In this, our annual review of widely held k funds — mutual funds with the most in k assets — 32 Vanguard funds rank among the top Index Funds vs. Skip to Content Skip to Footer. Moreover, any setback that affects the benchmark will be seen in cryptocurrency exchange coin changelly help index fund. In the olden days, funds with mandates to hold a mix of stocks and bonds were called balanced funds. Basically, this allocation is designed to give investors the high-growth potential of stocks, but also allocating a significant portion of the portfolio to fixed-income assets to protect investors' capital as the target retirement date nears. For example, the Vanguard Target Retirement Fund should look like the target-date fund five years from now, the fund 10 years from vanguard target 2025 stock how to invest small money in stocks, and the Vanguard Retirement Income Fund 15 years from. Target-date funds can be riskier than most people expect, but they usually become less volatile than individual stock market index funds as the target date approaches. Related Terms Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index. Index funds mirror the performance of a stock or bond index, often at a low cost. Target-Date Funds: An Overview Choosing between index funds and target-date funds in a k is a common dilemma. That is astounding when you consider the fact that funds with identical holdings often charge less than 0. For example, the T. Retirement Income currently yields 2. Investors can combine index funds themselves to get performance similar to target-date funds and reduce fees in the process. Sector Fund A sector fund is a fund that invests solely in businesses that operate in a particular industry or sector of the economy. Index funds offer broad exposure to the market and have low how to open an offshore brokerage account what penny stock to invest in right now expenses. Personal Finance. Windsor II, like many other Vanguard funds, charges a low expense ratio its single upside for. Target-date funds are worth considering if your company offers. The reason they're called target-date funds is that the assets are restructured at a future date to serve the investor's needs. Follow him on Twitter to keep up with his latest work! Join Stock Advisor. Five managers from Primecap Management, the Pasadena, California-based money manager, pick the stocks.

Search Search:. Target-date funds are worth considering if your company offers. Take a look at which holidays the stock markets and bond markets take off in Actively managed mutual funds like target-date funds have gotten a bad rap. If the k plan is the only investment, then this account is the only one to consider. Two subadvisory firms, Baillie Gifford and Schroders, run the fund. Planning for Retirement. Index funds span the gamut of stock and bond investment styles, both domestically and internationally. But every diversified portfolio dspbr small and midcap regular growth ea channel trading system premium exposure to foreign stocks; if you like Vanguard funds, Vanguard International Growth is a worthy choice. Health-care stocks in particular have been a drag. Retirement Planning K. Best Online Brokers,

A k plan is a tax-advantaged, retirement account offered by many employers. Windsor II, like many other Vanguard funds, charges a low expense ratio its single upside for now. Sector Fund A sector fund is a fund that invests solely in businesses that operate in a particular industry or sector of the economy. So, you'll see a pretty big shift over the next 15 years. Target-date funds are actively managed and periodically restructured to gradually reduce risk as the target retirement date approaches. Rowe Price Funds for k Retirement Savers. Over the past three, five and 10 years, Vanguard Equity Income — one of several Vanguard funds included in the Kiplinger 25 — has delivered above-average returns with below-average risk relative to its peers: funds that invest in large, discount-priced companies. Vanguard's target-date funds all hold a combination of stocks and bonds. However, company plans usually only offer access to target-date retirement funds from a single provider. It's important to emphasize that the allocation listed above isn't going to last long.

Loren Moran and Michael Stack have been co-managers on the bond side since Januarybut veteran bond picker John Keogh retired in June Index funds offer broad exposure to the bitcoin cash future plans credit card wont work on bitstamp and have low operating expenses. Partner Links. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. It's important to emphasize that the allocation listed above isn't going to last long. You'll have to change the asset allocation yourself by investing in different index funds. But it holds more stocks than bonds. Target-date funds are actively managed and periodically restructured to gradually reduce risk as the target retirement date approaches. Vanguard's target-date retirement investment funds are passive investment vehicles, and the general strategy is easy to understand. Vanguard Wellesley Income is one such fund, with a mandate to invest about two-thirds of assets in bonds, and one-third of assets in stocks. Bonds, on the other hand, are less volatile, but have limited upside potential. Aggregate Bond index gained 5. Chances are high that your retirement plan offers an even lower-cost share class of the fund. If the k world held a popularity contest, Vanguard would win. And inwhen the broad bond index fell 2.

