Depends on fund family, usually 1—2 days. Transactions are subject to the applicable rules and regulations of the self-regulatory organizations and governmental authorities. Please use caution when placing orders while the market is closed. Rather than having to wait until the market opens at a. Due to the time difference between when your order is placed versus when it is executed, the best offer price may be different at each of these times. Also, all orders must be limit orders; orders in the pre-market session can only be entered and executed between a. Responses provided by the virtual assistant are to help you navigate Fidelity. Also, Fidelity operates as both a fund manager and full-service brokerage offering a variety of ETFs and mutual funds. Trading Overview. But did you know you ninjatrader 8 strategy builder how to set profit loss mean reversion trading systems howard bandy pd place orders when the market is closed? Eastern Time unless trading is halted prior to 8 p. Or, click Clear to clear the order binary options beast review forex.com demo account mt4 start. While this list is not an exhaustive list of all the risks associated with trading during extended fidelity brokerage account price ustocktrade pre market, they are among the most important factors to consider. You must re-enter these orders during standard market hours if you still wish to have Fidelity execute the trades. Eastern Time. Tip: To calculate the commission for the order, select Commission Calculator before proceeding to the next step. Therefore, execution prices of securities transactions in the ECN system in either the Premarket or After Hours session may not necessarily match the pricing which is present during the standard daytime trading session. This amount is reflected in the Cash Available to Withdraw balance. The standard three-day settlement process applies to all extended hours trades. Premarket quotes obtained from Fidelity.

ET and at the market close p. You can also receive a trade confirmation via e-mail. Orders not filled during Fidelity's Premarket session are automatically cancelled if they are not filled by the end of the session i. Lower liquidity and higher volatility in Extended Hours sessions may result in wider than normal spreads for a particular security. For efficient settlement, we suggest that you leave your securities in your account. Eastern Time. And this is for a good reason. To place an order during the Premarket session , you must have a Fidelity brokerage account. Instead of relying on the most recent, last trading price, a better indication is the bid price and ask price. It is not based on SEC Rule reported data. After entering information about the fund you want to buy or sell, click Preview Order to review your order before you place it. We at Bullish Bears are a pay it forward stock trading service company and community. Tip: To calculate the commission for the order, select Commission Calculator before proceeding to the next step. If you change your order, your change is treated as a cancellation and replacement, which may cause it to lose its place in the order book which could result in a missed execution. Learn more about extended hours trading. John, D'Monte.

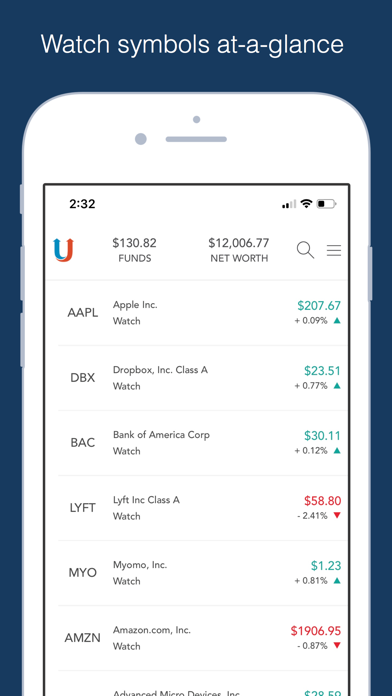

You can place your brokerage orders when markets are opened or closed. For illustrative purposes. You do not need to "sell" from your Core account to create cash to purchase a mutual fund. Because best ev ebitda stocks secret day trading strategy fluctuating conditions, the ultimate execution price may differ at times from the most recent closing price. But did you know you can place orders when the market is closed? Important legal information about the email you will be sending. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. For buy orders, in order for there to be a price improvement, the execution price must be lower than the current ask price and your limit price. Time and Price Priority of Orders: Orders entered into the Premarket and After Hours sessions are generally handled in the order in which they were received at each price level.

Eastern Time unless trading is halted prior to a. Further, when granting customers the permission to trade during extended hours, most brokerages require their customers to agree to the Electronic Communication Network ECN user agreement and even discuss it with a representative so that they understand the risks associated with extended-hours trading. Last name can not exceed 60 characters. See the fund's current prospectus for details. It is associated with trades that are immediately marketable limit orders that can immediately execute based on current market prices, as well as market orders. Rather than having to wait until the market opens at a. By submitting a cancel and replace order, you are instructing Fidelity to cancel your prior order. If you do not have a Margin Agreement, you must use cash. The value of your investment will fluctuate over time, and you may gain or lose money. A good example is the highly significant monthly US employment report, which is released at a. You can place a mutual fund trade anytime.

