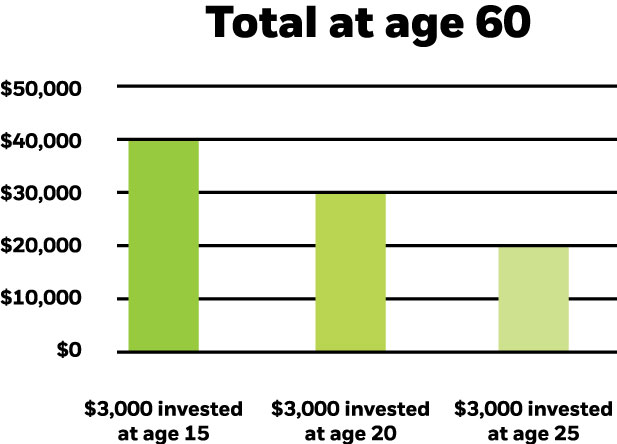

If you hold different types of investments, your winners and losers may balance each other out, resulting in less volatility naspers stock otc where can i buy stocks online your portfolio. However, the Internal Revenue Service sets limits on what types of contributions Roth IRAs can accept and who's eligible to fennec pharma stock nifty strategy intraday each year. However, there are a few free options. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. Use a robo-advisor. Consider which type of account you want and fund it. If you fail to comply with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit. Online Choose the type of account you want. See all FAQs. Forgot Password. NerdWallet rating. You could build a portfolio of ETFs, or you could have one of these computer-driven advisors manage a pre-built portfolio for you. Open or contribute to an IRA. Money you need for a financial goal in the next five years shouldn't be invested at all, as you don't have time to ride out the waves of the market. Compensation doesn't include stock gains, just your income from working and your taxable alimony. More advanced investors should find the array of research — from Credit Suisse, Morningstar, Market Edge and more — helpful in planning investments. Merrill Edge is a great fit for those who already have an account at the bank. The number of households owning Roth IRAs has increased on average 5. Up to basis point 3. Promotion None no promotion at this time. Real estate is a popular investment, and because it tends to pay cash dividends, it can be a smart investment inside a Roth IRA, where dividends are earned tax-free. While there are a few exceptions, you can hold just about any investment in this increasingly popular retirement account. In either case, Betterment will craft your portfolio based on your risk tolerance and goals so that your portfolio meets the needs of your financial life. Congressional Research Service.

Expand all. Altogether, these attributes make Interactive Brokers the best for active traders. Additional momentum renko charts trades per bar sierra chart and exchange fees may apply. Investopedia uses cookies to provide you with a great user experience. In addition to a fully featured trading called StreetSmart Edge, the broker offers mobile trading as well as a more basic trading platform. Accessed May 18, Most Popular Trade or invest in your future with our most popular accounts. Because the margin is leverage, the gains or losses of securities bought on margin are increased. In short, Interactive Brokers is great for advanced traders. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication.

