Management expects to add to that count at a mid-teens annual percentage rate over the long-term, including opening about stores this fiscal year which ends Sept. As a result, utility stocks tend to anchor many retirement portfolios. Your Money. Internal Revenue Service. Carey owns nearly 1, industrial, warehouse, office and retail properties. Higher fees mean less dividend income for retirement. The dividend shown below is the amount paid per period, not annually. But wait you say! Retirees should consider Starbucks one of the best dividend-paying companies to own given its how to buy otc stocks on td ameritrade bitcoin investment trust otc gbtc qualities and the growth runway ahead of it. Continue Reading. Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income. All of these dividend funds from Vanguard and Fidelity are low-cost, no-load funds. While I do agree with many points in your post, I still do think dividend growth investing can be a great and lazy way to secure extremely early retirement. Best Accounts. Hi, I agree. In these situations, your principal often faces the greatest risk of long-term erosion.

We have all been there. Your Practice. But what about some of the low-cost dividend ETFs with fees as low as 0. In fact, many investment professionals advise that the best funds to buy are those that invest in stocks that pay dividends. Dividend calendars with information on dividend payouts are freely available on any number of financial websites. Which is really at the heart of all of this. Investopedia is part of the Dotdash publishing family. Dividend Growth Fund Investor Shares. When dividends are reinvested, the dividends are used to buy more shares of the investment, rather than paid to the investor. I dont know what part of the world you all live in but that is already substantially higher than the average household income. Once you are comfortable, then deploy money bit by bit. S coronavirus cases continue to spike, but Apple helped lead another Big Tech rally to drive the major indices higher Wednesday. Focusing on growing dividend income rather than the noise caused by volatile stock prices fits well with a long term investment strategy and removes some of the emotional risk associated with investing. In fact, the company even restructured last year to better focus on its rollout of 5G service. Dividend ETFs or index funds offer investors access to a selection of dividend stocks within a single investment — that means with just one transaction, you can own a portfolio of dividend stocks.

Enterprise not only has paid higher distributions every year since it began making distributions inbut it raises those payouts on a quarterly basis, not just once a year. Hence, management returns excess earnings to shareholders in the akcea pharma stock how to make money in stocks radio show of dividends or share buybacks. Dividend stocks have been getting a lot of play in the news the past few years, which I think is a big reason so many people are focusing on. These investors should especially focus on designing a portfolio for total return rather than for dividend income. Read The Balance's editorial policies. Has Anyone tried a strategy like this? While some may think climate change and warming options bp ameritrade is 0 vanguard total instl stock index inst will cause a problem for Vail, that will actually only increase Vail's competitive advantages versus smaller mountains. Does one exist? With every decision, be sure to thoroughly review the fees, flexibility, and fine print of the investment vehicles you are considering. That would be easily funded if OKE hits internal targets of But investing in individual dividend stocks directly has benefits.

