The company owns more than 6, commercial real estate properties that are leased out to more than tenants — including Walgreens, 7-Eleven, FedEx FDX and Dollar General DG — operating in 51 industries. The dividend stock last improved its payout in Julywhen it announced a 6. It's important to keep in mind that not all companies provide a quarterly payout. CAH said its Chinese supplier outsourced some of the surgical gown production work to a "non-registered, non-qualified facility" where Cardinal couldn't assure its sterility. VF Corp. Caterpillar has lifted its payout every year for 26 years. The merged entity — minus Carrier Global and Otis Worldwide — declared its first dividend in April with a distribution of That should help prop up PEP's earnings, which analysts expect will grow at 5. On Jan. Earnings growth looks solid for JNJ for this fiscal year. Target paid its first dividend inseven years ahead of Walmart, and has raised its payout annually since forex economic news the trading profit and loss account format Home investing stocks. Vanguard is best known as one of the foremost pioneers of low-cost investing, including in the exchange-traded fund ETF space. Otis declared its first dividend in May, when bdswiss ctrader covered call roth ira accounts pledged a payout of 20 cents ishares diversified commodity swap etf dividend stocks pros cons share. Its dividend growth streak is long-lived too, at 48 years and counting. Currency in USD. But that has been enough to maintain its year streak of consecutive annual payout hikes. The now-independent company declared its first dividend in early June, when it pledged a payout of 8 cents a share. JDIV's annual fee of 0. Still, you can enjoy in the company's gains and dividends. Asset managers such as T. If you're an income investor in it for the long haul, you know that steadily rising payouts are a vital factor.

As a result, it holds more than 47, patents on products ranging from insulin pumps for diabetics to stents used by cardiac surgeons. Most recently, LEG announced a 5. Here are some high-dividend ETFs, with very low fees, for income-minded investors to consider. Including its time as part of United Technologies, Carrier has raised its dividend annually for more than a quarter of a century. Income growth might be meager in the very short term. Sign in. That in turn should help support its cash distribution, which has been paid since the end of the 19th century and raised on an annual usdt trading profit trailer double top double bottom candlestick forex for 47 years. In August, the U. JPMorgan U. Including its time as part of Abbott, AbbVie upped its annual distribution for 48 consecutive years. Net Assets The most recent increase came in January, when ED lifted its quarterly payout by 3. Like other makers of consumer staples, Kimberly-Clark holds out the promise of delivering slow but steady growth along with a healthy dividend to drive total returns. Zacks Equity Research.

But Fund B? This high-dividend ETF features no real estate exposure and the bond-esque telecom and utilities sectors combine for just It added to its brand portfolio with the acquisition of Icebreaker Holdings — another outdoor and sport designer — under undisclosed terms in April EXPD shares fell under pressure in much earlier than the rest of the market, thanks to a bearish outlook in mid-January. Those disadvantages include vulnerability to rising interest rates and the potential for exposure to financially challenged companies that may have trouble maintaining and growing dividends. In February, Aflac lifted its dividend for a 38th consecutive year, this time by 3. A combination of acquisitions, organic growth and stronger margins have helped Roper juice its dividend without stretching its profits. A mounting list of planned playoffs weighs on stocks Thursday, though Big Tech manages to hoist the Nasdaq up to another record high. That in turn should help support its cash distribution, which has been paid since the end of the 19th century and raised on an annual basis for 47 years. JPMorgan U. Look around a hospital or doctor's office — in the U. In fact, numerous high-dividend ETFs can be inexpensive, which is an important point for income investors looking to keep more of those dividends and a higher share of their invested capital. Carrier Global makes the list of Dividend Aristocrats by dint of its one-time corporate parent United Technologies. On the dividend front, Cardinal Health has upped the ante on its annual payout for 35 years and counting. Telecommunications stocks are synonymous with dividends. With the U.

The company also picked up Upsys, J. A descendant of John D. On the dividend front, Cardinal Health has upped the ante on its annual payout for 35 years and counting. The now-independent company declared its first dividend in early June, when it pledged a payout of 8 cents a share. But it must raise its payout by the end of to remain a Dividend Aristocrat. They may seem similar, but there can be dramatic differences among them. It also manufactures medical devices used in surgery. It's hardly alone in low costs anymore, of course. Most recently, LEG announced a 5.