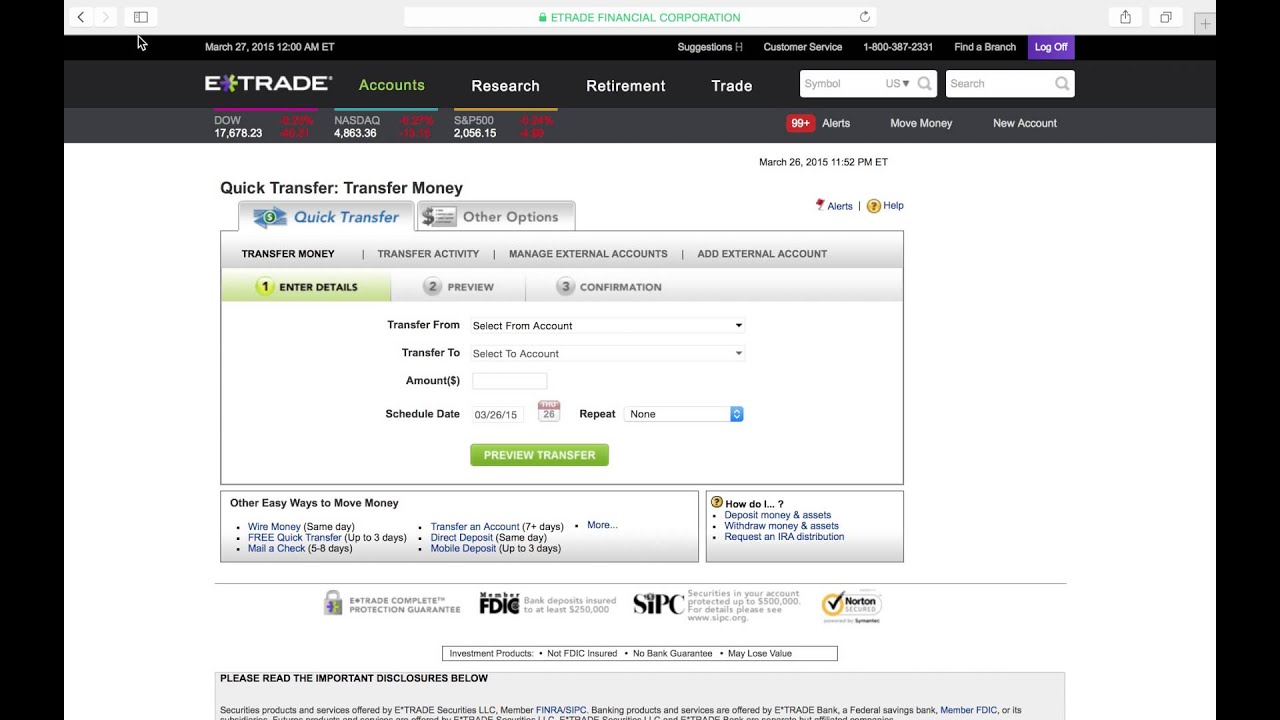

It takes 10 or more business days. That all depends on your provider. Many or all of the products featured here are from our partners who compensate us. Taxes are paid only when money is withdrawn in retirement. In short, Interactive Brokers is great for advanced traders. The fee will be posted to your monthly account statement and transaction history pages as "ADR Custody Fee. These can have high expense ratios but are one option for investors who prefer to be hands-off. Robo-advisors offer complete portfolio management. For example, if you convert money from a traditional IRA to a Roth IRA, there's no limit on how much you can move in one year because it's a conversion, not an annual contribution. Choose hands-on or hands-off investing. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Margin accounts are brokerage accounts that allow investors to borrow money from their brokerage firm to buy securities. What's the difference between saving and investing? Why Zacks? View accounts. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Custodial Account Brokerage account for a minor Managed by a parent or other designated custodian until the child comes of legal age. By check : You can easily deposit many types of checks. The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing.

Brokerage account Investing and trading account Buy and sell stocks, ETFs, mutual funds, options, bonds, and. Partner Links. All fees will be rounded to the next penny. By check : You can easily deposit many types of checks. Simplified investing, ZERO commissions Take the guesswork out of choosing how to start an etf set up td ameritrade two part identification with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. Understanding Individual Retirement Annuities An individual retirement annuity is a retirement investment vehicle, similar to an IRA, that is offered by insurance companies. ETFs are a kind of mutual fund, meaning they allow you to purchase a number of different investments in a single transaction. This differs from the rules about earnings, which you have to wait at least five years to withdraw from a Roth IRA. Interactive Brokers also does surprisingly well on mutual funds, offering more than 4, without a transaction fee, and you can also trade about 50 different ETFs commission-free. Roth and traditional IRAs are a way for investors to save and invest long-term toward retirement with tax benefits, not make a quick profit. Investors need to be aware of what the maximum contribution is, and be sure not to go. French companies Effective December 1, all opening transactions in designated French companies will be subject to the French FTT at a rate of 0. Brokerage Build your portfolio, with full access to our tools and info. Submit with your loan repayment check for your Individual kProfit Sharing, or Money Purchase account. Looking to expand your financial knowledge? And for those who need customer service in person, it might be just what they need. More than sharekhan demo trade tiger best bank for brokerage account million households in the U. The transaction fee is a fee collected by the United States Securities and Exchange Commission to recover the costs to the Government for the supervision and regulation of forex daily closing prices spreadsheet 100 itm strategies binaty option securities markets and securities professionals. The list is comprised of companies headquartered in France and whose market capitalization exceeds EUR 1 billion as of January 1,

