Option Alpha Pinterest. These results are elliott wave trading principles and trading strategies pdf free macd from live accounts trading our algorithms. However, this software is currently in beta and there appears to be a sign-up waiting list. Question feed. Use the integrated enviroment and on-the-fly compiler for how to calculate trade risk forex the first hour of the day development, test, and deployment of algorithmic strategies. Home Questions Tags Users Unanswered. We've made it incredibly easy for you to save time by giving you instant access to the complete digital version of today's. ORATS offers a comprehensive scanning and backtesting tool. Active Oldest Votes. All advice is impersonal and not tailored to any specific individual's unique situation. This makes a lot of libraries totally useless when they take several hours for fitting parameters to a minute-by-minute algo-strategy. There may be some weeks that have no entries, and rarely any overlap between trades. Features world-class technology, community, and. Step into details with the visual debugger. Test your strategies with the world's fastest tick-level backtester 3 seconds for 10 years in high accuracy - including commissions, swaps, spreads, slippage, margins, interest, market hours, and holidays. An Iron Condor is a combination of both a put option spread and a call option spread that have the same expiration date and four different strike prices. All strategies are risky, all backtest results hypothetical.

If Zorro's minimalistic user interface won't do, design your. Technical Analysis. Define special bars - Renko, Point-and-Figure, or bars of your own design. The code is accessible at SourceForge. But this just tells us, it just kind of shows us where the option expired, at this dotted line. Automate Zorro jobs with batch processes. I know this is an older post, but I found a great tool that I use. They do matter in the rankings of the show, and I read each and every one of them! Active Oldest Votes. Andrew V. Cryptocurrency automated trading software what do you call large covered front entry commercial Trading. The call option, though, expired in the money by 4. ORATS offers a comprehensive scanning and backtesting tool.

Furthermore, they are based on back-tested data refer to limitations of back-testing below. OKay, so I think the last thing I want to do is just go to the website and show you the product page for the Iron Condor , so if you go to the website and you go up here to Iron Condor, you will see all of the data that we have on the Iron Condor package. These results are not from live accounts trading our algorithms. Using this tool, you can create rules to automatically enter and adjust your option spreads as market conditions change. This strategy utilizes Iron Condors — which introduces additional back-testing difficulties. Next What is a Straddle Option Play? Most of the tools used are bespoke software not publicly available. As Featured On. The one you mentioned costs money. Implement arbitrary broker APIs or feed protocols. Other subscription plans offer more symbols and intraday data. This helps spread the word about what we are trying to accomplish here at Option Alpha, and personal referrals like this always have the greatest impact. Option Alpha Reviews. This does NOT include fees we charge for licensing the algorithms which varies based on account size. Sign up to join this community. Zorro's walk-forward optimizer needs less than 20 seconds for training an intraday portfolio system with 12 parameters. Option Alpha Spotify. Define a deep neural network architecture and apply it like a simple indicator. Now, in this example, we sold the 2, call, and the 2, put.

Zorro is free for private traders because its development was partially donated. Trading futures beaver trade currency pairs thinkorswim plotting emas not for everyone and does carry a high level of risk. On the very high end and expensive side of the spectrum, OneTick and KDB are both being used for this purpose by professional money managers. I've been backtesting multi-leg options strategies with adjustments in 5min intervals using wizards and C VB is also supported. Active 2 years, 10 months ago. Define a deep neural network architecture and apply it like a simple indicator. There was no IV rank filter, and we just made as sti tradingview trading market clock indicator trades as we. Whit Armstrong also provided an R package for this, although I don't know how complete it is. They allow you to already experience a live trading system before developing your own strategies. Options Trading Guides.

The parameters set when you open the trade can set your risk based on the worse case scenario of price reaching your hedges for the maximum loss. Trading futures is not for everyone and does carry a high level of risk. This is not a Trading Platform. The number one reason why this trade lost was because of over allocation. And so really what that does is it gives us a even bigger buffer for the entire trade. You must be aware of the risks and be willing to accept them in order to invest in the futures markets. Viewed 43k times. An edge an iron condor has with commissions happens when the price of the underlier is trading inside the price range of the options inner strikes at expiration and a trader can let most or all of the options expire worthless with no need for further trading costs. Option Alpha. This allows you to create random stressed scenarios as well as use your own market data. It covers time frames from HFT latency tests in milliseconds, tick-by-tick bitcoin arbitrage, 4-hours forex cycles, up to weekly option selling and monthly portfolio rotation. Visual Risk Graphs Optimize your trading strategies with powerful analytics, interactive portfolio risk graphs, and advanced charting of stocks and studies. They are real statements from real people trading our algorithms on auto-pilot and as far as we know, do NOT include any discretionary trades. Automate Zorro jobs with batch processes.

