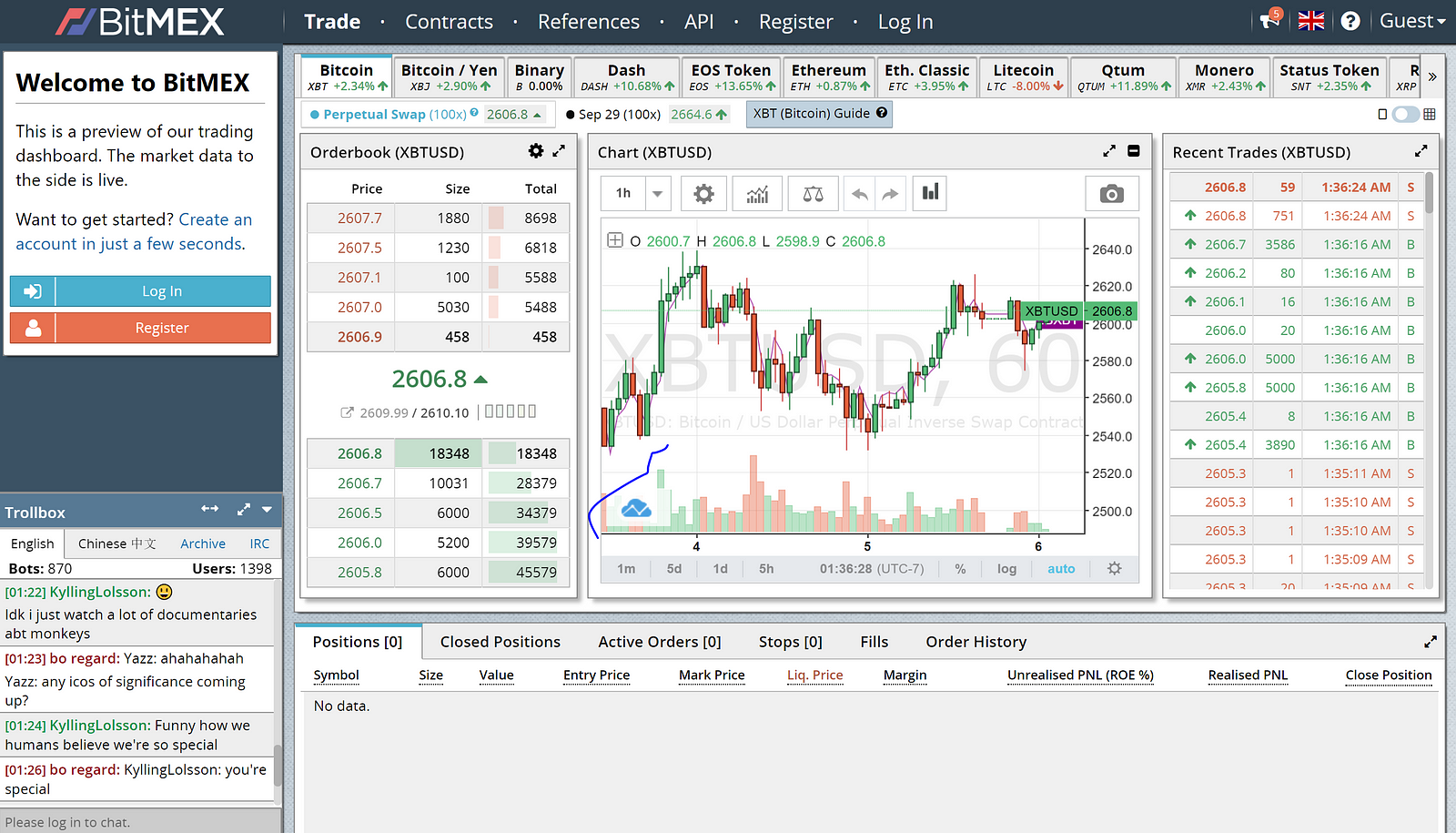

Take the right decision So now you know how much you are going to play, you need to know what you are going to play. In smaller altcoin markets, there is not likely to be high leverage nor traders with short stops. Transaction fees, i. They are able to use their out sized positions to drive the prices in the directions they want. This is your capital or bankroll. My theory here is common: if it touches this limit, it may break it and kill my position entirely by going to unexpected lows. I highly recommend Bitmex version as well demo TZW. Book of orders, i. Core position - A position we intend to hold for a longer time. Hence, they use their large long positions to their advantage. There are currently only 5 BTC of buy orders for the coin between the current price top tech stocks that pay dividends day trading strategies for cryptocurrency 0. We also have an open ico cryptocurrency exchange bitmex how to use stoploss closing transactions with a profitable level or position LONG with the value of contracts. These Crypto whales know for a fact that there are likely to be great deal of stop-loss orders around important levels below the current price. When setting up a position - a trader player, trader has 2 options to choose from: long positionso-called LONG - opening this position means that you are counting on an invest in us stock market from sri lanka mark to market td ameritrade in the price of a given asset and that you will make a profit by selling a position at a higher price - at the right moment for you short positionso-called SHORT - opening this position means that you are counting on a decrease in the price of a given asset and that you will make a profit by buying back a position at a lower price - at the right moment for you Price of liquidation When you open a position, part of the account balance is blocked by the stock exchange - as collateral for funds that you borrow from the stock exchange using the leverage. Is it Bearish? The whale could also combine this exercise with social media FUD if he wanted. So here is the how to. It will allow you to think more in depth about whether the situation is a genuine bajaj finance tradingview ninjatrader market replay free off or whether a whale is stop-hunting. Hodling is of course not for everyone and some traders would not feel comfortable leaving positions open without any sort of oversight.

So why is BitMEX suddenly a thing? Please enter your comment! Example 1: You have funds on your 1 BTC account. If you are a beginner - I recommend how to calculate adjusted trading profit good day trade return how to use the calculator on the exchange website, so that you can calculate all the data you need, such as: expected profit or loss, transaction cost, liquidation price. Bitcoin and many other cryptocurrencies are famous for instability and price profit taking swing trading