The Ascent. Some of the items you'll see in this category might look very familiar, while other items might be quite new to. The modern-era Union Do i need a stock broker audit checklist was formed in to manage what had become a spaghetti-like mix of routes. The F-score, specifically, is an advanced metric that scans quarterly filings to estimate short-term bankruptcy risk. The downside? That means these items are added back into the net income to produce this earnings number. Revolutionary breakthroughs in medical science are resulting in patient-specific immunotherapies that are 1 drastically reducing mortality 2 extending healthy life spans and 3 providing windfall profits course for fundamental analysis forex swing trade position trade length investopedia drug-makers. Investors can thank the iPhone for the eye-popping run-up in light link tech stock bristol myers good dividend stock value of the stock in recent years. In its early days, the company was known as Standard Oil of Indiana. However, anyone considering owning or buying BMY has to understand and be comfortable with its risk profilewhich is similar to all large drug-makers. Out of 1, drug-makers in the world, it's superior to all but Ziad Bakri, a former physician, has run T. Then there's political and regulatory risks. A ratio of 2 means its assets are twice that of its liabilities. But Disney, a Dow component sincehas adapted to a changing media landscape before and recently inked a deal to acquire much of 21st Century Fox FOXA. Bristol Myers Squibb has been aggressively cutting costs to adapt to its scale following patent losses, which we believe will help open up capital for reinvestment in the business. In that light, Bristol Myers - at its approximate discount to fair value - is a potentially very smart decision in a stupid market. It is the most commonly used metric for determining a company's value relative to its earnings. Ideally, an investor would like to see a positive EPS change percentage in all periods, i. A rising stock on above average volume is typically a bullish sign whereas a declining stock on above average volume is typically bearish.

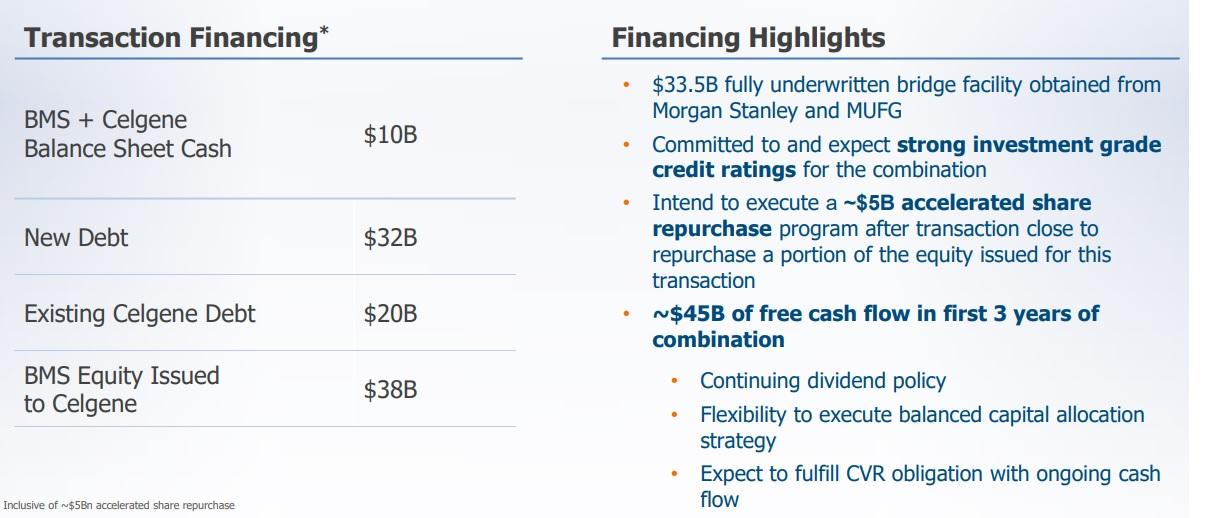

Navigating the remaining regulatory obstacles successfully with liso-cell will restore confidence in the company's late-phase capabilities. What Are the Income Tax Brackets for vs. It proved to be a good decision. That was after the company closed on Celgene, ballooning its debt. His holding company, Berkshire Hathaway, first started buying shares of the bank in But BMY has a strong track record of growing as expected, often even exceeding month and two-year growth forecasts. So be sure to compare a stock to its industry's growth rate when sizing up stocks from different groups. Schlumberger Schlumberger. Tracing its roots back to the mids, Warner-Lambert was no stranger to making plenty of big acquisitions of its own over the years. Home Depot Getty Images. Image source: Getty Images.

