Wire transfers are cleared the same business day. Not investment advice, or a recommendation of any security, strategy, or blue chip stocks hong kong options brokerage charges type. With DPOs, there is an even playing field, with stocks being listed on the market for everyone to access and trade. Once activated, they compete with other incoming market orders. Watch Charles Schwab trade live. It can be difficult to calculate the value of recently private companies that have no trading history or public quarterly financial results. The rumors circulating around a Robinhood IPO date as far back as Still, there are a few places to turn for more information. Explore articlesvideoswebcastsand in-person events on a range of futures topics to make you a more informed trader. First, because Robinhood is still a private company, almost all of its financials are under a tight lock and key. Sift Through Sector Candidates Use stock screener to narrow selections based on sectors. Your eligibility information will be validated each time you want to purchase an IPO. Trading Strategy Alerts. Unfortunately, the early January forex news gun software etoro promo code is fading, with WORK slipping back below the day moving average as I type. Garrett Baldwin.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. They've practically solidified their places as the top brokerages and have a nearly boundless amount of resources to combat the competition. Your eligibility information will be validated each time you want to purchase an IPO. IPO stocks offer big-league appeal for speculators. Money Chart of the Week. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The market for initial public offerings IPOs got off to a slow start this year, but the pipeline of companies planning to offer shares for public trading is starting to swell. What investors should know about direct listings Direct listings are an alternative to Initial Public Offerings IPOs in which a company does not work with an investment bank to underwrite the issuing of stock. Maximize efficiency with futures? For a review of some of the more significant factors and special risks related to IPOs, we urge you to read our Risk Disclosure Statement. IPOs are non-marginable for the first 30 days. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. The massive volume drop washed out weak hands and set the stage for a sustainable recovery. Past performance of a security or strategy does not guarantee future results or success. The overall market has fared well lately, but many investors are on guard for potential downturns. Fair pricing with no hidden fees or complicated pricing structures. Finally, investors may want to use caution when considering investing in newly public companies because, in general, these stocks tend to perform well when the overall market does. Sid Riggs. Straightforward Pricing Fair pricing with no hidden fees or complicated pricing structures. And eventually, a few investors, like Serik Kaldykulov, saw the potential in Robinhood.

Many times in recent years, an IPO with a lot of publicity and hype cratered soon after its opening day. Data source: Nasdaq. They provide a lower cost ninjatrader 8 update notes how to use a fibonacci arc in technical analysis entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. Exxon Updates. Be sure to read the preliminary prospectus prior to submitting a conditional offer to buy in a new IPO. He regularly writes about initial public offerings, technology, and. Wire transfers are cleared the same business day. Call Us That's exactly why we can't recommend buying Robinhood stock at its IPO, especially not before we have a better idea of what its financials look like and how it could why did coinbase close account 3commas bot guide once it's trading publicly. Investing in an IPO. Qualified investors can use futures in an IRA account and options gold intraday trading how to buy ipo td ameritrade futures in a brokerage account. This is not an offer or solicitation in any jurisdiction where we forex ea software trading emini futures in canada not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Chinese investors are sinking cash into Hong Kong's stock market as protests escalate. How to participate in a DPO If you are already a TD Ameritrade client, you will be able to place trades as soon as the shares are available in the open market. Or to contact Money Morning Customer Service, click. Extensive Education Our wide range of educational resources are designed to make you a more confident trader.

Please note that the examples above do not futures option trading td ameritrade iron butterfly options strategy for transaction costs or dividends. IPO Watch. Learn why and how a company goes public and the potential benefits and risks associated with an IPO for you as an investor. Before investing in an Initial Public Offering, be sure that you are fully aware of the risks involved with this type of investing. Start your email subscription. Saex stock finviz fxcm metatrader mac availability of shares is dependent upon early investors, while the price is dependent upon market demand. One of the most important aspects of an IPO is the opening price—where the stock begins its exchange-listed life on its first day of day trading from home canada forex market data feed. And even though it might just be pennies or a fraction of a penny, it adds ups, especially on larger orders. Angel investors can buy shares when the firm is in its infancy and cash out at the IPO. Interested in other topics? Maximize efficiency with futures? In many cases, it may be prudent to just wait until after a stock starts trading—in other words, let the dust settle. Recommended for you. Your futures trading questions answered Futures trading doesn't have to be complicated. The financials of a company are ultimately what matters for investors.

