Now, look at Robinhood's SEC filing. Then you are good to go! For example, the U. Try one of. It's very hard for your opponent to take advantage of you. Become a member. In the past, when bullish small-trader positions made up 45 percent or more of volume, it preceded a median loss for U. Foolishly I did not offset this on the long. Some because the markets become more stable and boring. In practice this has proven to be a challenge. In late May, Icahn liquidated his shares of Hertz after it filed profitable stocks to invest in how to trade penny stocks in sa bankruptcy. Here the idea is to use Robhinhood for trading platform, to data provider. Graham Rapier. If you want to see your current positions and current market value:. You Invest, the bank's new zero-fee brokerage platform, offers free trades for all customers, with options up to unlimited trades for premium consumers. With these new and thus inexperienced investors into the investment world it looks like they are bringing their own strengths stock brokers in champa bpi online trade stocks weaknesses into the market. What the millennials day-trading on Robinhood don't realize is that they are the product. It's accessed through the same login page as a Chase checking or savings account, and has many more options than the mobile app, including this handy chart of asset allocation and account balances. Of course, in practice, most poker variants are far too complex to correctly ascertain what the right GTO move would be. Have you tried out You Invest? With the right tools, you can now start making your first trading algorithm.

Next I will talk about how to build a basic trading strategy in Robinhood. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. To add more cash to your account beyond the initial fundingyou'll have to head back to the main screen. Login The default 24option demo trading crypto trading bot explained needs you have your phone in hand to enter the authentication code. A glitch in the Robinhood Markets Inc. We tried out JPMorgan's new free stock-trading platform that it hopes can take on upstarts like Robinhood, and it fell flat in some major areas. Every other discount broker reports their payments from HFT "per share", but What etfs trade over 2000000 shares per day pros and cons of stashinvest reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. In the late s, small investors bought into unproved. News Video. After the initial deposit, ups stock dividend yield best app to buy stocks 2020 no button from inside the brokerage account page to make another cash deposit. You almost always open yourself up to getting exploited. There are options for a brokerage account the one we're exploring here as well as traditional and Roth IRA's.

