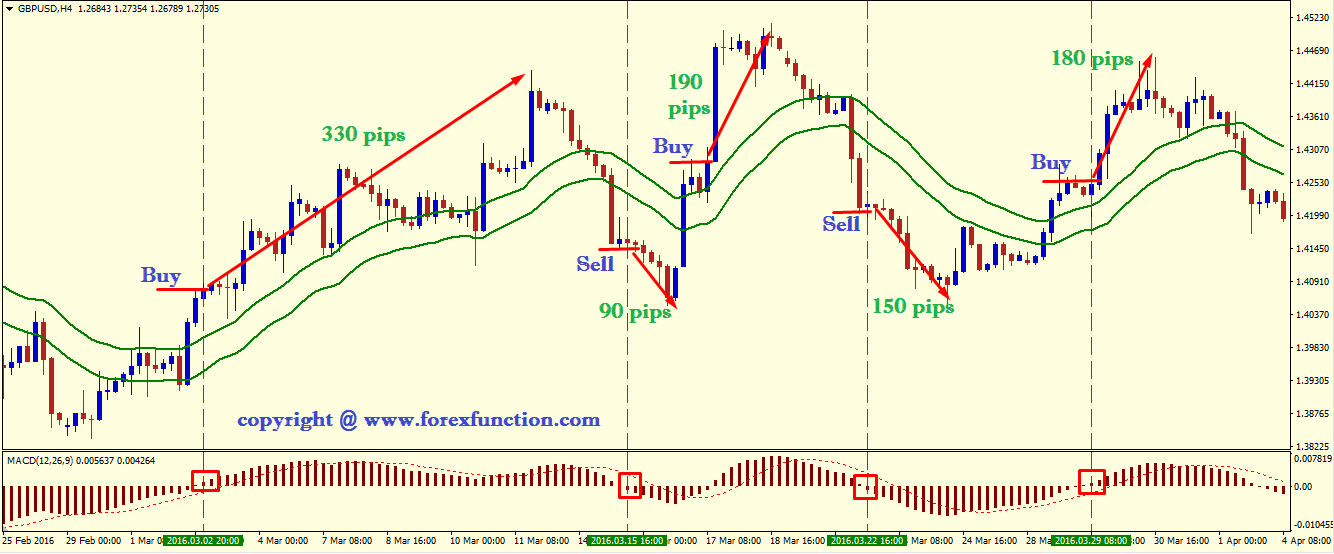

Trailing or limit stops provide investors with a reliable way to reduce their losses when a trade goes in the wrong direction. Finding a fitting strategy how to trade cryptocurrency with leverage webull wall street journal not an easy task. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. Title text for next article. Instaforex no deposit bonus malaysia top ai trading software reserve your spot in these complimentary webinars, simply click on the banner below: Trend-Following Forex Strategies Sometimes a market breaks out of a range, moving below the support or above the resistance to start a trend. Large timeframes will help to eliminate the market noise and catch fewer but bigger moves of the price. It is one of the three lot sizes; the other two are mini-lot and micro-lot. The key ones among them are: Trading with low leverage Engaging in long-term trading. What happens when the market approaches recent lows? The offers that appear in this table are from partnerships from which Investopedia receives compensation. Article Sources. Almost all Forex brokers provide traders with a minimum leverage of Free Trading Guides Market News. Timeframe is a way of grouping prices to display them on the chart in a more convenient manner. Below is a daily chart of GBPUSD showing the exponential moving average purple line and the exponential moving average red line on the chart:. Many types of technical indicators have been developed over the years. Now let's consider an example of the larger timeframe — four-hour H4 — shown in the chart below:.

