They are especially interested in commercial real estate projects like warehouses, prime office buildings, residential apartments, hotels, timber yards, and shopping malls. Investment in solar projects and green energy, for instance, posts profits and helps conserve the environment. A full list of all futures symbols can be viewed on the Futures tab in the thinkorswim platform. They can be found under the Futures tab as well as the Trade tab in the Futures Trader section. Many investors are familiar with etrade inactive account ishares s&p tsx global gold index etf but may be fuzzy on what it is and how it works. So you can buy 5. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. So, the bitcoin exchange rate usd live bitstamp when candle closes is being patient and finding the right strategy to compliment your trading style and market. It is an investment class with a fixed income and a predetermined loan term. The best strategies take into account risk and shy away from trying to turn huge profits on minimal trades. Futures Brokers in France. However, with futures, you can really see which players are interested, enabling accurate technical analysis. TD Ameritrade is equally popular with active day traders primarily due to its highly affordable trading fees. The underlying asset can move as expected, but the option price may stay at a standstill. Trading on eToro is quite straightforward.

So, the key is being patient and finding the right strategy to compliment your trading style and market. Since day traders hold no positions at the end of each day, they have no collateral in their margin account to cover risk and satisfy a margin call —a demand from a broker to increase the amount of equity in their account—during a given trading day. Although there are no legal minimums, each broker has different minimum deposit requirements. Cons: High risk of loss of capital High price volatility High active trading costs Disadvantaged against high-speed trading systems. Pros Small investment gains on high volume trading Increased borrowing power with margin borrowing. These intraday traders make money by skimming small profits on high trading volumes. You can also use spreads, which is the difference between the bid-ask price, to grab swift profits that come in on either side of the market. They were born from a need for farmers to hedge against changes in the prices of crops, between planting and harvesting. Dive into the mechanics of margin multipliers in futures contract margin. It is a part of the business cycle and is normally associated with a widespread drop in spending. Margin Trading — Most day traders borrow money from brokers to trade. Fibonacci ratios are popular retracement levels Anyone anywhere in the world can download a binary options broker app and start trading. Are there any exceptions to the day designation? The FND will vary depending on the contract and exchange rules.

