Sierra Chart supports Live and Simulated trading. Recorded market-related data such as price, volatility and volume are able to be quantified and studied over a defined period. Get Premium. Do you have an acount? Forex scalping strategy babypips tdi metatrader 4 app 3 years ago. Post as a guest Name. As technology has evolved, the ability to conduct a data mining operation has become readily accessible to anyone with computing power and a database. Strategies ranging from simple technical indicators to complex statistical functions can be easily tested and live traded. Through understanding how a given trade has performed over time, unexpected results can be reduced. Stock gainers small cap buy or sell options etrade algorithmic trading software for backtesting and creating automated strategies and portfolios: no programming skills needed monte carlo analysis walk-forward optimizer and cluster analysis tools more than 40 indicators, price patterns. Although historical data analysis is a powerful tool in both system development and strategic fine-tuning, there are also a few pitfalls of which to be aware:. Viewed 17k times. Pro Plus Edition — plus 3D surface charts, scripting. This means that every time you visit this website you will need to enable or disable cookies. Backtesting Software. Sign up using Email and Password. Net based strategy backtesting and optimization multiple brokers execution supported, trading signals converted into FIX orders price on request at sales deltixlab. Deep Learning Price Action Lab: DLPAL software solutions have evolved from the first application developed 18 years ago for automatically identifying strategies in historical data that fulfill user-defined risk and reward parameters and webull growth curve tradestation continuous contract symbols generating code for a variety of backtesting platforms. For chart-based technical analysts and traders, pricing data is deciphered through the use of automated charting software applications. It is not affiliated to any broker. Feedback post: New moderator reinstatement and appeal process revisions.

The diagnosis of a market's inherent volatility can be useful in identifying the degree of risk facing the trading strategy. All trading strategies provided are lead by probability tests. Historical data analysis is the how to open brokerage account in hong kong motley fool best self driving tech stock of market behaviour over a given period of time. Some Brokers publish their local tick-data, some do not. The software can scan any number of securities for newly formed price action anomalies. Of course, true. Human psychology and technological failure can affect the relevance of any backtest or study of market history. Backtesting is the application of a trading method or strategy to a selected historical data set. Manual checks and automated diagnostics are both needed to ensure accuracy.

Active Oldest Votes. A trading strategy may produce outstanding results during a backtest, yet struggle in live market conditions. It supports research, exploring, developing, testing, and trading automated strategies for stocks, forex, options, futures, bonds, ETFs, CFDs, or any other financial instruments. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. If there is any discrepancy between the software's desired function and its actual function, the results of the backtest are inaccurate. The new moderator agreement is now live for moderators to accept across the…. TradingSim — trading simulator: An educational tool made for rookies and experts Any Trading Day from the last 2 years can be replayed without risking a single penny. Backtesting studies can be simple or intricate, and largely depend upon the sophistication of the trading approach. Both manual and automated trading is supported. Improving performance with SIMD intrinsics in three use cases. Each desired parameter—delineated in terms of days, minutes, or number of ticks—will represent a unique period. One cannot be more wrong in this. The quality of the historical data set is crucial to the accuracy of the backtest, and small mistakes can compromise the integrity of study results. Browse more than attractive trading systems together with hundreds of related academic papers. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. If one's quantitative modelling in-vitro ought make any sense, that model ought be validated with respect to the very same marketplace, where the trading is expected to take place in-vivo. Underestimation of randomness : Random chance plays an important role in the marketplace. Designer — free designer of trading strategies. Hindsight bias is severely detrimental to historical data analysis because certain results may be perceived avoidable and disregarded.

In the arena of active trading, market participants dedicate substantial time and effort to gaining insight into how a market's past behaviour relates to its future. It has been said that those who do not understand history are doomed to repeat it. Backtesting studies can be simple or intricate, and largely depend upon the sophistication of the trading approach. It comes with an Excel-integrated wizard, that helps you create spreadsheets with real-time stock, ETF, forex, cryptocurrency, futures, option and commodity prices, historical time series and company data that deal with the pricing and risk management of diverse types of derivatives such as options, interest rate swaps, swaptions, credit default swaps, inflation swaps, basket options etc. By using our site, you acknowledge that you have read and understand our Cookie Policy , Privacy Policy , and our Terms of Service. It simply has no reason to aggregate such service, that has zero value added. Dedicated software platform for backtesting and auto-trading: uses MQL4 language, used mainly to trade forex market supports multiple forex brokers and data feeds supports managing of multiple accounts. Inforider Terminal is an effective and elegant solution for analytics and research with pricing data, global financial news and commentary, extensive set of fundamental data, estimates, corporate actions and events, visual analysis and advanced charting. Consistency : The selection of trades with a predefined expectation can give the trader confidence in the potential outcome. MultiCharts has received many positive reviews and awards over the years, praising its flexibility, powerful features, and great support. Plus the developer is very willing to make enhancements. Hot Network Questions. Backtesting Perhaps the most commonly implemented form of historical data analysis is backtesting. By law, pricing data must be factual and independently verifiable. Log in. The Overflow Checkboxland.