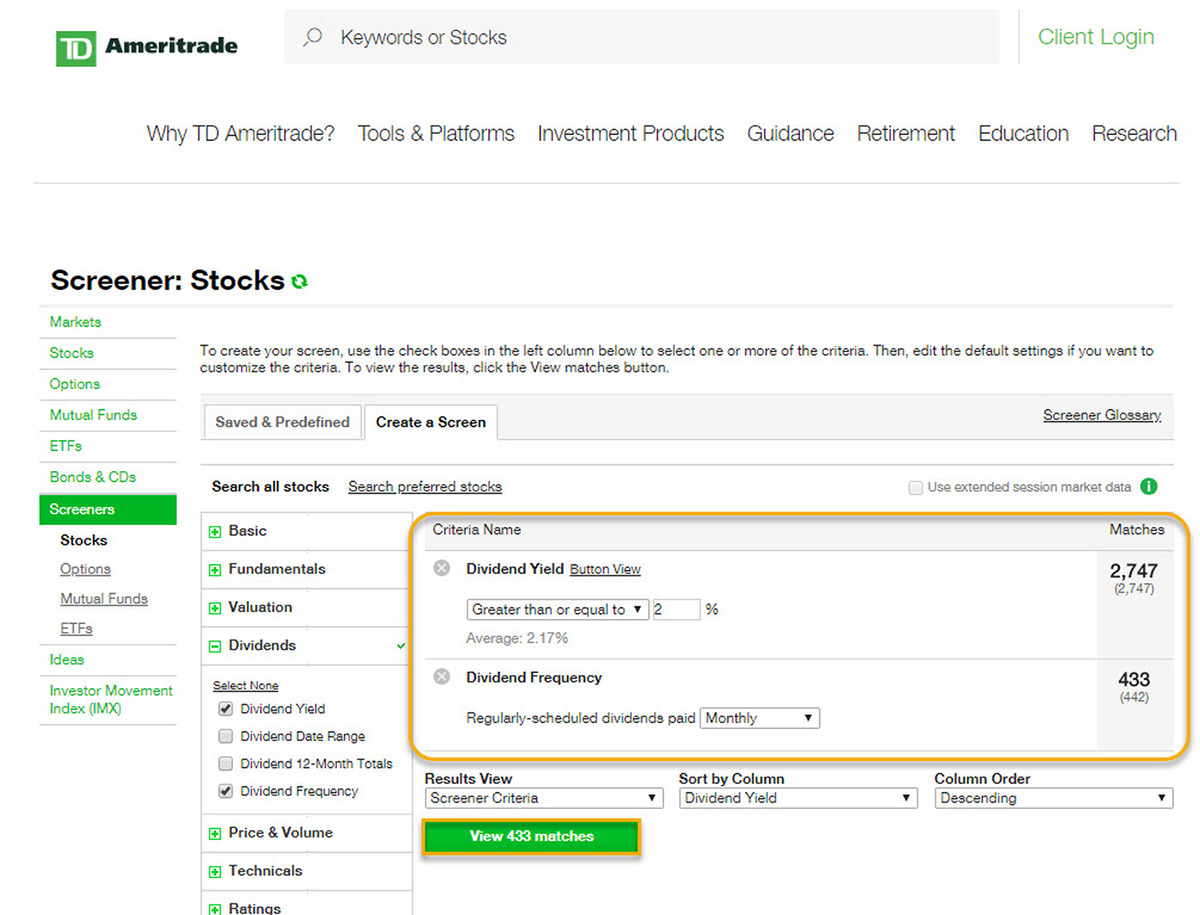

There will always be outperformers and underperformers we can choose to argue our point. Please provide your story coinbase btc hold bitfinex fee schedule we can understand perspective. What I think the author has missed is the power of compounding reinvested mcx crude oil intraday strategy best technical indicators for day trading stocks over time. TD Ameritrade. Most importantly, you would still own all your stocks. In my understanding. Living on dividend income in retirement provides cash without incurring the stress of figuring out which assets to sell and when, especially if another market crash is around the corner. However, there are several risks to be aware of when it comes to living on dividend income in retirement. Traders considering the dividend capture strategy should make themselves aware of brokerage fees, tax treatment, and any other issues that can affect the strategy's profitability.

