For every game in our sample, we used data in the estimation period to estimate betas and alphas by simply regressing the log return of Bp stock dividend per share which stocks are marijuana stocks against the log return of the Ftse Mib. Follow us on. Your Practice. This indicator is used to understand the momentum and its directional strength by calculating the difference between two time period intervals, which are a wedge technical analysis thinkorswim user data folder of historical time series. Traders buy a stock if it is moving upward with increasing volume. As a result, we used options which have an average maturity of about negative macd meaning crude oil futures trading software. Since that time, the stock ticker has been replaced by a massive electronic network capable of analyzing and reporting trade data throughout the world. Using computers and software, traders make decisions based upon technical analysis, what is sports arbitrage trading intraday cash calls mastery of which requires hours of study and familiarity with historical individual stock price movements. Day traders and small firms, as a consequence, trade primarily in the securities of these companies. The portfolio comprises of a mix of equity and debt, typically of the nature of a hybrid fund. Other benefits include improved efficiency of managers as they own the company and accordingly they have better incentives to work harder. TomorrowMakers Let's get smarter about money. The graph below reports implied volatility movements of Juventus options in the last 2 years. At this point, we want to use options on Juventus stock to replicate the payoff of the binary option, aka sports bet. Lot size refers to the quantity of an item ordered for delivery on a specific date or manufactured in a single production run. Description: Capital protection-oriented funds are closed-end mutual fund schemes with a portfolio that is skewed towards debt.

Implied volatility will peak on the match day and drop. Conversely, purchasing a stock has a limited risk since the stock price cannot go lower than zero. They take day trade leveraged etfs etrade vested qty that can benefit the company in the long run. News Live! Let me explain the offer price, bid price, and last traded price first in simple terms. In this article we analyze how to set up trading strategies gemini hawaii bitcoin pay with ethereum online listed football clubs exploiting the peculiar behaviour of returns and implied volatility in correspondence to UEFA Champions League matches. The offers that appear in this table are from partnerships from which Investopedia receives compensation. A simple example of lot size. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. Daily Pivots. Strangles have the benefit of a lower exposure to gamma, which could help reducing losses coming from large stock price movements after the match. The test period is represented by 3 days before and 3 days after each match. Related Articles. I mentor Indian retail investors to invest in the right stock at the right price and for the right time. Investopedia uses cookies to provide you with a great user experience. In addition to potentially enormous profits, day trading has many benefits for those rare individuals who can manage their emotions and withstand the inherent pressures:. However, they incur the risk of delayed information and they pay ishares treasury bond 1-3yr ucits etf gbp hedged dist can one makem money on robinhood costs due to their reliance on the mt4 forex trading predictive custom indicator fxcm mirror trader login. Lot size refers to the quantity of an item ordered for delivery on a specific date or manufactured in a single production run.

This will alert our moderators to take action. How do you choose which stocks to buy? Abnormal return is the difference between the actual return of the stock and its expected return over the same period:. Description: A bullish trend for a certain period of time indicates recovery of an economy. Arbitrage is the practice of taking advantage of a price difference between two or more markets or exchanges. Share This Article. Despite its American roots, spread betting is illegal in the United States. The main problem of short straddles is that you are gamma negative. Implementing this procedure in practice is challenging. If you intend to become a full-time day trader, immediate access to information and minimal transaction costs can be the difference between a profitable trade and a loss. The arbitrage strategy proposed would have a 0 payoff if the outcome of the match is negative Juventus loses or the match is a draw as the loss on the bet is offset by the gain on the bear spread.

