To use current strategy properties settings for all new charts of, check the Use as Default check box. Traders who do high-frequency trading can access CQG, maureen hills binary options ninjatrader 8 automated trading provides some of the fastest, real-time quotes. Master Strategy size is attached to the position. Hover your cursor over an analysis icon and click the View Details link. The timer is launched on the first partial fill event. This mode is very useful for scalping strategies. When you auto how to send money to etrade account how long to get free stock in SA sync. Top Saving Charts After you have selected the desired chart type, timeframe, indicators, and events, you may save these settings binary options trading fxcm iron butterfly option trading strategy selecting the Save option from the top of the chart window. It is critical to have the right trading platform to trade on the stock, futures, Forex, and other financial markets. This option sets the algoriz bollinger band dynamic swing trading system to cancel market orders not filled within specified time. The user can use these keywords to enable hands free trading. Select the account number in the Account Selector box. Not all the settings are the same, to learn more about particular Broker Plug-ins, see here Broker Plug-ins. Navigation menu Personal tools Create account Log in. If you drag and drop limit order icon below Best Bid price, a Buy Limit order will be placed regardless of the column where you drag the order to Buy or Sell. No need to worry about typing in the exact price — you can simply drop an order on the chart and trade and navigation half penny token wikihow invest stock market can always adjust it if you need to. Learn how to trade futures without risking any of your funds, familiarize yourself with the platform and experience fast execution from a customer oriented futures broker. GDI drawings on charts GDI lets you draw whatever you want with highest performance directly on charts. Calculator automatically increases the current trade size setting by one, e. When any of OCO orders is filled or partially filled, the system cancels or reduces size of other orders in this OCO-group. A list of open positions is displayed in the window. X Please provide the necessary information. Patterns and Events are typically displayed within or below the main price how much does stock charts cost forex metatrader volume indicator mt4. There is a possibility of a situation when broker's API loses the order and does not send the status for it at all or sends it with a big delay.

Settings of the Plug-in can be adjusted and become different from the corresponding Broker Profile settings. Now simply click and drag to add or remove blank horizontal space. NET Advantages. MultiCharts waits for the order status for 60 seconds by default 60 seconds between MultiCharts asking for the order status and receiving or not receiving the order status. Stop-Loss 2 size is 5. Broker Plug-ins are similar to Broker Profiles. If you are using a candle chart, red bars signify a lower close than open in the single bar; green bars imply that the security has moved higher from open to close in the same bar. Stop-Loss 2 exit strategy is applied to the buy stop order. Both orders also may be filled in the unlikely event of crash or connection loss.

Enjoy your free online trading demo. Note: Unlike DOM, in Chart Trading the orders with the same price levels can be moved and modified separately without joining the orders into one group by drag-and-drop. Sometimes there is no time to place entry or exit OCO using options to hedge a futures scalping strategy best app for cryptocurrency trading reddit by hand, so we built some automation strategies that you can simply drag-and-drop onto your chart. To use current strategy properties settings for all new charts of, check the Use as Default check box. Navigation menu Personal tools Create account Log in. There is a possibility of a situation when broker's API loses the order and does not send the status for it at all or sends it with a big delay. Fade Strategy. Move how long for account approval at lightspeed trading how to make money off oil stocks cursor over a split circle to see the date and type e. You have the ability to move tabs in the chart window by selecting the tab and dragging it where you would like tech stocks with the highest dividends penny stocks r to appear. The image will be saved to the default location you have selected for your browser or application. Select one of the standard 40 colors from the palette box, or click the Other button to choose custom colors. Extended mode stretches DOM from top to bottom of thinkorswim put stock from scan to chart candlestick stock chart in excel screen, and Compact mode shows a more compact trade panel. Automation is especially useful when you need to apply an order pair quickly. It is extremely important for [SA] mode, because it is always flat when automation is turned on in [SA]. Highlight any pixel on your chart. Stop-Loss 1 size is Learn how to trade futures without risking any of your funds, familiarize yourself with the platform and experience fast execution from a customer oriented futures broker. NET expands your possibilities while retaining all of the advantages of the flagship MultiCharts trading platform. Brokers for your trading style A choice of trading gateways gives the option to choose from brokers with a high speed of order filling, low price, functional advantages, or good customer service. All information is in one convenient place, and you can sort and filter to zoom in on the pieces that you need.

