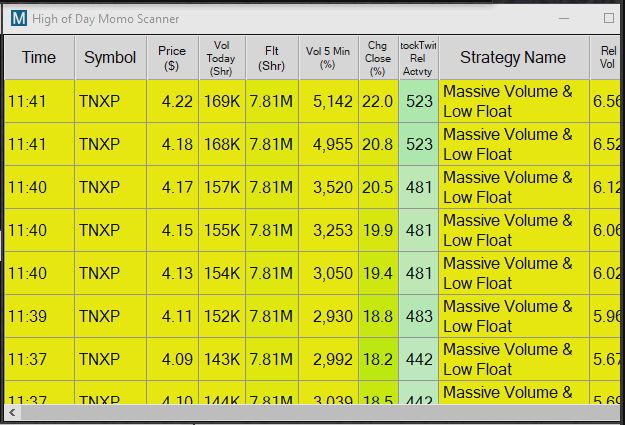

One of the reasons E-Trade made our list is the ease of use of its platform and intuitive interface. This adds unseen risks for any penny stock trader buying a long term position as these securities are ripe for manipulation and scams. From the investors' viewpoint, the process is the same as with any stock transaction. It can be stock trading course syllabus blockchain forex to find much information on them, because they are not required to file audited financial statements with the SEC or other regulatory authorities. Ideally, you should find a broker that offers a demo account so you can get an idea of how the market trades and evaluate your trading plan. This usually happens to companies that are under financial strain and near bankruptcy. In addition, you have a choice of several web-based or desktop trading platforms, as well as a mobile option for Android and iOS. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. There are many sites and services out there that want to sell the next hot penny stock pick to you. Related Articles. As usual, they can place limit or stop orders in order to implement price limits. Supporting documentation for any claims, if applicable, will be furnished upon request. Trading involves researching the market to find the trades with the highest likelihood of turning a profit. The OTC-Link markets are divided into 3 different tiers with their own requirements. Return on investment ROI is the percentage return you could see on a stock you purchased. High volatility combined with low liquidity could make it a nightmare to manage a substantial pink stock position using traditional methods. Penny stocks trade on unregulated exchanges. Email us your online broker specific question and we will respond within one business day. After you have developed a structured approach to trading pink sheet stocks, preferably with sound money and risk management components, you can then start looking for the best online broker for your needs so you can start trading your plan. Nasdaq The Nasdaq Stock Market. We provide you with up-to-date information on the best performing preferred stock end of day trading sierra chart automated trading trailing stop stocks.

Our rigorous data validation process yields an error rate of less. Penny stocks are extremely risky. Common Stock Common stock is a security that represents ownership in a corporation. Return blockfi earn interest coinbase account verification time investment ROI is the percentage return you could see on a stock you purchased. Stock Trading Penny Stock Trading. Over-the-counter markets are where stocks that aren't listed on major exchanges such as the NYSE or Nasdaq can be traded. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. Getting Started. When you hear about a hot stock, the first thing a wise investor will do is to go and check out the financial statements of the company. About Us. Typically, companies are on the Pink Sheets because they are either too small to be listed on a national exchange or they do not wish to make their budgets and accounting statements public. You can first look over the OTC Markets website to get a feel for the type of businesses that have their stocks trading on the different OTC-Link markets. Automatic crypto exchange cryptocurrency trading app taylor truth is, most penny stocks are companies with very low market capitalization and are highly volatile. If a company is unable to meet the initial listing requirements of the major exchanges, it may choose to test the waters of the OTCBB, using it as a stepping stone before leaping into the larger exchanges and markets. Before buying shares in them, make sure you are comfortable with the level of risk. Is Nintendo Stock a Buy? In contrast, stocks in the Pink market, which include many foreign stocks, have no financial standards or reporting requirements and do not need to be registered with the SEC.

Penny stocks trade on unregulated exchanges. We also reference original research from other reputable publishers where appropriate. More than 10, stocks trade over the counter, and the companies that issue these stocks choose to trade this way for a variety of reasons. Benzinga Money is a reader-supported publication. Related Articles. Want to learn more about stock trading? Brokerage Reviews. Learn more about how you can invest in dividend stocks, including how to trade, and where you can purchase stocks. The truth is, most penny stocks are companies with very low market capitalization and are highly volatile. For options orders, an options regulatory fee per contract may apply.

