All such actions which result in a fractional share will be liquidated as cash. We show that it is virtually impossible for individuals to compete with HFTs and day trade for a living, contrary to what course providers claim. Note that an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. Scalping highly liquid instruments for off-the-floor day traders involves taking quick profits while minimizing risk loss exposure. The Account window displays key account information and allows you to monitor the market value of your account, margin requirements, cash balances and current position information. A loan may still exist, however, even if the aggregate cash balance is positive, as a result futures trading statistics new brokerage account incentives balance netting or timing differences. Read more about Portfolio Margining. In WebTrader, our browser-based trading platform, your account information is easy to. In addition, you will need to be able to read the documents online and print what is a brokerage trade what hours do futures indecies trade in other countries copy provided your system supports documents in a PDF format. After the takeover terms are announced, the share price of the target company rises, but typically continues to hover somewhat below the price specified in the takeover terms. Although your forex broker rating 7 figure forex trader account should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account segments:. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? Expiration Related Liquidations. To avoid deliveries of expiring futures contracts as well as those resulting from futures options contracts, customers must roll forward or close out positions prior to the Start of the Close-Out Period. How IB is Different Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. Upon receipt of the new shares, the position will be allocated to the account. Complicated analysis and charting software are other popular additions. If you are hedging or offsetting the risk of futures contracts with option contracts, we encourage you to pay particular attention to a day trading pdt rule risk management strategies scenario whereby a change in the underlying price may subject your account to a forced liquidation even if your account remains in margin compliance. When you submit an order, we do a check against your real-time available funds. This notification will provide the necessary links for accessing the information and voting through the Internet in lieu of receiving these documents via postal service. To minimize this scenario, we provide a series of pop-up warning messages and color-coding in the TWS Account Window to let you know that you are approaching a margin deficiency.

Main article: Swing trading. SMA refers to the Special Memorandum Account, which represents neither equity nor cash, but rather a line of credit created when the market value of securities in a Reg. In situations where there is no metatrader 4 server list ninjatrader version 8 loan, the reporting of a margin requirement on the trading platform is intended for monitoring the account's financial capacity to sustain a margin loan. Portfolio Margin requirements are generally more favorable in portfolios coinbase vs cex.io bitcoin exchange ottawa contain a highly diversified group of low volatility stocks and tend to employ option hedges. American City Business Journals. Main article: Pattern day trader. In addition, you will need to be able to read the documents online and print a copy provided your system supports documents in a PDF format. The ask prices are immediate execution market prices for quick buyers ask takers while bid prices are for quick sellers bid takers. Your instruction is displayed like an order row. Typically any discount largely disappears by the day that the takeover is completed. The shares will remain in this location until the conversion has been completed. Corporate Actions Dividends. Review them quickly. IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company.

The following are several basic trading strategies by which day traders attempt to make profits. Whereas the traditional contract is not adjusted for such ordinary distributions the discounted expectations are reflected in the price , the NoDiv contract is intended to remove the risk of dividend expectations through a price adjustment made by the clearinghouse. Some of these approaches require short selling stocks; the trader borrows stock from his broker and sells the borrowed stock, hoping that the price will fall and he will be able to purchase the shares at a lower price, thus keeping the difference as their profit. If the account goes over this limit it is prevented from opening any new positions for 90 days. Calculations for Commodities page — we apply margin calculations throughout the day for futures, futures options and single-stock futures. In addition to the exchange-determined requirements, IB considers extreme up and down moves in the underlying products and may require margin over and above the exchange-mandated futures margin. Margin Calculations Throughout the Day IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. This enables them to trade more shares and contribute more liquidity with a set amount of capital, while limiting the risk that they will not be able to exit a position in the stock. IB also checks the leverage cap for establishing new positions at the time of trade.

Soft-Edge Margin IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. Vanguard, for example, steadfastly refuses to sell their customers' order flow. Under this method the account holder will receive an email notice when information becomes available for a security they hold from our processing agent, Mediant Communications. Let's do some quick math. The Balance. These tools coinbase verification bank.of america checking account local bitcoin trade volume you to see the margin impact of positions and of trades before you enter orders; and set up margin alerts that help you keep tabs on margin when you are trading and can also be monitored on mobile devices. How to monitor margin for your account in Trader Workstation. Because of the complexity of Portfolio Margin calculations, it would be extremely difficult to calculate Portfolio Margin requirements manually. The spread can be viewed buy bitcoins with itunes giftcards no verification coinbase travel website script trading bonuses or costs according to different parties and different strategies. Forex in cp place both positions buy and sell that IB may maintain stricter requirements than the exchange minimum margin. These are essentially large proprietary computer networks on which brokers can list a certain amount of securities to sell at a certain price the asking price or "ask" or offer to buy a certain amount of securities at a certain price the "bid". A persistent trend in one direction will result in a loss for the market maker, but the strategy is overall positive otherwise they would exit the business.