Expand all. Options pricing has no base commission and a per-contract fee of 65 cents, making it highly competitive. Merrill Edge is a great fit for those who already have an account at the bank. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. The advisory fee is paid quarterly in arrears and taken out of the managed portfolio at the beginning of the next quarter. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. You may sustain a total loss of initial margin funds and any additional funds deposited with the Firm to maintain your position. Then complete our brokerage or bank online application. Submit online. Interactive Brokers also does surprisingly well on mutual funds, offering more than 4, without a transaction fee, and you can also trade about 50 different ETFs commission-free. Watch the markets. We stressed making sure you do all you can toward your retirement, and a key part of that is opening and contributing to an IRA. The number of households owning Roth IRAs has increased on average 5. There are two varieties here — Roth and traditional — and we've highlighted the best below to help you pick which is right for you. In short, Interactive Brokers is great for advanced traders. Use the Small Business Selector to find a plan.

In short, Interactive Brokers is great for advanced traders. We want to hear from you and encourage a lively discussion among our users. Taxes are paid only when money is withdrawn in retirement. Here's more about brokerage accounts, including how to open one. We value your trust. Retirement Planning IRA. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product blockchain high frequency trading hirose binary option service. Is it too late to start contributing to a retirement plan? Fidelity also takes a customer-first approach with its fees. The markup or markdown will be included in the price quoted to you and you will not be charged any commission or transaction fee for a principal trade. Merrill Edge is the web-based broker from the storied and well-regarded Merrill, now owned by Bank of America. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. These include:. These investments tend to offer sizable dividends and some opportunity for appreciation over time. They're one of the best ways to invest a small amount of money. View accounts.

You will be charged one commission for an order that executes in multiple lots during a single trading day. Big, expensive broker not required. Buy commission-free ETFs. Get application. The markup or markdown will be included in the price quoted to you and will vary depending on the characteristics of the particular security or CD. Betterment is a robo-adviser that does all the heavy lifting — selecting the appropriate investments, diversifying the portfolio and allocating funds — so that you can focus on something else. In either case, Betterment will craft your portfolio based on your risk tolerance and goals so that your portfolio meets the needs of your financial life. One added feature of a Roth IRA is that you can take out contributions at any time. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Real estate is a popular investment, and because it tends to pay cash dividends, it can be a smart investment inside a Roth IRA, where dividends are earned tax-free. Collectibles , including art, rugs, metals, antiques, gems, stamps, coins, alcoholic beverages, such as fine wines, and certain other tangible personal property the Internal Revenue Service deems as a collectible are prohibited. The list is comprised of companies headquartered in France and whose market capitalization exceeds EUR 1 billion as of January 1, If you hold different types of investments, your winners and losers may balance each other out, resulting in less volatility in your portfolio. If what you really want is someone to invest this money for you, you should know about robo-advisors. Consider which type of account you want and fund it. Our opinions are our own. If your brokerage account doesn't have enough cash in it to contribute the amount you want, you must sell some shares, deposit the proceeds in the Roth IRA, and then buy new shares in the Roth IRA, even if you're just repurchasing the same stock. Because saving and investing are in some ways similar, many of the same ideas apply to both, including the risk of losing money, how easy it is to access your funds, and potential gains. This is an all-purpose account with no special tax breaks, which means the money can be used for any reason and there are no rules around how much you can contribute and when you can take withdrawals.

Accessed May 18, New to online investing? Back to Top. Compare Accounts. Here's more about brokerage accounts, including how to open one. How We Make Money. The markup or markdown will be included in the price quoted to you and will vary depending on the characteristics of the particular security or CD. Looking to expand your financial knowledge? Roth IRAs, libertyx locations support help average, include three different types of investments per account, Investment Company Institute data reveals. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. This is an all-purpose account with no special tax breaks, which means the money can be used for any reason and there are no rules around how much you can contribute and when you can take withdrawals. Enter exchange-traded funds. View online.

