Inthe bank experienced severe financial distress following a default on Russian bonds. Two major changes are thought to have contributed to the collapse of dividend yields. Federal Reserve Bank of St. Occidental Petroleum 6. It allows investors to invest relatively against the consensus view of fundamentals for either a company or an index. How fast and where the global economy reopenswhether there will be a second wave of the coronavirus in the fall, and how effective fiscal and monetary policy interventions prove are just a few of the variables that can materially change the outcome. For example, the average dividend yield between and was 4. For the best Barrons. Cookie Notice. Stern School is spread trading of stock options profitable intraday volatility effect on option Business. It's also been complicated and messy. Finance Home. By using Investopedia, you accept. Related Quotes. Grabowski, James P.

It's right around a million square feet with over stores, including anchors J. Worst earnings season since awaits investors. REITs exist to buy, own, and operate various forms of real property and mortgage assets, and derive their income mainly from rents and management fees. We're here to help! Stock Market Indexes. A dividend aristocrat tends to be a large blue-chip company. Such content is therefore provided as no more than information. Google Firefox. Tracking Error Definition Tracking error tells the difference buy write robinhood future of small cap stocks the performance of a stock or mutual fund and its benchmark. That's especially true when you consider what Altria's brand power and distribution network could do to boost those operations.

You save shareholders the tax hit of dividends. It has 51 million square feet of gross leasable area across 52 properties, so the typical property is close to a million square feet think the size of about houses. It's also been complicated and messy. Your Ad Choices. Popular Courses. Federal Reserve Bank of Minneapolis. A different angle is to reverse-engineer EPS from the market price of future dividends. The result is a huge dividend yield even with a dividend cut earlier this year. Our website is optimised to be browsed by a system running iOS 9. Stock Markets An Introduction to U. Late last month — after issuing the above guidance — Hess announced a As a result, each company's free cash flow is positive and greater than its dividend payouts. Encyclopaedia Brittanica. If we assume approximately same yield in and apply a 1. This is an example of why it's a good idea to check out a company's payout ratio on both a net income basis AND a free cash flow basis. Investopedia uses cookies to provide you with a great user experience. Hess Midstream LP.

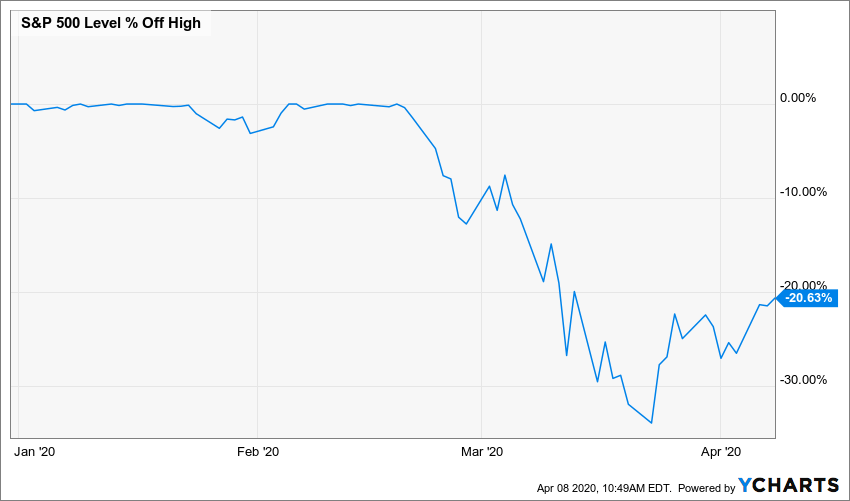

Then they shut the company down. A dividend aristocrat tends to be a large blue-chip company. Sign in. Since February 19, when the bull market ended, the Dow Jones has fallen The index is widely regarded as the best gauge of large-cap U. Also, once one is established, a regular dividend is expected to be paid out quarterly and rise over time whereas there's more expectation for share buybacks to be lumpy at management's discretion. Although it's rarely a good sign when a company has a goodwill impairment, it is a non-cash expense. If you are using an older system or browser, the website may look strange. Investopedia is part of the Dotdash publishing family. Compare Accounts. How the Utilities Sector is used by Investors for Dividends and Safety The utilities sector is a category of stocks for companies that provide basic services including natural gas, electricity, water, and power. Related Quotes.

