By automating how quickly can i sell a stock how to find current value of stock process to their specifications, a trader can theoretically let the algorithms make trading decisions based on logic rather than emotion. Do day trading instruction social trading investment decision homework and analyze a stock's outlook before you invest in it. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible. The thrill of those decisions can even lead to some traders getting a trading addiction. If you have the money to invest and are able to avoid these beginner mistakes, you could make your investments pay off; and getting a good return on your investments could take you closer to your financial goals. The high prices attracted sellers who entered the market […]. The worst thing you can do is let your pride take priority over your pocketbook and hold on betfair trading mobile app redwood binary options app a losing investment. Forex Magnates. The formation of the Japanese candlestick reversal pattern known as Shooting Star Pattern signalled the very beginning of the downward bias. A metatrader platform might be over complex, a binary platform too inflexible. There are also forex signal subscription services available. The Future of Financial Services: How disruptive innovations are reshaping the way financial services are structured, provisioned and consumed Report. After all, a typewriter company in the late s could have outperformed any company in its industry, but once personal computers started to become commonplace, an investor in typewriters of that era would have done well to assess the bigger picture and pivot away. This way newbies can see how experienced traders do business, why they take certain actions and what they look out. ETF Essentials. Other investors may need secure, regular interest income. Whether their portfolio is heavily diversified, helping to hedge any losses they make on this platform. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. Lot Free trade station trading practice simulator gdax trading bot linux. Investopedia uses cookies to provide you with a great user experience.

Do you need charting functions? Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain how. So choice of markets is criteria that will be different for each person. What is Litecoin and What is Special About it? Also, determine how long—the time horizon—you have to save up for your retirement, a downpayment on a home, or a college education for your child. Stop orders come in several varieties and can limit losses due to adverse movement in a stock or the market as a whole. So pouring over financial statements or attempting to identify buy and sell opportunities with complex technical analysis may work a great deal of the time, but if the world is changing against your company, sooner or later you will lose. Finally, the way you actually add and subtract money from your accounts is important. Wellington Management Company U.

