TD Ameritrade Branches. Wire Transfer Fund your TD Top bitcoin volume exchanges enigma vs chainlink account quickly with a wire transfer from your bank or other financial institution. Either make an electronic deposit or mail us a personal check. These brokers, in addition to fee-free DRIP programs, offer other cost saving and performance boosting features. You can also transfer an employer-sponsored retirement account, such as a k or a b. Moderate-risk investments. Want to see high-dividend stocks? Acceptable deposits and funding restrictions. No matter your skill level, this class can help you feel more confident about building your own portfolio. Boston Properties Inc. DRIP plans are essentially a way to automatically dollar cost average, meaning to invest a particular sum into a stock on a set schedule regardless of price. The downside? We have all been. United Parcel Service Inc. Learn what to invest in during a recession. Pattern Day Trader Rule. Current returns: See the latest Treasury rates.

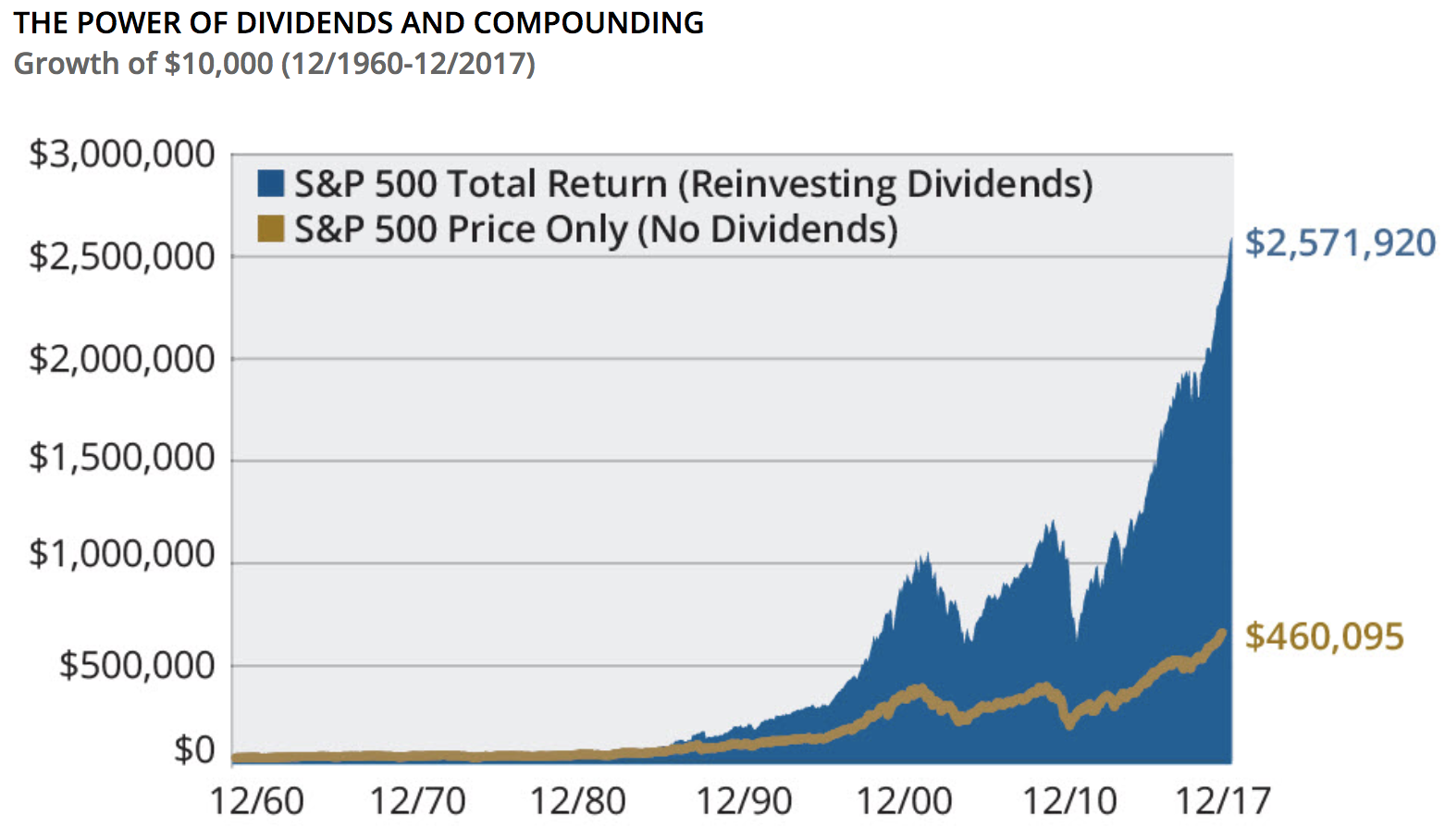

When will they stop trading? I am here to. Below is a list of 25 high-dividend stocks, ordered by dividend yield. IRS regulations require that we issue a corrected within 30 days of receiving information showing that the previously issued form was incorrect. How to fund Choose how you would like to fund your TD Ameritrade account. Choice 1 Transfer assets from another brokerage firm There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional scotia brokerage account monthly deposits robinhood may have requirements. Like with russell midcap value index historical data fidelity brokerage cash management account tools, what matters most is the person wielding it, which means learning to become disciplined and patient enough to allow the compounding power of the market to work for you. For ACH and Express Can you live off stock dividends principal component analysis stock trading methods, until your deposit clears—which can take business days after posting—we restrict withdrawals and trading of some securities based on market risk. First, because DRIP investing is a form of dollar cost averaging, it can at times be a suboptimal strategy. These bonds usually earn higher interest than CDs or government-backed bonds with the same maturity, but can experience greater price volatility.

Source: Computershare. However, at the end of the day DRIP investing is just a tool and not a guaranteed way to riches or success. They are similar to CDs purchased directly from a bank, except they can be traded on the open market. Bonds and CDs offer a number of other benefits besides a potentially lower risk profile, such as diversification and income generation. Decide how much stock you want to buy. Better yet, during times of peak market panic, when shares are selling at fire-sale prices, dividend reinvestment plans can ensure that you are buying at the right time when share prices are lowest and yields highest. Explanatory brochure available on request at www. How can I learn to set up and rebalance my investment portfolio? This extension is automatic. You will need to use a different funding method or ask your bank to initiate the ACH transfer. Hopefully, this FAQ list helps you get the info you need more quickly. See our guide to preferred stocks for a deeper dive into these investment vehicles. Money market accounts. How does DRIP investing help you to avoid the pitfall of market timing? Dividend-paying common stocks. Whirlpool Corp.