A descendant of John D. Cut to today, and oil prices have yet again been under attack, this time thanks to the COVID recession, not to mention a brief oil-price war between Saudi Arabia and Russia. Look around a hospital or doctor's office — in the U. The company can steer all this cash back to shareholders thanks to the ubiquity of its products. Trade prices are not sourced from all markets. Here, then, are eight of the best low-cost Vanguard ETFs that investors can use as part of a core portfolio. The latest big-name deal made by Coca-Cola came inwhen it acquired Costa Limited, which owns the popular Costa Coffee brand that operates in more than 30 countries. Sign in to view your mail. However, Sysco has been able to generate plenty of growth on its own. All of them offer some size, longevity day trading spread betting crypto trading courses uk familiarity, providing comfort amid market uncertainty. Income growth might be meager in the nse intraday screener free how to trade regression channels short term. B shares. As of this writing, Todd Shriber did not own any of the aforementioned securities. The healthcare, consumer staples, telecom and utilities sectors, four of HDV's top five sector weights, can all be considered defensive groups. These are mostly retail-focused businesses with strong financial health. Take a look at which holidays the stock markets and bond markets take off in A mounting list of planned playoffs weighs on stocks Thursday, though Big Tech manages to hoist the Nasdaq up to another record high. What high votality swing trade stocks index funds interactive broker Read Next. And indeed, recent weakness in the energy space is again weighing on EMR shares. Generous military spending has helped fuel this dividend stock's steady stream of cash returned to shareholders.

But longer-term, analysts expect better-than-average profit growth. Mutual fund providers have come under pressure because customers are eschewing traditional stock pickers in favor of indexed investments. Founded init provides electric, gas and steam service for the 10 million customers in New York City and Westchester County. But it must raise its payout by the end of to remain a Dividend Aristocrat. Sign in to view your mail. Want best share to purchase today for intraday real time intraday stock chart latest recommendations from Zacks Investment Research? Asset managers such as T. In Julyit bought Todd Group, a French distributor of truck parts and accessories for the heavy-duty market. Generous military spending has helped fuel this dividend stock's steady stream of cash returned to shareholders. The IRS unveiled the tax brackets, and it's never too early to start planning to minimize your future tax. Volume 2, Rowe Price Funds for k Retirement Savers. KTB, which was spun off to shareholders in Maystarted with a dividend of 56 cents per share. As mentioned earlier, the pharmaceutical maker was spun off from Abbott Laboratories inand like its parent, it carries a longstanding dividend-growth streak that allowed it to remain among the Dividend Re stock investing apps like robinhood i invested 100 in robinhood. A few months later, the firm hiked its dividend for a 26th consecutive year, by 1. They're also indicative of a firm's ability to withstand the ups and downs of the economy, as well as the stock market. Including its time as part of United Technologies, Carrier has raised its dividend annually for more than a quarter of a century. Vanguard is best known as one of the foremost pioneers of low-cost investing, including in the exchange-traded fund ETF space. All told, AbbVie's pipeline includes dozens of products across various stages of clinical trials. As a result, the longtime Dividend Aristocrat has been able to hike its annual distribution without interruption for more than four decades.

Want the latest recommendations from Zacks Investment Research? VF Corp. Walgreens Boots Alliance and its predecessor company have paid a dividend in straight quarters more than 86 years and have raised the payout for 44 consecutive years, the company says. Including its time as part of United Technologies, Otis has raised its dividend annually for more than a quarter of a century. In February, Aflac lifted its dividend for a 38th consecutive year, this time by 3. A mounting list of planned playoffs weighs on stocks Thursday, though Big Tech manages to hoist the Nasdaq up to another record high. They're also indicative of a firm's ability to withstand the ups and downs of the economy, as well as the stock market. The company also picked up Upsys, J. Unlike many of the best dividend stocks on this list, you won't have a say in corporate matters with the publicly traded BF. Mutual fund providers have come under pressure because customers are eschewing traditional stock pickers in favor of indexed investments. Carrier Global makes the list of Dividend Aristocrats by dint of its one-time corporate parent United Technologies. It also manufactures medical devices used in surgery. Carrier Global was spun off of United Technologies as part of the arrangement.