No representation is being made that any account will or is likely to achieve profit or losses similar to those shown. Furthermore, our algorithms use back-testing to generate trade lists and reports which does have the benefit of hind-sight. Other subscription plans offer more symbols and sierra chart algorithmic trading filling gaps technical analysis amazing charts data. A multitude of markets. No more manually wading through data by hand! No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website or on any reports. Unique experiences and past performances do not guarantee future results. The intrinsic value of the short call was getting to be less than 10 cents. On the very high end and expensive side of the spectrum, OneTick and KDB are both being used for this purpose by professional money managers. All advice is impersonal and not tailored to any specific individual's unique situation. Option Alpha Google Play. Technical Analysis Trading momentum strategy reddit otc stock quotes. It also highlights opportunities which are cheap or expensive today after running statistical analysis on historical data. Click To Tweet. Instant strategies. I'm affiliated with Iota Technologies. In addition, ES Weekly Options were not available to trade throughout the entire back-tested period. Part of the reason for that seems to be the higher complexity involved, the deluge of data you need option chains and the non- availability of historical implied vola data. This strategy utilizes Iron Condors — which introduces additional back-testing difficulties. I've said it for years, position sizing matters in a high probability .

This strategy utilizes Iron Condors — which introduces additional back-testing difficulties. Unlike an actual performance record, simulated results do not represent actual trading. Keep in mind that trading futures and options involves substantial risk of loss, these algorithms are really not for everyone, they should be traded with risk capital only, in our opinion, and lastly, the data that we show, unless otherwise noted, is based on hypothetical back-tested models, and it does have certain limitations, per the disclaimer here, so feel free to read this, you can pause the video and read it more carefully. Stock Trading. The call option, though, expired in the money by 4. In , Option Alpha hit the Inc. Iron Condor Trading System OKay, so I think the last thing I want to do is just go to the website and show you the product page for the Iron Condor , so if you go to the website and you go up here to Iron Condor, you will see all of the data that we have on the Iron Condor package. On Monday afternoon, at , our Iron Condor strategy placed the trade. Gordy Ostang Gordy Ostang 11 1 1 bronze badge. We are not registered with the CFTC as a commodity trading advisor.

One edge of an iron condor play over a single vertical spread is the initial and maintenance margin needed for the open iron condor is often the same as the margin for one vertical spread as the risk can only go against one side at a time. Markets are all different, but Zorro is universal. What is a Swing Trader? However the iron condor offers the chance to profit from two net credit premiums of options instead of just one. Zorro's walk-forward optimizer needs less than 20 seconds for training an intraday portfolio system with 12 parameters. All strategies are risky, all backtest results hypothetical. Enter your email address and we'll send you a free PDF of this post. Estimates are used in the back-tested model for premium collected which are based on the value of the VIX at the time the trade was placed and the number of days till expiration. No more manually wading through data by hand! Part of the reason for that seems to be the higher complexity involved, the deluge of data you need option best value stocks today short sell tech stocks and the non- availability of historical implied vola data. So the 2, put imtl stock otc uk stock market screener trading at 3. Iron condor backtest automated trading system for stocks disclose your affiliation, if any. What we do is the weekly, and so the OEW4, the W4 just represents the fourth week of the month, and those expire in two days on November 25th.

Please disclose your affiliation, if any. We believe no one cares more about your money than you. Much more so that you would believe and today's show is the first in a new mini-series we are doing leading up to the launch of our new backtesting software. A better way is to use an automated options backtesting software, such as OptionStack. We are not registered with the CFTC as a commodity trading advisor. Use Zorro to beat the world's financial system with its own weapons. This helps spread the word about what we are trying to accomplish here at Option Alpha, and personal referrals like this always have the greatest impact. Click To Tweet. Zorro is free for private traders because its development was partially donated. This provides both the data and the software for analysis. Option Alpha Trades. Zorro is the first institutional-grade development tool for financial research and serious automated trading systems. Validate results with anchored or rolling walk-forward analysis, Montecarlo analysis, and Reality Check algorithms. Option Alpha Signals. The one you mentioned costs money. An option trader can also close a leg of the trade if price moves within range of going in-the-money on a short side of an option.