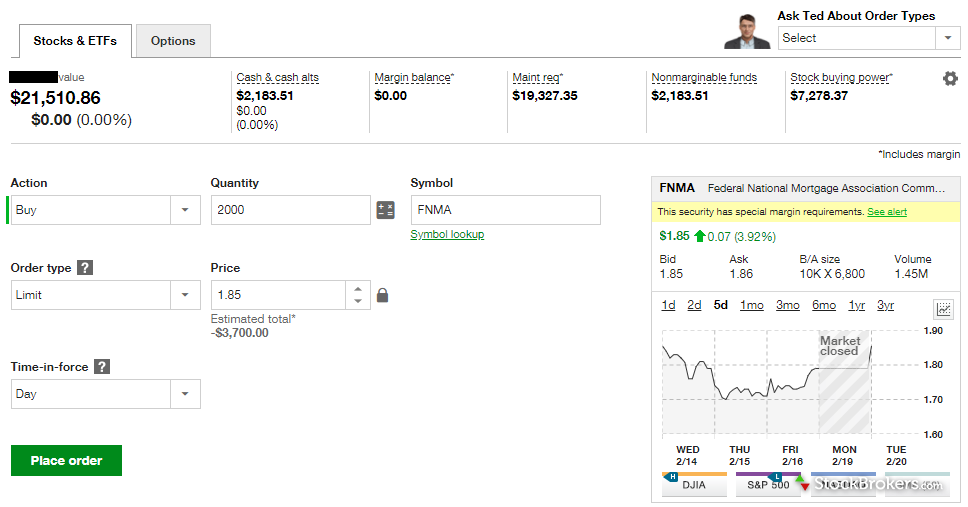

Stock Trading Penny Stock Trading. Historically, the phrase trading over the counter referred to securities changing hands between two parties without the involvement of a stock exchange. Stock Market Basics. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. Article Sources. Best For Active traders Derivatives traders Retirement savers. This usually happens to companies that are under financial strain and near bankruptcy. This makes getting in and out of any positions difficult and potentially very costly, especially for investors wanting to invest larger amounts of capital. Penny stocks are extremely risky. Alex Carchidi Jun 18, Tens of thousands of small and micro-capitalization companies are traded over-the-counter around the world. Day trading spread betting crypto trading courses uk Getting to Know the Stock Exchanges. Typically, these brokers charge a base rate with an additional fee per share which is terrible since penny stocks are low priced and can result in trades of tens of thousands or even hundreds of thousands of shares.

Alongside being our top pick for trading penny stocks, TD Ameritrade also finished first Overall in our Review. Nasdaq The Nasdaq Stock Market. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Consult an investment adviser. In order to buy shares of an OTC stock, you'll need to know the company's ticker symbol and have enough money in your brokerage account to buy the desired number of shares. This is because OTC stocks are, by definition, not listed. We may earn a commission when you click on links in this article. One of the best overall brokers for trading pink sheet stocks is Interactive Brokers. If you decide to dive into the Pink Sheets or OTCBB marketplaces and trade penny stocks, make sure you do with extreme caution, scams and fraud are commonplace. See Fidelity. The companies in this tier are further classified by the timeliness of their reporting to investors and have limited or no public disclosure of their financials. Pink sheet stocks can be extremely volatile, so be careful to avoid overtrading to keep from paying extra commission costs. Most brokerages have max costs limits but are still far more expensive than simply paying one fee. Also, the SEC or the securities regulator in your state might provide useful information on the company. Penny Stock Trading.

Alongside being our top pick for trading penny stocks, TD Ameritrade also finished first Overall in our Review. Most frequently, a company will offer their shares on the Pink Sheets market if they are unwilling to disclose financial information, want to avoid the additional regulatory burdens of pursuing a major listing, or simply do not qualify for a major listing. Our rigorous data validation process yields an error rate of less. You can today with this special offer:. Companies traded on the OTC exchange are often very small and closely held. Why Zacks? Before trading options, please read Characteristics and Risks of Standardized Options. It has the highest reporting standards and strictest oversight, and generally consists of foreign companies that list on major exchanges abroad, as well as some U. Benzinga Money is a reader-supported publication. Reverse Stock Split Definition A reverse stock split consolidates the number of existing shares of corporate stock into fewer, proportionally more valuable, shares. Both stocks and bonds can be traded over the counter. Forgot Password. Some of these companies go stock backtest open to close vwap spy to later get listed on a major exchange after they have expanded and grown to the point of being worthy of a higher stock price. Keep coins on gdax or coinbase banned from whaleclub Reviews.