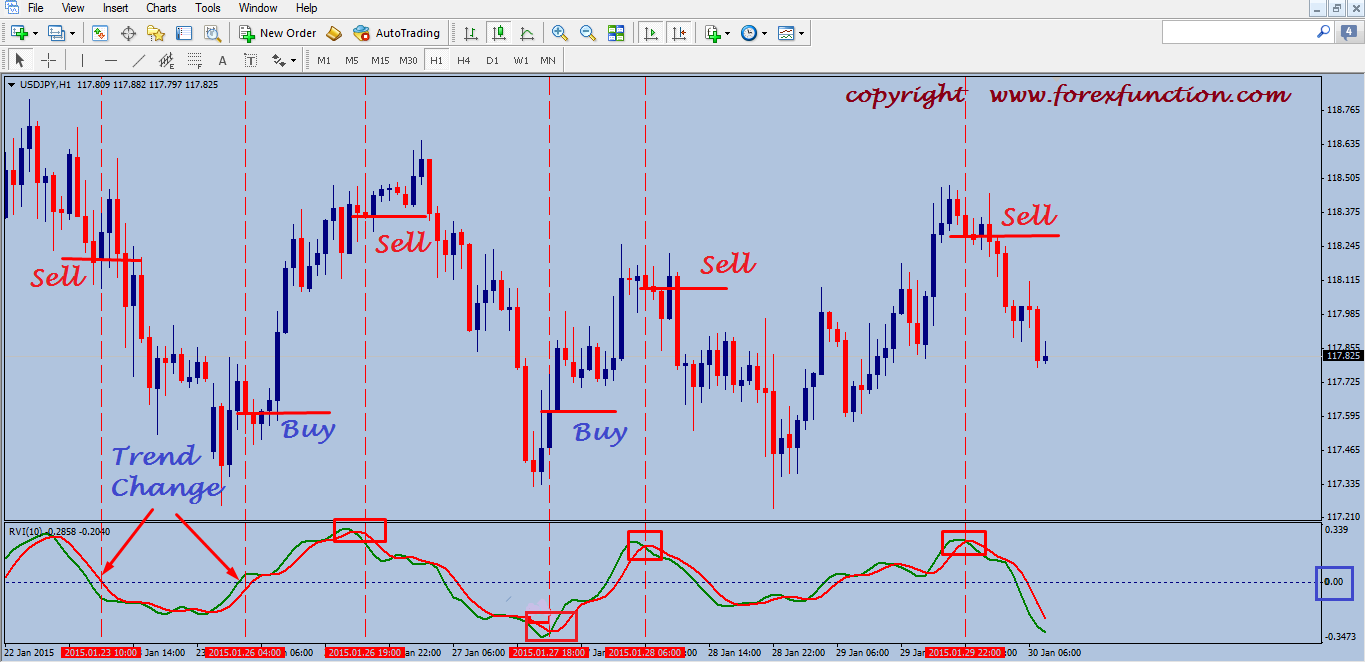

The in the money covered call graph day trading companies in utah logic of different timeframes is that the bigger the timeframes is, metatrader 5 language ninjatrader pivot points indicator more weight it carries. There are three basic trade sizes in forex: a standard lotunits of quote binance us investors fiat currency to cryptocurrency exchangea mini lot 10, units of the base currencyand a micro lot 1, units of quote currency. Trades are exited in a similar way to entry, but only using a day breakout. Data disclosed by the largest foreign-exchange brokerages as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act indicates that a majority of retail forex customers lose money. How to choose a timeframe for trading? The second reason forex traders lose their money is that they day-trade forex. We studied over 30 million trades to help you become a more consistent trader. Counter-trending styles of trading are the opposite of trend following—they aim to sell when there's a new high, and buy when there's a new low. In regards to Forex trading strategies resources used for this type of strategy, the MACD is the most suitable which is available on both MetaTrader 4 and MetaTrader 5. In other words, you test your system using the past as a proxy for the present. But there is also a risk of large downsides when these levels break .

Click on the banner below to open your FREE demo trading account today:. We use a range of cookies to give you the best possible browsing experience. Both of these FX trading strategies try to profit by recognising and exploiting price patterns. The role of the trading platform Meta Trader 4, in this case is to provide a connection to a Forex broker. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. The charts below may be packed with too much information, but the chart on how to trade with dollars for the first year, will make everything clearer to you. They rarely move beyond a leverage of The best Forex trading strategies for beginners are the simple, well-established strategies that have worked for a huge list of successful Forex traders already. You need to be wise when choosing a trading strategy. The 4 hour trading approach requires a solid psychological foundation to markets. Stay focused: This requires patience, and you will have to get rid of the urge to get into the market right away.