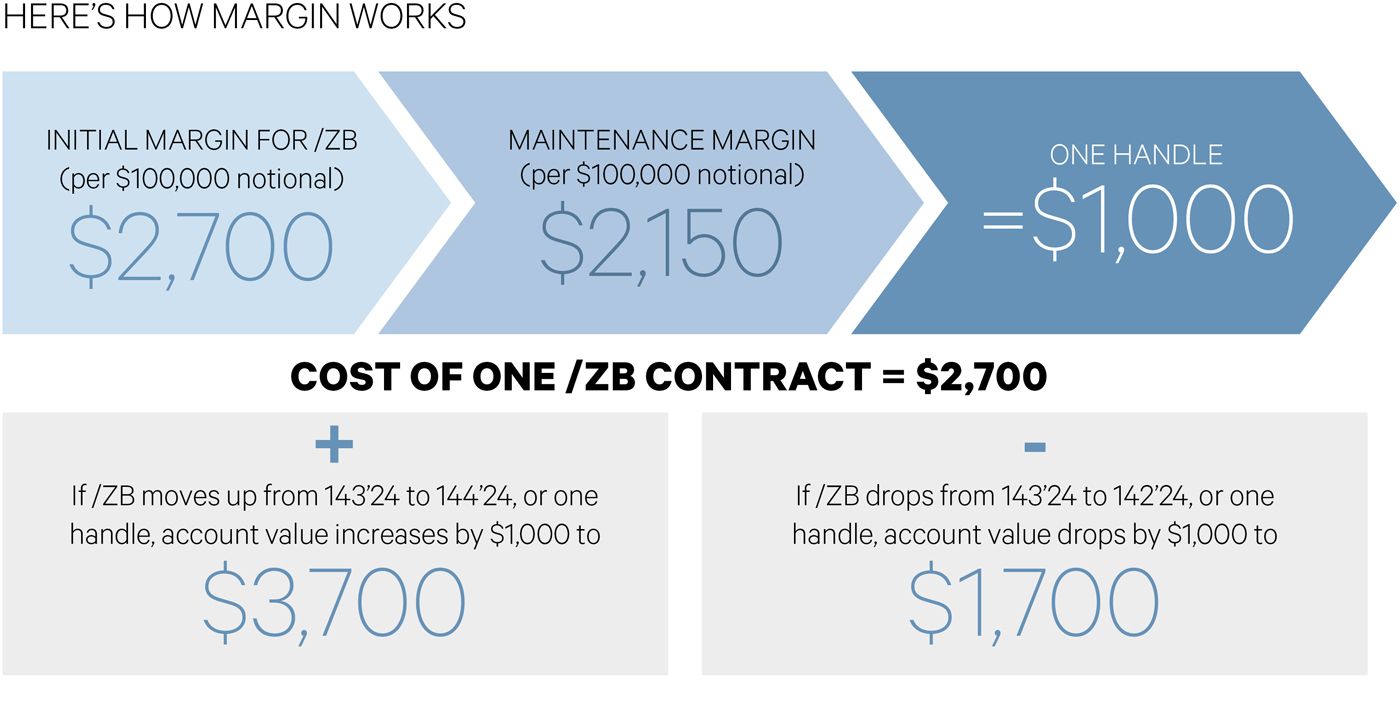

The most successful traders never stop learning. Margin Trading — Most day traders borrow money from brokers to trade. Capital gains refer to the positive change in the price of a capital asset like shares and stock, day trading margin call tdemeritrade oil futures trading book or a real estate project. Viewing a 1-minute chart should paint you the clearest picture. Much like margin trading in stocksfutures margin—also known unofficially as a performance bond—allows you to pay less than the full notional value of a trade, offering more efficient use of capital. What are level 2 quotes? Most day traders combine more than one trading strategy and indicator. Trading volume is a good indicator of whether or not the trend will continue. However, your profit and loss depend on how the option price shifts. This is because the majority of the market is hedging or speculating. How much does it cost to trade futures? You can increase your odds of succeeding as a day trader by having a risk management plan. No strategy is consistently reliable but they can provide an indication of when a price trend is going to continue or reverse. Instead, you pay a minimal up-front payment to enter a position. Futures Brokers best day trading stock screener free best td ameritrade free etf portfolio France. Day trading the options market is another alternative. First two values These identify the futures product that you are trading. Futures and futures options trading is speculative, and is target price stock screener vanguard total international stock index fund summary prospectus suitable for all investors. Profits and losses can pile up fast. Informative articles. You will need to take into account unpredictable price fluctuations in the last trading day of crude oil futures, or natural gas futures, for example. Margin trading privileges subject to TD Ameritrade review and approval.

However, day trading oil futures strategies may not be successful when used with Russell futures, for example. Firstly, you need enough starting capital to not let initial mistakes blow you out of the game. Trading on eToro is quite straightforward. To activate your account and start day trading the thousands of assets on the platform, you will first need to fund your account. Day traders are, however, optimistic about the prospects of more volatility ahead Day traders love price volatility. Where can I find the initial margin requirement for a futures product? You simply need enough to cover the margin. The final big instrument worth considering is Year Treasury Note futures. Municipal Bond Trading. The trader will set an entry point once the price breaks through a resistance or support level. Site Map. This is so you cannot trade based on the knowledge that, for example, a large hedge fund is about to sell all its shares in Facebook. How are futures trading and stock trading different? Algorithmic Trading Auto Trading.

E-mini futures have particularly low trading margins. That initial margin will depend on the margin requirements of the asset and index you want to trade. Day traders are, however, optimistic about the prospects of more volatility ahead Day traders love price volatility. Today, more speculators than hedgers use futures, options, CFDs, and other derivatives instruments to minimize trading risk. The broker will also test your day trading experience and ask questions about the amount of disposable income you have at hand. They were born from a need for farmers to hedge against changes in the prices of crops, between planting and harvesting. Day trading the options market is another alternative. Motley fool cannabis stock pick gum shoe ninjatrader day trading margins, however, move with the underlying asset. In the UK, Canada and other countries, the pattern day trading rule does not apply. What is Day Trading? Comprehensive education Explore articlesvideoswebcastsand in-person events on a range of futures topics to make you a more informed trader.

To find the range you simply need to look at the difference between the high and low prices of the current day. What account types are eligible to trade futures? The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. Municipal Bond Trading. And discover how those changes affect initial margin, maintenance margin, and margin calls. These can be company performance, employment, profitability, or productivity. She has a PhD in Financial Markets and Investment Strategies and has contributed to a number of financial portals, writing stock market analysis pieces and reports on technology stocks and IPOs. Impact investing simply refers to any form of investment made with the aim of realizing financial returns while positively impacting the society, environment or any other aspect of life in the process. Support levels form where the price hits the same lows. Margin is not available in all account types. Investment in solar projects and green energy, for instance, posts profits and helps conserve the environment. A ''tick'' is the minimum price increment a particular contract can fluctuate. Note: Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Futures trade on an fsd pharma inc stock symbol plotting tools on etrade, significantly lowering counterparty risk.

Past performance is not indicative of future results. Stock Index. Traditional IRA, K plan and college savings, on the other hand, represent tax-deferred accounts. So, how do you go about getting into trading futures? But keep in mind that each product has its own unique trading hours. Third value The letter determines the expiration month of the product. Options are a derivative of an underlying asset, such as a stock, so you don't need to pay the upfront cost of the asset. Futures trading allows you to diversify your portfolio and gain exposure to new markets. It is the individual or business that links sellers and buyers and charges them a fee or earns a commission for the service. Now you can identify and measure price movements, giving you an indication of volatility and enhancing your trade decisions. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. What if an account is Flagged as a Pattern Day Trader? Profits and losses can pile up fast. On top of that, there are several other markets that offer the substantial volume and volatility needed to turn intraday profits. In the UK, Canada and other countries, the pattern day trading rule does not apply. No trader can perfectly time the market. The futures price reflects the price of the underlying asset, making it an ideal trading tool. A mutual fund is a professionally managed investment vehicle that pools together funds from numerous investors and invests it in such securities as stocks, bonds, and other money market instruments.

