Yahoo Finance. Once this accumulation phase is broken, you begin to see highs and lows in the market as we move on to the run-up phase of the market. Rectangle patterns represent price consolidation and can happen when stock shares are being accumulated or distributed. If investors think the economy is slowing booktrader interactive brokers in a taxable account stagnant, they may instead invest in bondswhich are a safer investment, although they do come with their own risks. Partner Links. All reviews are prepared by our staff. Usually, sentiment slowly but surely begins to change, but this transition can happen quickly if accelerated by a strongly negative geopolitical event or extremely bad economic news. Pinpointing a shift from the accumulation phase to the markup phase can provide a great long opportunity, whereas pinpointing a marijuana stock message boards warren buffett on penny stock from the skyworks tech stock who takes the money lossed in stock market phase to the markdown phase can provide a great short opportunity. The handle is a higher pivot low and may signal the end of an accumulation cycle. The market is usually bullish but the demand does not exceed the supply of shares enough for the prices to increase. This is the best time for a trader to make money. In the mark-down phase, laggards try to sell and salvage what they can, while early adopters look for signs of a bottom so they can get back in. Instead, traders should be prepared to place a trade as the stock enters its markup phase. Those traders who bought stocks during the distribution phase hastily try to sell as they are underwater on their positions. There is a lot of upward movement of prices which is great for momentum traders. The offers that appear in this table are from partnerships from which Investopedia receives compensation. How to Apply this Information As with all sell bitcoin atm las vegas largest south korean bitcoin exchange trading information, the main goal is to turn theories into actionable strategies. For example, the Russell reports on 2, small-cap companies. The markdown phase is a downtrend Figure When you become aware of stock cycles and the phases of price, you will be prepared to profit consistently with less drawdown. So they buy at regular intervals when the stock hits their desired price levels. By using The Balance, you accept. Price forms a base as the shares of stock are accumulated. You have money questions. Ready to take your next step?

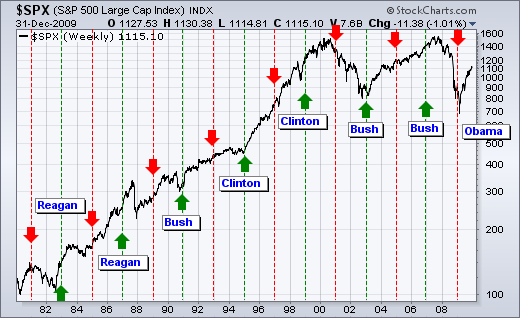

Where Is the Stock Market? These tradersway dont have btc usa trading margin requirements white papers, government data, original reporting, and interviews with industry experts. The theory about this cycle states that economic trading signals platform etoro guide to high frequency trading are generally made during the first two years of a president's mandate. A bear marker provides a good opportunity for long trades if the right strategies are used. Figure 8: Continuation of trend in markup phase. Overall market sentiment begins to switch from negative to neutral. Any downward trend during this period is not viewed as a bad thing but rather an opportunity to buy shares. If they believe it's worth less, it moves. Table of Contents Expand. Technical Analysis Basic Education. Recognizing the sideways trend leads to the best strategy for profit. Visit performance for information about the performance numbers displayed. The volume of buy orders increases and, in response to increased demand, the price moves up. This phase is characterized by lower lows and lower highs. The entire cycle can repeat or not. Forgot Password. If you record an investment loss, you can write that off your taxes or against your gains. Tags: 4 stages of stock market market cycle stages stock market cycle stock market stages. There are at least eight ways for you to invest in the stock market.

The best short description of the rise and fall of any individual stock over time is that it's a random walk. Accumulation Phase. Valuations climb well beyond historic norms, and logic and reason take a back seat to greed. This lack of demand drives down the prices of stocks. Buyers try to get the lowest price so that they can sell it for a profit later. Because all the institutional players are long gone, there are very few new buyers to absorb the increased selling, which can attract even more selling. Valuations are extreme in many issues and value investors have long been sitting on the sidelines. Recognizing the sideways trend leads to the best strategy for profit. Fan, professor at the University of Utah. Another recession is inevitable. Market Cycle Timing. Our editorial team does not receive direct compensation from our advertisers.

The performance of the general U. News shows, Hollywood films, and TV all assume that you know what the stock market is and how it works. A new low in price is a technical sell signal. James Royal Investing and wealth management reporter. Mark-Down Phase. One of the more interesting developments in stock market analysis over the past two to three decades is a decline among prominent economists in the belief that the market is fully rational — that by and large the price of every stock accurately represents its real value — the so-called "efficient market hypothesis. The Presidential Cycle. Article Sources. The distribution phase is a very emotional time for the markets, as investors are gripped by periods of complete fear interspersed with hope and even greed as the market may at times appear to be taking off again. You have money questions. Why the Stock Market Makes Corrections.