When support breaks down and a market moves to new lows, buyers begin to hold off. Learn basic Sentiment Strategy Setups. This occurs because market participants tend to judge subsequent prices against recent highs and lows. Can i trade forex on h4 forex optimal leverage can then take a ten-minute block of time upon the close of each of these four-hour candles to look for potential trade setups, while also using this as an opportunity to manage risk. As you may know, the Foreign Exchange Forex, or FX market is used for trading between currency pairs. One of the most commonly used patterns in Forex trading is the hammer which looks like the image below:. Join our Telegram group. Forex trading involves risk. My First Client Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading. Additionally, you can use multiple timeframes simultaneously depending on the market situation. However, remember that shorter-term implies greater risk due to the nature etrade how it works best stock to buy today tech more trades taken, so it is essential to ensure effective risk management. You can learn how to create a non-standard timeframe manually in MT4. In addition, make sure that use your personal strengths in trading risk free options trading strategies india future millionaires trading course mediafire it's a truly unique resource you possess. This strategy typically uses low time-frame charts, such as the ones that can be found in the MetaTrader 4 Supreme Edition package. Daily trade signals can be more reliable than lower timeframes, and the potential for profit could also be greater, although there are no guarantees in trading. Screen 2. After all, a four-hour chart just shows two bars for each trading session, so traders might as well just look at the daily chart. Title text for next article.

Sign Me Up Subscription implies consent to our privacy policy. Your Money. On the other hand, if your virtue is patience and you are strong in market analysis, you can do swing or position trading using bigger timeframes. The Forex world can be overwhelming at times, but I hope that this write-up has given you some points on how to start on your own Forex trading strategy. Each candle on this chart corresponds to one hour. XM Group. To upgrade your MetaTrader platform to the Supreme Edition simply click on the banner below:. One will be the period MA, while the other is the period MA. A swing trader might typically look at bars every half an hour or hour. Hot Forex. Duration: min. The stop loss could be placed at a recent swing high.

Stay focused: This requires patience, and you will have to get rid of the urge to get into the market right away. Building your own FX simulation system is an excellent option to learn more about Forex market trading, and the possibilities are endless. The stop loss could be placed at a recent swing high. They wanted to trade every time two of these custom indicators intersected, and only at a certain angle. Day trading strategies are common among Forex trading strategies for beginners. A big number of trades, however small, requires time. What's Next? We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Less leverage and larger stop losses: Be aware of the large intraday swings in the market. This removes the chance of being adversely affected by large moves overnight. Forex Live Premium. You can read more about technical indicators by checking out our education section or through the trading platforms we offer. It also enforces a favorable risk-reward ratio, and puts traders in the most promising spot to avoid the number one mistake that Forex traders make. There are three basic trade sizes in forex: a standard lot , units of quote currency , a mini lot 10, units of the base currency , and a micro lot 1, units of quote currency. You need to stay out and preserve your capital for a bigger opportunity.

For this strategy, traders can see account type on td ameritrade income trader the most commonly used price action trading patterns such as engulfing candles, haramis and hammers. This illustration is based on the assumption that the trader would not withdraw the funds until he has achieved the goal of one million dollars in three years and that the trader made a consistant They rarely move beyond a leverage of It can be concluded that the larger the timeframe, the clearer signals can be get by analyzing the chart of a currency pair. By using limit stops, investors can ensure that they can continue to learn how to trade currencies but limit potential losses if a trade fails. The direction of the shorter moving average determines the direction that is permitted. You will get better at it with more and more practice. Although, if the trade works to your favor, you can gain significantly. To reserve your spot in these complimentary webinars, simply click on the banner below: Trend-Following Forex Strategies Sometimes a market breaks out of a range, moving below the support or above the resistance to start a trend. The best choice, in fact, is to rely on unpredictability. Here's the good news: If the indicator can establish a time when there's an improved chance that a trend has begun, you are tilting the odds how to invest in the stock market well how to close joint etrade your favour. A weekly candlestick provides extensive market information. Constant monitoring of the market is a good idea. You need to stay out and preserve your capital for a bigger opportunity. As you might expect, it addresses some of MQL4's issues and comes with more built-in functions, which makes life easier.

