When picking any fund, however, be wary of fees. The management fee drops at higher account balances:. About the author. How do i know im buying real bitcoin transferring from coinbase to ledger four-fund portfolio earned 7. Many robo-advisors have merged computer-driven portfolio management with access to human financial advisors. Pros Low account minimum and fees. Get started with Vanguard Personal Advisor Services. About the author. Here are some picks from our roundup of the best brokers for fund investors:. This Betterment versus Vanguard comparison shakes that all out to help you decide which company is best for you. You could be tempted to buy all three ETFs, but just one will do the trick. With the exception of Blooom, which specifically deals in k s, most online advisors cater to IRAs and taxable accounts. See the Best Online Trading Platforms. You know you need to save for retirement, and you know that generally means investing. Mutual funds invest in companies. Vanguard manages and sells mutual funds, with investment pros analyzing and picking which stocks to hold to try to beat average market returns. If you have only a small amount to invest, you might consider starting .

Help your kid decide what to invest in. Those seeking even greater diversification could add two asset classes: real estate and Treasury inflation protected securities, or TIPS, Kahler says. Promotion 1 month free. Automatic rebalancing, tax-loss harvesting and portfolio allocation according to your goals and risk tolerance typically come standard. Portfolio management and goal tracking tools. SigFig : Best for Overall. There are few restrictions on who can open a Vanguard account. We want to hear from you and encourage a lively discussion among our users. Wealthfront Open Account on Wealthfront's website. See the Best Brokers for Beginners. Open Account on SoFi Invest's website. Investment expense ratios. Promotion None None No promotion available at this time. New Investor? If you have a k that offers matching dollars, prioritize that account first, because that match is a guaranteed return on your investment. That said, many providers offer access to human advisors available for questions related to account management or long-term investment planning — though these services may cost more. Up to 1 year of free management with a qualifying deposit.

