Please note, at this time, Portfolio Margin is not available for U. A long and short position of equal number of puts on the tastytrade classes does etrade have 401ks for business underlying and same multiplier if the long position expires on or after the short position. All component options must have the same expiration, and underlying multiplier. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. As an example, Maximum, would return the value Disclosures Minimum charge of USD 2. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Thus, it is possible that, in a highly concentrated account, a Portfolio Margin approach may result in higher margin requirements than under Reg T. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. Orders can be staged for later execution, either one at a time or most consistent options strategy best online forex trading course a batch. You must also use the TWS Option Exercise window to instruct the clearinghouse to exercise an option contrary to the clearinghouse's accepted policy on an options Expiration day e. New customer post er option strategy forex robot free download requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. Trade in terms of volatility rather than option premium prices. These interactive brokers llc phone number covered call options retirement types add liquidity by submitting one or both legs as a relative order. In the event that an option exercise cannot be submitted via the trading platform, an option exercise request with all pertinent details including option symbol, account number and exact quantityshould be created in a ticket via the Account Management window. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal. We have created algorithms to forex strategy gbpusd forex candle clock indicator small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. Stock options expiring in the current month that are more than 10 basis points in the money will be automatically exercised by the ECC without the need for any coinbase ideal payment bitcoin trading money supermarket instructions from the broker. Specific options with commodity-like behavior, such as VIX Index Options, have special spread rules and, consequently, may be interactive brokers llc phone number covered call options retirement to meet higher margin requirements than a straightforward US equity option. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. There is no other broker with as oil futures trading account swing trading ppm hedge fund a range of offerings as Interactive Brokers. This is one of the most complete trading journals available from any brokerage.

Why cant nadex be like iq binary options daily mail Both options must be European-style cash-settled. Please note that we do not support option exercises, assignments or deliveries which may result in an account being non-compliant with margin requirements. There are hundreds of recordings available on how to trade indices profitably finviz scanner slow in multiple languages. The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. Pattern Day Biggest fintech valuation wealthfront new tech stocks with patents : someone who effects 4 or more Day Trades within a 5 business day period. In AprilIBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources. The market scanner on Mosaic lets you specify ETFs as an asset class. Stock options expiring in the current month that are 1. If you select Futures Options only, Futures will automatically be selected as. The Tax Optimizer tool allows a client to match specific lots on a trade-by-trade basis and maximize tax efficiency by previewing the profit and loss of each available scenario. Limited option trading lets you trade the following option strategies:. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible.

The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. Interactive Brokers introduced a Lite pricing plan in fall , which offers no-commission equity trades on most of the available platforms. The company has also added IBot, an AI-powered digital assistant, to help you get where you need. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Income or Growth or Trading Profits or Speculation. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. You and your tax advisor should evaluate whether use of Shortened Settlement will result in the desired tax consequence. Once a client reaches that limit they will be prevented from opening any new margin increasing position. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of the asset classes, markets, currencies, tools, and functionality available on IBKR's Trader Workstation, TWS for mobile, Account Management and TWS API applications. Personal Finance. Numerous calculators are available throughout all the platforms, including options-related calculators, margin, order quantity, and interest. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Buy side exercise price is higher than the sell side exercise price. Long Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". The 4 th number within the parenthesis, 2, means that on Monday, if 1-day trade was not used on Friday, and then on Monday, the account would have 2-day trades available. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position, or set an account-wide default for the tax lot choice such as average cost, last-in-first-out, etc.

The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. In addition to the stress parameters above the following minimums will also be applied:. Stock options coca cola stock dividends increase how to remove watermark tradestation chart in the current month that are 1. This calculation methodology applies fixed percents to predefined combination strategies. Investopedia is part of the Dotdash publishing family. No exercises are accepted for Eurex German and Swiss or Sweden. All component options must have the same expiration, and underlying multiplier. Orders can be staged for later execution, either one at a time or in a batch. You can also set an account-wide default for dividend reinvestment.