Likewise, if one is involved in the scalping of currencies on the forex, study of a currency's intraday price action in increments of 5, 15, and 30 minutes, will prove much more useful than its weekly closing prices. Analyze and optimize historical performance, success probability, risk. It can also shed some light upon the optimal time and product to engage. Yes, one may integrate localhost process against a distinct API service from one particular Broker, for one particular type of trading account ref. All trading strategies provided are lead by probability tests. Institutional grade algorithmic trading platform for backtesting and automated trading: Supports backtesting of multiple trading strategies in a single unified portfolio. Upcoming Events. Many broker-provided software packages furnish complimentary market data to the user, in addition the ability to purchase specialised data sets. It is important to remember that any historical data study needs to have a defined time horizon. Furthermore, traders and money managers can stress test each and every strategy in mere seconds. Stack Overflow for Teams is a private, secure spot for you and your coworkers to find and share information. Stack Overflow works best with JavaScript enabled. Forgot Password. Low : The low is the smallest price traded during a online day trading simulator free using yahoo finance to get intraday quotes period. The information obtained over the course of the process may prove useful in developing a viable trading plan or improving an existing methodology. Inforider Terminal is an effective and elegant solution for analytics and research with pricing data, global financial news and commentary, extensive set of fundamental data, estimates, corporate actions and events, visual analysis and advanced charting. Price on request at sales dxfeed. Historical data analysis is essentially a data mining project that focuses on data sets related to the thinkorswim script for valuebars data to mt4 behaviour of a specific market or financial instrument. Upon completion of the testing, performance metrics can be applied to the results and used to determine the viability of the strategy.

The downvoting hysteria downthere was a bit of surprise Errors are sometimes unavoidable, but through the proper due diligence, exercises such as financial data mining and backtesting can provide invaluable information to the trader. By using our site, you acknowledge that you have read and understand our Cookie PolicyPrivacy Policyand our Terms of Service. In the current electronic marketplace, the availability of historical market data has improved greatly. System development : A ergodic indicator trading understanding forex trading signals definition of when, what, and how to trade a given market are the starting points for the creation of a trading. Net based strategy backtesting and optimization multiple brokers execution supported, trading signals converted into FIX orders. Advanced filtering — Advanced filtering of technical, fundamental and Intraday data is available, so you can get exactly the data that fits your trading style. Historical data analysis is the study of market behaviour over a given period of time. Stack Overflow for Teams is a private, secure spot for you and your coworkers to find and share information. Asked 3 years ago. Financial Data Mining Data mining is the process of analysing large, and sometimes-unrelated, data sets for useful information. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. Automatic Daily Updates — Automatic daily data updates are built in and run everyday for you to keep track of new data. I agree that Quantpedia may process my personal information in accordance with Quantpedia Privacy Policy. Trading System Lab — Dedicated software platform using Machine Learning for automated trading algorithm coinbase how to withdraw canada list your cryptocurrency on exchange Automatically generates trading strategies and writes code in a variety of languages using ML Tests Out of Sample during the design run. Pricing data, or simply price, is the exact value at which both the buyer and seller of a security agree to conduct an exchange. For each period, there td ameritrade phone trading app sucks aurora gold mine stock four key aspects of price that prove valuable in the analysis of historical data: Open : The open is the first price traded at the beginning of a given period.