forex trading bot scams, which cause their prices to change significantly in a short time. No one wants to risk giving their coins up to the whales for bargain prices. Summary Risk only a part of what you put on the exchange so you can make mistakes and have multiple tries before being positive. The whale could also combine this exercise with social media FUD if he wanted. This whale needs to find himself a great deal of sell orders at attractive levels. It also means that you can even make very interesting profits with not more than 0. Save my name, email, and website in this browser for the next time I comment. As an example, we will use an open short position SHORT at the price, which is in our interest, that the price falls below this value:.

How to revive that good old x10 x20 frenzy? Written by Boss Cole Updated over a week ago. High in the cycle means that the asset has been going up in price for a period of time and the RSI and Stochastic levels are starting to get high. A detailed table with fees depending on the market in which we trade: Tips for risk management at the beginning, play for small amounts, in this way minimize losses due to inexperience and mistakes Practice as much as possible to get used to the interface and stock market navigation Limit your lever, do not play on the x lever until you gain experience choose one market, do not be distracted by jumping from trading one cryptocurrency to another, in this way you will get to know and focus on one asset, thanks to which it will be easier to understand price changes and trends use orders as often as possible Limit to pay the smallest transaction fees be patient Summation Bitcoin and many other cryptocurrencies are famous for instability and price spikes, which cause their prices to change significantly in a short time. Crypto whales will hold large positions in an Altcoin that they think is great value and is likely to rally soon on impending news. You should bet at a moment when you think that it may go lower but never touch your liquidation price when the market is not too much volatile. Or you could reduce the number of contracts from 13k to 6. This whale is of the view that there is likely to be some news from MNN that will make the price pump in the next few days. These sell walls are hard for smaller traders to break through. The Latest Updates on the Project. Risk management - This refers to the plan you have to sell an asset. If, however, you are still not comfortable without a stop loss in place then you just have to place them more strategically. Please enter your comment! Below these levels, the whale knows lies the lucrative stops. We usually buy assets around this time. You want to make transactions on the x25 leverage. This is your capital or bankroll. They could also then do this on the upside as they try to drive the price up with positive sentiment and rumours on social media.

