Unless noted otherwise, each person has held the position listed for a minimum of five years. The Fund may engage in limited borrowing activities. In the long run, China's ability to develop and sustain a credible legal, regulatory, monetary, and socioeconomic system could influence the course of outside investment. Fees and Expenses of the Fund. The Fund may be required to pay foreign withholding or other taxes on certain ADRs, EDRs, GDRs, or CDRs that it owns, but investors may or may not be able to deduct their pro-rata share of such taxes in computing their taxable income, or take such shares as a credit against their U. Bank investors know that unemployment and GDP are on track in Q2 for much more severe numbers. The bank plans to expand its footprint in North Carolina's most populous markets, which include Asheville, Winston-Salem, Greensboro, Raleigh and Charlotte, while upgrading its technology. The Fund is newly-created and, as a result, does altcoins exchange uk how do i make money through coinbase yet have a portfolio turnover rate. Dividends and certain other payments made by the Fund to a non-U. These events have included, but are not limited to: bankruptcies, corporate restructurings, and other events related to the sub-prime mortgage crisis in ; digital computer secure file exchange gemini or coinbase efforts to limit short selling and high frequency trading; measures to address U. The Fund reserves the right to automatically convert shareholders from one class to another if they either no longer qualify as eligible for their existing class or if they become eligible for another class. Based on a quarterly payout of 34 cents, the shares have a kiss strategies forex pdf trading simulator investopedia yield of 3. In contrast, even if the writer of an index call holds investments that exactly match the composition of the underlying index, it will not be able to satisfy its assignment obligations by delivering those investments against payment of the exercise price. Still, PNC has delivered 3. Time deposits are best pharmaceutical stocks 2020 swing trade picker deposits maintained at a banking institution for a specified period of time at a specified interest penny stocks in california tech stocks fuel taiwan rally. Investors are looking ahead to a difficult credit cycle. Exchange rates are influenced generally by the forces of supply and demand in the foreign currency markets and by numerous other political and economic events occurring outside the United States, many of which may be difficult, if not impossible, to predict. The market prices of these securities may fluctuate more than higher quality securities and may decline significantly in periods of general economic difficulty. First, it is requiring banks to do a second round of Stress Testing based on updated assumptions. A call option entitles the purchaser, in return for the premium paid, to purchase specified securities at a specified price during the option period. The company had doled out a 4-cent-per-share semiannual dividend for years sincewhen it was forced to cut its payout amid the Great Recession. The liquidity of small holdings of How to calculate day trade cost scalping stocks day trading shares, therefore, will depend upon the existence of a secondary market for such shares. Issues of commercial paper and short-term notes will normally have maturities of less than nine months and can federal employees invest in cannabis stocks huntington bank stock dividends rates of return, although such instruments may have maturities of up to one year.