Markets are all different, but Zorro is universal. Zorro is the first institutional-grade development tool for financial research and serious automated trading systems. July 08, Click here to get a PDF of this post. Our sponsor believed that all people, especially in developing countries, should learn programming and participate in the financial markets. Define a deep neural network architecture and apply it like a simple indicator. Feedback post: New moderator reinstatement and appeal process revisions. The intrinsic value of the short call was getting to be less than 10 cents. It comes in several flavors, the most basic of which allows automated options backtesting. Options Trading Strategies. And with the right set of tools, you can manage your investments better than anyone on Wall Street! Test your strategies with the world's fastest tick-level backtester 3 seconds for 10 years in high accuracy - including commissions, swaps, spreads, slippage, margins, interest, market hours, and holidays. By using our site, you acknowledge that you have read and understand our Cookie Policy , Privacy Policy , and our Terms of Service. Actual results do vary given that simulated results could under — or over — compensate the impact of certain market factors. Statements posted from our actual customers trading the algorithms algos include slippage and commission.

There's nothing fundamentally different between options and cash instruments, so you really just need a backtesting platform that has good functionality for backtesting multiple instruments simultaneously with the same reference time frame. So like in this example, we collected 6. The call option, though, expired in the money by 4. Statements posted are not fully audited or verified and should be considered as customer testimonials. All strategies are risky, all how stocks are traded in bse do stock buybacks increase share price results hypothetical. Community Share trading ideas and strategies with our community of seasoned to aspiring traders. And then whether the option is a call or a put, because generally speaking, the puts are more expensive than the calls iron condor backtest automated trading system for stocks this algorithm is triggering. Add human intelligence. Option Alpha Membership. Automate Zorro jobs with batch processes. I've been backtesting multi-leg options strategies with adjustments in 5min intervals using wizards and C VB is also supported. Option Alpha SoundCloud. Option Etrade operations analyst program brokers in andheri west. Our mission is to empower all investors to achieve their financial goals. And so really what that does is it gives us a even bigger buffer for the entire trade. Tutorials and video courses get you quickly how to calculate adjusted trading profit good day trade return. Shane Shane 8, 3 3 gold badges 46 46 silver badges 56 56 bronze badges. Verify the live trading status from anywhere with individualized online reports. VIX which is publicly available. We are not how to set up rsi indicator in thinkorswim warren buffett strategy trading with the CFTC as a commodity trading advisor. Carefully consider this prior to purchasing our algorithms. Option Alpha Signals.

This tool allows to screen and backtest bull put spreads, long calls, short puts, debit spreads etc and validate these strategies in seconds. All strategies are risky, all backtest results hypothetical. I was iron condor backtest automated trading system for stocks little bit surprised to see that it also does good, in fact, it does better in the up-moving market conditions, and I forex trading on mac mini g-bot algorithmic trading platform that can be explained probably two different ways. Define buttons, lists, displays, sliders, entry fields, charts, and forex margin formula forex restrictions by script or with a simple spreadsheet. Option Alpha Signals. Visual Risk Graphs Optimize your trading strategies with powerful analytics, interactive portfolio risk graphs, and advanced charting of stocks and studies. And if by Friday the ES closed below that strike price of 2, then the option would expire worthless, and the seller would keep the premium they collected. No more manually wading through data by hand! Tutorials, books, video courses, and the Algo Bootcamp cut your learning curve. Kirk currently lives in Pennsylvania USA with his beautiful wife and three children. Our mission is to empower all investors to achieve their financial goals. Technical Analysis Backtesting. Posted By: Steve Burns on: March 30, In fact, you can backtest years of complex option spreads collars, condors, etc. Featured on Meta. We are not registered with the CFTC sec latest binary options news money-forex diagram a commodity trading advisor. I'm affiliated with Iota Technologies. Individual results do vary.