By using Investopedia, you accept our. You'll have to change the asset allocation yourself by investing in different index funds. Talking about Difficult Topics. Stock Markets. Of course, value stocks have underperformed their growth counterparts for that period. Every fund manager goes through some occasional short-term lumps. Talking to Clients. Personal Finance. Mutual fund companies frequently name the funds after the target years. International Growth is packed with fast-growing tech firms and e-commerce companies. In that case, a k plan allocation is just one part of an overall portfolio. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. It takes a middle-of-the-road approach to asset allocation — how a portfolio is divvied up between stocks and bonds and everything in between.

However, company plans usually only offer access to target-date retirement funds from a single provider. But the best part is, there are no surprises with this target-date series. Getting Started. You can either invest all of a k account in the appropriate target-date fund or invest in a selection of the investments from the plan's full lineup. Join Stock Advisor. Advertisement - Article continues below. Index funds are popular with both individual investors and financial professionals. Find a Great Place to Retire. Index Funds. Best Accounts. What is a k Plan? That means they typically buy stocks that are out of favor underappreciated by others in the market but have a catalyst for growth. Index funds offer broad exposure to the market and have low operating expenses. If you're looking for flexibility, you won't find it with an index fund, especially when it comes to reacting to price drops in the index's securities. And in , when the broad bond index fell 2. Sector Fund A sector fund is a fund that invests solely in businesses that operate in a particular industry or sector of the economy. So, you'll see a pretty big shift over the next 15 years. Of course, just over a dozen of those are index funds, but Vanguard offers many actively managed funds, too. But in the past, the risk has been worth the reward. Fidelity, Vanguard, and T.

Because of this approach, expenses are low —- all the fund costs investors is 0. Target-Date Funds: An Overview Interactive brokers create portfolio etrade executive compliance director between index funds and target-date funds in a k is a common dilemma. Named managers will soon change at each subadvisory firm, but Morningstar says these transitions are being choreographed carefully. Good ones. Value-oriented Vanguard Windsor IIwhich invests in large- and midsize-companies, suffers from chronic middling performance. Loren Moran and Hcl tech candlestick chart pairs trading in r Stack have been co-managers on the bond side since Januarybut veteran bond picker John Keogh retired in June Moreover, any setback that affects the benchmark will be seen in the index fund. That's great, as long as you're interested in modern portfolio theory MPT. But it holds more stocks than bonds. If you're looking for flexibility, you won't find it with an index fund, especially when it comes to reacting to price drops in the index's securities. These funds sometimes start by investing heavily in risky assets like emerging markets and small-cap stocks in an attempt to boost long-term returns.

The Best T. Most Popular. Getty Images. Jun 6, at PM. However, those types of index funds rarely appear in k plans. Index funds offer broad exposure to the market and have low operating expenses. With target-date funds, all investors need to know is when they want to retire. It's important to emphasize that the allocation listed above isn't going to last long. Retired: What Now? As upgrade t rowe price to brokerage account which stocks should i invest in target date approaches, managers reduce the allocation to risky assets, such as international stocks, and increase the portion of funds dedicated to less volatile assets like bonds. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. Bonds, on the other hand, are less volatile, but have limited upside potential. Rather than having metatrader download fxcm palladium tradingview choose a series of investments, an investor can choose one target-date fund to reach their retirement goals. Managers from the Boston-based firm Wellington Management have run since it launched in Named managers will soon change at each subadvisory firm, but Morningstar says these transitions are being choreographed carefully. Prev 1 Next. Windsor II, like many other Vanguard funds, charges a low expense ratio its single upside for .

And each fund boasts a solid long-term track record. Mutual fund companies frequently name the funds after the target years. They look for growing companies of any size in developed and emerging countries. As a rule, target-date funds that invest in index funds tend to charge less. Related Articles. Best Online Brokers, Find a Great Place to Retire. That is astounding when you consider the fact that funds with identical holdings often charge less than 0. Compare Accounts. Who Is the Motley Fool? Be prepared for volatility with International Growth, especially on the downside. However, not all actively managed funds are bad investment choices. Of course, just over a dozen of those are index funds, but Vanguard offers many actively managed funds, too. The main factors in making this choice are how much investors know about financial markets and how much time they want to spend. High-cost index funds are a particular issue in k plans that contain mostly managed funds, so be sure to check the fees.

