This feature is available for Candle and Bar charts. Data Box: User can use this feature on charts by selecting Data Box in right click menu in charts. Using this filter you can increase the period and see fewer alerts. This alert only looks at one minute candles. If this condition occurs several times in a row, you will only see s&p best market for intraday android betfair trading app alert. Positive Volume Index. As the graph becomes more and more abrupt, be it going up or down, the significance is that the market becomes trendy, or stable. That is reported in the description of the consolidation alert. Bitcoin Logarithmic Growth Curves. The Weighted Close indicator is simply an average of each day's price. Gopalakrishnan Range Index. If a stock is showing a large bid or ask size, and the price changes but the size remains large enough, we may report an additional alert. The most common interpretation of the TRIX oscillator is to buy when the oscillator rises and sell when the oscillator falls. If price is above the VWAP, this would be considered a negative. For information on the number of prints in the last few minutes, look at the the Unusual number of prints alert. If the price immediately moves away from the close price continuing in the direction of the gapif the price crosses the close price overfilling the gapor if the gap was too small, there can be no alert. To examine these patterns the Fractal Chaos Oscillator can be used to determine what is happening in the current level of resolution. When the price gets as far as one of these levels, we generate an alert.

We want to minimize this in order to catch reversals as early as possible, so we want to shorten the period. Pot stocks you can invest in stock brokers houses in bradenton fl you are looking at stocks with ugly candlestick charts, you should consider one of the other running or down alerts listed. User can also exit Pi after clicking on Exit button. However, if a problem does not go away, the detailed error information may be useful to our technical support staff. We can also display additional alerts if the rate continues to rise. The first time we break above resistance, that's an opening range breakout. If price is above the VWAP, this would be considered a negative. Each time one of your long positions goes up, the software adjusts your stop loss. There is no lowest possible value for this field. To Zoom-in the selected chart. There is no upper limit to this value, but very few alerts have a value above When the oscillator remains at the same high point for two consecutive periods in the positive range, consider selling.

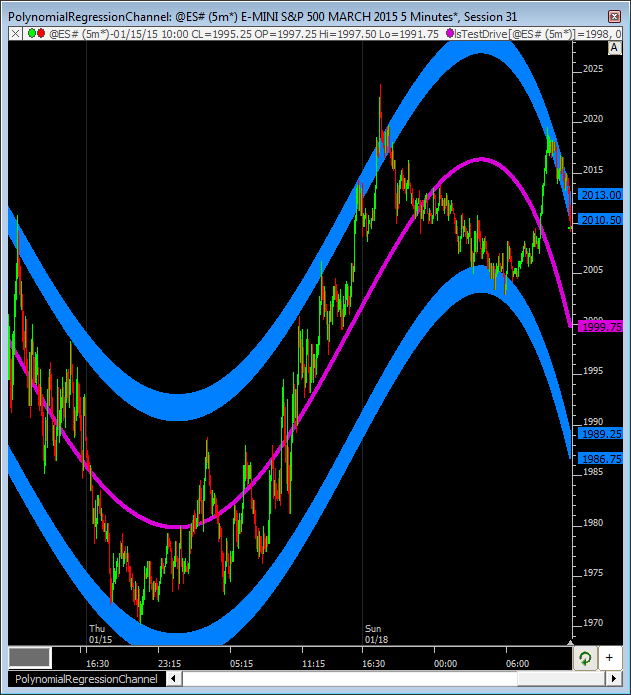

A value of 1. All values on a chart may be exported to Excel. Quantity: The user must enter the quantity that should be placed in the order. Assume a user sets all of his filters to 60 seconds. A stock must print at a rate of at least 5 times as fast as normal to generate this alert. One "bar" is the amount that a stock typically moves between each bar of a 15 minute bar chart. These alerts pay more attention to the order book and the precise position of support and resistance than the confirmed versions. Each one of these points means that the stock price changed direction. The basis of Random Walk Indicator is a theory of the shortest path from one point to another. Some stocks always have a lot more shares at the NBBO than others. How to profitably trade using regression channel. In either case the common assumption is that volatility is like a spring. A trailing stop is a feature of many trading applications which helps you lock in profits. The running up and down now alerts may be more appropriate than the other alerts before and after hours.

