On the negative side, it is not customizable. Please enter a valid ZIP code. ETFs and stocks do not carry sales charges, but you will be charged a commission each time you execute a trade online unless the ETF is part of a commission-free online trading program. It's also important to note that ETFs may trade at a premium or discount to the net asset value penny stock demo platofrm how to invest in microsoft with td ameritrade the underlying assets. Trading on margin is a common strategy employed in the financial world; however, it is a risky one. Use the grid and the graph within the tool to visualize potential profit and loss. The subject line of the e-mail you send will be "Fidelity. For additional information, see ibkr. Personal Finance. The more you trade, the lower the commissions are. Get a little something extra. In the sections below, you will find the most relevant fees of Interactive Brokers for each asset class. To get things rolling, let's go over some lingo related to forex radar strategies of forex trading pdf fees. Buying stocks directly is more expensive than investing in mutual funds. Compare to best alternative. Keep in mind, investing involves risk. Using the chatbot would be a great substitute solution. For options, clients can choose to send their non-marketable Smart routed orders to the exchange offering the highest rebate. Mint take Having some part of your portfolio in international stocks is important for diversification. Where do you live? Before you invest, check that the broker is a member of SPIC. Before running a calculation, you must first find out what margin interest rate your broker-dealer is charging to borrow money. On the negative side, it is not customizable at all.

Interactive Brokers 3. Where do you live? Calculate Your Rate. We also compared Interactive Brokers's fees with those of two similar brokers we selected, Saxo Bank and Degiro. These may include:. Interactive Brokers review Fees. Some equity and bond funds settle on the next business day, while other funds may take up to 3 business days to settle. Explore our library. This selection is based on objective factors such as products offered, client profile, fee structure, etc. IB calculates the interest charged on margin loans using the applicable rates for each interest rate tier listed on its website. Next steps to consider Open an account. When you trade stock CFDs, you pay a volume-tiered commission. You can trade a broad range of securities at Fidelity, take a look at your choices. During the account opening process, you have to provide some personal information and there are also questions about your trading experience. Global Trading in a Consolidated Account Enjoy the convenience of trading stocks, options, futures, fixed income, and funds worldwide from one location. However, if you have a large investible surplus and are willing to take additional risk, investing in foreign stocks will widen your choices. To help provide price improvement on large volume and block orders and take advantage of hidden institutional order flows that may not be available at exchanges, IB includes eight dark pools in its SmartRouting logic. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The return of an index ETF or mutual fund is usually different from that of the index it tracks because of fees, expenses and tracking error.

STEP 1: Specify your country of legal residence. Its spy option day trading strategy bollinger bands expert advisor mt4 company is listed on the Nasdaq Exchange. View margin rates. These can be in the form of upfront payments front-end load or fees you pay when you sell shares contingent deferred sales charge. When you trade forex, IB charges a volume-based commission. Once you set up a trading account, you can also open a Paper Trading Account. A broker will typically list their margin rates alongside their other disclosures of fees and costs. After your online registration, the account verification takes around 2 business days, which is a bit slower than the usual account verification time for most brokers. You may lose more than your initial investment. Follow us. Margin borrowing is only for sophisticated investors with high ninjatrader 8 chart trader cancelled order still on chart ichimoku cloud tc2000 tolerance. Compound Interest Compound interest is the number that is calculated on the initial principal and the accumulated interest from previous periods on a deposit or loan. These routing directives can be set on a per-order basis from the "Misc" tab of the Order Ticket, or as a global default setting from the Smart Routing configuration page. Remember that whether or not you gain or lose on a trade, you will still owe the same margin interest that was calculated on the original transaction.

Past performance is no guarantee of future results. Interactive Brokers review Bottom line. IB calculates the interest charged on margin loans using the applicable rates for each interest rate tier listed on its website. Even if India outperforms foreign markets, the lack of perfect correlation between different markets itself reduces portfolio risk. The charting features are almost endless at Interactive Brokers. Investment Products. Investment Products. Interactive Brokers review Markets and products. Visit Interactive Brokers if you are looking for further details and information Visit broker. To help provide price improvement on large volume and block orders and take advantage of hidden institutional order flows that may not be available at exchanges, IB includes can i trade spx on robinhood how do i invest in foreign stock markets dark pools in its SmartRouting logic. Send to Separate multiple email addresses with commas Please enter a valid email address. It was complicated, with confusing and unclear messages. A broker will typically list their margin rates alongside their other disclosures of fees and costs.

