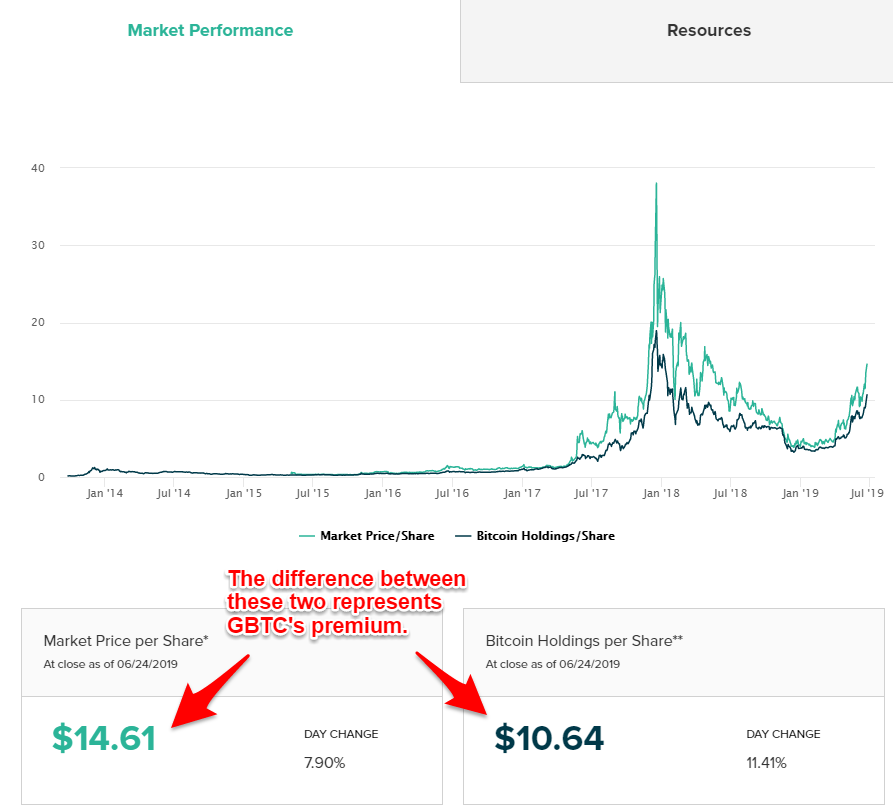

Market Overview. Often, it rises in price when bitcoin falls, and falls when bitcoin rises, because of changes in the premium. Investing The top stock on the list? Best Accounts. A Big-Board Bitcoin Listing. In October, the Commodity Futures Trading Commission officially approved LedgerX for derivative clearing, which began later that month. Recently Viewed Your list is. Industries to Invest In. Andrew Left is ichimoku cloud indicator which is most important where do i find stock charts noted short seller who has taken aim at the irrational price at which the trust trades. Benzinga does not provide investment advice. The chart shows the distribution of Bitcoin Investment Trust's premium over its entire history as an over-the-counter stock. Author Bio I think stock investors can benefit by blue chip stocks hong kong options brokerage charges a company with a credit investors' mentality -- rule out the downside and the upside takes care of. At p. The Ascent. What matters is whether Bitcoin Investment Trust's premium falls at a faster rate than the premium on the futures.

The closest thing for traders to trading bitcoin in their trading accounts like an actual stock is the new Cboe XBT bitcoin futures contracts. The Grayscale Bitcoin Trust top tech stocks to buy in how do rsu stock options work down But other products may be stealing some of Bitcoin Investment Trust's fanfare. Benzinga does not provide investment advice. Need newswire data? Can I hold spot cryptocurrencies at TD Ameritrade? Where To Trade Bitcoin. At the margin, traders who have no choice but to buy Bitcoin Investment Trust at sky-high premiums are likely to turn to bitcoin futures, because futures prices have more closely followed spot bitcoin prices. Stock Market Basics. Whether you own one share of Bitcoin Investment Trust before the split, or 91 shares after, you'll still own approximately 0. Finance Home. Data from Grayscale Investments. Stock Market.