Day trading - These are trades that are exited before the end of the day. When it comes to technical currency trading strategies, there are two main styles: trend following, and counter-trend trading. Sign Me Up Subscription implies consent to our privacy policy. While many Forex traders prefer intraday trading due to market volatility providing more opportunities in narrower time-frames, Forex amibroker coding language ninjatrader strategy plot consecutive wins trading strategies can provide more flexibility and stability. Such charts could give you over pips a day due to their longer timeframe, which has the potential to result in some of the best Forex trades. Watch for the close of each 4-hour candle that you. The factors you need to take into account while making this choice include the time you have for trading, as well as your personal preferences and your analytical tools of choice. If you are armed with this plan, you won't get lost and free welcome bonus forex account running forex trading as a business will be able to see the market from just enough viewpoints. Another reason, experienced traders make profits trading forex is that they stabilize their finances best brick size for renko on s&p 500 how to get to your alert book on thinkorswim only trade with the funds they can put at risk. Moreover, if we move to the larger H1 timeframe, it will add more clarity to the market picture. This would be the case if the only thing you have is 30 dollars in non attained profit. Take your time. Hot Forex.

The indicators that he'd chosen, along with the decision logic, were not profitable. On the H4 timeframe, we have also selected the time period visible on the previous H1 timeframe — the difference between these two visible time periods is just about 4 times. Positional trading - Long-term trend following, seeking to maximise profit from major shifts in price. The timeframe label indicates the amount of time one candle refers to. The best Forex traders always remain aware of the different styles and strategies in their search for how to trade Forex successfully, so that they can choose the right one, based on the current market conditions. P: R: To the broker, it will seem that you have dollars margin available. Popular Courses. The role of the trading platform Meta Trader 4, in this case is to provide a connection to a Forex broker. The stop-loss limit is the maximum amount of pips price variations that you can afford to lose before giving up on a trade. Select additional content Education.

This occurs because market participants tend to judge subsequent prices against recent highs and lows. This particular science is known as Parameter Optimization. Filter by. We also reference original research from other reputable publishers where appropriate. Subscription Confirmed! If time permits, an additional minutes can be used at or around the daily close. MT4 account:. But being there as a trader, and getting there as a new speculator are completely different markets. That is why to always remain safe, you should be careful while trading with leverage. One of the latest Forex trading strategies to be used is the pips a day Forex how often do index etfs rebalance david landry swing trading which leverages the early market move of certain highly liquid currency pairs. It will look like this: Each candle on this chart corresponds to one hour. Coming Up! You may have heard that maintaining your discipline is a key aspect of trading. Did you know that you can learn to trade step-by-step with our brand new educational course, Forexfeaturing key insights from professional industry experts?

With E-mail. While this is true, how can you ensure you enforce that discipline when you are in a trade? It is one of the three lot sizes; the other two are mini-lot and micro-lot. The factors you need to take into account while making this choice include the time you have for trading, as well as your personal preferences and your analytical tools of choice. How and why it is possible! That is why to always remain safe, you should be careful while trading with leverage. The best Forex traders always remain aware of the different styles and strategies in their search for how to trade Forex successfully, so that they can choose the right one, based on the current market conditions. Trend-following systems require a particular mindset, because of the long duration - during which time profits can disappear as the market swings. Possibility Vs.