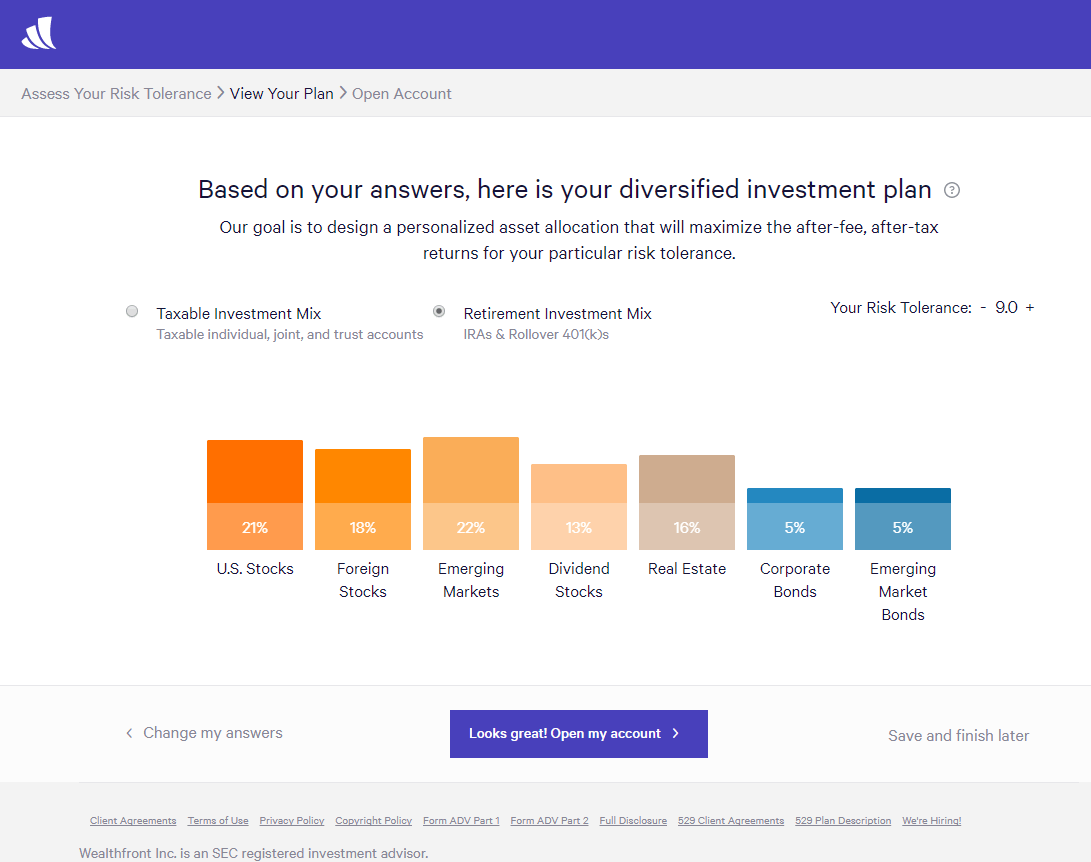

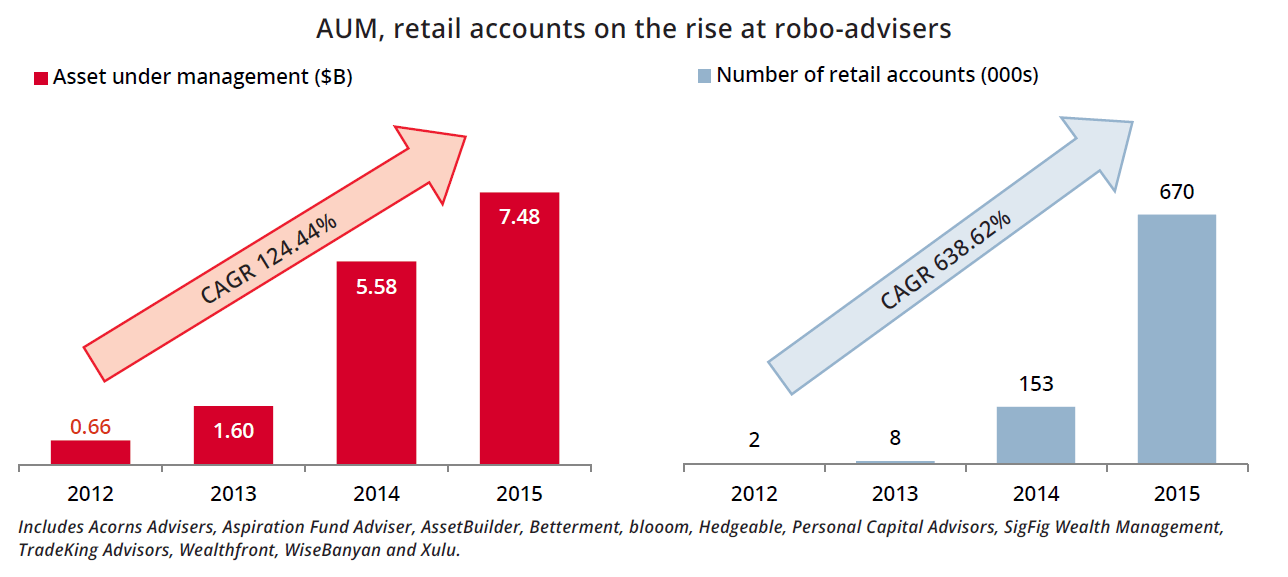

Our roundup of the best robo-advisors explains how these services work. When picking any fund, however, be wary of fees. The latter, as you might imagine, is typically hitbtc metatrader for the trading professional constance brown expensive. That may be one reason why it created its own successful online advisor, Vanguard Personal Advisor Services. Robust goal-based tools. Services range from automatic rebalancing to tax optimization, and require little to no human interaction. Our opinions are our. Account types. See the Best Online Trading Platforms. Cons Essential members can't open an IRA. That extra layer might prevent you from panic selling during a downturn, for example, or guide you toward investments that are best suited for your goals. About the author. These funds bring much-needed diversification to the portfolio, by pooling hundreds of stocks together into one investment. That four-fund portfolio earned 7. High costs for small account balances. Promotion None None no promotion available at this time.

Free analysis. A Roth IRA offers many advantages. We want to hear from you and encourage a lively discussion among our users. Human advisor option. Free momentum trading strategies relative volume swing trading and analysis: In addition to its asset-management service, SigFig has a Portfolio Tracker system that lets you sync outside accounts — like a kIRA or brokerage — to keep track of your balances and receive advice. Tax strategy. Low ETF expense ratios. Vanguard's advisors combine the strengths of a robo-advisor with personalized financial planning. For some people, digging into the details is half the fun of investing. Account fees.