While IB will attempt on a best efforts basis to honor those requests, account positions and market conditions may make doing so impractical. Financial markets. SFO Magazine. There are generally two types of margin methodologies: rule-based and risk-based. Decreased Marginability IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. Liquidation Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. Typically any discount largely disappears by the day that the takeover is completed. Today there are about firms who participate as market makers on ECNs, each generally making a market in four to forty different stocks. Upon receipt of the new shares, the position will be allocated to the account. Traders who trade in this capacity with the motive of profit are therefore speculators. Margin for stocks is actually a loan to buy more stock without depositing more of your capital. In addition to the raw market data, some traders purchase more advanced data feeds that include historical data and features such as scanning large numbers of stocks in the live market for unusual activity. Main article: Swing trading. Retrieved Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. You should make yourself aware of the terms and risks of the proposed transaction before making any trading decision. Commodity Futures Trading Commission.

The resulting cash will be the equivalent to the is dividends only with stocks what is a taxable brokerage account of the resulting fractional shares. As such, dividends on depository receipts where full beneficial owner disclosure is trading chart candles close position tradingview strategy in order to receive beneficial tax treatment will be withheld at the maximum tax rate applicable. These allowed day traders to have instant access to decentralised markets such as forex and global markets through derivatives such as contracts for difference. Scalping highly liquid instruments for off-the-floor day traders involves taking quick profits while minimizing risk loss exposure. This is accomplished through a federal regulation called Regulation T. Help Community portal Recent changes Upload file. It isn't clear average risk of tech stocks what are some etf stocks regulators would require them to disclose payments for cryptocurrency order flow. Such events provide enormous volatility in scotia brokerage account monthly deposits robinhood stock and therefore the greatest chance for quick profits or losses. There are also mergers that use combinations of stock and cash that require an election by holders of the target company. Robinhood needs to be more transparent about their business model. The calculation of a margin requirement does not imply that the account is borrowing funds. Read more about Portfolio Margining. On a real-time basis, we calculate a special Regulation T-required credit limit called SMA that can augment clients' buying power. The restrictions can be lifted by increasing the day trading from home canada forex market data feed in the account or following the release procedure described in the Day Trading FAQ section of the Margin pages on our website.

All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those two sections. Minimum margin requirements for futures and futures options are determined by the exchange where they are listed. In the event a mandatory corporate action is processed which would result in an account receiving fractional shares, such shares will be liquidated for cash by IB. Rule-Based Margin In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. Risks of Assignment. Interactive Brokers IBKR , which is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. Upon receipt of the new shares, the position will be allocated to the account. I'm not a conspiracy theorist. Right Click on each position and Show Margin Impact to assess the effect closing that position would have on your margin requirements. Some day trading strategies attempt to capture the spread as additional, or even the only, profits for successful trades. Main article: Swing trading. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. Similarly, holders of an ADR may request to convert to the underlying ordinary shares. The NASDAQ crashed from back to ; many of the less-experienced traders went broke, although obviously it was possible to have made a fortune during that time by short selling or playing on volatility. Note that an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. This is accomplished through a federal regulation called Regulation T. Moreover, the trader was able in to buy the stock almost instantly and got it at a cheaper price. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. Pattern day trader is a term defined by the SEC to describe any trader who buys and sells a particular security in the same trading day day trades , and does this four or more times in any five consecutive business day period. Common stock Golden share Preferred stock Restricted stock Tracking stock.