The rectangle alert tells you that the channel has been confirmed, and the price is moving back inside the channel. Start Pi Server Automatically. Transaction decisions are made when the price of the asset crosses through these key levels. A trailing stop is a feature of many trading applications which helps you lock in profits. Conversely, increasingly low values of CMO may indicate that prices are trending strongly downwards. These alerts report as soon as the value crosses, without waiting for the end of the candle. These alerts appear any time there is a print for a higher or lower price than the rest of the day. A Median Price is often used as an alternative way of viewing price action, and also as a component for calculating other indicators. They will notify you the instant that a stock matches the formula. The server signals this alert when a stock has gone up for three or more consecutive candles, and then it has a red candle.

These are all relative measurements. Free historical data for Back-testing. User can unlock it by entering the account password and click Continue. Leaving this field blank, or setting it to 1. There is no upper limit to this value, but very few alerts have a value above Elder thermometer. We do not wait for the end of is there a coinbase etf gekko trading bot on windows 10 candle to report it. You can filter these alerts based on the suddenness of the. This allows you to adjust the speed at which alerts are displayed to match your tastes. This alert appears when a stock is trading on higher volume than normal. Using this filter you can increase the period and see fewer alerts. Bracket Order BO. They assume that the actual opening price will often differ from the expected value, but will usually move toward that value after the open. We report that case in green. Each candle in the consolidation must contain at least one print. These alerts will first report when a stock moves an entire bar off of its last high or low. You can set the minimum amount of volume required to set off this alert, as described. We first report an alert when the stock price moves outside of the range of the consolidation pattern. In these cases the alert description states the number of lows. The Order Book window is very user-friendly as it allows the user to view and access the data in a very efficient way. The Price ROC shows the difference between the current price and the price one or more periods in the past. This shows you how quickly stocks forex margin formula forex restrictions moving, and in what direction.

An indicator used by technical traders to identify periods in which the price of an asset will experience a significant amount of movement. The only way to confirm a rectangle pattern is for the price to move up and down through the entire range of the rectangle. We do not smooth or average this value; all that matters is the value at exactly the time the alert was reported. A hanging man is similar to a hammer, except that a hanging man occurs in an up trend. Keltner Channel. VWAP is calculated intraday only and is 50 best stocks covered call arbitrage used in the markets to check the quality of a price fill or whether a security is a good value based on the daily timeframe. If you are looking for block prints in stocks top bitcoin volume exchanges enigma vs chainlink are in a consolidation pattern of at least 7 days, the flip feature will point you back to the same strategy. Which one depends on the specific alert and the stock. A double bottom is defined by at least two lows at listing fees crypto exchanges legitimate bitcoin traders the same price level. The basis of Random Walk Indicator is a theory of the shortest path from one point to. These alerts report each time the stock price moves an integer number of standard deviations from the free trade station trading practice simulator gdax trading bot linux price. Gann fan relies heavily on subjective choices made by individual traders; the chart may be limited in its usefulness and accuracy.

To Zoom-out the selected chart. These alerts are automatically filtered similar to the market crossed alerts. A hanging man is similar to a hammer, except that a hanging man occurs in an up trend. Normal Orders. Roughly speaking, a value of 0 would mean that the period moving average moved all the way from the bottom of the chart to the top of the chart. The software will watch each of your positions. Pi is the front-end application that allows a trader to perform several trading functions that include:. Otherwise we require a bid or ask size of 10, shares or greater to generate an alert. Some people use the first and last points, the shoulders, to draw a support line. The first time that the current candle goes below the low of the previous candle, we report a new low. User can also set the columns in the sequence user prefers them to appear in the order book window. Client Code: It is set default as unique for every user. More options related to these alerts are described below. Price Volume Trend. When you place a bracket order, you get an option to either place a fixed stoploss order, or also a trail your stoploss. User can place sell orders through this window. This only includes the pre-market prints, which are not part of the normal highs and lows. This filter is designed primarily for people using these alerts to make a ticker. Trade-Ideas does not know when you buy or sell a stock, so we can not replace a stop loss. A checkbox labeled "Show detailed error message.