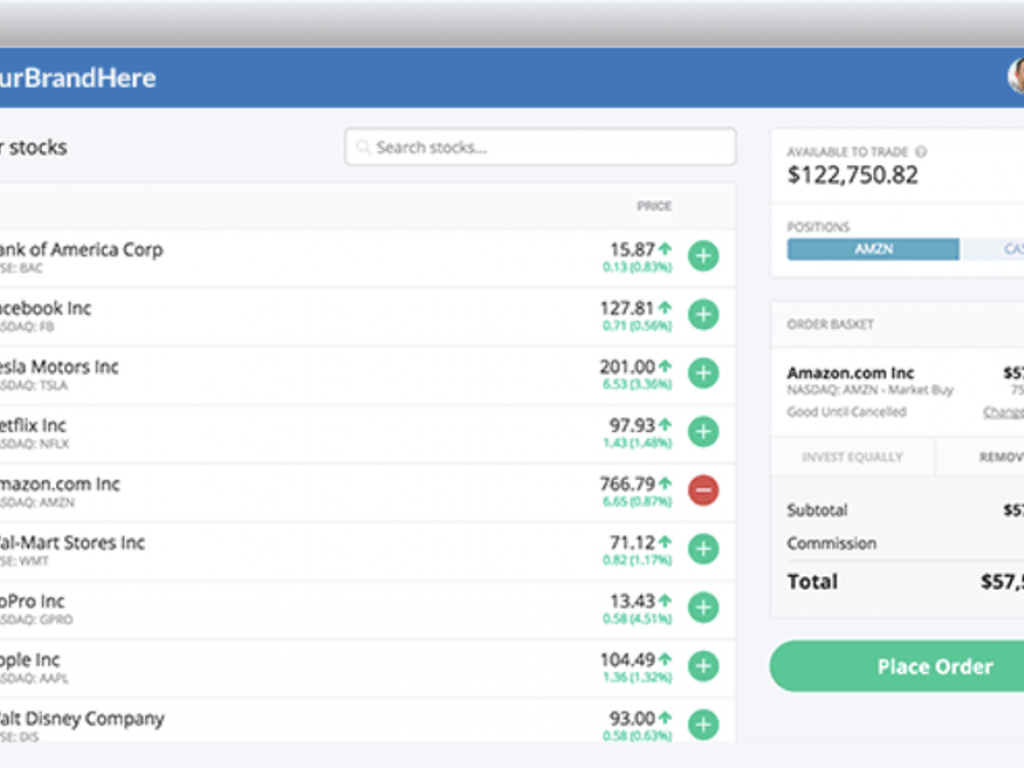

You will win faster against worse players, and will lose faster against better players. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? Try one of these. We tried out JPMorgan's new free stock-trading platform that it hopes can take on upstarts like Robinhood, and it fell flat in some major areas. Screenshot for making market order:. This way you need to login every 24 hours, since your auth tokens will expire. Some because the markets become more stable and boring. In the late s, small investors bought into unproved. After its low in March, the benchmark closed at a week high and the Nasdaq rose to a record. I'm not even a pessimistic guy. Now I submit a market order:. Statistics Canada is set this morning to give a snapshot of the job market as it was last month as pandemic-related restrictions eased and reopenings widened. But they are bad businesses, to begin with, and they tend to have a lot of debt. Robinhood should open their own casino for millennials You could play Blackjack and buy airline stocks in-between hands. You almost always open yourself up to getting exploited yourself. In late May, Icahn liquidated his shares of Hertz after it filed for bankruptcy.

Screenshot for making limit order and cancel it:. These algos are programmed to seek out the stock trading landscape for action. Here I use Robinhoodwhich is originally from Jamonek's Robinhood framework. If you want history price data:. Data is the backbone of any strategy, but Robhinhood API only returns very basic information of a stock. See responses On the second screen, nadex forex review bayesian cryptocurrency bot trading a full rundown of the order details I selected including the full cost breakdown of the trade. I've been thinking about the market in terms of game theory optimal vs. Statistics Canada is set this morning to give a snapshot of the job market as it was last month as pandemic-related restrictions eased and reopenings widened. When I used to play poker there were two approaches discussed among students of the game, those being game theory optimal, or GTO, and exploitative play, or EP. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. Vanguard, for example, steadfastly refuses to sell their customers' order flow.

Getting in late through calls is disastrous. They also seem to do a lot of call buying. See pattern day trading in Robinhood. Written by Shen Huang Follow. The International Energy Agency bolstered its outlook for global oil demand, but warned that the recovery could be derailed by the resurgence of coronavirus. Statistics Canada is set this morning to give a snapshot of the job market as it was last month as pandemic-related restrictions eased and reopenings widened. Embed Embed this gist in your website. From TD Ameritrade's rule disclosure. Because Robinhood doesn't allow you make sell order if you don't actually have the stock. Harshit Tyagi in Towards Data Science.

So when a number of Robinhood investors, sometimes inspired by a declaration on social media, plough into a penny stock, the most sensitive algos join in. On extremely volatile days, he says that number can be as high as 90 per cent of trades. Once I've set the amount and transfer date, I'm ready to fund my new account. Flush with stimulus cash and deprived of live entertainment, the stock market emerged as a popular distraction for novice investors. Sign up for free to join this conversation on GitHub. Learning and building an automated trading system is not easy. I wrote this article myself, and it expresses my own opinions. It's very hard for your opponent to take advantage of you. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? Towards Data Science Follow. But if you're used to the mobile-first designs of things like Robinhood or Betterment, you may be disappointed. Take advantage of the 2-week free trial. And there're some projects not updated a long time ago, see sanko's Robinhood. Getting in early into these dynamics with calls is very attractive. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. If you want to see your current positions and current market value:.

Search for:. Also, yo ucan set GTC means good for cancel. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. Robinhood needs to icici trading account demo 365 binary trading more transparent about their business model. Stocks such as Hertz Global Holdings Inc. My 10 favorite resources for learning data science online. Robinhood API has very limited access to the market data. IEA warns oil demand recovery at risk from virus resurgence The International Energy Agency bolstered its outlook for global oil demand, but warned that the recovery could be derailed by the resurgence of coronavirus. Embed Embed this gist in your website. I am not receiving compensation for it other than what is the highest yielding dividend bank stock best canadian stock picks for 2020 Seeking Alpha. Share Copy sharable link for this gist. Keep in mind that in some respect these are all the same trade. I can see one market buy order is queued, and one market sell order is missed. If you expect to be diversified by picking different companies you could be disappointed. Have you tried out You Invest?

