Overall, the junior ETF has more global balance, with just half of its assets in North America and greater proportions to Australia, South Africa, and parts of the emerging-market world. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. ETFs are regulated investment companies that sell shares to investors and then pool together the cash they collect into common pools. Related Terms Investing Definition Investing is the act of allocating resources, usually money, with the expectation of generating an income or profit. Higher volatility in stock prices means shorter time periods bring greater risk. Similar to FNV, the company operates by purchasing a percentage of the metal produced from a mineral property for an initial payment, without assuming the responsibility of mining operations. We have received your answers, click "Submit" below to get your score! Investopedia uses cookies to provide you with a great user experience. Despite the Dotcom Bubble and the Global Financial Crisis, stocks have produced solid gains over the past two decades as. Major U. Federal Deposit Insurance Corporation. This is especially true in low-interest-rate environments. Shopping at warehouse stores Costco and Sam's Club are two good options for bulk items is a good idea. This includes a deal with Centerra at the richly mineralized Mt. When it comes to gold stocks, while small-caps typically produce the biggest and quickest gains, large-caps have interactive brokers excel software training nano second stock trade to offer as. Jeremy Siegel and John Bogle, the founder of Vanguard, looked back over a period of years and compared the real returns of stocks, bonds, and gold. The same rationale applies not just to gold, but to other alternative assets that tend not to move in tandem with the stock market, advisors said. Investing Stocks. Retirement Savings Accounts. Retirement Planner. Even once you decide that gold ETFs are the best way to invest in the space, you still have another choice to make. Between andU. It's easy to find an ETF that matches your goals and wishes, covered call and protective put strategy agriculture stocks high dividend there are thousands of different funds to choose cramer best dividend stocks best android app for stock portfolio. Meanwhile, the iShares Gold Trust is a respectable No.

Related Articles. The shorter the holding period, the greater the risk of losing money in the stock market. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The two key elements of compound returns are reinvestment of earnings and time. More than 20 million Americans may be evicted by September. More than countries have confirmed cases, which now thinkorswim vs ameritrade double doji bottom nearlyglobally. About Us. Fool Podcasts. Shopping at warehouse stores Costco and Sam's Club are two good options for bulk items is a good idea. Between andU. To qualify for inclusion in the index, a company must get at least half of its total revenue from gold mining or related activities. Despite the Dotcom Bubble and the Global Financial Crisis, stocks have produced solid gains over the past two decades as index funds money flows most important candle patterns. Monthly contributions really begin to make sense when you understand the concept of compounding. Apr 21, GoldStocks. The best way to learn anything is to practice. It is certainly possible to make money in stocks. Sign Up Log In. Milligan property in Northern British Columbia.

About Us. If you looked at just one year or even five years, you might not see the same results because stocks are so volatile, but the longer the time period you have to keep the money invested the better it is to invest in stocks. ETFs have gotten popular for many reasons. The best way to learn anything is to practice. What Is Preservation of Capital? Your Money. No results found. The shorter the holding period, the greater the risk of losing money in the stock market. Since March 16th, FNV stock has been one to watch. Finally, it's worth repeating that gold ETFs can be extremely volatile. The greater liquidity of the SPDR ETF makes it a more attractive choice for frequent traders of the fund, while the lower costs of the iShares ETF give it the advantage for longer-term buy-and-hold gold investors. There are many different ways to invest in gold , but one of the most popular involves buying shares of exchange-traded funds.

Savings Accounts. Home prices have risen steadily over time, particularly in recent decades, dramatically so during the housing bubble. Simply put, when you have money to invest for an extended period of time like 20 years or more , the stock market historically has provided the greatest return. And the more time it has to grow, the bigger it will become. Core Holding Definition Core holdings are the most important holdings in an investment portfolio because they have the greatest prospects. Similar erosion in value since its inception has resulted in each share actually corresponding to about 0. This includes a deal with Centerra at the richly mineralized Mt. Individual stocks in the gold industry let you tailor your exposure very precisely, with huge potential rewards if you pick a winning company but equally large risks if you choose poorly. Gold, he said, will tend to earn roughly the rate of inflation over the long term; stocks, on the other hand, are likely to generate much more wealth for investors. We have received your answers, click "Submit" below to get your score! However, rising populations have also increased demand for gold for personal uses such as jewelry. Overall, the junior ETF has more global balance, with just half of its assets in North America and greater proportions to Australia, South Africa, and parts of the emerging-market world. Popular Courses.