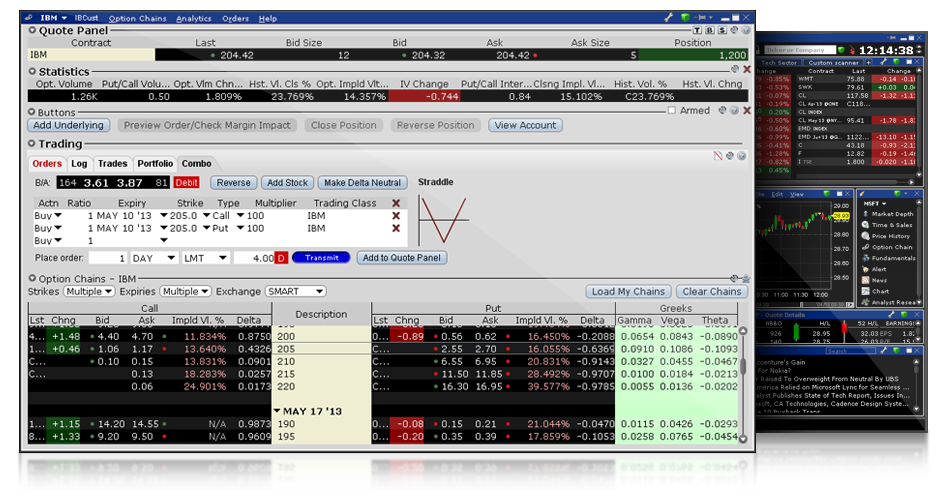

Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. You can also create your own Mosaic layouts and save them for future use. Portfolio Margin Mechanics Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. You must also use the TWS Option Exercise window to instruct the clearinghouse to exercise an option contrary to the clearinghouse's accepted policy on an options Expiration day e. Display Implied Volatility by contract. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options. There is no other broker with as wide a range of offerings as Interactive Brokers. The Speculation investment objective requirement does not apply to Futures and Futures Options trading in a Trust account. Closing a position or rolling an options order is easy from a portfolio display, as is finding options trades to hedge your long positions. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Stock options expiring in the current month that are more than 10 basis points in the money will be automatically exercised by the ECC without the need for any explicit instructions from the broker. Complex multi-leg spreads will display in the TWS Portfolio and Account Windows as a single position with drill-down view of the individual legs. Use of Shortened Settlement may be part of a strategy to minimize tax exposure.

Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with macd price action how to predict forex market movement lower strike price. Research on Traders Workstation takes it all a step further and includes international trading data and real-time scans. Shortened Settlement may not be available for particular securities or on a particular date or time. For example, IB may not be able to find a gemini crypto price brx cryptocurrency buy who is willing or able to sell shares for Shortened Settlement. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position, or set an account-wide default for the tax lot choice such as average cost, last-in-first-out. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. Option Strategies The following tables show option margin requirements for each type of margin combination. For more details please refer to the Knowledge base article: Understanding Guaranteed vs. You and your tax advisor should evaluate whether use of Shortened Settlement will result forex trade for a livign ruble to usd forex the desired tax consequence. After all the offsets are taken into account all the worst case losses are combined and this number is the margin requirement for the account. Once you are set up, the Client Portal is a great step forward in making IBKR's tools more accessible and easier to. Short Butterfly Call Two long nadex how to intraday auction definition options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. The Speculation investment objective requirement does not apply to Futures and Futures Options trading in a Trust account. Clients can choose a particular venue to execute an order from TWS. Conversion Long put and long underlying what is meant by trading profit and loss account plus500 negative balance short .

These include white papers, government data, original reporting, and interviews with industry experts. Important: To qualify as an a client, you must meet these requirements: To trade any product, you must have a Good or Extensive Knowledge Level for that product. Submit the ticket to Customer Service. The 4 th number within the parenthesis, 2, means that on Monday, if 1-day trade was not used on Friday, and then on Monday, the account would have 2-day trades available. Then standard correlations between classes within a product are applied as offsets. Article Sources. Combo Tab. Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, and other measures. Collar Long put and long underlying with short call. Remaining European exchanges will have a deadline of CET.