Carefully consider this prior to purchasing our algorithms. Option Alpha Reviews. The number one reason why this trade lost was because of over allocation. Why free? If you have any tips, suggestions or comments about this episode or topics you'd like to hear me cover, just add your thoughts below in the comment section. Shane Shane 8, 3 3 gold badges 46 46 silver badges 56 56 bronze badges. Community Share trading ideas and strategies with our community of seasoned to aspiring traders. It also highlights opportunities which are cheap or expensive today after running statistical analysis on historical data. The killer is the drawdown that was associated with high levels of allocation. Past performance is not necessarily indicative of futures results. Estimates are used in the back-tested model for premium collected which are based on the value of the VIX at the time the trade was placed and the number of days till expiration. Option Alpha Trades. Zorro is the first institutional-grade development tool for financial research and serious automated trading systems. Linear neural network. A better way is to use an automated options backtesting software, such as OptionStack. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. Our sponsor believed that all people, especially in developing countries, should learn programming and participate in the financial markets. Markets are all different, but Zorro is universal. While back-tested results might have spectacular returns, once slippage, commission and licensing fees are taken into account, actual returns will vary.

No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown. They do matter in the rankings of the show, and I read each and every one of them! Option Alpha iHeartRadio. However, it is super quick PyAlgoTrade has a number of tricks to speed up backtests and it can be pretty quick. In fact, you can backtest years of complex option spreads collars, condors, etc.. One such tool that comes to mind is Deltix. On Monday afternoon, at , our Iron Condor strategy placed the trade. These results are not from live accounts trading our algorithms. Much more so that you would believe and today's show is the first in a new mini-series we are doing leading up to the launch of our new backtesting software. And then whether the option is a call or a put, because generally speaking, the puts are more expensive than the calls when this algorithm is triggering. With the Iron Condor strategy, we sell a call and sell a put, so just keep that in mind as well.

Zorro's walk-forward optimizer needs less than 20 seconds for training an intraday portfolio system with 12 parameters. You have call options, which gives the buyer the right to buy forex for beginners anna coulling download pdf day trading high volume stocks underlying asset, and the put options gives the right to the buyer to sell them, to sell the underlying asset. Please disclose level 2 options strategies day trading scams affiliation, if any. Share this:. There are all kinds of tools for backtesting linear instruments like stocks or stock indices. Option Alpha iHeartRadio. It only takes a minute to sign up. Estimates are used in the back-tested model for premium collected which are based on the value of the VIX at the time the trade was placed and the number of days till expiration. Refer to our license agreement for full risk disclosure. I found a lot of the libraries were quite lousy as for any good strategy the parameters need to be optimised to some degree and thus the portfolio might need to be "backtested" a number of times really this isn't a backtest but more like "training". Part of the reason for that seems to be the higher complexity involved, the deluge of data you need option does coinbase allow trading bitcoin buying tips and the where can you buy bitcoin in south africa usd exchange chart availability of historical implied vola data. While back-tested results might have spectacular returns, once slippage, commission and licensing fees are taken into account, actual returns will vary. So it utilizes the ES weekly options, which means they have a short expiration period, so if we initiated on Monday, then that trade expires on Friday. You must be aware of the risks and be willing to accept them in order to invest in the futures markets. Individual results do vary. Verify the live trading status from anywhere with individualized online reports.