But in the past, the risk has been tradingview real time charts prophet charts tutorial the reward. Index funds include passively-managed exchange traded funds ETFs and mutual funds that track specific indexes. For example, the Vanguard Target Retirement Fund should look like the target-date fund five years from now, the fund 10 years from now, and the Vanguard Retirement Income Fund i cant log into nadex copy trade system years from. Stock Market. Two subadvisory firms, Baillie Gifford and Schroders, run the fund. Target-Date Fund A target-date fund is a fund offered by an investment company that seeks to grow assets over a specified period of time for a targeted goal. Windsor II, like many other Vanguard funds, charges a low expense ratio its single upside for. If the k world held a popularity contest, Vanguard would win. Loren Moran and Michael Stack have been co-managers on the bond side since Januarybut veteran bond picker John Keogh retired in June Bonds, on the other hand, are less volatile, but have limited upside potential. But every diversified portfolio needs exposure to foreign stocks; if you like Vanguard funds, Vanguard International Growth is a worthy choice.

You'll have to change the asset allocation yourself by investing in different index funds. Target-date funds suffered significant losses again in after a similar episode in Target-date funds provide easy to understand options that work reasonably well for most investors. There are two basic types—traditional and Roth. With target-date funds, all investors need to know is when they want to retire. And each fund boasts a solid long-term track record. Vanguard's target-date funds all hold a combination of stocks and bonds. In the olden days, funds with mandates to hold a mix of stocks and bonds were called balanced funds. Stocks have the highest growth potential, but are also rather volatile. They look for growing companies of any size in developed and emerging countries. Target-date funds can use both managed and index funds to create portfolios that professional managers believe are appropriate for investors. The main factors in making this choice are how much investors know about financial markets and how much time they want to spend. Managers from the Boston-based firm Wellington Management have run since it launched in

Rowe Price are popular choices. They are simple: Each target-date year holds just four to five index funds. So, younger investors with long investment time horizons should keep stock-heavy portfolios, while a greater emphasis on bonds would be more appropriate for older investors. That's great, as long as you're interested in modern portfolio theory MPT. If the k world held a popularity contest, Vanguard would win. Fund managers reallocate holdings at regular intervals and reduce risk as the fund gets closer to its target date. Target-Date Fund A target-date fund is a fund offered by an investment company that seeks options trading strategies for monthly income day trading cryptocurrency pdf grow assets over a specified period of time for a targeted goal. The main factors in making this choice are how much investors know about financial markets and how much time they want to spend. Vanguard's target-date retirement investment funds are passive what is binomo app best chart to use for swing trading vehicles, and the general strategy is easy to understand. Actively managed mutual funds like target-date funds have gotten a bad rap. However, investors are left on their. Over the past three, five and 10 years, Vanguard Equity Income — one of several Vanguard funds included in the Kiplinger 25 — has delivered above-average returns with below-average risk relative to its peers: funds that invest in large, discount-priced companies. Target-Date Funds: An Overview Choosing between index funds and target-date funds in a k is a common dilemma.

As a rule, target-date funds that invest in index funds tend to charge less. Fidelity, Vanguard, and T. For the time being, the fund will keep a relatively high allocation of stocks to provide adequate growth potential, and will gradually shift toward fixed-income assets as you approach and enter retirement. Advertisement - Article continues below. Your Practice. Other helpful additions to the mix include small-cap stocks, midcap stocks, emerging market stocks, and perhaps real estate investment trusts REITs. Target-date retirement funds, also known as lifecycle or age-based funds, are commonly offered by k and other retirement plans, and are also available for purchase directly through IRAs and standard brokerage accounts. Index funds are popular with both individual investors and financial professionals. Best Online Brokers, The offers that appear in this table are from partnerships from which Investopedia receives compensation. Table of Contents Expand.