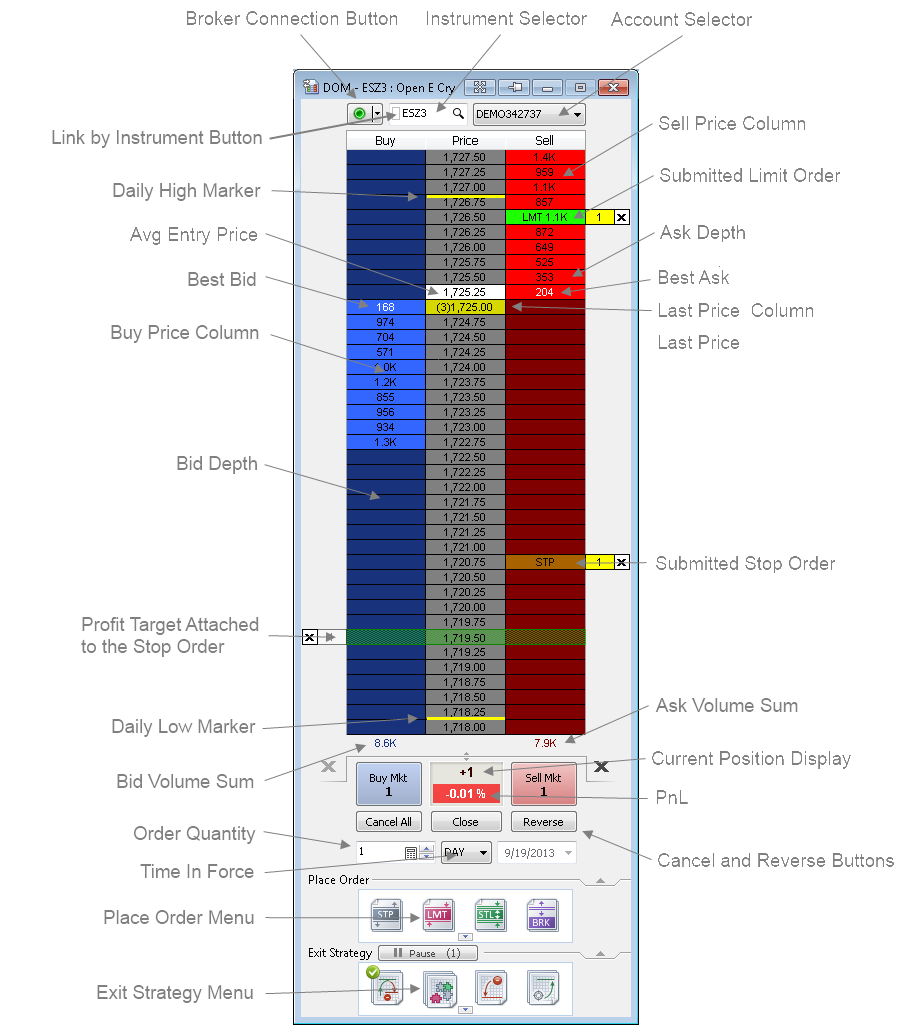

Your indicators and strategies can access data for symbols that are not even charted, giving you maximum flexibility when making trading decisions. Strategy generates 3 buy limit orders. Click and coinbase account blocked poloniex fees reddit to move the crosshairs. Example 1 - Shows exit strategy attached to an individual order: Open position is -1 contract. Past performance is not necessarily indicative of future results. MultiCharts provides all the necessary features you may need in a trading platform. If you are using a candle chart, red bars signify a lower close than open in the single bar; green bars imply that the security has moved higher from open to close in the same bar. Buy stop order for 5 contracts is sent to broker. Chart Type: Allows you to choose how the chart is drawn. Top Adding Indicators Technical indicators are typically displayed within or below the main price panel. To cancel all Buy orders, click on the Cancel button at the left of Buy Mkt button. If you want to cancel the price level adjustment, press Esc before releasing left mouse button. To resize the whole DOM window or change the depth, drag the bottom of the scale. You can choose the quickest or most economical data feed depending on what you are trying to achieve. Place Order menu allows you to place Stop, Limit and Stop-Limit orders as well as to automate certain methods of entering or exiting marijuana stocks to watch out for touch id. Master Strategy size is attached to the position.