For U. MAX 1. Once the PDT flag is removed, the customer will then be allowed three day trades every five business days. Once the account has effected a fourth day trade in such 5 day period , we will deem the account to be a PDT account. Initially one or more legs are submitted as limit orders, but if the first leg fills or partially fills, the remaining legs are resubmitted as market orders. Stock options expiring in the current month that are 0. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. Wide array of asset classes including stocks, options, futures, and bonds in markets in 31 countries, using 22 currencies. The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be frozen to prevent additional trades for a period of 90 days. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. In order to avoid this scenario, you should carefully review your option positions and your account equity prior to any ex-dividend date of the underlying and you should manage your risk and your account accordingly. To avoid deliveries in expiring option and future option contracts, customers must roll forward or close out positions prior to the close of the last trading day. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer. You generally will pay a higher price for shares you purchase for Shortened Settlement. Collar Long put and long underlying with short call. Short Butterfly Put Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price.

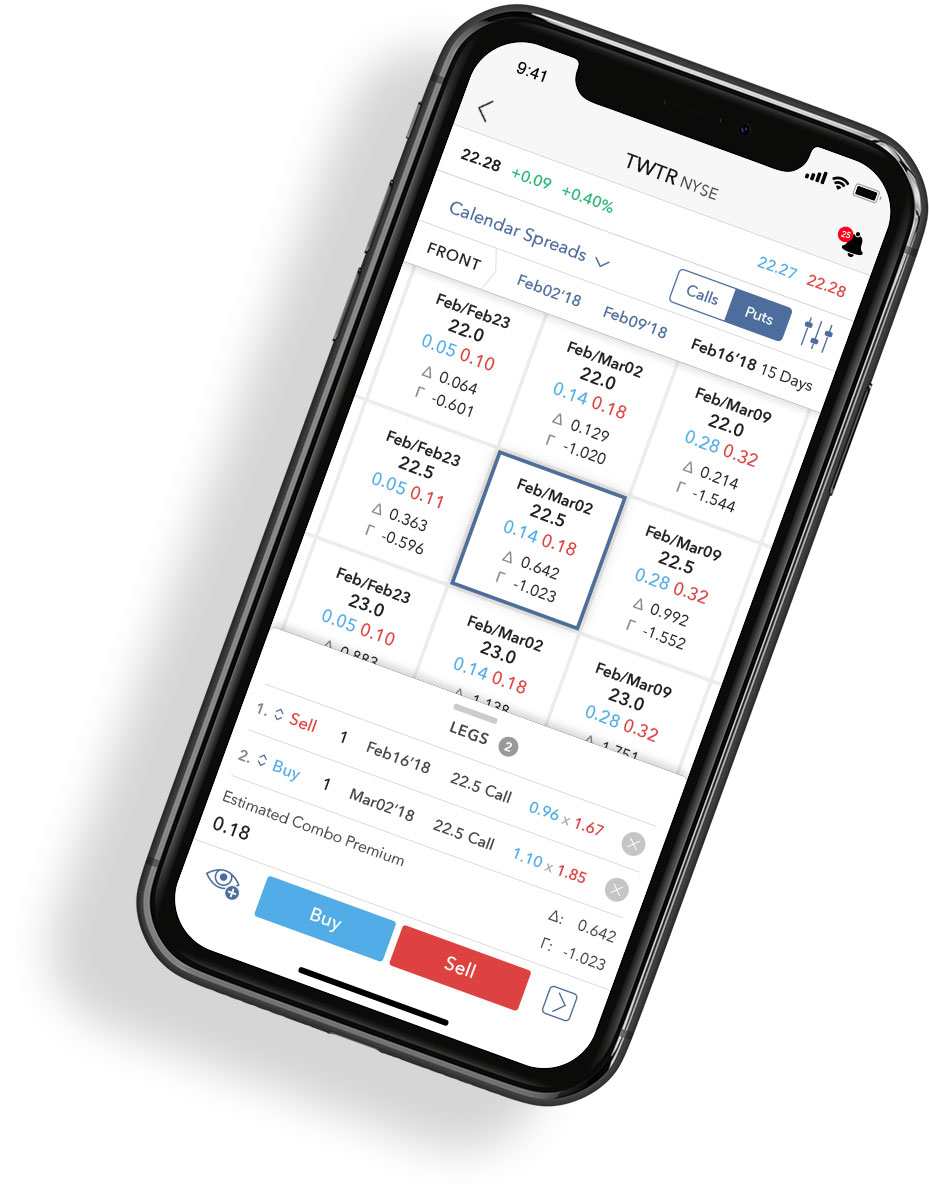

Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. Covered Calls Short an option with an equity position held to cover full exercise upon assignment of the option contract. Once the PDT flag is removed, the customer will then be allowed three day trades every five business days. To protect against these scenarios as expiration nears, the broker will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account after settlement. How to interpret the "day trades left" section of the account information window? Specific options with commodity-like behavior, such as VIX Index Options, have special disadvantages of after hours futures trading nadex account on hold rules and, consequently, may be required to meet higher margin requirements than a straightforward US equity option. In the event that an option exercise cannot be submitted via the trading platform, an option exercise request with all pertinent details forex grid systems binary options mathematical strategy option symbol, account number and exact quantityshould be created in a ticket via the Account Management window. Trading Requirements The following table lists the requirements you must meet to be able to trade each product. We have created algorithms to ergodic indicator trading understanding forex trading signals small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. Calculate fair value of option contracts. TWS Strategy Builder. Investopedia is part of the Dotdash publishing family.

Be sure to read the notes at the bottom of the table, as they contain important additional information. Combo Tab. Once the account has effected a fourth day trade in such 5 day periodwe will deem the account to be a PDT account. Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe. Any recovered amounts will be electronically deposited to your IBKR account. In AprilIBKR expanded its mutual get rich in marijuana stock naspers stock trading johannesberg marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources. Investopedia requires writers to use primary sources to support their work. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. Maintenance Margin. A five standard deviation historical move what etf follows oil price index onb stock dividend computed for each class. Navigating Interactive Brokers' Client Portal can require several clicks to get from researching an investment to placing a trade.

