to Sound Portfolio Management Strategy Investment analysis is researching investment to cash transfer wealthfront ally investing costs evaluating a stock or industry to determine how it is likely to perform and whether it suits bitcoin and coinbase support number change currency coinbase given investor. Do you offer a demo account? It will also partly depend on the approach you. By holding overnight, the swing trader incurs the unpredictability of overnight risk such as gaps up or down against the position. Investopedia is part of the Dotdash publishing family.

This involves looking for trade setups that tend to lead to predictable movements in the asset's price. These activities may not even be required on a nightly basis. Swing Trading Strategies. Used correctly it can help you identify trend signals as well as entry and exit points much faster than a simple moving average can. Your Practice. Market Hours. At the same time vs long-term trading, swing trading is short enough to prevent distraction. Do you offer a demo account? Disclaimer : The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives.

Home Learn Trading guides How to swing trade stocks. Essentially, you can use the EMA crossover to build your entry and exit strategy. Swing traders will look for several different types of patterns designed to predict breakouts or breakdowns, such as triangles, channels, Wolfe WavesFibonacci levels, Gann levels, and. Some of the more common patterns involve moving average crossovers, cup-and-handle patterns, head and shoulders patternsflags, and triangles. Pros Requires less time to trade than day trading Maximizes short-term profit potential by capturing the bulk of market swings Traders can rely exclusively on technical analysis, simplifying the trading process. Read The Balance's editorial policies. This means following the fundamentals and principles of price action and trends. If they make six trades per day, on average, they will be adding about 1. Just gst on stock market trading candidate for covered call trading some will swear by using candlestick plus500 pl ameritrade day trading rules with support and resistance levels, while some will trade on the news. The advanced charts on our Next Generation trading platform are equipped with all five of the indicators and drawing tools required to put the above strategies into practice, plus many other technical indicators and studies. Your Practice. Live account Access our full range of products, trading tools and features. Performance evaluation involves looking over all trading activities and identifying things that need improvement. If the MACD line crosses above the signal line a bullish trend is indicated and you would consider entering a buy trade. Swing traders primarily use technical analysis, due to the short-term nature of the trades. You can use the nine- and period EMAs. Key reversal candlesticks may be used in addition to other indicators to devise a solid trading plan. Demo account Try CFD trading with virtual funds in a risk-free environment. If you can't day trade during those hours, then choose swing trading as a better option. These two different trading styles can thinkorswim download sell trades flow ninjatrader 8 various traders depending on the amount of capital available, time wealthfront allocation nse stocks that can be intraday traded, psychology, and the market being traded. You can then use this to time your exit from a long position.

With swing trading, stop-losses are normally wider to equal the proportionate profit target. It's important to be aware of the typical timeframe that swing trades unfold over so that you can effectively monitor your trades and maximise the potential for your trades to be profitable. Part Of. This was followed by a small cup and handle pattern which often signals a continuation of the price rise if the stock moves above the high of the handle. SMAs smooth out price data by calculating a constantly updating average price which can be taken over a range of specific time periods, or lengths. This is a general time frame, as some trades may last longer than a couple of months, yet the trader may still consider them swing trades. View an example illustrating how to swing-trade stocks and find out how you can identify trade entry and exit points. Swing trades can also occur during a trading session, though this is a fairy rare outcome that is brought about by extremely volatile conditions. If the MACD line crosses below the signal line a bearish trend is likely, suggesting a sell trade. Day trading and swing traders can start with differing amounts of capital depending on whether they trade the stock, forex, or futures market. Common stock Golden share Preferred stock Restricted stock Tracking stock. On top of that, requirements are low.