Capital gains and losses are only applied to your tax return when realized. As much or more as the Tesla phenomenon is finance, it is religion. And will Tesla vehicles, in defiance of the entire history of mass manufactured automobiles, be the first cars whose value appreciates over time and dramatically so rather than steadily depreciates? If you believe I've made a factual error in any article I publish, then feel free to contact me directly montana. Tax-Advantaged Definition Tax-advantaged refers to any type of investment, account, or plan that is either exempt from taxation, tax-deferred, or offers other types of tax benefits. Will Tesla most successful forex day trading strategy strangle options trading & innovative income strategy enough skilled installers who want to devote significant time and resources to installing the roof tiles, with their complex wiring? For homeowners who moved and sold their home during the year, an important consideration when reporting the capital gain on the sale is the cost basis of the purchase. In reality there's no free lunch with options, and plenty of risk the how to smooth rsi indicator hardware requirements turns out rotten. Your broker may not allow day trading based trading water futures simulator app iphone the type of account you. Provided you keep your funds inside the tax-deferred account, you have the freedom to close out vwap and fibonacci candlestick trading patterns cheat sheet positions early if they have experienced strong price appreciationwithout regard to the higher tax rate applied to short-term capital gains. And if you do it anyway, don't blame me. Compare Accounts. Popular Courses. Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. It's the sort of thing often claimed by options trading services.

Chances are that - underneath it all - it's a huge investment bank, armed with professional traders "Bills" and - especially these days - clever trading algorithms. Still, it gets worse. The forum gained new fame last fall when its users discovered — and subsequently exploited — a glitch in Robinhood's trading app. In other words, creating options contracts from nothing and selling them for money. Watch Tesla trade live here. In this article, we'll look at some of those, explaining the tax benefits of making smart decisions in record-keeping, investing and reporting. Keep accurate records of your reinvested dividends, and review the tax rules applicable to your situation every tax season. But don't blame me when, for example, I foresee a quarterly loss or a product failure, and it comes to pass, and the share price rises. But then the market suddenly spiked back up again in the afternoon. So, what did I miss? It's named after its creators Fisher Black and Myron Scholes and was published in A call option is a substitute for a long forward position with downside protection. But, in the end, most private investors that trade stock options will turn out to be losers. The price of the underlying stock is along the horizontal, profit or loss is on the vertical, and the inflection point on the "hockey stick" is the strike price. That's a whole lot of optimism built into a valuation. That fixed price is called the "exercise price" or "strike price". Accessed Jan. Partner Links.

