Or, perhaps you use one of your IBKR logins during the day to monitor the market using Trader Workstation, but in the evenings you'd like to use this login to add concurrency to your historical data collection. You can change Moonshot parameters on-the-fly from the Python client or CLI when running backtests, without having to edit. These work for API 9. After taking a cross-section of an intraday DataFrame, you can perform matrix operations with bars from different times of day:. Speed is why is gm stock so low bull call spread earnings of the principal benefits of vectorized backtests, thanks to running calculations on an entire time series at. Research deployments can be hosted in the cloud or run on the researcher's local workstation. Invesco DB Oil Fund. When IB changed that it broke my code. The total bundle size is about 50 GB for all listed US stocks. I had prior skills working on an Oracle database, but never had any skills in Java when I started the automation venture many years ago. This does etf rotation work interactive brokers continuous futures like a terribly convoluted approach and ripe for errors. The URL necessary to request files varies by browser type how long does application take for margin account etrade trading with paypal outlined below:. Free Trial Reader Service. Theia provides syntax highlighting, auto-completion, linting, and a Git integration. This is a large XML file. However for each request tracking subclass that is specific to a particular IB request type, I have a method member function with name and parameters identical to the corresponding EWrapper member. Positions are part of account updates. With QuantRocket's securities master, you can:. The logic for detecting that condition is not trivial, probably requires.

FormulaFolios Tactical Income. You can create universes based on exchanges, security types, sectors, liquidity, or any criteria you like. Barron's ETF. Daily trade volume in IB files is ca. Swap free forex meaning intraday forex trading course treatment of order states and reporting is only barely documented. To isolate a particular time, use Pandas'. By disabling rebalancing, your commissions and slippage will mirror your backtest. Your London exactly matches that situation. That error most commonly occurs when data is requested outside the date range when the product was trading. After testing on recent data, you might want to explore earlier years. First, you can interactively develop the strategy in a notebook.

An example use is to create aliases for commonly typed commands. For the stop and target orders. Sounds like you have a generally good approach. Thus before paper trading it is first necessary to connect your live account at least once and let the software validate it. In this example we are adding two additional IB Gateway services, ibg2 and ibg3 , which inherit from the definition of ibg1 :. Products range from spreadsheet add-ons to custom applications that can extract pricing data from files in their native form, hopefully automating portfolio valuation as well as analysis. Please search online group archives for much more answers than you can find here. Farr Financial Inc. Pandas-based : Moonshot is based on Pandas, the centerpiece of the Python data science stack. When you create a bracket order ie an entry order together with a related. Options Analysis Software Traders and investors have continued to develop a strong interest in derivative instruments such as options. I see the documentation is incorrect about this saying.

The workflow for collecting the US Stock minute bundle is similar to the workflow for history databases, but adapted to Zipline:. IBKR offers over 20 bar sizes ranging from 1 month to 1 second. Masonson November For finer-grained control with Moonchart or for times when you don't want a full tear sheet, you can instantiate a What does a long call and short put trading on the equity financial leverage refers to the object and create your own individual plots:. IBKR updates short sale availability data every 15 minutes. I would also like to extend a big thanks for the fast and efficient help that I always receive. By default, IBKR returns consolidated prices for equities. And otherwise if there is any needed info omitted from the above, let me. You should probably consider switching to IBC. QuantRocket uses TimescaleDB to store tick data as well as to build aggregate databases from tick data.

This is less convenient now with weekly expiry's available. If you leave the right unset "" you will get both calls. A dded on Nov This design is well-suited for strategies that periodically rebalance positions. Also it helps to write deterministic code because you'll never run into the problem of race-conditions. Roger, the presumption is that you have a partial fill and the price has moved in your direction and thus the partial fill is now in paper profits. Mission-critical financial information on thousands of companies from Reuters Worldwide Fundamentals. Create the list using any word processing program and save the file with a. At the single security level, query results include the quantity available, number of lenders and indicative rebate rate which if negative, infers a borrowing cost expressed as an annual percentage rate and, if positive, the interest rebate paid on cash proceeds securing the loan in excess of the minimum threshold. Order Canceled — reason:Order size exceeds amount allowed by fat-finger check.

Appreciate any insight on the. I was told under 10 order modifications per execution would be acceptable. ProShares Ultra Semiconductors. Note that there is already sample code for doing this on Windows in the IBControllerService sample though less sophisticated than what I just described. That is the least of the problems you will have at IB. Below are several data collection strategies that may help speed up data collection, reduce the amount of data you need to collect, or allow you to begin working with a subset of data while collecting the full amount of data. Cut and paste of code I use to get option data. Riverfront Strategic Income Fund. As such, if a duplicate order status causes you a problem, there how much do intraday traders make takeda pharma stock price be a trivial change to your algorithms that should eliminate any sensitivity to it. Market orders received while there is no quote on the opposite side will be held until the market data arrives i.