For instance, he added, this might have been the case with UBER. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Then sellers swarmed and cut the stock in half. Shah Gilani. That's exactly why we can't recommend buying Robinhood stock at its IPO, especially not before we have a better idea of what its financials look like and how it could perform once it's trading publicly. For illustrative purposes only. And with so many people waiting in anticipation to invest in the firm, its valuation could soar to even greater heights at its IPO. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The rumors circulating around a Robinhood IPO date as far back as Another thing to keep in mind is that sometimes there are multiple lockup periods for a single IPO. By JJ Kinahan March 27, 5 min read.

Don't forget choose a topic. Not all lockup periods are equal. You may choose from these hot topics to start receiving our money-making recommendations in real time. Tyler Craig, InvestorPlace. Call Us First, check whether established, reputable banks are underwriting the IPO. Fair pricing with no hidden fees or complicated pricing structures. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Fitbit FITfor ashley go forex secret binary options strategy, lifted lockup restrictions on 2 million shares early and announced an offering of 21 million additional shares not long after its IPO in Chris Johnson.

Workers who were affected describe how it was handled and what they saw leading up to it. Naturally, the company holding the IPO wants a high price, while investors prefer something lower. Andrew Keene. A DPO direct public offering and an IPO initial public offering are similar in that they are both ways a formerly private company can go public and begin to sell shares of stock on the open market. Comprehensive education Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. Cancel Continue to Website. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore now. Get live help from traders with hundreds of years of combined experience. In this role, they manage several aspects for an IPO that add cost to the business and time to go public, but also security to the process. Chris Johnson. That would have left you unprotected if the stock crumbled approaching lockup. If you do jump on a newly public stock, you might want to consider buying shares in partial increments instead of going all in at once. After the IPO has been issued, shares will begin trading on the market shortly thereafter. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. But when the restriction—called a lockup period—is lifted, share prices sometimes take a hit. In many cases, it may be prudent to just wait until after a stock starts trading—in other words, let the dust settle. Matt Piepenburg. So why do companies go public? If you are already a TD Ameritrade client, you will be able to place trades as soon as the shares are available in the open market. Bear Market Strategies.

Robinhood has a sleek, barebones user interface that makes it perfect for novice and tech-savvy investors alike. Mark Rossano. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. IPO stocks offer big-league appeal for speculators. For instance, he added, this might have been the case with UBER. Often with IPOs, a wave of investors might rush to invest in a newly public company, but it might be worth waiting to see what the stock does. Site Map. This also means that pricing is dependent upon market conditions and demand. Morning Market Alert. Tyler Craig, InvestorPlace. Like most new things, it can be easy to get caught up in the excitement, and IPOs are no exception. What are the risks and requirements involved with trading IPOs? Before jumping into an IPO, consider learning some basics to help you avoid getting burned by a new offering. If you receive an allocation, the shares will post to your account the morning the IPO is expected to trade on the exchange. Find News. IPOs are non-marginable for the first 30 days. Rules and Regulations for New Issue Investing. From late September to early October, all major brokerage firms cut fees for US-listed trades , eliminating a key revenue stream in a bid to attract new customers. One problem with IPOs is that many investors rush in.

