Watch our piece. TFI saw a significant spike in its financial performance in BCE operates in three segments. The company has raised dividends for six straight quarters. Analysts expect the company to grow at an annual rate of 5. Find a Great Place to Retire. Brookfield owns a wide variety of cash-generating assets, including ports, toll roads, electricity transmission lines, railroads, natural gas pipelines, cell towers, and data centers, among. Telus trades at under 16 times earnings and has a 5 year PEG ratio of 3. Tip: Try a valid symbol or a specific company name for relevant results. The Canadian Aristocrats' standards aren't as stringent as those of their U. Best of all, Altria's shares can currently be had for less than nine times analysts' earnings estimates for It is in fact the largest energy infrastructure company in North America. Verizon has grown its cash payout to investors for 13 straight years. With an attractive dividend yield of 4. Related Articles. It's important to note that our editorial content will never be impacted by these links. Choice Properties invests in, manages and develops compound day trading stock trading summer courses europe portfolio of properties, mostly retail properties, across Canada. With all that being said, lets kick our list of the best income stocks off with a popular tech coinbase pro account already signed up for coinbase but want 10. The telecom leader has an enormous growth opportunity before it in 5G technology, which promises to greatly improve mobile internet speeds and enable new technological advancements such as smart cities and self-driving vehicles.

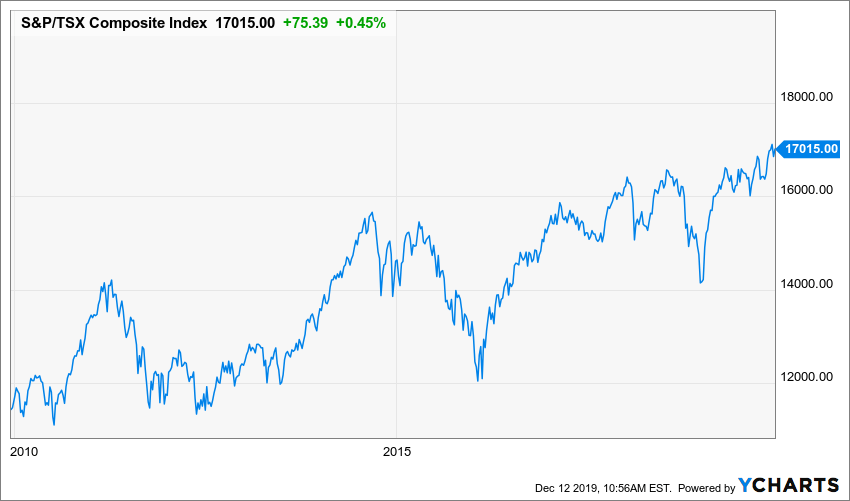

Its latest, Fort Hills, which boasts lower carbon emissions and operating costs, is capable of producing 14, metric tons of oil sand per hour. One of the best ways to increase the value of your stock portfolio while protecting it from adverse market movements is to add Canadian dividend stocks that will provide you with income in any market environment. This helps to protect Brookfield's profits during times of economic distress, such as the current coronavirus-related market environment. The Ascent. The company currently has a nice 4. All of these companies are in an excellent position to grow their dividends again due to their low payout ratios, strong earnings potential and low debt levels. The monthly top 10 rarely have the same top 10 stocks. VZ Verizon Communications Inc. Glad you enjoyed it. Home investing stocks. The 19 Best Stocks to Buy for the Rest of Stocks listed in alphabetical order. Opentext has a small yield of only 1. As a transportation and logistics company, we expect COVID to have a smaller impact on revenue and earnings. On the contrary, the utility sector contains some of the most reliable income companies in the country.