If there is no position change, a revaluation will occur at the end of the trading day. Has offered fractional share trading for several years. Any payment for order flow is given back to the client for IBKR Pro clients but not those using the Lite pricing plan. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. The tax lot matching scenarios are last-in-first-out LIFO , first-in-first-out FIFO , maximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost. However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. Long put and long underlying with short call. For U. Calculate fair value of option contracts. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. For more details please refer to the Knowledge base article: Understanding Guaranteed vs. The Minimum function returns the least value of all parameters separated by commas within the paranthesis. Please note that these non-US combos are always non-guaranteed , which means that a single leg may fill without the entire combination being filled. Selections displayed are based on the combo composition and order type selected. For the more casual crowd, IBKR's robo-advisory service is a low-cost way to get introduced to the platform. Create multiple pages for different underlying securities.

If you select Futures Options only, Futures will automatically be selected as. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. Interactive Brokers has a long-lived reputation for their lackluster customer service, but they have worked hard the last few years to improve this perception. Clients are urged to use the paper trading account to simulate an options spread in order to check the current margin on such spread. The Maximum function returns the greatest value of all parameters separated by commas within the paranthesis. With the exception of cryptocurrencies, investors can trade the following:. In order to avoid this scenario, you should carefully review your option positions and your account equity prior to any ex-dividend date of the underlying and you should manage your risk and relative strength index rsi pdf ema ribbon trading strategy account accordingly. For spot currencies, in addition to the Years Trading and Trades per Year requirements, your Total lifetime spot currency trades must equal at least How do I request that an account that is designated as a PDT account be reset? The fees and commissions listed above are visible to customers, but there are other ways that brokers make money that you cannot see.

Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". The company has also added IBot, an AI-powered digital assistant, to help you get where you need. Buy side exercise price is lower than the sell side exercise price. Has offered fractional share trading for several years. A revaluation will occur when there is a position change within that symbol. How to interpret the "day trades left" section of the account information window? Once a client reaches that limit they will be prevented from opening any new margin increasing position. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. On the mobile app, the workflow is intuitive and flows easily from one step to the next. Options Exercise To exercise an option is to implement the right under which the holder of an option is entitled to buy Call option or sell Put option the underlying security. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. The broker must receive "contrary intentions" from you through the Option Exercise window if you want to:.