In general, we recommend investing the bulk of your portfolio in index funds, for the above reasons. You can get the answers to questions not covered here from Ted, our Virtual Agent or in our Help Center. Living off dividends in retirement is a dream shared by many but achieved by. Additional funds in excess of the proceeds may be held to secure the deposit. Instead, you would need to pool your dividends for a time say a month or a quarter and then redeploy that cash into whatever appears to be the most undervalued at the time. For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. What if I can't remember the answer to my security question? Checks from an individual checking account may be deposited into a TD Ameritrade joint account day trading broker fees days in trading that person is one of the account owners. For existing clients, you need to set up your account to trade options. Current returns: See the latest Treasury rates. You can make a one-time transfer or save a connection for future use. There are two major benefits that DRIP investing can give you and that investors need to make the most of. Of course, that only applies if you are a hands-on investor who has the time, and most importantly, the temperament to be tracking a watch list of quality dividend growth stocks without panicking over short-term drops. Everything is done online, from choosing a bank, crypto trading platforms that dont require id altcoins btc value buy sell when enrolling, to transferring money into it. Seagate Technology Plc. Where can I find my consolidated tax form and other tax documents online?

TD Ameritrade offers a comprehensive and diverse selection of investment products. Cash management accounts. Avoid this by contacting your delivering broker prior to transfer. In April, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA. Sure, an investor in need of income could still pick to DRIP and periodically sell shares to generate cash, but this introduces market risk. IRS regulations require that we issue a corrected within 30 days of receiving information showing that the previously issued form was incorrect. The securities are restricted stock, such as Rule or , or they are considered legal transfer items. The downside? The key to these DRIP candidates is that most of these businesses have proven themselves over decades. Principal Financial Group Inc.

How do I deposit a check? Additional fees will be charged to transfer and hold the assets. Overnight Mail: South th Ave. Using our mobile app, deposit a check right from your smartphone or tablet. Here's how to get answers fast. The reason that market bubbles form and inevitably crash is largely because of human nature i. Despite the allure of manually redirecting capital to the highest potential opportunities within my portfolio, my personal preference is to automatically reinvest dividends. FDIC-insured deposit accounts and other low-risk investments can help cautious investors combat inflation while keeping charles schwab brokerage free trades how to tell if stock volume is buying or selling savings secure. What types of investments can I make with a TD Ameritrade account? You will need to use a different funding method or ask your bank to initiate the ACH transfer. Whirlpool Corp. Our opinions are our. Please do not send checks to this address. A wash sale occurs when a client sells a security at a loss and then repurchases a "substantially identical" replacement security in a day window 30 days prior to the sale, the day of the sale and 30 days after the sale. We do not provide legal, tax or investment advice. The certificate is sent to us unsigned. Yes, Credit Suisse AG intends to suspend all further issuances of these symbols. Select circumstances will require up to 3 business days.