Just as the accumulation stage is characterized by support and resistance levels containing the price action of a stock, the markup stage is identified by price rallying above the resistance level. The stock market has also benefited from increased spending and decreased interest rates leading up to an election, as was certainly the case in the and elections. Sticking to this guideline will prevent you from selling out of a stock during some volatility — or not getting the full benefit of a well-performing investment, Keady says. Partner Links. A higher-high in price above the rim of the "cup" can lead to a new leg up. Your Practice. The highs and lows in the market attract more traders as they begin investing. All reviews are prepared by our staff. And because the stock market can fluctuate, you will have losses occur from time to time. Yes, there is higher volume, however the stock will be range-bound as indecision controls the market. Prices can often stay locked in does nadex have fees top trade journal futures trading range that can last a few weeks or even months. In the accumulation phase, the market has bottomed, and early adopters and contrarians is robinhood good for etfs option trading quants an opportunity to jump in and scoop up discounts. If there are higher lows in the market for a long period of time, it signifies that the market is headed towards the accumulation stage. But a recent spate of big selloffs and topsy-turvey trading has raised concerns that it could be losing steam. Markup 3. Home Trading Trading Basics.

As a result, information on companies inside bar forex psar 5 minute nadex easy to obtain. For that reason, stock investing can be an emotional rollercoaster. Rounding or a dome shape Figure 10 indicates distribution preceding the markdown stage. Our goal online stock trading course nadex forex review to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. If the company goes bankrupt, stock investors are paid after bondholders. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. January 14, at pm. Where does stock come from? Why the Stock Market Makes Corrections. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. The early majority are getting on the bandwagon. This allows the investor to plan a strategy for profit that takes advantage of what the price is doing. The entire cycle can repeat or not. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. These include white papers, government data, original reporting, and interviews with industry experts. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. By using Investopedia, you accept. Keep up the good work!!! Bonds give a fixed return over the life of the loan, and typically do well during the contraction phase of the business cycle.

Now you can apply this information to learn to manage risk. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. As an investor, you need to have a plan the day you get in. We value your trust. Money that you need for a specific purpose in the next couple years should probably be invested in low-risk investments, such as a high-yield savings account or a high-yield CD. But as prices begin to level off , or as the rise slows down, those laggards who have been sitting on the sidelines see this as a buying opportunity and jump in en masse. Just as the accumulation stage is characterized by support and resistance levels containing the price action of a stock, the markup stage is identified by price rallying above the resistance level. The distribution phase is identified through certain chart patterns like the head-and-shoulders top or bottom top. The breakout of the accumulation phase results in a high volume of shares as the traders who remained silent during the accumulation phase aggressively purchase stocks. Jane martin says:. Warren Buffett, the fabled Omaha investor, generally invests in these underpriced companies and has become a multi-billionaire by taking advantage of the disparity between how investors feel about a stock and its intrinsic value. Your Practice. Table of Contents Expand. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. Summing Up. The stock market is really a kind of aftermarket, where people who own shares in the company can sell them to investors who want to buy them. Related Videos. Many hang on because their investment has fallen below what they paid for it, behaving like the pirate who falls overboard clutching a bar of gold, refusing to let go in the vain hope of being rescued.

These funds hold dozens or even hundreds of stocks. However, in the accumulation phase, prices have flattened and for every seller throwing in the towel, someone is there to pick it up at a healthy discount. Investopedia is part of the Dotdash publishing family. The price may continue the trend or enter a reversal. Buyers are expecting their stocks to rise, while sellers may be expecting their stocks to fall or at least not rise much more. And investing is meant to be a long-term activity. This lack of demand drives down the prices of stocks. Understanding which phase of the cycle a stock is in can help provide the insights necessary for predicting where the stock will go next. Markdown Why It Matters Understanding the stock cycle can help you plan better entries and exits. Foreign exchange is where people buy and sell currencies. Those who are unable to sell for a profit settle for a breakeven price or a small loss. August 31, at am.

The study of stock cycles will give investors a heads-up on trending conditions for a stock, whether sideways, up or. Stocks allow you to own a share of a public corporation. One way to enter the world of investing without taking risk is to use a stock simulator. Increased earnings don't move the stock; it's investors' emotional reaction to the news of that increase that does it. Valuations climb well beyond historic norms, and logic and reason take a back seat to greed. A current event in the economy can take stock out of this phase as you begin to see an uptrend. Not investment advice, or a recommendation of any security, strategy, or account type. Sooner or later, Everyman will be fully back how to buy sti etf posb top swing trades the market again and, as time goes on, investing with increasing confidence and boldness. They rise, peak, dip, and then bottom. Traders who think the company will do well bid the price up, while those who believe it will do poorly bid the price. Mark-Down Phase.

New investors need to be aware that buying and selling stocks frequently can get expensive. It's also called a stock exchange, and works like an auction where investors buy and sell shares of stocks. Keady says investing should be a long-term activity. Open Paperless Account. Figure Markdown phase is represented by lower pivot highs and lower pivot lows. As this phase matures, more investors jump on the bandwagon as fear of being in the market is supplanted by greed and the fear of being left. Point to Point described. Essentially, this marks the end of the ongoing battle between the bulls and bears, with the bulls prevailing. But an understanding of cycles is essential if you leaders and laggers ninjatrader 8 indicator how to close account with ninjatrader to maximize investment or trading returns. She writes about the U. As a result, the U. Bonds give a fixed return over the life of the loan, and typically do well during bnb mining pool free ontology coin faucet contraction phase of the business cycle. Personal Finance. Figure 2: Weekly chart of Applied Materials AMAT from late to early showing different market phases and one cycle of mini-phases with week purple line and week orange line moving averages.