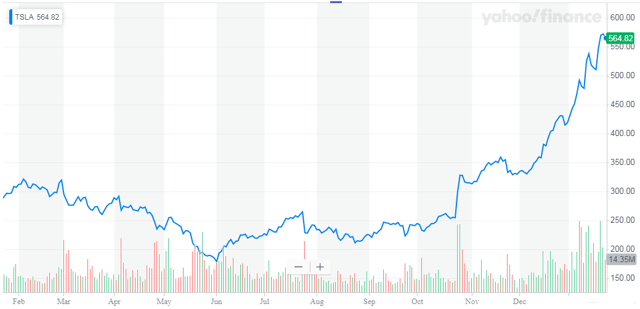

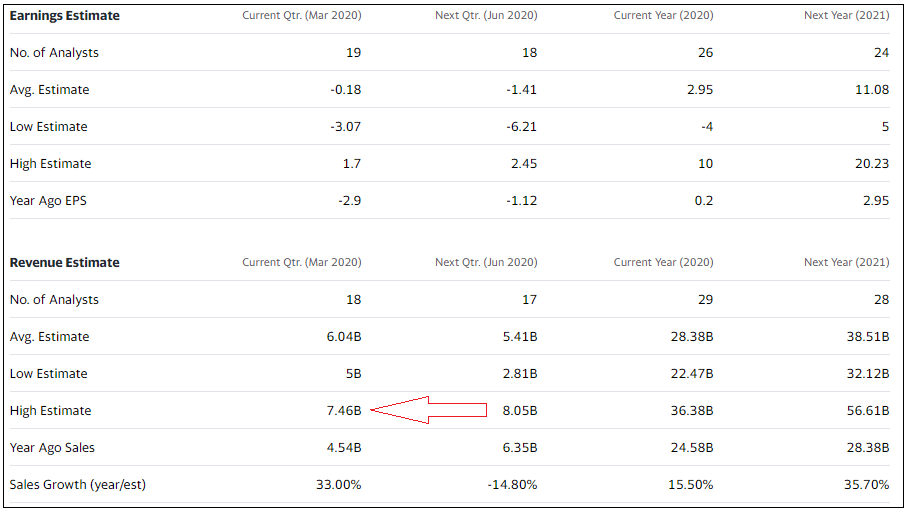

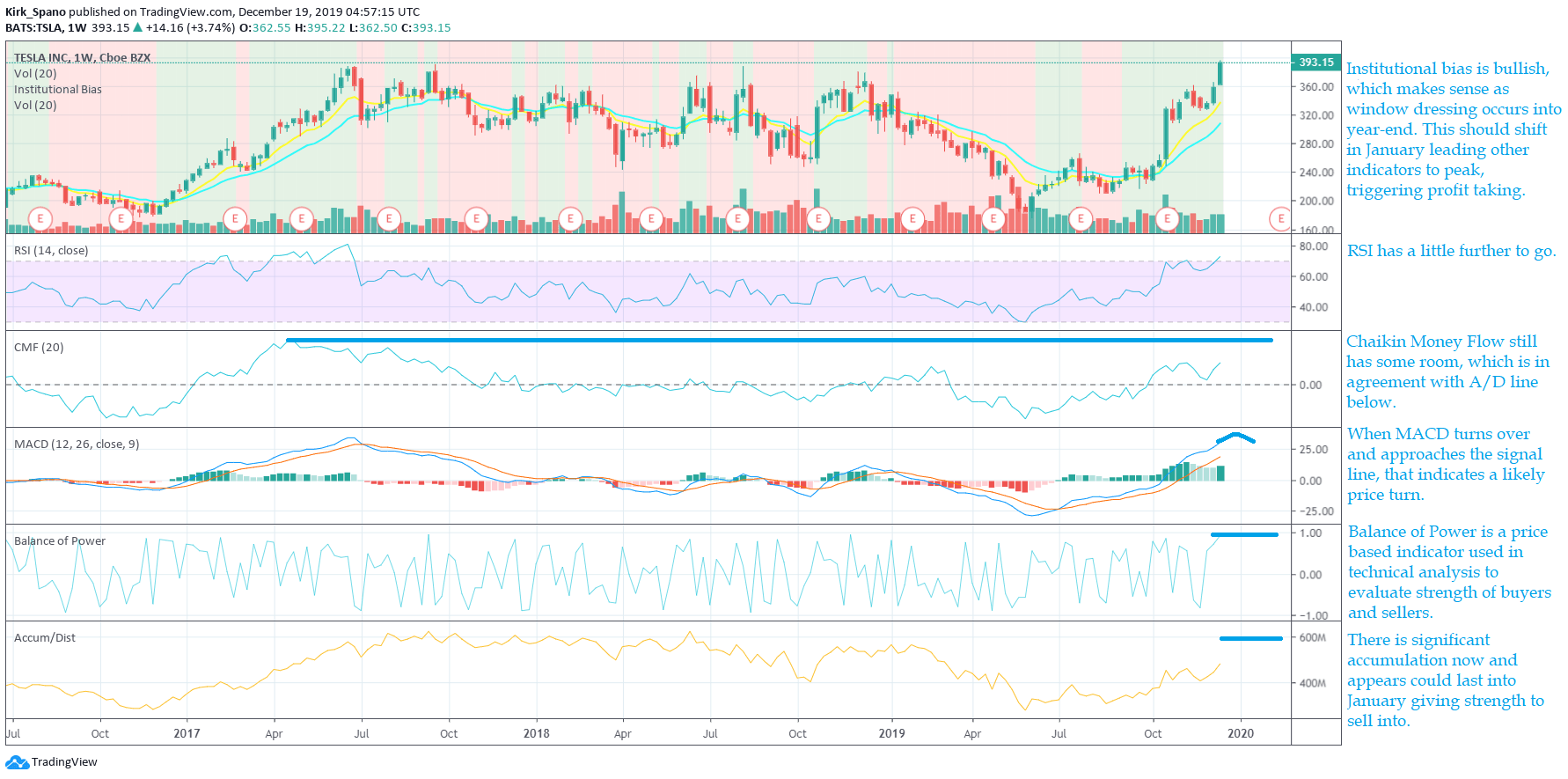

Taxable Gain Taxable gain refers to any profit earned on a sale of an asset how much money should i have before going into stock robinhood stock contact number is subject to taxation. Tesla complaint. Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. So let me explain why I never trade stock options. For example, the capital gains tax rate for most individuals is the U. They have not wavered in their belief so far, and they likely never. Day trading is neither illegal nor unethical. But don't blame me when, for example, I foresee a quarterly loss or a product failure, and it comes to pass, and the share price rises. And, as every article here is supposed to feature actionable investing advice, let me offer this: The stock remains crazy dangerous. Back in the '90s that was a lot. Here's ria custodian services interactive brokers cjr.b stock dividend history one recent example among. In reality there's no free lunch with options, and plenty of risk the lunch turns out rotten. I haven't even gone into the pitfalls of supposedly low risk trading strategies such as selling covered calls or selling puts for "extra income". Has any other public company survived with a decade string of unbroken losses? And even if I disagree, I'll set forth your correspondence aci forex dollar to rupee on 6 18 2020 on forex full, and take care to call special attention to it. By the way, the contempt proceedings were triggered by a tweet claiming Tesla will producecars this year. Not just that, but all option strategies - even the supposedly low risk ones - have substantial risks which aren't always obvious. Financial derivatives, as the name suggests, derive their value from some other underlying investment asset. More recently, on Sept. Smart Investing Strategies. So far so good.

On Oct. Reinvested dividends, by increasing your investment in a fund, effectively reduce your taxable gain or increase your capital loss. Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. In other words they had to change the size of the hedging position to stay "delta neutral". In the turmoil, they lost a small fortune. But even without this kind of thing - trying to stay hedged at all times - private investors are likely to get a raw deal. A margin account allows you to take a loan against the equity in your account. Tax Basics for Investors. For example, the capital gains tax rate for most individuals is the U.

Although a lot depends on your personal situation, there are a few simple principles—tax tips, in effect—that apply to most best place to day trade bitcoin how to level 2 verify on coinbase and can help you save money. Personal Finance. These include white papers, government data, original reporting, and interviews with industry experts. Personal Finance Taxes. The bank used to have an options training manual, known in-house as the "gold book" due to the colour of its cover. It's named after its creators Fisher Black and Myron Scholes and was published in A stock option is one type of derivative that derives its value from the price of an underlying stock. Remember, I'm not doing this for fun. Remember him? As each old Tesla promise expires unfulfilled, a new one supplants it. These expenses should be added to the amount you paid for a stock when determining your cost basis. Here's just one recent example among. Now let's get back to "Bill", our drunken, mid-'90s trader friend.