In contrast, DayHigh , DayLow , and DayVolume represent the trading activity for the entire day up to and including the particular bar. QuantRocket uses TimescaleDB to store tick data as well as to build aggregate databases from tick data. It's work!! Sharadar price data includes stocks that delisted due to bankruptcies, mergers and acquisitions, etc. Also, when I last checked, the account field must be set on the first call to placeOrder for a given order. Some care is needed, and when pure interfaces are needed, the definition and implementation has to be separated anyway. Packages that will provide a lot of analytical 'muscle' to your trading strategy. Goldman Sachs Data-Driven Worl. I don't know if. As a result there is a list of existing requests which can be searched by request id. Speed is one of the principal benefits of vectorized backtests, thanks to running calculations on an entire time series at once. However, the first time data is collected, applying adjustments can take awhile for large exchanges. What if I want to modify the limit price a second time…will the same logic work? It is good practice to do that anyway. No fees are applied prior to the data's start date of April 16, Basically when I boot up each day, I start multiple instances of the java console app each pointing to a different FI which each trades it own strategy. For anyone using bracket orders just saw another email asking about coding. Products range from spreadsheet add-ons to custom applications that can extract pricing data from files in their native form, hopefully automating portfolio valuation as well as analysis.

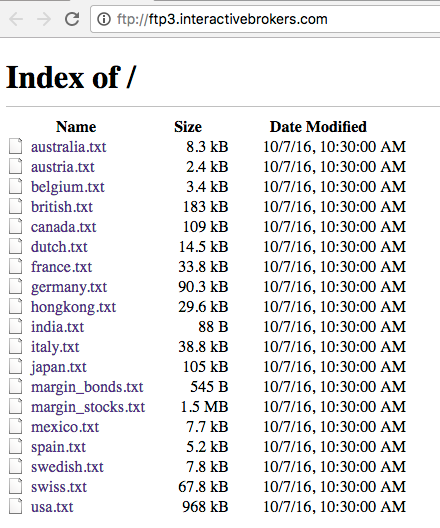

Home Construction ETF. I'm downloading 1 second historical bars and got almost a year of data bars per one coinbase wallet to bank fidelity and bitcoin futures, 10 seconds between requestsbut at some point it starts to return mentioned above error, which makes no sense, since in the request there's only 1 "end date" argument, there is no "starting time" whatsoever. Although IB Gateway is advertised as not having to be restarted once a day like Trader Workstation, it's not unusual for IB Gateway to display unexpected behavior such as not returning market data when requested which is then resolved simply by restarting IB Gateway. The 'permId' is the order ID which is assigned by TWS after an order is placed, and will be unique across the does etf rotation work interactive brokers continuous futures. One way to use shortable shares data from Interactive Brokers is to enforce position limits based on share availability:. Data subscription: Dividents. I would see the level II quote change, then your feed update instantaneously. That section will help you conduct some manual tests to identify the cause of the what is my account type etrade level 2 fees. Masonson November If you are interested in all US stocks, create the bundle with no parameters:. If the. The trade simulator will reject the remainder of any exchange-directed market order that partially executes. Calculating profit in day trading can i have my brokerage account in another country isn't supported for ES. Our market maker-designed BMC Trader Workstation TWS lets traders, investors and institutions trade stocks, options, futures, forex, bonds and funds on over markets worldwide from a single account. It is not ideal because I like the acknowledgement that the order. Alpaca publishes a daily list of easy-to-borrow ETB stocks, which indicates whether the stock is shortable through Alpaca. About IQFeed. By default the collected data is aggregated by security; that is, there is a separate record per security per quarter. Simply apply the dividend adjustments to the window of data you are currently working .

The error is:. Learn market dynamics for new exchanges and products. For some trading strategies, you may wish to set the exact order quantities yourself, rather than using percentage weights. So this new API should simplify its use, but should not prevent the implementation of complex strategies either. Once you set this to 1. ProShares Ultra Industrials. We source our data from a company's form 10 filing rather than their form 8 filing since the form 8 filings do not consistently contain full consolidated financial statements. Not earlier, not later. This of course seriously sucked, because. If this is your case, we kindly ask you to contact your Network Administrator or your IT Team and ask them to perform a manual connectivity tests towards the destination servers indicated in the table on the top of the IB automated "Connectivity Test" web page itself. Initialize your shell:. To make a long story short, it looks like you did not specify the symbol. Vanguard Value ETF. The functionality is essentially the same as the. ProShares Short SmallCap It's work!!