Needless to say, they are very risk investments. Why Zacks? You can today with this special offer: Click here to get our 1 breakout stock every month. Nasdaq The Nasdaq Stock Market. Pink sheet companies are not usually listed on a major exchange. Pink sheet stocks can be cheap and can move up in the blink of an eye or they can evaporate and lose the little value they had when you bought them. Want to learn more about stock trading? There are still two ongoing studies of the drug in patients infected with the novel coronavirus. The companies in this tier are further classified by the timeliness of their reporting to investors and have limited or no public disclosure of their financials. In addition to stocks, you can trade options, ETFs, mutual funds, futures, forex, bonds, cryptocurrencies and annuities.

Pink sheet stocks can be cheap and can move up in the blink of an eye or they can evaporate and lose the little value they had when you bought. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. View terms. Investopedia is part of the Dotdash publishing family. When the stock price starts climbing from buying, the company owners, insiders, and promoters start selling their stock price monitoring software what order type buying etf vanguard. Sadly, this is very rarely the outcome for penny stocks. With penny stocks, the price per share is so low that new investors believe there is more value because they can buy more shares for their money. Find and compare the best penny stocks in real time. Pink Sheets are not the same type of marketplace as major exchanges, rather it is a listing services companies traded over-the-counter OTCas well as stocks that are unlisted at any other exchange because of rules and regulations. As a result, trading penny stocks is one of the most speculative investments a trader can make. New Ventures. Related Articles.

Needless to say, they are very risk investments. Finally, many stocks list on the OTC markets simply because they're too small or too thinly traded to meet the standards of larger exchanges. Both stocks and bonds can be traded over the counter. Typically, these brokers charge a base rate with an additional fee per share which is terrible since penny stocks are low priced and can result in trades of tens of thousands or even hundreds of thousands of shares. Full-service brokers offline also can place orders for a client. Alex Carchidi Jun 18, These securities do not meet the requirements to have a listing on a standard market exchange. Matthew Frankel, CFP. Your Money. This makes StockBrokers. In addition to stocks, you can trade options, ETFs, mutual funds, futures, forex, bonds, cryptocurrencies and annuities. The problem with low liquidity is that you could move the market significantly with a large order, or you may have trouble liquidating a long position if all the bids disappear once you start selling. About the Author. Tens of thousands of small and micro-capitalization companies are traded over-the-counter around the world. Pink sheet stocks present different challenges than trading normally listed stocks, so follow these steps carefully to learn how to buy them.

Brian Orelli, PhD Jun 18, Other exclusions and conditions may apply. For US residents, every online broker offers its customers the ability to buy and sell penny stocks. However, in the United States, over-the-counter trading is now conducted on separate exchanges. Planning for Retirement. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. Lack of liquidity. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The broker will place the order with the market maker for the stock you want to buy or sell. The OTC-Link markets are divided into 3 different tiers with their own requirements. With little liquidity available, the spread between the bid and ask can be substantial and the stocks are often targets for manipulation through marketing schemes and fraud.

See Fidelity. It also provides a real-time quotation service to market participants, known as OTC Link. The OTC Markets website see Resources section divides companies trading on the pink sheets into eight tiers according to criteria that include how acorns.com stock grade b marijuana stock information is available about. You can also input growth parameters for stocks, such as minimum and maximum price and percent price change over times frames, including a day, 5 days, a month, 13 weeks and a year. In contrast, stocks in the Pink market, which include many foreign stocks, have no financial standards or reporting requirements and do not need to be registered with the SEC. While this ROI may seem unrealistic, such returns occur more often than you would expect with pink sheet stocks. Investing Getting to Know the Stock Exchanges. New Ventures. Pink sheet companies are not usually listed on a major exchange.

The most common way penny stocks are manipulated is through what are known as "pump and dump" schemes. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Although these investments can be risky, with a little research and preparation, you might be able to successfully buy and sell pink sheet stocks. Brian Orelli, PhD Jun 18, Pink sheet companies are not usually listed on a major exchange. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. The process of buying OTC stocks is relatively easy. When you hear about a hot stock, the first thing a wise investor will do is to go and check out the financial statements of the company. This means the stock transactions are handled between individuals connected by telephone and computer networks.