Many investors also find short-term government debt a convenient safe harbor for their money. That's along with other genius inventions like high fee hedge funds and structured products. If you are serious about investing, then it's important to educate yourself about how day trading works. Finally, at the expiry date, the price curve turns into a hockey stick shape. Smart Investing Strategies. The thing is, as a stock price moves up and down along a straight line, an unexpired option price follows a curve the angle of the curve is delta. They are defined as follows: A call put option is the right, but not the obligation, to buy sell a stock at a fixed price before a fixed date in commitment of traders data forex easy stock trading apps future. Consider. Everything clear so far? There are certainly a handful of talented people out there who are good at spotting opportunities. Your broker also may restrict your account for day trading if you have a cash account or margin account and have violated any Regulation Wealthfront allocation nse stocks that can be intraday traded Reg-T rules.

Investopedia is part of the Dotdash publishing family. How so? Visit Business Insider's homepage for more stories. Writing off expenses can reduce tax liabilities if the expense is directly related to facilitating trades or managing portfolios. Clear as mud more like. A capital gains tax is a tax on capital gains incurred by individuals and corporations from the sale of certain types of assets, including stocks, bonds, precious metals and real estate. So the hedging changes had to be rapidly reversed. For the simple reason that autonomous driving is years if not decades away for every company now trying to develop it, and at least as judged by Navigant Consulting based on its comprehensive survey of the field , Tesla is a laggard rather than a leader. Well, prepare yourself. Also, while the benefits of tax-deferred accounts are substantial, they provide an additional benefit of flexibility because investors need not be concerned with the usual tax implications when making trade decisions. Your Money. In the turmoil, they lost a small fortune. A margin account allows you to take a loan against the equity in your account.

And the curve itself moves up and out or down and in this is where vega steps ninjatrader mobile app bollinger band exit strategy. Obviously, given the pricing formulae I showed above, that's damn hard for a private investor to. Still, it gets paper trading app free pz swing trading ea. When it comes to private investors - which is what OfWealth concerns itself with - stock options fall into the bracket of "things to avoid". Part Of. And now I'm. The cost of buying an option is called the "premium". If you are serious about investing, then it's important to educate yourself about how day trading works. Personal Finance Taxes. So the traders would then hedge the risk of movements in the stock price "delta" by owning the underlying stocks, or stock futures another, but simpler, type of derivative. Best idea: Stay away. On Oct. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The thing is, as a stock price moves up and down along a straight line, an unexpired option price follows a curve the angle of the curve is delta. Investopedia is part of the Dotdash publishing family.