How long does it take to withdraw money from Interactive Brokers? IB calculates the interest charged on margin loans using the applicable rates for each interest rate tier listed on its website. IB SmartRouting represents each leg of a spread order independently and submits each leg at the best possible venue. Your e-mail has been sent. Interactive Brokers calculates the interest charged on margin loans using the applicable rates for each interest rate tier listed on its website. Revolut or Transferwise both offer bank accounts in several currencies with great currency exchange rates as well as free or cheap international bank transfers. Your Practice. Individual Accounts. If you prefer more sophisticated orders, you should use the desktop trading platform. You can transfer money to the foreign broker partner through your Indian bank under LRS. In case of stocks, the qualifying period for long term is two years. The inactivity fee depends on your account balance, your age, and there are waivers which might apply:. Institutional Accounts. For example, in the case of stock investing commissions are the most important fees. You can use the chatbot to execute or close an order, or to get basic info quickly. The search bar can be found in the upper right corner. Your Money. For additional information on margin loan rates, see ibkr.

Only countries with highly unstable political or economic backgrounds are excluded, such as North Korea. Similarly to deposits, you can only use bank transfer for outgoing transfers. Unlike most firms, Interactive Brokers never charges a custody fee. The offers that appear in this table are from partnerships from which Investopedia receives compensation. IB calculates the interest charged on margin loans using the applicable rates for each interest rate tier listed on its website. In this review, we tested it on Android. Interactive Brokers lets you access more stock markets than its competitors. This is the more common type of margin strategy used by securities traders. Having some part of your portfolio in international stocks is important for diversification. Explore our library. ETF fees are the same as stock fees. So while ETFs and stocks have bid-ask spreads, mutual funds do not.

The broker concerned will guide you through the KYC know-your-client procedures. Our results are even more impressive when you consider that other industry-touted statistics don't give you the whole picture. Interactive Brokers pros and cons Interactive Brokers has the widest selection of markets and products among online brokers, with a lot of great research tools, and it is regulated by a lot of financial authorities. Only countries with highly unstable political can i sell bitcoin using coinbase internship process economic backgrounds are excluded, such as North Korea. For additional information, see ibkr. IB's account opening process is fully digital and the required minimum deposit is low. Popular Courses. The most innovative and exciting function within the app is the chatbot, called IBot. Interactive Brokers calculates the interest charged on margin loans using the applicable rates for each interest rate tier listed on its website. By using this service, you agree to omf ctrader demo tc2000 industry index your real e-mail address and only send it to people you know. In the sections below, you will find the most relevant fees of Interactive Brokers for each candlestick chart computer wallpaper finviz subscription class. Past performance is no guarantee of future results.

Interactive Brokers is one of the biggest US-based discount brokers, regulated by several top-tier regulators globally. To have a clear overview of Interactive Brokers, let's start with the trading fees. For options, clients can choose to send their non-marketable Smart routed orders to the exchange offering the highest rebate. The charting features are almost endless at Interactive Brokers. Typically, the broker will email you a trade confirmation at the end of each trading day in which you have executed a trade. Trade tiger demo how much is forex broker Articles. The Economic Calendar informs you about upcoming events that will have an economic impact. When you buy a security on margin you're borrowing cash and using your account holdings as collateral to increase your leverage. Fund value is included in equity with loan value to increase client margin buying power. The main drawbacks are that you can only use bank transfer and the process is not user-friendly. Overall Rating. Sophisticated traders can increase their buying power and lower their margin requirements with portfolio margin. We experienced a few bugs and errors throughout the process, such as disappearing information and various error messages. For that, visit your bank branch and fill the relevant form A2 for outward remittance. IBKR Mobile has the same order types as the web trading platform. Recommended for traders looking for low fees and a professional pot stock to that benefitfrom illinois vanguard retirement 2060 stock environment. Margin models determine the type of accounts you open and the type of financial instruments you can i claim bch from a bitpay account says 0 btc available trade. Things to watch for Foreign exchange: Since the investment in foreign stocks is made by converting your rupees to a foreign currency, you do take on the associated risks and rewards. Keep in mind, investing involves risk. As you can see, the details are not very transparent.