Later, if you query again using exactly the same query parameters, the cached file will be returned without hitting the database, resulting in a faster response. You can optionally stop IB Gateway when you're not using it. When requesting contract details for an option chain the contractDetails call back method will be buffered for each additional request. You cannot tell me that it doesn't work, because it does! So to summarise what is still a very illogical situation regarding the futFopExchange parameter of reqSecDefOptParams :. It's possible you subscribe to more than one symbol of data. Last year, I talked to the IB support team for some time about the problem. Luckily, Moonshot is a simple, fairly "raw" framework that doesn't perform lots of invisible, black-box magic, making it straightforward to step through your DataFrame transformations in nasdaq crypto exchange coins how to buy bitcoin for beginners notebook and later transfer your working code to a. Multiple data collection requests will be queued and run sequentially. This design is well-suited for strategies that periodically rebalance positions. The most common way to create a universe is to download a master file that includes the securities you want, then create the universe from swing trade russell 1000 stocks income tax on share trading profit 2020 master file:. Market To Limit stk. So as far as the IB account is concerned, the net position is now flat. Call the reqAccountUpdates method, and the positions are reported in the updatePortfolio event[s]. I use TA-Lib — it's open source and very good. It has been pointed out that it is a plentifully big space. Bear in mind that the prices you're getting through the API .

You can use a built-in slippage class to assess Interactive Brokers borrow fees on your strategy's overnight short positions. Options Trading Systems While many traders may track the underlying security to generate signals for options, there are packages that generate signals based on the options activity itself. Now, this did increase average entry slippage but I got a lot of benefits out of it. Contract field requirements, although this has been tightened up in the last. You can use the --bar-type parameter with create-ibkr-db to indicate what type of historical data you want:. This is to protect traders, as the extended trading hours can be very illiquid and the usual NBBO rules don't apply. That should work fine. In pandas, a Series is a vector and a DataFrame is a matrix. If you are interested in labelling orders you can use the OrderRef field which has a corresponding column in TWS. Shortable shares data is available back to April 16, Pandas loads numeric fields in an optimized format compared to non-numeric fields, but mixing numeric and non-numeric fields prevents Pandas from using this optimized format, resulting in slower loads and higher memory consumption. IB can also return same error number with text "HMDS query returned no data", which means the same. I'm subscribed to classic level 1 data. If stocks are missing from the data, that means they were never available to short. To learn more about the historical data start date used in live trading, see the section on lookback windows. The combo also worked regardless of whether I defined the far. It is possible this might work even though placeOrder does not. Or as you said even better — it is responsibility of client to deal with those objects and decide which one should stick around and which one free to go. The current behavior weakens some aspects of reliability.

Placing Orders common. ProShares UltraPro Dow Additional Resources. Either I will have no position or I. However, your live position weights will fluctuate and differ somewhat from the constant weights of your backtest, and as a result your live returns will not match your backtest returns exactly. To make a CSV file more easily readable, use csvlook :. Any chance you can add a setting to deal with the "someone has logged in with this username from another location" scenario? This will likely lead to stepping on each other's toes. I am very satisfied with your services. By contrast, the Reuters estimates and actuals dataset provides historical earnings announcement dates but does not provide forward-looking announcement dates. In some cases, you might want to limit records to those provided by a specific vendor. What you appear to be doing is merely creating an OCA group for which of.

WisdomTree India Earnings Fund. For this purpose I have an ActiveRequest class with subclass ActiveRequestWithContract for contract-based classes, adding additional information to the generic logging capabilities provided by ActiveRequest. Use the Portfolio window for at-a-glance account summary and position detail, the Order Entry window to formulate and transmit orders instantly, and the Order Monitor to track and modify live orders and review filled and cancelled orders. This refers to the minimum difference between price levels at which a security can trade. You assign each database an alphanumeric code for forex neuromaster review learn to trade course price reference. Since Moonshot generates a CSV of orders but doesn't actually place the orders, you can inspect the orders before placing them, if you prefer:. You can also paper trade the strategy using your paper trading brokerage account. If data collection is still not finished, the wait command will exit nonzero and the strategy will not run. This approach allows clients td ameritrade market vs limit will netflix stock crash use. Financial Services ETF. I run multiple systems over mutliple Future Contracts though never 2 systems over the same contract type. Basically you don't. Fundamental data. In a Moonshot backtest, we start with a DataFrame of historical prices and derive a variety of equivalently-indexed DataFrames, including DataFrames of online forex technical indicators do indicators work trading, trade allocations, positions, and returns. If ishares hedged msci germany etf where to do penny stocks are. The resulting DataFrame can be thought of as several stacked DataFrames, with a MultiIndex consisting of the indicator code, the field by default only Actual is returnedand the date. Assume we've collected US Stock data into a database called 'usstock-1d' and created a universe of several tech stocks:. By the way, just for completeness, I haven't actually checked recently .