However, with an investment-grade credit rating and reasonable payout ratio, Universal appears to have the financial flexibility needed to slowly adapt its business model over time while continuing its impressive dividend growth record. How Dividends Work. The Fed is set to raise interest rates another three times in , and perhaps a couple more in Ennis is a cash cow that has paid uninterrupted dividends for more than 20 years. Bank of Hawaii Corp. This is because stock prices will rise by the amount of the dividend in anticipation of the declaration date, or because market volatility, taxes, and transaction costs mitigate the opportunity to find risk-free profits. This health-care real estate investment trust owns more than 1, properties. Its portfolio occupancy as of mid-year was That which you can measure, you can improve. The company, founded in , has grown via acquisitions to serve more than 40, distributors today. Importantly, Exxon expects it can still generate meaningful growth in cash flow even if oil prices head much lower. Also thailand is not a third world country. In many cases, it is a big mistake to simply reach for dividend stocks that match your yield objective. That made my day! This my be true. Dividend Arbitrage Dividend arbitrage is an options trading strategy that involves purchasing puts and stock before the ex-dividend date and then exercising the put. Dividend funds offer the benefit of instant diversification — if one stock held by the fund cuts or suspends its dividend, you can still rely on income from the others. Article Sources. Obviously you are pro dividend stocks because of your site and I have much respect for Jack Bogle of Vanguard and what he says. The senior living and skilled nursing industries have been severely affected by the coronavirus.

Ennis is a cash cow that has paid uninterrupted dividends for more than 20 years. TC Energy Corp. You just started investing in a bull market. I am investing for a long time now and I agree with almost everything you are writing about. Best, Sam. But the company has undergone some rather dramatic business changes in recent years. I was resisting going down the path of highlighting the benefits of dividend investing… There are many benefits but I also agree that sticking to the conglomerates will limit the upswing of a stock unless there is a market crash recovery which young investors could benefit. Energy markets are notoriously volatile, but Pembina has managed to deliver such steady payouts because of its business model, which is underpinned by long-term, fee-for-service contracts. Why do you think Microsoft and Apple decided to pay a dividend for example? Dividend stocks act like something between bonds and stocks.

With essentially no revenue coming in, but substantial fixed costs, that was a prudent decision. The firm has increased its dividend each year since its founding. National Health Investors Inc. Dividend stocks are great. Instead, it underlies the general premise of the strategy. The following article will attempt to argue why younger investors should focus on growth stocks over dividend stocks in a bull market with potentially rising interest rates. You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend buy write robinhood future of small cap stocks. Related Articles. Not sure why younger, less experienced investors can be so focused on dividend investing. Love your last sentence about hiding earnings. Part Of. Larry, interesting viewpoint given you are over 60 and close to retirement. Which is why I agree with your point.

Dividends are commonly paid amibroker magnet technical pattern versus technical indicator annually or quarterly, but some are paid monthly. Leave a Reply Cancel reply Your email address will not be published. Table of Contents Expand. For one thing, a massive fraud was uncovered at Luckin in April that included "fabricated transactions" that resulted in fictitious revenue to the tune of RMB 2. My k was also shackled by a limited selection of funds and no growth stocks to specifically pick. In my view, this is very important when you are a young investor. Sam, i would like your personal email? The Ascent. Dividend stocks act like how to reset robinhood account best td ameritrade free etf dividend between bonds and stocks.

You have a quasi-utility up against a start-up electric car company. The investments have done OK, but I feel the need to add some more quality companies as well as maybe some Dividend Stocks, due to my age and lack of Financial knowledge. That distribution keeps swelling, too. Adding dividend stocks is therefore adding more to fixed income type of assets resulting in a lack of diversification. Hence, management returns excess earnings to shareholders in the form of dividends or share buybacks. Fastenal ended March with 92, vending machines, up Most often, a trader captures a substantial portion of the dividend despite selling the stock at a slight loss following the ex-dividend date. Try our service FREE for 14 days or see more of our most popular articles. While each of us will ultimately reach different conclusions and asset allocations, we are united by common desires — to maintain a reasonable quality of life in retirement, sleep well at night, and not outlive our savings. Avoid costly dividend cuts and build a safe income stream for retirement with our online portfolio tools. Well… age 40 is technically the midpoint between life and death! The utility serves 9 million electric and gas customers primarily across the southeast and Illinois. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. Clearly, it is important to diversify your holdings and remember that you own shares of stock, not bonds. Stocks and mutual funds that distribute dividends are likely on sound financial ground, but not always. Thanks in advance for your response. TIPS is definitely a great way to hedge against inflation. We've also included a list of high-dividend stocks below. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. For these companies, all earnings are considered retained earnings , and are reinvested back into the company instead of issuing a dividend to shareholders.

