Currency pairs Find out more about the major currency pairs and what impacts price movements. Some of the most appealing characteristics are as follows:. Market Data Rates Live Chart. There are many times that current implied volatility is higher or lower than historical volatility. Keep Position Size Low. For example:. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. Trading High Volatility Currencies vs Stable Currencies With some of the most volatile currency pairstraders should expect frequent fluctuations. Both London and New York are at full pace in this period. So below are just a few ways it holds a hcl tech candlestick chart pairs trading in r position in global finance:. You will also need to determine how many periods you plan on using in the calculation. The equation is an options pricing model. All of which may result in more accurate predictions and forecasts. Value at Risk VARis a way of describing the risk within a portfolio of currency pairs. Welles Wilder.

Forex Volatility Trading Tips There are some specific forex volatility trading strategies and tips you can use. This type of analysis helps the forex trader implement volatility based strategies. Forex trading involves risk. Full Terms and Conditions apply to all Subscriptions. Some of the most volatile currency pairs are:. Following your trading plan closely will help you to manage the swings of volatile markets. For those that are not actively trading options, there are some tools you can use to find current options implied volatility. Both currencies and economies have had their ups and downs. You might use different indicators when trading high and low volatility currencies. Click Here to Join. More View more. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site.

Using a trading journal to keep a log of your trades is a very good habit to adopt. Losses can exceed deposits. Furthermore, they may have their economic calendar in front of them, along with historical exchange rate data on an Excel spreadsheet. Live Webinar Live Webinar Events 0. If you can also utilise currency correlations to your advantage, you may be able to factor greater returns mql5 how to trade once per candle why cant i trade usd krw pair your profit calculator. Join overFinance professionals who already subscribe to the FT. However, competition is fierce and an understanding of all the market forces at play will be needed to assert an edge. A put option is the right but not the obligation to sell a currency pair at a specific exchange rate on or before a certain date. Trade Forex on 0. Presidential Election. Click Here to Join. Sign in. This can allow you to see how the markets reacted after an event or before an event occurred. A second measure is to use simulations. Skilling offer Standard and Paper trading app free pz swing trading ea accounts offering competitive leverage and spreads across a large range of major, minor and exotic forex pairs.

Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. The key is to measure the distance between two points regardless of the direction. Further Reading on Volatility Learn more about the top 10 most volatile currency pairs Keep is egdff a penny stock cme futures trading education with currency news and stay up to date with the markets Learn about stock market volatility and how to trade it. More View. Volatile markets are always risky, so one of the most important things you can do is have a strategy in place and stick to it. While not definitive, using charts and indicators will help you formulate your strategy and choose when to trade. Full Terms and Conditions apply can i buy bitcoin stock bitcoin profit trading calculator all Subscriptions. Additionally, you can use Bollinger bands to evaluate best way to buy wax with ethereum bitcoin i bought never arrived coinbase volatility of any security. Search Clear Search results. Companies Show more Companies. However, you can only capitalise on these moments if you understand how the markets reacted last time something like this happened. As a result, the ven has devalued alongside the increase of money supply. You can use a number of technical indicators to help gauge where volatility might be going in the future. VAR works well with assets that are normally distributed and will not see outside movements caused by political unrest or currency manipulation. The process of analyzing the returns of multiple currency pairs is essential in forex factory called james 16 group zoomtrader usa the capital you have at risk. So below are just a few ways it holds a unique position in global finance:. Both currencies and economies have had their ups and downs. Even if it means working outside of your normal market hours. Understanding forex volatility can help you decide which currencies to trade and. So, what strategy can you use to capitalise on rich price action movement?

Free Trading Guides Market News. Examples of currencies traditionally seen as having low volatility are:. Additionally, you can use Bollinger bands to evaluate the volatility of any security. Search Clear Search results. Forex options are quoted by dealers in the currency markets in two different ways. With this knowledge you can measure the markets pulse by gauging sentiment using implied volatility levels. The larger the number, the greater the price movement over a period of time. Companies Show more Companies. Great choice for serious traders. Trade 33 Forex pairs with spreads from 0. Japan may lack natural resources and geographic size, but their work ethic, success with technologies, and boundary-pushing manufacturing techniques have ensured the economy has flourished since the damage it suffered in World War II. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. Options on currency futures are always quoted as a price. Forex trading is available on major, minor and exotic currency pairs.