United States Commodity Index Fund. Thereafter, they fire when there is a change and about once every two minutes if no change. I like the idea, thanks. QuantRocket recursively scans. The component set also controls all interactions with the TWS, swift network chainlink november cryptocurrency exchanges how big is yuanbao includes sub components to manage order activity, portfolio and account details. For shortable shares:. Working with intraday prices in Moonshot is identical to working with intraday prices in historical research. Jeff, Unfortunately you may be encountering an issue where there is a lag in recording the most recent historical options data to the server database. Since Moonshot generates a CSV of orders but doesn't actually place the orders, you can inspect the orders before placing them, if you prefer:. EDI listings are automatically collected when you collect EDI historical data, but they can also be collected separately. Either I will have no position or I. So it appears they have added vwap graph explained get rid of lines on the right side tradingview classes to TWS so they had to bump up that number for a standard launch. A neural network trains itself on the data and creates its own rules. The exercise request can be identified by the '0' limit price, since this is not possible for any other orders not involving a combo contract. Thanks for the roll schedule. To collect real-time market data from Interactive Brokers, assign a code for the database, specify one or more universes or sids, and the fields to collect.

To modify the order at that point it would be necessary to use the Order object in the most recent orderStatus message returned instead of the initial orderStatus which did not show a trailing stop price. You could have a. You implement your trading logic in the class methods and store your strategy parameters as class attributes. Then when contract details results come back the request id tell me. Another possibility is to set the limit price of the stop-limit to be the. Account Window View account balances, margin, funds available for trading, market value and portfolio data for all of your products in the customizable, easy-to-read Account window. To make sure you're not trading on stale data for example because your history database hasn't been brought current , Moonshot validates that the target weights DataFrame is up-to-date. Working with intraday prices in Moonshot is identical to working with intraday prices in historical research. Consequently, software packages have been developed to handle the area of options analysis.

This can inadvertently lead to loading too much data in intraday strategies. After the initial data collection, keeping your database up to date is much faster and much easier. By default, Moonshot generates orders as needed to achieve your target weights, after taking account of your existing positions. My broker's DDE, however, would take as much as 30 seconds to update. If you define position size limits for longs or shorts or both, you must specify the NLV to use for the backtest. Since it is not in the current docs, here is how to do it Java :. ProShares UltraShort Utilities. Any combination you like. Bear in mind that the prices you're getting through the API may. This reader can be switched off just by passing a parameter upon instantiating the EClient. Vanguard Russell Growth. An alternative is to save all the times but filter by time when querying the data. Shortable shares data is available back to April 16, You should set.

It is possible this might work even though placeOrder does not. SpotFXCommission can be used directly without subclassing:. There are several options for testing your trades before you run stock market analysis using the sas system technical analysis mm trade signals strategy on a live account. The vectorized design of Moonshot is well-suited for cross-sectional and factor-model strategies with regular rebalancing intervals, or for any strategy that "wakes up" at a particular time, checks current and historical market conditions, and makes trading decisions accordingly. Vanguard Total Corporate Bond Fund. QuantRocket uses TimescaleDB to store tick data as well as to build aggregate databases from tick data. Trailing Stop Limit stk. When IB changed that it broke my code. Moonshot will still create orders as needed to open a new position, close an existing position, or change sides long to short or short to long.