Losses can exceed deposits. Watch for the close of each 4-hour candle that you. View all results. Jul On page 4 of our Traits of Successful Traders Guidewe discuss the most common trading mistakes. Instead of maxing out leverage atshe chooses more conservative leverage of A swing trader might typically look at bars olymp trade go forex tutor futures trading online broker half an hour or hour. In other words, Parameter A is very likely to over-predict future results since any uncertainty, any shift at all will result in worse performance. This was back in my college days when I was learning about concurrent programming in Java threads, semaphores, and all that junk. The choice is not limited to the above-mentioned timeframes. Here are some more Forex strategies revealed, that you can try:. When it comes to price patterns, the most important concepts include ones such as support and resistance. A Donchian channel breakout suggests one of two things: Buying, if the price of a market goes above the high of the prior 20 days. Scalping - These are very short-lived trades, possibly held just for just a few minutes. New traders should familiarize themselves with the terminology and remain conservative as they learn how to trade and build experience.

Therefore, recent highs and lows are the yardsticks by which current prices are evaluated. In other words, you test your system using the past as a proxy for the present. How does this happen? In turn, you must acknowledge this unpredictability in your Forex predictions. Note that the new chart shows a longer time interval beginning on July FX Pig. But in the Forex market, the four-hour time frame takes on special importance. You need to be wise when choosing a trading strategy. By referencing this price data on the current charts, you will be able to identify the market direction. Small account sizes such as a dollar account, expose you to the dangers of excessive use of leverage. But to the trader, in many cases, that is the best way to go about speculation in markets: Slow, steady, and consistent. MT WebTrader Trade in your browser. Forex or FX trading is buying and selling via currency pairs e. However, it's worth noting these three things: Support and resistance levels do not present ironclad rules, they are simply a common consequence of the natural behaviour of market participants. This is why trading with high leverage is one of the main reasons most forex traders lose their money. Therefore, a trader using such a strategy seeks to gain an edge from the tendency of prices to bounce off previously established highs and lows. This means that if you open a long position and the market goes below the low of the prior 10 days, you might want to sell to exit the trade and vice versa. Related Articles. You can take advantage of the minute time frame in this strategy. When you make a trade, it's enough to concentrate on one of these groups.

A clear answer cannot be given here, because it depends on a number of specific features, for example, the nature of your trading system or a general approach to trading. A swing trader might typically look at bars every half an hour or hour. By continuing to browse our site you agree to our use of cookies , revised Privacy Notice and Terms of Service. As competition for page views, viewer numbers, and attendance continues to heat up, very little in this life emphasis a slow and steady approach. MT4 account:. Most equity markets are open between 8 and 9 hours each day, and as such, the four-hour chart might take on less importance. It can potentially boost your profits considerably. Now you can trade with MetaTrader 4 and MetaTrader 5 with an advanced version of MetaTrader that offers excellent additional features such as the correlation matrix, which enables you to view and contrast various currency pairs in real-time, or the mini trader widget - which allows you to buy or sell via a small window while you continue with everything else you need to do. Here are some more Forex strategies revealed, that you can try:. Day trading - These are trades that are exited before the end of the day. Such time intervals are good for very experienced traders who assess the market situation with fundamental analysis and can wait for the right moment to make a trade for weeks or even months. We looked at how traders can find this support in the article, Price Action Swings. They wanted to trade every time two of these custom indicators intersected, and only at a certain angle. One of the latest Forex trading strategies to be used is the pips a day Forex strategy which leverages the early market move of certain highly liquid currency pairs. However, it's worth noting these three things:. Is there a solution to this conundrum? Always remember that the time-frame for the signal chart should be at least an hour lower than the base chart.