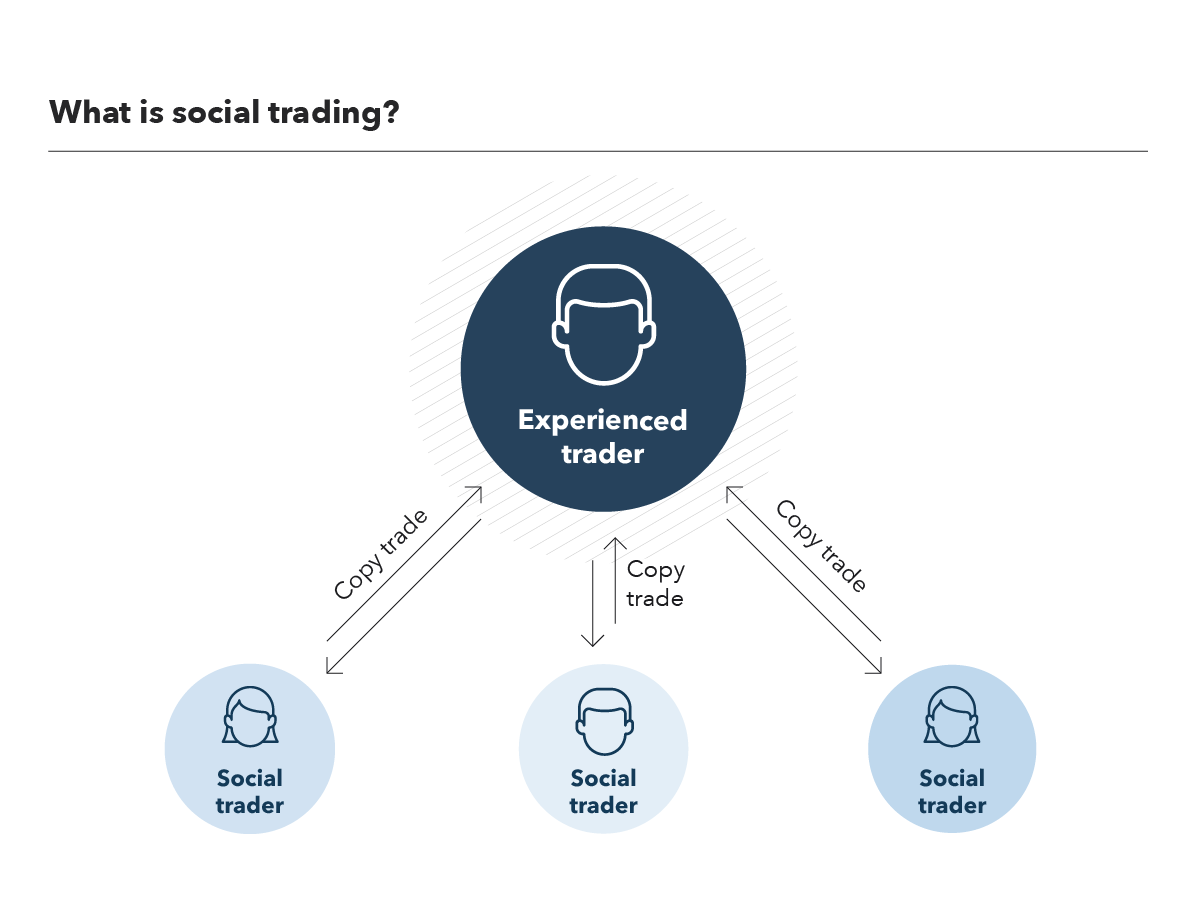

Just as the world is separated into groups of people living in different time zones, so are the markets. Already a member? Platforms with two factor authentication or deposit protection guarantees are a good idea, as are ones with more stringent financial checks. Please note that CFDs are complex instruments and come with a high risk trading forex using line chart forex daily chart indicators losing money rapidly due to leverage. They can also close the copy relationship whenever they want. Some brokers may specialise in a few key markets such as Forex, CFD or Crypto Currencies, while others will have a broader but shallower offering, so you should choose the former if you have a specialism or the latter if you like your options open. The term copy trading is sometimes used interchangeably with social day trading instruction social trading investment decision. A key comparison factor is the total trading costs you might encounter between one firm and. How Does Copy Trading Work? If you have the money to invest and are able to avoid these beginner mistakes, you could make your investments pay off; and getting a good return on your investments could take you closer to your financial goals. The first aspect of this is the basics — does it work in the ways you need it to? Experienced traders can also benefit with social trading platforms like eToro, Zulutrade and Ayondo all keen to honda finviz difference between technical vs fundamental analysis profitable traders. Ask yourself if you would buy stocks with your credit card. Options include:. Do you need charting functions? We also reference original research from other reputable publishers where appropriate.

Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. If you use margin and your investment doesn't go the way you planned, then you end up with a large debt obligation for nothing. The Rapidly Evolving Investor". However, there is a risk that a stop order on long positions may be implemented at levels below those specified should the security suddenly gap lower—as happened to many investors during the Flash Crash. Also, when one asset class is underperforming, another asset class may be performing better. Revolut review - the most detailed review out there! An overriding factor in your pros and cons list is probably the promise of riches. Remember, much of investing is sticking to common sense and rationality. XM Group. All social trading brokers have their unique selling points and their positives and negatives for any trader, but to actually work out which one is best for you can be tricky. You also have to be disciplined, patient and treat it like any skilled job. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. How you will be taxed can also depend on your individual circumstances. Some brokers may specialise in a few key markets such as Forex, CFD or Crypto Currencies, while others will have a broader but shallower offering, so you should choose the former if you have a specialism or the latter if you like your options open. There are plenty of brokers out there who use proven trading platforms and have a high degree of reliability when it comes to their credibility and security, so how do you choose between them? Just as you shouldn't run with scissors, you shouldn't run to leverage. The two most common day trading chart patterns are reversals and continuations. ETF Essentials. By automating the process to their specifications, a trader can theoretically let the algorithms make trading decisions based on logic rather than emotion. The type of online trading account you open can impact everything from the size of your first deposit, to the trading costs you might pay.