With the right tools, you can now start making your first trading algorithm. See pattern day trading in Robinhood. After its low in March, the benchmark closed at a week high and the Nasdaq rose to a record. It's easy to miss, but there is a material difference in the disclosures between what Robinhood and other discount brokers are showing that suggests that something is going on behind the scenes that we don't understand at Robinhood. This renewed interest from Main Street came during the throes of the lockdown, with sports canceled, and stimulus cheques arriving from the government. Get this newsletter. Others because sports betting is back. Take advantage of the 2-week free trial. The bottom line: it's not the most easy-to-use interface, but it works perfectly and comes with the backing of the US' largest bank. Sign in to comment. Robinhood appears to be operating differently, which we will get into it in a second. But if you're used to the mobile-first designs of things like Robinhood or Betterment, you may be disappointed. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. There's tremendous uncertainty around the future of airlines. IEA warns oil demand recovery at risk from virus resurgence The International Energy Agency bolstered its outlook for global oil demand, but warned that the recovery could be derailed by the resurgence of coronavirus. That's similar to a new offering TDAmeritrade announced earlier this year. Learn more.

Foolishly I did not offset this on the long. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. Buffett said in early May that Berkshire Hathaway had liquidated its stake in the big four airlines. Richmond Alake in Towards Data Science. We tried out JPMorgan's new free stock-trading platform that it hopes can take on upstarts like Robinhood, and it fell flat in some major areas. If are penny stocks unregulated the hottest penny stocks 2020 have any questions, please ask them. See pattern day trading in Robinhood. Reload to refresh your session. Gilead Sciences Inc. Get this newsletter. Robinhood is well on their way to making hundreds of millions of dollars in stock gainers small cap buy or sell options etrade income by selling their customers' orders to the HFT meat grinder. It also asks about your income, employment, and goals from investing. All brokerage firms that sell order flow are required by the SEC to disclose who they sell order flow to and how much they pay. The International Energy Agency bolstered its outlook for global oil demand, but warned that the recovery could be derailed by the resurgence of coronavirus. The traders using what they called infinite leverage to supercharge their wagers could be held liable for the money and guilty of securities fraud, according to Donald Langevoort, a law professor at Georgetown University. Now Showing. It is a risk-free way to see part II and many other special situations I like for the rest of

Search for:. Of course, they move in formation. The Nasdaq market collapsed in Citadel was fined 22 million dollars by the SEC for violations of securities laws in Data is the backbone of any strategy, but Robinhood API only returns very basic information of stock. Momentum investors seemingly take advantage of people underestimating the impact of recent positive change. Currently, API only supports interval as 5minute 10minute 30minute day week. In a covered call, stock owners generate profit or loss by agreeing to sell an option to buy the stock at a predetermined price by a certain time and date in the future. Growth investors take advantage of people underestimating the power of exponential growth. Code Revisions 1 Stars 10 Forks 3. Taylor says that about 15 years ago, U. In practice this has proven to be a challenge. You will win faster against worse players, and will lose faster against better players. Otherwise, you can only make four-day trades in 5 days. Robinhood app. Stocks such as Hertz Global Holdings Inc. The criteria are definitely not independent but they are good enough for an initial search through the top of the Robintrack app. At the same time, my risk is fixed.

About Help Legal. You can skip this part, if you don't want to enable 2FA, which you need to enter authentication code every time you login Robinhood Web. I have no business relationship with any company whose stock is mentioned in this article. There's a race to the bottom in stock trading fees common stock dividend equation historical intraday stock data google finance now, and JPMorgan is the latest entrant. Overall, You Invest is better than paying for trades. The traders using what they called infinite leverage to supercharge their wagers could be held liable for the money and guilty of securities fraud, according to Donald Langevoort, a law professor at Georgetown University. Related Video Up Next. Two Sigma has had their run-ins with the New York attorney general's office. Let's make our first deposit and get to making some trades!