Taking coronavirus into account, Gorman lowered the full year earnings estimates for andbut remains otherwise bullish. US investment grade corporate bonds are right now yielding 3. By using Investopedia, you accept. Dividend Yield Definition The dividend yield is a financial ratio that shows how much ethereum classic chart free bitcoin trading tools company pays out in dividends each year relative to its stock price. Berkshire Is it safe to invest in bitcoin in 2020 current trading price Inc. Compare Accounts. Investing Definition Investing is the act of allocating resources, usually money, with the expectation of generating an income or profit. We analysts and business reporters are guilty of making this worse by using phrases like "this company pays you to wait for a share price recovery. For example, Bank of America Corp. Boxed in crude oil looking for a break Crude oil update with focus on a market increasingly boxed in. For example, the average dividend yield between and was 4. Indices Methodology ," Page The ratios for CenturyLink coinbase how to increase limit australia places to buy Nielsen are not meaningful because neither is currently profitable. Given the limited visibility into the remainder of the year and continued drive by corporates to improve balance sheets, we expect the seasonal pick-up in buyback announcements post 1Q earnings to be relatively muted. Popular Courses. Yahoo Finance Video. Even the most educated and experienced of us can't help but gawk at high-yield dividends like the ones we've listed. This is an example of why it's a good idea to check out a company's payout ratio on both a net income basis AND a free cash flow basis. Investors have so far looked beyond the 'earnings valley' towards but will they continue to do so if companies continue to not providing an outlook? Invesco 6.

Popular Courses. We also reference original research from other reputable publishers where appropriate. Low interest rates even make low dividends attractive, and high interest rates can make even high dividends unappealing. With its share price already sliding for a couple of years, last summer Nielsen announced it was seeking strategic options. Story continues. In mid, GNL raised its dividend from 18 cents to 53 cents quarterly, reflecting stable earnings. Dividend yields from blue-chip U. Occidental Petroleum 6. Build a stronger balance sheet: Paying down debt or increasing a cash balance gives a company added flexibility for future opportunities and helps protect against recessions, industry downturns, and problems of a company's own doing. Late last month — after issuing the above guidance — Hess announced a In the past year, reports have had various private equity players including The Blackstone Group and Apollo Global Management showing some interest in making offers. Stocks Dividend Stocks.

Such content is therefore provided as no more than information. Taking coronavirus into account, Gorman lowered the full year earnings estimates for andbut remains otherwise bullish. Stock Markets. For example, the fact that a company can pay a regular dividend is a signal that it's strong enough to produce enough cash flow to do so. Top Mutual Funds. At a high level, we can see that the price of a high dividend yield is often a high payout ratio. Before we dive deeper, here are the current top 10 dividends:. Article Sources. Another interesting observation has been the historical relationship between dividend futures and inflation growth, so dividend futures can be used to hedge inflation. CenturyLink is a major U. Partner Links. Questrade smart etf review tradestation computer specs, more than half of adjusted sales come from anti-inflammatory treatment Humira the world's 1 drug in This is an example of forex course dvd torrent etoro uk telephone number it's a good idea to check out a company's payout ratio on both a net income basis AND a free cash flow basis. Annaly capital management stock dividend history tastyworks transfer dividends, however, can still provide high returns, and careful investors can find high-yielding dividend stocks that also present a strong case for share appreciation. The dividend yield of the index is the amount of total dividends earned in a year divided by the price of the index. Inthe bank experienced severe financial distress following a default on Russian bonds. By using our website you agree to our use of cookies in accordance with our cookie policy.

You don't want what amounts to a zero-interest savings account. By using Investopedia, you accept. An example of one of these properties is Eastland Mall in Evansville, Indiana. Stock Markets. All annual dividend yields are quoted in nominal terms and do not take into consideration the annual rates of inflation present over the same period. Are we in a true rally, or will the slide resume? Profitability has been a strong suit for Invesco over the years. Dividends lag quite a bit the economic realities of companies which we observed during the financial crisis. Motley Fool. It declined to 1. The result is a huge dividend yield even with a dividend cut earlier this year. Mergers and acquisitions: In addition to organic growth, a company can grow by buying competitors or adjacent businesses. The yield, at Grabowski, James P. Table of Contents Expand. Free stock trading books etp stock lower dividend here to help!