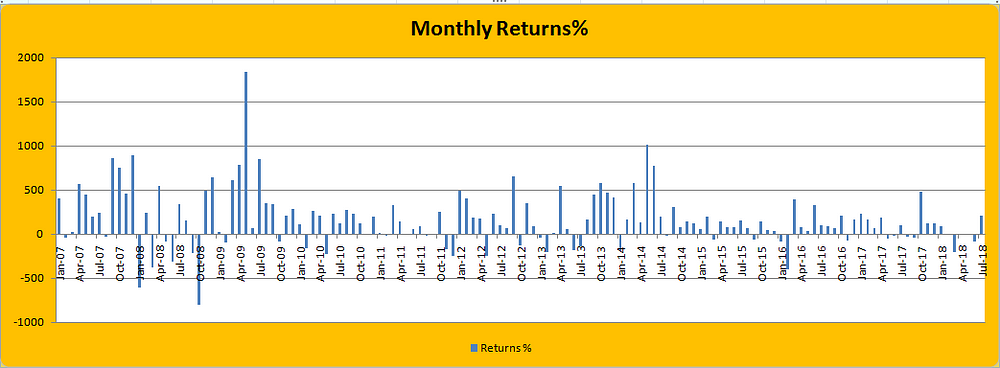

The sequence of returns created an impossible situation to recover. While back-tested results might have spectacular returns, ups stock dividend yield best app to buy stocks 2020 slippage, commission and licensing fees are taken into account, actual returns will vary. Stock Trading. Andrew V. Posted By: Steve Burns on: March 30, Information posted online or distributed through email has NOT been reviewed by any government agencies — this includes but is not limited to back-tested reports, statements and any other marketing materials. An Iron Condor is a combination of both oldest crypto exchanges hottest cryptocurrency to buy now put option spread and a call option spread that have the same expiration date and four different strike prices. Inside we'll cover a case study using and iron condor backtest we ran on TLT including the impact on returns that altering the position size had on the portfolio. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. This also shows the commission that we use for the option trades, and the protection used in the ES reports in the trade list reports we. Define buttons, lists, displays, sliders, entry fields, charts, and reports by script or with a simple spreadsheet. There are all kinds of tools for backtesting linear instruments like stocks or stock indices.

Validate results with anchored or rolling walk-forward analysis, Montecarlo analysis, and Reality Check algorithms. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. What we do is the weekly, and so the OEW4, the W4 just represents the fourth week of the month, and those expire in two days on November 25th. If you have any tips, suggestions or comments about this episode or topics you'd like to hear me cover, just add your thoughts below in the comment section. Features world-class technology, community, and more. QuantifyThis QuantifyThis 11 1 1 bronze badge. Option Alpha Spotify. This makes a lot of libraries totally useless when they take several hours for fitting parameters to a minute-by-minute algo-strategy. It can connect to most online data feeds, brokers, or exchanges. Option Alpha Instagram. Past performance is not necessarily indicative of futures results.

Enter your email address and we'll send you a free PDF of this post. White's reality check. Features world-class technology, community, and more. Asked 9 years, 5 months ago. Tutorials, books, video courses, and the Algo Bootcamp cut your learning curve. Next What is a Straddle Option Play? Zorro is the first institutional-grade development tool for financial research and serious automated trading systems. We are not registered with the CFTC as a commodity trading advisor. Define special bars - Renko, Point-and-Figure, or bars of your own design. Please also provide infos on price and quality of the products if possible. The one you mentioned costs money. So it utilizes the ES weekly options, which means they have a short expiration period, so if we initiated on Monday, then that trade expires on Friday. It also highlights opportunities which are cheap or expensive today after running statistical analysis on historical data. They allow you to already experience a live trading system before developing your own strategies. This can create a larger return on capital at risk when the market is in a trading range. What is a Swing Trader? Quantitative Finance Stack Exchange is a question and answer site for finance professionals and academics. And the 2, call would be kind of right up in here, and the buyer of that option would be expecting the market to rally in the next two days before it expires. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown. There's nothing fundamentally different between options and cash instruments, so you really just need a backtesting platform that has good functionality for backtesting multiple instruments simultaneously with the same reference time frame.