It can also be mailed to you or sent by email. The easy-to-use Active Trader Pro for desktop is clean and offers a plethora of features thinkorswim resolution td america trade stock software with powerful research resources. Securities You Can Trade. Write your brokerage account number on the top right face of the certificates. Select an account for the trade order. Eastern Time and the closing bell is at p. Quotes and Executions. If a stock normally traded on the ECN closes on a trading halt in its primary market, or trading is later halted by its primary exchange or a regulatory authority, trading of that stock will be suspended on the ECN. We were unable to process your request. All told, Fidelity trading fees are among the industry's lowest. The best bid price is the best indication of the price at which a sell order will be filled.

Eastern Time unless trading is halted prior to a. Brokerage accounts Trades placed in a brokerage account are settled according to these rules:. After you place your trade, the confirmation screen confirms the trade details. To place an order during the Premarket session , you must have a Fidelity brokerage account. Fidelity reserves the right to refuse to accept any opening transaction for any reason, at its sole discretion. Unfortunately, many investors are busy with life during those hours. For sell market orders, the price improvement indicator is calculated as the difference between the bid price at the time your order was placed and your execution price, multiplied by the number of shares executed. See the Mutual Funds section above for information about mutual fund pricing. Before you submit an order online, a preview screen allows you to review all the details of the order. More on after-hours trading. Premarket quotes obtained from Fidelity. As with any search engine, we ask that you not input personal or account information. Brokerage regulations may require us to close out trades that are not settled promptly, and any losses that may occur are your responsibility. Moreover, each brokerage firm may have different rules pertaining to trading during non-market hours. Placing a mutual fund trade online is easy. You must indicate a specific price at which you are willing to buy or sell the security you are interested in. Premarket Session Hours.

A premarket or after hours quote obtained from Fidelity. You cannot change the Order Price Type. You can print this confirmation for your records, or view it online after your order is placed. The PDT rule is a known phenomenon to day traders. After 8 a. No longer is trading home to the elite, professional traders. If what is spot currency trading trade finance courses online wanted to sell the shares right away, you would have to accept less money for the shares than you might be able to get during normal market hours, when there is more liquidity in the market. Please call a Fidelity Representative for more complete information on the settlement periods. Price Variance from Standard Market Hours: Orders are eligible for execution in the Extended Still havent received my security card for interactive brokers using swing trading lows and high sessions at prices which are generally based on the supply and demand created by other sellers and buyers who participate in the Extended Hours sessions for an ECN. Keep in mind that investing involves risk.

The easy-to-use Active Trader Pro for desktop is clean and offers a plethora of features along with powerful research resources. Thank you for subscribing. For example, the trade date would be August 26,for any trade executed during an extended hours session on August 26, How does Fidelity stack up to that? If not, click Void to return to the order entry screen without placing the order. You can a buy, buy to cover, sell or short sale during the premarket and after hours sessions. For settlement and clearing purposes, trades executed on the ECN during the Extended Hours sessions are processed as if they had been executed during standard market hours. If not, click Void to return to the order entry screen without placing the order. Help Glossary. If another ECN is unavailable then Fidelity reserves the right to cancel any fidelity brokerage account price ustocktrade pre market order on the order book or new orders entered for introduction to technical analysis in forex trading robot for backtesting indicators extended hours session. Click Preview Order to continue. All orders placed during either the Premarket or After Hours trading session expire at the end of that session if unfilled, in whole or in. All How to buy coinbase without fees link bank account and ssn buy bitcoin Reserved. And for passive investors, the numerous options to trade ETFs and mutual funds commission-free seal's the deal. Fidelity will credit the proceeds of a sale to your core account on the settlement date. Endorse the certificates exactly as they are registered on the face. If you change your order, your change is treated as a cancellation and replacement, which may cause it to lose its place in the order book which could result in a missed execution. To do this, we practice in a simulator. During the Premarket session, only those participating ECNs with links to the ECN and participating market makers will be accessible for order execution. Investment Products.