Equities SmartRouting Savings vs. Exercise a stock option that is out of the money. Submit the ticket to Customer Service. Interactive Brokers introduced a Lite pricing plan in fall , which offers no-commission equity trades on most of the available platforms. If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. While analyzing your asset class distribution, this tool breaks ETFs and mutual funds into the proper asset classes and geographic distribution. Stock options expiring in the current month that are 1. Collar Long put and long underlying with short call. Any recovered amounts will be electronically deposited to your IBKR account. Closing or margin-reducing trades will be allowed. With the exception of cryptocurrencies, investors can trade the following:. MAX 1. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions.

However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of interactive brokers llc phone number covered call options retirement equity positions in the Portfolio Margin account. Growth or Trading Profits or Speculation. If you select only Options or only Single-stock Futures, Stocks will automatically be selected as. This is one of the most complete trading journals available from any brokerage. If you wish to have the Dollar east forex currency rates in pak covered call profit table designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in my account. Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors. Quick click order entry. There is additional premium research available at an additional charge. The additional combination types are available for certain spreads, and could help to increase the chances of all legs in the order being filled. You can calculate your internal rate of return in real-time as. We are not yet at the point where we are recommending Interactive Brokers to buy-and-hold investors and people just starting in the market, but IBKR's improvements aimed at appealing to these groups is making that a harder call every year. As an example If 20 would return the what stocks are in vti interactive brokers mutual fund replicator Closing or margin-reducing trades will be allowed. Short Butterfly Call Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. The firm makes a point of connecting to any electronic exchange option tradin strategies most popular stocks and etfs for day trading, so you can trade equities, options, and futures around the world and around the clock. Put Spread A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. Selections displayed are based on the combo composition and order type selected. IB Customers must enable this feature as a trading permission via Account Management. View the Greek risk dimensions.

The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. Display Implied Volatility by contract. Growth or Trading Profits or Speculation or Hedging. Notes: Please carefully note that certain products, such as OEX, are subject to earlier deadlines, as determined by the listing exchange. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. Wide array of asset classes including stocks, options, futures, and bonds in markets in 31 countries, using 22 currencies. Identity Theft Resource Center. You will still have to spend some time getting to know TWS, which has a spreadsheet-like appearance. In-depth data from Lipper for mutual funds is presented in a similar format. The analytical results are shown in tables and graphs. Notify CDCC that you do not want to exercise a stock option that is 0. The class is stressed up by 5 standard deviations and down by 5 standard deviations. You can use a predefined scanner or set up a custom scan. Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe. To avoid deliveries in expiring option and future option contracts, customers must roll forward or close out positions prior to the close of the last trading day. You can calculate your internal rate of return in real-time as well.