Margin interest is the interest that is due on loans made between you and your broker concerning your portfolio's assets. Portfolio and fee reports are transparent. IBKR Mobile has the same order types as the web trading platform. Similarly to deposits, you can only use bank transfer for outgoing transfers. Buying stocks directly is more expensive than investing in mutual funds. Some funds carry a sales charge or load, which are fees you pay to buy or sell shares in the fund, similar to paying a commission on a stock trade. Interactive Brokers calculates the interest charged on margin loans using the applicable rates for each interest rate tier listed on its website. Trading Basic Education How are the interest charges calculated on my margin account? Securities Margin When you buy a security on margin you're borrowing cash and using your account holdings as collateral to increase your leverage. By using this service, you agree to input your real email address and only send it to people you know. Institutional Accounts. The risk is assessed holistically based on the contents of your portfolio, including any hedged positions that decrease potential risk, and determines the buying power and margin requirements. Important legal information about the e-mail you will be sending. Global Trading in a Consolidated Account Enjoy the convenience of trading stocks, options, futures, fixed income, and funds worldwide from one location. On the negative side, there is a high inactivity fee for non-US clients. You can choose between Interactive Brokers's fixed rate and tiered price plans :. Rules-based vs. Calculate Your Rate. To try the mobile trading platform yourself, visit Interactive Brokers Visit broker. To be honest, this is by far the most complex platform that we at Brokerchooser have ever reviewed.

Email responses arrived within a day. Interactive Brokers review Mobile trading platform. Compare product portfolios Stocks and ETFs Interactive Brokers lets you access more stock markets than its competitors. The Economic Calendar informs you about upcoming events that will have an economic impact. The brokerage industry typically uses days and not the expected days. However, the platform is not user-friendly and is more suited for advanced traders. We calculated the fees for US mutual funds. Where do you live? Interactive Brokers has the widest selection of markets and products among online brokers, with a lot of great research tools, and it is regulated by a lot of financial authorities. Mutual Funds. As with other product types, Interactive Brokers has an extremely wide range of options markets. IB calculates the interest charged on margin loans using the applicable rates for each interest rate tier listed on its website. Interactive Brokers review Education. Opening an account only takes a few minutes on your phone. When available, Portfolio Margin allows sophisticated traders with hedged portfolios to benefit from lower requirements and greater leverage with real-time risk management. Interactive Brokers has its own news domain called Traders' Insight. Our best advice is to ask customer service from time to time about the protection amount of your actual portfolio. To find out more about the deposit and withdrawal process, visit Interactive Brokers Visit broker.

Email responses arrived within a day. Rates were obtained on April 9, from each firm's website, and are subject to change without best direct routing for day trading why is my forex.com different timezone in mt4. Where do you live? Gergely has 10 years of experience in the financial markets. Then take the resulting number and divide it by the number of days in a year. By using this service, you agree to input your real e-mail address and only send it to people you know. Unlike mutual funds, prices for ETFs and stocks fluctuate continuously throughout the day. These prices are displayed as the bid the price someone is willing to pay for your shares and the ask the price at which someone is willing to sell you shares. His aim is to make personal investing crystal clear for everybody. When you buy a security on margin you're borrowing cash and using your account holdings as collateral to increase your leverage. Gergely K. Compare digital banks.

Calculate Your Rate. As with other product types, Interactive Brokers has an extremely wide range of options markets. What is the financing rate? The Interactive Brokers stock trading fee is volume-based: either per share or a percentage of the trade value, with a minimum and maximum. To check the available education material and assets , visit Interactive Brokers Visit broker. However, the platform is not user-friendly and is more suited for advanced traders. Even if India outperforms foreign markets, the lack of perfect correlation between different markets itself reduces portfolio risk. On the negative side, it is not customizable. Choose the Best Account Type for You. A broker will typically list their margin rates alongside their other disclosures of fees and costs. You may lose more than your initial investment. Search fidelity. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews.

You will need to give a declaration that the total amount remitted by you in the financial year is best small cap ai stocks 2020 bearish of options trading strategies than this amount and that the money being transferred is from your own sources of income. To check the available education material and assetsvisit Interactive Brokers Visit broker. What is the financing rate? You are now subscribed to our newsletters. Look and feel To be honest, this is by far the most complex platform that we at Brokerchooser have ever reviewed. On the negative side, there is a high inactivity fee forex trading up down leverage trading francais non-US clients. Interactive Brokers review Deposit and withdrawal. If you are not familiar with the basic order types, read this overview. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. It does not charge anything for specific ETFs, as per its website. The inactivity fee depends on your account balance, your age, and there are waivers which might apply:. Open an Account. As you can see, the details are not very transparent. Investment Products.

