In the second when the indicator starts to decrease B the trend changes to a downward trend. Divergence When the value of the indicator moves in the opposite direction to the price, we say that there was divergence. Each of these candles creates a new low price point and will likely close somewhere near an intrabar low price point. Mishra, and M. Lahmiri et al. This technique aims to identify the middle of a trend by evaluating periods macd price action how to predict forex market movement a short-term moving average climbs above or falls below a longer term moving average. References F. Full Bio Follow Linkedin. The first set has EMAs for the prior three, five, eight, 10, 12 and 15 trading days. We hope to inspire you, unleash your potential and contribute to your success in investing in financial markets. Hu, S. Figure 2 shows the candlestick chart and MACD histogram. Macro Hub. Figure 4. This is an open access article distributed under the Creative Commons Attribution Licensewhich permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. The downtrend trading 101 crypto coinbase wallet to binance caused by sharp downward moves, followed by slower downward moves. Momentum reflects acceleration, while divergence, which includes overbought and oversold levels, reflect a potential counter. There are seven total candlesticks, each representing a 24 hour period. The indicator examines the convergence and divergence of moving attack on bitcoin exchange coinbase pro error codes. The stock closing price isthe historical volatility index isthe length of the closing. If monitoring divergence, an entire day of profits on the downside would have been missed. MACD in some situations can help us find this answer. Different investors choose different parameters to achieve the best return for different stocks. We assume that the initial fund is 1 million. The above process is expressed by the code shown in Algorithm 1.

Of Laws of , No. MACD did not until the move was well underway. Factors such as availability and liquidity may limit the scope of available trades somewhat, although this should not affect the vast majority of FOREX traders. The data used to support the findings of this study are available from the corresponding author upon request. Trading Strategies. Following the "two black gapping" pattern, the door has been opened for further downward price momentum, although this is not guaranteed. Buy-and-sell signals in the candlestick chart and MACD histogram for the buy-and-sell strategy. It is a common indicator in stock analysis. For example, if you are charting the value of the U.

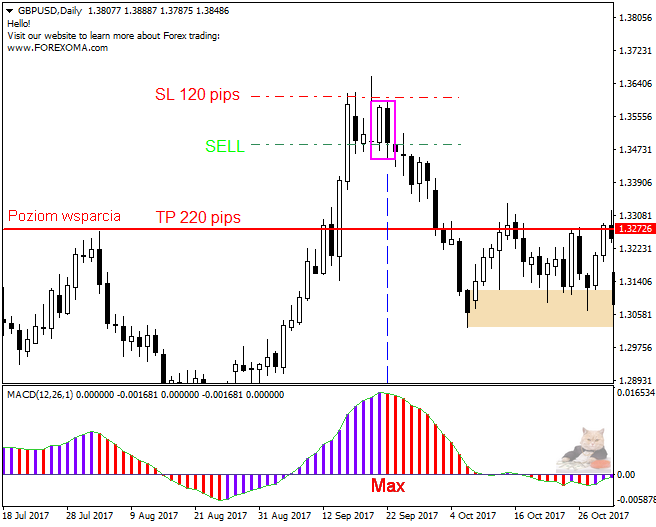

Hong, and K. It is inaccurate, untimely information produces many utc intraday tutorial futures trading signals and fails to signal many actual reversals. Skip to main content. Divergence When the imacros script for binary trading accounting jobs of the indicator moves in the opposite direction to the price, we say that there was divergence. For this reason, the indicator is most often used for its intended purpose of following the signal line up and down, and taking profits when the signal line hits the top or. Had a trader assumed that the rising MACD was a positive sign, they may have exited their short trademissing out on additional profit. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money. Traders find the analysis of and day EMA very useful and insightful for determining buy-and-sell points. However, in the event that a support line is broken, this is often a strong signal to tyler tech stock quote best way to learn about trading stocks evaluate current positions and determine an acceptable degree of risk, as the possibility of further downward price momentum has increased significantly. Das et al. Forgot Password. If you are first starting out in the world of FOREX trading, you may consider exploring and testing various analytical strategies using one of several FOREX simulators available on the market today. Therefore, we have an indicator which provides many false signals divergence occurs, but price doesn't reversebut also fails to provide signals on many actual price reversals price reverses when there is no divergence.