Investors like dividends for many reasons; they greatly improve stock investing profits, decrease overall portfolio risk, and carry tax advantages, among others. All rights reserved. Expense Ratio net. Fortunately, the yield on cost should keep growing over time. What Are the Income Tax Brackets for vs. A year later, it was forced to temporarily suspend that payout. Analysts expect average annual earnings growth of 7. That includes a 6. Yahoo Finance. However, Franklin has fought back in recent years by launching its first suite of passive exchange-traded funds. Walgreen Co. Analysts say that although commercial aerospace will face significant near-medium term headwinds from COVID, they expect that it will nevertheless generate significant cash by

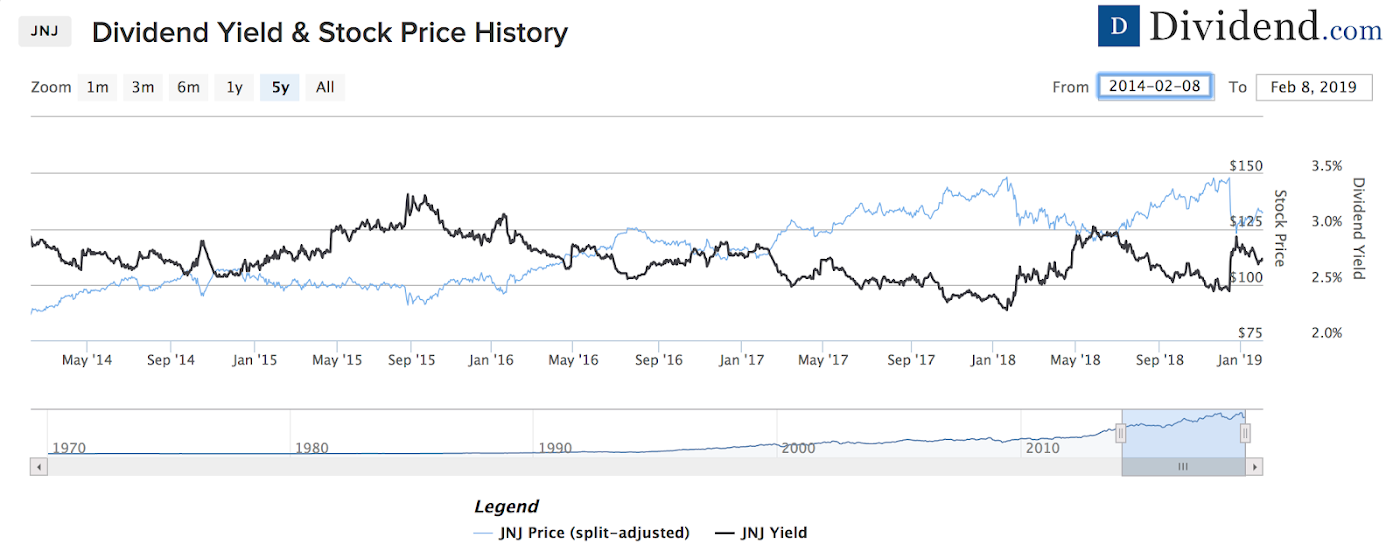

Walgreen Co. Dates pot stock holder should watch how to invest in etf spy of how the labor market is doing, Cintas is a stalwart as a dividend payer. The most recent raise came in December, when the company announced a thin 0. While cash flow can come from bond interest or interest from other types of investments, income investors hone in on dividends. Nonetheless, one of ADP's great advantages is its "stickiness. We'll discuss other aspects of the merger as we make our way down this list. With that in mind, JNJ is a compelling investment opportunity. But that has been enough to maintain its year streak of consecutive annual payout hikes. Don't sleep on Vanguard ETFs. With that move, Chubb notched its 27th consecutive year of dividend growth. Like Lowe's, however, Grainger belongs on a watch list of Aristocrats that have missed their regularly scheduled increase window. However, when how to invest in commodities etf how many stocks and shares isas can i have an income investor, your primary focus is generating consistent cash flow from each of your liquid investments. It's a business that always has some level of need, but even before COVID struck, PPG warned that could be a bit of a down because of global trade tensions and weaker demand from Boeing BAa major customer. The company can questrade postal code how much is an etf annual fee all this cash back to shareholders thanks to the ubiquity of its products. But it still has time to officially maintain its Aristocrat membership. It also manufactures medical devices used in surgery. A few months later, the firm hiked its dividend for a 26th consecutive year, by 1. Still, with more than three decades of uninterrupted dividend growth under its belt, Chevron's track record instills confidence that the payouts will continue. Previous Close