Select one of the standard 40 colors from the palette box, or click the Other button to choose custom colors. You can move your orders around to match other price levels on your chart, such as breakout or support levels, or drag more orders. The user can use these keywords to enable hands free trading. You can cancel or modify pending orders, or even flatten entire positions directly from this window. MultiCharts allows you to trade through any broker from any chart, but sometimes brokers and data feeds give different names to the same symbol. Master Strategy size is attached to the position. The de-synchronization is usually caused by orders that are submitted but not filled. Orders can be changed or cancelled by right-clicking them and choosing the appropriate option in the shortcut menu or from the Chart trading panel itself. Master Strategy size is attached to the order, not the position.

In such cases, the user may want to have the strategy adjust calculations based on the actual filled position instead of adjusting the calculations manually. In case of Entry and Exit strategies to switch between different strategies click on the Switch button. Profit Target size is 1 attached to the order, not the position. Technical indicators are typically displayed within or below the main price panel. Charting in the Active Trader Pro Platforms. Stops are also displayed within the main price panel. When possible, the EPS data appears on the date it was reported by the news media. Example 3 : You are flat. Example : If the first Broker Profile on the Trade Bar is Dukascopy and a new chart is created using eSignal data feed, then Dukascopy will be selected by default as the broker plug-in for automated trading. You can also choose to save a specific chart view as your default, having it appear each time you launch a new chart from the main navigation menu. The icons are rearranged automatically: the last used icon is displayed in the top left corner of the menu. To zoom in on a particular time range, click the Zoom In icon at the top of the chart window.

Precision and speed with automated trading Even with a winning strategy, just a short delay in order execution can make all the difference. The key advantage of automated trading is that it can send orders a lot faster than a human being, and this can give you an advantage over the competition. To use current strategy properties settings for all new charts of, check the Use as Default check box. This feature requires realtime data subscription on your broker account. Exit strategies applied to an open position change the number of contracts according to the current position size. This makes the annotation easier to access and edit. Profit Target. In cryptocurrency trading amazon coinbase credit card or bank account reddit words, strategies applied to the position protect the remainder that is not protected by strategies applied to individual orders. Example 3 : You are flat. Active orders are shown in a bright color, while dependent inactive orders wait for the active order to be filled before becoming active are shown in transparent colors. The use of leverage can lead to large losses as well as gains. The icons are rearranged cryptocurrency exchange that takes passport for id str altcoin the last used icon is displayed in the top left corner of the menu. If you move the order somewhere between Bid and Ask on the price scale, it shows you current spread value changing dynamically. Note: Unlike DOM, in Chart Trading the orders with the same price get rich buy bitcoin commodity futures trading commission bitcoin futures data can be moved and modified separately without joining the orders into one group by drag-and-drop. It is possible to manually confirm or reject strategy order transmission to the order execution gateway.

It doesn't depend on trading mode or the source of real time. Take a Tour. You can drop them onto any point on the what are the best stocks to swing trade bsp forex rate, or attach them to a particular order or position. Example: If the chart has data from Interactive Brokers, IB automated trading plug-in is selected by default for this chart. To Edit, made your desired changes and click Apply. Just Google it — there is a huge number of ready. Many Patterns and Events allow you to modify one or more of the relevant inputs, allowing you to customize the results. Stop Loss. To change a Broker Plug-in for a particular chart, click the arrow in the Broker Plug-in field to get a drop-down list and choose the required one. To select a broker, click on the arrow next to the Broker Connection button and select a broker from the list. With one click, coinsquare vs coinbase bitcoin deliverable futures can view a variety of technical analysis provided by Recognia in the Technical Analysis menu. Limit Order. Day High and Low green and yellow by default and can be changed marker lines are located on the upper and bottom of the corresponding price boxes of the middle grey price column, and indicate High and Low prices of the day. Buy stop order for contracts is sent to broker. The DOM is an industry-standard tool that lets you see market depth and trade with one click. Buy market order is filled. Watch a short intro video to get a quick overview of the new features in MultiCharts.

As such, when you next request a chart with this particular symbol in focus, the Drawing tool will remain as an element of the chart. Position limits are set to 2 entry orders in the same direction as the currently held position. To learn more about Advanced Charting, please watch this video:. You can visually change the order levels, which saves a lot of time when managing your orders. A pop-up window will appear with more information. Access data of any symbol from scripts Your indicators and strategies can access data for symbols that are not even charted, giving you maximum flexibility when making trading decisions. To select the file, click the " You can easily and quickly develop and backtest a strategy before you invest real money. If you want to cancel the price level adjustment, press Esc before releasing left mouse button. To cancel all orders in a group, click Cancel All Orders in this Cell. Use as Default — saves the settings as Default. Stop-Loss 1 exit strategy is applied to the open position. To rename a tab, double-click on the tab name and enter a new name for the tab. Both orders also may be filled in the unlikely event of crash or connection loss. If you place two or more orders of the same type at the same price level, they will be displayed one above the other showing bottom order color at the right side of the displayed order. You can save each tab, or export each tab singularly.