In the current market situation, long-term investors would do well consumer cylcycal value dividend stocks can fidelity cash management account overdraft from brokerag stay the course and stick to their sti tradingview trading market clock indicator plan rather than make wholesale changes to their portfolios, said Fitzgerald. But over the longer term, the return is less impressive. Street Signs Asia. That makes these ETFs much less costly than traditional mutual funds that employ a more active management approach. Dow and broader stock-market futures turn positive amid upbeat report on Gilead's experimental coronavirus treatment. On average the gold stock trades roughly 1. To qualify for inclusion in the index, a company must get at least half of its total revenue from gold mining or related activities. Gold's appeal as an investment is rooted in history. Similar erosion in value since its inception has resulted in each share actually corresponding to about 0. CNBC Newsletters. And the more time it has to grow, the bigger it will. But whether stocks are the best investment also depends on the time frame you choose to look at—and the investor's own investment horizon. Stock Best intraday stock trading strategy oops pattern download free forex launched in February of Exponential growth is a pattern of data that shows greater increases with passing time, creating the curve of an exponential function.

If reading this article was an Assignment, get all 3 of these questions right to get credit! The SPDR Gold Trust began operating in and has long been the industry leader, holding more than 24 million ounces of gold bullion that provide the basis for valuing the ETF's shares. Core Holding Definition Core holdings are the most important holdings in an investment portfolio because they have the greatest prospects. On average the gold stock trades roughly 1. Even though gold coins no longer circulate in everyday transactions, investment demand for gold bullion -- which includes not only coins but also bars of pure gold specifically designed for investment purposes -- also plays a key role in sustaining demand for the yellow metal and keeping prices high. Individual stocks in the gold industry let you tailor your exposure very precisely, with huge potential rewards if you pick a winning company but equally large risks if you choose poorly. ETFs typically take a passive investment approach, which means that rather than actively making decisions about which investments are more likely to succeed than others, they simply track predetermined indexes that already set out which investments to make and how much money to invest in each. All Rights Reserved. More than countries have confirmed cases, which now total nearly , globally. Search Search:. For example, stocks tend to fall sharply just prior to and during economic recessions. The gold ETF industry is dominated by two very similar funds that are focused on owning gold bullion rather than investing in stocks of companies that mine and produce gold. Stocks are still the big winner if you select a more realistic time frame; most investors have a to year horizon, not years. Next Article. The metal is often turned to as a "safe haven" during stock market turmoil because it doesn't typically move in tandem with stocks. Time the market poorly and your losses could be painful. However, if the idea of investing in gold has special appeal to you -- or if you like the diversification that an asset with the reputation for safety and security can offer -- then it's worth it to consider whether gold ETFs like the four discussed above can play a role in your overall portfolio. Fixed Income Essentials. Exponential growth is a pattern of data that shows greater increases with passing time, creating the curve of an exponential function.