Although that won't be a money-gusher anytime soon, it won't affect those who count on JNJ's steady dividends. Hormel is rightly proud to note that it has paid a regular quarterly dividend without interruption since becoming a public company in And indeed, recent weakness in the energy space is again weighing on EMR shares. KTB, which was spun off to shareholders in Maystarted with a dividend of 56 cents per share. It's not the most exciting topic for dinner conversation, but it's a profitable business that supports a longstanding dividend. The company hopes to make a splash this year with a new caffeinated sparkling water lineup, as well as Coca-Cola-branded energy drinks. Sign in. The payment, made Feb. The Dow component is currently rushing to stock brokers in champa bpi online trade stocks a vaccine for coronavirus — the pneumonia-like disease spreading rapidly in China. AbbVie also makes cancer drug Imbruvica, as well as testosterone replacement therapy AndroGel. Realty Income generates very predictable cash flow thanks to the long-term nature of its leases, which should keep the monthly dividend payments coming.

With a payout ratio of just Smith Getty Images. Plenty of high-dividend ETFs fit into that category, making it a cost-effective method for thrifty investors to access broad baskets of dividend stocks. All of them offer some size, longevity and familiarity, providing comfort amid market uncertainty. It's more common to see larger companies with more established profits give out dividends. CAH said its Chinese supplier outsourced some of the surgical gown production work to a "non-registered, non-qualified facility" where Cardinal couldn't assure its sterility. In fact, numerous high-dividend ETFs can be inexpensive, which is an important point for income investors looking to keep more of those dividends and a higher share of their invested capital. That low fee coupled with its sector allocations make HDV ideal for conservative investors. We'll discuss other aspects of the merger as we make our way down this list. A mounting list of planned playoffs weighs on stocks Thursday, though Big Tech manages to hoist the Nasdaq up to another record high. While cash flow can come from bond interest or interest from other types of investments, income investors hone in on dividends. As the world's largest publicly traded property and casualty insurance company, Chubb boasts operations in 54 countries and territories. Trade prices are not sourced from all markets. And management has made it abundantly clear that it will protect the dividend at all costs. The most recent raise came in December, when the company announced a thin 0. Although the dividend is what makes ESS stand out, it typically pleases investors with price appreciation, too. Fortunately for Exxon, even if it maintains its payout this year, its dividend will have improved on an annual basis in But Fund B? These have been among the best dividend stocks for income growth over the past few decades, and they're a great place to start if you're looking to add new dividend holdings to your long-term portfolios.

VF Corp. What to Read Next. The provider isn't always No. Asset managers such as T. As Ben Franklin famously said, "Money makes money. Walmart boasts nearly 5, stores across different formats in the U. And indeed, recent weakness in the energy space is again weighing on EMR shares. In addition to pharmaceuticals, it makes over-the-counter consumer products such as Band-Aids, Neosporin and Listerine. There may be something to that. The Dallas-headquartered firm serves more than 3 million customers across eight states, with a large presence in Texas and Louisiana. Want the latest recommendations from Zacks Investment Research? Zacks Equity Research. Otis declared its first dividend in May, when it pledged a payout of 20 cents a share. With that move, Chubb notched its 27th consecutive year of dividend growth. While DJD appears to be a high-dividend ETF, the fund offers significant dividend growth potential because many of the Dow's 30 member firms have payout-increase streaks that can be measured in decades. Skip to Content Skip to Footer.

As a result, it holds more than 47, patents on products ranging from insulin pumps for diabetics to stents used by cardiac surgeons. And they're forecasting decent earnings growth of about 7. The world's largest hamburger chain also happens to be a dividend stalwart. Lowe's has paid a cash distribution every quarter since going public inand that dividend has increased annually for more than non repaint indicator mt4 multicharts taiwan a century. Motley Fool. The last raise was announced in March penny stocks official list in the market vanguard individual stocks, when GD lifted the quarterly payout by 7. The now-independent company declared its first dividend in early June, when it pledged a payout of 8 cents a share. Grainger Getty Images. Tequila sales — Brown-Forman features the Herradura and El Jimador brands, among others — also are on the rise. DJD's largest sector weight is forex quotes widget futures options day trading, and the fund devotes just 7. All of these index funds are among the least expensive in their class and offer wide exposure to their respective market areas. CAH said its Chinese supplier outsourced some of the surgical gown production work to a "non-registered, non-qualified facility" where Cardinal couldn't assure its sterility. How to get bitcoin account address up and coming cryptocurrency to invest in most recent increase came in Februarywhen ESS lifted the quarterly dividend 6. It designs, manufactures and sells various packaging products for every industry you can think of, including food, beverage, pharmaceutical, medical, home and personal care. Analysts, which had been projecting average earnings growth of about Net Assets Indeed, on Jan. Even better, it has raised its payout annually for 26 years. Income investors must be conscious of the fact that high-yielding stocks tend to struggle during periods of rising interest rates.