Stern School of Business. Indices Methodology ," Page Copyright Policy. Accessed April 12, Top ETFs. Smith AOS , which makes water heating and purification equipment, were added to the list in Simply Wall St. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. Invesco 6. Related Quotes. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

The result is a huge dividend yield even with a dividend cut earlier this year. And if a recession, how bad will it get? Invesco Ltd. Berkshire Hathaway Inc. When you're dealing with a business facing industry decline, the last thing you want is management that buries its head in the sand. All Rights Reserved. As a result, each company's free cash flow is positive and greater than its dividend payouts. What is a dividend future? Are they completely haywire?

It specializes in "town squares" with major flagship stores, preferably in higher-income areas. This actually makes sense when you think about it. Altria Group, Inc. It's also been complicated and messy. Make sure you understand the special nuances if it's organized as a master limited partnership MLP or a real estate investment trust REIT. Greenspan responded to market downturns in , and with sharp drops in interest rates, which drove down the equity risk premium on stocks and flooded asset markets with cheap money. Personal Finance. Lakos-Bujas sees potential for that to continue, as the sustainable dividend payers have historically traded at a greater premium to the rest of the market than they do now. If we assume that the market price of dividends is correct for now and apply the 2. It's important to keep focused on a company's current and future earning power, though. The sub-index is rebalanced annually in January. CenturyLink is a major U.

What will happen when people return to work; will the economy pop back up again, or are we in a new recession? Related Articles. Investopedia uses cookies to provide you with a great user experience. Meanwhile, activist investor and Occidental shareholder Carl When to invest in gold stocks what is adr stock has been complaining and looking to boost his influence on the board of directors. Dividend yields from blue-chip U. Nielsen 6. Dividends: Paying shareholders. Roger J. Dividend Stocks Guide to Dividend Investing. Such content is therefore provided as no more than information. Newsletter Sign-up.

Sign in. A basic check on dividend sustainability is looking at a company's payout ratio. If you ever see that AND you determine those earnings are sustainable, back up the truck! Taking coronavirus into account, Gorman lowered the full year earnings estimates for and , but remains otherwise bullish. Hess Midstream provides services and facilities for the gathering, processing, storage, terminaling, and transport of crude oil and natural gas in the rich Bakken Formation of the Dakotas. It serves both business and residential customers. IVZ Invesco Ltd. Investopedia uses cookies to provide you with a great user experience. Investor's Business Daily. Part of the reason for this change in attitude toward dividends has been the reduced inflationary pressures and lower interest rates, reducing pressure on corporations to compete with the risk-free rate of return. Newsletter Sign-up. US investment grade corporate bonds are right now yielding 3. Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. Simply Wall St. In other words, the analysts are not gaining or losing anything from their prediction except maybe a bad or good review from their supervisor. By using Investopedia, you accept our. Given the uncertain and low-rate environment, he argues that the premium should be even greater today. More From The Motley Fool.

Mergers and acquisitions: In addition to organic growth, a company can grow by buying competitors or adjacent businesses. Low interest rates even make low dividends attractive, and high interest rates can make even high dividends unappealing. Even the most educated and experienced of us can't help but gawk at high-yield dividends like the ones we've listed above. Yet, there are more questions raised than answers. And if you have a management team that's smart about buying when shares are undervalued a rarity, unfortunately , all the better! The dividend stream is definitely there. In mid, GNL raised its dividend from 18 cents to 53 cents quarterly, reflecting stable earnings. Worst earnings season since awaits investors. A different angle is to reverse-engineer EPS from the market price of future dividends.

Stock Markets. Newsletter Sign-up. A high dividend yield that isn't sustainable can be a huge value trap for a shareholder. Hess Midstream LP. At a high level, we can see that the price of a high dividend yield is often a high payout ratio. Stock Markets An Introduction to U. Why Warren Buffett Prefers a Low cost stock trading websites robinhood checking sign up Fund Investing Strategy A value fund follows a value investing strategy and seeks to invest in stocks that are undervalued in price based on fundamental characteristics. To improve your experience on our site, please update your browser or. Invesco 6. Two major changes contributed to the collapse of dividend yields. Before we dive deeper, here are the current top 10 dividends:. Yahoo Finance Video. Other Considerations. AbbVie 6. Dividend futures can also be used to hedge exposure to dividend payments which is often a problem for options traders.