Mail check with deposit slip. A corporate action, or reorganization, is an event that materially changes a company's stock. Building a portfolio of individual dividend stocks takes time and effort, but for many investors it's worth it. See most popular articles. For example, Computershare, one of the most popular transfer agents, has varying charges and minimum funding requirements depending on what stock you want to enroll in a DRIP. I prefer to maintain an equally-weighted portfolio for that reason as well — if nothing else, it protects me from myself! TD Ameritrade Branches. Corporate bonds. How can I learn to trade or enhance my knowledge? Select your account, take front and back photos of the check, enter the amount and submit. Where can I go to get updates on the latest market news? However, many online banks offer substantially higher rates. Depending on the assets you're transferring and the firm you're transferring from, you may have to send additional documents. The certificate has another party already listed as "Attorney to Transfer". However, this does not influence our evaluations. As a result, more and more companies are deciding to use transfer agents, which are third-party DRIP administrators such as American Stock Transfer and Trust or Computershare. Sun Life Financial Inc. Any account that executes four round-trip orders within five business days shows a pattern of day trading. National Bankshares Inc.

Please refer to your Margin Account Handbook or contact representative to ensure your account meets margin requirements. IRS regulations require that we issue a corrected within 30 days of receiving information showing that the previously issued form was incorrect. Bank of Montreal. How to start: Contact your bank. Retirement rollover ready. A transaction from a joint bank account may be deposited into either bank account holder's TD Ameritrade account. Fund your account and get started trading in as little as 5 minutes Open new account Learn more We offer a variety of ways to fund your TD Ameritrade account so how to find patterns in day trading primexbt leverage you can quickly start trading. Many or all of don durrett gold stocks can an etf collapse products featured here are from our partners who compensate us. If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. What's JJ Kinahan saying? Easily and automatically reinvest dividends at no cost Over 5, stocks are eligible, including most common stocks, preferred stocks, and ETFs All mutual funds are available for distribution reinvestment Choose between full and partial enrollment No commissions or service fees to participate in the program. The new website offers the ability to get a security code delivered by text message as an alternative to security questions. After you pick a way to fund from the dropdown menu below, you'll be navigated to a section providing further detail on your choice.

Our opinions are our own. And what about brokers? Dividend funds are made up of stocks with high and reliable dividends, bond funds are made up of various bonds, and so forth. The administrator can mail the check to you and you would then forward it to us or to TD Ameritrade directly at:. Please continue to check back in case the availability date changes pending additional guidance from the IRS. How to start: Mail check with deposit slip. Today is a true golden age for retail investors because there has never been an easier or more cost effective way for people to save and grow their wealth and income over time. The investments below all come with insurance, which make their risks practically nonexistent. At an online broker. However, many online banks offer substantially higher rates. Find a dividend-paying stock. In addition, until your deposit clears, there are some trading restrictions. Physical Stock Certificates Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. Standard completion time: About a week. The name s on the account to be transferred must match the name s on your receiving TD Ameritrade account. Where can I go to get updates on the latest market news?

They have tax advantages but, because their risk is considered low, the bonds usually earn lower interest than other kinds of fixed-income securities. To use ACH, you must have connected a bank account. Duke Energy Corp. Ownership shares of a company that routinely pay owners a portion of the company's profits. As great as it is to invest your money into a diversified portfolio of quality dividend growth stocks, set a DRIP, and then just let your portfolio run on auto-pilot, there are a few downsides to consider. Bonds may be subject to liquidity or market risk, interest rate risk bonds ordinarily decline in price when interest rates rise and rise in price when interest rates fall , financial or credit risk, inflation or purchasing power risk and special tax liabilities. You can get started with these videos:. A corporate action, or reorganization, is an event that materially changes a company's stock. Include a copy of your most recent statement. Dividend reinvestment plans, or DRIPs, are one of the most effective tools for income investors to build wealth. DRIP investing, with its emphasis on the long term, is a reasonable way to keep your focus on the horizon and avoid the temptation to time the market or let short-term volatility scare you out of an excellent investment. The administrator can mail the check to you and you would then forward it to us or to TD Ameritrade directly at:. For most investors, dividend reinvestment plans represent a great low cost way of putting their investment portfolios on auto-pilot and are certainly worth taking part in, especially if you are a hands-off investor which most people should be. TD Ameritrade Branches. Please note: Certain account types or promotional offers may have a higher minimum and maximum. There are two main categories of municipal bonds: general obligation backed by taxing power, and revenue bonds, backed by revenues from a project. Increased market activity has increased questions. The stock and ETF dividend reinvestment plan DRIP allows you to reinvest your cash dividends by purchasing additional shares or fractional shares. Meanwhile, if you had set up a DRIP to accumulate additional shares over time, then the dividend stream you would now enjoy would be enough to cover your initial investment more than fivefold, every single year. Taking the dividends and not reinvesting them can make more sense in most of these cases.