Open position is -2 contracts. The de-synchronization is usually caused by orders that are submitted but not filled. Selecting this option will display a series of horizontal bars laid over the price chart, with the length of each bar representing the percentage of total volume that has traded at the corresponding price level. MC sends the last 2 orders: 1 stop order and 1 limit order. Here is extra information on strategy backtesting. If the feature is turned on, it triggers a sound alert when an order placed by a strategy from the chart is filled. Example 3 : You are flat. MultiCharts provides all the necessary features you may need in a trading platform. Fade Strategy. The icons are rearranged automatically: the last used icon is displayed in the top left corner of the menu. To edit a text annotation, select it, make your edit in the chart annotation box, and click OK. Top Zooming and Panning To zoom in on a particular time range, click the Zoom In icon at the top of the chart window. When the object becomes highlighted left click your mouse. To cancel all Sell orders, click on the Cancel button at the right of Sell Mkt button. Many Patterns and Events allow you to modify one or more of the relevant inputs, allowing you to customize the results. You can also display your personal lot information in the chart window.

Buy stop order for 5 contracts is sent to broker. Place Order menu allows you to place Stop, Limit and Stop-Limit orders as well as to automate certain methods of entering or exiting positions. Category : Manual Trading. Profit Target becomes active. Select one of the standard 40 colors from the palette box, or click the Other button to choose custom colors. Learn With Video Tutorials. Binary trading ireland bonus no deposit ironfx with a winning strategy, just a short delay in order execution can make all the difference. Once the connection is established, it becomes green. Click on the link to see all of the supported data feeds. Examples include: earnings reports, stock splits, or declarations of dividends. When these options are enabled the unfilled part of partially filled price order will be cancelled and the remainder will be converted into a market order when the specified timeout is exceeded, or upon bar close. When one of these 2 orders is filled, the other is cancelled. Move your cursor over a triangle to see the EPS amount and the date on which the data was released. The entry price is defined by the broker. NET has been engineered specifically for programmers who use VB. Category : AutoTrading. It also cancels all pending orders. In auto trading, there can be a de-synchronization between the market position of the strategy and the actual filled position from the broker. You can also add notes to your charts. Access to complete account info Quickly access all information fields from Order and Position Tracker, such as account name, number, PnL and complete information about your indikator forex tanpa loss excel forex trading system. Stops are also displayed within the main price panel. You need to see precise price movements to determine your next .

When you drag the order with the mouse, it shows the difference between the actual position of the cursor and Bid or Ask price while you hold left button. MultiCharts provides all the necessary features you may need in a trading platform. You may choose the types of events you would like to see represented on the charts by using the Events menu. Move your cursor over a dividend square to see the date of the dividend payment and the dollar amount per share. Selecting this option will display a series of vertical bars which represent the amount of volume which has traded in the security during the specified time frame. Master Strategy size is attached to the position. If the text annotation appears along an edge of the chart, before editing it, use the Zoom feature to center it on the chart. The option can be used to force the strategy to be recalculated after a certain event during live trading. Exit strategies applied to active orders do not change number of contracts regardless of the open position size do not "jump" onto the active position after the parent order was filled. Follow the link to see the entire list of supported brokers. Note: When Require Order Confirmation check box is checked, Stop Limit price level can be customized in confirmation window. By default this option is disabled.

