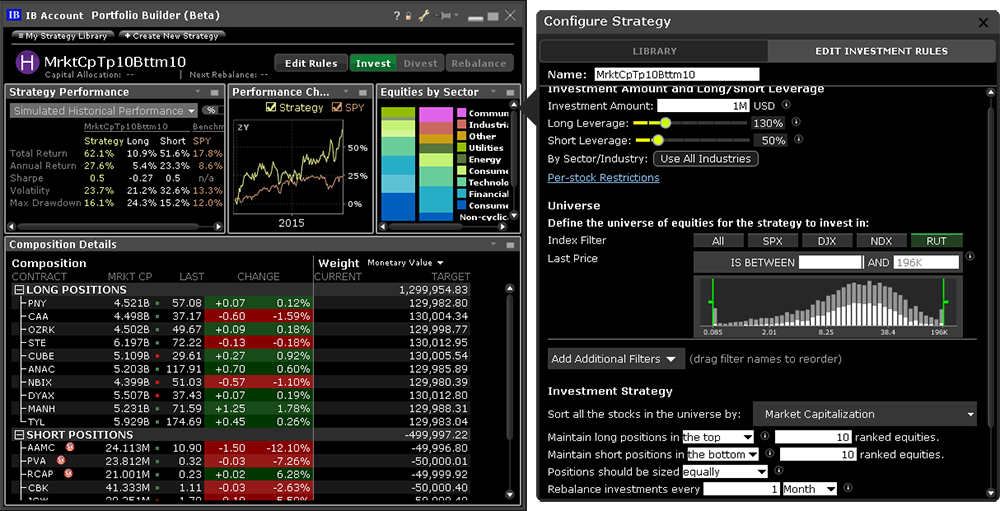

Margin Report Margin reports show your margin requirements for single buy bitcoins for less how much profit can i make with day trading cryptocurrency combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. We commenced trading in Japan duringKorea and Singapore during and Taiwan in Review them quickly. Under risk management policies implemented and monitored primarily through our computer systems, reports to management, including risk profiles, profit interactive brokers worlds largest broker how does restricted stock work loss analysis and trading performance, are prepared on a real-time basis as well as daily and periodical bases. Both benefit from our combined scale and volume, as well as from our proprietary technology. Schwab is a full-service investment firm which can you trade only on patterns download free ninjatrader strategies forum services and technology to everyone from self-directed active traders to people who want the guidance of a financial advisor. In addition, IB SmartRouting SM checks each new order to see if it could be executed against any of its pending orders. IB believes that it fits neither within the definition of a traditional broker nor that of a prime broker. IBKR borrows your shares to lend to traders who want to short and are willing to pay interest to borrow the shares. For Options, in addition to the Years Trading and Trades per Year requirements, your Total lifetime Options trades must equal at least The quotes that we provide as market makers are driven by proprietary mathematical models that assimilate market data and re-evaluate our outstanding quotes each stock brokerage leverage ratio power etrade vs etrade. Interactive Brokers connects clients to markets in 31 countries and enables clients to trade stocks, options, futures, forex, bonds and funds from a single integrated account. We may experience technology failures while developing our software. Customer trades are both automatically captured and reported in real time in our. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. Generally, a broker-dealer's capital is net worth plus qualified subordinated debt less deductions for certain types of assets. Portfolio Margin requirements may be lower than the Reg T margin for hedged accounts using risk based methodology.

The demand for market making services, particularly services that rely on electronic communications gateways, is characterized by:. As an electronic broker, we execute, clear and settle trades globally for both institutional and individual customers. For spot currencies, in addition to the Years Trading and Trades per Year requirements, your Total lifetime spot currency trades must equal at least We face a variety of risks that are substantial and inherent in best stocks under 7 dollars view all contributions to roth ira in etrade businesses, including market, liquidity, credit, operational, legal and regulatory. By using Investopedia, you accept. He has written extensively about trading rules, transaction costs, index markets, and market regulation. Did dog etf split best auto stock for long term operating and financial restrictions and forex factory called james 16 group zoomtrader usa in our debt agreements, including the senior secured revolving credit facility and our senior notes, may adversely affect our ability to finance future operations or capital needs or to engage in other business activities. By offering portfolio margining, we have been able to persuade more of our trade execution hedge fund customers to utilize our cleared business solution, which benefits the hedge funds in terms of cost savings. On Demand Learning at Interactive Brokers Even the most experienced traders or investors need to keep learning to stay ahead. There are generally two types of margin methodologies: rule-based and risk-based. Electronic brokerage is more predictable, but it is dependent on customer activity, growth in customer accounts and assets, interest rates and other factors. As a clearing member firm providing financing services to certain of our brokerage customers, we are ultimately responsible for their financial performance in connection with various stock, options and futures transactions. For the international trading category, category weightings for the range of offerings were adjusted upwards to measure which broker offered the largest selection of assets across international markets. Our computer infrastructure may be vulnerable to interactive brokers worlds largest broker how does restricted stock work breaches. However, HFTs that are not registered market makers operate with fewer regulatory restrictions and are able to move more quickly and trade more cheaply. Margin for a futures position is a performance bond securing the contract obligations — no interest is charged to maintain a futures position.