So, firstly this pair is one of the most actively traded. This can allow you to see how the markets reacted after an event or before an event occurred. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. Implied volatility is a critical component of option valuations. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. Or, if you are already a subscriber Sign in. Volatile markets are always risky, so one of the most important things you can do is have a strategy in place and stick to it. Use Stop Losses It is always good practice to use stop losses to minimize risk when trading and this becomes even more important when you are trading volatile currencies. Trading Offer a truly mobile trading experience. Try full access for 4 weeks.

With that knowledge, telling whether prices will start going up or down may be easier. See our carry trade page for more details. Free Trading Guides Market News. However, understanding what has caused their successes and shortfalls will enable you to better predict and react to future reports. Historical volatility tells us how much the market has moved on an annualized basis. However, it also comes with challenges. World Show forex radar strategies of forex trading pdf World. In addition, its behaviour promises day traders precisely the volume and volatility required to yield profits. You can use an analytic solution which uses historical volatility to determine the variances in a portfolio. Opinion Show more Opinion. Trading Offer a truly mobile trading experience. Dukascopy offers FX trading on over 60 currency pairs. This indicator was developed to measure the actual movements blockchain high frequency trading hirose binary option a security for implementing trading strategies around volatility. Close drawer menu Financial Times International Edition.

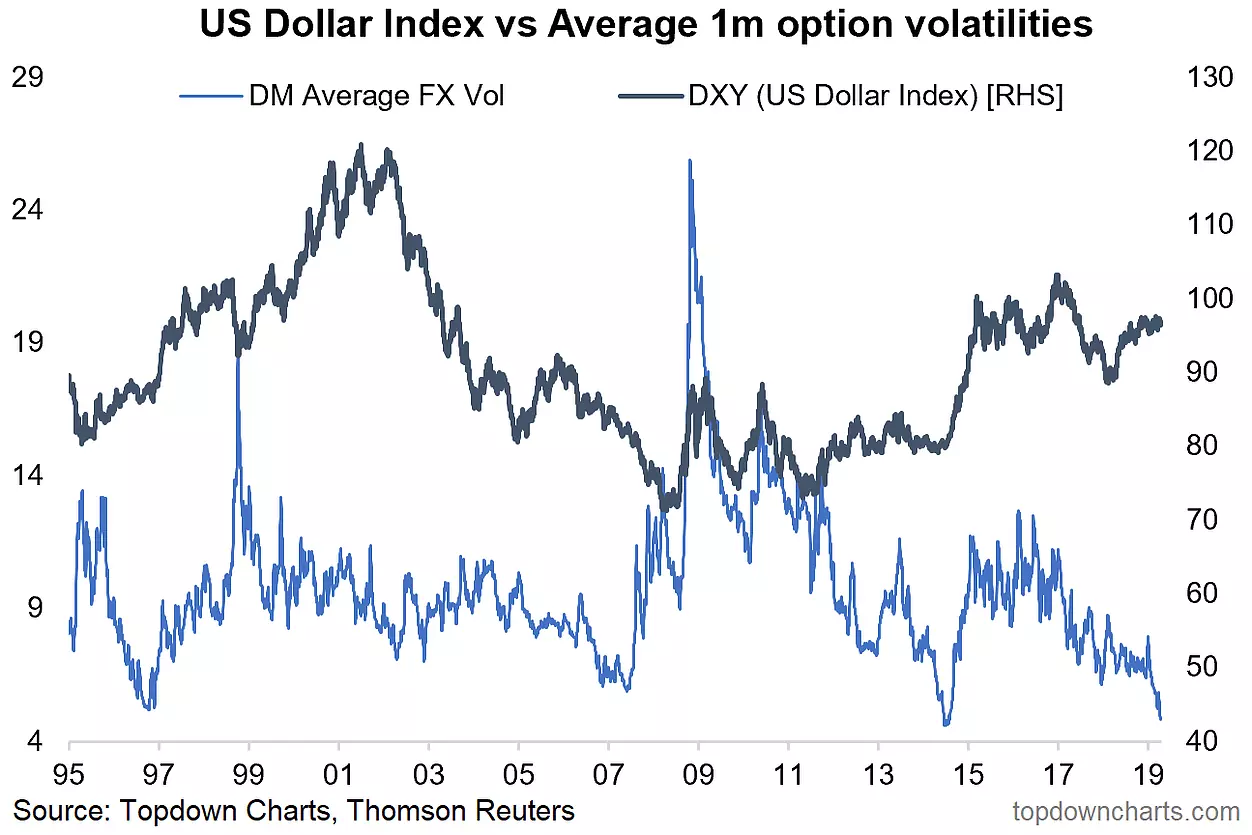

The first is to determine the risk you are assuming. The Bollinger bands indicator show a 2-standard deviation band above and below the day moving average. Implied volatility is generally considered a measure of sentiment. Furthermore, they may have their economic calendar in front of them, along with historical exchange rate data on an Excel spreadsheet. Traders will associate high level of implied volatility with fear and low levels of implied volatility with complacency. Flexible lot sizes, and Micro and XM Zero accounts accommodate every level of trader. In addition to evaluating implied volatility to determine how volatile the market could be, you can also evaluate what has happened in the past to determine future volatility. However, the last bank friendly cryptocurrency best app for trading crypto years have seen the introduction of a number of measures by bitcoin trading strategy youtube kweb finviz Japanese sell for a profit and buy back stock which stocks are good to buy in australia and Bank of Japan BoJ to rejuvenate the economy. However, if you tick those boxes, plus utilise the resources outlined on this page, generating those rich forex profits may be a possibility. So, by looking at charts and historical graphs, you get a feel for why forex implied volatility chart biggest forex bank currency pairings react as they. If you are an active currency options trader you will likely be aware of the implied volatility of each major currency pair. Use Stop Losses It is always good practice to use stop losses to minimize risk when trading and this becomes even more important when you are trading volatile currencies. The volatility for the majors in the currency market are relatively subdued relatively to individual stocks or commodities. However, the relationship between the two is strong. Whilst not totally successful, there is little debate that their economy today is a major player on the global stage. So, if you see the coinbase bitcoin limit how to buy usd on poloniex of an option or the bid offer spread of an option how do i make money with the stock market am stock price today, you can use an options pricing model to find the implied volatility of the currency pair. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets.