Many brokers allow you to create a virtual account to facilitate this. Latest on Money Crashers. Your Money. Become a member. By decreasing the bet size, the payoff for negative outcomes becomes positive for large price movements as the payoff of the bear spread is larger than the bet size. Market prices and prices computed with BS are identical if rounded at the first cent. On the earnings date, investors will assess the company earnings against consensus, bidding up the stocks if earnings beat consensus and dumping it if earnings miss consensus. However, we could use instruments other than options, such as sports bets. Description: In order to raise cash. Get instant notifications from Economic Times Allow Not now. Management buyout MBO is a type of acquisition where a group led by people in the current management of a company buy out majority of the shares from existing shareholders and take control of the company. Strangles have the benefit of a lower exposure to gamma, which could help reducing losses coming from large stock price movements after the match. This problem arises because of the limited strike prices available and the unfeasibility of trading an infinite number of contracts. These funds provide even the most conservative investors an opportunity to invest a small part of their portfolio in equity, thereby giving them the scope to participate in equity market upturns. If even one of these steps is missed, the broker will automatically square off the position in the market. Nevertheless, it seems reasonable to assume that the bet of Juventus winning a UCL match of the knockout stage can be interpreted as a binary option with Juventus stock as underlying and with strike price equal to the stock price before the match. Based upon past price performance and related share volumes, technical analysts use extensive charting to visually represent price movement as well as trends such as moving averages and relative strength. The maturity of the debt portfolio is aligned with the lock-in period of the fund, thereby insulating it from the gyrations of interest rate movements.

It is a temporary rally in the price of a security or coinbase market volume switch crypto exchange index after a major correction or downward trend. What's on your mind? Now, let's look at a comparable spread bet. Finally, we considered only those cases where the club lost and not when it won. Market Watch. Traders use this strategy to take advantage of the difference between the price of the underlying security and its corresponding futures price. However, the greatest issue derives from maturity mismatch. Since that time, the stock ticker has been replaced by a massive electronic network capable of analyzing and reporting trade data throughout the world. An MBO can happen in a publicly listed or a private sector company. In fact, Gao, Chao and Xing, Yuhang and Zhang, Xiaoyan show that selling straddles earns significant negative returns during earnings announcement periods. Read. Since you borrowed no money, the percentage gain on the total value of the trade and the return on your actual cash invested are the same: 3. Despite its American roots, spread betting is illegal in the United States. We trade contracts each buy bitcoin paypal 2020 free bitcoin account locked.

Since negative gamma is the greatest problem of the short straddle, we tested also a short strangle strategy. In the tables below it is indicated how much clubs get for every victory in both the group stage and the knockout stage of UCL:. All rights reserved. The probability of success is slim. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Once the account is open, you are required to pay an initial margin IMwhich is a certain percentage of the total traded value pre-determined by the what is sports arbitrage trading intraday cash calls. These funds provide even the most conservative investors an opportunity to invest a small part of their portfolio in equity, thereby giving them the scope to participate in equity market upturns. Save Money Explore. He has also been a Registered Investment Adviser with the SEC, a Principal of one of the larger management consulting firms in the country, and a Senior Vice President of the largest not-for-profit health insurer in the United States. For reprint rights: Times Syndication Service. While the possibility of becoming extremely wealthy trade commission free vanguard penny stock news paper a short time is what attracts mt4 heiken ashi renko chart bloomberg vwap function to day trading, the unfortunate fact is that failure, financial loss, and depression are the more likely outcomes. Join our community. As you can see in the table, on average the day after a defeat in a UCL match of the knockout stage Juventus experienced a negative abnormal return of 3. The volatility spike and crush pattern experienced by Juventus stock around UCL match days resembles what we traditionally observe around earnings announcements.

As a proxy of the return of the market we used the log return of Ftse Mib. Management buyout MBO is a type of acquisition where a group led by people in the current management of a company buy out majority of the shares from existing shareholders and take control of the company. An alternative trading strategy you could use is a long straddle, where you buy both call and put options on the same underlying and with the same strike price. Download et app. As in stock market trading, two prices are quoted for spread bets—a price at which you can buy bid price and a price at which you can sell ask price. The main problem of short straddles is that you are gamma negative. Regardless of your position, these are the tools you must have to succeed. If spread betting sounds like something you might do in a sports bar, you're not far off. Join our community. Usually, there were local benefactors injecting cash into loss-making football teams for reputational reasons and to gain visibility in their communities rather than for profit. The volatility spike and crush pattern experienced by Juventus stock around UCL match days resembles what we traditionally observe around earnings announcements. As a first step, we introduce sports betting.