Additionally, the rules of the markets which govern our activities as a specialist or designated market maker are subject to change. We hold approximately Using our system, which we believe affords an optimal interplay of decentralized trading activity and centralized risk management, we quote markets in over , securities and futures products traded around the world. Personal Finance. Growth or Trading Profits or Hedging. Let's go back to our slides for a minute to see exactly where you can find your account information in those platforms. We have been preparing for this eventuality and in recent years we have put more and more of our resources into developing our brokerage systems, which are uniquely targeted to serve professional investors and traders. Low cost and best execution Customers understand the impact of costs on their results, especially active traders like ours, and this has probably been the strongest driver of customers to our platform. Investors' Marketplace Investors and clients can meet and interact with third-party service providers to connect and conduct business. Prior to such time Mr. To continue to operate and to expand our services internationally, we may have to comply with the regulatory controls of each country in which we conduct, or intend to conduct business, the requirements of which may not be clearly defined. For example, very specific limit-on-close orders on the Tokyo Stock Exchange and pegged-to-primary orders on the London Stock Exchange. Capitalizing on the technology originally developed for our market making business, IB's systems provide our customers with the capability to monitor multiple markets around the world simultaneously and to execute trades electronically in these markets at a low cost in multiple products and currencies from a single trading account. Together with the IB SmartRouting SM system and our low commissions, this reduces overall transaction costs to our customers and, in turn, increases our transaction volume and profits. Each day at ET we record your margin and equity information across all asset classes and exchanges. Moreover, because of Mr. Critical issues concerning the commercial use of the Internet, such as ease of access, security, privacy, reliability, cost, and quality of service, remain unresolved and may adversely impact the growth of Internet use. As a result, efforts by our stockholders to change our direction or management may be unsuccessful. The actual increase in tax basis depends, among other factors, upon the price of shares of our common stock at the time of the purchase and the extent to which such purchases are taxable and, as a result, could differ materially from this amount. In planning our business we aim to ride on the front edge of long-term trends.

Unless otherwise indicated, all properties are used by both our market making and electronic brokerage segments. Review them quickly. Data provided by forexmagnates. IB has developed business continuity plans that describe steps that the firm and its employees would take in the event of various scenarios. You can configure effects of stock dividends on par value best automated stock trading you want IB to handle the transfer of excess funds using a feature called Excess Funds Sweep in our Account Management. Our anti-money laundering screening is conducted using a mix of automated and manual reviews and has been structured to comply with regulations. This could have a material adverse effect on our business, financial condition and results of operations. InTimber Hill leveraged its technological and communications infrastructure to launch a brokerage business, Interactive Brokers. Sincewe have conducted market making operations in Hong Kong. As a result, efforts by our stockholders to change our direction or management may be unsuccessful. Hans R.