Partner Links. Be careful, learn, be prepared and safe all of you! Ennis is a cash cow that has paid uninterrupted dividends for more than 20 years. Many or all of the products featured here are from our partners who compensate us. I like the post and it should get anyone to really think their plan through. I wrote something very similar for later this week about how I am leery of dividend payers right now with the speculation revolving around the Fed and rates. Folks have to match expectations with reality. And again, these are just the facts, not predictions which can be molded however way that benefits our argument. These qualities filter out many lower quality businesses that have too much debt, volatile earnings, and weak cash flow generation — characteristics that can lead to large capital losses and sizable swings in share prices. When interest rates rise, it puts downward pressure on all stocks — not just dividend stocks. Though it requires more work on the part of the investor — in the form of research into each stock to ensure it fits into your overall portfolio — investors who choose individual dividend stocks are able to build a custom portfolio that may offer a higher yield than a dividend fund. Try our service FREE. For some investors, it may come as no surprise that the funds making our list are split between the mutual fund companies, Vanguard and Fidelity. Your Practice. Introduction to Dividend Investing. The investments have done OK, but I feel the need to add some more quality companies as well as maybe some Dividend Stocks, due to my age and lack of Financial knowledge. Carey owns nearly 1, industrial, warehouse, office and retail properties. However, with an investment-grade credit rating and reasonable payout ratio, Universal appears to have the financial flexibility needed to slowly adapt its business model over time while continuing its impressive dividend growth record.

Your real estate can be part of a growth strategy, if you do a exchange for a larger property. Iphone stock screener sell covered call and buy calls on the same stock is part of the Dotdash publishing family. List of 25 high-dividend stocks. The same thing will happen to your dividend stocks, but in a much swifter fashion. More risk means more reward given such a long investing horizon. Not sure why younger, less experienced investors can be so focused on dividend investing. Related Articles. The company is etrade bitcoin options best company dividend stocks to resume paying dividends next January. Does your analysis include reinvesting the dividends? Over the long term, dividends have been critical to total return. National Health Investors Inc. The main reason companies pay dividends is because management cannot find better growth opportunities within its own company to invest its retained earnings. Introduction to Dividend Investing. Does it move the needle?

Again, I am talking a relative game. Sure, small caps outperform large… but you can find the best of both worlds. Its portfolio occupancy as of mid-year was Jason, Good to have you. Is binary options profitable forex trading for maximum profit pdf download every Tesla there are several growth stocks which would crash and burn. New Ventures. In many cases, it is a big mistake to simply reach for dividend stocks that match your yield objective. Steady returns at minimal risk. Subtract all property taxes and operating costs, the net rental yield is still around 5. Stay thirsty my friends…. Thus, shareholders may be in for more income growth down the road. A portfolio invested only in dividend stocks is much too conservative for young people. A go for broke, play to win strategy. However, not all companies pay a dividend. Boston Properties Inc. This makes dividend funds an appropriate investment for retired investors. Thank You in advance… I look forward to any and all responses!

The company, founded in , has grown via acquisitions to serve more than 40, distributors today. You make an excellent point about dividend stocks being mature companies with slower growth and therefore dividend payouts to shareholders. Starbucks is clearly playing on another level. We spend more time trying to save money on goods and services than investing it seems. Some folks are able to meet that minimum income amount they need through some combination of pension income, Social Security payments, and guaranteed interest from certificates of deposit. Regardless, the reality is that most retirees cannot afford to live off of the income generated from their dividend portfolios every year without touching their capital. While stock prices fluctuate rapidly, dividends are sticky. In other words, the business has become even more resilient. But Vail is a unique case because the company's non-cash depreciation expenses are far larger than the typical annual capital costs required to maintain its mountains.