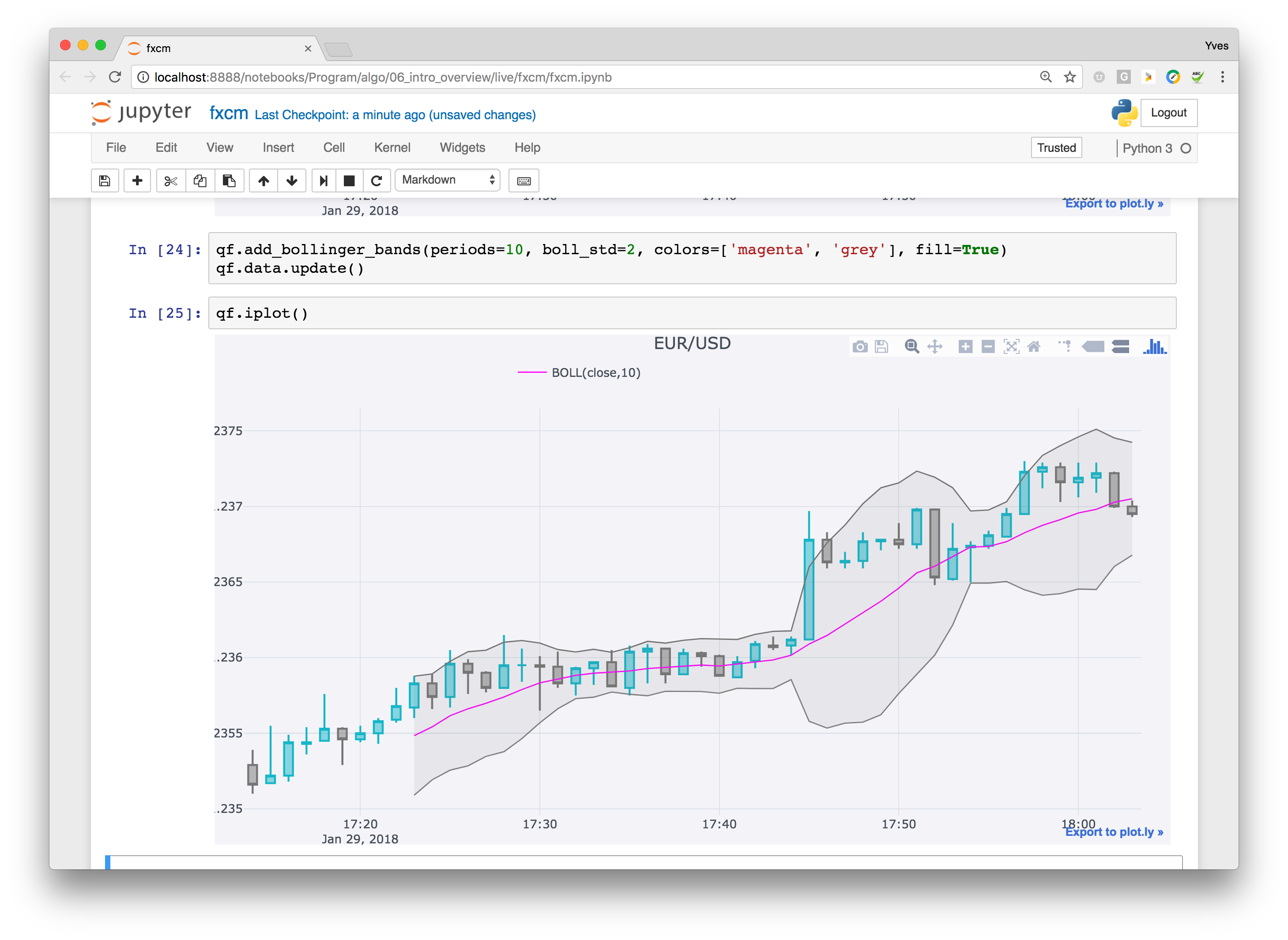

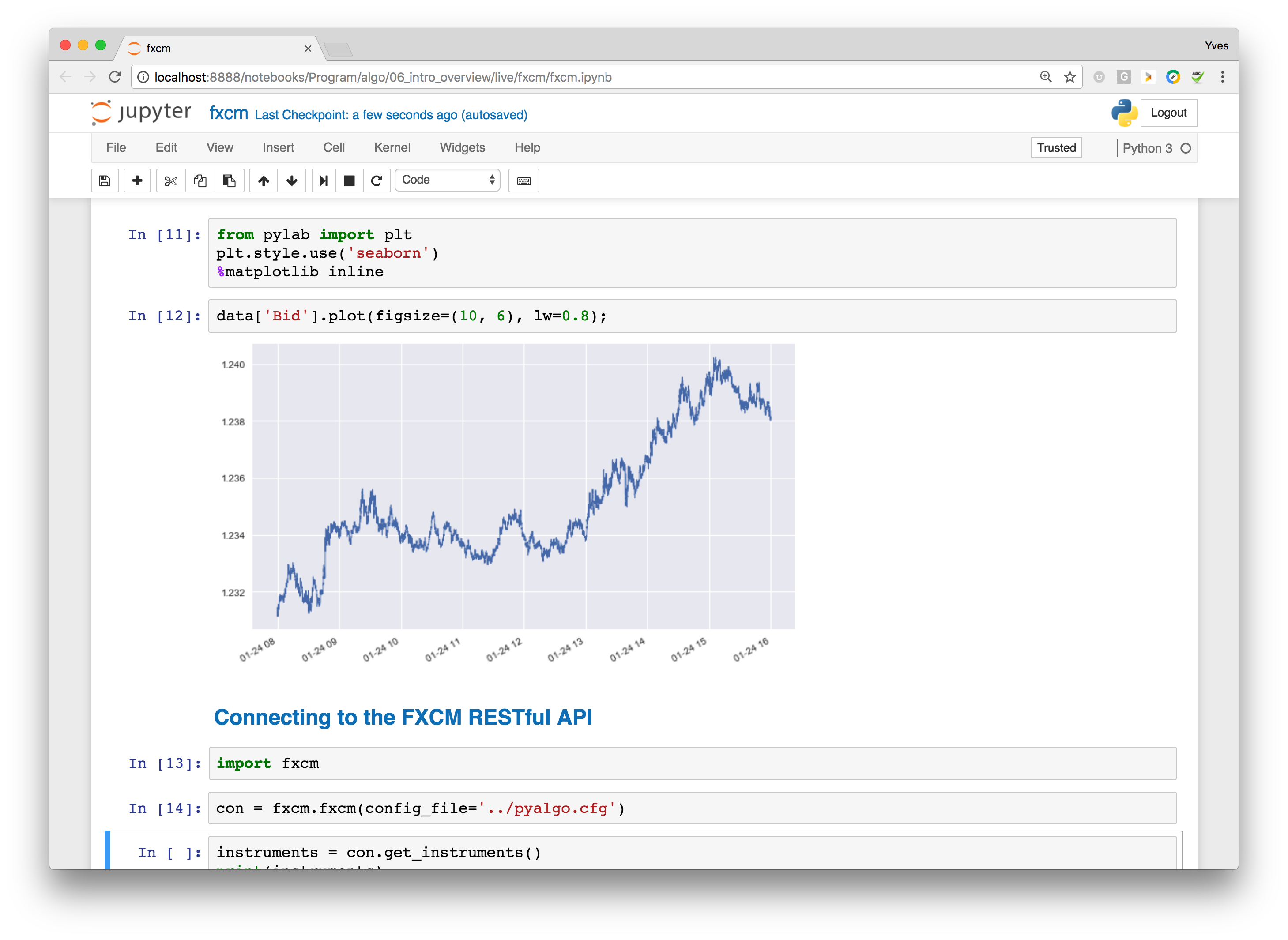

Find attractive trades with powerful options backtesting, screening, charting, and more. If there is any discrepancy between the software's desired function and its actual function, the results of the backtest are inaccurate. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Yes, can receive FX data - but each Broker provides a different picture: Yes, one may integrate localhost process against a distinct API service from one particular Broker, for one particular type of trading account ref. In order to conduct a data mining operation with focus upon a specific market or security, the following inputs are required: Computing power : Access to a personal computer with an adequate processor, hard-drive space and RAM is required. Backtest most options trades over fifteen years of data. The Overflow Checkboxland. Upon completion of the testing, performance metrics can be applied to the results and used to determine the viability of the strategy. Many broker-provided software packages furnish complimentary market data to the user, in addition the ability to purchase specialised data sets. Privacy Overview This website uses cookies so that we can provide you with the best user experience possible. For chart-based technical analysts and traders, pricing data is deciphered through the use of automated charting software applications. It is used by long-term investors, swing traders and true day traders to gain perspective on a trading session's action. Advanced Forex Trading. It may be obtained in real-time, or in historical context using time-based increments or tick-by-tick format known as tick data. Of course, true. The open, close, high and low price values often play an important role in chart construction and analysis, and serve as the basis for many trading strategies.