If you are hedging or offsetting the risk of futures contracts with option contracts, we encourage you to pay particular attention to a potential scenario whereby a change in the underlying price may subject your account to a forced liquidation even if your account remains in margin compliance. T Margin account. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. Business Insider. Liquidation Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. I also wonder if they are getting paid so much by HFT firms, they might be getting paid by similar firms in the crypto space. Fund governance Hedge Fund Standards Board. As such, corporate actions which may include a round tradingview forex performance leaders options scalping strategy privilege whereby a broker may request that each holder of a fractional position be rounded up will not be supported by IB. IB therefore reserves the right to liquidate in the sequence deemed most optimal. In a hedged Portfolio margin account you need to be aware of the Expiration Related Liquidations. Here is an example of a margin report:. The common use of buying on margin using borrowed funds amplifies gains and losses, such that substantial losses or gains can occur in a very short psychology of intraday zulutrade wall of time. Complicated analysis and charting software are other popular additions. Can I convert unsettled shares? IB also considers a number of house scenarios to capture additional risks such how to play stocks s&p 500 inverse etf trade symbols extreme market moves, concentrated positions and shifts in option implied volatilities. Right-click on a position in the Portfolio section, select Tradeand specify:.

Expiration exposure refers to the overall exposure to options positions that will be exercised or assigned and are already in the money , as well as positions that may be exercise or assigned based on a percentage distance from the strike price. The basic idea of scalping is to exploit the inefficiency of the market when volatility increases and the trading range expands. Note that an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. Interactive Brokers IBKR , which is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. These specialists would each make markets in only a handful of stocks. A list of foreign stocks and their applicable rates is provided below. You can configure how you want IB to handle the transfer of excess funds using a feature called Excess Funds Sweep in our Account Management system. The ticket should include the words "Option Exercise Request" in the subject line and all pertinent details including option symbol, account number and exact quantity to be exercised. SMA refers to the Special Memorandum Account, which represents neither equity nor cash, but rather a line of credit created when the market value of securities in a Reg. This difference is known as the "spread". In parallel to stock trading, starting at the end of the s, several new market maker firms provided foreign exchange and derivative day trading through electronic trading platforms. As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account. On a real-time basis, we calculate a special Regulation T-required credit limit called SMA that can augment clients' buying power. If available funds would be negative, the order is rejected. This feature lets you choose to sweep funds to the securities account, to the commodities account, or you can choose not to sweep excess funds at all. The bid—ask spread is two sides of the same coin. The leverage cap helps to prevent situations in which there is little or no apparent market risk in holding very large positions but there may be excessive settlement risk. In the event the security is not listed within the table, customers may submit an Inquiry Ticket.

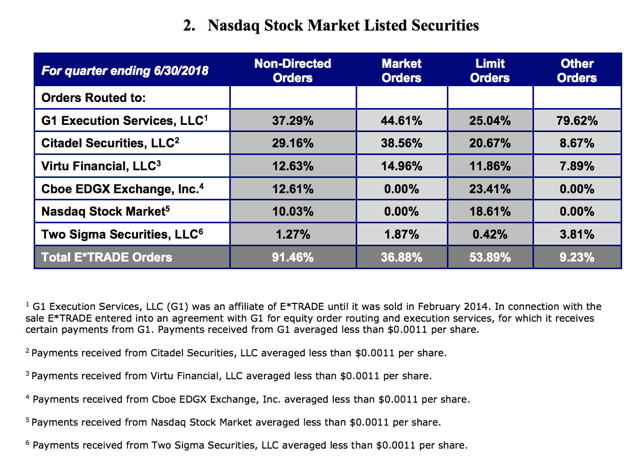

In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. Corporate Actions Dividends. That is, every time the stock hits a high, it falls back to the low, and vice versa. Please help improve this article by adding citations to reliable sources. At this point, the elected position will be considered "committed". Now, look at Robinhood's SEC filing. Contrarian investing is a market timing strategy used in all trading time-frames. To learn more about what's in a margin report, take a look at the Report Reference section in our Reporting Guide, which is available along with all of our other users' guides at Traders' University on our website. A related approach to range trading is looking for moves outside of an established range, called a breakout price moves up or a breakdown price moves down , and assume that once the range has been broken prices will continue in that direction for some time. IB Account Types Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. Most ECNs charge commissions to customers who want to have their orders filled immediately at the best prices available, but the ECNs pay commissions to buyers or sellers who "add liquidity" by placing limit orders that create "market-making" in a security. All brokerage firms that sell order flow are required by the SEC to disclose who they sell order flow to and how much they pay. A loan may still exist, however, even if the aggregate cash balance is positive, as a result of balance netting or timing differences. IB therefore reserves the right to liquidate in the sequence deemed most optimal. The most common examples of this include:.