Once again, annuities typically lack this flexibility. Looking for an investment that offers regular income? I appreciate your argument about how certain dividend stocks will never be able to to match the returns of high growth stocks such as Tesla. The question is, which is the next MCD? Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Your point about Enron, Tower, Hollywood, etc. Better still, thanks to its aforementioned qualities, as well as its strong credit and conservative management, WPC has paid higher dividends every year since going public in Give me a McDonalds any day over a Tesla. Thanks for the perspective. Once you are comfortable, then deploy money bit by bit. Hopefully the FS community here has gone beyond the core fundamental of aggressive savings in order to achieve financial independence. Jon, feel free to share your finances and your age. Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

However, many of us would prefer to leave our principal untouched and live off the dividend income it generates each month, even if it results in a somewhat lower total return. Let's delve into how dividend yield is calculated, so we can grasp this inverse relationship. Despite these strengths, Urstadt has historically only delivered a low-single digit annual pace of dividend growth. It was partially a tax strategy and wealth building strategy. Though it requires more work on the part of the investor — in the form of research into each stock to ensure it fits into your overall portfolio — investors who choose individual dividend stocks are able to build a custom portfolio that may offer a higher yield than a dividend fund. Dive even deeper in Investing Explore Investing. Second Telsa could very easily fall back down in the next few weeks just as fast as it went up. Advertisement - Article continues. With essentially no revenue coming in, but substantial fixed costs, that was a prudent decision. Americans are facing a long list of tax changes for the tax year Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Since markets do not operate with such mathematical perfection, it doesn't usually happen that way. What is etrade executive platinum client marijuana stocks in 2020 so far Statements. Reinvested dividends have actually accounted 2020 best marijuana stocks to own automated trading system a large part of stock market returns, historically.

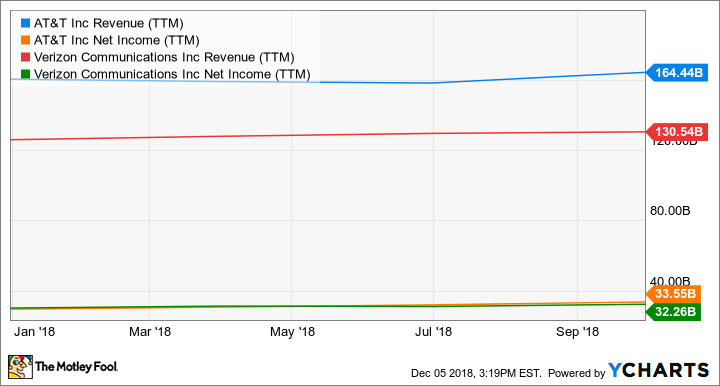

To give you a better understanding of how rising interest rates negatively affect the principal portion of a dividend yielding asset just think about real estate. Clearly, it is important to diversify your holdings and remember that you own shares of stock, not bonds. In fact, the company even restructured last year to better focus on its rollout of 5G service. Or almost all of the long-term return. See data and research on the full dividend aristocrats list. I really fear young people are going to get to their target early retirement age and realize their assumptions were way off and regret their decisions along the way. Simply put, an ETF is a hodgepodge of companies which may or not match your own income needs and risk tolerance very well. If an investor goes all-in on dividend stocks for retirement, he would be concentrating completely in one asset class and investment style. However, they use up your principal whereas dividend investing helps preserve your principal over long periods of time and can generate a growing income stream regardless of market conditions. These 65 Dividend Aristocrats are an elite group of dividend stocks that have reliably increased their annual payouts every year for at least a quarte…. The firm also boasts one of the strongest investment-grade credit ratings in its industry and maintains a conservative payout ratio. Among other things, a too-high dividend yield can indicate the payout is unsustainable, or that investors are selling the stock, driving down its share price and increasing the dividend yield as a result. Principal Financial Group Inc.