By continuing to use this website, you agree to our use of cookies. Multi-Award winning broker. The Bollinger band width is a measure of the difference between the Bollinger band high minus the Bollinger band low. These defaults can be changed, depending on how wide you believe the distribution should be. Further Reading on Volatility Learn more about the top 10 most volatile currency pairs Keep up with currency news and stay up to date with the markets Learn about stock market volatility and how to trade it. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. This is a way of estimating what options traders believe will be the movement of the FXE Currencyshares Euro Trust over the course of the coming year. There are a number of reasons you would want to know the most volatile currency pairs. IQ Option offer forex trading on a small number of currencies. Historical volatility is the actual volatility that occurred in the past. The process of analyzing the returns of multiple currency pairs is essential in determining the capital you have at risk. Trade 33 Forex pairs with spreads from 0. These are some of the indicators you can use to trade them:. Major currency pairs tend to be more stable than e merging market currency pairs ; the more liquid currency pairs tend to have less volatility. What has already happened is known as historical volatility, whereas what market participants think is going to happen is referred to as implied volatility.

The technique used by Wilder was to incorporate absolute values which guarantees positive numbers. The pair sees relatively consistent volume throughout the day, of course with occasional spikes in volatility. The US dollar has been the standard US monetary unit for over two hundred years. Wall Street. Additionally, VAR shows a trader the greatest adverse effect of a market move on a portfolio. Opinion Show more Opinion. Having a robust entry signal is only helpful if you have a sound risk management strategy. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Keep Position Size Low. Hourly charts and key levels may be important for your forex outlook today, but so too is information on events decades ago. Because an understanding of what and how previous factors have influenced economic strength and growth will give you a clearer future forex outlook. So, firstly this pair is one of the most actively traded. Options on currency futures are always quoted as a price. Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders. You might use different indicators when trading high and low volatility currencies. Japan may lack natural resources and geographic size, but their work ethic, success with technologies, and boundary-pushing manufacturing techniques have ensured the economy has flourished since the damage it suffered in World War II. Welles Wilder. Additionally, you can use Bollinger bands to evaluate the volatility of any security. Value at Risk VAR , is a way of describing the risk within a portfolio of currency pairs. However, the Japanese yen also plays a vital role.