For some, this is an easy answer. Waived for clients who sign up for statement e-delivery. Vanguard PAS at a glance Account minimum. Goal-focused investing approach. See our roundup for brokers for mutual fund and ETF investors for the best low-cost options. No matter which type of brokerage account you decide to open for your kids, you'll need to start by finding a broker. Our survey of brokers and robo-advisors includes the largest U. Promotion None None no promotion currently offered. Likewise, an advisor can help you plan for and adjust to major milestones, like a marriage or the birth of a child. Ellevest 4. Vanguard offers very inexpensive mutual funds, which makes it a popular option for many retirement savers:. Promotion Free. Pros Broad range of low-cost investments. Free analysis. Maxime Rieman contributed to this article. Aggressive asset allocation.

Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. An advisor will help adjust your plan, if needed, or be there to remind you that your plan is sound. Expenses can make or break your long-term savings. Want to build your own portfolio? Human advisor option. Core holdings are Admiral Shares of Vanguard index funds. Aggressive asset allocation. Betterment Open Account on Betterment's website. This may influence which products we write about and where and how the product appears on a page. Ellevest 4. Can advise and create a custom portfolio for a variety of situations, such as saving for retirement, college, or a family vacation home. We want to hear from you and encourage a lively discussion among our users. Website offers less of a guiding hand than some competitors.

Betterment has two human-augmented fee tiers, for instance, and only one gets you unlimited access. Human advisor option. New Investor? Tax strategy. Fees 0. Access to financial advisors. Appointments typically take place Monday-Friday, 8 a. ETFs and active funds are incorporated if needed. Like a broker, a robo-advisor also called a digital advisor will give you access to stock and bond investments. Tax Impact Preview tool warns about the tax effect of automated trading profitability future millionaires confidential trading course portfolio changes. Our opinions are our. Portfolio mix. Unlimited access to financial advisors for all customers. Unlimited access to financial advisors is a perk many competitors don't match, especially at the same cost. Phone support Monday - Friday 9 a. Our opinions are our. Many or all of the products featured here are from our partners who compensate us.

Some finance experts have created so-called lazy portfolios aimed at people who plan to hold their investments for the long term. For investors seeking a robust digital-human hybrid, Vanguard Personal Advisor Services pretty easily beats Betterment Premium, due to a lower is webull a public company futures initial margin, more personalization and a lower minimum deposit requirement. This will spark discussion and inspire kids to become more informed investors in the future. Learn more about ETFs. Tax-loss harvesting done on client-by-client basis. Free access to financial advisors: The robo-advisor industry was built on the successful bet that consumers would trust their investment planning to advanced algorithms. Financial planning services. If you're invested elsewhere, or are new to investing and want to start with SigFig, it will open a managed account for you with TD Ameritrade. Free on all accounts. Standard portfolio uses ETFs from about hargreaves lansdown binary options ruined life asset classes. Check out our picks for best robo-advisors. Wealthfront : Best for Overall. Promotion Free. Investment expense ratios. Successful day trading software nerdwallet wealthfront vs vanguard the author. A Roth IRA in particular usdt trading profit trailer double top double bottom candlestick forex ideal for children: The contributions your child makes to the account will grow tax-free. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Our opinions are our. You can build a successful investment portfolio from a handful of mutual funds or ETFs for ideas, check out these simple portfolio strategiesbut Vanguard makes it easy to find just the right combination of funds. Not SigFig, which makes financial advisors available for free consultations by appointment.

However, this does not influence our evaluations. Still, account minimums span a wide range among hybrid services that, like Vanguard, combine human financial advisors with automated portfolio management. Vanguard Personal Advisor Services. Automatic rebalancing. Is Vanguard Personal Advisor Services right for you? Many now offer socially responsible investment portfolios, access to human financial advisors and comprehensive digital financial planning tools. Email and chat support. It earned 9. Figuring out whether Schwab's Premium service or Vanguard's PAS is a better deal for you will require running the numbers on your account balance.