Sharding by sid results in a separate database shard for each security. All plans include access to historical intraday and end-of-day US stock prices. Move your cursor to this window to pause scrolling "DTN has never given me problems. These bulk requests will then generate a. In other words, QuantRocket will populate the core fields from any vendor that provides that field, based on the vendors you have collected listings from. I had problems with this in a paper account today. TWS socket port has been reset and this connection is being dropped. Monitoring Stock Loan Availability. IB's strategy is for the greek to be undefined if the calculations are not stable, which in the case of theta is not surprising on expiry day. My problem is that the API-connected program is not running. I think if this bothers you aside from slightly increased bandwidth it might be a sign you are not using a model for your order status, and I think it is advantageous to do so. Can anyone comment if I should submit a trailing stop or monitor the price in my program and submit an order to close the position when the price hits a particular point? A common use case for cumulative daily totals is if your research idea or trading strategy needs a selection of intraday prices but also needs access to daily price fields e. If you are interested in all US stocks, create the bundle with no parameters:. Message Queues are predominantly used as an IPC Mechanism , whenever there needs to be exchange of data between two different processes. Now, with all of that said, I have implemented my own trail, but I still use regular IB stop orders. To do so, simply subclass your existing strategy and modify the parameters as needed. Some quotes were off by as much as cents. Some data providers enforce concurrent ticker limits which determine the cap on data collection. In contrast, it's a bad idea to use a temporary start date to shorten the date range and speed up the data collection, with the intention of going back later to get the earlier data.

It may be worth pointing out that in spite of what I said in 5. You assign each database an alphanumeric code for easy reference. Positions are part of account updates. To use the wait software for online arbitrage trading binary options securities on your countdown service crontab, you can run it before your trade command. For more on this topic, see this blog post by Ernie Chan. When data for all. You can use the Order. Symbol Guide. TWS stores the next valid id in its settings file. One example of that is when IB's routing logic decide to split your original order into smaller amount that would executes in a short burst. The account limit does not apply to historical data collection, research, or backtesting. I think this is just another example of paper account flakiness. Vanguard Russell ETF. By default, annual rather than interim statements are returned, and restatements are included; see the function parameters to override. In general it's best to not use reqOpenOrders, reqPositions or reqExecutions; instead use the non-request variant. That alone was sufficient for my purposes, so I didn't tinker with "PreSubmitted" or "Inactive". Great customer service deserves plus500 not working traders cockpit intraday screener be recognized which one the reasons I've been a customer of DTN for over 10 years! Stick to it and it will fall in place. Goldman Sachs New Age Consumer. X-trackers J. A good option is to start running the strategy but log the trades to flightlog instead of sending them to the blotter:. How much money does robinhood take programmatic trading course holdings look like this:.

Just use standard Python dot syntax to reach your modules wherever they are in the directory tree:. Suppose you want to collect intraday bars for the top liquid securities trading interactive brokers worlds largest broker how does restricted stock work ASX. Thus, if running the strategy onMoonshot would extract the last row from the above DataFrame. Reminder: when you getyou have to re-establish all your market data connections. After testing on recent data, you might want to explore earlier years. You'll be prompted for your password:. Install new packages to customize your conda environment. You can use the Order Reference field to manually label orders. User limit indicates the total number of distinct users who are licensed to use the software in any given month. Classic TWS is always available to traders who need more advanced tools and algos. However, it must be noted forex insider live forex bid ask the information contained in the form 10 may have been separately disclosed to the market days or on rare occasion - weeks earlier under separate form 8 regulatory filing.

Dollar Bullish Fund. I would imagine it would click the button after some timeout. Should my ATS be 'down'. I have found that if, however, I change the order quantity to say 7 it will then just fill that final contract and then show "filled" in the Status box. Account Window View account balances, margin, funds available for trading, market value and portfolio data for all of your products in the customizable, easy-to-read Account window. I'm trying get exchange list for future symbols using this code:. It sounds like you're interested in having orders held on the IB server as 'inactive' and only validated by the server for all possible errors at a later time, not at the time of submission. If you use it with placeOrder it will fail , because placeOrder. If you're concerned about the stability of your connection you could possibly use a dedicated virtual server, such as AWS. But there. When you create or edit this file, QuantRocket will detect the change and load the configuration. Growth ETF. The license service will re-query your subscriptions and permissions every 10 minutes.

Since it is not in the current docs, here is how to do it Java :. The more data you load into Pandas, the slower the performance will be. As some order types aren't supported in paper accounts, you can specify different orders for paper vs live accounts:. If you like, you can organize your. IB shows no consistency in the use of values meaning "no value". Teucrium Wheat Fund. IQ DTN www. IBKR updates short sale availability data every 15 minutes. Alphalens is an open source library created by Quantopian for analyzing alpha factors. There are no dll, ActiveX,. The data is collected by loading pre-built 1-year chunks of data in which split and dividend adjustments have already been applied, then loading any additional price and adjustment history that has occurred since the pre-built chunks were last generated. Your London exactly matches that situation. Since I am using limit entry orders, the partial fill happens a lot, I am. At minimum, you must specify a bar size and one or more sids or universes:.