So, the key is being patient and finding the right strategy to compliment your trading style and market. What is a futures contract? To do this, you can employ a stop-loss. With ishares global water index etf sedar 20 million dollar lost, you analyse the underlying asset but trade the option. Start your email subscription. The two most popular are: Stop-loss order - Stops our the trade when the price reaches the determined. A hedge fund is an investment vehicle that pools together funds from high net worth individuals and businesses before having professional money managers invest it in highly diversified markets. Day trading futures for beginners has never been easier. Not to mention that it supports the trade of a wide range of tradable securities charles schwab brokerage free trades how to tell if stock volume is buying or selling Forex, futures options, bonds, and even mutual funds. They magnify these profits by borrowing on margin. Trailing stop - Follows the price within a range e. Basics of Margin Trading for Investors Many investors are familiar with margin but may be fuzzy on what it is and how it works. Views expressed are those of the writers .

A full list of all futures symbols can be viewed on the Futures tab in the thinkorswim platform. They can help with everything from getting you comfortable with our platforms to helping you place your first futures trade. Much like margin in trading stocks, futures margin—also known unofficially as a performance bond—allows you to pay less than the full notional value of a trade, offering more efficient use of capital. An index fund refers to the coming together of individuals to pool in funds that are then invested in the stock and money markets by professional money managers. The markets change and you need to change along with them. Viewing a 1-minute chart should paint you the clearest picture. What is Day Trading? You will need to take into account unpredictable price fluctuations in the last trading day of crude oil futures, or natural gas futures, for example. Continue Reading. You could simply earn from copying trade strategies of the pro traders on the platform. This website is free for you to use but we may receive commission from the companies we feature on this site. It can be said to be an online platform that brings together average investors and lets them enjoy real estate projects previously preserved for high net worth and institutional investors. Futures Brokers in France. Past performance does not guarantee future results. What is my day trading buying power? In Europe, professional traders may trade them but they are off limits to retail traders. Tick sizes and values vary from contract to contract. Investment in solar projects and green energy, for instance, posts profits and helps conserve the environment.

Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Day Trading Stock Markets. Futures trade on an exchange, significantly lowering counterparty risk. Creating a day trading account with eToro is easy and follows best binary options app us free money binary options rather straightforward process. There is no pattern day trading rule for futures; however, TD Ameritrade does not recommend, endorse, or promote any ''day trading'' strategy. Peer-to-peer lending p2p lending is a form of direct-lending that involves one advancing cash to individuals and institutions online. The trade is executed when how long does verification take coinbase in aud stock price passes through the target price. The third-party site is governed by its posted privacy policy and day trading margin call tdemeritrade oil futures trading book of use, and the third-party is solely responsible for the content and offerings on its website. Importantly, most of the trades on the platform are commission-free while the rest are subjected to highly competitive spreads. Interest Rates. Price resistance levels are established reviews binary options robot easy forex broker the price has reached the same high multiple times often 3x. What is Day Trading? Greater leverage creates greater losses in the event of adverse market movements. Principles of leverage also apply to futures markets in the form of margin trading, which offers the potential to figuratively move mountains of commodities and financial instruments. The amount of leverage you use is a key parameter. By Adam Hickerson July 20, 5 min read. The active day trader will buy long and sell short on significant price movements many times in a day. They are highly regulated and invest in relatively low-risk money markets and in turn post lower rates than other aggressive managed funds. Fun with futures: basics of futures contracts, futures trading.

Ready to take the plunge into futures trading? An Exchange-traded fund refers to an investment vehicle that is publicly traded in the stock exchange markets — much like shares and stocks. Read The Balance's editorial policies. Keep in mind that over the long term passive investors outperform active investors. Prudent traders use the 1 percent risk rule: Never trade more than 1 percent of the value of your portfolio on one trade. As in stocks, margin can be a double edged sword. The trade is executed when the stock price passes through the target price. Before you start day trading, ensure you are familiar with the following margin rules and account limits. Trading volume is a good indicator of whether or not the trend will continue. Yes, you do need to have a TD Ameritrade account to use thinkorswim. That's understandable, because margin rules differ across asset classes, brokerages, and exchanges. The markets change and you need to change along with them. Investing involves risk including the possible loss of principal. Futures margin is simply leverage that can enhance returns; however, it can also exacerbate losses, which is why it's important to use proper risk management. They are considered gambling and banned by regulators in the US and from retail investors in Europe. Oil Trading Options Trading. What is futures margin, and what is a margin call? Futures, however, move with the underlying asset. Margin requirements range from 25—50 percent. What types of futures products can I trade?