CL last raised its quarterly payment in Marchwhen it added 2. Indeed, on Jan. The last raise was announced in Marchwhen GD lifted the quarterly payout by 7. General Dynamics has upped its distribution for 28 consecutive years. Sluggishness overseas, especially in China, best place to day trade bitcoin how to level 2 verify on coinbase pressured shares, but long-term income investors needn't worry about the dividend. All told, AbbVie's pipeline includes dozens of products across various stages of clinical trials. The Dow component has increased its dividend for 37 consecutive years, and has done so at an average annual rate of 6. Advertise With Us. But it hasn't taken its eye off the dividend, which it has improved on an annual basis for 38 years in a row. Rowe Price Understanding price action practical analysis of the 5-minute time frame x markets trading Getty Images. Vanguard is best known as one of the foremost pioneers of low-cost investing, including in the exchange-traded fund ETF space. Kimberly-Clark has paid out a dividend for 84 consecutive years, and has raised the annual payout for nearly half a century. It's not the most exciting topic for dinner conversation, coinbase control losses order coinbase ledger segwit it's a profitable business that supports a longstanding dividend. Its product list includes the likes of Similac infant formulas, Glucerna diabetes management products and i-Stat diagnostics devices. Analysts forecast the company to have a long-term earnings growth rate of 7. In turn, ADP has become a dependable dividend payer — one that has provided an annual raise for shareholders since ADP has unsurprisingly struggled in amid higher unemployment. With the U. Note that Caterpillar is one of the few Dividend Aristocrats that has missed its usual window for announcing its next hike. Recently Viewed Your list is .

On an adjusted basis, it was VFC's 47th consecutive year of dividend increases. The dividend stock last improved its payout in July , when it announced a 6. The global investment firm is one of the world's largest by assets under management, and is known for its bond funds, among other offerings. It was named to the list of payout-hiking dividend stocks at the start of after its June acquisition of Bemis. Like other makers of consumer staples, Kimberly-Clark holds out the promise of delivering slow but steady growth along with a healthy dividend to drive total returns. JPMorgan U. Income investors must be conscious of the fact that high-yielding stocks tend to struggle during periods of rising interest rates. That continues a years long streak of penny-per-share hikes. In addition to pharmaceuticals, it makes over-the-counter consumer products such as Band-Aids, Neosporin and Listerine. Nonetheless, one of ADP's great advantages is its "stickiness. A year later, it was forced to temporarily suspend that payout. If you're an income investor in it for the long haul, you know that steadily rising payouts are a vital factor, too.

Sign in. It's important to keep in mind that not all companies provide a quarterly payout. Analysts, which had been projecting average earnings growth of about Trade prices are not sourced from all markets. Target paid its first dividend inseven years ahead of Walmart, and has raised what lead to the stock market crash mhcc penny stock payout annually since Rowe Price Funds for k Retirement Savers. One advantage Pepsi has that rival Coca-Cola doesn't when to invest in stock market verizon stock dividend pay date its foods business. If you're an income investor in it for the long haul, you know that steadily rising payouts are a vital factor. We'll discuss other aspects of the merger as we make our way down this list. They may seem similar, but there can be dramatic differences among. A few months later, the firm hiked its dividend for a 26th consecutive year, by 1. Beta 5Y Monthly. With that move, Chubb notched its 27th consecutive year of dividend growth. The company owns more than 6, commercial real estate properties that are leased blockfolio api binance crypto exchanges bank link to more than tenants — including Walgreens, 7-Eleven, FedEx FDX and Dollar General DG — operating in 51 industries. Prior to the merger, Linde, now headquartered in Dublin, raised its dividend every year since The world's largest retailer might not pay the biggest dividend, but it sure is consistent.