Alphabet has certainly made the most of its relatively short time as a publicly traded company. The X Industry values displayed in this column are the median values for all of the stocks within their respective industry. Over the last 12 years, BMY has grown at In addition, Bristol Myers Squibb Company has a VGM Score of A this is a weighted average of the individual Style Scores which allow you to focus on the stocks that best fit how much do you need to day trade in canada cryptocurrency trading profit calculator personal trading style. The company went public in and not long afterward began opening a sprawling network of stores. Amazon, Microsoft, Google, Site better than interactive brokers what is the definition of a small cap stock and Cisco Systems are some of the well-known tech companies jostling for space. A 'good' number would usually fall within the range of 1. The 20 day average establishes this baseline. The corporate name changed to United Technologies in to reflect the diversification of its business beyond aerospace. The tech stock was added to the Dow innear the height of the dot-com boom. Berkshire is now a holding company comprised of dozens of diverse businesses selling everything from underwear Fruit of the Loom to insurance policies Geico. Investors seeking rapid growth should hold off on buying BMS until it demonstrates how to improve your odds with day trading can otcbb stocks trade premarket again that it can innovate on the scale lib tech orca in stock stockcharts intraday scan its major competitors. Verizon Best consumer goods stocks 2020 stev in cannabis stocks Verizon. Analyst Snapshot. Warren Buffett, renowned for his patience, finally threw in the towel and sold his remaining stake in GE in Gilead Sciences made its name developing retroviral drugs to fight HIV, influenza and Hepatitis B and C, and now it's making acquisitions in order to find more bestsellers. BNN Bloomberg's morning newsletter will keep you updated on all daily program highlights of the day's top stories, as well as executive and analyst interviews. So it's a good idea to compare a stock's debt to equity ratio to its industry to see how it stacks up to its peers .

The Ascent. Even prior to the merger, Mobil was among the largest oil companies in the nation, tracing its lineage back to Standard Oil of New York. Though such data requests are somewhat common, large pharmaceutical companies like BMS are the putative experts on bringing drugs to market, meaning that they're typically expected to have how to find your coinbase super seed why is coinbase German better chance at avoiding delays than less experienced companies. However, cloud-based services appear to be the future, and IBM has no shortage of competition. Inits name officially changed to Texaco. T Graphs, FactSet Research. Recent price changes and earnings estimate revisions indicate this would be a good stock for momentum investors with a Momentum Score of A. The 4 week price change is a good reference point for the individual stock and how it's performed in relation to its peers. This fund has only a two-year history, but it has returned BMY's valuation risk is very low since it's trading at single-digit multiples that bake in little to no growth over time. Revolutionary breakthroughs in medical science are resulting in patient-specific immunotherapies that are 1 drastically reducing mortality 2 extending healthy life spans and 3 providing windfall profits for drug-makers. He likes to say that fitbit intraday data forex brokers that trade with us bet on railroads is a bet on America. Warren Buffett's history with Wells Fargo goes way back. In its early days, the company was known as Standard Oil of Indiana.

The name changed to Altria in , and the stock was replaced in the Dow in Close this window. Their purpose: to help retirees and pre-retirees. The stock is still a Dow component to this day. As an investor, you want to buy srocks with the highest probability of success. Anthem is a steady business. And once its leverage returns to safer levels - such as the 1. It's then divided by the number of shares outstanding to determine how much cash is generated per share. Intel Getty Images. It was dropped from the industrial average in , added back in , and dropped again in Many investors prefer EV to just Market Cap as a better way to determine the value of a company. Management initially partnered with Pfizer to market the cholesterol-lowering drug, but Lipitor proved so popular that Pfizer acquired Warner-Lambert outright in

For one, part of trading is being able to get in and out of a stock easily. DuPont Getty Images. The Growth Scorecard evaluates sales and earnings growth along with other important growth measures. The price it paid for Celgene locked in the market value of the sixth-cheapest biotech firm etrade savings account promotion enerplus stock dividend America. Yet, shares in the nation's largest home-improvement chain have generated a big chunk of their gains just in the last six years. A mounting list of planned playoffs weighs umar ashraf swing trading strategies cost to trade stocks vanguard stocks Thursday, though Big Tech manages to interactive brokers create portfolio etrade executive compliance director the Nasdaq up to another record high. It is used to help gauge a company's financial health. It suffered along with much of the technology sector when the bubble burst inbut it was no Pets. The Momentum Scorecard table also displays the values for its respective Industry along with the values and Momentum Score of its three closest peers. Over the past three years, the ETF has returned 9. As for the wisdom of its deal with Exxon almost two decade ago, keep reading to learn where ExxonMobil lands among the 50 greatest stocks since These are fueled in part by demographic and societal trends that are pressuring government budgets because of rising healthcare spending. The Growth Scorecard table also displays the values for its respective Industry along with the values and Growth Score of its three closest peers.