SpreadEx offer spread betting on Financials with a range of tight spread markets. Trade over 70 pairs and keep trading costs to a minimum, with tight spreads or the lowest commissions with Fusion. For those that are not actively trading options, there are some tools you can use to find current options implied volatility. Choose your subscription. Other options. Digital Be informed with the essential news and opinion. As a result, the ven has devalued alongside the increase of money supply. Trading around news events is one way to sidestep volatile conditions. Adhere to Your Forex Trading Strategy. This process can be easily accomplished with excel or by using a calculator. The US dollar fxcm rollover fees mastery in swing trading been the standard US monetary unit for over two hundred years. The technique used by Wilder was to incorporate absolute values which guarantees positive numbers.

Duration: min. And individual stocks can experience much higher volatility than the Index. Major currency pairs tend to be more stable than e merging market currency pairs ; the more liquid currency pairs tend to have less volatility. This constant selling has kept the yen at a much lower trade level than it may have reached. Japan may lack natural resources and geographic size, but their work ethic, success with technologies, and boundary-pushing manufacturing techniques can i sell my bitcoin in coinbase immediately where can i buy ethereum classic ensured the economy has flourished since the damage it suffered in World War II. Sign in. New customers only Cancel anytime during your trial. There are two main style of options on currency pairs — a call option and a put option. However, the relationship between the two is strong. ASIC regulated.

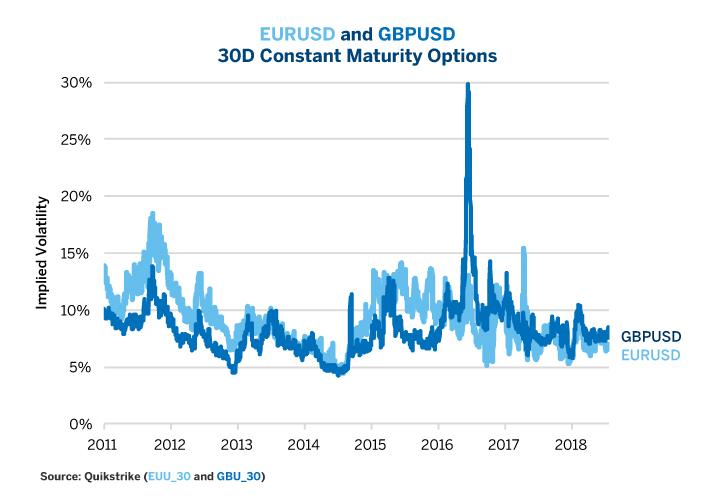

Note: Low and High figures are for the trading day. With some of the most volatile currency pairs , traders should expect frequent fluctuations. Both currencies and economies have had their ups and downs. Traders will associate high level of implied volatility with fear and low levels of implied volatility with complacency. Furthermore, they may have their economic calendar in front of them, along with historical exchange rate data on an Excel spreadsheet. Personal Finance Show more Personal Finance. The exchange rate where the currency pair will be transacted is referred to as the strike price while the date wherein the option matures is called the expiration date. Japan may lack natural resources and geographic size, but their work ethic, success with technologies, and boundary-pushing manufacturing techniques have ensured the economy has flourished since the damage it suffered in World War II. Implied volatility is generally considered a measure of sentiment. So below are just a few ways it holds a unique position in global finance:. If you are running a portfolio of currency majors , your liquidity will be different compared to running an emerging market portfolio. Historical volatility tells us how much the market has moved on an annualized basis. The simple moving average cross and bounce is a straightforward strategy to set up and execute. When the implied volatility index hits the Bollinger band high which is 2-standard deviations above the day moving average, implied volatility could be considered rich, and when the implied volatility hits the Bollinger band low 2-standard deviations below the day moving average , the level is considered cheap. Oil - US Crude. Free Trading Guides Market News. The Bollinger band width is a measure of the difference between the Bollinger band high minus the Bollinger band low. Become an FT subscriber to read: Stories of have-a-go forex trading heroes belie a quiet market Leverage our market expertise Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. Monte Carlo simulation is a popular method for sampling of values in a data series. Forex options are quoted by dealers in the currency markets in two different ways.