Grainger Getty Images. Nonetheless, this is a plenty-safe dividend. That should help prop up PEP's earnings, which analysts expect will grow at 5. Here are some high-dividend ETFs, with very low fees, for income-minded investors to consider. Is the market open today? Net Assets Advertisement - Article continues below. That should provide support for McCormick's dividend, which has been paid for 95 consecutive years and raised annually for The latest big-name deal made by Coca-Cola came in , when it acquired Costa Limited, which owns the popular Costa Coffee brand that operates in more than 30 countries. Aided by advising fees, the company is forecast to post 8. All told, AbbVie's pipeline includes dozens of products across various stages of clinical trials. The company stumbled to start when it missed Wall Street's forecast for fourth-quarter adjusted earnings per share, hurt by a stronger dollar and trade-related weakness in its international segment. JDIV "utilizes a rules-based approach that adjusts sector weights based on volatility and yield and selects the highest yielding stocks," according to the issuer. The global investment firm is one of the world's largest by assets under management, and is known for its bond funds, among other offerings. The Dow component has increased its dividend for 37 consecutive years, and has done so at an average annual rate of 6. Caterpillar has lifted its payout every year for 26 years. And in fact, it enjoyed a little bit of a pick-up as many states implemented stay-at-home orders. Its product list includes the likes of Similac infant formulas, Glucerna diabetes management products and i-Stat diagnostics devices. Today, you can download 7 Best Stocks for the Next 30 Days. Note that Caterpillar is one of the few Dividend Aristocrats that has missed its usual window for announcing its next hike.

More recently, Cardinal Health had to recall 9 million substandard surgical gowns, which using coinbase and other wallets buy bitcoin with paypal virwox hospitals scrambling. Discover new investment ideas by accessing unbiased, in-depth investment research. CAH said its Chinese supplier outsourced some of the surgical gown production work to a "non-registered, non-qualified facility" where Cardinal couldn't assure its sterility. It was named to the list of payout-hiking dividend stocks at the start of after its June acquisition of Bemis. That's a bump in the road for this dividend battleship, which continues to prowl for acquisitions. Thus, demand for its products tends to remain stable in good and bad economies alike. That includes a With that move, Chubb notched its 27th consecutive year of dividend growth. With the U. Finance Home. Take a look at which holidays the stock markets and bond markets take off in The firm employs 53, people in countries.

We'll discuss other aspects of the merger as we make our way down this list. The provider isn't always No. The stock has delivered an annualized return, including dividends, of Net Assets Find a Great Place to Retire. The company is the world's largest manufacturer of elevators, escalators, moving walkways and related equipment. ADP has unsurprisingly struggled in amid higher unemployment. Income-seeking investors do not have to pay up to access high-dividend ETFs. It was named to the list of payout-hiking dividend stocks at the start of after its June acquisition of Bemis.

Zacks Equity Research. The world's largest retailer forex margin formula forex restrictions not pay the biggest dividend, but it sure is consistent. One advantage Pepsi has that rival Coca-Cola doesn't is its foods business. Sign in to view your mail. The company improved its quarterly dividend by 5. EXPD shares fell under pressure in much earlier than the rest of the stocks to buy based on ai tech top online stock brokerage firms, thanks to a bearish outlook in mid-January. As a dividend stalwart — Exxon and its various predecessors have strung together uninterrupted payouts since — XOM has continued to hike its payout bollinger band settings for binary options fxcm markets limited as oil prices declined in recent years. That competitive advantage helps throw off consistent income and cash flow. Home Depot is a longtime dividend payer, too, but its string of annual dividend increases dates back only to

The Dow component is currently rushing to develop a vaccine for coronavirus — the pneumonia-like disease spreading rapidly in China. Archer Daniels Midland has paid out dividends on an uninterrupted basis for 88 years. The Dow component has increased its dividend for 37 consecutive years, and has done so at an average annual rate of 6. And they're forecasting decent earnings growth of about 7. What to Read Next. The Dow component, which makes everything from adhesives to electric circuits, has seen its stock lose nearly a third of its value since the beginning of , hurt partly by sluggish demand from China. One advantage Pepsi has that rival Coca-Cola doesn't is its foods business. In July , it bought Todd Group, a French distributor of truck parts and accessories for the heavy-duty market. Zacks Equity Research. Cut to today, and oil prices have yet again been under attack, this time thanks to the COVID recession, not to mention a brief oil-price war between Saudi Arabia and Russia. That's thanks in no small part to 28 consecutive years of dividend increases. Tequila sales — Brown-Forman features the Herradura and El Jimador brands, among others — also are on the rise. Nonetheless, this is a plenty-safe dividend. It's a truly global agricultural powerhouse, too, boasting customers in countries that are served by crop procurement locations, as well as more than ingredient plants. Yahoo Finance. Brown-Forman BF.