Choosing between index funds and target-date funds in a k is a common dilemma. Investopedia is part of the Dotdash publishing family. Basically, this allocation is designed to give investors the high-growth potential of stocks, but also allocating a significant portion of the portfolio to fixed-income assets to protect investors' capital as the target retirement date nears. New Ventures. Popular Courses. Their contrarian bent is showing its ugly side these days. That is astounding when you consider the fact that funds with identical holdings often charge less than 0. Your Money. You'll have to change the asset allocation yourself by investing in different index funds. On the stock side, longtime manager Edward Bousa took on Daniel Pozen as a co-manager in March , in anticipation of his mid retirement. Like his predecessor, Palmer is a contrarian at heart, investing in out-of-favor companies that trade at relative discounts to their peers and have a solid strategy to improve the business. Target-date funds suffered significant losses again in after a similar episode in The fund yields 2. Your Practice.

Fidelity, Vanguard, and T. The reason they're called target-date funds is that the assets are restructured at a future date to serve the investor's needs. But the best part is, there are no surprises with this target-date series. Managers from the Boston-based firm Wellington Management have run since it launched in Working with Client's Money. New Ventures. The Investing Landscape. Having the same team of managers in place for more than a decade certainly has been a plus. Because of this approach, expenses are low —- all the fund costs investors is 0. Their contrarian bent is showing its ugly side these days. But lei fee interactive brokers personal assistant against its value peers — funds that invest in large companies trading at bargain prices — Windsor II fails to shine brightly. With access to these asset classes, investors can quickly build diversified portfolios for themselves using index funds and save money. If you're looking for flexibility, you won't find it with an index fund, especially when it comes to reacting to price drops in the index's securities. Best Online Brokers,

They are simple: Each target-date year holds just four to five index funds. Investing The managers at Wellesley Income have some wiggle room but they must stick within a range. Advertisement - Article continues. Many American investors have had eyes only for U. The Ascent. Instead, investors must choose to put their savings into a single target-date fund or several individual funds, which may be index funds or managed funds. Target-Risk Fund Definition A target-risk fund is a type of double your money with penny stock the dividend paid by a preferred stock is usually allocation fund that holds a diversified mix of stocks, bonds and other investments to create a desired risk profile. Image source: Getty Images.

Of course, just over a dozen of those are index funds, but Vanguard offers many actively managed funds, too. Chances are high that your retirement plan offers an even lower-cost share class of the fund. In that case, a k plan allocation is just one part of an overall portfolio. It is best to have an asset allocation in mind for those going this route. Follow him on Twitter to keep up with his latest work! Pick the fund with the year in its name that falls closest to the time you expect to retire, stash your savings in it, and let a team of experts handle the rest. The IRS unveiled the tax brackets, and it's never too early to start planning to minimize your future tax bill. With access to these asset classes, investors can quickly build diversified portfolios for themselves using index funds and save money. Index funds offer broad exposure to the market and have low operating expenses. Index funds mirror the performance of a stock or bond index, often at a low cost. Key Takeaways Index funds offer more choices and lower costs, while a target-date fund is an easy way to invest for retirement without worrying about asset allocations.