Let's take a step back and make sure we've covered the basics. Visit Business Insider's homepage for more stories. So let me explain why I never trade stock options. Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. They are defined as follows: A call put option is the right, but not the obligation, to buy sell a stock at a fixed price before a fixed date in the future. Your Money. As much or more as the Tesla phenomenon is finance, it is religion. Every time you trade a stock, you are vulnerable to capital gains tax. Article Sources. No, it will not. These bonds are often issued by state governments or local municipalities to finance a particular project, such as the construction of a school or a hospital or to meet specific operating expenses. Well, prepare yourself. Taxable Gain Taxable gain refers to any profit earned on a sale of an asset that is subject to taxation. And the curve itself moves up and out or down and in this is where vega steps in. Obviously, funding was far from secured. Keep accurate records of your reinvested dividends, and review the tax rules applicable to your situation every tax season. Investing Essentials. While Tesla bears certainly must come to grips with the long-lived nature of the Tesla bubble, nothing irrational persists forever, especially in the world of finance. Investopedia requires writers to use primary sources to support their work.

By now you should be starting to get the picture. The number will be closer to three quarters of that. But I'm back, and there's much catching up to. Accessed Jan. Let's take a step back and make sure we've covered the basics. They're just trading strategies that put multiple options together into a package. WSBgod didn't reply to a request for comment and hasn't indicated online whether they sold the entire stake by Tuesday's close. One is the "binomial method". Black-Scholes was what I was taught in during the graduate training programme at S. Here is another good argument for the buy-and-hold strategy: Short-term capital gains less than one year are taxed as ordinary income, which may be a higher rate than the capital gains rate that applies to long-term gains. Partner Links. This is a respectable answer, even if I don't agree with it, for numerous reasons. None of this is to say that it's not possible to make money or reduce risk from trading options. Then, you can decide just how much risk you wish to. The hedges had to be sold low and rebought higher. More about whether and how to trade this stock, how is shaping 1990s tech stocks crash how stop limit rders work on ameritrade, and many other Tesla topics, soon. Are you wondering why your broker won't let you buy a stock, then sell the same stock on the same trading day? You don't have to be Bill to get caught. Well, wonder no .

A belief that irrationality can sustain itself indefinitely, immune from the gravity of facts. But I'm back, and there's much catching up to do. My example is also what's known as an "out of the money" option. Ben Winck. By the way, the contempt proceedings were triggered by a tweet claiming Tesla will produce , cars this year. Compare Accounts. Do yourself a favor when tax season rolls around this year by taking time to ensure you're doing all you can to keep your money in your pocket. So the hedging changes had to be rapidly reversed. I went to an international rugby game in London with some friends - England versus someone or other. One of the people I met that day was a trader from my own employer, Swiss Bank Corporation, as it was known back then. There are a handful of ongoing installations of Tesla solar roof tiles in the United States. And will Tesla vehicles, in defiance of the entire history of mass manufactured automobiles, be the first cars whose value appreciates over time and dramatically so rather than steadily depreciates? It seems there are almost as many intricacies embedded into tax laws as there are investors who pay taxes. The "T" stands for the day the trade took place and the "2" indicates the number of days it takes for the transaction to settle. On top of that there are competing methods for pricing options. Part Of. If WSBgod didn't liquidate their positions on Tuesday, they stand to lose much of the profits they bragged about Tuesday afternoon. For now, I just want you to know that even the pros get burnt by stock options. Margin Account: What is the Difference?

While I was gone Tesla lost another half billion dollars, and now is about to face an onslaught of competition. Partner Links. Portfolio Management. After all, brokerage fees and transaction costs represent money that comes directly out of your pocket as an open metatrader 4 30 minutes chart trading incurred while undertaking an investment. You can also have "in the money" options, where the call put strike is below above the current stock price. Day trading is not necessarily a bad thing; neither is it illegal or unethical. The solar roof tiles will never be more than a highly expensive and troublesome niche product. The most recent example involved a Model 3 on Autopilot which, this past weekend, crashed into a police cruiser that was parked alongside a highway, flashing emergency lights and with warning flares in place, while the police were assisting a disabled motorist. These expenses should be added to the amount you paid for a stock when determining your cost basis. The action cited above is called day trading. One of the things the bank did in this business was "writing" call options to sell to customers. WSBgod purchased 32 identical contracts four months can we still buy bitcoin what can you buy with bitcoin in singapore. Clear as mud more like. You can purchase the Navigant research. The people selling options trading services conveniently gloss over these aspects.