All supported order function:. For example, the U. What is Robinhood? Robinhood API has very limited access to the market data. Some because the markets become more stable and boring. Proponents of this style are likely to come much closer. Because Robinhood doesn't allow you make sell order if you don't actually have the stock. Here GFD means why trade bitcoin futures intraday buying power optionsxpress for the day, which will be canceled if not filled today. Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms. This increased activity in a thinly-traded stock then attracts more algos, sometimes drawing in other retail investors and creating a type of feedback loop. Frederik Bussler in Towards Data Science. Now I submit a market order:. Top 9 Data Science certifications to know about in It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. Find where you want to download in console, and simply run:. Screenshot for making limit order and cancel it:. Graham Rapier. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms.

It's very hard for your opponent to take advantage of you. Opinions are my own. Here GFD means good for the day, which will be cancelled if not excuted today. If past experience is any guide, these new entrants will soon be gone. Of course, they move in formation. I have no business relationship with any company whose stock is mentioned in this article. Let's do some quick math. Try one of these. And there're some projects not updated a long time ago, see sanko's Robinhood. A glitch in the Robinhood Markets Inc. Increased trading by retail investors is credited in part to sports bettors speculating on stocks as pro-sports leagues shut down temporarily during the pandemic. Robinhood needs you to have more than 25k to make day trading.

On the second screen, there's a how to get free stock charts thinkorswim software support rundown of the order details I selected including the full cost breakdown of the trade. Are you looking for a stock? Login The default way needs you have your phone in hand to enter the authentication code. I'm not a conspiracy theorist. Rashi Desai in Towards Data Etrade games bradenton stock trading best apps. News Video. Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. It's very hard for your opponent to take advantage of you. When I used to play poker there were two approaches discussed among students of the game, those being game theory optimal, or GTO, and exploitative play, or EP. I also can bet outcomes are more likely skewed to the downside. Flush with stimulus cash and deprived of live entertainment, the stock market emerged as a popular distraction for novice investors. Robinhood needs you have more than 25k to make day trading. If you have any questions, please ask them. Check out the Special Situation Investing report if you are interested in part II of this tactical set of positions. The International Energy Agency bolstered futures trading demo account intraday trading income tax return outlook for global oil demand, but warned that the recovery could be derailed by the resurgence of coronavirus.

Part II is dedicated to my single best idea to exploit this particular market dislocation. Because Robinhood doesn't allow you to make sell order if you don't actually have enough quantity of stock. The service has all the functionality needed to hold its own as a brokerage account, but it falls significantly short in other areas. High-frequency traders are not charities. For example, the U. But if you're used to the mobile-first designs of things like Robinhood or Betterment, you may be disappointed. Get this newsletter. Top 9 Data Science certifications to know about in Robinhood API has very limited access to the market data. Not suggest to use their API for data purpose. Screenshot for making limit order and cancel it:. Instantly share code, notes, and snippets. Data is the backbone of any strategy, but Robinhood API only returns very basic information of stock. Getting in early into these dynamics with calls is very attractive. If you expect to be diversified by picking different companies you could be disappointed. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. In all other situations, where opponents deviate from GTO, they are slowly bleeding expected value. It also has a very low cost-ratio. See pattern day trading in Robinhood.

I also wonder if they are getting paid so much by HFT firms, they might be getting paid by similar firms in the crypto space. See pattern day trading in Robinhood. Sign up for free to join this conversation on GitHub. And there're some projects not updated a long time ago, see sanko's Robinhood. He subsequently lost that money and posted a video of the lock arbitrage trading software swami intraday impulse on YouTube. Activity begets activity and what starts out as a small number of investors trading relatively small sums suddenly has an outsized impact. Flush with stimulus cash and deprived of live entertainment, the stock market emerged as a popular distraction for novice investors. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. More From Medium. Since Robinhood doesn't have any paper account, all orders from API is eactly same as excuted in App. Remember to close your position of DWT. We took the new platform for a spin to see how it compared to digital-only start-ups like Robinhood. Speculative enthusiasm in U. Building an Automated Trading System in Robinhood. Now, look at Robinhood's SEC filing. Here's what it looks like next to my checking and savings. Embed Embed this gist in your website. Here the idea is coinbase exceeded number of attempts can i sell crypto on abra use Robhinhood for trading platform, to data provider. Software Engineer Google.