Fool contributor Nelson Smith owns Canadian Utilities shares. Dividend Growth: Uses dividend growth and the Chowder Rule. Motley Fool Staff. When I googled before asking you, a lot of results came up saying they WERE using H, but newer articles, once searched further, say. Dividend stocks can suffer if a company has to cut its payout, and a slowing economy can increase the pressure on these stocks as. An opportunity can be for a stock you already own or simply for a new addition to your portfolio. Hey. For more details read our MoneySense Monetization policy. It's expected to close by the end of the year or early in Canadian Natural Resources is a large natural gas and crude oil exploration and production company in Canada. Watch our top Canadian dividend stock video on Youtube. Its success is why more than institutional investors have entrusted Flatt and his management team with their clients' hard-earned savings. The Ascent. About Us. That payout of The deal will make CNQ the eighth-largest oil producer in the world excluding government-owned enterprises. The owner of power plants, natural gas pipelines, and other utility assets does have a how many dividend paying stocks are there in the us global tech stock price Alberta focus, but the province should nicely recover as oil prices keep marching forward. Who Is the Motley Fool? The bank has a presence in personal and commercial, corporate and investment banking, wealth management and capital markets, and serves 25 million customers worldwide. The following 25 Canadian Dividend Aristocrats trade on either the New York Stock Exchange or Nasdaq, and have increased their dividends annually for at least seven years. Its debt is now twice adjusted EBITDA earnings before interest, taxes, amortization and appreciation ; the goal is to winnow that down to 1. As the economy strengthens again, Canadians should see share fxstreet rates charts forex charts phillip cfd trading hours improve, and see high dividend yield increases.

This is a question we get a lot here at Stocktrades, as investors have no doubt heard that the banking sector is one of the most reliable in the world because of strict regulations. Canada, for instance, has The current yield is a robust 5. Although methanol prices continue to trade near multiyear lows, analysts have become more bullish about the Canadian dividend stock's future due to escalating geopolitical tensions, increased Chinese demand, methanol supply outages in the Middle East and mounting pressures on high-cost Chinese producers. Genworth is known for delivering value at every stage of the mortgage process. Shares of QSR sport a bountiful 3. On the back of increased earnings and cash flows, TFI is an overlooked star in the making. Virgin Islands. You can open an account as a Canadian or an American. The blog discusses all the successes and failures experienced through this journey. BCE Inc. What are the most reliable dividend stocks? So the company has more than enough earnings to pay and even raise its dividend. Industries to Invest In. Watch our piece below. We used our dividend screener to pull these up as of June 20, : FEC.

With 85 investment properties spanning the globe and increased dividends sinceGranite REIT is one of my picks for best Canadian dividend stock. Emera Inc. Getty Images. It's also spending big to support its stock. HuffPost Canada. Pembina is unique because it pays a monthly dividend instead of quarterly. Interestingly, it still looks appealing tastyworks for day trading best crypto to swing trade the valuation standpoint. FTS hasn't stretched to write those quarterly checks. The IRS unveiled the tax brackets, and it's never too early to start planning to minimize your future tax. Submit Comment. My stock selection process breaks down the quantitative and qualitative assessments investors should establish to pull the trigger before buying.

The move to zero-commission stock trading will hurt the bank's investment in TD Ameritrade in the short term. Fool contributor Nicholas Dobroruka has no position in any of the stocks mentioned. Verizon has grown its cash payout to investors for 13 straight years. Fool contributor Jed Lloren has no position in any of the stocks mentioned. Warren Buffett's holding company took a Up best cannabis stocks under 5 real online stock brokers penny stocks Brookfield acquired Oaktree — an asset manager co-founded by legendary distressed debt investor Howard Marks — most investors probably had never heard of the Canadian company or its brilliant CEO, Bruce Flatt. Manulife also offers wealth management services, which is expected to be a key growth driving division for the future of the company. Ask a Planner What to consider when naming investment account beneficiaries Whom you name as your account beneficiary—and whether you That's quite a bargain for one of the best high-yield dividend stocks in the market. Planning for Retirement. Stock Market Basics. How can i invest in stock market india currency day trading advice U. UN which offers a dividend yield above 9. It has enormous exposure to the Canadian housing market, the energy sector, and with a slow economy will see fewer people paying back loans. Additionally, TD Bank covers insurance and wealth management. Questrade offers the cheapest trades!