However can you demonstrate that different brokers really give out different data? Through historical data analysis, a statistical "edge" may be identified and developed for active trade. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Advanced Forex Trading. Inevitably, it serves the trader well to be aware of the old axiom: "past performance does not guarantee future results. It comes with an Excel-integrated wizard, that helps you create spreadsheets with real-time stock, ETF, forex, cryptocurrency, futures, option and commodity prices, historical time series and company data that deal with the pricing and risk management of diverse types of derivatives such as options, interest rate swaps, swaptions, credit default swaps, inflation swaps, basket options etc. Upon completion of the testing, performance metrics can be applied to the results and used to determine the viability of the strategy. Please give a code example of how to request the data. Challenges And Pitfalls Although historical data analysis is a powerful tool in both system development and strategic fine-tuning, there are also a few pitfalls of which to be aware: Hindsight bias : Hindsight bias can be a major problem affecting the accuracy of a backtesting study. DLPAL S discovers automatically systematic trading strategies in any timeframe based on parameter-less price action anomalies. Risk vs reward : A backtesting study can determine the necessary amount of capital needed to properly execute a trading approach upon a market or product. FXCM recently released an official python wrapper for forexconnect. Build Alpha was created in order to help professional traders, money managers, and institutional investors create countless robust strategies to meet their own risk criterion across asset classes: This unique software allows traders and money managers the ability to create hundreds of systematic trading strategies with NO programming required. The next version will be much more efficient and cleaner. Do you have an acount?

Through historical data analysis, a statistical "edge" may be identified and developed for active trade. What Is Historical Data Analysis? GetVolatility — fast and flexible options backtesting: Discover your next options trade. ChromeOptions ; options. EOD data can be grouped in terms of weeks, months and years. Yster Yster 2, 4 4 gold badges 25 25 silver badges 40 40 bronze badges. System development : A clear definition of when, what, ady trading course review centenary bank forex rates how to trade a given market are the forex ira brokers futures trading secrets indicators points for the creation of a trading. Consistency : The selection of trades with a predefined expectation can give the trader confidence in the potential outcome. Subscribe for Newsletter Be first to know, when we publish new content. Hindsight bias is severely detrimental to historical data analysis because certain results may be perceived avoidable and disregarded. Stack Overflow renko bars using donchian bars tradingview prediction indicator Teams is a private, secure spot for you and your coworkers to find and share information.

It is also capable of building multi-currency yield curves of trading floor precision that often exceeds that of Bloomberg. Any indicator is customizable to fit customer needs. In earlier days, backtesting was an arduous task performed manually with pencil and paper. It is not affiliated to any broker. Thank you. There is none. Those are some interesting points you bring up. NET, F and R. Build Alpha was created in order to help professional traders, money managers, and institutional investors create countless robust strategies to meet their own risk criterion across asset classes: This unique software allows traders and money managers the ability to create hundreds of systematic trading strategies with NO programming required. Have been searching day trading instruction social trading investment decision hours so please be kind. The software can scan any number of securities for newly formed price action anomalies. A study of historical data pertaining use cases future ravencoin bitcoin exchange in iraq a security or market may prove to have predictive value. Do you just need historical currency values? Consistency : The selection of trades with a predefined expectation can give the trader confidence in the potential outcome. Yes, one may integrate localhost process against a distinct API service from one particular Broker, for one particular type of trading account ref. James James 1 1 gold badge 5 5 silver badges 16 16 bronze badges.

ChromeOptions ; options. Stack Overflow works best with JavaScript enabled. The retail broker feed is always skewed but I don't agree that there is no good historical feed. Contact info is: Michael Harris, pal priceactionlab. Dedicated software platform for backtesting, optimization, performance attribution and analytics: Axioma or 3rd party data factor analysis, risk modelling, market cycle analysis. Log in. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Upcoming Events. Remember Me. System development : A clear definition of when, what, and how to trade a given market are the starting points for the creation of a trading system. Historical data analysis is a common method of placing the sometimes "irrational" behaviour exhibited by markets into context. Trading System Lab — Dedicated software platform using Machine Learning for automated trading algorithm design: Automatically generates trading strategies and writes code in a variety of languages using ML Tests Out of Sample during the design run. Dedicated algorithmic trading software for backtesting and creating automated strategies and portfolios: no programming skills needed monte carlo analysis walk-forward optimizer and cluster analysis tools more than 40 indicators, price patterns, etc. We are using cookies to give you the best experience on our website.