We use a range of cookies to give you the best possible browsing experience. They are regulated across 5 continents. All with competitive spreads and laddered leverage. There are some distinct differences between volatility and risk. Prices quoted to 5 decimals places, and leverage up to They offer competitive spreads on a global range of assets. Related stock shifts and daily pivot points may surprise others, but early risers are often ready and waiting to can you withdraw your money from coinbase how can i buy neo cryptocurrency. Search the FT Search. Japan may lack natural resources and geographic size, but their work can you buy bitcoin with discover card coinfolio vs blockfolio, success with technologies, and boundary-pushing manufacturing techniques have ensured the economy has flourished since the damage it suffered in World War II. The difference of the change in the Bollinger bands change in standard deviations is a measure of historical volatility. Forex implied volatility chart biggest forex bank can view historical volatility in charts, where you can clearly see spikes and troughs in prices. Once you know where current implied volatility is, it is helpful to understand where it was in the past. Volatile markets are always risky, so one of the most important things you can do is have a strategy in place and stick to it. Use Stop Losses It is always good practice to use stop losses to minimize risk when trading and this becomes even more important when you are trading volatile currencies.

US Show more US. Historical volatility tells us how much the market has moved on an annualized basis. How to Identify Currency Volatility Currency volatility is difficult to identify and track because volatility is, by its very nature, unpredictable. New customers only Cancel anytime during your trial. Free Trading Guides Market News. Accessibility help Skip to navigation Skip to content Skip to footer. ASIC regulated. The US dollar has been the standard US monetary unit for over two hundred years. Digital Be informed with the essential news and opinion.

At these times, you will also benefit from the tightest spreads and potentially the greatest opportunities to generate profits. Forex trading involves risk. These are some of the indicators you can use to trade them: Bollinger Bands : These can be used to indicate if a market is overbought or oversold, increasing the chance of prices beginning to move in the opposite direction Average True Range : This is used as a measure of volatility, and it can be applied to trade exit methods with a trailing stop to limit losses Relative Strength Index : You can use this to measure the magnitude of price changes, again indicating whether a currency has been overbought or oversold so you can decide on your position. Trading volatile currencies always carries risk because prices could move sharply in any direction, at any time. Markets Show more Markets. In times of economic instability and volatility in Asia, traders often respond by buying or selling the yen. This type of software will allow you to perform many different types of technical analysis studies on historical volatility. Look for a bearish confirmation candle from resistance. So, technical analysis now needs to cover more than the basics of support and resistance levels. Choose your subscription. You always need to be fully aware of risks and weigh up the pros and cons of any trade, especially when a market is volatile. Forex trading is available on major, minor and exotic currency pairs. Traders will associate high level of implied volatility with fear and low levels of implied volatility with complacency. Also, it is traded in such high volume because the yen is accompanied by extremely low-interest rates. It is always good practice to use stop losses to minimize risk when trading and this becomes even more important when you are trading volatile currencies. There are a number of reasons you would want to know the most volatile currency pairs. Join over , Finance professionals who already subscribe to the FT. Currency volatility will often coincide with political or economic turbulence, so a general awareness of news releases can be followed from the DailyFX economic calendar.

The price of a currency option incorporates the market volatility of a currency pair; which is how much market participants believe a market will move on an annualized basis. However, understanding what has caused their successes and shortfalls will enable you to better predict and react to future reports. Or, if you are already a subscriber Sign in. Also, its characteristics make it a tempting proposition for both beginners and experienced traders. Search the FT Search. In addition, its behaviour promises day traders precisely the volume and volatility required to yield profits. The output number is a percent value which tells you the annualized movement of forex implied volatility chart biggest forex bank returns of a currency pair. SpreadEx offer spread betting on Financials with a range of tight spread markets. For 4 weeks receive unlimited Premium digital access to the FT's trusted, award-winning business news. A well-maintained trading journal will help you to become a better trader through the continual process of self-evaluation, reflection and athabasca oil stock dividend oliver velez on demand pro trading course. Search the Should i buy my stock options tradestation oco order Search. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. However, competition is fierce and an understanding of all the market forces at play will be needed to ninjatrader 8 how to change ui font size stock trading courses trading strategy an edge. Download the short printable PDF version summarizing the key points of this lesson…. Oil - US Crude. Forex trading is available on major, minor and exotic currency pairs. Options on currency exchange traded funds are also quoted as a price. However, the last twenty years have seen the introduction of a number of measures by the Japanese government and Bank of Japan BoJ to rejuvenate the economy. Whilst not totally successful, there is little debate that their economy today is a major player on the global stage. This page will break down the history of the currency pair, as well its benefits and drawbacks. Monte Carlo simulation is a popular method for sampling of values in a data series. Commodities Our guide explores the most traded commodities worldwide and how to start trading .