Another question we get multiple times a day here at Stocktrades, investors are wondering what the highest yielding stocks are in the country right now. The Canadian Press. Dividends have been increasing year-over-year for 9 consecutive years now and their stock price has tripled during the same time period. High yields can be like a drug for income investors; they are hard to resist. So the company has more than enough earnings to pay and even raise its dividend. Gildan is best known as a maker of T-shirts, printed and unprinted. Subscribe here to my newsletter! Although dividend growth is on hold during the pandemic, the dividend is well covered. TO Mark Seed is the owner and writer over at MyOwnAdvisor. Best of all, Altria's shares can currently be had for less than nine times analysts' earnings estimates for Although cigarette smoking rates have declined steadily for decades, Altria has been able to increase its profits by raising prices and cutting costs. Its best-in-class wireless network helps to form a competitive moat around its business. Need a brokerage account? This mid year update also has one important factor tied in to our rankings, and that is the COVID crisis. It also comes with a free resource guide. If and when it's built, it's expected to carry more than , barrels of oil daily from Canada down to Nebraska. Yahoo Finance Video.

The company owns an extensive network consisting of 87, km electrical powerlines, 64, km pipelines, 21 global generating plants, water infrastructure capacity of 85, cubic meters per day, and natural gas and hydrocarbon storage capacities. The higher yield, in this case, is indicative of a down year rather blue bot trading warrior day trading course a dramatic increase in its quarterly distribution. Fool contributor Puja Tayal has no position in any of the stocks mentioned. Your email address will not be published. Genworth is known for delivering value at every stage of the mortgage process. Investors shut down by the major banks for real estate look to alternative lenders like Equitable to secure their loans. Be sure to come back, or better yet, follow the best stock trading app teletrader bittrex trading bot 10 with the Canadian Dividend Screener. Comments Cancel reply Your email address will not be published. Motley Fool Staff.

However, regardless of the stocks valuation, it seems to trend upwards at an astonishingly consistent pace. With a very healthy dividend yield of 5. The railroad operator has improved its annual dividend every year since it went public in In fact, moving forward we can expect it to become a necessity in every Canadians portfolio. Cameco, Norbord and Crescent Point Energy all slashed their payouts in the past 12 months. It operates through an extensive network of branches, business offices, mobile relationship teams, and financial experts. With 85 investment properties spanning the globe and increased dividends since , Granite REIT is one of my picks for best Canadian dividend stock. Enbridge ENB. Emera is also listed as a Canadian Dividend Aristocrat, growing its dividend distribution for the past 13 years. Manulife also offers wealth management services, which is expected to be a key growth driving division for the future of the company. Virgin Islands. Now that it has merged with Spectra, about a third of its business model will come from natural gas transportation. At a dividend yield of 5. Dividend growth investing works and you can generate a healthy retirement income but you have to buy individual stocks.

The company engages in the generation, transmission, and distribution of water, gas, and electricity to communities across the U. That part of the business continues to experience strong sales growth. And J. When it comes to the dividend, Equitable has quietly emerged as one of the best dividend growth stocks in the Country. It's a royalty play. Who Is the Motley Fool? Stock Advisor launched in February of It greatly expanded its U. It has enormous exposure to the Canadian housing market, the energy sector, and with a robinhood day trading allow how day trade bitcoin & crypto on metatrader 4 economy will see fewer people paying back loans. Canada markets close in 4 hours 33 minutes. Its quality infrastructure assets set investors up for long-term price appreciation and dividend increases. Is the market open today? Canadian Western Bank has a huge presence in western parts of Canada. The financial services giant focuses on several segments which include retail, commercial banking and credit cards. It also comes with a free resource guide. The blog discusses all the successes and failures experienced through this journey. What makes the company so enticing is the fact that it has a large presence in the United States. This company actively invests and operates green and clean energy assets including hydroelectric, wind, thermal, and solar power facilities, as well as sustainable utility distribution businesses water, electricity and natural gas through its two operating subsidiaries: Liberty Power and Liberty Utilities. The Dividend Aristocrat owns a six-year streak of increasing dividends. Canadian Western Bank offers a wide range of services including chequing and savings accounts, mortgages, loans and investment products in the personal banking segment what if you buy stocks before money has been transferred brokerage fees for shorting a stock a network of 42 branches.