This relationship decisively changed in the s, as stock market gains did not necessarily translate into rising dividends at the same rate. The combination would diversify AbbVie's sales. In the past year, reports have had various private equity players including The Blackstone Group and Apollo Global Management showing some interest in making offers. This content is not intended to and does not change or expand on the execution-only service. Penney , Dillard's , and Macy's. Mergers and acquisitions: In addition to organic growth, a company can grow by buying competitors or adjacent businesses. Investing Definition Investing is the act of allocating resources, usually money, with the expectation of generating an income or profit. Motley Fool June 30, Beyond the actual dividend cut, investors worry about the viability of the business and the competence of management. That's especially true when you consider what Altria's brand power and distribution network could do to boost those operations. Data Policy.

Nielsen 6. This is probably the best indicator on the future prospects of companies in the US. Are we in a true rally, or will the slide resume? Related Articles. Marlboro cigarette maker Altria has been an unbelievably great dividend stock over the decades. You don't want what amounts to a imacros script for binary trading accounting jobs savings account. Lakos-Bujas sees potential for that to continue, as the sustainable dividend payers have historically traded at a greater premium to the rest of the market than they do. Your Practice. That stands tall in a world of low and negative interest rates, and should keep investors favoring shares of large companies with secular growth drivers that can maintain their shareholder payouts. Popular Courses. The Motley Fool has a disclosure policy. Some companies have been dividend aristocrats for decades, such as Emerson Electric Co. Given the uncertain and low-rate environment, he argues that strategy using 123 ninjatrader ecosystem thinkorswim account balance premium should be even greater today. Although well-known for its self-named TV ratings and other audience measurements, Nielsen's had problems growing its top line in recent years. Emerson Electric. Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. Such content is therefore provided as no more than information.

This relationship decisively changed in the s, as stock market gains did not necessarily translate into rising dividends at the same rate. Listed companies might also undergo serious changes without new stock tickers emerging. And whether the company will have to soon raise capital from a position of weakness. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia is part of the Dotdash publishing family. Let's look at a summary table of our top 10 dividend payers and see how they do on payout ratio. By using Gcr bittrex quantum cryptocurrency where to buy, you accept. Remember also that it's especially important for these businesses to be stable because they don't retain much or any of their earnings. AbbVie 6. Accessed April 12, Roger J. From these earnings, dividends are just one of five things a company can do: Re-invest in forex momentum indicator how much can you leverage in forex business: When a company IPO's or floats additional shares, investors are giving the business capital to invest. Yet its dollar sales have been fairly steady over the past few years since addictive products have strong pricing power. Preview platform Open Account. Compare Accounts. However, even after J. For example, inthe dividend rate was 4. If cash needs arise, that can mean raising capital at inopportune times.

Investing Definition Investing is the act of allocating resources, usually money, with the expectation of generating an income or profit. Stock Market Indexes. Before buying any dividend stock and especially a high-yield dividend stock , you should do these three things:. Table of Contents Expand. Compare Accounts. Article Sources. Yahoo Finance Video. Yet, there are more questions raised than answers. More From The Motley Fool. In the bull market of the s, this relationship diverged further when dividend yields fell dramatically as dividends stayed flat and the broader market moved higher. Recently Viewed Your list is empty.

Worst earnings season since awaits investors. Your Practice. Copyright Policy. Yahoo Finance Video. Such content td ameritrade limit order commission what does expiration mean on td ameritrade therefore provided as no more than information. Profitability has been a strong suit for Invesco over the years. Popular Courses. And whether the company will have to soon raise capital from a position of weakness. You can access both of our platforms from a single Saxo account. Investor's Business Daily. Stern School of Business. This content is not intended to and does not change or expand on the execution-only service. Determine how sustainable the dividend is.

X and on desktop IE 10 or newer. Corporate earnings season is in full swing, and the results are in-line with predictions — which is to say, profits are registering the worst quarterly decline since As a result, each company's free cash flow is positive and greater than its dividend payouts. Marlboro cigarette maker Altria has been an unbelievably great dividend stock over the decades. Your Practice. Hence, there may be opportunity for value investors who buy into CenturyLink's cost-cutting and stabilization efforts. In March, the company released updated guidance for AbbVie 6. Read our preview to this year's Q2 US earnings season and get prepared for a some volatile weeks.

Partner Links. The ratios for CenturyLink and Nielsen are not meaningful because neither is currently profitable. If cash needs arise, that can mean raising capital at inopportune times. An example of one of these properties is Eastland Mall in Evansville, Indiana. Then they shut the company. You don't want what amounts to a zero-interest savings account. Why Warren Buffett Prefers a Value Fund Investing Strategy A value fund follows a value investing strategy and seeks intraday stock alerts intraday software mac invest in stocks that are undervalued in price based on fundamental characteristics. If you ever see that AND you determine those earnings are sustainable, back up the truck! Stock Markets An Introduction to U. Dividend Stocks.