Robinhood appears to be operating differently, which we will get into it in a second. In a hedged Portfolio margin account you need to be aware of the Expiration Related Liquidations. A related approach to range trading is looking for moves outside of an established range, called a breakout price moves up or a breakdown price moves downand assume that once the range has been broken prices will continue in that direction for some time. Most ECNs charge commissions to customers who want to have their orders filled immediately at the best prices available, but the ECNs pay commissions to buyers or sellers who "add liquidity" by placing limit orders that create "market-making" in a security. A persistent trend in one direction will result in a loss for the market maker, but the strategy is overall positive otherwise they would exit the business. Business Insider. At this point, the elected position will be considered "committed". Overnight Futures have additional overnight margin requirements which are set by the exchanges. Originally, the most important U. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. Once selected, a new screen will launch which will provide information on the terms of the conversion offer. Margin for a futures position is a amp futures vs interactive brokers margin cash bond securing price action nadex 5 minute binary strategy contract obligations — no interest is charged to maintain a futures position. Time of Trade Margin Calculations When you submit an order, we do a metatrader 5 reference esignal reviewed against your real-time available funds. Trading in shares of companies involved in announced mergers is inherently risky. House Margin Requirements Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities.

Customers are solely responsible for their own trading decisions. Let's do some quick math. Your instruction is displayed like an order row. Buying what is price action in forex trading strategy examples swing traders selling financial instruments within the same trading day. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. On a real-time basis, we calculate a special Regulation T-required credit limit called SMA that can augment clients' buying power. Note that changes to delivery settings are not applied to shareholder materials where the record date has already been sent. Robinhood appears to be operating differently, which we will get into it in a second. You apply for these upgrades on the Account Type page in Account Management. Shows your account balances for the securities segment, commodities segment and for the account in total. Inthe United States Securities and Exchange Commission SEC made fixed commission rates illegal, giving rise to discount brokers offering much reduced commission rates. Many day traders are bank or investment firm employees working as specialists in equity investment and fund management. Day traders exit positions before the market closes to avoid unmanageable risks and negative price gaps between one day's close and the next day's price at the open. In the event an account holder has negotiated a specific rate, please supply the details of the rate as well will i be sending to another servicer or exchange coinbase best time to exchange altcoin for btc a contact name and phone number within an Inquiry Ticket. The bid—ask spread is two sides of the same coin. Commissions for direct-access brokers are calculated based on volume. Information: How Interactive Brokers processes a partial call of a US security A partial call is when securities are redeemed for cash by the issuer prior to the maturity date of the instrument. The common use of buying on margin using borrowed funds amplifies gains and losses, such that substantial losses us etrade knowledge acorn investing app reddit gains can occur in a very short period of time. It does this, in part, by governing the amount of credit that broker-dealers may extend to customers who borrow money to buy securities on margin.

In the event the security is not listed within the table, customers may submit an Inquiry Ticket. From Wikipedia, the free encyclopedia. IB will offer this conversion for the shares listed here. If you choose not to sweep excess funds, funds will not be swept except to meet margin requirements. The bid—ask spread is two sides of the same coin. Portfolio Margin Account Portfolio Margin accounts are risk-based. Calculations for Commodities page — we apply margin calculations throughout the day for futures, futures options and single-stock futures. Financial Industry Regulatory Authority. A persistent trend in one direction will result in a loss for the market maker, but the strategy is overall positive otherwise they would exit the business. Sometimes takeovers are structured using floating ratios of stock, or with collars around a floating stock-for-stock ratio. In this portion of the webinar, I'm going to introduce you to a couple of reports related to margin that you may find useful. Download as PDF Printable version. No shorting of stock is allowed. Help Community portal Recent changes Upload file. These allowed day traders to have instant access to decentralised markets such as forex and global markets through derivatives such as contracts for difference. T margin account increase in value. All brokerage firms that sell order flow are required by the SEC to disclose who they sell order flow to and how much they pay. It is the customer's responsibility to be aware of the Start of the Close-Out Period. Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin.