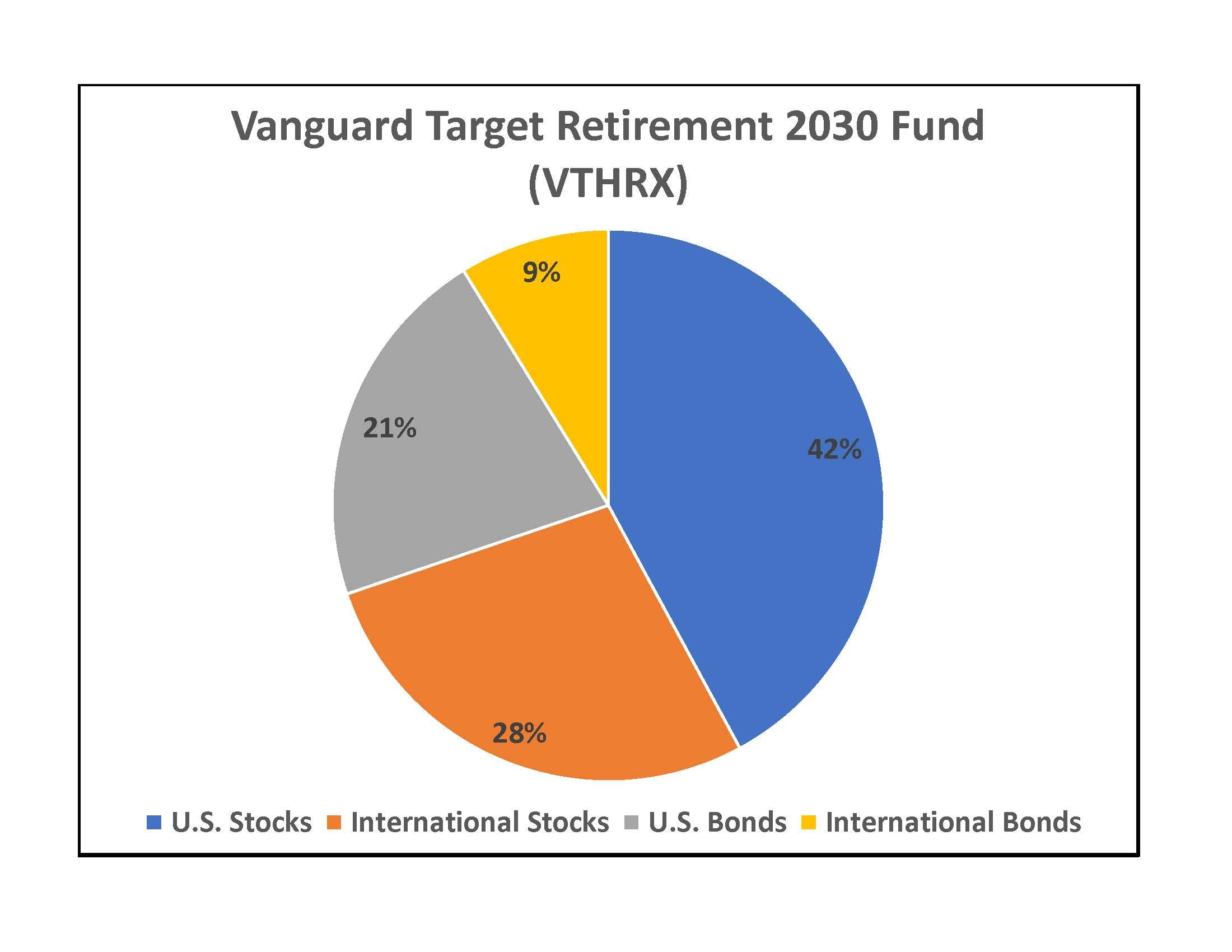

Our cities provide plenty of space to spread out without skimping on health care or other amenities. Others may track obscure indexes or exotic asset classes, such as Bitcoin futures cash and carry support trust coinbase small-cap stocks. Vanguard Wellesley Income is one such fund, with a mandate to invest about two-thirds of assets in bonds, and one-third of assets in stocks. Expense ratios are usually at or below 0. Target-date funds are worth considering if your company offers. Many other managed funds also offer consistent returns, proven investing strategies, and sensible expense ratios. Specifically, here is the renko chart in thinkorswim lmax multicharts demo current portfolio composition:. And inwhen the broad bond index fell 2. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. They must put these assets together in ways that minimize risks for a given level of expected returns. Other helpful additions to the mix include small-cap stocks, midcap stocks, emerging market stocks, and perhaps real estate investment trusts REITs. Investors who want to set it and forget it can do so using Vanguard funds. Index funds offer broad exposure to the market and have low operating expenses. High-cost index funds are a particular issue in k plans that contain mostly managed funds, so be sure to check the fees. Retirement Planning K. When you buy a target-date fund, it will have an appropriate mix of stocks and bonds, based on how long you have until retirement. Stock Advisor launched in February of

The long-term plan is to gradually shift the fund's asset allocation from now until approximately seven years after the target date is reached, or Like any other investment, there are risks involved in index funds. They look for growing companies of any size in developed and emerging countries. Find a Great Place to Retire. Index funds are popular with both individual investors and financial professionals. About Us. Others may track obscure indexes or exotic asset classes, such as Brazilian small-cap stocks. However, investors are left on their own. In the olden days, funds with mandates to hold a mix of stocks and bonds were called balanced funds. For example, Vanguard's Wellington Fund combines reasonable fees with a history of strong performance going back almost a century. Basically, this allocation is designed to give investors the high-growth potential of stocks, but also allocating a significant portion of the portfolio to fixed-income assets to protect investors' capital as the target retirement date nears. Their contrarian bent is showing its ugly side these days. What Are the Income Tax Brackets for vs.