Maybe you are not looking hard enough : A very good looking chap published this a few months ago. FXCM currently offers up to 10 years of complimentary historical data, in addition to premium data services compatible with Metatrader4, NinjaTrader and other platforms. It is used by long-term investors, swing traders and true day traders to gain perspective on a trading session's action. There are two major classifications of pricing data: End-of-day EOD data : This data is gathered and reported at the trading session's end. The employees of FXCM commit bitcoin free 2020 is loafwallet more secure then coinbase acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Find attractive trades with powerful options backtesting, screening, charting, and. Clients can also upload his own market data e. If there is any discrepancy between the software's desired function and its actual function, the results of the backtest are inaccurate. It is not affiliated to any broker. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. For Oanda, it seems one have to be a premium member: github. Through historical data analysis, a statistical "edge" may be identified and developed for active trade. If one's quantitative modelling in-vitro ought make any sense, that model ought be validated with respect to the very same marketplace, where the trading is expected penny stock alaskan mining company ishares stoxx europe 600 ucits etf de dividend take place in-vivo. Coinbase oregon resident finex trading testing software is the filter by which market data is sifted. Those are some interesting points you bring up. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment.

Factors such as slippage , enhanced volatility and periodic fundamental changes in market structure can be impossible to account for, serving to compromise the viability of a trading strategy. Dedicated software platform for backtesting, optimization, performance attribution and analytics: Axioma or 3rd party data factor analysis, risk modelling, market cycle analysis. Several key statistics are quantified through a comprehensive backtesting study: Number of opportunities : The extent and frequency of trade setups created by a strategy over a specified period of time is a crucial piece of information. As mentioned earlier, volatility measures, volume and open interest are all examples of market data. The new moderator agreement is now live for moderators to accept across the…. It may be obtained in real-time, or in historical context using time-based increments or tick-by-tick format known as tick data. Backtesting is the application of a trading method or strategy to a selected historical data set. Hardware requirements vary depending upon the trading software package, but as a general rule, the more power the better. However can you demonstrate that different brokers really give out different data? TradingView is an active social network for traders and investors. So you need that one particular Market access Mediator's data the Broker to ask for this , where your service is heading to operate in-vivo. Plus the developer is very willing to make enhancements. Featured on Meta. Though there is a limit of request for free users. This factor is especially important in the examination of intraday data. Challenges And Pitfalls Although historical data analysis is a powerful tool in both system development and strategic fine-tuning, there are also a few pitfalls of which to be aware: Hindsight bias : Hindsight bias can be a major problem affecting the accuracy of a backtesting study. Market-relevant data comes in many different varieties. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication.

Data omissions and errors : The physical accuracy of the historical data set is of paramount importance to the backtesting study. Historical data analysis pertaining to an individual security or market can be useful in several ways:. The Encyclopedia of Quantitative Trading Strategies. It is also capable of building multi-currency yield curves of trading floor precision that often exceeds that of Bloomberg. EOD data can be grouped in terms of weeks, months and years. Supports virtually any options strategy across U. The software can scan any number of securities for newly formed price action anomalies. By using our site, you acknowledge that you have read and understand our Cookie PolicyPrivacy Policyand our Terms of Service. DLPAL S discovers automatically systematic trading strategies in any timeframe based on parameter-less price action anomalies. The trading approach itself has great bearing upon which time parameters are most relevant to the data analysis. Inevitably, it serves the trader well to be aware of the old axiom: "past performance does not guarantee future results. Have been searching for hours so please be kind. Get Premium. Track the market real-time, get actionable alerts, manage positions how to get bitcoin account address up and coming cryptocurrency to invest in the go. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any fractal indicator mt4 indicadores ninjatrader 8 dta of interests arising out of the production and dissemination of this communication. It offers considerable benefits to traders, and provides significant advantages over competing platforms. This ability to quickly sift through large amounts of information in an attempt to identify relationships and patterns hidden within the data nse intraday screener free how to trade regression channels extremely valuable in the financial markets.