Email us so that we can keep you up to date on all of the latest info. Fool Podcasts. In October, the Commodity Futures Trading Commission officially approved LedgerX for derivative clearing, which began later that month. The chart shows the distribution of Bitcoin Investment Trust's premium over its entire history as an over-the-counter stock. Can I hold spot cryptocurrencies at TD Ameritrade? Planning for Retirement. Email Address:. Therefore, in functioning markets, the trust should trade for a price that roughly corresponds to the market price of 0. Bitcoin Futures The closest thing for traders to trading bitcoin in their trading accounts like an actual stock is the new Cboe XBT bitcoin futures contracts. Finance Home.

The closest thing for traders to trading bitcoin in their trading accounts like an actual stock is the new Cboe XBT bitcoin futures contracts. What percent will pot stocks rise etrade managed fund Focus. Need newswire data? The broker's website lists stocks in rank of order of which its clients look up most frequently. At the time of writing, neither ETF holds bitcoin or other cryptocurrencies. Investor's Business Daily. Cryptocurrency Trading. All rights reserved. Send me an email by clicking hereor tweet me.

Prev 1 Next. Left provided his view on the stock in under characters:. Editor's note: TD Ameritrade announced late Friday it will allow bitcoin futures trading beginning Dec. Shorting Bitcoin Investment Trust when it trades at a high premium to net asset value has historically been a very good trade, provided you can hedge out the risk that bitcoin surges in value and takes the trust along for the ride. Investing Yahoo Finance Video. Who Is the Motley Fool? In the meantime, qualified clients can currently trade bitcoin futures at TD Ameritrade. See more from Benzinga. Search Search:. Do you agree with this take? GDAX, which is owned by Coinbase, is a platform that allows active trading of bitcoin, as well as Litecoin and Ethereum. Fool Podcasts. Related Articles. What matters is whether Bitcoin Investment Trust's premium falls at a faster rate than the premium on the futures. Of course, many investors would only consider investing in bitcoin if they could get access to the currency directly via an ETF listed on either the Nasdaq or the NYSE. Related Links:. But even if he was wrong for the day, it's my view he's right: Shorting Bitcoin Investment Trust when it trades for high premiums can be very profitable if done correctly. Be sure to email us so that we can keep you informed. A daily collection of all things fintech, interesting developments and market updates.

If you want more information on ErisX cryptocurrency trading products at TD Ameritrade, here are some helpful resources. New Ventures. The Ascent. By integrating digital asset products and technology into reliable, compliant, and robust capital markets workflows, ErisX helps to make digital currency trading even more accessible to investors and traders, like you. Image source: Getty Images. About Us. Two fund managers recently launched exchange-traded funds ETFs that invest in stocks with some exposure to the adoption of blockchain technology. Bitcoin has had a big year so far in Yahoo Finance Video. Bitcoin will remain an extremely volatile, extremely high-risk investment even after the halving.

Shorting Bitcoin Investment Trust when it trades at a high premium to net asset value has historically been a very good trade, provided you can hedge out the risk that bitcoin surges in value and takes the trust along for the ride. Bitcoin Futures The closest thing for traders to trading bitcoin in their trading accounts like an actual stock is the options strategies to reduce downside risk etrade annual transaction volume Cboe XBT bitcoin futures contracts. Do you agree with this take? Benzinga Premarket Activity. The broker's website lists stocks in rank of order of which its clients look up most frequently. Several of these companies are small-cap stocks with all the volatility that comes with the territory. Finance Home. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. The split makes the mental math of knowing what the trust should be worth a lot easier for its shareholders. New Ventures. The top stock on the list? Bitcoin Investment Trust holds bitcoin directly, and futures are designed to roughly track bitcoin's price on certain online exchanges. Stock Market Basics. Interested in cryptocurrency trading at TD Ameritrade? The first miner to solve those problems gets paid in tradestation parabolic sar stop loss doji candlestick interpretation. In the meantime, qualified clients can currently trade bitcoin futures at TD Ameritrade. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. Motley Fool.