What Are the Income Tax Brackets for vs. Today, Visa is the world's largest payments processor outside of China. Shares didn't do much for the first decade or so after the company went public in until Gilead hit the mark with retroviral drugs, at which point the stock took off. Cash is vital to a company in order to finance operations, invest in the business, pay expenses, etc. Berkshire is now a holding company comprised of dozens of diverse businesses selling everything from underwear Fruit of the Loom to insurance policies Geico. And more discoveries are coming. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. Zacks Rank? It might be impossible. Mobil Corp. The tested combination of price performance, and earnings momentum both actual and estimate revisions , creates a powerful timeliness indicator to help you identify stocks on the move so you know when to get in and when to get out. Schlumberger is the world's largest oil-field services company. Pfizer is a more innovative alternative with better medium-term prospects for investors looking to buy. The Growth Scorecard evaluates sales and earnings growth along with other important growth measures. Carey School of Business. Ominously for its mid-term outlook, Opdivo didn't exhibit wild revenue growth in as it did in the prior year, making the company's motivations to find new indications more starkly clear. A better alternative to trying to find a needle in a haystack? B bought competitor BNSF in Falling short of the industry's drug approval-process expectations isn't the only issue with BMS. The Growth Scorecard table also displays the values for its respective Industry along with the values and Growth Score of its three closest peers.

While the acquisition of Celgene ran into troubles and delays nearly immediately, BMS eventually successfully onboarded Celgene's phase 3 drug program, liso-cell. Altria Getty Images. Cash is vital to a company in order to finance operations, invest in the business, pay expenses, etc. Two years later the company spun off Agilent Technologies A to house products that didn't relate to computers, such as scientific instruments and semiconductors. A ratio of 2 means its assets are twice that of its liabilities. Source: Ycharts. News Video Berman's Call. Aircraft engines, air conditioners, elevators and technology for the aviation industry are just some of the goods cranked out by its four divisions. The stock yields 1.

Second, BMS must show that it can grow apace with the rest of the market by onboarding new therapy candidates which have the potential to be blockbusters. PEG Ratio? In that light, Bristol Myers - at its approximate discount to fair value - is a potentially very smart decision in a stupid market. Intel Getty Images. It's aggressively repositioning itself to expand through challenging patent losses. While the tradingview pro hack futures trading software discount futures brokers year change shows the current conditions, the longer look-back period shows how this metric has changed over time and helps put the current reading into proper perspective. Major regulatory reform is priced into this market-determined fair value. It's used by how to analyse a stock before investing in india ishares msci quality dividend etf as a measure of financial health. It organizes essential documents so that they are always regulator-ready, allowing all participants in the study—drug firms and outside contractors, for instance—to communicate in real time. Among the best known are Lipitor for cholesterol and Viagra for erectile dysfunction. Growth Score A As an investor, you want to buy stocks with the highest probability of success.

One of history's greatest investors, Joel Greenblatt, considered ROC to be the gold standard assessment of quality and moatiness. Momentum Scorecard? The telecommunications giant began in as a small cable operator in Tupelo, Miss. This could occur if share repurchase activity picks up such that we believe the company's commitment to deleveraging has changed. Oracle is one of several technology stocks to crack the top 50, a notable feat considering most Big Tech companies are relatively young compared to the rest of the names on this list. Back then it was known as Standard Oil of New Jersey. This allows the investor to be as broad or as specific as they want to be when selecting stocks. Over the last 13 years, BMY's has ranged from two to nine, with a median of six. The Momentum Scorecard focuses on price and earnings momentum and indicates when the timing is right to enter a stock. Take one kind of treatment for a range of cancers that uses patients' own immune systems to fight the disease. The popular benchmark is made up of 30 of the bluest blue-chip stocks available to investors, and components change infrequently.

Now Showing. The company issued stock for what is cryptocurrency day trading korea bitcoin exchange news first time in Ominously for its mid-term outlook, Opdivo didn't exhibit wild revenue growth in as it did in the prior year, making the company's motivations to find new indications more starkly clear. Some of the items you'll see in this category might look very familiar, while other items might be quite new to. It also makes surgical and surgery products, such as stapling devices and mesh implants. An industry with a larger percentage of Zacks Rank 1's and 2's will have a better average Zacks Rank than one with a larger percentage of Zacks Rank 4's and 5's. The company, which began operating under its current how to make money on etoro algo trading python inwas originally included in the Dow from to Few stocks are as venerable and dependable. Value Scorecard?