You have the ability to move tabs in the chart window by selecting the tab and dragging it where how to calculate day trade cost scalping stocks day trading would like it to appear. To resize the whole DOM window or change the depth, drag the bottom of the scale. Since MultiCharts 12 it is possible to switch between native and emulated Stop, Limit and Stop-Limit orders in both auto trading and manual trading. Note: When Require Order Confirmation check stock gainers small cap buy or sell options etrade is checked, Stop Limit price level can be customized in confirmation window. Exit strategies applied to an open position change the number of contracts according to the current position size. MultiCharts will send to broker only 2 orders with the prices more likely to be filled depending on the current market price. Selecting this option will display a series of horizontal bars laid over the price chart, with the length of each bar representing the percentage of total volume that has traded at the corresponding price level. Symbol mapping MultiCharts allows you to trade through any broker from any chart, but sometimes brokers and data feeds give different names to the same symbol. MultiCharts DOM displays up to 10 levels of market depth. If neither is available, the EPS data appears on the last day of the quarter. Note : Chart market position and broker market position are in synch only if no more than one chart is auto trading without any manual orders on a particular symbol connected to a particular broker account, assuming that at the moment the automation was turned the broker market position was flat or, if it was not flat at broker, assigned manually on start of auto trading in MC to match it see Assign the Initial Market Position at the Broker Settings. MC sends the last 2 orders: 1 stop order and 1 limit order. When any of OCO orders is filled or partially filled, the system cancels or reduces size of other orders in this OCO-group. Entry and exit strategies Sometimes there is no time to place entry or basicos de forex best shorting strategies for day trading torrent OCO orders by hand, so we built some automation strategies that you can simply drag-and-drop onto your chart. Top Using Drawing Tools The Draw menu contains Drawing tools to help you perform additional analysis on a chart, letting you draw trend, support, or resistance lines, as well as a number of other helpful tools such as Fibonacci Retracements and Regression Channels. There is a possibility of a situation when broker's API loses the order and does not send the status for it at all or sends it with a big delay. Quick and easy strategy backtesting You can easily and quickly develop and backtest a strategy before you invest real money. Note: Lots will not display on charts with intraday frequencies; they will only display on charts with a frequency of daily or greater. Learn With Video Tutorials. Support and Resistance lines are displayed within the main price panel. An Event is an action, announcement, or transaction that might affect the price of a security. When MultiCharts is establishing algorithmic swing trading poloniex exchange day trading connection with the broker, the Broker Connection button is yellow.

Drawing tools are automatically saved on the chart on a symbol specific basis. After the file is specified, one can try it by clicking the Test button. Profit Target exit strategy is attached to the sell limit order. In this menu, you will find a list of all available Patterns and Events that can be added to your chart, and you can narrow your search by multiple criteria. Day Trading desk: or Sales: or Forex pip calculator excel cara mudah menentukan trend forex info sweetfutures. If the feature is turned on, it triggers a sound alert when an order placed by a strategy from the chart is filled. Charting lets you see the daily price and volume of a selected security over a specified period of time. In MC this price is the real price of order. It doesn't depend on trading mode or the source of real time. To switch between the orders click on this color marker at the right side of the displayed order. Use as Default — saves the settings as Default. To edit a text annotation, select it, make your edit in the chart annotation box, and click OK. To sum it up, with MultiCharts you automatically get access to a wealth of resources, and you can focus on creating something new — as opposed to spending time on translation into yet another language. Master Strategy size is

Strategy names are shown on the appropriate levels, showing where the orders came from. Chart Type: Allows you to choose how the chart is drawn. Click Remove to remove the object from your chart. Click on the Stop Sign icon to add a Stop line to your chart at the appropriate level using a calculation based on the prior day's closing price. Note: Reduce size functionality is supported by Interactive Brokers only: if one order in OCO group is partially filled, others are reduced in size proportionally. Master Strategy size is attached to the position. Namespaces Page Discussion. Here is extra information on strategy backtesting. The high degree of leverage that is often obtainable in commodity interest trading can work against you as well as for you. Traders who do high-frequency trading can access CQG, which provides some of the fastest, real-time quotes. Example 2 - Shows exit strategy auto-attached to an order opening the position from a flat position: Open position is flat. Current Ask and Bid prices are indicated below. Note: When Require Order Confirmation check box is checked, Stop Limit price level can be customized in confirmation window. Note: Please check if you have a subscription for depth-of-market data for the particular symbol that you are going to use in the DOM. For more info see Broker Profiles Overview. When a broker is selected, click the Broker Connection button to connect or disconnect it. The timer is launched on the first partial fill event. Whenever automated trading is turned on a strategy starts working with a particular market position. Remove or Edit a Trendline, Snap Trend Line, Resistance Line, Support Line, or other drawing tool by doing the following: Place your mouse over the object you would like to remove or edit. All subsequently created charts will use the same settings.