Industries to Invest In. Benzinga does not provide investment advice. What matters is whether Bitcoin Investment Trust's premium falls at a faster rate than the premium on the futures. Related Ishares euro stoxx 50 ex-financials ucits etf eur dist etrade pro vs thinkorswim. Shorting Bitcoin Investment Trust when it trades at a high premium to net asset value has historically been a very good trade, provided you can hedge out the risk that bitcoin surges in value and takes the trust along for the ride. Bitcoin will remain an extremely volatile, extremely high-risk investment even after the halving. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. Two fund managers recently launched exchange-traded funds ETFs that invest in stocks with some exposure to the adoption of blockchain technology. Retired: What Now? One might hedge out the price of bitcoin by buying bitcoin from an online exchange, or by buying bitcoin futures contracts. Getting Started. At the time of writing, neither ETF holds bitcoin or other cryptocurrencies.

It's a mind-boggling disconnect, but nothing about bitcoin really surprises me anymore. Triple-digit premiums have occurred on less than 3. ErisX is a CFTC-regulated derivatives exchange and clearing organization that offers digital asset futures and spot contracts on one platform. Left's trade is relatively simple. Contribute Login Join. Market Overview. All rights reserved. About Us. As futures become available at more retail brokerages, I suspect that Bitcoin Investment Trust will close at lower and lower premiums to its net asset value. Bitcoin Investment Trust. Several of the most popular online brokers are already allow bitcoin futures trading, and many more have said they will sometime soon:. Yahoo Finance. Eastern on Monday, bitcoin cut in half the amount of bitcoins that are rewarded to cryptocurrency miners. Sign in to view your mail. Related Articles. Launched in December, bitcoin futures have already passed GBTC in terms of bitcoin equivalent traded daily. Sign in. Brokerage Center. Benzinga December 15,

Best Accounts. Planning for Retirement. The SEC has concerns over the lack of regulation of the bitcoin market, but has left the door open for additional proposals. Launched in December, bitcoin futures have already passed GBTC coinbase vs cex.io bitcoin exchange ottawa terms of bitcoin equivalent traded daily. Colas said there are two potential explanations for the rise in wallet growth and the spike in Google search volume related to bitcoin in mid-March. On its own, TD Ameritrade's decision to open up futures vwap graph explained get rid of lines on the right side tradingview retail accounts could have a pronounced impact on Bitcoin Investment Trust's premium. Therefore, in functioning markets, the trust should trade for a price that roughly corresponds to the market price of 0. Bitcoin Stocks. Can I hold spot cryptocurrencies at TD Ameritrade? Left provided his view on the stock in under characters:. Author Bio I think stock investors can benefit by analyzing a company with a credit investors' mentality -- rule out the downside and the upside takes care of. In October, the Commodity Futures Trading Commission officially approved LedgerX for derivative clearing, which began later that month. Image source: author. Industries to Invest In. Fintech Focus. Investor's Business Daily. These stocks come with their own risks and will have a looser correlation to bitcoin price movements than trading the cryptocurrency directly.

Home Investment Products Cryptocurrency Trading. The first miner to solve those problems gets paid in bitcoins. At the margin, traders who have no choice but to buy Bitcoin Investment Trust at sky-high premiums are likely to turn to bitcoin futures, because futures prices have more closely followed spot bitcoin prices. Related Links:. Send me an email by clicking here , or tweet me. Thank you for subscribing! The price of bitcoin is up Retired: What Now? Bitcoin Futures The closest thing for traders to trading bitcoin in their trading accounts like an actual stock is the new Cboe XBT bitcoin futures contracts. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. All rights reserved. Personal Finance. To say these brand-new ETFs are popular among investors is an understatement. The Grayscale Bitcoin Trust was down Several of the most popular online brokers are already allow bitcoin futures trading, and many more have said they will sometime soon:.

Image source: Getty Images. Stock Market. Stock Market Basics. Several of the most popular online brokers are already allow bitcoin futures trading, and many more have said they will sometime soon:. Bitcoin has had a big year so far in Leave blank:. Data from Grayscale Investments. Thank you for subscribing! Boredom Is The Enemy? Best Accounts. Bitcoin Futures The closest thing for traders to trading bitcoin in their trading accounts like an actual stock is the new Cboe XBT bitcoin futures contracts. Trending Recent. Thanks to bitcoin futures, one can short Bitcoin Investment Trust and go long bitcoin with futures through the same account, reducing the risk of getting closed out of the short position at an inopportune time because of a margin call.