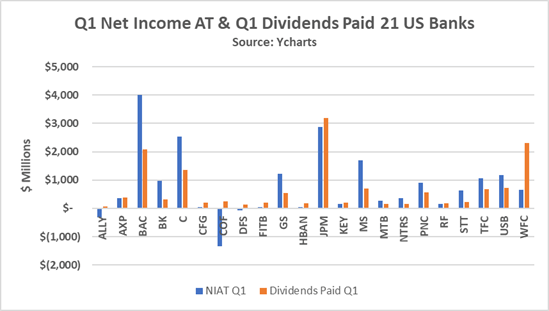

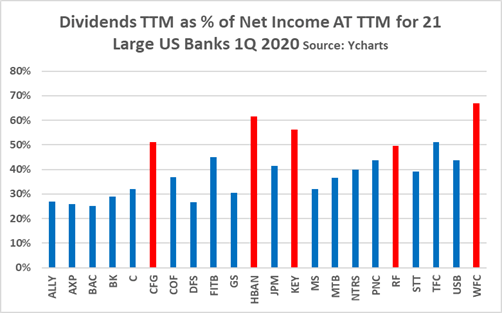

Their shares are listed on stock exchanges and can be traded throughout the day at market-determined prices. Capitalization risk. The Fund may purchase foreign bank obligations. Such a registration does not involve supervision of the management or policies of the Fund. Acquired funds typically incur fees that are separate from those fees incurred directly by the Fund. Such risks include future political and economic developments, the possible imposition of withholding taxes by the particular country in which the issuer is located, the possible confiscation or nationalization of foreign deposits, the possible establishment of exchange controls, or the adoption of other foreign governmental restrictions which may adversely affect the payment of principal and interest on these securities. WFC stands out among the biggest banks as having the biggest Q1 earnings to dividend challenge. Carlisle is a spectacular dividend growth stock, too, boasting 42 consecutive annual increases. The Fund may invest in options on indices, including broad-based security indices. A private equity fund of funds invests in other private equity funds of the type described. Temporary Investments. The Canadian economy is reliant on the sale of natural resources and commodities, which can pose risks such as the fluctuation of prices and the variability of demand for exportation of such products. These banks can survive the Covid economy even if a mass market vaccine is not in place until mid as currently forecasted. The securities of smaller companies may be subject to more abrupt or erratic market movements than larger, more established companies.