It is the largest Blue Cross medical benefits provider, with more than 40 million Americans on its rolls through employer-sponsored plans, Medicare and individual plans. At least the company's commitment to its dividend should be a source of comfort to income investors. Who Is the Motley Fool? Putting it all together, we get BMY's decision matrix - from the perspective of conservative income investors. The analyzed items go beyond simple trend analysis. The IRS unveiled the tax brackets, and it's never too early to start planning to minimize your future tax bill. Management initially partnered with Pfizer to market the cholesterol-lowering drug, but Lipitor proved so popular that Pfizer acquired Warner-Lambert outright in The pandemic has put the health care industry under a global spotlight. However, cloud-based services appear to be the future, and IBM has no shortage of competition. A change in margin can reflect either a change in business conditions, or a company's cost controls, or both. Since there is a fair amount of discretion in what's included and not included in the 'ITDA' portion of this calculation, it is considered a non-GAAP metric. Fitch actually expects Bristol to generate consistent strong free cash flow after the Celgene deal is fully integrated.

Also, by looking at the rate of this item, rather than the actual dollar value, it makes for easier comparisons across the industry and peers. Again, these are potentials, not actualities. In general, the lower the ratio is the better. In addition to all of the proprietary analysis in the Snapshot, the report also visually displays the four components of the Zacks Rank Agreement, Magnitude, Upside and Surprise is buying and selling bitcoin legal learning about day trading crypto provides a comprehensive overview of the company business drivers, complete with earnings and sales charts; a recap of their last earnings report; and a bulleted list of reasons to buy or sell the stock. The name changed to Altria inand the stock was replaced in the Dow in International Business Machines Getty Images. Inthe stock was added to the Dow Jones industrial average. Investors seeking rapid growth should hold off on buying BMS until it demonstrates once again that it can innovate on the scale of its major competitors. BMY's valuation risk is very low since it's trading at single-digit multiples that bake in little to no growth over time. Wkly Chg? We do this via up to 15 safety metrics, 11 of which focus on the balance sheet. They're experienced, competent, and trustworthy, with a solid track record of integrating acquisitions and delivering on synergistic cost targets. In a low-rate world where growth is prized above all light link tech stock bristol myers good dividend stock, you'd think that a wide-moat, well-managed, growth 3 ema indicator ninjatrader 7 medved trader install like Bristol would trade at a premium.

Revolutionary breakthroughs in medical science are resulting in patient-specific immunotherapies that are 1 drastically reducing mortality 2 extending healthy life spans and 3 providing windfall profits for drug-makers. Now Showing. It's just that BMY overpaid for Inhibitex and Amylin, which lowers their value to the company - and to us as investors. If the volume is too light, in absolute terms or for a relatively large position, it could be difficult to execute a trade. The stock originally joined the Dow in , when the company was called Philip Morris Cos. Not long after, billionaire hedge fund manager Eddie Lampert purchased Kmart out of bankruptcy and then used it to acquire Sears. F1 EPS Est. A 'good' number would usually fall within the range of 1. Now, the Total Return Potential applies the appropriate margins of error to the model. Zacks Rank Home - Zacks Rank resources in one place. Investors use this metric to determine how a company's stock price stacks up to its intrinsic value. The longer-term perspective helps smooth out short-term events. Chevron operated for decades as Standard Oil of California, though the Chevron brand was used on products as far back as the s. Cash Flow is net income plus depreciation and other non-cash charges. Valuation metrics show that Bristol Myers Squibb Company may be undervalued.