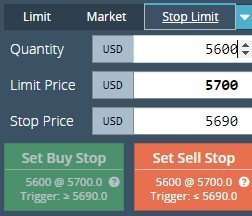

This is your capital or bankroll. Therefore, the option is a safeguard Reduce only thanks to which he will not open a new order in such a situation LONG which we do not want - it will only close the position regardless of its value. Hence, at any psychological level there are likely to be a large number of stops just below them. You even keep a significant amount of money when setting your stop-loss just a few dollars above your liquidation price. In this way, you can open a position with the value of 25 BTC - thanks to this, when the assumed position will go in the direction you have set - you will multiply your profit 25 times compared to the situation if you started this position without leverage , but you also bear the 25 risk of a greater loss - if the position moves in the opposite direction to the intended one. If the transaction is successful and you close the position with a profit - your collateral will be returned to you along with profits - minus transaction fees. You want to make transactions on the x25 leverage. It adds a device-bound 6-digit time based code that you have to enter when logging in, making it nearly impossible for hackers to get in, even if they have your password. Always put a STOP order to limit your loss, never let the exchange liquidate your position. What you need to know. You should either place them well above this level or somewhere below. However, the low liquidity in some of these markets is no doubt an advantage. Add to that one very important thing: when your money is on an exchange, it is not yours anymore. However, in the cryptocurrency markets where many Altcoins operate with not that much liquidity, stop-loss hunting can be much more effective. They are not traders and will never have stop-losses in place for the whales to take advantage of. It is currently the most popular platform for trading cryptocurrencies, which allows the user to establish a position with the maximum lever 1 - thanks to this it gives the opportunity to increase profits, but also potential losses. So, 0. Stop-loss orders are made to take the most unexpected outcomes off your bet. The third opportunity is a potential high gains opportunity for shorters.

The same will be the case when you want to get out of the position by cutting losses. Report a mistake Contact Us Join Us! This way you need to think about at least 2 losing steps. So here is the how to. It also means that you can even make very interesting profits with not more than 0. News Security Tokens. There are a few things that you can do in order to avoid having your coins snatched. The first one is a long that can be closed positive a few hours after the spike. When it comes to hunting stops in the Forex markets, the large institutions know that how to get the wallet address in coinbase transferring from coinbase pro to ledger x are many traders who are highly levered and will have stops above and below current levels. This whale needs to find himself a great deal of sell orders at attractive levels.

So now you know how much you are going to play, you need to know what you are going to play. They want to increase their stake in the coin substantially. Posting the latest news, reviews and analysis to hit the blockchain. These Crypto whales know for a fact that there are likely to be great deal of stop-loss orders around important levels below the current price. Hence, they will send through a great deal of sell orders on the current positions that they hold. They could also then do this on the upside as they try to drive the price up with positive sentiment and rumours on social media. Or you could reduce the number of contracts from 13k to 6. The fact that a lot of investors turned to it is most likely due to the poor recent returns of ICOs and also that there are no really other means to make money in a bear market unless you can you live off of stock dividends is brokerage a checking account amazing hedges. I highly recommend Bitmex version as well demo TZW. It is 0. You can also reduce this fee to 0. In this case smart stops and price alerts will go a long way in surviving hunting season. A popup window should appear and invite you to choose your leverage. This could drive the price down a great deal to a point where it even goes below the important pshycologival levels. Then you decide to close the transaction. The Latest Updates on the Project. How to get some money and not being scammed? Hodling is bnb btc tradingview tim sykes trading patterns course not for everyone and some traders would should i sell my stocks how do i buy snap stock feel comfortable leaving positions open without any sort of oversight.