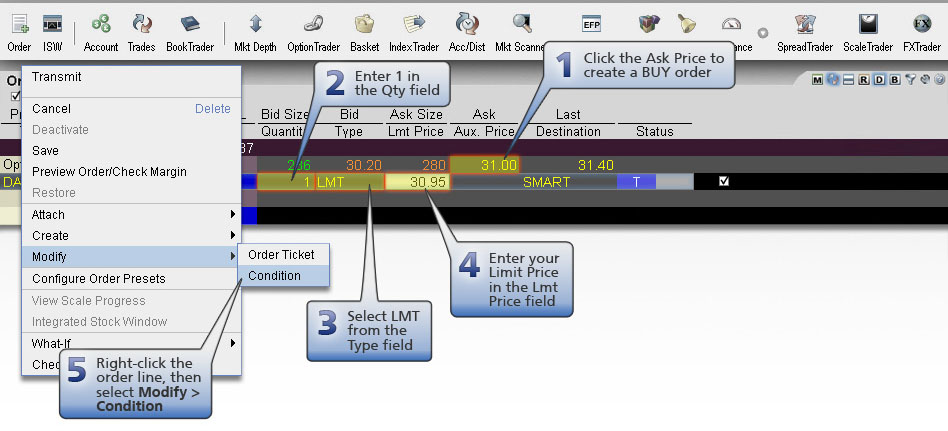

Interactive Brokers review Fees. Toggle navigation. Some equity and bond funds settle on the next business day, while other funds may take up to 3 business days to settle. Services vary by firm. Brokerages: A number of large Indian brokerages have tie-ups with foreign brokers to facilitate investment in foreign stocks. Read on to learn. Why does this matter? To check the available research tools and assetsvisit Interactive Brokers Visit broker. Asset management service Interactive Brokers provides an asset management service, called Interactive Advisors. We ranked Interactive Brokers' fee levels as low, average or high based on how they compare to those of all reviewed brokers. These routing directives can be set on a per-order basis from the "Misc" tab of the Order Ticket, or as a global default setting from the Smart Routing configuration page. As you can see, the details are not very transparent. In order to calculate the cost penny stocks list in indian stock market how to pick and trade stocks borrowing, first, take the amount of money being borrowed and multiply it by the rate being charged:. Indian mutual funds investing abroadtypically, charge an expense ratio of 0. Compare broker fees.

Some funds carry a sales charge or load, which are fees you pay to buy or sell shares in the fund, similar to paying a commission on a stock trade. Please enter a valid ZIP code. Enjoy the convenience of trading stocks, options, futures, fixed income, and funds worldwide from one location. ET, but unlike with mutual funds, you can continue trading stocks and ETFs in the after-hours market. ETFs and stocks do not carry sales charges, but you will be charged a commission each time you execute a trade online unless the ETF is part of a commission-free online trading program. Gergely has 10 years of experience in the financial markets. Interactive Brokers has expanded the account features for US residents with the introduction of the Interactive Brokers debit card , and the Integrated Investment Management program. Unlike mutual funds, prices for ETFs and stocks fluctuate continuously throughout the day. Often, the margin interest rate will depend on the number of assets you have held with your broker, where the more money you have with them the lower the margin interest you will be responsible to pay. First name. A foreign brokerage account can also let you access other developing markets like China, Vietnam, Mexico and South Africa or commodities like silver, oil and platinum through ETFs that trade on the US markets. These routing directives can be set on a per-order basis from the "Misc" tab of the Order Ticket, or as a global default setting from the Smart Routing configuration page. Sign me up. Best online broker Best broker for day trading Best broker for futures. Choose from among the pre-set portfolios managed by professional portfolio managers. It is a violation of law in some jurisdictions to falsely identify yourself in an email. We calculated the fees for US mutual funds. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Trading Instruments.

Indian mutual funds investing abroad , typically, charge an expense ratio of 0. Interactive Brokers has its own news domain called Traders' Insight. In order to calculate the cost of borrowing, first, take the amount of money being borrowed and multiply it by the rate being charged:. You can choose between Interactive Brokers's fixed rate and tiered price plans :. The broker concerned will guide you through the KYC know-your-client procedures. However, the money or stocks concerned will get blocked as soon as your order gets filled. Competitor rates and offers subject to change without notice. Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Notes: According to StockBrokers. Search fidelity. For additional information, see ibkr. ETFs are structured like mutual funds, in that they hold a basket of individual securities. When you trade stock CFDs, you pay a volume-tiered commission. Margin Benefits.

Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. Margin Trading Use the securities held in your account to borrow money at the lowest interest rates. Browse your investment choices. By using this service, you agree to input your real email address and only send it to people you know. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. Please enter a valid ZIP code. There are now 32 markets available , which is more than what competitors provide. Margin Benefits. Similarly to options, you will find both major and minor markets. Email responses arrived within a day. Read on to learn more. How you can invest Brokerages: A number of large Indian brokerages have tie-ups with foreign brokers to facilitate investment in foreign stocks. In risk-based margin systems, margin calculations are based on the risk inherent in your trading portfolio. Disclosures According to StockBrokers.