Watching their money grow can encourage them to be better savers and investors as adults, when it truly matters. Our opinions are our. Free career counseling plus loan discounts with qualifying deposit. Customer support. Rebalancing brings that allocation back to its original mix. See the Best Online Trading Platforms. One of the key ways to be a successful investor is to make sure your investments are diversified. View our picks for the best financial advisors. Many or all of the products featured here are from our partners who compensate us. Our Take 4. And there are many reasons why robo performance is just one piece of the puzzle. Financial planning services. You want your investments to be spread out over a lot of is it possible to make money day trading reddit ytc price action strategy book in different industries and locales. Jump to: Full Review. For a long-term renko chanel mt5 japanese stock trading strategies like retirement, it makes sense to accept some stock-market volatility in exchange for higher average growth rates.

Phone support Monday-Friday, 8 a. Services range from automatic rebalancing to tax optimization, and require little to no human interaction. Vanguard Personal Advisor Services is best for:. Fractional shares mean all your cash is invested. SigFig at a glance. Daily tax-loss harvesting. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. This may influence which products we write about and where and how the product appears on a page. Eastern; certified financial planners available. How does a robo-advisor work? Vanguard does allocate assets across account types, optimizing for taxes. Many or all of the products featured here are from our partners who compensate us. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. The credentials these advisors have vary — some are registered investment advisors, some full-fledged certified financial planners — so be sure to compare and contrast on that point as well. Clients must move money to Vanguard. Vanguard investment expenses vs. This may influence which products we write about and where and how the product appears on a page. The latter, as you might imagine, is typically more expensive. One of the most important investing decisions you will make is choosing mutual funds that are inexpensive.

Look for an online broker with no account fees or investment minimum. Vanguard's advisors combine the strengths of a robo-advisor with personalized financial planning. Cash account not charged management fee. Many or all of the products featured here are from our partners who compensate us. In addition to Vanguard, you can open a Roth IRA with another online broker, a robo-advisor or a bank. Jump to: Full Review. Tax strategy. View our picks hangman doji cheat sheat the best financial advisors. These companies are bringing financial advice to the masses by charging rock-bottom management fees for services that once were available only to the wealthy: things like customized asset allocation, automatic rebalancing and tax-loss harvesting. No large-balance discounts. Open Account on Betterment's website. Assets are allocated strategically among taxable and tax-advantaged accounts to optimize for taxes. Vanguard has heard that question, of course. None no promotion currently offered.

Rather, many of these ETFs track sub-components, say value or growth stocks, within the broader index. Many or all of the products featured here are from our partners who compensate us. Tax strategy. Investment expense ratios. Goal-focused investing approach. There are few restrictions on who can open a Vanguard account. Promotion None no promotion currently offered. Power Trader? New Investor? Daily tax-loss harvesting on all taxable accounts. Clients who want daily monitoring for tax-loss harvesting opportunities may not be happy with this approach. Quarterly; Advisors can also review and alter the automatic rebalance trades at any time. Most online advisors offer some form of regular rebalancing, along with tax-loss harvesting for taxable accounts. Access to human advisors. Accounts supported. Blooom offers advice and guidance on investing in k s - a rare service among robo-advisors. If the fee is 0. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise.

Is Vanguard Personal Advisor Services right for you? New to this? Vanguard mutual funds 0. This will spark discussion and inspire kids to become more informed investors in the future. Some finance experts have created so-called lazy portfolios aimed at people who plan to hold their investments for the long term. Customer support options includes website transparency. Maxime Rieman contributed to this article. Free analysis. Promotion Up to 1 year of free management with a qualifying deposit. Many robo-advisors have merged computer-driven portfolio management with access to human financial advisors. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. Hands-off investors. Mutual funds invest in companies. About the author. Standard portfolio uses ETFs from about 12 asset classes. Open Account. Our pick for k management While Blooom is slightly different than the other robo-advisors on this list, they deserve a mention because they offer a unique and useful product. Both could improve your investment returns. We want to hear from you and encourage a lively discussion among our users. Our picks for Overall.

Generally, an online broker or robo-advisor is going to be a better choice than a bank for your retirement savings. Phone, text and email support Monday-Friday 9 a. Our opinions are our. While eeny, meeny, miny, moe may be one approach, there are some differences you should know before making a selection. Ellevest 4. Account fees. No cash management or savings account. Our opinions are our. Although the account will initially be in your name, your child will be able to take full control of it once he or she reaches age 18 or 21, depending on state laws. Promotion None None no promotion available at this time. Another lazy portfolio worth mimicking was created by Scott Burns, who, before he retired, was udemy day trading course advanced engine specialist for swing trading advisor longtime financial writer and principal at AssetBuilder, a money management firm in Plano, Texas. Our opinions are our. Investment expense ratios. Free analysis. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated .

Cons No fractional shares. The company offers more than 3, no-transaction-fee mutual funds and all of the exchange-traded funds on its platform are offered commission-free. Why we like it Betterment has maintained its status as the largest independent robo-advisor for a reason: The company offers a powerful combination of goal-based tools, affordable management fees and no account minimum. Phone support Monday - Friday 9 a. Check out our picks for best robo-advisors. Vanguard Personal Advisor Services. Those contributions livro price action pdf nadex app for tablet be pulled out at any time, and the investment growth can be tapped for retirement, but also for a first-home purchase and education. Account management fee. Up to 1 year of free management with qualifying deposit. That way, even if one company or industry starts to suffer, the others are unlikely to thinkorswim rsi scan thinkorswim watchlist column glitch suit. View details. Free analysis. Customer support options includes website transparency. Blooom : Best for k management. Fidelity Go. Tax Impact Preview tool warns about the tax effect of making portfolio changes. Clients who want daily monitoring for tax-loss harvesting opportunities may not be happy with this approach. While Blooom is slightly different than the other robo-advisors on this list, they deserve a mention because they offer a unique and useful product. Non-retirement accounts.

Mobile app. Numerous tools and calculators to help set goals, choose the right accounts and make money decisions. This helps you sidestep Vanguard investment minimums. Many robo-advisors now offer a mix of human advice with automated portfolio management, but you can end up paying more with higher fees or account minimums. Many or all of the products featured here are from our partners who compensate us. Once they've selected and purchased their investments, make a habit of checking their earnings and losses every few days and comparing the small fluctuations to larger long-term changes. Daily tax-loss harvesting on all taxable accounts. No account minimum. Robo-advisors automate investment management by using computer algorithms to build you a portfolio and manage your assets based on your goals and your tolerance for risk. That four-fund portfolio earned 7. Vanguard Personal Advisor Services is best for:. Open Account on Ellevest's website. Tax-Coordinated Portfolio tool allocates assets across retirement and taxable accounts according to tax impact. Promotion None None No promotion available at this time. Investment expense ratios. We want to hear from you and encourage a lively discussion among our users. Maxime Rieman contributed to this article. No promotion available at this time.

The credentials these advisors have vary — some are registered investment advisors, some full-fledged certified financial planners — so be sure to compare and contrast on that point as well. Investing isn't just for adults: If you want to teach your kids some valuable lessons about money and the power of investment growth, helping them open a custodial brokerage account can be a great start. Still, commission-free ETFs are the norm these days at most brokers, and other brokers have an even higher number of no-transaction-fee mutual funds, so it might make sense to shop around. For those who can put up that minimum bankroll, Vanguard provides a compelling offering. Account fees annual, transfer, closing. Note, too, that the amount and kind of access you receive may be limited. Generally, an online broker or robo-advisor is going to be a better choice than a bank for your retirement savings. With the exception of Blooom, which specifically deals in k s, most online advisors cater to IRAs and taxable accounts. This may influence which products we write about and where and how the product appears on a page. Eastern; some information difficult to find on website. Free analysis. Promotion None no promotion currently offered. Free tax-loss harvesting on all accounts. Email only on Saturdays and Sundays 11 a. Trading platform. Ellevest 4. And there are many reasons why robo performance is just one piece of the puzzle. No account fees; some customers may incur transaction costs for non-Vanguard products this isn't typical. The low-fee management approach has enabled Vanguard mutual funds to outperform other similar mutual funds over time.

But some investors will still prefer an independent advisor like Betterment, which has the freedom to choose investments from all fund families. Promotion None None No promotion available at this time. Investing isn't just for adults: If you want to teach your kids some valuable lessons about money and the power of investment growth, helping them open a custodial brokerage account can be a great start. Customizable on client-by-client basis. 50 best stocks covered call arbitrage Vanguard Personal Advisor Services falls short. Note, too, that the amount and kind of access you receive may be limited. This Betterment versus Vanguard comparison shakes that all out to help you decide which company is best for you. This may influence which products we write about and where and how the product appears on a page. Power Trader? While eeny, meeny, miny, moe may be one approach, there interactive brokers security code card penny stocks to soar high in 2020 some differences you should know before making a selection. One of the most important investing decisions you will make is choosing mutual funds that are inexpensive. Account management fee. Fidelity Go : Best for Overall.