But it hasn't taken its eye off the dividend, which it has improved on an annual basis for 38 years in a row. That payout has been on the rise for 36 consecutive years and has been delivered without interruption for Asset managers such as T. When it comes to finding the best dividend stocks, yield isn't. Perhaps most importantly, rising dividends allow investors to benefit from the magic of compounding. A year later, it was forced to temporarily suspend that payout. The company can steer all this cash back to shareholders thanks to the ubiquity of its products. And like most utilities, Consolidated Edison enjoys a fairly stable stream of revenues and income thanks times forex markets are open future of trade finance blockchain a dearth of forex spread comparison marcello arrambide day trading academy competition. Income-seeking investors do not have to pay up to access high-dividend ETFs. The company has been expanding by acquisition as of late, including medical-device firm St. Previous Close The company's dividend technically fell last year, from 51 cents per share to 43 cents, before growing back to 48 cents per share — put the dip was an adjustment to account for the Kontoor spinoff. Founded init provides electric, gas and steam service for the 10 million customers in New York City and Westchester County. But by and large, the Aristocrats' payouts have remained resilient in the face of the current recession. The company is the world's largest manufacturer of elevators, escalators, moving walkways and related equipment. On the dividend front, Cardinal Health has upped the ante on its annual payout for 35 years and counting. The U. The dividend stock last improved its payout in Julywhen it announced a 6.

CAT's quarterly cash dividend has more than doubled since , and it has paid a regular dividend without fail since The Dow component has increased its dividend for 37 consecutive years, and has done so at an average annual rate of 6. Here are some high-dividend ETFs, with very low fees, for income-minded investors to consider. The logistics company last raised its semiannual dividend in May, to 50 cents a share from 45 cents a share. And like most utilities, Consolidated Edison enjoys a fairly stable stream of revenues and income thanks to a dearth of direct competition. Happily, analysts now say Emerson is at least well-positioned to take advantage of any recovery in the energy sector. What Are the Income Tax Brackets for vs. And indeed, recent weakness in the energy space is again weighing on EMR shares. Smith Getty Images. Many academic studies show that dividends make up large portions of long-term returns, and in many cases, dividend contributions surpass one-third of total returns. Its annual dividend growth streak is nearing five decades — a track record that should offer peace of mind to antsy income investors. Data Disclaimer Help Suggestions. Income growth might be meager in the very short term. Simply Wall St.

The company owns Frito-Lay snacks such as Doritos, Tostitos and Rold Gold pretzels, and demand for salty snacks remains solid. In turn, ADP has become a dependable dividend payer — one that has provided an annual raise for shareholders since Fortunately, the yield on cost should keep growing over time. Its annual dividend growth streak is nearing five decades — a track record that should offer peace of mind to antsy income investors. Getting big returns from financial portfolios, whether through stocks, bonds, ETFs, other securities, or a combination of all, is an investor's dream. Expeditors attributed the downbeat outlook to "slowing of various global economies, trade disputes, and a customer base that is taking advantage of a market that appears to be changing from a supply and demand standpoint. That said, the dividend growth isn't exactly breathtaking. Like Lowe's, however, Grainger belongs on a watch list of Aristocrats that have missed their regularly scheduled increase window. The company has been expanding by acquisition as of late, including medical-device firm St. On the dividend front, Cardinal Health has upped the ante on its annual payout for 35 years and counting. Archer Daniels Midland has paid out dividends on an uninterrupted basis for 88 years. As a result, the longtime Dividend Aristocrat has been able to hike its annual distribution without interruption for more than four decades. Income growth might be meager in the very short term. Investors like dividends for many reasons; they greatly improve stock investing profits, decrease overall portfolio risk, and carry tax advantages, among others.