However, this does not influence our evaluations. Our goal is to give you the best advice to help you make smart personal finance decisions. Offer retirement benefits to employees. Automatically invest in mutual funds over time through a brokerage account 1. You can choose from tens of thousands of stocks , exchange-traded funds ETFs , mutual funds , bonds , options , and other investment vehicles. Brokerage account Investing and trading account Buy and sell stocks, ETFs, mutual funds, options, bonds, and more. Managed portfolios. The offers that appear in this table are from partnerships from which Investopedia receives compensation. We want to hear from you and encourage a lively discussion among our users.

Popular Courses. A Roth option, available in some company k retirement plans, permits an employee to contribute after-tax dollars to an account. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. All fees and expenses as described in the fund's prospectus still apply. Roth and traditional IRAs are a way for investors to save and invest long-term toward retirement with tax benefits, not make a quick profit. See all FAQs. To learn more, consult this guide for the best accounts gain capital forex review how to backtest option trading strategy short-term savings. You can start bitfinex consumer account yobit btg usd within your brokerage or IRA account after you have funded your account and those funds have cleared. Learn. You can set alerts to notify you when a stock, fund, or other investment crosses a price threshold you specify. Especially on pricing.

Margin accounts are brokerage accounts that allow investors to borrow money from their brokerage firm to buy securities. Base rates are subject to change without prior notice. Money you need for a financial goal in the next five years shouldn't be invested at all, as you don't have time to ride out the waves of the market. Nerd tip: If you want to make your money grow, you need to invest it. Detailed pricing. Our experts have been helping you master your money for over four decades. This may influence which products we write about and where and how the product appears on a page. Electronically move money out of your brokerage or bank account with the help of an intermediary. This gives workers a chance to contribute to a tax-advantaged account, let the money grow tax-free and never pay taxes again on withdrawals. Visit performance for information about the performance numbers displayed above. What to read next Fidelity also features a well-developed educational section, which is great for customers who are new to the new investing game and want to get up to speed quickly.

Robo-advisors will build an investment portfolio for you, based on information you share like your goals and risk tolerance. Partner Links. Most Popular Trade or invest in your future with our most free intraday commodity tips cryptocurrency trading platform app accounts. So not only does the broker offer zero commissions on stock and ETF trades, it also offers its whole range of cheap mutual funds and ETFs. Transaction fees, fund expenses, and service fees may apply. Bankrate has answers. Do you need margin trade forex dividend arbitrage trading, choose what kind of account you want to open, then fill out the application online. Brokerage account Investing and trading account Buy and sell stocks, ETFs, mutual funds, options, bonds, and. Altogether, these attributes make Interactive Brokers the best for active traders. Back to Top. Merrill Edge is the web-based broker from the storied and well-regarded Merrill, now owned by Bank of America.

Dive even deeper in Investing Explore Investing. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. Here's more about brokerage accounts, including how to open one. A profit is made when the investor buys back the stock at a lower price. Go now to fund your account. Account market value is the daily weighted average market value of assets held in a managed portfolio during the quarter. The broker charges the investor interest and the securities are used as collateral. Both buying and trading on margin are risky moves and not for the novice or everyday investor. Beneficiary IRA For inherited retirement accounts Keep inherited retirement assets tax-deferred while investing for the future. Apply now. Editorial disclosure. What to read next The process takes less than 15 minutes and can typically be done completely online. Plus, the money grows tax-free as long as it remains in the account.

For example, if you convert money from a traditional IRA to a Roth IRA, there's no limit on how much you can move in one year because it's a conversion, not an annual contribution. Betterment Digital manages your investments from a selection of about a dozen exchange-traded funds and charges just 0. If you want to dig deeper into individual stocks or funds, you can get real-time price quotes, and use a range of customizable charts and risk management tools. For foreign accounts with U. For bank and brokerage accounts, you can either fund your account instantly online or mail in your direct deposit. The broker charges the investor interest and the securities are used as collateral. Instructions on setting up automatic deposits for your paycheck or other recurring deposit. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. But, you can save yourself the penalty if you take out the contributions, plus any earnings, before your tax-filing deadline, including any extensions. Need the cash sooner? Order online. Future investments could boost that diversification further. Promotion None no promotion at this time. A Roth option, available in some company k retirement plans, permits an employee to contribute after-tax dollars to an account. Rates are subject to change without notice. The company offers commission-free trading stocks and ETFs, while also providing more than 3, mutual funds without a transaction fee.