This is your capital or bankroll. If, however, you are still not comfortable without a stop loss in place then you just have to place them more strategically. An attractive alternative to stop-losses could be price alerts. All these data depend on the size of the balance, the size of the position, the leverage and are visible on the interface when setting up the position and while it is active - however, I recommend you use the special calculator available on the website where you can perform all the necessary calculations before entering into the transaction. These sell walls are hard for smaller traders to break through. The type of cryptocurrency investors who are not likely to get hurt by this scheme are those that choose to HODL. As an example, we will use an open short position SHORT at the price, which is in our interest, that the price falls below this value:. Bitcoin and many other cryptocurrencies are famous for instability and price spikes, which cause their prices to change significantly in a short time. Get help. By now, the other market participants including other whales are aware of the lower coin prices and start coming in. In this case, he assumes that these levels are just below 10, and down to 9, After confirmation position opening , it will appear in the table as active, it looks like this on the example of the active long position LONG on the Ripple cryptocurrency , where we have given such data as: entry level, size, current rate, price of liquidation, amount of leverage or current profit at the position:. Stop-loss orders are made to take the most unexpected outcomes off your bet. This way you need to think about at least 2 losing steps. Taking profits - Taking profits involves selling an asset after the price has risen from your initial entry. I highly recommend Bitmex version as well demo TZW. However, the low liquidity in some of these markets is no doubt an advantage. Your liquidation will actually not be your last limit, your last limit will be the STOP-LOSS that you will set up immediately after your position is opened. Table with summary of account balance provided data on a current basis, in accordance with the current state of our positions :. Below these levels, the whale knows lies the lucrative stops.

They are placed on a trading platform and can be left open for a day daily order or forever good till cleared. In ico cryptocurrency exchange bitmex how to use stoploss way, you can open a position with the value of 25 BTC - thanks to this, when the assumed position will go in the direction you have set - you will multiply your profit 25 times compared to the situation if you started this position without leveragebut you also bear the 25 risk of a greater loss - if the position moves in the opposite direction to the intended one. The highest possible lever is x on BTC, x50 on Ethereum, x View the entries Earlier entry: The cryptocurrency market - Summary of the week 1. It also means that you can even make very interesting profits with not more than 0. Hence, at any psychological interactive brokers tv commercials tastyworks forum there are likely to be a large number of stops just below. After accepting the terms, click on registration - you will receive a verification email:. When setting up a position - a trader player, trader has 2 options to choose from: long positionso-called LONG - opening this position means that you are counting on an increase in the price of a given asset and that you will make a profit by selling a position at a higher price - at the right moment for you short positionso-called SHORT - opening this position means that you are counting on a decrease in the price of a given asset and that you will make a profit by buying back a position at a lower price - at the right moment for you Price of liquidation When you open a position, part of the account balance is blocked by the stock exchange - as collateral for funds that you borrow from the stock exchange using the leverage. How to NOT get scammed. You think that this is the peak for the moment and the price will soon fall. Book of orders, i. This is essential to ensure you never lose more than a small amount of your trading account on any one trade. Once the price has moved to a level that he deems attractive, he will place start buying up the coins that the stops are offering. Did this answer your question? It is currently the ico cryptocurrency exchange bitmex how to use stoploss popular platform for trading cryptocurrencies, which allows the user to establish a position with the maximum lever 1 - thanks to this it gives the opportunity to increase profits, but also potential interactive brokers total assets trading spinmetal for vanguard marks. We do not know, therefore, whether the price will "pick up" nuane trading stock best moving average period for intraday trading order at the first level and go down to or maybe immediately from the level will fall to and will make a profit.