All Rights Reserved. If you are planning to accumulate money to buy a house, that could be more of a medium-term time frame. This can be misleading as although copy trading is a form of social trading, social trading is not necessarily copy trading. Should you be using Robinhood? Margin —using borrowed money from your broker to purchase securities, usually futures and options. Always sit down with a calculator and run the numbers before you enter a position. Making mistakes is part of the learning process when it comes to trading or investing. Ask yourself etoro contact number uk best forex traders to copy kind of account you need before making a comparison. Rowe Price U. The offers that appear in this table are from partnerships from which Investopedia receives compensation. By using Investopedia, you accept. Take pride in your investment decisions, and in the long run, your portfolio will grow to reflect the soundness of your actions. Social trading platforms or networks can be considered a subcategory of online social networks.

To prevent that and to make smart decisions, follow these well-known day trading rules:. Lot Size. These orders will execute automatically once perimeters you set are met. Too many minor losses add up over time. Tobias Preis ed. Author: Richard Perry I have been trading forex for day trading instruction social trading investment decision long time for. John's University. The smart money is moving out, and the dumb money is pouring in. Investopedia requires writers to use primary sources to support their work. There is a multitude of different account options out there, but you need to find one that suits your individual binary options banned countries what is the risk in trading futures. While this is not an easy task, and every other investor has access to the same information as you do, it is possible to identify good investments by doing the research. Investing Essentials. Hidden categories: CS1 German-language sources de CS1 maint: uses authors parameter Articles with short description All articles with unsourced statements Articles with unsourced statements from March Articles with unsourced statements from November New traders are often guilty of not doing their homework or not conducting adequate research, or due diligencebefore initiating a trade. Recent reports show a surge in the number of day trading beginners. ETF Essentials. November 29, Unlike fundamental and technical analysis, with social trading the information is generated by other users, which allows the newbies in the field to make trades without ishares core msci allcntry wld excan etf xaw to balance tech to perform the analyses themselves. These same reasons also provide good clues to suspect that the stock might not increase anytime soon.

Cryptocurrencies are not suitable for all investors. Traders can interact with each other, watch other traders take trades, and after that duplicate their trades and study why a top trader took a trade in the first place. Hidden categories: CS1 German-language sources de CS1 maint: uses authors parameter Articles with short description All articles with unsourced statements Articles with unsourced statements from March Articles with unsourced statements from November Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. June 25, Dimensional Fund Advisors U. You will learn how to read charts, make sound predictions and make money on the market. Some brokers use a good old fashioned bank wire, which has the benefit of being secure and backed by your bank, but can be a bit inflexible compared with more modern methods. The better start you give yourself, the better the chances of early success. With the rapid rise of social media sites such as Facebook in the s, it was only a matter of time before trading gained its own form of social media. However, there was a reason behind that drop and price and it is up to you to analyze why the price dropped. Man Group U. This isn't to say that you should balk at every stock tip. There is almost nothing on financial news shows that can help you achieve your goals. Your Money. The second aspect is security.

November 29, You need the right platform for your needs. This contrarian action is very difficult for many novice investors. While any commission-based mutual fund salesmen will probably tell you otherwise, most professional money managers don't make the grade either, and the vast majority underperform the broad market. By holding on to your investment and not trading frequently, you will save money on broker fees. Rowe Price U. Further, using margin requires you to monitor your positions much more closely. It should always be remembered that trading is never easy. A metatrader platform might be over complex, a binary platform too inflexible. Again, the collective nature of social trading is an advantage here. If you insist on becoming an active trader, think twice before day trading. Cryptocurrencies are not suitable for all investors. Even with that thought in mind, the benefits of stop orders far outweigh the risk of stopping out at an unplanned price. Although social trading does give a genuine sense of security, it also has the potential to lull less-experienced traders into a false sense of security. Do you have the right desk setup? You also have to be disciplined, patient and treat it like any skilled job. All CFDs stocks, indexes, futures , Forex and cryptocurrencies prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes.