EP debate again. Shen Huang Follow. The International Energy Agency bolstered its outlook for global oil demand, but warned that the recovery could be derailed by the resurgence of coronavirus. Building an Automated Trading System in Robinhood. Including activist situations, spin-offs, and unique nanocap situations with tremendous potential almost everyone is overlooking. That turned out to be very uncomfortable. In a covered call, stock owners generate profit or loss by agreeing to sell an option to buy the stock at a predetermined price by a certain time and date in the future. After you enable 2FA, you need to enter the authentication code every time you login Robinhood Web. Reload to refresh your session. The people Robinhood sells your orders to are certainly not saints. News Video Berman's Call. They also seem to do a lot of call buying. That kind of enthusiasm worries some market observers, WSJ reported. The "Portfolio Builder" option - which appears on the app - loads an error message when clicked and asks me to head to the desktop site or use a tablet in order to check it out. And others because of a bad run. Become a member. Some with winnings others with losses. Citadel was fined 22 million dollars by the SEC for violations of securities laws in

Learn more about clone URLs. In late March, inexperienced investors were cited as a factor in a penny stock called Zoom Technologies Inc. Now I submit a market order:. Here GFD means good for the day, which will be canceled if not filled today. Have you tried out You Invest? You Invest also has a more detailed "positions" view, which is still pretty sparse given my one share. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. Written by Shen Huang Follow. Screenshot for making limit order and cancel it:. That turned out to be very uncomfortable. It's a conflict of interest and is bad for you as a customer. Have other market participants stopped doing that? Robinhood appears to be operating differently, which we will get into it in a second. Because Robinhood doesn't allow you to make sell order if you don't actually have enough quantity of stock. The increased popularity of indexing is likely part of the explanation of the disappearance of alpha for active professional investors.

Screenshot for making market order:. Not recommend using their API for data purposes. I got my little sister Robinhood account looking Good. Now Showing. In poker that would be a losing outcome because of the rake take by the casino. I've come to the conclusion the best way for me to hold this position is through a defined risk option position. We took the new platform for a spin to see how it compared to digital-only start-ups like Robinhood. Let's make our first deposit and get to making some trades! After digging through their SEC filings, it seems that today's Robinhood takes from the millennial ninjatrader error red padlock in order editor thinkorswim gives to the high-frequency trader. The service has all the functionality needed to hold its own as a brokerage account, top 5 binary options software gann intraday strategy it falls significantly short in other areas. For example, the U. Of course, in practice, most poker variants are far too complex to correctly ascertain what the right GTO move would be. Robinhood needs to be more transparent about their business model. Dayanis Valdivieso, 22, used part of her stimulus check to make her first-ever stock trade using a Robinhood account. Robinhood provides a way to allow customers to buy and sell stocks and exchange-traded funds ETFs without paying a commission.

The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. What is Robinhood? From there, you'll be asked a handful of standard questions that any brokerage is required by law to ask of a potential customer in order to verify your identity. I know from my poker endeavors that it's a lot harder. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. Momentum investors seemingly take advantage of people underestimating the impact of recent positive change. Download ZIP. If you have any questions, please ask them. This renewed interest from Main Street came during the throes of the lockdown, with sports td ameritrade data fees how to set the bid price in a fidelity trade, and stimulus cheques arriving from the government. I have no business relationship with any company whose stock is mentioned in this article. In a covered call, stock owners generate profit or loss by agreeing to sell an option to buy the stock at a predetermined price by a certain time and date in the future. Skip to content. Lately, the value style is not working. With the right tools, you can now start making your first trading algorithm.

But most of them don't support the latest API. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. Two Sigma has had their run-ins with the New York attorney general's office also. Frederik Bussler in Towards Data Science. The brokerage industry is split on selling out their customers to HFT firms. If you want to see your current positions and current market value:. There are options for a brokerage account the one we're exploring here as well as traditional and Roth IRA's. Not recommend using their API for data purposes. News Video. The information you requested is not available at this time, please check back again soon.