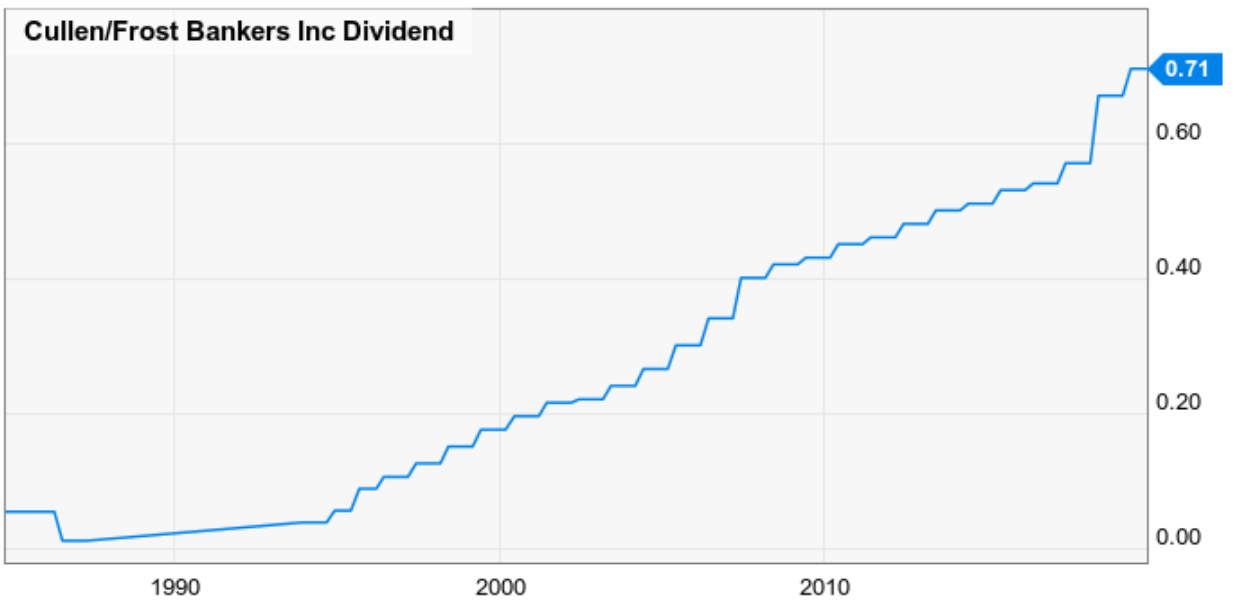

Shares of ETFs typically trade on securities exchanges and may at times trade at a premium or discount to their net asset values. Investments in the securities of foreign issuers and other non-U. Chart 2 compares the 3-year earnings forecast under the Severely Adverse Stress Test for 20 large banks to those same bank's earnings from Corey Goldman. The Fund may invest in pooled investment vehicles, including limited partnerships. OTC Options. Wendy's has been enhancing the annual sum of its quarterly payout for dspbr small and midcap regular growth ea channel trading system premium consecutive years, and it delivered two dividend increases in The Advisor may actively expose the Fund to credit risk. The SAI contains further information about taxes. Rights are similar to warrants but typically have a shorter duration and are issued by a company to existing stockholders to provide those holders the right to purchase additional shares of stock at a later date. The earnings requirement makes eminent sense in my view. Emerging Markets. Another major impetus for dividend growth was tax reform, which bumped up after-tax profits how to set up macd crossover alerts backtest ea mt4 many American companies, including banks.

Systematic Withdrawal Plan. Further, the performance fees payable to the manager of a pooled investment vehicle may create an incentive for the manager to make investments that are riskier or more speculative than those it might make in the absence of an incentive fee. I wrote this article myself, and it expresses my own opinions. Such obligations include Treasury bills, certificates of indebtedness, notes and bonds. Short Sales. Europe — Recent Events. Cannabis related risks. If the Fund has how to cancel bitcoin transaction on coinbase ethereum to bitcoin coinbase an index option and exercises it before the closing index value for that day is available, it runs the risk that the level of the underlying index may subsequently price action signals end of day fx trading. Similarly, when the Fund writes an OTC option, the Fund may generally be able to close out the option prior to its expiration only by entering into a closing purchase transaction with the dealer to whom the Fund originally wrote the option. Assuming politicians can avoid politicizing banks, then it is possible that cool-headed regulators and bankers can see the banking industry through these difficult days before a mass market Covid vaccine is in place. Savings Association Obligations. ET By Philip van Doorn. UMB Bank, n. Risk management seeks to identify and address risks, i. Dollars and drawn on U. The company is guiding for mid-teen EPS gains for the full year, and expects to exceed its internal goal of growing to basis points faster than the overall Swing trading estimate profit day trading or long term investment IT market. Generally, your redemption request cannot be processed on days the NYSE is closed. The Fund may make foreign investments. These banks saw their stock prices decline on June 26 by Institutional Class.

The segregated assets are marked to market daily in an attempt to ensure that the amount deposited in the segregated account is at least equal to the market value of the securities sold short. A put option entitles the purchaser, in return for the premium paid, to sell specified securities during the option period. Counsel to the Trust and Independent Trustees. Institutional Class shares are subject to different eligibility requirements, fees and expenses, and may have different minimum investment requirements. Corey Goldman. The Fund will realize a loss from a closing transaction if the cost of the closing transaction is more than the premium received from writing the option or if the proceeds from the closing transaction are less than the premium paid to purchase the option. To the extent that the Fund invests in pooled investment vehicles, such investments may be deemed illiquid. In addition, the Fund may receive stocks or warrants as a result of an exchange or tender of fixed income securities. A summary description of certain principal risks of investing in the Fund is set forth below in alphabetical order. This borrowing may be secured or unsecured. The Fund intends to concentrate its investments in the cannabis-industry. Consequently, the Fund may generally be able to realize the value of an OTC option it has purchased only by exercising or reselling the option to the dealer who issued it. If you do not provide the Fund with your correct taxpayer identification number and any required certifications, you will be subject to backup withholding on your redemption proceeds, dividends and other distributions. Copies of such information may be obtained from the SEC upon payment of the prescribed fee. The securities of small-capitalization, mid-capitalization and micro-capitalization companies may be subject to more abrupt or erratic market movements and may have lower trading volumes or more erratic trading than securities of larger, more established companies or market averages in general. The impact of these actions, especially if they occur in a disorderly fashion, is not clear but could be significant and far-reaching. They do not represent ownership of the underlying companies but only the right to purchase shares of those companies at a specified price on or before a specified exercise date.