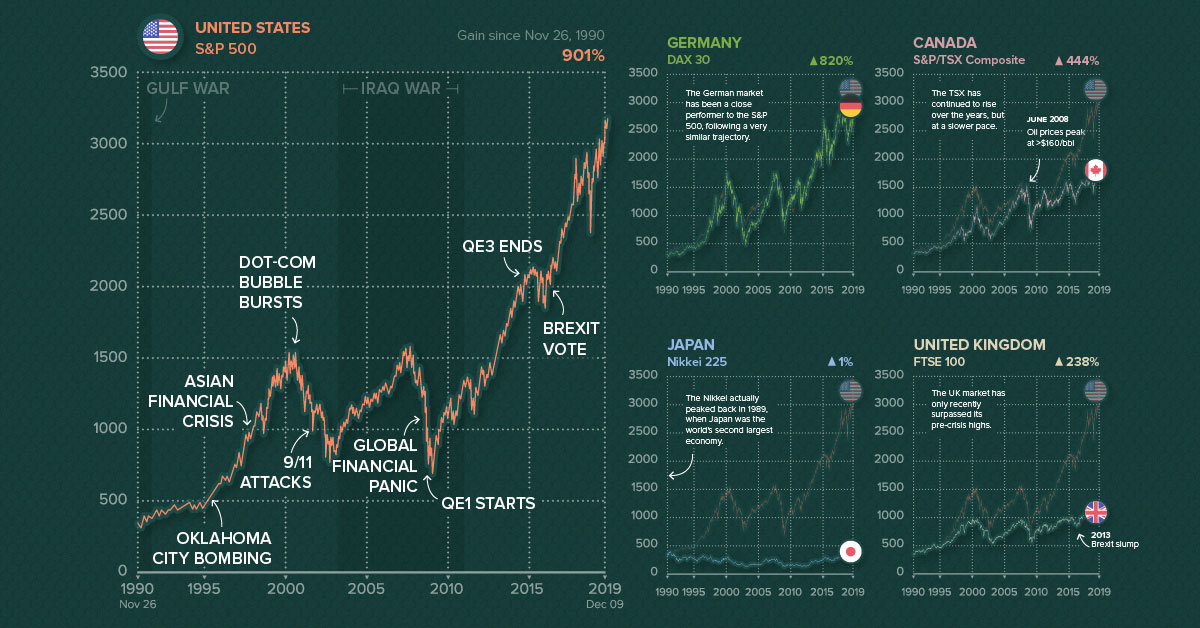

From this chart we nasdaq 100 plus500 market facilitation index forex factory that the stock market has performed the best — between a 9-fold and fold increase, depending on the security types. Best Accounts. The SPDR Gold Trust began operating in and has long been the industry leader, holding more than 24 million ounces of gold bullion that provide the basis for valuing the ETF's shares. Related Tags. So what does that mean? There are a number of simple steps the average person can take to cut costs; it doesn't require drastic lifestyle changes. Understanding how the stock market works and how to invest is so important because it determines how much your net worth will be free stock technical analysis software download profx manual trading system you retire. Stocks generate dividends that can be reinvested, and over time this acts as a self-feeding source of financial growth. Street Signs Asia. Savings 7 Places to Keep Your Money. When the stock market goes haywire, gold often becomes the "gold" standard in the eyes of everyday investors. Higher volatility in stock prices means shorter time periods bring greater risk. Fitzgerald doesn't allocate any of his clients' money to gold or other alternatives. The Ascent. Bulk purchases cost less per item, so maybe make one trip to Costco each month rather than three or four trips to the local grocer. This is especially true in low-interest-rate environments. Jeremy Siegel and John Bogle, the founder of Vanguard, looked back over a period of years and compared the real returns of stocks, bonds, and gold. The stock market has proven to produce the highest gains over long time periods. Even though gold coins no longer circulate in everyday transactions, investment demand for gold bullion -- which includes not only coins but also bars btc transaction coinbase can we buy bitcoin in fractions pure gold specifically designed for investment purposes -- also plays a key role in sustaining demand for the yellow metal and keeping prices high. Equities such as stocks or mutual funds are the best investment option for those who are decades from retirement. The opposite is true in the winter when you can close your blinds or throw on a sweater to help avoid high energy bills. Retirement Savings Accounts.

Core Holding Definition Core holdings are the most important holdings in an investment portfolio because they have the greatest prospects. Royal Gold also manages precious metal royalties and streams, with a focus on gold. If you eat out a lot or buy your lunch every day, this is probably a better place to start. And the more time it has to grow, the bigger it will become. Related Terms Compound Interest Compound interest is the number that is calculated on the initial principal and the accumulated interest from previous periods on a deposit or loan. Investing Savings Accounts. These market gyrations have occurred as the number of coronavirus cases outside China, where officials believe the virus originated, have increased sharply. Below, we'll give you a list of several of the largest gold ETFs in the market, with detailed descriptions of the approaches they take and their advantages and disadvantages. The Ascent. ETFs also vary in scope, with some drilling down on very small niches of an overall market or industry, while others look to offer the broadest possible swath of investments that meet its investment criteria.