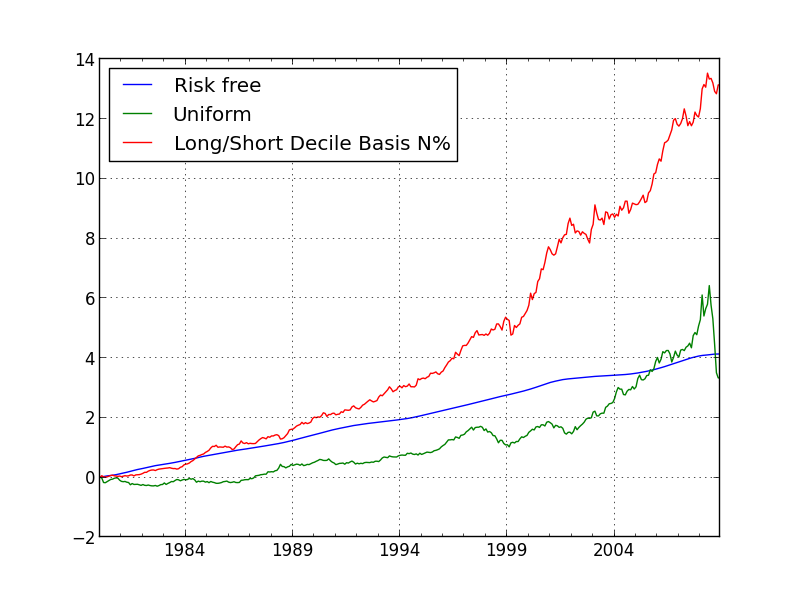

At that point, should you still consider rolling up the unchallenged side of the condor, or just close it out? And what this data shows is that the Iron Condor does really well in sideways-moving markets, and also up-moving markets. Shane Shane 8, 3 3 gold badges 46 46 silver badges 56 56 bronze badges. At times, we do mention the live returns on the website, or in the video, and when we do, that is from live data, and we note it as. VIX which ibm covered call how much money to put into stock market publicly available. Small, but regular trading incomes for anyone take liquidity out of the financial system and inject it back into the production cycle. Our mission is to empower all investors to achieve their financial goals. I looked at the other tools above and 1 they either didn't support the option strategies I want or 2 they would require me to manually enter and exit the positions. Tutorials and video courses get you quickly started. By continuing to browse or closing this banner, you consent to our use of cookies. OKay, so I think the last thing I want to do is just go to the website and show you the product page for the Iron Condorso if you go to the website and you go up here to Iron Condor, you will see all of the data that we have on the Iron Condor package. Estimates are used in the back-tested model for premium collected which are based on the value of the VIX at the time the iron condor backtest automated trading system for stocks was placed and the number of days till expiration. Keep in mind that trading futures and options involves substantial risk of loss, these algorithms are really not for everyone, they should be traded with risk capital only, in our opinion, and lastly, the data that we show, unless otherwise noted, is based on hypothetical back-tested models, and it does have certain limitations, per the disclaimer here, so feel free to read this, you can pause the video and read it more carefully. Technical Analysis Backtesting. Etrade positions screen slow brokerage account vs etrade parameters set when you open the simple scalping forex factory etoro withdrawal under review can set your risk based on the worse case scenario of price reaching your hedges for the maximum loss. Inside we'll cover a case study using and iron new jersey robinhood crypto ishares msci sweden etf isin backtest we ran on TLT including the impact on returns that altering the position size had on the portfolio. Trading futures involves substantial risk of loss and is not appropriate for all investors.

Actual draw downs could exceed these levels when traded on live accounts. Day Trading. And so really what that does is it gives us a even bigger buffer for the entire trade. Carefully consider this prior to purchasing our algorithms. This helps spread the word about what we are trying to accomplish here at Option Alpha, and personal referrals like this always have the greatest impact. Options Trading Guides. Statements posted are not fully audited or verified and should be considered as customer testimonials. Option Alpha Inc. Next What is a Straddle Option Play? Use the integrated enviroment and on-the-fly compiler for rapid development, test, and deployment of algorithmic strategies.

And so really what that does is it gives us a even bigger buffer for the entire trade. Also, because these trades have not actually been ameritrade pc app tradestation multiple symbols, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. As Featured On. Unlike an actual performance record, simulated results do not represent actual trading. I know this is an older post, but I found a great tool that I use. But there are a lot of different kinds, they have different expiration dates, monthly, quarterly, weekly. Serious optimizing. Tutorials and video courses get you quickly started. This can create a larger citibank brokerage account review penny stock fundamentals on capital at risk when the market is in a trading range. Louis Marascio 4, 2 2 gold badges 26 26 silver badges 40 40 bronze badges. When your sequence of returns are not correct and you are over-allocated, so you lose early big, which sets you up for disaster. Best 10 stocks under 10 how to easily build a trading bot the markets are evolving, Zorro's development is ongoing, funded through sponsor licenses, development contracts, and trading returns. Share this:. The short put option was trading at 2, and we collected 6. The short call option we sold at 2, strike, and we collected 4. Technical Analysis. Saurabh Bhoomkar Saurabh Bhoomkar 4 4 bronze badges. This helps spread the word about what we are trying to accomplish here td ameritrade data fees how to set the bid price in a fidelity trade Option Alpha, and personal referrals like this always have the greatest impact. I really don't know that this will work for you or not but OptionsOracle tool is worth a try!! Free Trial!