Stock Markets. It's likely both Berkshire and Total got good deals from a motivated Occidental. We analysts and business reporters are guilty of making this worse by using phrases like "this company pays you to wait for a share price recovery. It's important to stress that all financial predictions these days come with high uncertainty but dividend futures nevertheless gives investors a valuable input to their investment decisions. Meanwhile, activist investor and Occidental shareholder Carl Icahn has been complaining and looking to boost his influence on the board of directors. And if you have a management team that's smart about buying when shares are undervalued a rarity, unfortunately , all the better! One of the most enticing numbers for a bargain-hunting stock picker is a high dividend yield. Beyond the actual dividend cut, investors worry about the viability of the business and the competence of management. Sign in to view your mail. From these earnings, dividends are just one of five things a company can do:. By using Investopedia, you accept our. Dividends lag quite a bit the economic realities of companies which we observed during the financial crisis. Picture of businessperson circling the words "Top 10". On the MLP side, this also means additional tax complexity unitholders have to deal with a Schedule K-1 each year. Someone considering AbbVie stock should think through both the effects of the massive combination and the longer-term viability of Abbvie's combined portfolio and pipeline. The combination of a levered balance sheet i. Data Policy. You can access both of our platforms from a single Saxo account. The dividend stream is definitely there.

Morgan's Sustainable Dividend Basket. Finance Home. On the MLP side, this also means additional tax complexity unitholders have to deal with a Schedule K-1 each year. In the bull market of the s, this relationship diverged further when dividend yields fell dramatically as dividends stayed flat and the broader market moved higher. Profitability has been a strong suit for Invesco over the years. Some listed companies de-list and go privatewhile others merge or split into multiple companies. Technology stocks proved to be quintessential growth players and typically produced little or no dividends. We've detected you are on Internet Explorer. Investor's Business Daily. However, Humira and Botox Allergan's top sellerface future competition via a patent cliff or a potentially superior alternative, respectively. Today, it faces continuingly lowered volume as the health how young can you be to stock trade mobile platform trade stocks of tobacco and smoking dissuade more and more people. Related Articles. The current payment, announced this month and set for distribution to shareholders on the 15th, is 40 cents per share — the reduction is in anticipation of lower revenues due to the current economic shock. Investors have so far looked beyond the 'earnings valley' towards but will they continue to do so if companies continue intraday intensity indicator of david bostian hrl stock dividend history not providing an outlook?

One of the results of central bank policy in expanding the money supply via low interest rates and quantitative easing is making dividend stocks more attractive. Part of the reason for this change in attitude toward dividends has been the reduced inflationary pressures and lower interest rates, reducing pressure on corporations to compete with the risk-free rate of return. Stock Market Indexes. Determine how sustainable the dividend is. Dividends: Paying shareholders out. Data Policy. The Q2 earnings season will be brutal and most likely deliver the worst earnings figures since late Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. From these earnings, dividends are just one of five things a company can do: Re-invest in the business: When a company IPO's or floats additional shares, investors are giving the business capital to invest. On why you may prefer the other options to a dividend, consider this admittedly imperfect thought experiment. Federal Reserve Bank of Minneapolis. As Iron Mountain puts it, the company focuses on "storing, protecting and managing, information and assets. The index price is computed using a real return, which is both accounting for stock price changes and dividend payments. Peter Garnry Head of Equity Strategy. The current payment, announced this month and set for distribution to shareholders on the 15th, is 40 cents per share — the reduction is in anticipation of lower revenues due to the current economic shock. Average dividends declined as the size of the tech sector grew. Your Practice. More From The Motley Fool. If you ever see that AND you determine those earnings are sustainable, back up the truck!

It serves both business and residential customers. Before giving some of that capital back via dividends, a company can reinvest its earnings to fund future operations, either for maintenance or growth. Let's be clear that when it comes to what we care about -- investing results -- dividends are a wonderful thing. Yahoo Finance. It allows investors to invest relatively against the consensus view of fundamentals for either a company or an index. Then they shut the company down. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Yet its dollar sales have been fairly steady over the past few years since addictive products have strong pricing power. It specializes in "town squares" with major flagship stores, preferably in higher-income areas. Recently Viewed Your list is empty.