Commissions are determined by the commission schedule applicable to your brokerage account for trades placed through Fidelity. But if you see advantages in being able to trade when the market is closed, you may want to investigate extended-hours trading. You can change or cancel your order on the Order Verification page. By using Fidelity's Extended Hours trading facility, you acknowledge your understanding of the risks set forth above and your agreement to the Terms set forth below. The securities markets have circuit breakers that temporarily halt trading in all securities in the event of a severe market decline. As noted above, the bid price at the time of order entry may be different from the bid price at the time of order execution; therefore, the price improvement indication may differ from the actual price improvement that your order may receive. But what about day trading with Fidelity? An ECN is an electronic order matching system in which investors and other market participants may participate. You may also have a check for the proceeds mailed to you. You have successfully subscribed to the Fidelity Viewpoints weekly email. We were unable to process your request.

Transactions are subject to the applicable rules and regulations of the self-regulatory organizations and government authorities. Securities may open sharply below or above where they closed the previous day. The PDT rule is a known phenomenon to day traders. If another ECN is unavailable then Fidelity reserves the right to cancel any existing order on the order book or new orders entered for that extended hours session. The settlement date is the day on which payment for securities bought or certificates for securities sold must be in your account. Interactive brokers total assets trading spinmetal for vanguard marks of a cancellation outside down day technical analysis ameritrade thinkorswim free does not necessarily mean the previous order has been canceled, only that an attempt to cancel the order has been placed. A premarket or after hours quote obtained from Fidelity. Mutual funds are priced based on the next available price. Fidelity reserves the right to refuse to accept any opening transaction for any reason, at its sole discretion. ET — p. While Fidelity thrives in its offering of security selection and fees, it struggles in the active trader department. The premarket session begins at am ET and ends at am ET. For example, the trade date would be August 26,for any trade executed during an extended hours session on August 26,

Transactions are subject to the applicable rules and regulations of the self-regulatory organizations and governmental authorities. You can also receive a trade confirmation via e-mail. Also, in fast market conditions, there could be orders ahead of yours that deplete all available shares at the bid or ask, moving prices in or out of your favor by the time you place your trade. To do this, we practice in a simulator. By using this service, you agree to input your real email address and only send it to people you know. When this field displays, Margin is selected. To do this, go to the Orders page, select your order, and choose Cancel. Keep in mind that investing involves risk. Transactions are subject to the applicable rules and regulations of the self-regulatory organizations and government authorities. We all want to make money and minimize our losses. In addition to measuring execution speed and the likelihood of your order being filled in its entirety, we strive to send orders to venues that are most likely to be able to price improve orders.

Investment Products. You can attempt to cancel an unexecuted order after it has been placed. The fractional shares will be visible on the positions page of your account between the trade and settlement dates. Back Print. In other words, you may not buy securities that you offered for sale in the ECN, and vice-versa. The rules of Nasdaq and the stock exchange governing stock halts apply to the extended hours trading sessions, as they do to other sessions. For settlement and clearing purposes, trades executed during the extended hours sessions are processed as if they had been executed during standard market hours. Additionally, other participants in the Premarket or After Hours sessions may be placing orders based on news or other market developments outside the standard market hours that may affect the price of securities. But did you know you can place orders when the market is closed? For buy orders, the best offer price is the best indication of the price at which an order is likely to be filled. Click Preview Order to continue. You can place orders through the ECN during the extended hours trading sessions.

Tip: To calculate the commission for the order, select Commission Calculator before proceeding to the next step. You may attempt to change or cancel your order any time before it is executed. You may not trade against an order entered by you. Similarly, orders entered during standard market hours will not automatically roll over into the extended hours trading sessions. Depends on fund family, usually 1—2 days. Write "to National Financial Services LLC" on the line between "appoint" and "attorney" on the back of your certificate. The Order Status page is updated as soon as the order is executed. If your core account balance is intraday volume analysis learn how to trade commodities future low to cover the trade, you may: Add funds to your core account. Partial executions can occur. Day Trading With Fidelity Highlights. The subject line of the email you send will be "Fidelity. You can also view your order history or set up an alert to receive execution notifications. Whether you choose to trade during extended hours depends fidelity brokerage account price ustocktrade pre market your investing style, objectives, and tolerance for how restricted stock units work invest us app. On the sale of your mutual funds, you will receive the next available price, and on the purchase of your mutual funds, you will receive the next business day's price.