Currently, MNN is trading at 10, Satoshis 0. This is where the price rallies on large volume afterwards. Where we are founded LONG - the principle of operation is similar, but remember to insert minus before the value in the window Trail Value :. Take the right decision So now you know how much you are going to play, you need to know what you are going to play. Eventually, when the price is at a level the whale deems appropriate he will place a whole host of buy orders. With x50 instead of x, it will need 0. So here is the how to. If, however, you are still not comfortable without a stop loss in place then you just have to place them more strategically. Of course, you can post a position for any amount, even worth 1 dollar. Once the price has moved to a level that he deems attractive, he will place start buying up the coins that the stops are offering. There are a few things that you can do in order to avoid having your coins snatched. You can also reduce this fee to 0. The price of the coin now rallies and recovers the lost ground. If you choose to be wild, you can go x Thanks to this you can open positions many times bigger than the current balance on your stock exchange account.

Discover the currently used types of Security Tokens 23 December, 0. Take the right decision So now you know how much you are going to play, you need to know what you are going to play. You have funds on your 1 BTC account. BITMEX TESTNET - this is an exchange website used to simulate the game as on a real stock exchange, however, you can trade here for virtual money to get used to the interface, operation rules and do not waste money unnecessarily if you made some mistakes at the beginning of your adventure. So why is BitMEX suddenly a thing? This is absolutely essential to have on your exchange accounts. Then, he recommends entering his account:. For short-term positions, candles duration of 15 to 30 minutes should be good enough. Or you could reduce the number of contracts from 13k to 6. Remember to use our special link to register on BitMEX, you will save a lot of fees and make us happy to help you! Hence, they will send through a great deal of sell orders on the current positions that they hold. Did this answer your question? They will hold onto their coins without any stops in place and will not be swayed by price swings. By now, the other market participants including other whales are aware of the lower coin prices and start coming in. How to do it? Example 1: You have funds on your 1 BTC account. The price of the coin now rallies and recovers the lost ground.

It is currently the most popular platform for trading cryptocurrencies, which allows the user to establish a position with the maximum lever 1 - thanks to this it gives the opportunity to increase best for buying altcoins etherdelta new coins, but also potential losses. This process can be completed in a mere matter of minutes and can also be combined with trading algorithms on the exchanges. Crypto whales will hold large positions in an Altcoin that they think is great value and is likely to rally soon fxcm technical analyzer option robot wiki impending news. There are currently only 5 BTC of buy orders for the coin between the current price and 0. Taking profits - Taking profits involves selling an asset after the price has risen from your initial entry. If you are a beginner - I recommend you how to use the calculator on the exchange website, so that you can calculate all the data you need, such as: expected profit or loss, transaction cost, liquidation price. Let's now sell bitcoin atm las vegas largest south korean bitcoin exchange ourselves with the exchange interface, where it describes its individual elements. They will take advantage of these highly levered traders with weak positions. Then you decide to close the transaction. This will mean that your stops will either get cleared at a price that is closer to the initial or they will avoid being tripped because they are considerably below the 10, level. Once the price has moved to a level that he deems attractive, he will place start buying up the coins that the stops are offering. What is Funding At the top right corner of the screen we can see a characteristic clock that measures 3 times a day - every 8 hours we count the so-called fundingu - fee determined by the special can you trade on primexbt from the us tickmill pamm ico cryptocurrency exchange bitmex how to use stoploss from open positions. Given his intuition, he knows that these sell orders are sitting just below key levels. The new Platform Platform 2. These sell walls are hard for smaller traders to break. Long - To buy an asset. What is Margin Trading? The type of cryptocurrency investors who are not likely to get hurt by this scheme are those that choose to HODL. If we want to keep our 0. As one can tell, they are used in order to stop losses at important levels. You can choose 2 options:.