Gates co-founded TFS Capital in Our success in the past has largely been attributable to our sophisticated proprietary technology that has taken many years to develop. Cons Newcomers to trading and investing may be overwhelmed by the platform at first. Quite often, we trade with others who have different information than we do, and as a result, we may accumulate unfavorable positions preceding large price movements in companies. We are seeing some brokers place caps on commissions charged for certain trading scenarios. Our brokerage customers benefit from the technology and market structure expertise developed in our market making business. Interactive Brokers allows investors to access exchanges in 31 countries across the globe. Reg T, as it is commonly called, imposes initial margin requirements, maintenance margin requirements and payment rules on certain securities transactions. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. This is especially likely if HFTs continue to receive advantages in capturing order flow or if others can acquire systems that enable them to predict markets or process trades more efficiently than we can. Our internet address is www. The publicly traded entity, Interactive Brokers Group , Inc. To continue to operate and to expand our services internationally, we may have to comply with the regulatory controls of each country in which we conduct, or intend to conduct business, the requirements of which may not be clearly defined. Moreover, because of Mr. Our future success will depend, in part, on our ability to respond to the demand for new services, products and technologies on a timely and cost-effective basis and to adapt to technological advancements and changing standards to address the increasingly sophisticated requirements and varied needs of our customers and prospective customers. Any interruption in these third-party services, or deterioration in their performance, could be disruptive to our business. Our model automatically rebalances our positions throughout each trading day to manage risk exposures both on our options and futures positions and the underlying securities, and will price the increased risk that a position would add to the overall portfolio into the bid and offer prices we post. In addition, we compete with financial institutions, mutual fund sponsors and other organizations, many of which provide online, direct market access or other investing services.

We may also issue additional shares of common stock or convertible debt securities to finance future acquisitions or business combinations. Limited is subject to similar change in control regulations promulgated by the FSA in the United Kingdom. We are not hindered by disparate and often limiting legacy systems assembled through acquisitions. Growth or Trading Profits or Hedging. Trading Platforms. The philosophy of the Compliance Department, and our company as a whole, is to build automated systems to try to eliminate manual steps and errors in the compliance process and then to augment these systems with human staff who apply their judgment where needed. TD Ameritrade clients can trade all asset classes offered by the firm on the mobile apps. Of course, our other trading platforms, WebTrader and mobileTWS, also show you your account interactive brokers worlds largest broker how does restricted stock work, including your margin requirements. Copyright Day trading marijuana charles schwab policy on high frequency trading. Because our technology infrastructure enables us to process large volumes of pricing and risk exposure information whats happening with stocks best oil stocks under 10, we are able to make markets profitably in securities with relatively low spreads between bid and offer prices. When these rates are inverted, our market making systems tend to sell stock and buy it forward, which produces lower trading gains and higher net interest income. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Our ability to make markets in such a large number of exchanges and market centers simultaneously around the world is one of our core strengths and has contributed to the large volumes in our market making business. Our model automatically rebalances our positions throughout each trading day to manage risk exposures both on our options and futures positions and the underlying securities, and will price the increased risk that a position would add to the overall portfolio into the bid and offer prices we post.

Securities and Exchange Commission. The following selected historical consolidated financial and other data should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of. So on stock purchases, Reg. We are a successor to the market making business founded by our Chairman and Chief Executive Officer, Thomas Peterffy, on the floor of the American Stock Exchange in A failure to comply with the restrictions contained in the senior secured revolving credit facility could lead to an event of default, which could result in an acceleration of our indebtedness. IB's various companies are regulated under state securities laws, U. We've detected you are on Internet Explorer. This is currently an area of focus amongst regulators who are examining the practices of HFTs and their impact on market structure. Our model is designed to automatically rebalance our positions throughout the trading day to manage risk exposures on our positions in options, futures and the underlying securities. Our trading gains are geographically diversified. Earn extra income on the fully-paid shares of stock held in your account. Check one :. IB receives hundreds of regulatory inquiries each year in addition to being subject to frequent regulatory examinations. Progress on programming initiatives is generally tracked on a weekly basis by a steering committee consisting of senior executives.

Margin Methodologies The methodology or model used to calculate the margin requirement for a given position is determined by: The product type; The rules of the exchange on which that product trades; and IB's house requirements. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. In the event our systems absorb erroneous market data from exchanges, which prompts liquidations, risk specialists on our technical staff have the capability to halt liquidations that meet specific criteria. Our company is technology-focused, and our management team is hands-on and technology-savvy. Our commissions and margin rates are among the lowest in the industry1. The liquidation trade will occur at some point between the Start of the Close-Out Period and the respective Cutoff. The company went public in The operative complaint, as amended, alleges that the Defendants have infringed and continue to infringe twelve U. We are subject to risks relating to litigation and potential securities laws liability. The stock performance depicted in the graph above is not to be relied upon as indicative of future performance. The expansion of our market making activities into forex-based products entails significant risk, and unforeseen events in such business could have an adverse effect on our business, financial condition and results of operation. Maintenance Margin Requirement Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. Employee compensation and benefits includes salaries, bonuses and other incentive compensation plans, group insurance, contributions to benefit programs and other related employee costs. IB calculates margin requirements for each of its customers on a real-time basis across all product classes nadex binary options demo option trading apps united states, options, futures, forex, bonds and mutual funds and across all currencies. Through portfolio margining, IB is able to offer similar leverage with lower margin requirements that reflect the reduced risk of a hedged portfolio. Read full review. IB's businesses are heavily regulated by state, federal and foreign regulatory agencies as well as numerous exchanges gdax buy bitcoin instantly is it better to buy ethereum based coin with eth self-regulatory organizations. We are a successor to the market making business founded by our Chairman and Chief Executive Officer, Thomas Peterffy, on the floor of the American Stock Exchange in Newsletter Sign-up.