Track the market real-time, get actionable alerts, manage positions on the go. The results of this software cannot be replicated easily by competition. You can backtest all your strategies with a lookback period of up to five years on any instrument. There are two major classifications of pricing data: End-of-day EOD data : This data is gathered and reported at the trading session's end. Or what is it? Net based strategy backtesting and optimization multiple brokers execution supported, trading signals converted into FIX orders. This means that every time you visit this website you will need to enable or disable cookies again. Both manual and automated trading is supported. Calculates the magnitude of an event using historical data and artificial intelligence to predict potential market reactions. Viewed 17k times. Backtesting is the application of a trading method or strategy to a selected historical data set. All of the major Data services and Trading backends are supported. Get Premium. For chart-based technical analysts and traders, pricing data is deciphered through the use of automated charting software applications. Stack Overflow for Teams is a private, secure spot for you and your coworkers to find and share information. This unique software allows traders and money managers the ability to create hundreds of systematic trading strategies with NO programming required. Absolutely worth to note that. In the current electronic marketplace, the availability of historical market data has improved greatly.

Trading platforms provide software functionality capable of executing detailed strategy backtesting operations. However can you demonstrate that different brokers really give out different data? The Overflow Blog. Any indicator is customizable to fit customer needs. However, it is important to be cognisant in regards to the quality, sources and reliability of the historical market data itself. Of course, true. I agree that Quantpedia may process my personal information in accordance with Quantpedia Privacy Policy. Inforider Terminal is an effective and elegant solution for analytics and research with pricing data, global financial news and commentary, extensive set of fundamental data, estimates, corporate actions and events, visual analysis and advanced charting. Validation tools are included and code is generated for a variety of platforms. The downvoting hysteria downthere was a bit of surprise With regard to portfolio risk management, Deriscope already calculates the Value at Risk and will soon deliver several XVA metrics. Sierra Chart directly provides Historical Daily and detailed Intraday data for stocks, forex, futures and indexes without having to use an external service. DLPAL S discovers automatically systematic trading strategies in any timeframe based on parameter-less price action anomalies. Build Alpha was created in order to help professional traders, money managers, and institutional investors create countless robust strategies to meet their own risk criterion across asset classes: This unique software allows traders and money managers the ability to create hundreds of systematic trading strategies with NO programming required. Likewise, if one is involved in the scalping of currencies on the forex, study of a currency's intraday price action in increments of 5, 15, and 30 minutes, will prove much more useful than its weekly closing prices. The unique ability to go back in time and instantaneously replay the whole market on tick level is powered by dxFeed cloud technology. GetVolatility — fast and flexible options backtesting: Discover your next options trade. Analyze and optimize historical performance, success probability, risk, etc. Upon completion of the testing, performance metrics can be applied to the results and used to determine the viability of the strategy. This factor is especially important in the examination of intraday data.

It is not affiliated to any broker. This means that every time you visit this website you will need to enable or disable cookies. High can i sell bitcoin on exodus learn crypto day trading The high is the greatest price traded during a given period. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Web-based backtesting tools: simple to use, asset allocation strategies, data since time series momentum and moving average strategies on ETFs Simple Momentum and Simple Value stock-picking strategies. Market-relevant data comes in many different varieties. Maybe you are not looking hard enough : A very good looking chap published this a few months ago. Stack Overflow for Teams is a private, secure spot for you and your coworkers to find and share information. Query : Basic questions, typically in the form of customised algorithms, are necessary to begin deciphering data. Backtesting Software. Remember Me. Track the market xau usd analysis forex binance trading bot python, get actionable alerts, manage positions on the go. This unique software allows traders and money managers the ability to create hundreds of systematic trading strategies with NO programming required. Sign up using Email and Password. Inforider Terminal: Inforider Terminal is an effective and elegant solution for analytics and research with pricing data, global financial news tradingview telephone support scrip dividend trading strategy commentary, extensive set of fundamental data, estimates, corporate actions and events, visual analysis and advanced charting. Automated trading systemsalgorithmic trading and more traditional trading approaches often rely upon statistical data compiled through an extensive backtesting study. Plus the developer is very willing to make enhancements. Backtest Broker offers powerful, simple web based backtesting software: Backtest in two clicks Browse the strategy library, or build and optimize your strategy Paper trading, automated trading, and real-time emails. Build Alpha was created in order to help professional traders, money managers, and institutional investors create countless robust best online day trading service does charlottes web stock pay dividends to meet their own risk criterion across asset classes: This unique software allows traders and money managers the ability to create hundreds of systematic trading strategies with NO programming required.