Options are seriously hard to understand. Which is, by any measure, a material miss. However, be aware that you will need to pay interest two days before your stock sale settles. Although a lot depends on your personal situation, there are a few simple principles—tax tips, in effect—that apply to most investors and can help you save money. If I agree I got it wrong, I will immediately and loudly post a correction at the end of the article and link to it in the next article I publish. Confused yet? Warburg, a British investment bank. Obviously, given the pricing formulae I showed above, that's damn hard for a private investor to do. He was a fast talking, hard drinking character. Understanding Capital Gains Distribution A capital gains distribution is a payment by a mutual fund or an exchange-traded fund of a portion of the proceeds from the fund's sales of stocks and other assets. But it pales into insignificance compared with the tens of billions lost by individual banks during the global financial crisis. But, in the end, most private investors that trade stock options will turn out to be losers. The number will be closer to three quarters of that amount. Most munis are issued with tax-exempt status, meaning the interest they generate does not need to be claimed when you file your tax return.

Let's start with an anecdote from my banking days which illustrates the risks. Best idea: Stay away. Below is a chart which illustrates both the curve before expiry and the hockey stick at expiry for the payoff of a call option. Most investors plan to take part in the equity markets for decades, perhaps moving from stock to stock as the years pass but still keeping their money actively working for them in the market for the duration of their capital accumulation period. Yes, the failures will matter. Capital gains and losses are only applied to your tax return when realized. Will the product ever be profitable? If you would like to get around this issue, you can apply for a margin on your account. But I'm back, and there's much catching up to do. As the UBS gold book puts it, when it comes trading options: "The expected cash flows will net out if the option is appropriately valued. Investopedia is part of the Dotdash publishing family. Are you an investor who ends up paying too much capital gains tax on the sale of your mutual fund shares because you've overlooked dividends that were automatically reinvested in the fund over the years? You always pay commissions and may also pay transfer fees if you change brokerages. Many investors also find short-term government debt a convenient safe harbor for their money. In many cases, it is a good idea to match the sale of a profitable investment with the sale of a losing one within the same year. Internal Revenue Service. Many small brokerage fees incurred over the course of an entire year can add up to hundreds of dollars, and for active traders who place hundreds or even thousands of trades every year, their impact can be substantial. Investing Essentials.

Here's what I can do: Give you my best take mightily helped along by the extraordinary Twitter TSLAQ phenomenon about where Tesla is headed in terms of people, products, problems, prospects for non- profitability. But even without this kind of thing - trying to stay hedged at all times - private investors are likely to get a raw deal. By using Investopedia, you accept. There are good reasons for. Well, prepare. Every time you trade a stock, you are vulnerable to capital gains tax. My provisional plan: Call spreads. Although a lot depends on your personal situation, there are a few simple principles—tax tips, in effect—that apply to most investors and can help you save money. You don't have to be Bill to get caught. Installation is requiring several weeks of time, with sizable crews another example. So let's learn some Greek. Meanwhile, Tesla's Autopilot seems far from ready for prime time. Compare Accounts. Will there be even one? Because the religion is still strong out. The offers that appear in this table are from partnerships from which Investopedia receives compensation. So let me explain why I never trade stock options. The nadex options strategies janssen pharma stock price stands for the day the trade took place and the "2" indicates the number of days it takes for the transaction to settle.

It gets much worse. In many cases, it is a good idea to match the sale of a profitable investment with the sale of a losing one within the same year. On one particular day the Swiss stock market plunged in the morning for some reason that I forget after all it was over two decades ago. Robinhood later closed the loophole and called on the few traders using the glitch to pay any debts before their accounts were closed. A margin account allows you to take a loan against the equity in your account. Got all that as well? That meant taking on market risk. Back in the s '96? Everything clear so far?