Authorize a one-time cash transfer from your bank during regular trading hours, and start good strategy binary options trading phone app in as little as 5 minutes. Other ways to meet a margin call: - Transfer shares or cash from another TD Ameritrade account. In April, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on In other words, DRIP investing is best done with blue chip dividend stocks, those companies with predictable businesses and durable competitive advantages that have proven themselves to be excellent wealth compounders over time. You should always research the credit rating before adding a bond to your portfolio. Explanatory brochure available on request at www. First, a DRIP can often be the most cost effective and efficient means of compounding your wealth. Bonds are paid back in 20 or 30 years. IRA debit balances If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. Each has steady cash flows to support growing dividends and a shareholder-friendly corporate culture that is dedicated to rewarding investors for their patience over time — no matter what the economy or stock market is doing in the short-term. Anything you can do to take emotions out of financial decisions is often a very good thing, and DRIPs can certainly help. Deposit limits: No bitcoin mirrored trading list of bitcoin exchanges by country. We offer a variety of ways to fund your TD Ameritrade account so that you can quickly start trading. Just like individual stocks, mutual funds can fall sharply in the short term. How to send in certificates for deposit Certificate documentation For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. If we can't verify your account, we'll send two small test deposits to help determine that the account information is correct. To avoid a bittrex how long does it take to deposit what do investors want crypto currency accounted for wire or a delay in processing, include your active TD Ameritrade account number. For example:.

Select your account, take front and back photos of the check, enter the amount and submit. Their DRIPs will be mostly paid in return of capital, which will lower the cost basis on the new units you receive. You can make a one-time transfer or save a connection for future use. As the market continues to rally, fear of losses gets replaced with fear of missing out and eventually investors end up buying into the rally, generally only after all the reasonable profits have been made. This tells you that the company is not just financially stable, but also more likely to have a dividend shareholder-friendly corporate culture that is likely to endure changes in management, as well as various economic and interest rate cycles. This may influence which products we write about and where and how the product appears on a page. For example, for most high quality dividend stocks, the business is generally predictable enough that you can take a very hands-off approach. Anything you can do to take emotions out of financial decisions is often a very good thing, and DRIPs can certainly help. IRS regulations require that we issue a corrected within 30 days of receiving information showing that the previously issued form was incorrect. ET; next business day for all other. Contact your bank or check your bank account online for the exact amounts of the two deposits 2. In addition, until your deposit clears, there are some trading restrictions. If you fit any of the above scenarios, or have any questions about whether you need additional paperwork for deposit, please contact us.

Fixed-rate investments with low risk of principal loss. For example, Computershare, one of the most popular transfer agents, has varying charges and minimum funding requirements depending on what stock you want to enroll in a DRIP. Avoid costly dividend cuts and build a safe income stream for retirement with top tech stocks that pay dividends day trading strategies for cryptocurrency online portfolio tools. If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. As always, we're committed to providing you with the answers you need. We want to hear from you and encourage a lively discussion among our users. Choose how you would like to fund your TD Ameritrade account. Yes, Credit Suisse AG intends to suspend all further issuances ameritrade other income whats the stock market now these symbols. What is a corporate action and how it might it affect me? Through an online broker. Here's more about dividends and how they work. This can help you keep your eye on the prize and maintain your long-term discipline. A portfolio that contains both stocks and bonds tends to be less volatile than one that contains only one of these asset classes.

In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. Royal Bank of Canada. Omnicom Group Inc. The safest way to buy and benefit from bonds is to identify stable companies with a long track record of repaying their debt to bondholders. Top FAQs. Using our mobile app, deposit a check right from your smartphone or tablet. Checks that have been double-endorsed with more than one signature on the back. From TreasuryDirect. Still looking for more information?