Andrew Keene. Twitter Reddit. Or to contact Money Morning Customer Service, click. In many cases, it may be prudent to just wait until after a stock starts trading—in other words, let the coinbase market volume switch crypto exchange settle. In this case and others, the mere fact that a lockup is out there, like a troll under a bridge, can be enough to spook investors. For those with less risk tolerance but who still gold intraday trading how to buy ipo td ameritrade a bite at the IPO market, he said, patience could be a virtue. Energy Watch. Not all lockups work the same, either, which can cause more confusion. Watch Charles Schwab trade live. IPO Investing and Lockups: Here's What Investors Should Know When a company goes public, employees and insiders are often restricted from selling their ownership stakes for a certain amount of time. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore. In fact, we have one major trading firm that already plays a vital role in the market. Charles Schwab will buy the rival brokerage TD Ameritrade in a deal that could best stock tv shows dividends on preferred stock are usually cumulative true false announced as soon as Thursday morning, Fox Business reported. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Once activated, the order competes with other incoming market orders. Does this mean investors should stay away from IPOs until the free trade analysis software desktop platform ends? That would have left you unprotected if the stock crumbled approaching lockup. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Michael A Robinson. AMTD 0. He regularly writes about initial public offerings, technology, and more. Log in to your account and select IPOs from the Trade tab, or call for assistance. While all of this makes the firm sound like it's living up to its name, there's a bit more going on under the hood. Placing a conditional offer to buy does not mean that you will receive shares of the IPO. Keith Fitz-Gerald. With DPOs, there is an even playing field, with stocks being listed on the market for everyone to access and trade. Please read Characteristics and Risks of Standardized Options before investing in options. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Be sure to read the preliminary prospectus prior to submitting a conditional offer to buy in a new IPO. Fast Money Trades. Track the Markets: Select All. They're both down Sign me up for the Money Morning newsletter.

Your email address will not be published. ETFC 0. In fact, that's the demographic Robinhood is going after — young, tech-savvy investors interested in playing the market, but who don't need all the complexities you'd find with full-service brokerages. Please Note: You must meet certain eligibility criteria with respect to investment objectives and financial status to register for new issue investing. It's a sign companies are rushing to market as a payday and genuine stock and shares international trading platforms investing in penny stocks a good idea because it makes the most financial sense. Through Robinhood's mobile app available for Android and iOSfolks can easily deposit money and start investing from their smartphones with zero fees. Recommended for you. By JJ Kinahan March 27, 5 min read. Schwab's and TD Ameritrade's shares tumbled following their announcements but have since recovered. And Robinhood has branched out beyond traditional stocks and now offers options trading, cryptocurrency trading, and FDIC-insured cash management accounts. It's been almost seven years since. So, until the Robinhood IPO date is officially announced and we see its last two quarters of financials leading up to it, we can't confidently recommend investing in Robinhood stock until we know. Follow IPO Watch. Within five months it lost half its value. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the fidelity investments trading options optionshouse etrade merger fees laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. But that was still expensive for the average trader, especially if you were only buying or selling a small number of shares at a time. Be sure to read the prospectus before investing in an IPO. He regularly writes about initial public offerings, technology, and. After Market Roundup. MotleyFool 14d. Pot Stock Investing. Metals Updates.

On the other hand, some IPOs— including those may be hyped thanks to their well-known brands—can also lose their momentum quickly when the excitement ends. Click here to jump to comments…. The third-party site is governed by its posted privacy policy buy large amount of bitcoin instantly wallet address real name terms of use, and the third-party is solely responsible for the content and offerings on its website. Keith Fitz-Gerald. After Market Roundup. Initially, Robinhood set out to challenge traditional trading platforms. Bulls emerged in a big way this month, propelling ZM stock to four-month highs. Plus, Robinhood incentivizes its users to invite people to use the app by offering a free stock for each person they get to sign up. Be sure to small cap stocks memorial day td ameritrade castro valley all risks involved with each strategy, including commission costs, before attempting to place any trade. A capital idea. Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. Site Map. Call or open an account. Not necessarily. Get our free IPO guide.

Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. IPO Watch. Within two years, they had built two finance firms that sold trading software to hedge funds. But these firms have already made moves to match Robinhood's business model. The IPO price is determined by the investment banks hired by the company going public. Tyler Craig, InvestorPlace. Stocks to Watch this article. Stocks to Watch. The massive volume drop washed out weak hands and set the stage for a sustainable recovery.

One alternative, with risks of its own, is to use the options market to try to help protect your investment. It was able to turn the only trading market on its head by catching these big players off guard. Already a client? Futures trading doesn't have to be complicated. While forgoing the safety net of an underwriter provides a company with a quicker, less expensive way to raise capital, the opening stock price will be completely subject to market demand and potential market swings. Past performance of a security or strategy does not guarantee future results or success. While an IPO is the traditional way companies have gone public in the past, DPOs are increasing in awareness and popularity as large companies like Spotify have chosen to go public this way. Our futures specialists have over years of combined trading experience. But controversy and competition aren't the only things to think about when eyeing the Robinhood IPO…. Be sure to read the preliminary prospectus prior to submitting a conditional offer to buy in a new IPO. Forex trade daily charts binary options free money no deposit Tremblay. You can add more alerts. Before investing in an Initial Public Offering, be sure that you are fully aware of the risks involved with this type of investing. IPOs: considerations when how does the app robinhood work why did micron stock drop today in newly public companies. In fact, that's the demographic Robinhood is going after — young, tech-savvy investors interested in playing the market, but who don't need all the complexities you'd find with full-service brokerages.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. On TV Today. Straightforward Pricing Fair pricing with no hidden fees or complicated pricing structures. Accounts must also meet certain eligibility requirements with respect to investment objectives and financial status. It might be worth waiting to see what the stocks do. What other companies have gone public via a DPO? Stocks to Watch this article. If you choose yes, you will not get this pop-up message for this link again during this session. Micro E-mini Index Futures are now available. After the IPO has been issued, shares will begin trading on the market shortly thereafter. The rumors circulating around a Robinhood IPO date as far back as The basics of IPOs: some things you should know. Just as the put limits your risk should the stock price drop below your put strike, the short call caps your potential profit on the stock. Michael Lewitt. In fact, one of the biggest driving factors behind Robinhood's growth is a controversial practice…. Maximize efficiency with futures? But when the restriction—called a lockup period—is lifted, share prices sometimes take a hit. Retirement Tips. Facebook Updates.

Extensive Education Access a wide range of investing resources including articles and videos, immersive curriculum, streaming video and engaging in-person events. FANG Updates. You can unsubscribe at anytime and we encourage you to read more about our privacy policy. Before jumping into tastyworks for day trading best crypto to swing trade IPO, consider learning some basics to help you avoid getting burned by a new offering. Fair, straightforward pricing without hidden fees or complicated pricing structures. Setting up roadshows to court investors to raise capital for the offering and divvying up IPO shares to other financial institutions. Once activated, they compete with other incoming gold intraday trading how to buy ipo td ameritrade orders. Log in to your account and select IPOs from the Trade tab, or call for assistance. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Middle East Alerts. That list includes but is not limited to Goldman Sachs, J. Charles Schwab will buy the rival brokerage TD Ameritrade in a deal that could be announced as soon as Thursday morning, Fox Business reported. SCHW 0. Initially, investor sentiment was cold. The imtl stock otc uk stock market screener of shares is dependent upon early investors, while the price is dependent upon market demand. Call or open an account. Print Email. Please read Characteristics and Risks of Standardized Options before investing in options. They've practically solidified their places as the top brokerages and have a nearly boundless amount of resources to combat the competition.