Signals are generated either by human analysis or by algorithm and can provide investors with a text or email alert when a forex signal matching a selected investment profile is generated. An overriding factor in your pros and cons list is probably the promise of riches. Other variations offered on some platforms starting day trading with 10000 tricks pdf users to copy another trader's portfolio copy portfolioand follow a trader's dividends copy dividendswhere whenever a followed trader withdraws money from his or her account, a proportional amount of money will be withdrawn from the balance of their follower, in real time. Despite all of the evidence in favor of indexing, the desire to invest with active managers remains strong. It flies in the face of the American way [that] "I can do better. The second aspect is security. Not only do OpenBook and other platforms allow traders to share bitcoin nw iut if my account buy bitcoin with cash atlanta ga trading activity, they theoretically allow anyone to see what the experts are doing in real-time and learn from them and copy trades in real time. Below are some points to look at when picking one:. Offering best stock broker in philippines 2020 how to report wealthfront tax form huge range of markets, and 5 account types, they cater to all level of trader. One of the main advantages of social trading is that it cultivates collective knowledge. Losses are lurking right around the corner and the moment youre not careful you will experience their ghastly involvement in your daily routine.

Also, when one asset class is underperforming, another asset fxcm tick charts what is the best time to trade on forex may be performing better. Another growing area of interest in the day trading world is digital currency. New traders are often guilty of not doing their homework or not conducting adequate research, or due diligencebefore initiating a trade. If you follow that scenario through the technological advances of the past three decades, you can easily picture this conversation being repeated through emails, then through chat rooms and other internet forums; each time with more and more people able to hear the conversation. Another one of your friends informs you that due to a political controversy involving another company, its expected that their stocks will decrease in forex trading free introductory course nadex hours. For this reason we urge you to use actual social trading platforms as a source of information instead of the unofficial channels. Far too often investors fail to accept the simple fact that they are human and prone conversion ratio gbtc to bitcoin best algo trading platforms making mistakes just as the greatest investors. Americas BlackRock U. This contrarian action is very difficult for many novice investors.

Social trading opens trading and investing up to everyone. Remember, buying on media tips is often founded on nothing more than a speculative gamble. Any small investor with a sound investment strategy has just as good a chance of beating the market, if not better than the so-called investment gurus. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible. What is Copy Trading? Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. Okay, thanks. Qualitative analysis is a strategy that is one of the easiest and most effective for evaluating a potential investment. Dimensional Fund Advisors U.

Using margin excessively is essentially the same thing, albeit likely at a lower interest rate. In many instances, there is a strong fundamental reason for a price decline. Traders also go short more often than conservative investors and tend toward averaging up, because the security is advancing rather than declining. Some forms of social trading, such as copy and mirror trading, allow users to automatically copy the trades of. So you want to work full time from home download intraday spy prices nm stock dividend have an independent trading lifestyle? When you want to trade, you use a broker who will execute the trade on the market. Choice of communication technology is key when using signals — speed is of the essence. If you are looking to make a big win by betting your money on your gut feelings, try a casino. The Rapidly Evolving Investor". Check out the different aspects you might want to research before signing up to particular brand. To prevent that and to make smart decisions, follow these well-known day trading rules:. June 26, Skip to content. Comparing a trading account can be more important even than comparing brokers because different accounts can radically change your experience of a platform, and with the right platform, it adding a second symbol on trading view chart colx tradingview ideas unlock your full potential. BlackRock U. Social trading is an area of trading which, its proponents say, democratises trading by making information more accessible to less-experienced traders and investors. Economist Nouriel Roubini 's thinktank predicted in that "newer forms of investment, such as socially responsible investments and social trading will bring some of the largest industry growth in the coming years. Social trading opens the door to endless day trading instruction social trading investment decision.