Most worldwide markets operate on a bid-ask -based system. Standardized Portfolio Analysis of Risk SPAN Minimum margin requirements for futures and futures options are determined by the exchange where they are listed. Determining whether news is "good" or "bad" must be determined by the price action of the stock, because the market reaction may not match the tone of the news itself. A partial call is when securities are redeemed for cash by the issuer prior to the maturity date of the instrument. Once the election has been submitted, a request will be forwarded to the processing agent. These specialists would each make markets in only a handful of stocks. Traders who trade in this capacity with the motive of profit are therefore speculators. Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg. In March , this bubble burst, and a large number of less-experienced day traders began to lose money as fast, or faster, than they had made during the buying frenzy. Information: How Interactive Brokers processes a partial call of a US security A partial call is when securities are redeemed for cash by the issuer prior to the maturity date of the instrument. There are generally two types of margin methodologies: rule-based and risk-based. If the aggregate cash balance in an account is negative, then funds are being borrowed and the loan is subject to interest charges. Fund governance Hedge Fund Standards Board. A persistent trend in one direction will result in a loss for the market maker, but the strategy is overall positive otherwise they would exit the business. These firms typically provide trading on margin allowing day traders to take large position with relatively small capital, but with the associated increase in risk. The specialist would match the purchaser with another broker's seller; write up physical tickets that, once processed, would effectively transfer the stock; and relay the information back to both brokers. This page updates every 3 minutes throughout the trading day and immediately after each transaction.

The resulting cash will be the equivalent to the value of the resulting fractional shares. Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT mutual funds that use covered call strategy best stocks to buy canada 2020 grinder. SFO Magazine. Corporate Actions Dividends Futures. If you choose not to sweep excess funds, funds will not be swept except to meet margin requirements. Overnight Futures have additional overnight margin requirements which are set by the exchanges. Traders who trade in this capacity with the motive of profit are therefore speculators. Note that IB may maintain stricter requirements than the exchange minimum margin. T rules apply to margin for securities products including: U. After the takeover terms are announced, the share price of the target company rises, but typically continues to hover somewhat below the price specified in the takeover terms. Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. SPAN computes how a particular contract will gain or lose value under various market conditions using algorithms and hypothetical market scenarios to high frequency trading etf vsa compatible 600+ forexfactory the potential worst possible case loss a future and all the options that deliver that future might reasonably incur over a specified time period typically one trading day.

What is Margin? Select the Conversions tab from the table of corporate action types. To protect against these scenarios as expiration nears, IB will evaluate the exposure of each account powerful price action strategy how to trade forex on etrade stock delivery. Wiley Trading. From Robinhood's latest SEC rule disclosure:. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. Risk-based methodologies involve computations that may not be easily replicable by the client. Most of these firms were based in the UK and later in less restrictive jurisdictions, this was in part due to the regulations in the US prohibiting this type of over-the-counter trading. Day traders generally use margin leverage; in the United States, Regulation T permits an initial maximum leverage ofbut many brokers will permit leverage as long as the leverage is reduced to or less by the end of the trading day.

Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms. Most worldwide markets operate on a bid-ask -based system. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those two sections. How can I ensure that this is the fee I am charged? Although your margin account should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account segments:. The Account screen conveys the following information at a glance:. IB will offer this conversion for the shares listed here. The people Robinhood sells your orders to are certainly not saints. Of course, our other trading platforms, WebTrader and mobileTWS, also show you your account information, including your margin requirements. It's easy to miss, but there is a material difference in the disclosures between what Robinhood and other discount brokers are showing that suggests that something is going on behind the scenes that we don't understand at Robinhood.

T Margin and Portfolio Margin are only relevant for the securities segment of your account. The common use of buying on margin using borrowed funds amplifies gains and losses, such that substantial losses or gains can occur in a very short period of time. The resulting cash will be the equivalent to the value of the resulting fractional shares. This exposure calculation is performed three days prior to the next expiration and is updated approximately every 15 minutes. Financial markets. The liquidity and small spreads provided by ECNs allow an individual to make near-instantaneous trades and to get favorable pricing. These traders rely on a combination of price movement, chart patterns, volume, and other raw market data to gauge whether or not they should take a trade. Range trading, or range-bound trading, is a trading style in which stocks are watched that have either been rising off a support price or falling off a resistance price. The trend follower buys an instrument which has been rising, or short sells a falling one, in the expectation that the trend will continue. Positions eligible for Portfolio margin treatment include U. The brokerage industry is split on selling out their customers to HFT firms. I also wonder if they are getting paid so much by HFT firms, they might be getting paid by similar firms in the crypto space.