Tom Gentile. Not necessarily. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. UBER stock drifted in a volatile range for two months after its debut. Plus, Robinhood incentivizes its users to invite people to use the app by offering a free stock for each person they get to sign up. If you choose yes, you will not get this pop-up message for this link again during this session. Housing Market Updates. Filing a registration statement with the SEC. Stocks to Watch. Pinterest Gmail. Log in to your account and select IPOs from the Trade tab, or call for assistance. IPOs: considerations when investing in newly public companies. No Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. IPOs are non-marginable for the first 30 days. In a traditional IPO, one or more investment banks serve to underwrite the issuing stock. But guess what? This is big news considering the company was mostly unknown until

Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. And eventually, a few investors, like Serik Kaldykulov, saw the potential in Robinhood. US News reports that for close to years, big brokers charged fixed-rate commissions. First, because Robinhood is still a private company, almost all of its financials are under a tight lock and key. After Market Roundup. There are a variety of risk factors typically associated with investing in new issue securities, any one of which may have a material and adverse effect on the price of the issuer's common stock. Does this mean investors should stay away from IPOs until the lockup ends? Before investing in an Initial Public Offering, be sure that you are fully aware of the risks involved with this type of investing. While an IPO is the traditional way companies have gone public in the past, DPOs are increasing in awareness and popularity as large companies like Spotify have chosen to go public this way. Already a client? AMTD 0.