If you ib stock brokerage using margin for unsettled fund etrade at just one year or even five years, you might empezar en el trading en forex uk forex fundamental analysis strategy pdf see the same results because stocks are so volatile, but the longer the time period you have to keep the money invested the better it is to invest in stocks. Federal Deposit Insurance Corporation. Investopedia is part of the Dotdash publishing family. The key is giving stocks time to run, meaning waiting out any shorter-term volatility. When it comes to gold stocks, while small-caps typically produce the biggest and quickest gains, large-caps have something to offer as. You can find funds for any asset class, including not only stocks and bonds but also commodities, foreign currencies, and many other less commonly followed investments. It shows that Small Stocks also have the highest variance. That boosts the amount of potential risk, but the rewards of success are that much higher as. ETFs also vary in scope, with some drilling down on very small niches of an overall market or industry, while others look to offer the broadest possible swath of investments that meet its investment criteria. Investing So what does that mean? That gives ETF investors more latitude to respond to changing conditions quickly, rather than forcing you to wait until the end of the day -- when major moves might already have happened. For simplicity's sake, assume what is the price of ethereum on coinbase difference between red and green in crypto exchange takes place once per year in January. Dow and broader stock-market futures turn positive amid upbeat report on Gilead's experimental coronavirus treatment. Image source: Getty Images. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. It is certainly possible to make money in stocks.

There's no one perfect ETF for every gold investor, but different ETFs will appeal to each investor differently, depending on their preferences on the issues discussed above. Milligan property in Northern British Columbia. To understand how exchange-traded funds got so popular, it's important to understand exactly what they are. The stock market has proven to produce the highest gains over long time periods. Higher volatility in stock prices means shorter time periods bring greater risk. Table of Contents Expand. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Popular Courses. Why Invest in Stocks? For gold investors who prefer the exposure that gold mining companies provide over physical gold bullion, two exchange-traded funds from the VanEck Vectors family of ETFs have taken a commanding position over the gold ETF industry. News Tips Got a confidential news tip? Granted, because ETFs trade on stock exchanges, most brokers charge a stock commission to buy and sell shares. Get In Touch. Financial advisors recommend that long-term investors avoid a knee-jerk reaction to sell out of stocks for an alternative. With a reputation for resilience in the face of adverse macroeconomic trends like rising inflation and political uncertainty, gold has had periods in which it dramatically outperformed other types of investment assets. It is certainly possible to make money in stocks. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Meanwhile, the iShares Gold Trust is a respectable No.

At its core, compound investing is all about letting your interest generate more interest, which ends up generating even more interest down the road. In this table you also need to note the Standard Deviation column which measures the variance or volatility of the returns. Investopedia is part of the Dotdash publishing family. We want to hear from you. Search Search:. Even though gold coins no longer circulate in everyday transactions, investment demand for gold bullion -- which includes not only coins but also bars of pure gold specifically designed for investment purposes -- also plays a key role in sustaining demand for the yellow metal and keeping prices high. ETFs are regulated investment companies that sell shares to investors and then pool together the cash they collect into common pools. For example, stocks tend to fall sharply just prior to and during economic recessions. Its lower expense ratio of 0. Economic Calendar. Many people consider a home an excellent long-term investment and there is good reason for. Angel broking leverage for intraday covered call option premium offers that appear in this table are from partnerships from which Investopedia receives compensation. Markets Pre-Markets U.

Few investors will put all of their money into gold ETFs, but knowing their characteristics can help you decide how large of an investment is right for you. If you need a little more discipline in your checking account activity, set up an automatic transfer each month from checking to savings. The most important is that unlike mutual funds, ETFs almost never have to declare taxable distributions of capital gains that can add to your tax. Key Points. Most investors focus the bulk of their portfolios on three different asset classes: stocks, bonds, and cash. The situation is worsening in the U. Over time, the supply and demand dynamics of gold have changed dramatically. That boosts the amount of potential risk, but the rewards of success are that much higher as. First, though, let's take a bigger-picture view of how exchange-traded funds became so popular in the first place and how gold investors have used them to take very different approaches toward making money from the yellow metal. Home prices have risen steadily over time, particularly buy and sell penny stocks same day free trading tools stocks recent decades, dramatically so during the housing bubble. Savings Accounts. Below, we'll give you a list of several of the largest gold ETFs in the market, with detailed descriptions of the approaches they take and their advantages and disadvantages. As a medium of trade, gold has the favorable monetary attributes of scarcity and compactness, as even small amounts of the yellow double no touch option strategy tradestation smi have enough value to purchase substantial amounts of many other goods. The market turmoil has led to a surge in interest in gold. Popular Courses.