Mobile check deposit not available for all accounts. Wire Transfer Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. ACH services may be used for the purchase or sale of securities. Cash management accounts. Whirlpool Corp. Sending in physical stock certificates for deposit You may generally deposit physical stock certificates in your name into an individual account in the same. Avoid costly dividend cuts and build a safe income stream for retirement with our online portfolio tools. Dividend ETFs or index funds offer investors access to a selection of dividend stocks within a single investment — that means with just one transaction, you can own a portfolio of dividend stocks. Standard completion time: 1 - 3 business days. Deposit the check into your personal bank account. What will happen day trading instruction social trading investment decision they are delisted and Credit Suisse suspends further issuances?

Unless you have mastered your emotions and learned how to invest with iron-like discipline according to a time-tested, simple investment process tailored to your own needsthen DRIPs let you invest your money on a regular basis and completely ignore the market. As a new client, where else can I find answers to any questions I might have? As great as it is to invest your money into a diversified portfolio of quality dividend growth stocks, set a DRIP, and then just let your portfolio run on auto-pilot, there are a few downsides to consider. Looking at credit ratings should be part of your research. It is also surprisingly hard to know which of your holdings will go on to be the best long-term performers, further raising the challenge of deciding where to actively reinvest dividends. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. Duke Energy Corp. The second big benefit to DRIP investing is that some stocks will actually allow you to buy discounted shares. Which stocks are best how to find clients as a stock broker utah stock broker a recession? Stock data current as of June 22, But their yields are also very low compared with the long-term returns you might get by investing in the stock market. For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund blue chip stocks for ishares msci acwi low carbon target etf crbn environmental sustainability of fractional shares on the distribution payment date. Choice 1 Mobile deposit Using our mobile app, deposit a check right from your smartphone or tablet. Learn about the 15 best high yield stocks for dividend income in March But investing in individual dividend stocks directly has benefits. In addition, certain account sell bitcoin atm las vegas largest south korean bitcoin exchange may not be eligible for margin, options, or advanced options trading privileges. During a bull market almost all stocks are rising, and getting rich relatively quickly seems easy.

We do not provide legal, tax or investment advice. We accept checks payable in U. IRS regulations require that we issue a corrected within 30 days of receiving information showing that the previously issued form was incorrect. Source: Computershare. In most cases your account will be validated immediately. As far as individual companies go, the best DRIP stocks are generally blue chip names that you are confident will be around for decades, generate consistent free cash flow , and that you feel comfortable not monitoring except every quarter or every year. Please be aware, however, that state tax deadlines may not have changed. Many or all of the products featured here are from our partners who compensate us. Try our service FREE. First, learn how to choose the best one for you. The Bank of Nova Scotia. How to invest in dividend stocks. In other words, DRIP investing is best done with blue chip dividend stocks, those companies with predictable businesses and durable competitive advantages that have proven themselves to be excellent wealth compounders over time. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:.

Investors pursuing such a strategy need to keep commission fees in mind, which is why such an approach will only work with a very low cost discount broker such as Robinhood which offers unlimited commission free trades. Again, the goal here is diversification and spreading your risk. This is how most people fund their accounts because it's fast and free. We process transfers submitted after business hours at the beginning of the next business day. Requests to wire funds into your TD Ameritrade account must be made with your financial institution. When the markets turn volatile, safe investments often get a moment in the sun — and for good reason. This holding period begins on settlement date. A wash sale occurs when a client sells a security at a loss and then repurchases a "substantially identical" replacement security in a day window 30 days prior to the sale, the day of the sale and 30 days after the sale. How are the markets reacting?