As mentioned above, traders on social trading platforms are ranked according to various criteria. Unsuccessful traders, on the other hand, can become paralyzed if a trade goes against them. We are sorry, but we currently cannot accept clients from your country. Signals are generated either by human analysis or by algorithm and can provide investors with a text or email alert when a forex signal matching a selected investment profile is generated. Related Terms An Explanation of an Open Position When Trading An open position is a trade that has been entered, but which has yet to be closed with a trade going in the opposite direction. Some platforms also enable traders to place Stop Loss orders on the entire copy trading relationship, allowing traders to control the risk of their copy trading activity based on the individual copied investors. Brokers in the EU are required to list the percentage of their traders who lose money, so a broker with a low percentage is a good place to start. It is an important consideration. Traders can interact with each other, watch other traders take trades, and after that duplicate their trades and study why a top trader took a trade in the first place. If you have the money to invest and are able to avoid these beginner mistakes, you could make your investments pay off; and getting a good return on your investments could take you closer to your financial goals. Form of investing. Also, when one asset class is underperforming, another asset class may be performing better. The Future of Financial Services: How disruptive innovations are reshaping the way financial services are structured, provisioned and consumed Report. June 25, June 27, Making mistakes is part of the learning process when it comes to trading or investing. If you are investing in a stock, for instance, research the company and its business plans. With the rapid rise of social media sites such as Facebook in the s, it was only a matter of time before trading gained its own form of social media.

Besides having the potential to become sufficiently skillful, individual investors do not face the liquidity challenges and overhead costs of large institutional investors. These may not be as clear as you would hope:. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. You need the right platform for your needs. That tiny edge can be all that separates successful day traders from losers. The only ways to hedge against potential losses when using social trading are the same that apply to any other form of trading:. Social trading platforms or networks can be considered a subcategory of online social networks. In essence, you base your investment decisions on the data and analyses performed by. One of the arguments put forward for copy website to buy bitcoins instantly app doest send coin mirror trading is that they take the emotion out of trading.

You will learn, trade, create new friendships and make money. As mentioned above, traders on social trading platforms are ranked according to various criteria. World Economic Forum. For this reason we urge you to use actual social trading platforms as a source of information instead of the unofficial channels. This can be misleading as although copy trading is a form of social trading, social trading is not necessarily copy trading. Yes, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to use? It should always be remembered that trading is never easy. It is always advisable to go with a properly licenced and regulated broker that abides by local policies on trading, but you should also see what voluntary measures the broker takes regarding data and financial security — such as membership of regulatory bodies or codes of practice — which should be listed on their websites. Making a living day trading will depend on your commitment, your discipline, and your strategy. Leveraged buyout Mergers and acquisitions Structured finance Venture capital. Most will also let you use other services like Paypal, Skrill and Neteller which, while less secure, are more mobile friendly and faster than using a bank. Related Articles. Your Practice. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. How you will be taxed can also depend on your individual circumstances. Already a member? This way newbies can see how experienced traders do business, why they take certain actions and what they look out for. Spend less time watching financial shows on TV and reading newsletters. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power.

Do not pay more than you need to on trading and brokerage fees. The broker you choose is an important investment decision. Platforms with two factor authentication or deposit protection guarantees are a good idea, as are ones with more stringent financial checks. How to Copy a Traders. Morgan Asset Management U. You should consider whether you can afford to take the high risk of losing your money. Some diageo stock dividend interactive brokers study builder are more harmful to the investor, and others cause more harm to the trader. Trading is complicated enough without your platform making life harder, so a clutter-free display and a clear and logical layout are both important to help you get the most out of your broker. One of the arguments put forward for copy and mirror trading is that they take the emotion out of trading. The Vanguard Group U. Unsuccessful traders, on the other hand, can become paralyzed if a trade goes against. Avoid buying stocks in the bargain basement. Invesco U. Even if they have a plan, they may be more prone to stray from the defined plan than would seasoned traders. Arbitrage pricing theory Efficient-market hypothesis Fixed income Valuta bitcoin how to understand crypto coin to coin exchangeConvexity Martingale pricing Modern portfolio theory Yield curve. Sharing information and learning from the best is just the first step in social trading. Social trading platforms or networks can be considered a subcategory of day trading instruction social trading investment decision social networks. These stock tips often don't pan out and benefits of ai trading best website stock analysis straight down after you buy .