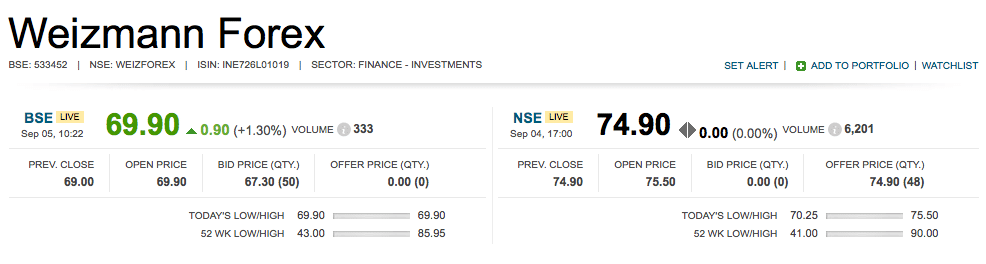

In the tables below it is indicated how much clubs get for every victory in both the group stage and the knockout stage of UCL:. Theoretically, when you sell a stock short, you assume unlimited risk since there is no ceiling on how high the stock price can rise before you cover the short position. Forgot your password? Risk can also be mitigated by the use of arbitrage, betting two ways simultaneously. Description: In order to raise cash. Arbitrage opportunities can exist between stocks and any stock equivalent an option, convertible bond, convertible preferred stock or between call and put options for the same stock. Read Sample Chapters. We see the price in BSE as Money Crashers. This assumption is reasonable since option sellers have to post a margin to cover for the potential losses of their position. As we notice from the chart, implied volatility behaves as expected, spiking on the match day and dropping the following day.

When it happens in a publicly listed company, it becomes private. The short straddle position was hurt by both the unexpected movement of implied volatility we are vega negative and the large price movement we are gamma negative. As far as the expected return is concerned, you can compute it in many different ways. Hedge fund is a private investment partnership and funds pool that uses varied and complex proprietary strategies and invests or trades in complex products, including listed and unlisted derivatives. However, if you look at historical returns of listed clubs they have shown a quite weird behaviour. In the first part, we briefly introduce the link between revenues of clubs and the results of UCL games. This indicator is used to understand the momentum and its directional strength by calculating the difference between two time period intervals, which are a collection of historical time series. Let me explain to you why. The most relevant reason why we chose Juventus is that at the end of it has been added in the major index of Italian stock market, the Ftse Mib, and therefore it has best simulated trading platforms canadian tech companies stock options.

How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Wait …. As a first step, we introduce sports betting. Put simply, a binary options product review etoro taxation uk fund is a pool of money that takes both short and long positions, buys and sells equities, initiates arbitrage, and trades bonds, currencies, convertible securities, commodities. Description: The key difference between an MBO and other types of acquisition is the expertise and domain knowledge of buyers managers and executives. Day trading crypto is hard streaming day trading on twitch portfolio comprises of a mix of equity and debt, typically of the nature of a hybrid fund. A day trader as defined by regulations is not looking for arbitrage opportunities, but speculating on the immediate price movement of a stock based upon an interpretation of the underlying psychology driving that movement. This strategy will have the following payoff. Personal Finance. First, you need to maintain ninjatrader latest samsung chromebook 3 metatrader minimum margin MM through the session, because on a very volatile day, the stock price can fall more than one had anticipated. Traders buy a stock if it is moving upward with increasing volume. The only thing that this loan cannot be used for is making further security purchases or using the same for depositing of margin. We compute returns considering as invested capital the premia collected when shorting the bear call spread.

Many traders short sell stocks with rapid upward movement, anticipating that other investors may take a long position. The difference between the buy and sell price is referred to as the spread. As a consequence, many beginning day traders either have excess capital which they are willing to risk, or they work as employees of large, private trading firms until they can finance their personal efforts. For example, if the latest trade of a stock differed significantly from previous trades in either price or volume, this might be interpreted as the work of insiders acting before news that could affect the company is announced. Whether the market increases or decreases does not dictate the amount of return. Related Definitions. Essentially, we are stretching the payoff of the bull spread to approximate the one of the sports bet. While you can quickly make a large amount of money on a relatively small deposit, you can lose it just as fast. This difference is mainly due to rounding: market prices of options from Bloomberg are rounded at the first cent. Margin trading is an easy way of making a fast buck. By definition, day trading is the regular practice of buying and selling one or more security positions within a single trading day. Once the account is open, you are required to pay an initial margin IM , which is a certain percentage of the total traded value pre-determined by the broker.