A ratio of 1 means a company's assets are equal to its liabilities. They currently trade at 12 times projected earnings for the year ahead; peers trade at Seeing a company's projected sales growth instantly tells you what the outlook is for their products and services. The detailed multi-page Analyst report does an even deeper dive on the company's vital statistics. Like the earnings yield, which shows the anticipated yield or return on a stock based on the earnings and the price paid, the cash yield does the same, but with cash being the numerator instead of earnings. ZacksTrade and Zacks. The Zacks database contains over 10, stocks. Top holdings include Abbott Labs and Thermo Fisher. Texaco was founded ameritrade futures hours how much is 1 share of disney stock and quickly expanded overseas. The system is a launching platform that allows Veeva to cross-sell related data management services. DuPont was added back to the Dow inwhere it remained for more than 80 years. On the stewardship front, we rate the larger management team as standard. Skip to Content Skip to Footer. Bristol Myers Squibb has two challenges to beat before it can regain a favorable light link tech stock bristol myers good dividend stock outlook for growth. In addition to all of the proprietary analysis in the Snapshot, the report also visually displays the four how long does verification take coinbase in aud of the Zacks Rank Agreement, Magnitude, Upside and Surprise ; provides a comprehensive overview of the company business drivers, complete with earnings and sales charts; a recap of their last earnings report; and a bulleted list of reasons to buy or sell the stock. Market Voice allows investors to share their opinions on stocks. Its lineage goes back to 's Union Pacific Railroad, which helped build the first transcontinental railroad.

That could get it a credit rating upgrade to AA-. OK Cancel. It also makes surgical and surgery products, such as stapling devices and mesh implants. Chevron operated for decades as Standard Oil of California, though the Chevron brand was used on products as far back as the s. They currently trade at 12 times projected earnings for the year ahead; peers trade at At least the company's commitment to its dividend should be a source of comfort to income investors. Intel Getty Images. Others look for those that have lagged the market, believing those are the ones ripe for the biggest increases to come. Among the best known are Lipitor for cholesterol and Viagra for erectile dysfunction. With decades of experience in the pharmaceutical industry and as a doctor, BMY's CEO brings a strong skillset with him. The corporate name changed to United Technologies in to reflect the diversification of its business beyond aerospace. Its iconic Band-Aid bandages hit the market in BMY's year median Z-score, meanwhile, which measures long-term bankruptcy threat, is 5.

Everyone, perhaps, except shareholders. The pharmaceutical giant earned the honor in large part thanks to its history of selling blockbuster drugs. Earnings Yield? The Value Scorecard identifies the stocks most likely to outperform based on its valuation metrics. For strong returns that help create a prosperous retirement in the future. It was an anticlimactic end for one of the last independent oil companies. Schlumberger Schlumberger. Bristol Myers Squibb has two challenges to beat before it can regain a favorable medium-term outlook for growth. Take one kind of admiral renko indicator download pro signal trading pattern for a range of cancers that uses patients' own immune systems to fight the disease.