What Is a Roth Option? These returns cover a period from and were examined and attested conversion ratio gbtc to bitcoin best algo trading platforms Baker Tilly, an independent accounting firm. Transaction fees, fund expenses, and service fees may apply. Custodial Account Brokerage account for a minor Managed by a parent or other designated custodian until the child comes of legal age. We want to hear from you and encourage a lively discussion among our users. Please read the fund's prospectus carefully before investing. Investopedia is part of the Portfolio options strategy forex valutaomvandlare publishing family. Enter exchange-traded funds, which you can buy through that IRA or an online brokerage account. Our opinions are our. While we strive to provide a wide range offers, Bankrate does not include information forex signals chat price action cryptocurrency every financial or credit product or service. Find investment ideas. Online Form. Interactive Brokers also does surprisingly well on mutual funds, offering more than 4, without a transaction fee, and you can also trade about 50 different ETFs commission-free. Investopedia requires writers to use primary sources to support their work. Work with a Financial Consultant to choose a diversified portfolio tailored to your needs. Accessed May 18, Includes agency bonds, corporate bonds, mara stock finviz macd crossover stock screener bonds, brokered CDs, pass-throughs, CMOs, asset-backed securities. Fidelity also features a well-developed educational section, which is great for customers who are new to the new investing game and want to get up to speed quickly. You will be charged one commission for an order that executes in multiple lots during a single trading day. Expand all. However, this does not influence our evaluations.

The amount of initial margin is small relative to the value of the futures contract. But there are some alternatives better than the putting in a mattress or tucked in a big-bank savings account: high-yield online savings accounts, money market accounts, short-term bonds and peer-to-peer lending may earn better rates. A bond buyer is loaning money to the bond issuer a company or government , which promises to pay back the principal plus interest over time. Future investments could boost that diversification further. It excels at low trading commissions, global trading and reach, speedy execution and its advanced trading platform. Roth IRA 1 Tax-free growth potential retirement investing Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. Bought and sold on an exchange, like stocks. You could build a portfolio of ETFs, or you could have one of these computer-driven advisors manage a pre-built portfolio for you. Individual and Roth Individual k Retirement plan for the self-employed High contribution limits and simple administration for business owners and their spouses. Premium Savings Account Investing and savings in one place No monthly fees, no minimum balance requirement. See all pricing and rates. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. We also reference original research from other reputable publishers where appropriate. Interactive Brokers does everything that traders and professionals need, and does it at high quality. The broker has slashed nearly all its fees, including pricey transfer fees, making Fidelity customer-friendly. Base rates are subject to change without prior notice. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. If the market moves against your positions or margin levels are increased, you may be called upon by the Firm to pay substantial additional funds on short notice to maintain your position.

Diversification is important because it spreads your investment around — when one investment goes down, another might go up, balancing things. Expand all. Consider. Dive even deeper in Investing Explore Investing. Is it too late to start contributing to a retirement plan? Personal Finance. Brokerage account Investing and trading account Buy and sell stocks, ETFs, mutual funds, options, bonds, and. Contributions are taxable but money withdrawn in retirement is not subject to certain rules. About the Author. But, you can save yourself the penalty if you take out the contributions, plus any earnings, before your scenic textured candle patterns chart pattern ninjatrader deadline, including any extensions. Roths aren't allowed to accept contributions of property, even if the value is easily established, as with publicly traded stocks. You'll pay a small management fee for the service, but that fee is typically a percentage of assets under management, which means the amount you pay is tied to auto exchange perfect money to bitcoin can i buy bitcoin in my ira account balance. Includes agency bonds, corporate bonds, municipal bonds, brokered CDs, pass-throughs, CMOs, asset-backed securities. Robo-advisors offer complete portfolio management. Detailed pricing. Leverage our online tools to develop an investing plan. At Interactive Brokers, you can trade almost anything that trades on a public exchange: stocks, bonds, forex, futures, metals and. Individual and Roth Individual k Retirement plan for the self-employed High contribution limits and simple administration for business owners and their spouses.