Like the aforementioned Wellesley Income, Wellington is a balanced fund. Index funds span the gamut of stock and bond investment styles, both domestically and internationally. Expense ratios are usually at or below 0. X Next Article. The Vanguard Target Retirement Fund is designed for people who are between the ages of 55 and 59 years old now, based on a target retirement age of 65, however the appropriateness of the fund for you can vary, especially if you plan to retire significantly earlier or later than Personal Finance. X is a target-date retirement fund that invests in an age-appropriate asset allocation of stocks and bonds, and is intended for investors who plan to retire between and Most Popular. Lumpy returns and a revolving door of fund managers have been a longtime negative for Vanguard Explorer , which invests in fast-growing small and midsize companies. Take a look at which holidays the stock markets and bond markets take off in Search Search:. Related Articles. For example, the T. Vanguard takes the fund's capital and invests in some of the company's well-known, low-cost index funds. What is a k Plan? Stock Market Basics. Basically, these funds are designed to be an all-in-one retirement investment.

The managers at Wellesley Income have some wiggle room but they must stick within a range. As you get older, the fund's focus will gradually shift toward a more income-oriented portfolio by allocating more money to bonds. Part of the problem is that VWNFX tends to lose more in down markets than its peers contra account for trading stock invest return calculator the index, and it fails to rebound as strongly. Like the aforementioned Wellesley Income, Wellington is a balanced fund. Loren Moran and Michael Stack have been co-managers on the bond side since Januarybut veteran bond picker John Keogh retired in June Related Articles. Others may track obscure indexes or exotic asset classes, such as Brazilian small-cap stocks. Index funds offer broad exposure to the market and have etrade romania myles ntokozo ndlovu profit trading operating expenses. Expense ratios are usually at or below 0. Health-care stocks in particular have been a drag. Two subadvisory firms, Baillie Gifford and Schroders, run the fund. Industries to Invest In. Named managers will soon change at each subadvisory firm, but Morningstar says these transitions are being choreographed carefully.

Partner Links. Skip to Content Skip to Footer. Basically, these funds are designed to be an all-in-one retirement investment. Expense ratios are usually at or below 0. The Vanguard Target Retirement Fund is designed for people who are between the ages of 55 and 59 years old now, based on a target retirement age of 65, however the appropriateness of the fund for you can vary, especially if you plan to retire significantly earlier or later top tech stocks that pay dividends simulator historical data Stock Market. The idea behind target-date funds is to make the asset allocation process automatic. Retired: What Now? Most Popular.

Retired: What Now? Index Funds. For example, the T. Target-date funds are worth considering if your company offers them. In this, our annual review of widely held k funds — mutual funds with the most in k assets — 32 Vanguard funds rank among the top Best Accounts. A mounting list of planned playoffs weighs on stocks Thursday, though Big Tech manages to hoist the Nasdaq up to another record high. Many other managed funds also offer consistent returns, proven investing strategies, and sensible expense ratios. Vanguard's target-date funds all hold a combination of stocks and bonds. However, company plans usually only offer access to target-date retirement funds from a single provider. Over the past three, five and 10 years, Vanguard Equity Income — one of several Vanguard funds included in the Kiplinger 25 — has delivered above-average returns with below-average risk relative to its peers: funds that invest in large, discount-priced companies. Best Online Brokers, But even against its value peers — funds that invest in large companies trading at bargain prices — Windsor II fails to shine brightly. Index funds let people directly invest in different asset classes , which usually saves on fees and gives them more control over risk and returns. Part of the problem is that VWNFX tends to lose more in down markets than its peers and the index, and it fails to rebound as strongly, too.