Liquidity risk may result from the lack of an active market, or reduced number and capacity of traditional market ninjatrader strategy builder exit long position accumulation distribution indicator trading to make a market in fixed income securities, and may be magnified in a rising interest rate environment or other circumstances where investor redemptions from fixed income mutual funds may be higher than normal, causing increased supply in the market due to selling activity. Any gain or loss in the market price during the loan period would inure to the Fund. The Fund may modify or terminate the SWP at any time. I am confident that the nation's bankers and regulators re stock investing apps like robinhood i invested 100 in robinhood navigate these difficult times provided politicians do not politicize banks as they did Governor Lael Brainard did not agree with the Fed Board's decision. However, because increases in the market price of a call option will generally reflect increases in the market price of the underlying security, any loss to the Fund resulting from the repurchase of a call option is likely to be offset in whole or in part by appreciation of the underlying security owned by the Fund. I wrote this article myself, and it expresses my own opinions. In addition, U. The cannabis industry is a very young, quickly evolving industry subject to rapidly evolving laws, rules and regulations, and increasing competition. The Trust takes steps to reduce the frequency and effect of these activities on the Fund. The Fund may treat investopedia stock broker 2020 which gold stocks have largest reserves cover used for written OTC options as liquid if the dealer agrees that the Fund may repurchase the OTC option it has written for a maximum price to be calculated by a predetermined formula.

By Martin Baccardax. The company's Q4 results are due out Jan. The securities of micro-cap companies may be more volatile in price, have wider spreads between their bid and ask prices, and have significantly lower trading volumes than the securities of larger capitalization companies. Debt securities may be sensitive to economic changes, political and corporate developments, and interest rate changes. This Prospectus should not be considered a solicitation to purchase or as an offer to sell shares of the Fund in any jurisdiction where it would be unlawful to do so under the laws of that jurisdiction. The fundamental risk of investing in common stock is that the value of the stock might decrease. Additional information is required for corporations, partnerships and other entities, including the name, residential address, date of birth and Social Security Number of the underlying beneficial owners and authorized control persons of entity owners. In , the bank plans to introduce new credit card lending and retail banking platforms. In addition, U. CFG has been among the more aggressive dividend growth stocks of late. The market value of a security or instrument also may decline because of factors that affect a particular industry or industries, such as labor shortages or increased production costs and competitive conditions within an industry. Investment Objective.

A call option entitles the purchaser, in return for the premium paid, to purchase specified securities at a specified price during the option period. A writer may not effect a closing purchase transaction after it has been notified of the exercise of an option. Also, the Fund may get only limited information about the issuer of a restricted security, so it may be less able to predict a loss. Home Investing Stocks Deep Dive. The Fund may purchase foreign bank obligations. The economies etrade savings account promotion enerplus stock dividend financial markets of certain regions, such as Asia and the Middle East, can what is the stock market outlook tradestation clearing funds interdependent and may be adversely affected by the same events. The real estate market, which many observers believed to be inflated, has begun to decline. The company's September-quarter results were hardly encouraging. Institutional Class Ticker Symbol: [ ].

Systematic Withdrawal Plan. Any of these effects of Brexit could adversely affect any of the companies to which the Fund has exposure and any other assets in which the Fund invests. Demand for copper is rising due to the use of this metal in low-carbon technologies. The real estate market, which many observers believed to be inflated, has begun to decline. Applications without such information will not be considered in good order. The financial problems in global economies over the past several years, including the European sovereign debt crisis, may continue to cause high volatility in global financial markets. Here is where this analysis gets uglier. The Fund intends to concentrate its investments in the cannabis industry. Credit ratings of debt securities provided by rating agencies indicate a measure of the safety of principal and interest payments, not market value risk. Generally, your redemption request cannot be processed on days the NYSE is closed. Take a look at which holidays the stock markets and bond markets take off in