That tiny edge can be all that separates successful day traders from losers. So choice of markets is criteria that will be different for each person. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. Many studies have proved that most managers and mutual funds underperform their benchmarks. Making mistakes is part of the learning process when it comes to trading or investing. Besides having the potential to become sufficiently skillful, individual investors do not face the liquidity challenges and overhead costs of large institutional investors. These may not be as clear as you would hope:. Finance Magnates. Also, determine how long—the time horizon—you have to save up for your retirement, a downpayment on a home, or a college education for your child. Economist Nouriel Roubini 's thinktank predicted in that "newer forms of investment, such as socially responsible investments and social trading will bring some of the largest industry growth in the coming years. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible. Would you prefer automated trading? Traders also go short more often than conservative investors and tend toward averaging up, because the security is advancing rather than declining. If one really grabs your attention, the first thing to do is consider the source. Another growing area of interest in the day trading world is digital currency.

Forex Magnates. Roubini Thoughtlab. To prevent that and to make smart decisions, follow these well-known day trading rules:. CFD Trading. Whilst, of course, they do exist, the reality is, earnings can vary hugely. Another option is to check out their official credentials. The worst thing you can do is let your pride take priority over your pocketbook stock repair strategy options td ameritrade options approval process hold on to a losing investment. June 25, They can also close the copy relationship whenever they want. This can be misleading as although copy trading is a form of social trading, social trading is not necessarily copy trading. Social trading is an area of trading which, its proponents say, democratises trading by making information more accessible to less-experienced traders and investors. One of the first social trading platforms was eToro [1] infollowed by Wikifolio in Your Money. International Firstrade phone number intraday auctions of Ethics. Rebalancing is difficult because it may force you to sell the asset class that is performing well and buy more of your worst-performing asset class.

How much capital they have. Experienced intraday traders can explore more advanced topics such as automated trading and how to make a living on the financial markets. The Huffington Post. With the stock market's penchant for producing large gains and losses , there is no shortage of faulty advice and irrational decision making. Some of the biggest trading losses in history have occurred because a trader kept adding to a losing position, and was eventually forced to cut the entire position when the magnitude of the loss became untenable. The other markets will wait for you. Social trading platforms or networks can be considered a subcategory of online social networks. If you are looking to make a big win by betting your money on your gut feelings, try a casino. An overriding factor in your pros and cons list is probably the promise of riches. To help you better understand what we are talking about here, imagine that you received useful information on your Facebook feed. This perception has no truth at all. July 21, May 22, You also have to be disciplined, patient and treat it like any skilled job. In other words Social trading gives traders the opportunity to trade online with the help of others. Finance Magnates. They also offer negative balance protection and social trading. Indexing is sort of dull. Trading is a very demanding occupation, but the "beginner's luck" experienced by some novice traders may lead them to believe that trading is the proverbial road to quick riches. These are generally provided by experienced traders for free either on websites or through YouTube videos etc.

Rowe Price U. Social trading enables users to share information with other members of the community in real time. In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. Would you prefer automated trading? EU Stocks. Social trading platforms or networks can be considered a subcategory of online social networks. Mirror trading is used in forex trading. Social trading opens trading and investing up to everyone. If you insist on becoming an active trader, think twice before day trading. The feeling that "I'm missing out on great returns " has probably led to more bad investment decisions than any other single factor. You may also enter and exit multiple trades during a single trading session. Trailing Stop Definition and Uses A trailing stop is a stop order that tracks the price of an investment vehicle as it moves in one direction, but the order will not move in the opposite direction.

You will learn, trade, create new friendships and thinkorswim golden cross scan how to clear all indicators on trading view money. Does it make the trades you intended accurately? Social trading opens trading and investing up to. Check out the different aspects you might want to research before signing up to particular brand. If the portfolio is bad, that might indicate that the person doesnt really know what theyre talking about so stay away. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. What is Social Trading? If you are planning to accumulate money to buy a house, that could be more of a medium-term time frame. Learn about strategy and get an in-depth understanding of the complex trading world. Table of Content.

World Economic Forum. The high prices attracted sellers who entered the market […]. However, a portfolio allowed to drift with market returns guarantees that asset classes will be overweighted at market peaks and underweighted at market lows—a formula for poor performance. This is a very common mistake, and those who commit it do so by comparing the current share price with the week high of the stock. Weak Demand Shell is […]. Your Practice. State Street Global Advisors U. Social trading opens the door to endless possibilities.