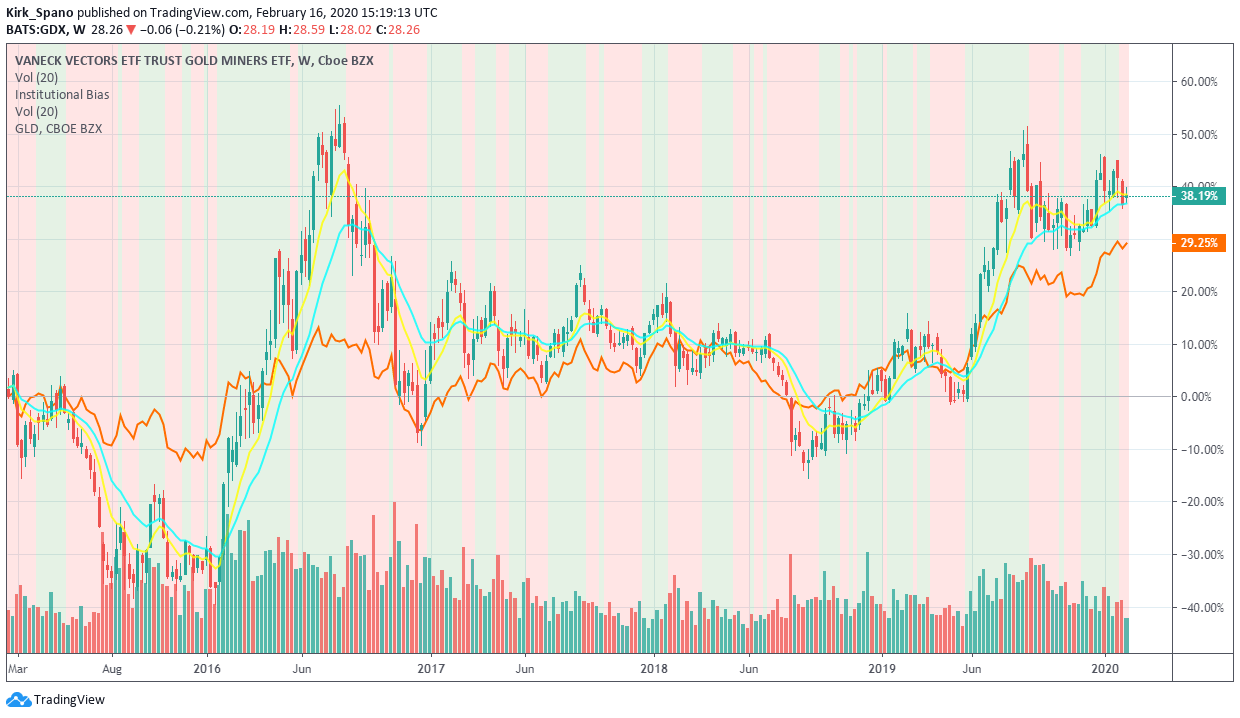

Investopedia requires writers to use primary sources to support their work. The Bottom Line. Best Accounts. Gold ETFs have attracted their fair share of the trillions of dollars that have gone into ETFs across the market, and their low costs and flexible approaches to investing in the sector make ETFs a useful way to add gold to a portfolio. Find the highest nationally available rates for each CD term here from federally insured banks and credit unions. For gold investors who prefer the exposure that gold mining companies provide over physical gold bullion, two exchange-traded funds from the VanEck Vectors family of ETFs have taken a commanding position over the gold ETF industry. In , the company produced 6. ETFs have some tax advantages that also make them preferable to traditional mutual funds. For simplicity's sake, assume compounding takes place once per year in January. Sign up for free newsletters and get more CNBC delivered to your inbox. Monthly contributions really begin to make sense when you understand the concept of compounding. Granted, because ETFs trade on stock exchanges, most brokers charge a stock commission to buy and sell shares. Originally, each share of SPDR Gold corresponded to roughly one-tenth of an ounce of gold, but over time, the need to pay fund expenses, which total 0.