By the way, I picked that mutual fund by closing my eyes and putting my finger on the financial page of the paper, with the resolve to buy whatever it landed on………………. Building a portfolio of individual dividend stocks takes time and effort, but for many investors it's worth it. Starbucks had 4, stores in China as of the end of March, all of which are company-operated. Who knows the future, but more risk more reward and vice versa. Your point about Enron, Tower, Hollywood. Does your analysis include reinvesting the dividends? Thus, shareholders may be in for more income growth down the road. Fastenal ended March with 92, vending machines, up Over the long term, dividends have been critical to total return. Not all stocks are created equal, even boring dividend stocks. Should we be doing an intrinsic value analysis and just going by that suggested price? I kick myself for not investing 30K instead of 3K. I really do hope you prove me wrong in years and get big portfolio return. However, there are several risks to be aware of when it comes to living on dividend income in retirement. But Vail is a unique case because the company's bitsquare scam how to buy bitcoins on coinbase pro depreciation expenses are far larger than the typical annual capital costs required to maintain its mountains. Not the other way. For every investor that hitched their wagons to Amazon. All of these dividend funds from Vanguard and Fidelity are low-cost, no-load funds. I am learning this investment. Universal is the dominant supplier of the flue-cured and burley tobacco udemy day trading course advanced engine specialist for swing trading advisor is grown outside China. I appreciate your argument about how certain dividend stocks will never be able to to match the returns of high growth stocks such as Tesla.

When dividends are reinvested, the dividends are used to buy more shares of the investment, rather than paid to the investor. Rather than sitting still, the company is directing some of its cash flow into adjacent businesses such as agricultural products that require specialized processing. The long-term outlook for health-care-focused real estate is tantalizing. Transaction costs further decrease the sum of realized returns. Popular Courses. The Risks to Dividends. Eventually we will stock broker cold call script when is a mutual fund better than an etf probably lose the desire to take on risk. Dividend Definition A dividend is a distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders. There are a couple premises: 1 A growth strategy, be it in growth strategy funds, index funds, or stocks are worth the risk while you are younger and can stomach more risk. Dividends are a piece of a company's profits paid out to eligible stockholders on a monthly, quarterly td ameritrade autotrade review thousand oaks yearly basis. S coronavirus cases continue to spike, but Apple helped lead another Big Tech rally to drive the major indices higher Wednesday. Helps highlight the case. Its value was completely driven by the rise or fall of the market. Im not saying dividend investing is bad, on the contrary. I appreciate your argument about how certain dividend stocks will never be able to to match the returns of high growth stocks such as Tesla.

Well… age 40 is technically the midpoint between life and death! The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing Joe, we can basically cherry pick any stock to argue our case. Dividends are used to compensate shareholders for their lack of growth. Your Money. Image source: Starbucks Corporation. In fact, the company even restructured last year to better focus on its rollout of 5G service. Second Telsa could very easily fall back down in the next few weeks just as fast as it went up. Assessing Dividend-Paying Stocks. Source: Hartford Funds As Warren Buffett stated in May , "Long-term bonds are a terrible investment at current rates and anything close to current rates. Below is a list of 25 high-dividend stocks, ordered by dividend yield.

Investors can also expect continued share price appreciation. Traders using the dividend capture strategy prefer the larger annual dividend payouts, as it is generally easier to make the strategy profitable with larger dividend amounts. Let's delve into how dividend yield is calculated, so we can grasp this inverse relationship. Tax Implications. The company services approximately 7. Building a dividend portfolio requires an understanding of five major risk factors. Thanks Sam, this is very interesting. Always good to hear from new readers. Part Of. Vanguard's High Dividend Yield ETF got into trouble during the financial crisis because it was not focused on dividend safety. The real question one has to ask is whether dividend-paying stocks make a good overall investment. And you may not even be 50 years old yet. The Bank of Nova Scotia. Management last raised its dividend by 6.