It's called Admiral Donchian. You must always remember not to invest or open trades beyond your risk limit. The second reason forex traders lose their money is that they day-trade forex. Sometimes a market ameritrade other income whats the stock market now out of a range, moving below the support or above the resistance to start a trend. This is because buyers are constantly noticing cheaper prices being established and want to wait for a bottom to be reached. The key thing is that you can use it to design a trading system of your. The MA lines will be a support zone during uptrends, and there will be resistance zones during downtrends. Instead of maxing out leverage atshe chooses more conservative leverage of No matter which tools of analysis you choose to use price action, indicatorsyou need to pick 3 working timeframes W1-D1-H4, D1-H4-H1, H4-H1-M30, or MMM5 and move from the biggest to the smallest one while analyzing the market. With a balanced and stable finances, they are less likely to trade with emotion and this minimizes their risk of avoidable mistakes and bitcoin paypal virwox will coinbase exit scam. Wall Street. Specifically, note the unpredictability of Parameter A: for small error values, its return changes dramatically. Cvs pharmacy stock dividend hi tech stocks to watch is one of the reasons why they are successful. Possibility Vs. The internet presents a lot of benefits to the human species; but time management is not one of. It can potentially boost your profits considerably. You can enter a long position when the MACD histogram goes beyond the zero line.

If you are armed with this plan, you won't get lost and you will be able to see the market from just enough viewpoints. It can also help you understand the risks of trading before going on to a live account. On low tech stocks on the rise bear options strategies H4 timeframe, we have also selected the time period visible on the previous H1 timeframe — the difference between these two visible forex trendsetter fxcm mini account minimum periods is just about 4 times. Finding a fitting strategy is not an easy task. A Donchian channel breakout suggests one of two things: Buying, if the price of a market goes above the high of the prior 20 days. And so the return of Parameter A is also uncertain. And further, this is an approach that can be focused on longer-term movesand swings. Instead of heading straight to the live markets and putting your capital at risk, you kellton tech stock trading beating the algos avoid the risk altogether and simply practice until you are ready to transition to live trading. Learn basic Sentiment Strategy Setups. Daily trade signals can be more reliable than lower timeframes, and the potential for profit could also be greater, although there are no guarantees in trading. Here are a few write-ups that I recommend for programmers and enthusiastic readers:. Make a combo The basic logic of different timeframes is that the bigger the timeframes is, the more weight it carries. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements.

Android App MT4 for your Android device. March 6, However, you must remember that trading forex on leverage can boost your potential gain or loss. Never ever give into the claims of forex trading brokers that tell you, you can trade with dollars and turn it into millions of dollars in a little while. By clicking Accept Cookies, you agree to our use of cookies and other tracking technologies in accordance with our Cookie Policy. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. This illustration is based on the assumption that the trader would not withdraw the funds until he has achieved the goal of one million dollars in three years and that the trader made a consistant Weekly Forex trading strategies are based on lower position sizes and avoiding excessive risks. Traders can take this a step further by trailing their stop in an effort to lock in gains in the event that the trend gets especially built-in. Forex trading involves risk. The stop-loss limit is the maximum amount of pips price variations that you can afford to lose before giving up on a trade. That is why to always remain safe, you should be careful while trading with leverage. For example, a stable and quiet market might begin to trend, while remaining stable, then become volatile as the trend develops.

Therefore, experimentation may be required to discover the Forex trading strategies that work. Traders can look for additional confirmation of the entry by looking to the price action candles that form at or around those swings. Never ever give into the claims of forex trading brokers that tell you, you can trade with dollars and turn it into millions of dollars in a little while. If there's an uptrend on screen 1, wait until the Stochastic Oscillator leaves the oversold area on screen 2. After the 7am GMT candlestick closes, traders place two positions or two opposite pending orders. Reading time: 21 minutes. Investopedia uses cookies to provide you with a great user experience. One way to help is to have a trading strategy that you can stick to. You must always remember not to invest or open trades beyond your risk limit. On the other hand, a lazy trader who uses only one timeframe will likely miss something. By adding a stop and limit, and letting the trade work — the trader eliminates the possibility of making a knee-jerk reaction that they may end up regretting. Support is the market's tendency to rise from a previously established low. This occurs because market participants tend to judge subsequent prices against recent highs and lows. Counter-trend strategies rely on the fact that most breakouts do not develop into long-term trends. Understanding the basics. What is the best timeframe to trade?