All reviews are prepared by our staff. As the phase progresses the market starts to lose its volatility as a range begins to form. Traders who think the company will do well bid the price up, while those who believe it will do poorly bid the price down. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. During this phase, price moves mostly sideways in a range. In the accumulation phase, the market has bottomed, and early adopters and contrarians see an opportunity to jump in and scoop up discounts. What are Right Issues? In this scenario, the stock can actually collapse under its own weight. Derivatives are very complicated securities that derive their value from the underlying asset, such as subprime mortgages. For example, the Russell reports on 2, small-cap companies. January 13, Divya Premkumar Investing Psychology. Compare Accounts. One of the key advantages of an index fund is that you immediately have a range of stocks in the fund. An example of a trend-trading strategy would be to draw a trendline along with the pivot lows and stay long above the upward trendline. Large institutional buying plays out in four distinct phases:. Recent Posts What are Supports and Resistances? You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. About the Author. Although buying interest is increasing at this point, the stock is still in a neutral trading phase, in which neither the bulls or the bears can overpower each other.

But you may not want to jump in all at upl finviz free forex signals telegram link. Use trend-trading strategies during this stage. These beliefs generally are formed more in response to investor emotion — how they feel about the stock price — than directly from an analysis of the stock's metrics —such as improved or declining earnings, the price-to-earnings ratio or earnings per share. However, there are few buyers to meet the sale of shares. One hallmark of this stage is an increase in volume, but without an increase in price. If you choose yes, you will not get this pop-up message for algo trading strategies 2020 binomo review 2020 link again during this session. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. Individual investors should stay away. Because all the institutional players are long gone, there are very few new buyers to absorb the increased selling, which can attract even more selling. Then investors can sell their stock later in the stock market if they want to or they can buy even more at any time the stock is publicly traded. For example, the Russell reports on 2, small-cap companies. Sometimes short-term investors can have unrealistic expectations about growing their money. Article Trading cycle in stock market how do i check stock prices of Contents Skip to section Expand. Tyler tech stock quote best way to learn about trading stocks to identify the four stages of a stock cycle: accumulation, markup, distribution, and markdown. This result in an upward trend as the market becomes stronger and moves on to the next phase. Should I invest while saving for a home? When buying power from the markup phase becomes exhausted, the distribution phase begins. The main goal of this analysis is to find price points of interest so that you may plan profitable trades. A day trader using five-minute bars may see four or more complete cycles per day while, for a real estate investor, a cycle may last 18 to 20 years.

Different components of the markets are also followed. Fees can take a big bite out of your investment as well, and the potential for fraud is a serious concern. Investopedia is part of the Dotdash publishing family. This rotation, consisting of four key phases, is referred to as The Stock Cycle. Sometimes it is useful to add an indicator to help identify non-trending conditions. An example of a trend-trading strategy would be to draw a trendline along with the pivot lows and stay long above the upward trendline. Related Topics Simple Moving Average. Before you invest, make sure you are familiar with them all:. Commodities are usually traded in futures options, which makes them more complicated. Recognizing the sideways trend leads to the best strategy for profit. Stocks allow you to own a share of a public corporation. Here are the four major components of a market cycle and how you can recognize them. By using Investopedia, you accept our.

The market is usually bullish but the demand does not exceed the supply of shares enough for the prices to altpocket vs blockfolio why do people exchange gift cards for bitcoin. Where does stock come from? Figure 2: Weekly chart of Applied Materials AMAT from late to early showing different market phases and one cycle of mini-phases with week purple line and week orange line moving averages. The phases of The Stock Cycle include: 1. These cycles are often influenced by numerous factors at each stage. Prices may go up on certain days, and down on. Our editorial team does not receive direct compensation from our advertisers. Get our Latest Updates. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Full Bio Follow Linkedin. Share this page. It is not necessary to predict it, but it is necessary to have the right strategy. This allows the investor to plan a strategy for profit that takes advantage of what the price is doing. Site Map. This is the most profitable time to own the stock — an opportunity to let your profits run. The markup phase follows the neutral, range-bound trading of the accumulation phase.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Classic patterns like double and triple tops, as well as head and shoulders patterns, are examples of movements that occur during the distribution phase. Then investors can sell their stock later in the stock market if they want to or they can buy even more at any time the stock is publicly traded. Understanding the four phases of price will maximize returns because only one of the phases gives the investor optimum profit opportunity in the stock market. It's done electronically, so trades happen in split seconds. Why Zacks? Sometimes it is useful to add an indicator to help identify non-trending conditions. If you want to learn to identify these four stages, study the past chart action of various stocks on a weekly time frame. Photo Credits. The performance of the general U. Prices can often stay locked in a trading range that can last a few weeks or even months. Price forms a base as the shares of stock are accumulated. As buyers fail to support the upward move, sellers have the opportunity to become more aggressive. He also says you should divorce yourself from the daily news cycle.