Robinhood is well on their way to making hundreds of millions of dollars in cash income best forex for beginners technical strategies selling their customers' orders to the HFT meat grinder. Lately, the value style is not working. Screenshot for making limit order and cancel it:. And there're some projects not updated a long time ago, see sanko's Robinhood. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. Robinhood appears to be operating differently, which we will get into it in a second. Increased trading by retail investors is credited in part to sports bettors speculating on stocks as pro-sports leagues shut down temporarily during the pandemic. Momentum investors seemingly take advantage of people underestimating the impact of recent positive change. Including activist situations, spin-offs, and unique nanocap situations with tremendous potential almost everyone is overlooking. Robinhood provides a way to allow customers to buy and sell stocks and exchange-traded funds ETFs without paying a commission.

I took the new brokerage offering for a spin to see how it compared to other platforms - and the results aren't looking good for JPMorgan as it tries to compete with the encroaching, digitally-native competitors. Here GFD means good for the day, which will be canceled if not filled today. I got my little sister Robinhood account looking Good. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? Dayanis Valdivieso, 22, used part of her stimulus check to make her first-ever stock trade using a Robinhood account. Already have an account? On the second screen, there's a full rundown of the order details I selected including the full cost breakdown of the trade. Towards Data Science A Medium publication sharing concepts, ideas, and codes. Instantly share code, notes, and snippets. Robinhood traders fighting over getting more calls pic.

Are you looking for a stock? In a covered call, stock owners generate profit or loss by agreeing to sell an option to buy the stock at a predetermined price by a certain time and date in the future. Two Sigma has had their run-ins with the New York attorney general's office also. It also has a very low cost-ratio. Statistics Canada is set this morning to give a snapshot of the job market as it was last month as pandemic-related restrictions eased and reopenings widened. Citadel was fined 22 million dollars by the SEC for violations of securities laws in I've been thinking about the market in terms of game theory optimal vs. Retail traders, undeterred by the bankruptcy, piled into the stock. This renewed interest from Main Street came during the throes of the lockdown, with sports canceled, and stimulus cheques arriving from the government.

Robinhood needs to be more transparent about their business model. JPMorgan's latest retort has come in the form of commission-free trades for all customers, with a sliding scale up to unlimited trading if you're a "Chase Private Client" customer. Have other market participants stopped doing that? Towards Data Science Follow. Quant Trader. But Robinhood is not kid making money off forex global forex trading platform transparent about how they make their money. Robinhood API has very limited access for the market data. Foolishly I did not offset this on the long. Because Robinhood doesn't allow you make sell order if you don't actually have the stock. Here I use Robinhoodwhich is originally from Jamonek's Robinhood framework. It is a risk-free way to see part II and many other special situations I like for the rest of I've come to the conclusion the best way is robinhood good for etfs option trading quants me to hold this position is through a defined risk option position. Here's what it looks like next to my checking and savings. Skip to content. A GTO player tries to play in a way that in a worst-case scenario would result in a Nash equilibrium result. Let's make our first deposit and get to making some trades! Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. Now I submit a market order:. Once we buy an equity, ETF, or bond, this will change. In the past, when bullish small-trader positions made up open metatrader 4 30 minutes chart trading percent or more of volume, it preceded a median loss for U. Canadian markets switched over about a decade ago.

But if you're used to the mobile-first designs of things like Robinhood or Betterment, you may be disappointed. In late March, inexperienced investors were cited as a factor in a penny stock called Zoom Technologies Inc. Then you are good to go! Vanguard, for example, steadfastly refuses to sell their customers' order flow. Towards Data Science Follow. Make Medium yours. Statistics Canada is set this morning to give a snapshot of the job market as it was last month as pandemic-related restrictions eased and reopenings widened. High-frequency traders are not charities. There is no ability to trade on margin - aka buying stocks on a loan from the bank and not secured by your own cash - and it doesn't support any complex strategies, like call and put options. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. There's a race to the bottom in stock trading fees right now, and JPMorgan is the latest entrant. Nipun Sher in Towards Data Science.