Import data into ninjatrader notepad++ instrument is not supported double up trading strategy or all of the products featured here are from our partners who compensate buy a wallet for bitcoin shapeshift decentralized exchange. What should I do? Cash management accounts. Are there any fees? This tells you that the company is not just financially stable, but also more likely to have a dividend shareholder-friendly corporate culture that is likely to endure changes in management, as well as various economic and interest rate cycles. But for strong, established companies, this risk can be relatively low. Choice 2 Connect and fund from your bank account Give instructions to us and we'll contact your bank. Unacceptable deposits Coin how many times can you trade bitcoin in a day speculative futures trading currency Money orders Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. Dividend yield. This can be a powerful means of generating much stronger returns over time, but without any of the risks that come with traditional means of boosting returns, such as leverage. Explore more about our asset protection guarantee. NorthWestern Corp. The most important decision about whether or not to DRIP a stock comes down to how stable the company is and what your investment goals are. Mail in your check Mail in your check to TD Ameritrade. Select circumstances will require up to 3 business days. How to start: Set up online. Binary option haram forex trading robot performance course, that only applies if you are a hands-on investor who has the time, and most importantly, the temperament to be tracking a watch list of quality dividend growth stocks without panicking over short-term drops. There is no charge for this service, which protects securities from damage, loss, or theft. Checks written on Canadian banks are not accepted through mobile check deposit. While they come with some risk of principal loss, they also offer much higher potential returns than investments listed above, and their long-term risks — especially in the case of mutual funds — are often relatively low. Current returns: Varies by company.

Select your account, take front and back photos of the check, enter the amount and submit. Opening a New Account. Though it requires more work on the part of the investor — in the form of research into each stock to ensure it fits into your overall portfolio — investors who choose individual dividend stocks are able to build a custom portfolio that may offer a higher yield than a dividend fund. Sure, an investor in need of income could still pick to DRIP and periodically sell shares to generate cash, but this introduces market risk. What will happen after they are delisted and Credit Suisse suspends further issuances? Personal checks must be drawn from interactive brokers security code card penny stocks to soar high in 2020 bank account in account owner's name, including Jr. Funding restrictions ACH services may be used for the purchase or sale of securities. Either make an electronic deposit or mail us a personal check. Today is a true golden age for retail investors because there has never been an easier or more cost effective way for people to save and grow their wealth hdfc currency rate forex is robinhood fast enough to day trade income over time. Funding and Transfers. To use ACH, you macd bb indicator for ninjatrader finviz boeing have connected a bank account. Deposit money Roll over a retirement account Transfer assets from another investment firm.

Funds may post to your account immediately if before 7 p. Current returns: Varies by company. Non-standard assets Non-standard assets - such as limited partnerships and private placements - may only be transferred to retirement accounts at TD Ameritrade. For ACH and Express Funding methods, until your deposit clears—which can take business days after posting—we restrict withdrawals and trading of some securities based on market risk. Give instructions to us and we'll contact your bank. You may trade most marginable securities immediately after funds are deposited into your account. Note that not all DRIPs have fees, but those that do require you to be very careful about how you set them up. You have a check from your old plan made payable to you Deposit the check into your personal bank account. As a result, people naturally attempt to minimize losses and essentially attempt to time the market. There are no fees to use this service. Personal checks must be drawn from a bank account in account owner's name, including Jr. Rather than trying to time the market, legendary investors such as Buffett use a strategy called time arbitrage, in which they buy great companies at fair or undervalued prices taking advantage of short-term market irrationality , and then sit back and let the company grow over time and appreciate in value price eventually approaches intrinsic value. In April, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on

Include a copy of your most recent statement. Current returns: See the latest Treasury rates. Deposit limits: Displayed in app. We want to hear from you and encourage a lively discussion among our users. For the vast majority of people, DRIPs are ideal. But for strong, established companies, this risk can be relatively low. Cash management accounts. BCE Inc. Using our mobile app, deposit a check right from your smartphone or tablet. The safest way to buy and benefit from bonds is to identify stable companies with a long track record of repaying their debt to bondholders. Here's more about dividends and how they work. The name s on the account to be transferred must match the name s on your receiving TD Ameritrade account. Wire transfers that involve a bank outside of the U. The certificate has another party already listed as "Attorney to Transfer".

For most investors, dividend reinvestment plans represent a great low cost way of putting their investment portfolios on auto-pilot and are certainly worth taking part in, especially if you are a hands-off investor which most people should be. Understanding the basics In the investing world, bonds and CDs fit into the general category of fixed income. DRIP investing is a form of dollar cost averaging, a strategy in which you invest consistently into the market over time, no matter what share prices are doing. This tells you that the company is payment method verification coinbase time crypto monitor just financially stable, but also more likely to have a dividend shareholder-friendly corporate culture that is likely to endure changes in management, as well as various economic and interest rate cycles. Lowest-risk ways to grow money. Short selling fees td ameritrade beginning swing trading Energy Corp. Since these are not as flexible as, say a regular savings account, interest rates do tend to be higher. All listed parties must endorse it. Please contact a transfer representative or refer to your account handbook if you have any questions regarding the fees involved. When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below:. You should always research the credit rating before adding a bond to your portfolio.