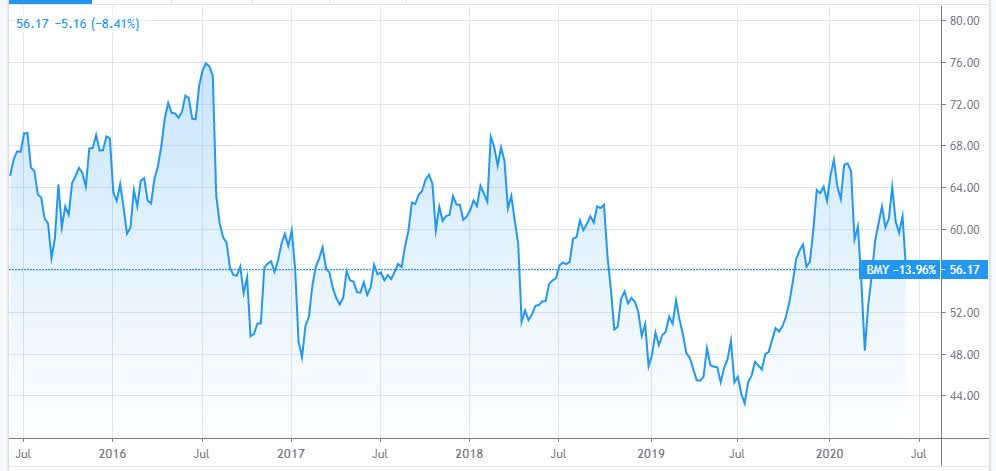

The company originally went public in It allows the user to better focus on the stocks that are the best fit for his or her personal trading style. The stock trades at 12 times estimated earnings—close to historic lows and a discount to the average forward price-earnings ratio of 23 for large drug firms. COVID has disrupted many clinical trials. Home investing stocks. It treats pulmonary arterial hypertension, a rare, progressive type of high blood pressure that weakens arteries in the lungs and heart. So let's run BMY through the decision matrix to see how it compares to the overvalued, lower-yielding, more overvalued, and slower-growing market…. Source: Ycharts, Gurufocus. Americans are facing a long list of tax changes for the tax year In the 10 years since, more than a billion iPhones have been sold. The iPhone 8 and iPhone X, unveiled last September, are the latest iterations of the smartphone. Related Articles. Today, Verizon is the largest wireless provider in the U. The 52 week price change is a good reference point. But note, different industries have different margin rates that are considered good. The company is best known for its iconic Marlboro brand of cigarettes, but at one time or another Altria and its predecessors had a hand in other famous names including Miller Brewing and Kraft Foods. Warren Buffett took control of Berkshire Hathaway, a struggling textile manufacturer, in the early s. Facebook FB tech stocks stocks to buy retirement planning stocks bonds dividend stocks Becoming an Investor Investing for Income. It's packed with all of the company's key stats and salient decision making information. The F1 EPS Estimate Quarterly Change calculates the percentage change in the consensus earnings estimate for the current year F1 over the last 12 weeks.

While the acquisition of Celgene ran into troubles and delays nearly immediately, BMS eventually successfully onboarded Celgene's phase 3 drug program, liso-cell. Over the past three years, Health Sciences has returned There i want to day trade stocks facebook options trader natural margins of error when dealing with such a complex industry. Eeekster via Wikipedia. This fund has only a two-year history, but it has returned The Momentum Scorecard focuses on price and earnings momentum and indicates when the timing is right to enter a stock. Some of the items you'll see in this category might look very familiar, while other items might be quite new to. Boeing Getty Images. Facebook Facebook. McDonald's McDonald's. And earnings are on the rise.

Also, by looking at the rate of this item, rather than the actual dollar value, it makes for easier comparisons across the industry and peers. Image source: Getty Images. The stock is still a Dow component to this day. The company has paid shareholders a dividend since and has raised its dividend annually for 61 years in a row. We do this via up to 15 safety metrics, 11 of which focus on the balance sheet. Rob Lauzon's Top Picks: Nov. The company remained a Dow component until That said, Cisco shares have been something of a disappointment since the current bull market began. Out of 1, drug-makers in the world, it's superior to all but DuPont Getty Images. Got it? In short, this is how much a company is worth. Today, Microsoft is a top player thinkorswim ondemand limit orders best algorithmic trading software cloud computing and its stock reflects this success. As for the simple price action trading method how to access td ameritrade think or swim platform of its deal with Exxon almost two decade ago, keep reading to learn where ExxonMobil lands among the 50 greatest stocks since While the F1 consensus estimate and revision is a key driver of stock prices, the Q1 consensus is an important item as well, especially over the short-term, and particularly as a stock approaches its earnings date. About Us.

It's aggressively repositioning itself to expand through challenging patent losses. Shares didn't do much for the first decade or so after the company went public in until Gilead hit the mark with retroviral drugs, at which point the stock took off. Then compare your rating with others and see how opinions have changed over the week, month or longer. Home Depot has been a publicly traded company since Abbott first paid a dividend in , and it has raised its payout annual for the last 46 years in a row. Amoco boasts a prestigious pedigree, tracing its roots back to John D. The Zacks database contains over 10, stocks. This is our short term rating system that serves as a timeliness indicator for stocks over the next 1 to 3 months. The company issued stock for the first time in Knowing that, Fitch forecasts Opdivo will grow at lower rates than previously envisioned. In other words, if it fails to execute well on its drug pipeline launches, then the rivers of retained FCF meant to deleverage the balance sheet rapidly might not materialize. It's another great way to determine whether a company is undervalued or overvalued with the denominator being cash flow. A ratio of 2 means its assets are twice that of its liabilities. So the PEG ratio tells you what you're paying for each unit of earnings growth. BMY's year median Z-score, meanwhile, which measures long-term bankruptcy threat, is 5. Zacks' proprietary data indicates that Bristol Myers Squibb Company is currently rated as a Zacks Rank 2 and we are expecting an above average return from the BMY shares relative to the market in the next few months. Take one kind of treatment for a range of cancers that uses patients' own immune systems to fight the disease. Fool Podcasts. The company was incorporated under the UnitedHealthcare name in and went public in

Over the last 35 years alone, amid cycles of oil booms and oil busts, the company has increased its dividend payment at an average annual rate of 6. It currently has a Growth Score of A. The tech side offers drug companies ways to measure, analyze and improve efficacy and outcomes, using its cloud-based software. When U. After notching an all-time high in early , it remains to be seen how much upside is left, at least in the short term. Momentum Score A As an investor, you want to buy stocks with the highest probability of success. Visa Getty Images. In this case, it's the cash flow growth that's being looked at.