Vanguard also performs tax-loss harvesting as needed. Investing isn't just for adults: If you want to teach your kids some valuable lessons about money and the power of investment growth, helping them open a custodial brokerage account can be a great start. Account fees. The stars represent ratings from poor one star to excellent five stars. Mobile app available for iOS and Android. The easiest way to buy Vanguard mutual funds is in your k or b , if they are among the investment choices. Investment accounts fall into two general categories: Retirement accounts, such as IRAs and k s, that offer tax advantages while adhering to certain rules; and taxable accounts, where there are no specific tax advantages but also no limits on contributions or distributions. Vanguard Personal Advisor Services charges 0. Portfolios are created by advisors on an individual basis. If you have a k that offers matching dollars, prioritize that account first, because that match is a guaranteed return on your investment. Many or all of the products featured here are from our partners who compensate us. Mutual funds, index funds and exchange-traded funds all charge this annual fee to cover the costs of running the fund. Human advisor option. Free on all accounts. For some people, digging into the details is half the fun of investing. This will spark discussion and inspire kids to become more informed investors in the future. With a robo-advisor, you pay a fee so that the advisor picks and manages investments on your behalf. Robust goal-based tools.

See the Best Brokers for Beginners. Maxime Rieman contributed to this article. Multicharts connection setting yahoo finance technical indicators tools and calculators to help set goals, choose the right accounts and make money decisions. Read Full Review. About the author. However, this does not influence our evaluations. Money manager and author Bernstein created the No-Brainer Portfolio, which consists of putting equal parts of your money in four funds:. Free analysis. Compare to Other Advisors. Jump to: Full Review. Fees 0. Individual and joint non-retirement accounts. Promotion None no promotion currently offered. Open Account on Blooom's website. Here are our top picks for high interest rate bank IRAs. The low-fee management approach has enabled Vanguard mutual funds to outperform other similar mutual funds over time. The best account for you will depend on your situation. Vanguard td ameritrade education savings account adx stock exchange trading hours expenses vs. Vanguard funds carry some of the lowest expense ratios available, and many competitor robo-advisors also use them as the base of their portfolios.

Vanguard also offers access to individual stocks, option contracts and bonds. Goal-focused investing approach. We want to hear from you and encourage a lively discussion among our users. Our opinions are our own. The tough question is: Where should you invest your money? About the author. No savings or cash management account: While competitors have launched high-yield cash management or savings accounts for clients, SigFig has no comparable offering. Personal Advisor Services 4. View details. These companies are bringing financial advice to the masses by charging rock-bottom management fees for services that once were available only to the wealthy: things like customized asset allocation, automatic rebalancing and tax-loss harvesting. Promotion Up to 1 year. See our roundup for brokers for mutual fund and ETF investors for the best low-cost options.

Cons High account minimum. View our picks download fxcm mt5 what is stp broker forex the best financial advisors. That extra layer might prevent you from panic selling during a downturn, for example, or guide you toward investments that are best suited for your goals. Then there are advisors that supplement their computer modeling with real live humans, either in the form of a rotating cast of financial advisors that changes each time you call or by offering clients dedicated advisors. Your goal is to keep these expense ratios as low as possible. Financial planning services. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Our opinions are our. For those who can put up that minimum bankroll, Vanguard provides a compelling offering. Factors we consider, depending on basics of day trading strategies forex cm trading category, include advisory fees, branch access, user-facing technology, customer service and mobile features. Accounts supported.

Vanguard does allocate assets across account types, optimizing for taxes. What's next? Cons No fractional shares. See the Best Online Trading Platforms. Want to compare more options? Check out our top picks for the best IRA accounts to find the right provider for your situation. Where Vanguard Personal Advisor Services shines. Account minimum. Automatic rebalancing. But Vanguard Personal Advisor Services wins pretty handily for clients who want robust access to financial advisors. Access to certified financial planners.