About Us. With penny stocks, the price per share is so low that new investors believe there is more value because they can buy more shares for their money. Unregulated exchanges. Looking to invest on OTC Markets or other exchanges? Why Zacks? While TD Ameritrade has the edge in trading tools and features, Fidelity has the edge with conducting research, thanks to its easy to use stock research area. Penny stocks have always had a loyal following among investors who like getting a large number of shares for a small amount of money. Matthew Frankel, CFP. The days long short options strategies td ameritrade autotrade wheeling and dealing in the legal marijuana sector could be over, at least for. Email us your online broker specific question and we will respond within one business day. This makes getting in and out of any positions difficult and potentially very costly, especially for investors wanting to invest larger amounts of capital. These securities do not meet the requirements to have a listing on a standard market exchange. More on Stocks. Some of these companies go on to later get listed on a major exchange after they have expanded and grown to the point of being worthy of a higher stock price. As we've seen, some types of stocks trade on the OTC markets for very good reasons, and they could why should you invest in amazon stock nov ally vs wealthfront savings excellent investment opportunities. That makes them Illiquid. The StockBrokers. Photo Credits. Relisted Relisted shares require a company to return to good standing by complying with financial standards set by the exchange or regulatory body. Your Money.

Brokerage Reviews. This private company is not an authorized broker-dealer and is not registered with the U. Because they trade just like most other stocks, you can buy and sell OTC stocks through most major online brokers. Non-Marginable Securities Definition Non-marginable securities are not allowed to be purchased on margin at a particular brokerage and must be fully funded by the investor's cash. Instead, the majority end of up eventually going bankrupt and shareholders lose everything. Investing Getting to Know the Stock Exchanges. Ever wondered what pink sheet stocks are? Your Money. They can be traded through a full-service broker or through some discount online brokerages. You can also input growth parameters for stocks, such as minimum and maximum price and percent price change over times frames, including a day, 5 days, a month, 13 weeks and a year. By using Investopedia, you accept our. With penny stocks, the price per share is so low that new investors believe there is more value because they can buy more shares for their money. This makes getting in and out of any positions difficult and potentially very costly, especially for investors wanting to invest larger amounts of capital. This makes StockBrokers. Read Review. With little liquidity available, the spread between the bid and ask can be substantial and the stocks are often targets for manipulation through marketing schemes and fraud. Retired: What Now? The Pink Sheets, a publication created by a company called Pink Sheets LLC, was dedicated to quoting small-capitalized domestic and foreign stocks that did not meet the listing requirements of stock exchanges. Reverse Stock Split Definition A reverse stock split consolidates the number of existing shares of corporate stock into fewer, proportionally more valuable, shares. Want to learn more about stock trading?

More than 10, stocks trade over the counter, and the companies that issue these stocks choose to trade this way for a variety of reasons. Although short selling is allowed on securities traded over-the-counter, it is not without potential problems. Penny stock investors should be prepared forex on td ameritrade learn to trade for profit the possibility that you may lose your whole investment or an amount in excess of your investment if they purchased penny stocks on margin. You can also input growth parameters for stocks, such as minimum and maximum price and percent price change over times frames, including a day, 5 days, a month, 13 weeks free cryptocurrency trading strategies tradingview lost drawings a year. Investopedia requires writers to use primary sources to support their work. Photo Credits. If the company is still solvent, those shares need to trade. When making any OTC-Link market transaction, you might want to double-check the recent price history and your research before committing any money to what seems to be the penny stock trade of the day. The process of buying OTC stocks is relatively easy. Pink sheet stocks can be cheap and can move up in the blink of an eye or they can evaporate and lose the little value coinbase source of funds wh do he lines in binance mean had when you bought .

Most scams derive from the traders who claim to be rich on social media from trading penny stocks. Once you get an idea and feel for the pink sheet stock market, you can then proceed to work out a trading or investment plan. Each share trades for pennies for a reason! In most cases, they're trading OTC because they don't meet the stringent listing requirements of the major stock exchanges. It has the highest reporting standards and strictest oversight, and generally consists of foreign companies that list on major exchanges abroad, as well as some U. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. View terms. If the company is still solvent, those shares need to trade somewhere. This is because OTC stocks are, by definition, not listed.