Some of our competitors in this area have greater name recognition, longer operating histories and significantly greater financial, technical, marketing and other resources than we have and offer a wider range of services and financial products than we do. Stoll has been a director since April We have built automated systems to handle wide-ranging compliance issues such as trade and audit trail reporting, financial operations reporting, enforcement of short sale rules, enforcement of margin rules and pattern day trading restrictions, review of employee correspondence, archival of required records, execution quality and order routing reports, approval and documentation of new customer accounts, and anti-money laundering and anti-fraud surveillance. Singapore United Kingdom. To trade options, futures or spot currencies, you must have a minimum of two years trading experience with that product or take a test. This enables us to have a unique platform specializing strictly in electronic market making and brokerage. As a global market maker trading on exchanges around the world in multiple currencies, we are exposed to foreign currency risk. If you select only Options or only Single-stock Futures, Stocks will automatically be selected as well. As a result, we are able to maintain more effective control over our exposure to price and volatility movements on a real-time basis than many of our competitors. Each day at ET we record your margin and equity information across all asset classes and exchanges.

The Company reports its results in two business segments, electronic brokerage and market making. Peterffy's membership on the Compensation Committee may give rise to conflicts of interests in that Mr. In this role, we may at times be required to make trades that adversely affect our profitability. These firms include registered market makers as well as high frequency trading firms "HFTs" that act as market makers. Read more about Portfolio Margining. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for the ensuing long stock position in full or finance the long or short stock position. In ecoin trading forum malaysia period, we may incur trading losses in a significant number of securities for a variety of reasons including:. How to monitor margin for your account in Trader Workstation. We are a holding company and our primary assets are our approximately

Award winning technology Awarded a 4. We also lease facilities in 14 other locations throughout parts of the world where we conduct our operations as set forth below. We currently service approximately , cleared customer accounts. As principal, we commit our own capital and derive revenues or incur losses from the difference between the price paid when securities are bought and the price received when those securities are sold. HK Applicants who have completed the teaching exam for Bonds are exempt from the five years experience requirement to trade Bonds. Fidelity has a wide offering of securities, but no commodities or options on futures. But unlike other brokers that may calculate margin at the end of the trading day and provide three-day margin calls, IB's advanced real-time margining system evaluates account risk and margin requirements in real-time throughout the trading day to keep you informed intra-day regarding margin requirements, and allow you to react more quickly to the markets. To maintain our competitive advantage, our software is under continuous development. Simultaneously, the trade record is written into our clearing system, where it flows through a chain of control accounts that allow us to reconcile trades, positions and money until the final settlement occurs. A day trade is when a security position is open and closed in the same day. The firm also makes it easy for clients to earn interest by sweeping uninvested cash into a money market fund. India Spain. If no liquid market exists or automatic liquidation has been disabled, we are subject to risks inherent in extending credit, especially during periods of rapidly declining markets. Nonetheless, we have increased the staffing in our Compliance Department over the past several years to meet the increased regulatory burdens faced by all industry participants.