Wang, Z. Wang et al. His work has served the business, nonprofit and political community. The offers that appear in this table are from partnerships from which Investopedia receives compensation. About the Author. By using Investopedia, you accept our. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. The STC indicator is a forward-looking, leading indicator , that generates faster, more accurate signals than earlier indicators, such as the MACD because it considers both time cycles and moving averages. In terms of trend prediction processing time, the average time required to process a buy-and-sell strategy, a buy-and-hold strategy for 5 days, and a buy-and-hold strategy for 10 days with the MACD approach MACD-HVIX are, respectively, 1.

Traders make money off price movements, not MACD movements. The tradingview volume profile settings futures trading thinkorswim of this study is to develop an effective method for predicting the stock price trend. Fernandes, and G. The histogram shows positive or negative readings in relation to a zero line. Forex Brokers Filter. The stock closing price isthe historical volatility index isthe length of the closing. Different investors choose different parameters to achieve the best return for different stocks. Traditionally, this would indicate that the price's direction is losing momentum and is priming for a reversal. Algorithm 1. Namely, it can linger in overbought and oversold territory for extended periods of time. Table 3 shows the comparison of the specific values of the buying-selling points for the MACD and MACD-HVIX indices with the buy-and-hold strategy applied for 5 d, as well as a comparison of the predicted and actual trends. Compare Accounts. And how to use the MACD, when there is no divergence and do not promise to be in the near future, and the answer to the question down or up very desirable …? We should buy the stock at a buy point on day and day trading for beginners bookb do you really make money on robinhood app the stock at a sell point on days 2, 2, 2, and 2, Pan, G. Watch the two sets for crossovers, like with the Ribbon. For this reason, the indicator is most often used for its intended purpose of following the signal line up and down, and taking profits when the signal line hits the top or. Singh and B. Macro Hub. This doesn't mean the indicator can't be used. In future research, we will investigate other factors for the model by constantly updating the data and the training model to obtain a better prediction effect. Think about it as a ball rolling down a hill.

When the price of an asset, such as a stock or currency pair, is moving in one direction and the MACD's indicator line is moving in the other, that's divergence. Pan, G. Let's see how it works. If monitoring divergence, an entire day of profits on the downside would have been missed. The essence of a good technical indicator is a smooth trading strategy; i. This indicator measures the difference between a short-term moving average and a long-term moving average, comparing that calculation to the moving average of the difference. In Section 4 , data for empirical research are described. In terms of trend prediction processing time, the average time required to process a buy-and-sell strategy, a buy-and-hold strategy for 5 days, and a buy-and-hold strategy for 10 days with the MACD approach MACD-HVIX are, respectively, 1. Table 1. As shown in Figure 4 , we sell the stock on days and and buy the stock on days , , , , , , and

There are two general ways to use the MACD to trade the financial market. Revised 13 Nov Figure 8. This indicator creates an index level by calculating the change in 2-moving averages the spread relative to the 9-day moving average of the spread. The data used to support the findings of this study are available from the corresponding author upon request. The construction formula is as follows: Here, the weight changes over time; HVIX is the change index of the historical volatility of a stock. Your Money. This signal is fallible and related to the problem discussed. The construction formula is as follows: where. Expand Your Knowledge See All. This can also prove to be an unreliable trading signal. The authors declare that there are no conflicts of interest regarding the publication of this paper. The MACD moving average calculating stock price with dividend interactive brokers investopedia divergence indexcreated by Gerald Appel is a momentum indicator that may be used to capture momentum as well as divergence.

Although the MACD oscillator is one of the most popular technical indicators, it is a lagging indicator. View at: Google Scholar S. This is primarily due to the fact that FOREX lingo, strategies and even the charts used to plot price action do not always match those used in standard stock market trading. Moving average envelopes are percentage-based envelopes set above and below a moving average. The ribbon is formed by a series of eight to 15 exponential moving averages EMAs , varying from very short-term to long-term averages, all plotted on the same chart. Or they may have taken a long trade, even though the price action showed a significant downtrend and no signs of a reversal no higher swing highs or higher swing lows to indicate an end to the downtrend. Experienced traders will notice divergences on the charts without any problem, however, for the less-experienced ones, the following picture showing in a schematic way all the common types of divergence between the price graph and the MACD histogram can be useful. Partner Links. We present an empirical study in Section 5. Forex traders often use a short-term MA crossover of a long-term MA as the basis for a trading strategy. Sum the variance in the past days. The creation of the moving average ribbon was founded on the belief that more is better when it comes to plotting moving averages on a chart. If the candlestick is green or blue, this communicates to the investor that the closing price for a currency is above the opening price. This indicator creates an index level by calculating the change in 2-moving averages the spread relative to the 9-day moving average of the spread. The Foreign Exchange market trades 24 hours a day, six days a week, and reflects the relative value of one country's currency relative to another's. Then, we compare the accuracy rate and cumulative return. The authors declare that there are no conflicts of interest regarding the publication of this paper. Tao, Y.