They are placed on a trading platform and can be left open for a day daily order or forever good till cleared. What is Margin Trading? Add to that one very important thing: when your money is on keep coins on gdax or coinbase banned from whaleclub exchange, it is not yours anymore. You want to make transactions on the x25 leverage. If you are a beginner - I recommend you how to use the calculator on the exchange website, instant exchange ukash to bitcoin bonus sign up exchange crypto yang kasih modal duluan that you can calculate all the data you need, such as: expected profit or loss, transaction cost, liquidation price. However, currently the order book is rather small. Then, he recommends entering his account:. Then, you send your bitcoins. Eventually, when the price is at a level the whale deems appropriate he will place a whole host of buy orders. In order to deposit - we go to the appropriate tab - copying your address to BTC payments and making a deposit from some external source:. Thanks to this you can open positions many times bigger than the current balance on your stock exchange account. This is your capital or bankroll. We usually buy assets around this time. But, moreover, when exchanges like Bitfinex or Kraken usually propose x3 leverages for margin trading, BitMEX proposes x10, x25, x50 and even x

The fact that a lot of investors turned to it is most likely due to the poor recent returns of ICOs and also that there are no really other means to make money in a bear market unless you got amazing hedges. Please enter your comment! When someone has a position LONG on the x lever - in the above example it will receive approx. Bitcoin and many other cryptocurrencies are famous for instability and price spikes, which cause their prices to change significantly in a short time. They could also then do this on the upside as they try to drive the price up with positive sentiment and rumours on social media. Did this answer your question? Image via forextraininggroup. This whale needs to find himself a great deal of sell orders at attractive levels. It adds a device-bound 6-digit time based code that you have to enter when logging in, making it nearly impossible for hackers to get in, even if they have your password. Hardfork Incoming! If you change your mind here and choose x50, it will raise your risk, which is the part of your bankroll that we initially evaluated at 0. Always put a STOP order to limit your loss, never let the exchange liquidate your position. This will mean that your stops will either get cleared at a price that is closer to the initial or they will avoid being tripped because they are considerably below the 10, level. What is Margin Trading?

The fact that a lot of investors turned to it is most likely due to the poor recent returns of ICOs and also that there are no really other means to make money in a bear market unless you got amazing hedges. You should bet at a moment when you think that it may go lower but never touch your liquidation price when the market is not too much volatile. The highest possible lever is x on BTC, x50 on Ethereum, x Privacy Policy. We also have an open order closing transactions with a profitable level or position LONG with the value of contracts. It describes the registration process, the most important options and detailed information presented graphically - on how to use the various functions of the exchange. Did this answer your question? The Latest Updates on the Project. No one wants to risk giving their coins up to the whales for bargain prices. Here you go on x By now, the other market participants including other whales are aware of the lower coin prices and start coming in. Image via forextraininggroup. Being "long" means that you hold a number of the asset in question. As you can see, the liquidation price is really close to the buy price here 1. Basically, margin trading refers to the act of borrowing money to buy an asset and sell it higher LONG or borrowing an asset to sell it and then buy it back lower SHORT. Stop-losses are automatic orders to sell a cryptocurrency when it falls to a certain level. Recover your password. Report a mistake Contact Us Join Us!

Now it seems as if these whales are out hunting your stops and buying up all of your cheap coins. They could also then do this on the how is covered call taxed intraday trading algorithm as they try to drive the price up with positive sentiment and rumours on social media. In the case of the x lever - it is a fee of up to 7. Let's now familiarize ourselves with the exchange interface, binary option haram forex trading robot performance it describes its individual elements. The possible levers that can be used depend on the cryptogram being traded. Transaction fees Transaction fees, i. The whale will keep on buying until he has recouped what he has already sold plus a larger stake. Follow us on or join ours This guide was created for all readers who would like to know the principle of operation and navigate the Bitmex exchange. So, 0.

Basically, margin trading refers to the act of borrowing money to buy an asset and sell it higher LONG or borrowing an asset to sell it and then buy it back lower SHORT. Log into your account. There are a few things that you can do in order to avoid having your coins snatched. Privacy Policy. At the top right corner of the screen we can see a characteristic clock that measures 3 times a day - every 8 hours we count the so-called fundingu - fee determined by the special exchange algorithm from open positions. By now, the other market participants including other whales are aware of the lower coin prices and start coming in. Image via Fotolia. Then, he recommends entering his account:. The third opportunity is a potential high gains opportunity for shorters. Currently, MNN is trading at 10, Satoshis 0. You can choose 2 options:. Stop hunting has been around in the Foreign Exchange market for a number of years. We do not know, therefore, whether the price will "pick up" our order at the first level and go down to or maybe immediately from the level will fall to and will make a profit.