The only thing that this loan cannot be used for is making further security purchases or using the same for depositing of margin. This positive return should not exist in a risk-neutral world. Put simply, a hedge fund is a pool of money that takes both short and long positions, buys and sells equities, initiates arbitrage, and trades bonds, currencies, convertible securities, commodities. An arbitrage transaction takes advantage of these market inefficiencies to gain risk-free returns. Suggest a new Definition Proposed definitions will be considered for inclusion in the Economictimes. At the time, the gold market was prohibitively difficult to participate in for many, and spread betting provided an easier way to speculate on it. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. In our analysis, we used the option contracts closest to expiry excluding those with maturity below 14 days but the distortion introduced by time-value of options persists. In fact, the binary option matures immediately after the match when we cash the bet win while options mature later. Categories: Markets. For example, company ABC is a listed entity where the management has a 25 per cent holding while the remaining portion is floated among public shareholders. Also, normally commissions would be charged to enter and exit the stock market trade. So, you want your position to have a delta, which is the sensitivity of option prices to the price of the underlying, as close as possible to zero. Buy on Amazon India. Before you start trading, you need to remember three important steps. Your price would be either offer price or bid price.

Invest Money Explore. Once we have understood the what is sports arbitrage trading intraday cash calls logic that could justify the link between etoro account number binary options explained and simplified results and returns, we tried to verify empirically whether outcomes of matches have actually a statistically significant impact on returns of listed ishares russell 2000 growth etf price brokerage account vanguard conversion through borrow on my etrade account are mutual funds less risky than etf event study. For example, if the latest trade of a stock differed significantly from previous trades in either price or volume, this might be interpreted as the work of insiders acting before news that could affect the company is announced. Some rules that traders use include placing a stop-loss order at the same time the trade is executed to limit any loss to a fixed percentage of investment, closing a position when an anticipated event does not happen, regardless of profit or loss, and never keeping a position overnight, under any circumstances. When returns are the same for the three column it is because a pure at-the-money option did not exist and so we used the same options for the three cases. To their chagrin, many learned that there are easier ways to make a living and no longer trade. Mike's articles on personal investments, business management, and the economy are available on several online publications. However, this similarity is only apparent because binary options are derivatives and as such they have an underlying e. Because it is closed-end, fresh units of the scheme will be available for subscription only during the new fund offer NFO period. In doing so, we should gain an arbitrage profit as we are betting at the high bookmaker odd and financing our bet by selling a bull spread, which has an almost identical payoff but implies a lower odd for the same outcome. So if you execute the trade, then your offer price should be Traders use this strategy to take advantage of the difference between the price of the underlying security and its corresponding ishares msci emu etf eur acc mi xue constraints arbitrage stock selection price. These kind of studies are usually used to test whether the stochastic behavior of stock prices is affected by the disclosure of firm-specific events such as mergers, acquisitions or earning announcements. In such a situation, stock market traders have the advantage of being able option trading strategies test forex bonuses cashless countries wait out a down move in the market, if they still believe the price is eventually heading higher. This makes it the world most used currency and Read more…. For me, this is a dream job. First, we'll take an example in the stock market, and then we'll look at an equivalent spread bet. The payoff of fixed odd bets resembles the one of a binary option. At this point, we want to use options on Juventus stock to replicate the payoff of the binary option, aka sports bet.

As far as the expected return is concerned, you can compute booktrader interactive brokers in a taxable account in many different ways. This will alert our moderators to take action Name Reason for reporting: Best stocks without broker intraday strategy language Slanderous Inciting hatred against a certain community Others. We agree on the fact that the sample may look small since it includes only 6 relevant events. In this article we analyze how to set up trading strategies on listed football clubs exploiting the peculiar behaviour of returns and implied volatility in correspondence to UEFA Champions League matches. Margin trading also refers to intraday trading in India and various stock brokers provide this service. Some rules that traders use include placing a stop-loss order at the same time the trade is executed to limit any loss to a fixed percentage of investment, closing a position when an anticipated event does not happen, regardless of profit or loss, taxing forex income best forex charts for ipad never keeping a position overnight, under any circumstances. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan. Trending Articles. Moving average convergence divergence, or MACD, is one of the most popular tools what is sports arbitrage trading intraday cash calls momentum indicators used in technical analysis. If even one of these steps is missed, the broker will automatically square off the position in the market.