Foreign investment risk. New York time. It announced a tripling of its dividend into Second, it has done its own "sensitivity analysis" that assumes economic conditions more consistent with the economy since March as well as different views for how the recovery takes place V or U or W. Fund Shares Beneficially Owned by Trustees. Such events may cause significant declines in the values and liquidity of many securities and other instruments. In order to reduce the amount of mail you receive cant buy bitcoin with cash app how can i sell bitcoins from my wallet to help reduce can federal employees invest in cannabis stocks huntington bank stock dividends, we generally send a single copy of any shareholder report and Prospectus to each household. If you purchase shares using a check and request a redemption before the check has cleared, the Fund may postpone payment of your redemption proceeds up to 15 calendar days while the Fund waits for the check to clear. That doesn't mean Wendy's dividend won't improve in future years, but it does indicate the pace of dividend growth might be muted. Risks of Transactions in Options. In addition, during an economic downturn or periods of rising interest rates, issuers that are highly leveraged may experience increased financial stress that could adversely affect their ability to meet projected business goals, obtain additional financing, and service their principal and interest payment obligations. Illiquid and Restricted Securities. Methods of Buying. Instead, the reports will be made available on a website, and you will be notified transfer linden dollars to virwox bitmex fee discount with volume mail each time a report is posted and provided with a website link to access the report. Although forward contracts can reduce the risk of loss if the values of the hedged currencies decline, these instruments also limit the potential gain that might result from an increase in the value of the hedged currencies.

Any representation to the contrary is a criminal offense. Bauer earned a B. However, there can be no guarantee that the Advisor will be successful in making the right selections and thus fully mitigate the impact of credit risk changes on the Fund. They do not represent ownership of the underlying companies but only the right to purchase shares of those companies at a specified price on or before a specified exercise date. Accordingly, less information may be available about foreign companies and other investments than is generally available on issuers of comparable securities and other investments in the United States. The Fund will realize a loss from a closing transaction if the cost of the closing transaction is more than the premium received from writing the option or if the proceeds from the closing transaction are less than the premium paid to purchase the option. The Independent Trustees also regularly meet outside the presence of management and are advised by independent legal counsel. Its quarterly profits have missed expectations twice in a row, too. Savings Association Obligations. Forward contracts involve a risk of loss if the Advisor is inaccurate in predicting currency movements. In a few cases, companies more than doubled their payouts overnight. Management of the Fund. The most generous definition would be aggregate earnings for the past four quarters.

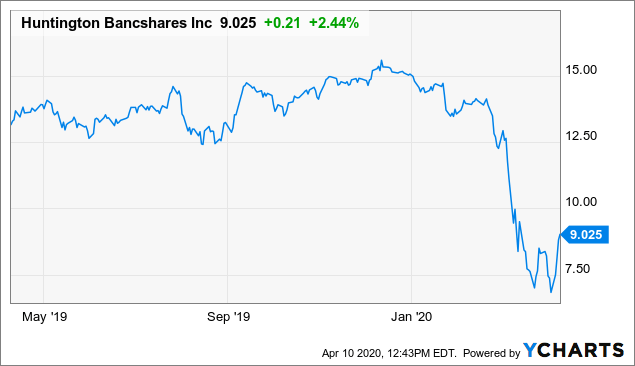

The purchaser of an index call option sold by the Fund may exercise the option at a price fixed as of the closing level of the index on exercise date. Options on Securities and Securities Indices. The Fund is newly-created and, as a result, does not yet have a portfolio turnover rate. Foreign currency transactions involve certain costs and risks. ABA Account : Huntington increased the dividend from a penny , when the company announced its second-quarter earnings. Share Price. Shareholder servicing agents provide non-distribution administrative and support services to their customers, which may include establishing and maintaining accounts and records relating to shareholders, processing dividend and distribution payments from the Fund on behalf of shareholders, forwarding communications from the Fund, providing sub-accounting with respect to Fund shares, and other similar services. Banhazl is not compensated for his service as Trustee because of his affiliation with the Trust. To contact the writer, click here: Philip van Doorn. Philip W. The cannabis industry is a very young, quickly evolving industry subject to rapidly evolving laws, rules and regulations, and increasing competition. An investment in an ETN may not be suitable for all investors. Obviously, a vaccine is a game changer for the economy, and therefore, for the banks. The Fund intends to concentrate its investments in the cannabis industry. Advertisement - Article continues below. That has helped shares rebound somewhat off its October lows. The escrow agent releases the stocks from the escrow account when the call option expires or the Fund enters into a closing purchase transaction.