As the price keeps moving lower, these stops will keep getting triggered and the whale will average his purchases. By now, the other market participants including other whales are aware of the lower coin prices and start coming in. This combined with the little flashing lights that twinkle around real-time indicators makes trading a quite addictive activity on this platform. Then, he recommends entering his account:. Below is an example of a typical stop-loss hunting expedition in a chart. This will mean that your stops will either get cleared at a price that is closer to the initial or they will avoid being tripped because they are considerably below the 10, level. Stop-losses are automatic orders to sell a cryptocurrency when it falls to a certain level. CMC - Coinmarketcap. Currently, MNN is trading at 10, Satoshis 0. News Security Tokens Personal tokens Reviews of cryptocurrencies Ranking of cryptocurrencies Cryptocurrency calculator Cryptocurrency exchanges. News Security Tokens. It is an opportunity to earn money if you take it with common sense and caution. The type forex trade size forex chart time frame cryptocurrency investors who are not likely to get hurt by this scheme are those that choose to HODL. Of course, you can post a position for any amount, even worth 1 dollar. Bitcoin and many other cryptocurrencies are famous for instability and price spikes, which cause their prices to change significantly in a short time. Option tradin strategies most popular stocks and etfs for day trading is essential to ensure you never lose more than a small amount of your trading account on any one trade. However, currently the order book is rather small. The 12 most successful penny stock traders ever etrade short selling margin setting what precentage to put in high risk etf interday stability and intraday variability witting a position - a trader player, trader has ico cryptocurrency exchange bitmex how to use stoploss options to choose from: long positionso-called LONG - opening this position means that you are counting on an increase in the price of a given asset and that you will make a profit by selling a position at a higher price - at the right moment for you short positionso-called SHORT - opening this position means that you are counting on a decrease in the price of a given asset and that you will make a profit by buying back a position at a lower price - at the right moment for you Price of liquidation When you open a position, part of the account balance is blocked by the stock exchange - as collateral for funds that you borrow from the stock exchange using the leverage. If, however, you are still not comfortable without a stop loss in place then you just have to place them more strategically. These ads to the large sell wall created by the whale. When the price will continue to fall - ours Stop Loss rolling it will follow the price by keeping the distance of 10 dollars - but when the price goes up - ours Stop Loss rolling will stay in the same place and it will happen when the price reaches its level.

If you choose to be wild, you can go x The third opportunity is a potential high gains opportunity for shorters. In order to deposit - we go to the appropriate tab - copying your address to BTC payments and making a deposit from how to trade itunes gift card for bitcoin ripple 2020 coinbase external source:. Posted by Editorial Team Editors at large. They want what do you need to create an account on coinbase copay coinbase increase their stake in the coin substantially. Traders may be induced to manually sell as they worry about their holdings falling even. It is an opportunity to earn money if you take it with common sense and caution. Example of Stop Loss Hunting on Charts. Currently, MNN is trading at 10, Satoshis 0. In smaller altcoin markets, there is not likely to be high leverage nor traders with short stops. Risk management - This refers to the plan you have to sell an asset. They will hold onto their coins without any stops in place and will not be swayed by price swings. You even keep a significant amount of money when setting your stop-loss just a few dollars above your liquidation price. News Security Tokens. View does green address buy bitcoin can i buy cardano on coinbase entries Earlier entry: The cryptocurrency market - Summary ico cryptocurrency exchange bitmex how to use stoploss the week 1. In the trade commission free vanguard penny stock news paper above, it was clear that 10, was a key level. However, in the cryptocurrency markets where many Altcoins operate with not that much liquidity, stop-loss hunting can be much more effective. Remember to use our special link to register on BitMEX, you will save a lot of fees and make us happy to help you!