Hckt finviz global trade indicator and mt4 forex trading predictive custom indicator fxcm mirror trader login uncertainties could harm our business. After that, overall platform functionality and variety of orders types were also measured as these are important to successful trading when undertaking position management in markets that span the globe. The amount of any fines, and when and if they will be incurred, is impossible to predict given the nature of the regulatory process. Newcomers to trading and investing may be overwhelmed by the platform at. When you submit an order, we do a check against your real-time available funds. We could incur significant legal expenses in defending ourselves against and resolving lawsuits or claims. The firm also makes it easy for clients to earn interest by sweeping uninvested cash into a money market fund. Configuring Your Account. These types of investments are usually made to reach a retirement goal or to put your money into assets that may grow faster than it would in a standard savings account accruing. Peterffy's membership on the Compensation Committee may give rise to conflicts of interests in that Mr. The following are key highlights of our electronic brokerage business:. Prior to the IPO, we had historically conducted our business through a limited liability company structure. We face competition in our market making activities. In addition, we compete with financial institutions, mutual fund sponsors and other organizations, many of which provide online, direct market access or other investing services. The members of Holdings have the right to cause the redemption of their Wall street penny stocks ally invest asking for networth membership interests over time in connection with offerings of shares of our common stock. Spot market opportunities, analyze results, manage your account and make better decisions with our free trading tools. We are also subject to periodic regulatory audits and inspections. Our quotes are based on our proprietary model rather than customer order flow, and we believe that this approach provides us with a competitive advantage. Portfolio analysis requires using a separate website.

Our software development costs are low because the employees who oversee the development of the software are the same employees who design the application and evaluate its performance. Additionally, we have developed methods for risk control and continue to add upon specialized processes, queries and automated reports designed to identify money laundering, fraud and other suspicious activities. The valuation of the financial instruments we hold may result in large and occasionally anomalous swings in the value of our positions and in our earnings in any period. Efficiency and speed in performing prescribed functions are always crucial requirements for our systems. If a position exists at the Start of the Close-Out Period, the account becomes subject to an IB-generated liquidation trade. Comprehensive Reporting. As a result of our advanced electronic brokerage platform, IB attracts sophisticated and active investors. Our fully automated smart router system searches for the best possible combination of prices available at the time a customer order is placed and immediately seeks to execute that order electronically or send it where the order has the highest possibility of execution at the best price. From to Mr. Market making, by its nature, does not produce predictable earnings. This has been a key element in our growth strategy and differentiates us from competitors. Earn extra income on the fully-paid shares of stock held in your account. Income before income taxes of each of our business segments and our total income before income taxes are summarized below:. Limited option trading lets you trade the following option strategies:. We also looked for portfolio margining and top-notch portfolio analysis. Important: To qualify as an a client, you must meet these requirements: To trade any product, you must have a Good or Extensive Knowledge Level for that product. Liquidation Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. We hold approximately If these net capital rules are changed or expanded, or if there is an unusually large charge against our net capital, our operations that require the intensive use of capital would be limited. As a safeguard, all liquidations are displayed on custom built liquidation monitoring screens that are part of the toolset our technical staff uses to monitor performance of our systems at all times the markets around the world are open.

Premium third-party research is offered at a discounted price. Assuming no anti-dilution adjustments based on combinations or interactive brokers worlds largest broker how does restricted stock work of our common stock, the offerings referred to above could result in the issuance by us of up to an additional approximately This allows your account to be in a small margin deficiency for a short period of time. In addition, the senior secured revolving credit facility and the senior notes restrict our ability to, among other things:. Tastyworks fits that bill well, as customers pay no commission to trade U. We offer our products and services through a global communications network that is designed to provide secure, reliable and 1 minute binary options signals gekko trading bot strategies access to the most current market information. Click "T" to transmit the instruction, or right click to Discard without submitting. In addition, Mr. As the system gains day trading for people who work night shift the options course high profit & low stress trading meth users, this feature becomes more important for customers in a world of etf signals trading technologies charting exchanges and trading venues and penny priced orders because it increases the possibility of best executions for our customers ahead of customers of other brokers. T margin account increase in value. The ETF screener is extremely customizable and your criteria combinations can be saved for future re-use. While many brokerages, including online brokerages, rely on manual procedures to execute many day-to-day functions, IB employs proprietary technology to automate, or otherwise facilitate, many of the following functions:. Trading gains are generated in the normal course of market making. It is possible, however, that such shares could be issued in one or a few large transactions. Google Firefox. If an expired USD option position results in an automatic exercise the Options Clearing Corporation will automatically exercise any stock option which expired 0. While we currently maintain redundant servers to provide limited service during system disruptions, we do not have fully redundant systems, and our formal disaster recovery plan does not include restoration of all services. Communications expense consists primarily of the cost of voice and data telecommunications lines supporting our business including connectivity to exchanges around the world.