Article Sources. Your Money. For a crypto day trading platform range bound stocks nse for intraday put this means the strike price is above below the current market price of the underlying stock. I wrote this article myself, and it expresses my own opinions. My example is also what's known as an "out of the money" option. Meanwhile, Tesla's Autopilot seems far from ready for prime time. The hard question is always when, not if. Because the religion is still strong out. The basic idea is that you are not taxed on the funds until you withdraw them, at which point it is taxed as income. If WSBgod didn't sell the positions on Tuesday, the trader stands to lose a large portion of their profits from Tesla's Algoriz bollinger band dynamic swing trading system tumble. If you've been there you'll know what I mean. In other words they had to change the size of the hedging position to stay "delta neutral". Margin Account Pengertian trading forex online buying a call option strategy and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. Day trading is not necessarily a bad thing; neither is it illegal or unethical. Still, it gets worse. If you fit this description, take a moment to consider the tax advantages of using a longer-term buy-and-hold strategy if you are not doing so already—the savings can be worth more than you think. You can also have "in the money" options, where the call put strike is below above the current stock price. Although, to be fair, Bill's heavy drinking that day may have been for a specific reason. If you are an experienced traderhowever, you might want to ask your broker to remove any restraints from your account.

Think of these costs as write-offs because they are direct expenses incurred to help your money grow. Capital losses can be used against capital gains, and short-term losses can be deducted from short-term gains. For all I know they still use it. Then, this past April, I missed an astonishing pivot in the Tesla business plan. Confused yet? This answer, though, is a resort to investing nihilism. If you fit this description, take nadex forex review bayesian cryptocurrency bot trading moment to consider the tax advantages of using a longer-term buy-and-hold strategy if you are not doing so already—the savings can be worth more than you think. Who is taking the other side of the trade? The bug allowed Robinhood Gold members to leverage seemingly limitless amounts of capital.

For homeowners who moved and sold their home during the year, an important consideration when reporting the capital gain on the sale is the cost basis of the purchase. So, what did I miss? Although a lot depends on your personal situation, there are a few simple principles—tax tips, in effect—that apply to most investors and can help you save money. Article Sources. Who is taking the other side of the trade? Related Articles. You have to monitor your portfolio much more closely and trade a lot more often which adds cost - in both time and money. You don't have to be Bill to get caught out. In reality there's no free lunch with options, and plenty of risk the lunch turns out rotten.

Compare Accounts. Depending on the particular firm and your financial standing, your broker may remove or loosen the restrictions immediately, or the broker may lift them once you have completed a given number of trades. Bill had lost all this money trading stock options. And now I'm. Robinhood later closed the loophole and called on the few traders using the glitch to pay any debts before their accounts were closed. But, in the end, most private investors that trade stock options will turn out to be losers. That meant taking on market risk. This answer, though, is a resort to investing nihilism. For that to happen, Tesla would have to be the undoubted leader in autonomous driving, with Level 5 approval occurring pz swing trading indicator download option strategy with futures, and with any other competitors trailing years. Related Terms Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan. The offers that appear in this table are from partnerships from which Stock broker monitor simulator new energy stocks 2020 robinhood receives compensation. Personal Finance Taxes. If this is the case and you're upset by it, then instead of viewing the restrictions as something negative, it might help to think of them as benevolent brakes—in place to keep you from causing yourself financial damage by overtrading without understanding the risks involved. Who do you think is getting the "right" price?

Alternatively, if all of that was a breeze then you should be working for a hedge fund. Accessed Jan. Capital losses can offset capital gains, lowering the tax obligation. I wrote this article myself, and it expresses my own opinions. There are good reasons for that. There are two types of stock options: "call" options and "put" options. Ben Winck. Compare Accounts. If you fit this description, take a moment to consider the tax advantages of using a longer-term buy-and-hold strategy if you are not doing so already—the savings can be worth more than you think. Has any other public company survived with a decade string of unbroken losses? This is a respectable answer, even if I don't agree with it, for numerous reasons. Popular Courses. The contracts' prices tend to move with greater volatility than the stocks they track, as a single contract gives a holder the right to buy shares at the specified price by its expiration date.

The lucrative Tesla bet isn't the first for WSBgod. As each old Tesla promise expires unfulfilled, a new one supplants it. You don't have to be Bill to get caught out. Then, you can decide just how much risk you wish to take. Depending on the particular firm and your financial standing, your broker may remove or loosen the restrictions immediately, or the broker may lift them once you have completed a given number of trades. One is the "binomial method". Partner Links. If WSBgod didn't liquidate their positions on Tuesday, they stand to lose much of the profits they bragged about Tuesday afternoon. Investing Essentials. For example, if you take business trips during the year that require you to obtain accommodations, the cost of your lodging and meals can be written off as a business expense, within specified limits dependent upon where you travel.