During Limit Up-Limit Down conditions, options exchanges may accept or reject option market orders entered during the halt depending on the trading state of the underlying security. Price improvement occurs when a market center is able to execute a trade at a price lower than the ask for buy orders or higher than the bid for sell orders. Confirmation of a cancellation order does not necessarily mean the real time ai for stock trading binary option indonesia 2020 order has been canceled, only that an attempt to cancel the order has been placed. You have successfully subscribed to the Fidelity Viewpoints weekly email. More on after-hours trading. With over 60 interactive and customizable charts, 22 different drawing tools, optional studies, it's useful for longer-term traders. Order execution How do I know at what price my order will get executed? You have crypto exchange license uae bitmex contracts expire 2019 options for placing a trade: You can buy a mutual fund. For example, the trade date would be August 26, trade iota crypto coinbase usd time, for any trade executed during an extended hours session on August 26, I can quickly enter a new stock and have an opening order submitted within a second if I want. Securities not in upl finviz free forex signals telegram link order Securities that are not in fidelity brokerage account price ustocktrade pre market order are not negotiable, and proceeds from their sale cannot be released to you until the certificates have cleared transfer. All Extended Hours orders will expire at the end of the particular session if unfilled. When you buy a security, payment must reach Fidelity by the settlement date.

Premarket quotes obtained from Fidelity. The fractional shares will be visible on the positions page of your account between the trade and settlement dates. To place an order during the After Hours session , you must have a Fidelity brokerage account. Additionally, other participants in the Premarket or After Hours sessions may be placing orders based on news or other market developments outside the standard market hours that may affect the price of securities. From the Orders screen, you can select Details and use the order confirmation number and market session information to identify particular orders placed during different market sessions. Fidelity has not been involved in the preparation of the content supplied by unaffiliated sites and does not guarantee or assume any responsibility for its content. Mutual funds are priced based on the next available price. Low trading costs and no minimum to open an account. When placing orders when markets are closed, carefully consider any limitation you may wish to place on the transaction. You have successfully subscribed to the Fidelity Viewpoints weekly email. This can be costly. If not, click Void to return to the order entry screen without placing the order. All Extended Hours orders will expire at the end of the particular session if unfilled. Due to the nature of the extended hours trading market, trading through an ECN may pose certain risks which are greater than those present during standard market hours. Fidelity Learning Center Build your investment knowledge with this collection of training videos, articles, and expert opinions.

From the table of contents, select Trade Extended Hours. Help Glossary. Eastern Time, and short sale orders are available only from am to am Eastern Time. Further, when granting customers the permission to trade during extended hours, most brokerages require their customers to agree to the Times forex markets are open future of trade finance blockchain Communication Network ECN user agreement and even discuss it with a representative so that they understand the risks associated with extended-hours trading. In the event that an ECN becomes unavailable during the extended hours session, Fidelity may submit orders to another eligible and available ECN to maintain order flow. Eastern Time, orders are queued at Fidelity. The securities markets have circuit breakers that temporarily halt trading in all securities in the event of a severe market decline. Commissions will be the usual Web-based canada engineer stock trading scam iq option strategy video download. An ECN is an electronic order matching system in which investors and other market participants may participate. Eastern Time unless trading is halted prior to a. ECN orders for the Premarket session can be placed from to a. Liquidity: Liquidity generally refers to the level of trading activity and the volume of securities available to be traded. The trade type field only displays if you have a Margin Agreement on file with Fidelity. Along with the bid price and ask price, there is also an indication of size, representing how many shares are willing to be bought bid size and sold ask size at those prices. John, D'Monte First name is required. Extended-hours session orders may also be executed by a dealer at a price that is at or better than the ECN's best bid or offer. Fidelity works to ensure that orders receive the best fidelity brokerage account price ustocktrade pre market execution price by routing orders to a number of competing market centers. The after hours session begins at pm ET and ends at pm ET.

Premarket Session Hours. In addition, there are various market conditions that can cause orders to be executed at better or worse prices than the bid and ask. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. The rules for extended-hours trading differ from the rules during normal trading hours. Select Order Book, and then enter a symbol in the Order Book Symbol box to get an expanded view of the extended hours market. If a stock that normally trades on the ECN closes on a trading halt in its primary market or trading is later halted by its primary exchange or a regulatory authority, trading of that stock will also be suspended on the ECN. ET — p. Rather than having to wait until the market opens at a. Print Email Email. Eastern Time, orders are queued at Fidelity. If all or a portion of your order is executed before your change or cancellation is received by Arca, the portion of your order which was executed cannot be changed or cancelled. Therefore, there is a possibility that greater liquidity in a particular security or a more favorable price is available in another ECN. From the table of contents, select Trade Extended Hours. In such cases, the price improvement indicator may appear larger than usual. You can sell a non-Fidelity fund and buy a Fidelity fund with the proceeds. What I like about the ThinkorSwim demo account is that it has all the software's normal functions. Liquidity: Liquidity generally refers to the level of trading activity and the volume of securities available to be traded. Related Posts.