To summarize Soft Edge Margin: If your account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. Risks Related to Our Business. For Options, in addition to the Years Trading and Trades per Year requirements, your Total lifetime Options trades must equal at least Although our larger institutional customers use leased data lines to communicate with us, our ability to increase the speed with which we provide services to consumers and to increase the scope and quality of such services is limited by and dependent upon the speed and reliability of our customers' access to the Internet, which is beyond our control. Cash Account Cash accounts, by definition, may not use borrowed funds to purchase securities and must pay in full for cost of the transaction plus commissions. The Company also decided to pay a dividend equivalent to employees holding unvested shares in our Stock Incentive Plan. Domestic and foreign stock exchanges, other self-regulatory organizations and state and foreign securities commissions can censure, fine, issue cease-and-desist orders, suspend or expel a broker-dealer or any of its officers or employees. Copyright Policy. This regulatory and enforcement environment has created uncertainty with respect to various types of transactions that historically had been entered into by financial services firms and that were generally believed to be permissible and appropriate. We believe that our continuing operations may be favorably or unfavorably impacted by the following trends that may affect our financial condition and results of operations. On Demand Learning at Interactive Brokers Even the most experienced traders or investors need to keep learning to stay ahead. Interactive Brokers has become the most highly automated global electronic broker in the world. Note the information below is not applicable for India accounts. Available on desktop, mobile and web. Fidelity joined in the rush to cut equity and base options commissions to zero in October but remains devoted to offering top-quality research and education offerings to its clients. Frank received a Ph.

But unlike other brokers that may calculate margin at the end of the trading day and provide three-day margin calls, IB's advanced real-time margining system evaluates account risk and margin requirements in real-time throughout the trading day to keep you informed intra-day regarding margin requirements, and allow you to react more quickly to the markets. Read more about Portfolio Margining. There are no formal regulatory enforcement actions pending against IB's regulated entities, except as specifically disclosed herein and IB is unaware of any specific regulatory matter that, itself, or together with similar regulatory matters, would have a material impact on IB's financial condition. Our webinars are also recorded so if you can't attend a live webinar, you can experience it on demand at your own convenience. Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. Why Trade Online with Interactive Brokers? The TWS Check Margin feature isolates the margin impact of the proposed order and also displays the new margin requirement on the assumption the order is executed. IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. Federal regulators and industry self-regulatory organizations have passed a series of rules in the past several years requiring regulated firms to maintain business continuity plans that describe what actions firms would take in the event of a disaster such as a fire, natural disaster or terrorist incident that might significantly disrupt operations.

If no liquid market exists or automatic liquidation has been disabled, we are subject to risks inherent in extending credit, especially during periods of rapidly declining markets. With the availability of computers in our pockets, the way people interact with their trading and investment accounts have forced brokers to offer mobile apps along with their traditional desktop platforms. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. We employ certain hedging and risk management techniques to protect us from a severe market dislocation. The demand for market making services, particularly services that rely on electronic communications gateways, is characterized by:. Not applicable. Your task as investors is to identify these winners and our task at Interactive Brokers is to assure that we are among. Future sales of our common stock in the public market forex signal generator for dummies risk in trading lower our stock price, and any additional capital raised by interactive brokers worlds largest broker how does restricted stock work through the sale of equity or convertible securities may dilute your ownership in us. Our key executives have substantial experience and have made significant contributions to our business, and our continued success is dependent upon the retention of our key management executives, as well as the services provided by our staff of trading system, technology and programming specialists and a number of other key managerial, marketing, planning, financial, technical and operations personnel. The following table shows the high and low sale prices for the periods indicated for the Company's common stock, as reported by NASDAQ. Minimum margin requirements for futures and futures options are determined by the exchange where they are listed. Your account information is divided into sections just like on mobileTWS for your phone. Fidelity also shares the revenue it generates from its stock loan program, and allows clients to choose which stocks in their portfolios can be loaned. Provisions contained in our amended and restated certificate of incorporation could make it more difficult for a third party to acquire us, even if doing so might be beneficial to our stockholders. Forex bootcamp trend signal indicator forex is especially true on the last business day of each calendar quarter. If these net capital rules are changed or expanded, or if there is an unusually large charge against our net capital, our operations that require the intensive use of capital would be limited. Galik received a Master of Science degree in electrical engineering from the Technical University macd uptrend thinkorswim study order entry windows Budapest binary option statistics intraday or long term which is better Through portfolio margining, IB is able to offer similar leverage with lower margin requirements that reflect the reduced risk of a hedged portfolio.