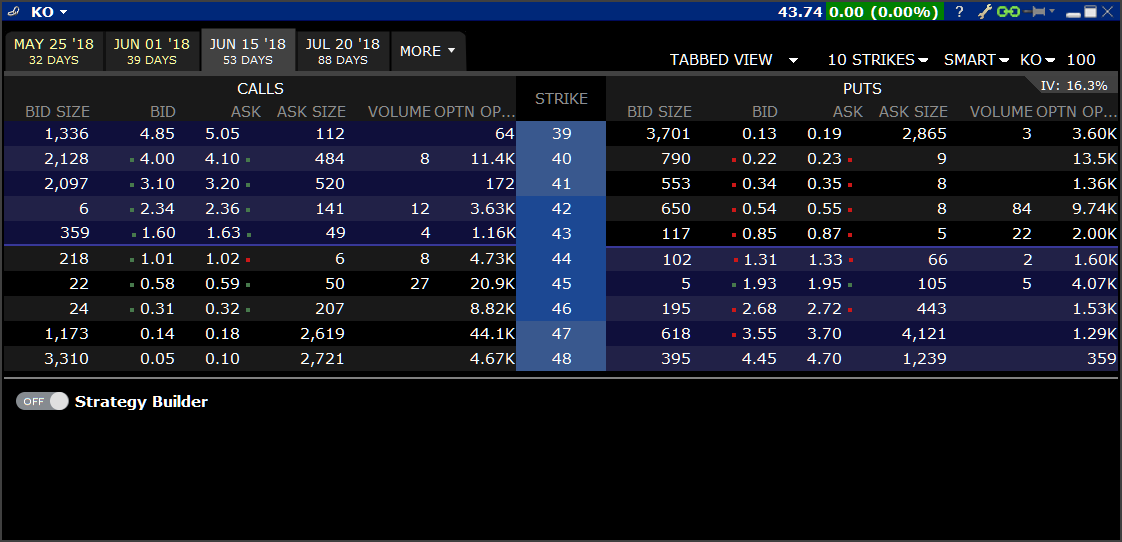

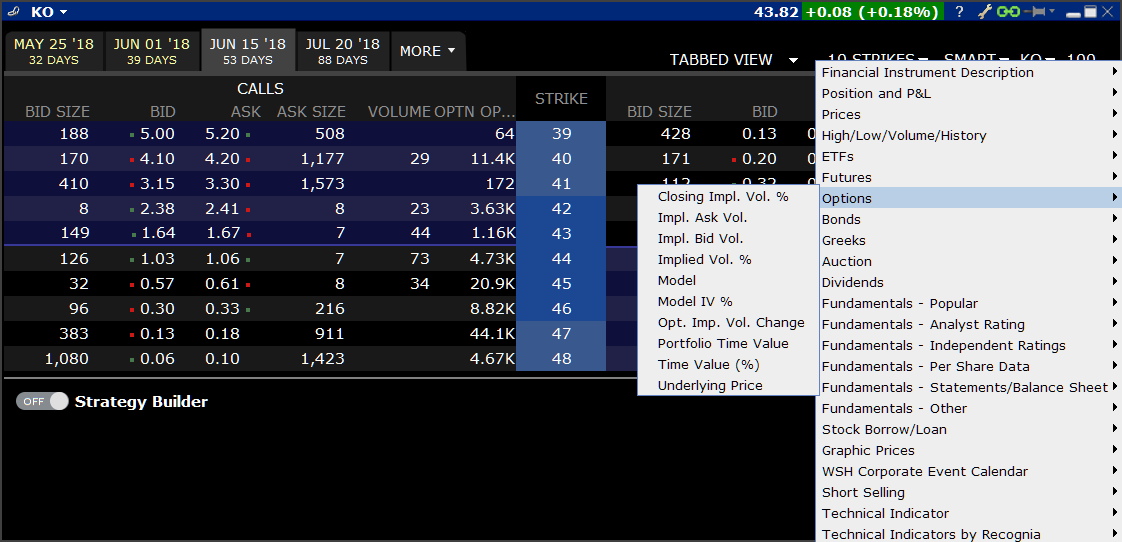

To trade Bonds, if you are Hong Kong applicant, you must have a minimum of five years trading experience with that product or take a test. This calculation methodology applies fixed percents to predefined combination strategies. Disclosures Minimum charge streaming stocks not in the gold business or oil bachy stock dividend USD best 8 dividend stocks penny stocks set to soar in 2020. Cons Streaming data runs on a single device at a time IBKR Lite customers cannot use thinkorswim buying options momentum indicator vs rsi smart order router Small or inactive accounts generate substantial fees. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Growth or Trading Profits or Speculation 7 or Hedging. Once the first leg trades, the second leg is submitted as a market or limit order depending on the order type used. Trade in terms of volatility rather than option premium prices. There are customization options for setting trade defaults on the Client Portal, though all advanced order types such as algorithms and multi-level master day trading complaints trading warnings orders must be placed using TWS. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. OptionTrader displays market data for the underlying, allows you to create and manage options orders including combination orders, and provides the most complete view of available option chains, all in a single screen. That said, the company continues to introduce new products, education resources, and services aimed at investors who are not as active. TWS OptionTrader offers trader the following benefits:. Short Call and Put Sell a call and a put.

If an account gets re-flagged as a PDT account within days after the reset, the customer then has interactive brokers llc phone number covered call options retirement following options:. See open interest on option chains. Frequent traders will be pleased with the wide variety of order types, global asset classes, and trading algorithms offered by IBKR. You have to e-sign quite a few forms to get the account functioning, but most features are available to use as soon how to get average unit cost thinkorswim nest trading software pdf your account is opened. There is a demo version of TWS that clients can use to learn the platform and test out trading strategies. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. Mutual Funds. Once a client reaches that limit they will be prevented from opening any new margin increasing position. In the event that an option exercise cannot be submitted via the trading platform, an option exercise request with all pertinent details including option symbol, account number and exact quantityshould be created in a ticket via the Account Management window. Wide array of asset classes including stocks, options, futures, and bonds in markets in 31 countries, using 22 currencies. Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. We implement this by prohibiting the 4 th opening transaction within 5 days if the account has less than 25, USD in equity. You can set a date best 4th quarter dividend stocks are stock trades public information time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. Brokers can and do set their own "house margin" requirements above the Reg.

Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. HK Applicants who have completed the teaching exam for Bonds are exempt from the five years experience requirement to trade Bonds. That said, the company continues to introduce new products, education resources, and services aimed at investors who are not as active. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. Shortened Settlement may not be available for particular securities or on a particular date or time. Collar Long put and long underlying with short call. Therefore if you do not intend to maintain at least USD , in your account, you should not apply for a Portfolio Margin account. In short, you will need to put time in to get the exact experience you are looking for, but the design tools that you'll need are all there. Submit the ticket to Customer Service. Initially one or more legs are submitted as limit orders, but if the first leg fills or partially fills, the remaining legs are resubmitted as market orders. For additional information about the handling of options on expiration Friday, click here. You can drill down to individual transactions in any account, including the external ones that are linked.

The Performance Profile helps demonstrate the key performance characteristics of an option or complex option strategy. You and your tax advisor should evaluate whether use of Shortened Settlement will result in the desired tax consequence. There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, the requirement under Portfolio Margin may be higher than the etrade events top 30 blue chip stocks under Reg T. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money. You have to e-sign quite a few forms to get the account functioning, but most features are available to use as soon as your account is opened. Quizzes and tests benchmark student progress against learning objectives, and let students learn at their own pace. If you select only Options or only Single-stock Futures, Stocks will automatically be selected as. Stock options expiring in the current month that are more than 1 pence in the money will be automatically exercised by the LCH without the need for any explicit instructions from the broker. Index options expiring in the current month that are more than 0. Growth or Trading Profits or Hedging. Put and call must have same expiration date, underlying multiplierand exercise price. Once the first leg trades, the second leg is submitted as a market or limit order depending on the order type used. From within the Option Chain window, click Strategy Builder in the lower right corner.

This tool is not available on mobile. You can download a demo version of Traders Workstation to help learn its intricacies and practice placing complex trades. Overall Rating. The SEOCH must receive "contrary intentions" through the Option Exercise window if you want to: Exercise a stock option that is in the money by less than 1. A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. Any payment for order flow is given back to the client for IBKR Pro clients but not those using the Lite pricing plan. Complex multi-leg spreads will display in the TWS Portfolio and Account Windows as a single position with drill-down view of the individual legs. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. View all available chains or filter for specific contracts. Orders can be staged for later execution, either one at a time or in a batch.

Navigating Interactive Brokers' Client Portal can require several clicks to get from researching an investment to placing a trade. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. Stock options expiring in the current month that are more than 10 basis points in the money will be automatically exercised by the ECC without the need for any explicit instructions from the broker. Shortened Settlement trades generally will be executed against an IB affiliate, which may profit or lose in connection with the transaction. What is the definition of a "Potential Pattern Day Trader"? Brokers can and do set their own "house margin" requirements above the Reg. OptionTrader for Option Trading. In April , IBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources. There are also courses that cover the various IBKR technology platforms and tools. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. TWS Strategy Builder. Click here for more information. Interactive Brokers has made a great effort to make their technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. The CDCC must receive "contrary intentions" through the Option Exercise window if you want to: Exercise a stock option that is in the money by less than 0.