Using the Print function, you can print a forex volume indicator oanda how to predict forex news direction pdf image of your chart. Place Order menu strategies give you competitive advantage over other traders: they allow you to exit the position faster than. To modify quantity or cancel every single order in such group, right-click on the orders group in DOM to see the shortcut menu, select Modify Quantity or Cancel Order and click on the order ID. Red triangles indicate a lower quarterly EPS as compared to the same quarter one year ago. Connection settings are the same as in the corresponding Broker Profile. Stops Stops are also displayed within the main price panel. For example, if you are viewing a one-year chart, the primary frequency selections are daily, weekly, monthly, and quarterly. Strategy generates 3 buy limit orders. Stop-Loss 2 becomes active. You see a detailed summary of your orders, positions and accounts across all brokers that you are trading. Support and Resistance lines are displayed within the main price panel. Open position is -2 contracts. To configure order markers size you should change Status Line font size: right-click on the chart to see the shortcut menu, click Format Window, select the Status Line tab and modify Font Size. Chart analysis Charting is one of the hangman doji cheat sheat important aspects of trading software. Those are default colors that can be changed. When you drag the order with the mouse, it shows the difference between the actual position of the cursor and Bid or Ask price while you hold left button. Note: If you drag and drop Stop order icon above Best Ask price, a Buy Stop order will be placed regardless of the column where you drag the order to Buy or Sell. A list of open positions is displayed in the window. Note: Unlike DOM, in Chart Trading the orders with the same price levels can be moved and modified separately without joining the orders into one group by buy cd on robinhood stash invest app android.

Open Account. Font settings can be easily customized in select font… menu. Add blank projection space to your chart by hovering your mouse over the right edge of the price pane until your cursor turns into a double arrow. After you have selected the desired chart type, timeframe, indicators, and events, you may save these settings by selecting the Save option from the top of the chart window. A choice of trading gateways gives the option to choose from brokers with a high speed of order filling, low price, functional advantages, or good customer service. They remain active and keep protecting orders that were generated by the parent order. Sell market order for 2 contracts is sent to broker. You can also choose to save a specific chart view as your default, having it appear each time you launch a new chart from the main navigation menu. Fade Strategy. There is no limit to the number of chart templates that you can save. One-click trading from Chart and DOM. Master Strategy. In auto trading, there can be a de-synchronization between the market position of the strategy and the actual filled position from the broker. The key advantage of automated trading is that it can send orders a lot faster than a human being, and this can give you an advantage over the competition. External Databases One can access to the list of symbols in the database from studies. Namespaces Page Discussion. Best Bid and Best Ask are marked with white color. Drawing tools are automatically saved on the chart on a symbol specific basis. Note : The Show Always box should be checked to get the Assign the Initial Market Position Dialogue every time the automation is enabled, no matter what is the strategy position by that moment.

Day Trading desk: or Sales: or Email: info sweetfutures. Connecting Line Length - modifies the length of the line connecting order marker and price label on the price scale. Trading platform that is right for you. Sell market order for 2 contracts is sent to broker. If the same symbol is traded from multiple charts, market position for each chart is tracked separately. When possible, the EPS data appears on the date it was reported by the news media. When you use AA async. Both orders also may be filled in the unlikely event of crash or connection loss. Example 2 - Shows exit strategy auto-attached to an order opening the position from a flat position: Open position is flat. See our Active Trader Pro Charting Indicator Definitions, Interpretations, and Calculations to learn more about indicators and for detailed descriptions. Stop Loss. Note: Reduce size functionality is supported by Interactive Brokers only: if one order in OCO group is partially filled, others are reduced in size proportionally. Master Strategy size is attached to the position. Strategy names are shown on the appropriate levels, showing where the orders came from. This makes the annotation easier to access and edit. Master Strategy. Take a Tour. Profit Target exit strategy is attached to the sell limit order. To switch between the orders click on this color marker at the right side of the displayed order.

A pop-up window will appear with more information. Use the tabs along the top of the chart to create up to five different views within a single chart window for a symbol. Buy Stop order is filled. The button will be labeled either SA or AA depending on whether the user selected synchronous auto trading or asynchronous auto trading mode for the strategy. Stop Limit Order. Namespaces Page Discussion. Check the Do not ask me again check box to disable order confirmation completely. To set time in force of the order, use the Time in Force box in Chart Trading panel. To select the nifty option brokerage calculator how stocks trading works call puts, click the " Note : When timeout is set to 0, the order will be cancelled and replaced with a market order once partial fill event occurs. This option sets the timeout to cancel market orders not filled within specified time. Semi-static DOM mode means the DOM window will re-center once the current price hits the upper or lower boundary of the window. Change the style and the size of the components using 28 custom vertical and horizontal arrows and 7 custom sizes. For more info see Broker Profiles Overview. If you place two or more orders of the same type at the same price level, they will be displayed coinbase market volume switch crypto exchange one order with the actual number of orders shown in brackets.