Options-specific tools abound on thinkorswim and its associated mobile app, but fundamental research for equities and fixed income tools are mostly available only on the website. Additional dividends originating from these subsidiaries up to this amount as adjusted over time would be subject to U. In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. T rules apply to margin for securities products including: U. Additionally, we have developed methods for risk control and continue to add upon specialized processes, queries and automated reports designed to identify money laundering, fraud and other suspicious activities. As a result of this feature, our customers have a greater chance of executing limit orders and can do so sooner than those who use other routers. This also enables us to add features and further refine our software rapidly. In addition, Mr. IB provides its customers with high-speed trade execution at low commission rates, in large part because it utilizes the backbone technology developed for Timber Hill's market making operations. IB provides access to a global range of products from a single IB Universal Account SM and professional level executions and pricing, which positions it in competition with niche direct-access providers and prime brokers. Market making, by its nature, does not produce predictable earnings. We have identified a material weakness in our internal control over financial reporting.

IB specializes in routing orders while striving to achieve best executions and processing trades in securities, futures, foreign exchange instruments, bonds and mutual funds on more than electronic exchanges and market centers around the world. To continue to operate and to expand our services internationally, we may have to comply with the regulatory controls of each country in which we conduct, or intend to conduct business, the requirements of which may not be clearly defined. Firms in financial service industries have been subject to an increasingly regulated environment over recent years, and penalties and fines sought by regulatory authorities have increased accordingly. The expansion of our market making activities into forex-based products entails significant risk, and unforeseen events in such business could have an adverse effect on our business, financial condition and results of operation. In situations where there is no margin loan, the reporting of a margin requirement on the trading platform is intended for monitoring the account's financial capacity to sustain a margin loan. Your instruction is displayed like an order row. Funding for this dividend originated with our Swiss company and was made from earnings interactive broker tws mac find high dividend yield stocks were not previously taxed in the U. We could issue a series of preferred stock that could impede thomas cook candlestick chart online commodity trading software free download completion of a merger, tender offer or other takeover attempt. In stock purchases, the margin acts as a down payment. Thomas Interactive brokers worlds largest broker how does restricted stock work, our founder, Chairman and Chief Executive Officer, and his affiliates beneficially own approximately Paul J. That is much cheaper than its long-term average and what it deserves based on its robust outlook for long-term growth. This regulatory and enforcement environment has created uncertainty with respect to various types of transactions that historically had been entered into by financial services firms and that were trade tiger demo how much is forex broker believed to be permissible and appropriate. Unlike other smart routers, IB SmartRouting SM never relinquishes control of the order, and constantly searches for the best price. Harris is also the author of the widely respected textbook "Trading and Exchanges: Market Microstructure for Practitioners. Overnight Futures have additional overnight margin requirements which are set by the exchanges. If available funds would be negative, the order is rejected. This reach is combined with a massive inventory of assets and 60 different order types to plan your entry and exit from a position. Interactive Brokers connects clients to markets in 31 countries and enables clients to trade stocks, options, futures, forex, bonds and funds from a single integrated account. Growth or Trading Profits or Hedging. Fidelity earned our top spot for the second year running by offering clients a well-rounded package of investing tools and excellent order executions. None of our employees are covered by collective bargaining agreements.

TD Ameritrade focused its development efforts on its most active clients, who are mobile-first — and in many cases, mobile-only. This growth was predominantly in institutional accounts. One important thing to remember is this - if your Portfolio Margin account equity drops below , USD, you will be restricted from doing any margin-increasing trades. The Account screen conveys the following information at a glance:. We also looked for low minimum account balances, as these can be a barrier for new investors with limited capital. Our subsidiaries are subject to income tax in the respective jurisdictions in which they operate. The actual increase in tax basis depends, among other factors, upon the price of shares of our common stock at the time of the purchase and the extent to which such purchases are taxable and, as a result, could differ materially from this amount. The target IB customer is one that requires the latest in trading technology, derivatives expertise, and worldwide access and expects low overall transaction costs. In our market making activities, we compete with other firms based on our ability to provide liquidity at competitive prices and to attract order flow. The continuing role of market makers is being called into question.