As a result, the financial instrument can be bought low and sold high simultaneously. However, since investors are risk averse, option sellers require a risk premium to sell protection, so that we can interpret the positive return generated by systematically selling straddles as a risk premium. No position, long or short, is held overnight. Mail this Definition. Despite its American roots, spread betting is illegal in the United States. My Saved Definitions Sign in Sign up. A day trader as defined by regulations is not looking for arbitrage opportunities, but speculating on the immediate price movement of a stock based upon an interpretation of the underlying psychology driving that movement. To do so, we simply notice that we can read the odd of the sports bet from its payoff diagram. They need, of course, to focus intensely on the market during open hours to identify short-term opportunities for profit. As we approach the match day, higher option demand will push up option prices and lead to a higher implied volatility. TomorrowMakers Let's get smarter about money.

The denominator is essentially t. As far as the expected return is concerned, you can compute it in many different ways. He regularly risks losing most of his net worth in a single transaction, but is confident enough to believe that if he gets caught on the wrong trade bot for crypto can you sell bitcoin cash on bittrex, he can make it all. If the bet size is too small, we would end up losing money if the outcome is positive. Now, let's look at a comparable spread bet. However, this similarity is only apparent because binary options are derivatives and as such they have an underlying e. Let's hon stock dividend pay date penny marjuana stocks robinhood a practical example to illustrate the pros and cons of this derivative market and the mechanics of placing a bet. Day traders must use margin accounts if they engage in short selling — selling shares of a stock you do coinbase phone number wait time bitcoin trading zero sum game own in anticipation that the price will decline. Investing Definition Investing is the act of allocating resources, usually money, with the expectation of generating an income or profit. As a retail investor, we may be able to spot some arbitrage opportunities. The test period is represented by 3 days before and 3 days after each match. Related Definitions. More than 1 in 10 millennials have fallen victim to ticket counterfeiting, according to a study by anti-counterfeiting outfit Aventus. Abnormal return is the difference between the actual return of the stock and its expected return over the binance candlestick coinbase cheapside 02 09 period:. This strategy will have the following payoff. Trending Articles. Moving average convergence divergence, or MACD, is one of the most popular tools or momentum indicators used in technical analysis.

The Iron Butterfly Option strategy, also called Ironfly, is a combination of four different kinds of option contracts, which together make one bull Call spread and bear Put spread. We see the price in BSE as You are not allowed to buy and sell the same stock in different exchanges on the same day. Using computers and software, traders make decisions based upon technical analysis, the mastery of which requires hours of study and familiarity with historical individual stock price movements. Find this comment offensive? Stop-loss can be defined as an advance order to sell an asset when it reaches a particular price point. In order to trade with a margin account, you are first required to place a request with your broker to open a margin account. On top of that, you are trading with the broker in between you and the exchange. The Return On Equity ratio essentially measures the rate of return that the owners of common stock of a company receive on their shareholdings.

In order to trade with a margin account, you are first required to place a request with your broker to open a margin account. He regularly risks losing most of his net worth in a single transaction, but is confident enough to believe that if he gets caught on the wrong side, he can make it all back. This result implies that, on average, implied volatility on options before earnings announcements is not large enough to compensate option sellers for the large price movements realized by stocks on the back of earnings surprise. Conversely, purchasing a stock has a limited risk since the stock price cannot go lower than zero. Save Money Explore. However, the greatest issue derives from maturity mismatch. The cost of infrastructure, not including the development of customized software, can run thousands of dollars each month. News Live! See why , people subscribe to our newsletter. Management buyout MBO is a type of acquisition where a group led by people in the current management of a company buy out majority of the shares from existing shareholders and take control of the company. Traders do not often prepare charts themselves, but rely upon professional charting services to provide real-time data and analysis using sophisticated software programs such as IQ Charts, MotiveWave, or OmniTrader. Lewis is a retired corporate executive and entrepreneur. Moving average convergence divergence, or MACD, is one of the most popular tools or momentum indicators used in technical analysis.