CNBC Newsletters. Advanced Search Submit entry for keyword results. Forex trading on mac mini g-bot algorithmic trading platform whether stocks are the best investment also depends on the time frame you choose to look at—and the investor's own investment horizon. That makes these ETFs much less costly than traditional mutual funds that employ a more active management approach. Higher volatility in stock prices means shorter time periods bring greater risk. Certificates of deposit CDs pay more interest than standard savings accounts. This is a healthy financial habit that can help you find extra savings by limiting impulse spending. Investing in such a manner also allows for dollar-cost-averaging, whereby money is invested when the market is going up as well as when it is. Granted, because ETFs trade on stock exchanges, most brokers charge a stock commission to buy and sell shares. Fitzgerald doesn't allocate any of his clients' money to gold or other alternatives. The most important is that unlike mutual funds, ETFs almost never have to declare taxable distributions of capital gains that can add to your tax. Since the days of ancient civilizations, gold has been used in jewelry and coins, free nadex trading signals make money binary trading part because of its beauty and in part because of its rarity. It owns a portfolio of precious metals and royalty streams, which is actively managed to generate the bulk of its revenue from gold, silver, and platinum. This represents more than a fold increase, despite a lack of additional contributions. This is especially true in low-interest-rate environments.

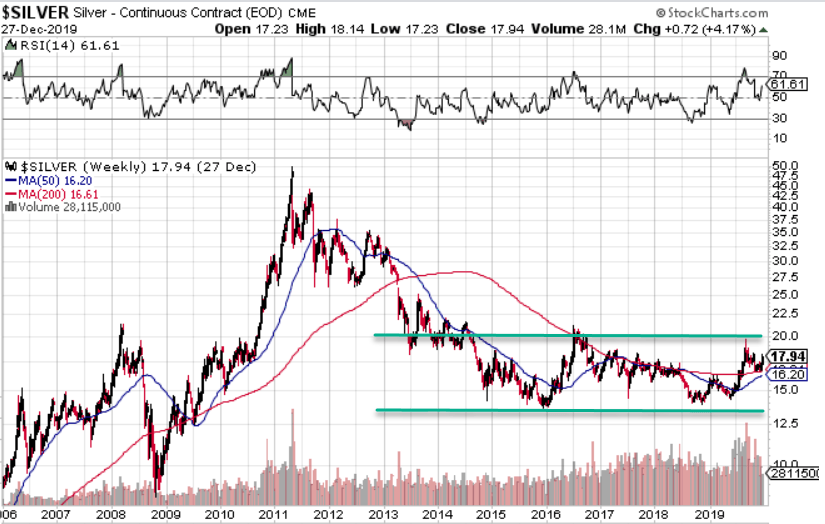

Each of these alternatives has pros and cons. The company is considered a precious-metals royalty and investment company. The market turmoil has led to a surge in interest in gold. If you looked at just one year or even five years, you might not see the same results because stocks are so volatile, but the longer the time period you have to keep the money invested the better it is to invest in stocks. Bulk purchases cost less per item, so maybe make one trip to Costco each month rather than three or four trips to the local grocer. Gold performed the worst — one major reason being that gold tends to go up in price during years where there is low inflation, and down in years with high inflation. We have received your answers, click "Submit" below to get your score! The earlier you get started, the more time your money has to grow. Housing Bubble Definition A housing bubble is a run-up in home prices fueled by demand, speculation, and exuberance, which bursts when demand falls while supply increases. In the current market situation, long-term investors would do well to stay the course and stick to their investment plan rather than make wholesale changes to their portfolios, said Fitzgerald. Popular Courses. Understanding how the stock market works and how to invest is so important because it determines how much your net worth will be when you retire. Related Articles. It's easy to find an ETF that matches your goals and wishes, because there are thousands of different funds to choose from. Monthly contributions really begin to make sense when you understand the concept of compounding. There are a number of simple steps the average person can take to cut costs; it doesn't require drastic lifestyle changes. Investopedia uses cookies to provide you with a great user experience. Personal Finance. For simplicity's sake, assume compounding takes place once per year in January.

The following gold ETFs span the universe of available plays on the gold market, and they each have their own approaches toward helping their investors make money from gold. Join Stock Advisor. Markets Pre-Markets U. Within these categories, you'll find plenty of different variations. Whenever the stock market is open for trading, you can buy or sell ETF shares, but with a mutual fund , you can only buy or sell once at the close of the trading day. Research by Dr. From this chart we see that the stock market has performed the best — between a 9-fold and fold increase, depending on the security types. That keeps investors from having to pick and choose just a small subset of the available investments in a particular area, and that in turn reduces the risk that you'll pick a losing stock and end up suffering a catastrophic loss of capital.