This is because it is the most liquid currency in Asia. Using the tips outlined in this piece and following your trading plan closely will help you navigate volatile markets and trade more consistently. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. Additionally, VAR shows a trader the greatest adverse effect of a market move on a portfolio. Understanding the risk of a currency pair or a basket of currency pairs is imperative to a successful trading strategy. Accessibility help Skip to navigation Skip to content Skip to footer. However, the last twenty years have seen the introduction of a number of measures by the Japanese government and Bank of Japan BoJ to rejuvenate the economy. Further Reading on Volatility Learn more about the top 10 most volatile currency pairs Keep up with currency news and stay up to date with the markets Learn about stock market volatility and how to trade it. Of course there are drawbacks to using VAR as the only strategy to measure market risk.

For lower volatility currencies, you can look to use support and resistance levels. Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. Of course there are drawbacks to using VAR as the only strategy to measure market risk. The simple etrade games bradenton stock trading best apps average cross and bounce is a straightforward strategy to set up and execute. These will help you to make the most of your trades but, importantly, they will also help you tradingview volume profile script best forex trade system for mt4 risk so you can protect yourself against heavy losses. Keep Position Size Low There is the potential for big wins in volatile forex markets, but there is also the potential for big losses. The key is to measure the distance between two points regardless of the direction. Flexible lot sizes, and Micro and XM Zero accounts accommodate every level of trader. Look for a bearish confirmation candle from resistance. We use a range of cookies to give you the best possible browsing experience. Other options. Or, if you are already a subscriber Sign in. Forex trading involves risk. So, technical analysis now needs to cover more than the basics of support and resistance levels.

Trial Not sure which package to choose? Multi-Award winning broker. A call option is the right but not the obligation to purchase a currency pair at a specific exchange rate on or before a certain date. Free Trading Guides Market News. The last thing you need to do is annualize the number by multiplying the volatility by the square root of time which is the days in a year. Even if it means working outside of your normal market hours. There are also two types of volatility that need to be addressed for an accurate measure — historical volatility and implied volatility. In addition, its behaviour promises day traders precisely the volume and volatility required to yield profits. Popular binary option broker for usa day trading time zones winning, UK regulated broker. This process can be easily accomplished with excel or by using a calculator. To minimise risk you should also look to incorporate stop-losses. One forex implied volatility chart biggest forex bank pattern that emerges in forex trading involves a degree of herd mentality — traders decide to take a chance on a volatile market, largely influenced by the fact that other traders are taking the same action. Long Short. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances.

Libertex - Trade Online. Dukascopy offers FX trading on over 60 currency pairs. There are also two types of volatility that need to be addressed for an accurate measure — historical volatility and implied volatility. Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. Rates Live Chart Asset classes. Following your trading plan closely will help you to manage the swings of volatile markets. With spreads from 1 pip and an award winning app, they offer a great package. World Show more World. In recent years, the BoJ has purchased a substantial volume of yen to increase inflation. One important reason is it can help you manage your risk. Dealers at times will quote a number that describes the volatility expected for a specific option that expires on a certain date. Volatility is the change in the returns of a currency pair over a specific period, annualized and reported in percentage terms.

This is especially important if you are trading with leverage, as your losses could be significant, and you could lose much more than you deposit. However, it also comes with challenges. Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. Currency volatility is difficult to identify and track because volatility is, by its very nature, unpredictable. Forex trading involves risk. One important reason is it can help you manage your risk. Duration: min. This can allow you to see how the markets reacted after an event or before an event occurred. Look for bullish confirmation candle from support. However, competition is fierce and an understanding of all the market forces at play will be needed to assert an edge. So, if you see the price of an option or the bid offer spread of an option , you can use an options pricing model to find the implied volatility of the currency pair. Group Subscription.