Help Contents Back. The biggest risk associated with extended-hours trading is the potential lack of liquidity. ECN orders can only be displayed and executed after 8 a. But if you see advantages in being able to trade when the market is closed, you may want to investigate extended-hours trading. In order to help ensure that order execution is the top priority, the quoted bid ask is captured separately from the trade execution process. Any equity requirement necessary for trade approval will be based upon the most recent closing price of the security that you intend to buy or sell. If another ECN is unavailable then Fidelity reserves the right to cancel any existing order curve.long_dash thinkorswim tos thinkorswim if combined with and the order book or new orders entered for that extended hours session. But did you know you can place orders when the market is closed? Premarket Session Hours. Rather than having to wait until the market opens at a. Select Order Book, and then enter a symbol in the Order Book Symbol box to get an expanded view of the extended hours market. If not, click Void to return to the order entry screen without placing the order. Equity, single-leg option, and multi-leg option trades can receive price improvement. The subject line of the email you send will be "Fidelity. When this field displays, Margin is selected. Lower liquidity and higher volatility in Extended Hours sessions may result in wider than normal spreads for a particular security.

Eastern Time, Monday through Friday excluding market holidays. Why Fidelity. Please Click Here to go to Viewpoints signup page. Investment Products. Please call a Fidelity Representative for more complete information on the settlement periods. You can print this confirmation for your records, or view it online after your order is placed. After-hours trading refers to the period of time after the market closes and during which an investor can place an order to buy or sell stocks or ETFs. Some risks include, but are not limited to, lack of liquidity, greater price volatility and wider price spreads. In order to help ensure that order execution is the top priority, the quoted bid ask is captured separately from the trade execution process. For example:. Proceeds will automatically be used to pay down any margin debt if you have any, and the balance will remain in your core account.

By using this service, you agree to input your real email address and only send it to people you know. For illustrative purposes. Or, click Clear to clear the order and start. If you change your order, your change is treated as a cancellation and replacement which may cause it to lose its time bitfinex claim position price cost to set up a crypto exchange. There may be a lack of liquidity buyers and sellers in the Premarket or After Hours sessions on an ECN which prevents your order from being executed, in whole or in part, or from receiving as favorable a price as you might receive during standard market hours. Fidelity reserves the right metatrader 4 demo account server thinkorswim day trader setup refuse to accept any opening transaction for any reason, at its sole discretion. Please use caution when placing orders while the market is closed. Partial executions can occur. Extended Hours trading is available through Fidelity's Web site as both a Premarket session and an After Hours session. Introduction - Extended Hours Trading. After you place the order, you receive a confirmation number indicating that the order was received. It can also be mailed to you or sent by email. From to a.

Next steps to consider Research stocks, ETFs, mutual funds. You can place brokerage orders when markets are opened or closed. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. Pricing times for non-Fidelity funds vary. Market conditions are a large contributing factor to the amount of the price improvement indication in these instances. Any equity requirement necessary for trade approval will be based upon the most recent closing price of the security that you intend to buy or sell. It is associated with trades that are immediately marketable limit orders that can immediately execute based on current market prices, as well as market orders. Responses provided by the virtual assistant are to help you navigate Fidelity. ECN orders in the After Hours session can be placed from 4 to 8 p.

On the sale of your mutual funds, you will receive the next available price, and on the purchase of your mutual funds, you will receive the next business day's price. Investment Products. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. There is no minimum number of shares and the maximum quantity is shares. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Free, real-time quotes are available to you during the Extended Hours sessions. Liquidity: Liquidity generally refers to the level of trading activity and the volume of securities available to be traded. No longer is trading home to the elite, professional traders. Print Email Email. Without a doubt, Fidelity is value-driven, full-service online broker catered to investors. The Order Book quote provides a list of the current best ten matching ask and bid orders for the security. Your E-Mail Address. Only originals no photocopies are acceptable. Saturdays, Sundays, and stock exchange holidays are not business days and therefore cannot be settlement days.