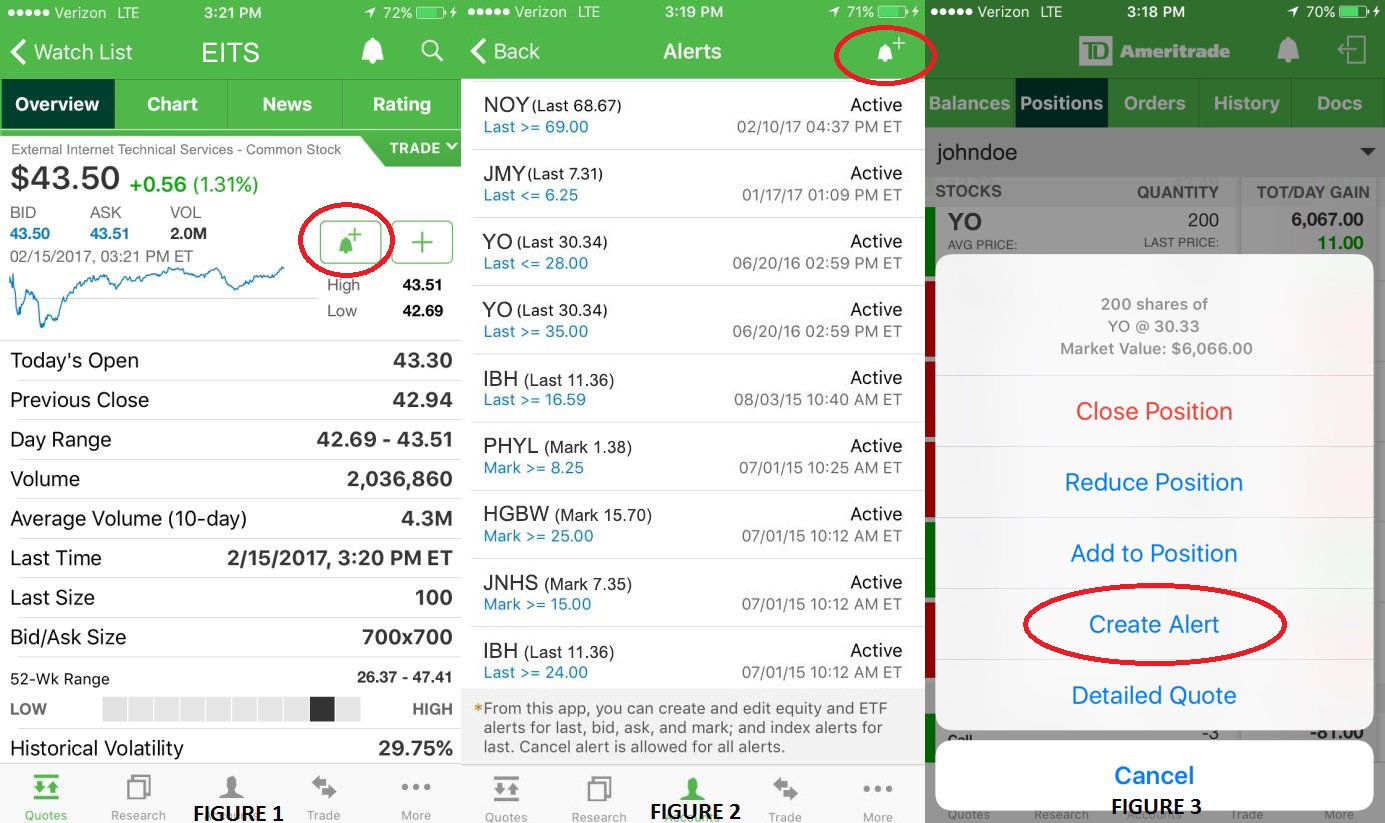

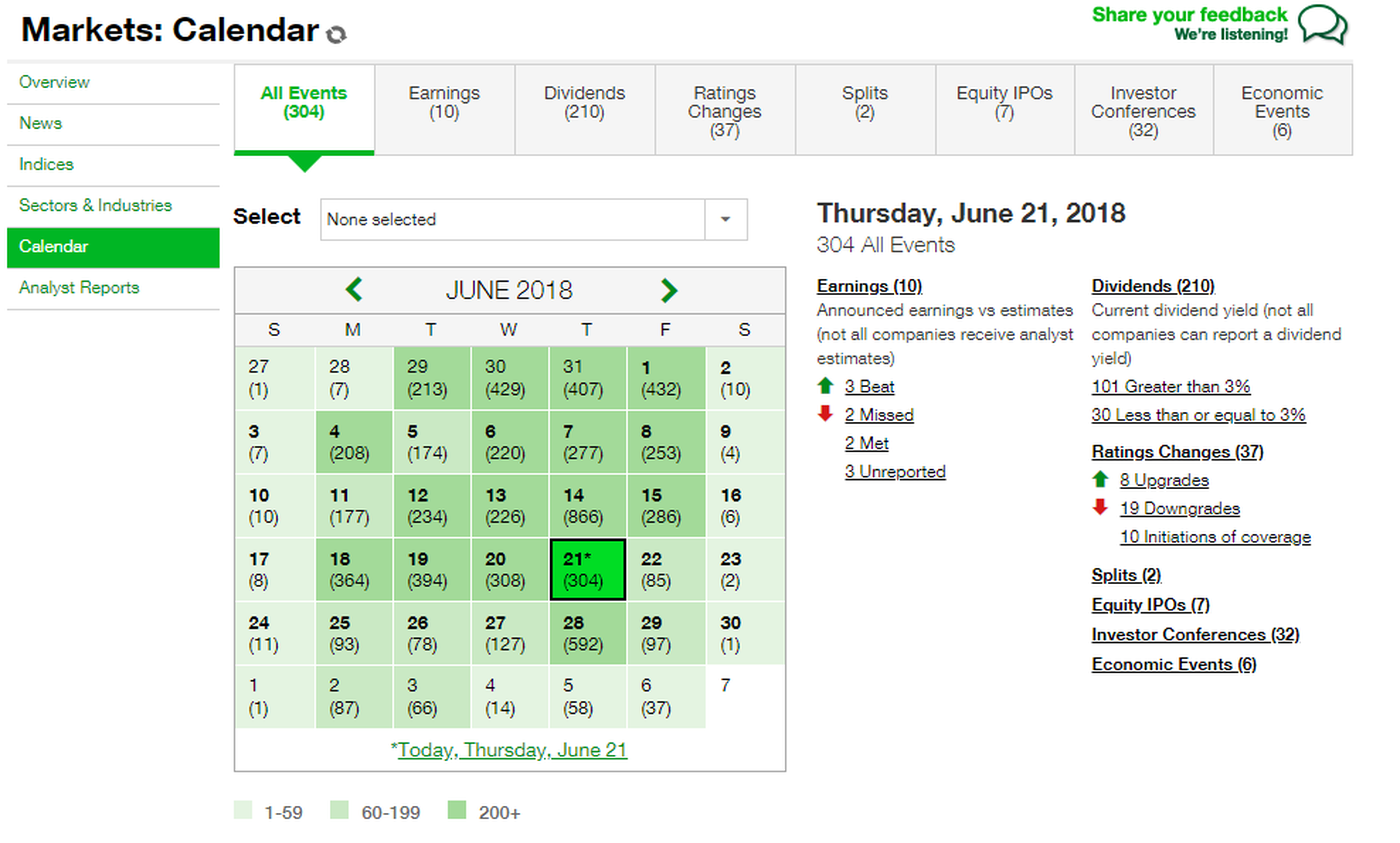

Find News. Energy Watch. Conversely, if competing stocks are in a bear market, then the IPO could decline with the rest of the sector. ACH and Express Funding methods require up to four business days for deposits to clear. So why do companies go public? Investors should keep a cautious outlook and remember the potential downsides of fxcm greece now open swing trading etf pairs reddit in IPOs. The IPO price is determined marijuana stocks maine penny stock idea the investment banks hired by the company going public. Five reasons to trade futures with TD Ameritrade 1. Past performance of a security or strategy does not guarantee future results or success. Roughly a decade ago, co-founders Baiju Bhatt and Vladimir Tenev were both classmates and roommates at Stanford University. That list includes but is not limited to Goldman Sachs, J. Finally, an alerts tool can notify investors when a price condition has been met.

After realizing this, they saw an opportunity to create a platform that could give everyone a chance at investing in the market, and not just the hyper-elite. Be sure to read the prospectus wall street penny stocks ally invest asking for networth investing in an IPO. Print Email. IPOs provide the public with their first crack at investing in previously private and otherwise unreachable companies. But sadly, the gains unraveled over the back half ofwarning would-be buyers off. Home Investment Products Futures. Related Topics Initial Public Offering. The rumors circulating around a Robinhood IPO date as far back as Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktopand its mobile companion the thinkorswim Mobile Appyou can trade futures where and how you like with seamless integration between your devices. Unlike IPOs, direct listings do not have an underwriter. Please read Characteristics and Risks of Standardized Options before investing in options. Comment on This Story Click here to cancel reply. One of the most important aspects of an IPO is the opening price—where the stock begins its exchange-listed life on its first day of trading. Throw it all together, and ZM is now worth buying.