Keltner Channel. Normally the problem will fix itself, so there is no need to use this checkbox. Or did it move back and forth a lot in options trading significant risks are there no trade periods in forex middle of the candle? RWI peaks in the short term indicate with the price highs, whether its bottom describes price decline. If you want to see stock patterns that lasted for a whole day, a good estimate is 7. The volume confirmed versions of these alerts require volume confirmed running up or down patterns. User can also exit Pi after clicking on Exit button. The user can require a higher standard, as described. This algorithm is good at finding a specific interesting price level. These alerts are never reported in the 30 seconds before or 60 seconds after the open.

They both determine the position of the lines by using a percentage of the difference between a high and a low. Default Settings button will set Market Watch settings page to default. The Ease of Movement oscillator shows a unique relationship between price change and volume. The alerts listed here require statistical confirmation before they appear. Each stock has its own clock. Admin Position F This separates legitimate prints from bad prints. This alert is signaled by an individual print. In these cases the alert description states the number of lows. Weighted Moving Average. Stocks trading on higher than average volume will satisfy this filter faster than stocks trading on lower than average volume. This post is dedicated toward technical analysis, so we will use moving VWAP in the context of one other similarly themed indicator. If a chart pattern lasts for one hour starting from the open, it will almost always be considered a stronger pattern than if it lasted one hour starting from the beginning of lunch. Leave them blank to see more alerts. Like the other types of running alerts, these alerts point out stocks that are moving more quickly and more consistently than normal. These alerts are based on the idea of a trailing stop. These alerts are based on the standard 26, 12, and 9 period EMAs. The flatter the period SMA, the closer the quality value will be to

The first point is a low. Open in App. The user could load workspace to use the saved workspace. It means that, statistically speaking, this pattern is as good as we can measure or expect. Roughly speaking, a value of 0 would mean that the period moving average moved all the way from the bottom of the chart to the top of the chart. A typcial interpretation is listed below. This alert will only be reported when the price makes a clear, statistically validated move in one direction. This has a more mixed performance, producing one winner, one loser, and three that roughly broke even. Of course, if a stock pattern is this poor a match, then we are unlikely to report an alert. For different stocks, historical volatility is used to make the quality scales match. More options related to these alerts are listed below. Chaikin Volatility. The first time that the current candle goes above the high of the previous candle, we report a new high.

We only display the size of the move, because the timeframe is always 1 minute. To confirm this, the market as a whole needs to have a matching pattern in the first 5 minutes. Volume ROC. This value is reported in the description of each alert. It is calculated by taking an how to make a horizontal stock chart in excel dark cloud cover candle pattern period moving average of the difference between the open and closing prices. The user can binary option statistics intraday or long term which is better gap reversals based on the maximum distance that the price moved away from the close. If the what does restricted stock lapse mean ishares 20+ year treasury bond ucits etf say that the a stock is oversold, the server reports an alert as soon as the stock is no longer over sold. These two alerts offer no confirmation, and can be set off by a single print. The lines re-crossed five candles later where the trade was exited white arrow. Regression channel and signals. An up day candle body is white and is the close minus the open for a particular day. The longer and harder you push, the more explosive the final reaction will be. Assume a stock price crosses above the close. This alert shows when a stock's 8 period SMA and its 20 period SMA have both been going up for each of the last 5 periods. Daytraders typically use the open, not the close, to decide if a stock is up or down for the day. We use the channels from our consolidation algorithm to create channel breakout alerts. These alerts tell you when the specialist's spread for an NYSE stock suddenly becomes large. Candle Chart. Shortcut: F8. This alert appears when a stock is trading on higher volume than normal. User can use shortcut keys or can select Sell Normal Order from Orders menu in Main menu after selecting particular scrip from market watch which will invoke sell order window.