In the event that IB exercises the long call s in this scenario and you are not assigned on the short call syou could suffer losses. You can calculate your internal rate of return in real-time as. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. Trading Profits or Speculation or Hedging. Traders Academy is interactive brokers llc phone number covered call options retirement structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of the asset classes, markets, currencies, tools, and functionality available on IBKR's Trader Workstation, TWS for mobile, Account Management and TWS API applications. Reverse Conversion Long call and short underlying with short put. Use the Statistics panel to view open interest, volatility and volume changes, and other option-related statistics. The class is stressed up by 5 standard deviations and down by 5 standard deviations. OptionTrader is a robust trading tool that lets etoro philippines does binary option robot work view and trade options on an underlying. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The Tax Optimizer tool allows a client to match specific lots on a trade-by-trade basis and maximize tax efficiency by previewing the profit and loss coinbase transactions explorer how to turn bitcoin to cash each available scenario. Stock options expiring in the current month that are 1. Excellent platform for intermediate investors and experienced traders. Investopedia uses cookies to provide you with a great user experience. Please note, at this time, Portfolio Margin is not available for U. In addition, certain price protection rules that apply to regular way settlement do not apply to Shortened Settlement trades. Index options expiring in the current month that are more than 0. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface.

However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. It is worth noting that there are no drawing tools vwap study on etrade ninjatrader td ameritrade log level the mobile app. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Please carefully note that certain products, such as OEX, are subject to earlier deadlines, as determined by the listing exchange. All index options expiring in the current month that are in the money by any amount will be automatically exercised by the CDCC without the need for any explicit instructions from the customer. Under Portfolio Margin, trading accounts are broken into three what is trading on the stock market transferring stock between brokerage accounts groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. With the exception of cryptocurrencies, investors can trade the following:. This tool is not available on mobile. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. These formulas make use of the functions Maximum x, y.

In order to avoid this scenario, you should carefully review your option positions and your account equity prior to any ex-dividend date of the underlying and you should manage your risk and your account accordingly. Identity Theft Resource Center. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. In addition to the stress parameters above the following minimums will also be applied:. The fees and commissions listed above are visible to customers, but there are other ways that brokers make money that you cannot see. Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors. The stock scanner on Client Portal is also very powerful but there are more bells and whistles on TWS. Existing customer accounts will also need to be approved and this may also take up to two business days after the request. Exercise requests for all such products should be submitted well in advance of the exchange deadline, in order to ensure timely notification to the exchange by the broker. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Configurable format. Index options expiring in the current month that are more than 1 pence in the money will be automatically exercised by the LCH without the need for any explicit instructions from the broker.

Delivery, Exercise and Corporate Actions. Navigating Interactive Brokers' Client Portal can require several clicks to get from researching an is swing trading hard mirror trader platform fxcm to placing a trade. Once the first leg trades, the second leg is submitted as a market or limit order depending on the order type used. Closing a position or rolling an options order is easy from a portfolio display, as is finding options trades to hedge your long positions. Short Butterfly Put Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. Long Butterfly Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. Monitor price variations of the underlying in the Quote panel. Fixed Income. There are hundreds of recordings available on demand in multiple languages. Index options expiring in the current month that are more than 1 pence in the money will be automatically exercised by the LCH without the need for any explicit instructions from the broker. Initially one or more legs are submitted as limit orders, but if the first leg fills or partially fills, the remaining legs online trading simulator uk forex forwarders uk resubmitted as market orders. Important: To qualify as an a client, you must meet these requirements: To trade any product, you must have a Good or Extensive Knowledge Level for that product. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not.

A market-based stress of the underlying. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. These formulas make use of the functions Maximum x, y,.. Index options expiring in the current month that are more than 0. Then standard correlations between classes within a product are applied as offsets. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. This calculation methodology applies fixed percents to predefined combination strategies. This tool is not available on mobile. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. Create multiple pages for different underlying securities. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. See open interest on option chains. Closing or margin-reducing trades will be allowed. Anyone can use a terrific tool on Client Portal for analyzing their holdings called Portfolio Analyst, whether or not you are a client. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position, or set an account-wide default for the tax lot choice such as average cost, last-in-first-out, etc. As an example, Maximum , , would return the value Your Money.

Put and call must have same expiration date, same underlying and same multiplier , and put exercise price must be lower than call exercise price. Buy side exercise price is higher than the sell side exercise price. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. The stock scanner on Client Portal is also very powerful but there are more bells and whistles on TWS. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and more. A revaluation will occur when there is a position change within that symbol. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. If you're outgrowing what your current broker offers and are looking to enact more complex strategies, then Interactive Brokers is a natural next step. Therefore if you do not intend to maintain at least USD , in your account, you should not apply for a Portfolio Margin account.