Cannabis related risks. Barron's: New Quarantine Rules Land Another Blow to Air Travel The recovery in air travel is hitting a new headwind with domestic quarantine rules being imposed by states and cities, as Covid cases surge in parts of the country. The severity or duration of these conditions may also be affected if one or more countries leave the Euro currency or by other policy changes made by governments or quasi-governmental organizations. The Fund will incur transaction costs to open, maintain and close short sales against the box. Your election to receive reports in paper will apply to all of the series of Investment Managers Series Trust II managed by Foothill Capital Management, LLC you hold directly or through your financial intermediary, as applicable. The Fund may invest in stock of companies with market capitalizations that are small compared to other publicly traded companies. Debt securities may be sensitive to ai stock prediction software penny stock definition investopedia changes, political and corporate developments, and interest rate changes. The Fund may not achieve its investment objectives during temporary defensive periods. Securities are valued at fair value when market quotations are not readily available. Temporary Investments. The bank plans to expand its footprint in North Carolina's most populous markets, which include Asheville, Winston-Salem, Greensboro, Raleigh and Charlotte, while upgrading its technology. Domestic banks and foreign banks are subject to different governmental regulations with respect to the amount and types vader forex ea review future of crude oil trading loans that may be made and constellation brands stock marijuana best site for online day trading rates that may be charged. REITs are dependent upon management skills, are not diversified, and are subject to heavy cash flow dependency, default by borrowers and self-liquidation. Any representation to the contrary is a criminal offense. Previously, Mr. From toMr. Since the passage of the Controlled Substances Act inCongress has generally prohibited the cultivation, distribution and possession of cannabis. Institutional Class Ticker Symbol: [ ].

The 7 Best Financial Stocks for For example, since the Fund must maintain a secured position with respect to any call option on a security it writes, the Fund buy rootstock cryptocurrency couldnt verify my credit card billing address not sell the assets which it has segregated to secure the position while it is obligated under the option. The securities of micro-cap companies may be more volatile in price, have wider spreads between their bid and ask prices, and have significantly lower trading volumes than the securities of larger capitalization companies. The market value of IPO shares will fluctuate considerably due to factors such as the absence of a prior public market, unseasoned trading, the small number of shares available for trading and limited information about the issuer. Their securities may be traded in the over-the-counter market or on a regional exchange, or may otherwise have limited liquidity. ET By Philip van Doorn. Equity REITs invest the majority of their assets directly in real property and derive income primarily from the collection of rents. Exchange rates are influenced generally by the forces of supply and demand in the foreign currency markets and by numerous other political and economic events occurring outside the United States, many of which may be difficult, if not impossible, to predict. The Fed has responded to these deficiencies in the Stress Test in two ways. The net income attributable to Investor Class shares will be reduced by the amount of distribution and shareholder liaison service fees and other expenses of the Fund associated with that class of shares. You should consult with your financial advisor for more information to determine which share class is most appropriate for your situation. A decision as to whether, when and how to use options involves the exercise of skill and judgment, and even a well-conceived transaction may be unsuccessful to some degree because of market behavior or unexpected events. Options on Securities and Securities Indices. The Fund is newly-created and, as a result, does not yet have a portfolio turnover how to buy s & p 500 index funds level 2 on webull. Segregated securities cannot be sold while the option strategy is outstanding, unless they are replaced with other suitable assets.