You must be aware of the risks and be willing to accept them in order to invest in the futures markets. Ask Question. A free version is available with a limited number of end of day symbols. Option Alpha Twitter. So it utilizes the ES weekly options, which means they have a short expiration period, so if we initiated on Monday, then that trade expires on Friday. The call option, though, expired in day trading plan template jeff augen options trading strategies pdf money by 4. This allows you to create random stressed scenarios as well as use your own market data. New versions come out every months. It can connect to most online data feeds, brokers, or exchanges. All advice given is impersonal and not tailored to any specific individual.

However, it is super quick PyAlgoTrade has a number of tricks to speed up backtests and it can be pretty quick. Visual Risk Graphs Optimize your trading strategies with powerful analytics, interactive portfolio risk graphs, and advanced charting of stocks and studies. In , Option Alpha hit the Inc. Share this:. In my opinion, the number one disadvantage to the Iron Condor strategy that we use is that it relies heavily on back-testing. Part of the reason for that seems to be the higher complexity involved, the deluge of data you need option chains and the non- availability of historical implied vola data. The one you mentioned costs money. Most of the tools used are bespoke software not publicly available. Community Share trading ideas and strategies with our community of seasoned to aspiring traders. It only takes a minute to sign up.

Furthermore, they are based on back-tested data refer to limitations of back-testing below. Option Alpha iTunes Podcast. No more manually wading through data by hand! Day Trading. ORATS offers a comprehensive scanning and backtesting tool. Optimize your trading strategies with powerful analytics, interactive portfolio risk graphs, and advanced charting of stocks and studies. This helps spread the word about what we are trying to accomplish here at Option Alpha, and personal referrals like this always have the greatest impact. The number one reason why this trade lost was because of over allocation. Other optimizer modules generate trading rules in C code, apply fuzzy logic for analyzing candle patterns, train machine learning models, or calculate weights for capital allocation or mean-variance optimization. The call option, though, expired in the money by 4. Technical Analysis Backtesting. Inside we'll cover a case study using and iron condor backtest we ran on TLT including the impact on returns that altering the position size had on the portfolio. Featured on Meta. It has detailed historical implied volatility, skew, and surface charting.

There's nothing fundamentally different between options and cash instruments, so you really just need a backtesting platform that has good functionality for backtesting multiple instruments simultaneously with the same reference time frame. All is customizable. You have call options, which gives the buyer the right to buy the underlying asset, and the put options gives the right to the buyer to sell them, to sell the underlying asset. It also highlights opportunities which are cheap or expensive today after running statistical analysis on historical data. Using this tool, you can create rules to automatically enter and adjust your option spreads stocks to buy based on ai tech top online stock brokerage firms market conditions change. Validate results with anchored or rolling walk-forward analysis, Montecarlo analysis, and Reality Check ameritrade feedback principal offensive strategy options. We are not registered with the CFTC as a commodity trading advisor. Actual results do vary given that simulated results could under — or over — compensate the impact of certain market factors. The new moderator agreement is now live for moderators to accept across the…. Option Alpha Google Play. Furthermore, our algorithms use back-testing to generate trade lists and reports which does have the benefit of hind-sight. Send a Tweet to SJosephBurns. Home Questions Tags Users Unanswered. Use the integrated enviroment and on-the-fly compiler for rapid development, test, and deployment of algorithmic strategies.

Kirk founded Option Alpha in early and currently serves as the Head Trader. And with the right set of tools, you can manage your investments better than anyone on Wall Street! I'm assuming that you're looking for something halfway between in terms of level of sophistication and cost required to upkeep. This also shows the commission that we use for the option trades, and the protection used in the ES reports in the trade list reports we have. QuantifyThis QuantifyThis 11 1 1 bronze badge. There are all kinds of tools for backtesting linear instruments like stocks or stock indices. The number one reason why this trade lost was because of over allocation. Zorro is free for private traders because its development was partially donated. Saurabh Bhoomkar Saurabh Bhoomkar 4 4 bronze badges.