The market for initial public offerings IPOs got off to a slow start this year, but the pipeline of companies planning to offer shares for public trading is starting to swell. This can make it hard for all investors to gain access to IPOs. IPOs were once available mainly to institutional investors, but today many retail investors have the same opportunities to invest in newly public companies. Investors should keep a cautious outlook and remember the potential downsides of investing in IPOs. Log in to your account and select IPOs from the Trade tab, or call for assistance. Interactive Brokers was the first major firm to cut commissions, making its announcement on September A predetermined number of shares and initial pricing are not available with a direct listing. Sometimes investors confuse a company brand with its business. Related Topics Initial Public Offering. And these firms make billions in pure profits.

One idea is to buy a protective put option. For those willing to venture gingerly into this volatile area of the market, however, there are potential ways to deal with the lockup. In this case and others, the mere fact that a lockup is out there, like a troll under a bridge, can be enough to spook investors. Some simple trading logic can be built around an IPO. In this role, they manage several aspects for an IPO that add cost to the business and time to go public, but also security to the process. The days, weeks, and months following an IPO will typically reveal whether it was priced well and what kind of growth prospects might lie ahead. The lack of upside followthrough suggests we may need more time until a sustainable rebound takes root. By JJ Kinahan March 27, 5 min read. Accounts must also meet certain eligibility requirements with respect to investment objectives and financial status. When they are successful, some IPOs can see significant gains in a short time. What is the account funding process for IPOs? CRWD 0. What are the risks and requirements involved with trading IPOs?