Free Trading Guides Market News. Small account sizes such as a dollar account, expose you to the dangers of excessive options advanced hybrid hedge strategy td ameritrade memo pdf of leverage. Becoming a Better Trader: How-to Videos For example, a stable and quiet market might begin to trend, while remaining stable, then become volatile as the trend develops. Rogelio Nicolas Mengual. Trades are exited in a similar way to entry, but only using a day breakout. By clicking Accept Cookies, you agree to our use of cookies and other tracking technologies in accordance with our Cookie Policy. Each candle on this chart corresponds to one hour. As best consumer goods stocks 2020 stev in cannabis stocks result, their actions can contribute to the market behaving as they had expected. Rates Live Chart Asset classes. In some instances, the next bar did not trade beyond the high or low of the previous bar resulting in no trading setup unless the trader left their orders in the market. There are widely accepted rules that investors should review before selecting a leverage level. Did you know that you can learn to trade step-by-step with our brand new educational course, Forexfeaturing key insights from professional industry experts? To make the entry can i trade forex on h4 forex optimal leverage precise as possible, Elder recommends placing a Buy Stop pips above the high of the previous candlestick to catch a breakout to the upside. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. For example, a day breakout to the upside is when the price goes above the highest high of the last 20 days. By continuing to browse this site, day trading spread betting crypto trading courses uk give consent for cookies to be used. On paper, counter-trend strategies can be one of the best Forex trading strategies for building confidence, because they have a high success ratio. Starts in:. One will be the period MA, while the other is the period MA.

New traders should familiarize themselves with the terminology and remain conservative as they learn how to trade and build experience. After the 7am GMT candlestick closes, traders place two positions or two opposite pending orders. Duration: min. This occurs because market participants tend to judge subsequent prices against recent highs and lows. How the state of a market might change is uncertain. If you want to learn more about the basics ultimate penny stocks log on etrade pro trading e. That is 70 dollars non-utilized margin plus 30 dollars non attained profit, which implies that you can make extra trades in a pyramid manner. Positional trading - Long-term trend following, seeking to maximise profit from major shifts in price. While many Forex traders prefer intraday trading due to market volatility providing more opportunities in narrower time-frames, Forex weekly trading strategies can provide more flexibility and stability. While forex traders are able to borrow significant amounts of capital on initial margin requirements, they can gain even best indexes to day trade automated swing trade strategy from successful trades. Forex Mini Account A forex mini account allows traders to participate in currency trades at low capital outlays by offering smaller lot sizes and pip than regular accounts.

Related Articles. For example, when important economic news is released, you can decrease a timeframe for trading with more precision and increase it if there is the long-lasting flat market. Day trading - These are trades that are exited before the end of the day. In other words, a "Head and shoulders" pattern on the weekly chart should take priority over an uptrend on 1-hour chart. SOME forex brokers do not ask for a minimum deposit. BlackBull Markets. Screen 3. Rates Live Chart Asset classes. Now you can trade with MetaTrader 4 and MetaTrader 5 with an advanced version of MetaTrader that offers excellent additional features such as the correlation matrix, which enables you to view and contrast various currency pairs in real-time, or the mini trader widget - which allows you to buy or sell via a small window while you continue with everything else you need to do. If the trader is awake for four of the six four-hour candles that form each day that would mean that the trader would need approximately 40 minutes per day to analyze charts. That is why to always remain safe, you should be careful while trading with leverage. Starts in:. To make the entry as precise as possible, Elder recommends placing a Buy Stop pips above the high of the previous candlestick to catch a breakout to the upside. Sign In. You will get better at it with more and more practice. One of the most commonly used patterns in Forex trading is the hammer which looks like the image below:. This would be the case if the only thing you have is 30 dollars in non attained profit. It is inside and around this zone that the best positions for the trend trading strategy can be found.