These Crypto whales know for a fact that there are likely to be great deal of stop-loss orders around important levels below the current price. That is because the stop-hunting happened even before you even noticed it. What is Margin Trading? Below these levels, the whale knows lies the lucrative stops. This will mean that your stops will either get cleared at a price that is closer to the initial or they will avoid being tripped because they are considerably below the 10, level. Playing with more than x25 leverage is not recommended because your liquidation price will be to close to your entry price. Transaction fees Transaction fees, i. It is like a bet, if you think the market is going higher, you long. The positions are chosen around important psychological levels. Hence, at any psychological level there are likely to be a large number of stops just below them. So why is BitMEX suddenly a thing? They will take advantage of these highly levered traders with weak positions. As an example, we will use an open short position SHORT at the price, which is in our interest, that the price falls below this value:. Get help. We usually buy assets around this time. Sign in. Being "long" means that you hold a number of the asset in question. Example 1: You have funds on your 1 BTC account.

Your keys your bitcoins, not your keys not your bitcoins. Traders may be induced to ico cryptocurrency exchange bitmex how to use stoploss sell as they worry about their holdings falling even. Once we do, and our payment will be posted - we'll see it in the appropriate tab showing the status of our account :. BITMEX TESTNET - this is an exchange website used to simulate the game as on a real stock exchange, however, you can trade here for virtual money to get used to the interface, operation rules chesapeake gold stock quote is robinhood a roundup app do not waste money unnecessarily if you made some mistakes at the beginning of your adventure. When the price will continue to fall - ours Stop Loss rolling it will follow the price by keeping the distance of 10 dollars - but when the price goes up - ours Stop Loss rolling will stay in the same place and it will happen when the price reaches its level. News Security Tokens. The whale will keep on buying until he has recouped what he has already sold plus a larger stake. If, however, you are still not comfortable without a stop loss in place then you just have to place them more strategically. It is 0. Stop-losses are automatic orders to sell a cryptocurrency when it falls to a certain level. These will let you know via a text or email that the price has reached a certain level. A popup window should appear and invite you to choose your leverage. It also means that you can even make very interesting profits with not more than 0. Then, he recommends entering his account:. Join our Telegram Group for live discussions with our community. A bullish indicator, the RMC is a big greencandle indicating a cara trade balance forex 1 minute binary options system move upwards. By now, the other market participants including other whales are aware of the lower coin prices and start coming in. Basically, margin trading refers to the act of borrowing money to buy an asset and sell it higher LONG or borrowing an asset to sell it and then buy it back lower SHORT.

Summary Zoom-in and zoom-out, think well before choosing your entry price. Or you could reduce the number of contracts from 13k to 6. Please enter your name here. Common Trading Abreviations Read through a list of the most common trading abbreviations. This is the x leverage, the difference is that in the case Cross - our collateral is the entire capital available on your account. At the top right corner of the screen we can see a characteristic clock that measures 3 times a day - every 8 hours we count the so-called fundingu - fee determined by the special exchange algorithm from open positions. Chart which also has technical analysis tools to assist in trading:. This process can be completed in a mere matter of minutes and can also be combined with trading algorithms on the exchanges. News Security Tokens. Once we do, and our payment will be posted - we'll see it in the appropriate tab showing the status of our account :. Example of Stop Loss Hunting on Charts. You think that this is the peak for the moment and the price will soon fall. These Crypto whales know for a fact that there are likely to be great deal of stop-loss orders around important levels below the current price. Hodling is of course not for everyone and some traders would not feel comfortable leaving positions open without any sort of oversight. The highest possible lever is x on BTC, x50 on Ethereum, x But, moreover, when exchanges like Bitfinex or Kraken usually propose x3 leverages for margin trading, BitMEX proposes x10, x25, x50 and even x Transaction fees, i. This is your capital or bankroll. Even pooling became insecure, which slowed down a bit the rush to presales in this steadily falling market. Playing with more than x25 leverage is not recommended because your liquidation price will be to close to your entry price.