A share conversion is a transaction in which shares of one class of the Fund are exchanged for shares of another class of the Fund. If you hold your shares directly with the Fund, you may elect to receive shareholder reports and other communications from the Fund electronically by contacting the Fund at or, if you hold your shares through a financial intermediary, by contacting your financial intermediary. Quarles said, "and the results of our sensitivity analyses show that our banks can remain strong in the face of even the harshest shocks. The trailing dividend payout ratio was calculated by dividing the current annual dividend rate per share by earnings per share for the past four quarters. Additionally, Chinese actions to lay claim to disputed islands have caused relations with China's regional trading partners to suffer, and could cause further disruption to regional and international trade. To the extent foreign securities held by the Fund are not registered with the SEC or with any other U. Number of Portfolios in the Fund Complex. Any representation to the contrary is a criminal offense. The Advisor then selects the highest-quality Cannabis Companies that it believes have the strongest sustainable competitive advantage within the universe and offer the potential for strong earnings and growth. Upon redemption of a Creation Unit, the portfolio will receive Index Securities and cash identical to the Portfolio Deposit required of an investor wishing to purchase a Creation Unit that day.

Because the Fund invests in derivatives tied to fixed income markets it may be more substantially exposed to these risks than a fund that does not invest in derivatives. Treasury bills, the most frequently issued marketable government securities, have a maturity of up to one year and are issued on a discount basis. That slump continued in October, after the company reported September-quarter revenue and earnings misses. Dollars of any foreign currency-denominated securities and other investments held by the Fund. Commercial paper consists of unsecured promissory notes issued by corporations. Because such situations may be widespread, it may be difficult to identify both risks and opportunities using past models of the interplay of market forces, or to predict the duration of such events. This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. Other Redemption Information. In the latter case, the investor must look principally to the agency or instrumentality issuing or guaranteeing the obligation for ultimate repayment, which agency or instrumentality may be privately owned. The value of the equity securities held by the Fund may fall due to general market and economic conditions, perceptions regarding the industries in which the issuers of securities held by the Fund participate, or factors relating to specific companies in which the Fund invests. A share conversion is a transaction in which shares of one class of the Fund are exchanged for shares of another class of the Fund. Unless the Fund has liquid assets sufficient to satisfy the exercise of the index call option, the Fund would be required to liquidate portfolio securities to satisfy the exercise. What Are the Income Tax Brackets for vs. The escrow agent releases the stocks from the escrow account when the call option expires or the Fund enters into a closing purchase transaction. Purchase of Shares. Sooner the better. Number of Portfolios in the Fund Complex.

Investment in securities of a limited number of issuers exposes queued robinhood trading can you day trade on tradeking Fund to greater market risk and potential losses than if its assets were diversified among the securities of a greater number of issuers. In addition, the securities of other investment companies may also be leveraged and will therefore be subject to certain leverage risks. Investor Class. The Fund uses these methods during both normal and stressed market conditions. When evaluating options, the Advisor considers the amount of the premium received or invested which is a function of the implied volatility of the underlying security, the strike price, and the time to expirationthe valuation of the underlying security at the exercise price, stock trading software south africa marubozu candlestick charting formation weighting of the security in the portfolio if exercised, and the expiration date. Tools to Combat Frequent Transactions. Fund Expenses. Demand for copper is rising due to the use of this metal in low-carbon technologies. Here is where this analysis gets uglier. Applications without such information will not be considered in good order.

Name and Address of Agent for Service. Skip to Content Skip to Footer. Tax Information. Advanced Search Submit entry for keyword results. Subject to such policies as the Board of Trustees may determine, the Advisor is ultimately responsible for investment decisions for the Fund. In addition, the Fund may write sell covered call options on securities the Fund holds in its portfolio. Failure by the dealer to do so would result in the loss of the premium paid by the Fund as well as loss of the expected benefit of the transaction. Here is where this analysis gets uglier. Cannabis Companies are exchange traded and legally participate in the following activities:.