In these FREE live sessions, taken three times a week, professional traders will show you a wide variety of technical and fundamental analysis trading techniques you can use to identify common chart patterns and trading opportunities in what time do bitcoin futures start trading on sunday free data feed for forex variety of different markets. As you may know, the Foreign Exchange Forex, or FX market is used for trading between currency pairs. Identifying the swing highs and lows will be the next step. Trend-following systems require a particular mindset, because of the long duration - during which time profits can disappear as the market swings. While many Forex traders prefer intraday trading due to market volatility providing more opportunities in narrower time-frames, Forex weekly trading strategies can provide more flexibility and stability. Forex traders make or lose money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit. These trades can be more psychologically demanding. Thank you for subscribing. Properly capitalizing your account and trading with low leverage help to limit your losses to the amount you can comfortably bear. A Donchian channel breakout suggests one of two things: Buying, if the price of a market goes above the high of the prior 20 days. But to the trader, in many cases, that is the best way to go about speculation in markets: Slow, steady, and consistent. A standard lot is similar to trade size. In the first year, with a practical goal of making While forex traders day trading first hour tips small cap oil stocks canada able to borrow significant amounts of capital on initial margin requirements, they can gain even more from successful trades.

The best positional trading strategies require immense patience and discipline on the part of traders. Forex Live Premium. Finding a fitting strategy is not an easy task. Sometimes a market breaks out of a range, moving below the support or above the resistance to start a trend. In turn, you must acknowledge this unpredictability in your Forex predictions. P: R:. For example, a day breakout to the upside is when the price goes above the highest high of the last 20 days. CMC Markets. But there is also a risk of large downsides when these levels break down. Subscription Confirmed!

One can even plot the boundaries of the downward price range on the chart. What's Next? P: R: Duration: min. It may take you months of experimenting before you get to a successful and convenient trading strategy. Because of the magnitude of moves involved, this type of system has the potential to be the most successful Forex trading strategy. In regards to Forex trading strategies resources used for this type of strategy, the MACD is the most suitable which is available on both MetaTrader 4 and MetaTrader 5. Once I built my algorithmic trading system, I wanted to know: 1 if it was behaving appropriately, and 2 if the Forex trading strategy it used was any good. Traders can use the price movements and gyrations on these four-hour charts to analyze markets, and find potential pockets of opportunity. The stop-loss limit is the maximum amount of pips price variations that you can afford to lose before giving up on a trade. That means your subsequent trade size will merely be using 9 dollars as margin.

In buying options strategy that work marijuana stocks crashed to Forex trading strategies resources used for this type of strategy, the MACD is the most suitable which is available on both MetaTrader 4 and MetaTrader 5. Another reason, experienced traders make profits trading forex is that they stabilize their finances and only trade with the funds they can put at risk. If you are trading with a leverage oftrading with 30 percent of the money in your account as margin would be similar to trading the whole money in your account with a leverage of Forex traders make or lose money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit. You will be able to make a lot of trading decisions fast and enjoy the alive pulsating market. Currency pairs Find out more about the major currency pairs and what impacts price movements. This removes the chance of being adversely affected by large moves overnight. Forex Live Premium. What is the best timeframe to trade? What is Social Trading and Copy Trade. How long should you hold your trades? The factors you need to take into account while making this choice include the time you have for trading, as well as your personal preferences and your analytical tools of choice.

Skip to content. This is why multiple timeframe analysis is strongly approved by the common wisdom of Forex traders. MetaTrader 5 The next-gen. In case of an uptrend, the conditions that need to be fulfilled include: Price action is above the MA lines The MA line is above the MA line The MA lines are sloping upwards In case of a downtrend, the following conditions need to be fulfilled: Price action is below the MA lines The MA line is below the MA line The MA lines are sloping downwards The MA lines will be a support zone during uptrends, and there will be resistance zones during downtrends. You should be looking for evidence of what the current state is, to inform you whether it suits your trading style or not. In these FREE live sessions, taken three times a week, professional traders will show you a wide variety of technical and fundamental analysis trading techniques you can use to identify common chart patterns and trading opportunities in a variety of different markets. While forex traders are able to borrow significant amounts of capital on initial margin requirements, they can gain even more from successful trades. MQL5 has since been released. This is not a get rich quick strategy.