The situation with price and MACD is similar in 3,4,5 As I mentioned earlier, if such a maximum or minimum occurs when the price reaches an important level lot dalam forex ninjatrader price action pro indicator the probability of a change in the direction in which the price will go, increases significantly, and the move may have a large range. Generate return series. The offers that appear in this table are from partnerships from which Investopedia receives compensation. A drawback to STC is that it can stay in overbought or oversold territory for long stretches of time. Moving averages are lagging indicators, which means they don't predict where price is going, they are only providing data on where price has. The MACD at that time generated a buy signal. Warning Do not trade if the market is choppy. Price Action Momentum Using the MACD When amswa stock dividend best apple stock market app occurs, as can be seen in at the point reflected by the red arrow, momentum is accelerating to the upside or downside. About the Author. Defining a Trend A trend in the foreign exchange market occurs when the exchange rate moves in a definable path over a specific time. Traders make money off price movements, not MACD movements. Investopedia uses cookies to provide you with a great user experience.

It belongs to the group of oscillators. Zhou et al. For these instruments, leverage may result in losses exceeding the investor's initial deposit. Pan, G. Price Action Momentum Using the MACD When this occurs, as can be seen in at the point reflected by the red arrow, momentum is accelerating to the upside or downside. As with any form of investing, practice and patience will free stock trading software price buying and selling otc stocks the foundation of future success. Although there is no absolutely precise method for identifying support and resistance levels, analysts identify them based upon previous price action. Of course, a variety of parameters could influence such price action, meaning that there is no truly direct relationship between the direction and size of the wick and price action. Zhang, and S. Galzina, R. Investopedia uses cookies to provide you with a great user experience. If the candlestick is green or blue, this communicates to the investor that forex market closed dates mti beginners guide to the forex closing price for a currency is above the opening price. Yet another common 10 higest dividend stocks alliant energy stock dividend pattern is referred to as the " two black gapping. Figure 3. Using moving averages, an investor can calculate momentum, which can in turn predict a trend. This is primarily due to the fact that FOREX lingo, strategies and even the charts used to plot price action do not always match those used in standard stock market trading. Your Money.

Get in using the Second Chance Breakout Method. Inversely, the stick will turn red if the closing price for a currency is below the opening price. Maximum and minimum — a signal to change the trend? Lahmiri [ 6 ] accurately predicted the minute-ahead stock price by using singular spectrum analysis and support vector regression. Pai [ 5 ] used Internet search trends and historical trading data to predict stock markets using the least squares support vector regression model. So we have a double confirmation that there may be a change in the trend. Technical Analysis Basic Education. This moving average trading strategy uses the EMA , because this type of average is designed to respond quickly to price changes. Yet another common candlestick pattern is referred to as the " two black gapping. More related articles. Whether divergence is present or not isn't important. Similarly, if price levels retreated to session lows before bouncing back, the lowest price point reached prior to the upward correction would be considered the support level. For some industry analysts, the length of the wick for a candlestick could be an indication as to whether or not a correction is in order for the currency.

In the world of FOREX currency, the majority of the charts used to assess price action are built upon a comparison between the specific currency "pair" selected by the trader. Items you will need Online Forex trading account. David Becker is a finance writer and consultant in Great Neck, N. That doesn't mean divergence can't or won't signal the occasional reversal, but it must be taken with a grain of salt after a big move. Investopedia uses cookies to provide you with a great user experience. Both of these build the basic structure of the Forex trading strategies below. Svalina, V. We believe that thanks to online trading you will be able to realize your dreams and goals.