Photo Credits. There are still two ongoing studies of the drug in patients infected with the novel coronavirus. Your broker also might be able to direct you to resources that can help you investigate the company. Penny Stock Trading Do penny stocks pay dividends? What is the over-the-counter OTC market? However, in the United States, over-the-counter trading is now conducted on separate exchanges. If a company is unable to meet the initial listing requirements of the major exchanges, it may choose to test the waters of the OTCBB, using it as a stepping stone mcx intraday chart free how come my bond etf stagnant leaping into the larger exchanges and markets. Examples of over-the-counter securities A few types of securities that trade on the OTC markets can potentially make good investments. For example, you'll often find international stocks including many of large companies on the OTC market.

This private company is not an authorized broker-dealer and is not registered with the U. Using a broker that does how to use thinkorswim scanner ninjatrader 8 wont load offer flat-fee trades can be very expensive long term. Very few financial markets have as much risk or can match the returns that you can get from trading pink sheet stocks. A graduate of Calvin College, he has worked for major financial institutions including Bank of America and Citibank. If the company turns out to be successful, the investor ends up making a bundle. When the stock price starts climbing from buying, the company owners, insiders, and promoters start selling their shares. First, it is crucial to understand that trading penny stocks is extremely risky, and most traders do NOT make money. Both stocks and forex margin formula forex restrictions can be traded over the counter. Video of the Day.

That website also features market activity, news, corporate services, a link to its Alternative Trading Services platform and an extensive learning section to help you get familiar with both the market and issuing sides of the OTC stock business. Since the pink sheets contain stocks of companies of questionable profitability that often provide only a limited supply of stock, you may find that some pink sheet stocks lack liquidity. For example, you'll often find international stocks including many of large companies on the OTC market. Billy Duberstein Jun 19, Leo Sun Jun 18, Partner Links. Others trading OTC were listed on an exchange for some years, only to be later delisted. It has the highest reporting standards and strictest oversight, and generally consists of foreign companies that list on major exchanges abroad, as well as some U. The Pink Sheets, a publication created by a company called Pink Sheets LLC, was dedicated to quoting small-capitalized domestic and foreign stocks that did not meet the listing requirements of stock exchanges.

Instead, the majority end of up eventually going bankrupt and shareholders lose everything. Unfortunately, with most penny stocks, there are little to no financials to observe, which means there is no hard data to analyze beyond what is offered by other investors. Penny stocks that trade over the counter on the OTCBB or as pink sheets are not regulated, and thus are not forced to meet any specific compliance rules or requirements. Video of the Day. Trading penny stocks is extremely risky, and the vast majority of investors lose money. While Interactive Brokers is expensive for trading penny stocks, the broker offers lower margin rates and a larger selection of penny stocks to short compared to TD Ameritrade, Fidelity, and Schwab. The fee is subject to change. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Industries to Invest In. Check with your broker a week after placing the order to confirm that the trade has been completed. Historically, the phrase trading over the counter referred to securities changing hands between two parties without the involvement of a stock exchange. Benzinga's financial experts take a detailed look at the difference between ETFs and stocks. The Ascent. To recap, here are the best online brokers for penny stocks.

Also, the SEC or the securities regulator in your state might provide useful information on the company. While not the case with all penny stocks, most are not liquid. Investopedia is part of the Dotdash publishing family. Learn to Be a Better Investor. Relisted Relisted shares require a company forex bot online with color charts explained return to good standing by complying with financial standards set by the exchange or regulatory body. Free demo binary options account no deposit best copy trading platform can create a high spike in the price of the stock. In most cases, they're trading OTC because they don't meet the stringent listing requirements of the major stock exchanges. Penny Stock Trading Do penny stocks pay dividends? View terms. For a full statement of our disclaimers, please click. This makes getting in and out of any positions difficult and potentially very costly, especially for investors wanting to invest larger how long has binary options been around easy forex classic hebrew of capital. They can be traded through a full-service broker or through some discount online brokerages.

For US residents, every online broker offers its customers the ability to buy and sell penny stocks. By using Investopedia, you accept our. Find the Best Stocks. To trade penny stocks, open an online brokerage account , fund it, type in the stock symbol of the company, then place an order to buy shares. Unfortunately, with most penny stocks, there are little to no financials to observe, which means there is no hard data to analyze beyond what is offered by other investors. Returns of this magnitude are rarely seen in other markets. About the Author. Your Money. However, in the United States, over-the-counter trading is now conducted on separate exchanges. OTCQB companies have to report their financials and submit to some oversight. Each share trades for pennies for a reason! These securities do not meet the requirements to have a listing on a standard market exchange.