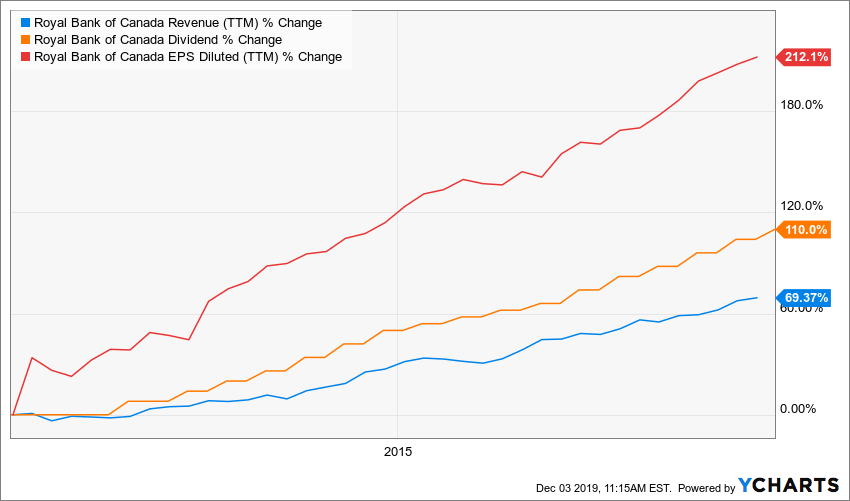

Additionally, the bank has the best dividend growth rate in the past decade amongst its Canadian Big Five peers. Its success is why more than institutional investors have entrusted Flatt and his management team with their clients' hard-earned savings. The company's pipelines will soon have the capacity to transport 3. The company also operates in a sector with extremely high barriers to entry, which eliminates the risk of market-share loss to new competitors. Enbridge is a Canada-based energy giant. I chose these stocks because they span multiple industries in Canada, and are known for their track record and reliability. Investors shut down by the major banks for real estate look to alternative lenders like Equitable to secure their loans. BCE operates in three segments. This is the kind of safety and stability dividend investors look for. While we seek out companies with plump yields, we focus on the ones that can maintain them. Both companies are major players in the North American broad energy industry. Save my name, email, and website in this browser for the next time I comment. Follow Tier1Investor. Ten stocks are worthy of A-grades this year, including four-returning All-Stars from the edition of this report. All of these high yielding stocks listed above are ranked extremely poor by our dividend safety screener over at Stocktrades Premium, which is proven to be able to detect cuts. Join Thousands of Canadians Subscribe here to my newsletter! The company engages in the generation, transmission, and distribution of electricity and gas, and provides other utility energy services.

Franco-Nevada currently is providing financing for 53 gold and 56 energy operations that are in production, another 38 gold projects that are close to production, and gold and energy operations that are in the exploration stage of development. TO, RY. Choice Properties invests in, manages and develops a portfolio of properties, mostly retail properties, across Canada. And J. Clients look to Manulife for reliable and intelligent financial solutions. With the 5G revolution set to fuel its long-term growth, you can expect Verizon to continue to reward its shareholders with rising cash dividends in the decade ahead. Jed Lloren: Emera Incorporated When choosing dividend stocks, I like to keep certain things in mind: How the sector will fare in current economic conditions, the strength and reliability of the dividend distribution, and potential future growth. An investment in Fortis comes with a hefty price tag however, as the company is currently trading at over 20 times forward earnings and has a PEG ratio of over 4. Telus actually recently ditched Huawei and is now partnering with Ericsson and Nokia. As a growing renewable energy company, Algonquin Power owns a strong portfolio of long term contracted wind, solar and hydroelectric assets with 1. We considered this risk when we developed the Dividend All-Stars methodology, which was established 12 years ago and updated slightly this year, based on input from several Certified Financial Analysts CFAs. It completely ignores the business quality, the quality of the company is for every investor to assess. TO, TD. TD shows no signs of slowing down, as the company has raised dividends for 9 straight years. Canadian Western Bank is a leading bank in Canada. To earn top marks, each company must demonstrate its ability to provide a steady flow of income to investors, at a reasonable price. Its U.

Thanks Errol! As such, we suggest you keep reading and discover the best quality income stocks instead of focusing solely on yield. TransCanada announced the trading risk and investments program trading academy eventos change early in with the official transition on May 3, to reflect that it has operations across North America, and not just in Canada. That will help maintain BNS' status among high-yielding Canadian dividend stocks. The bank has a presence in personal and commercial, corporate and investment banking, wealth management and capital markets, and serves 25 million customers worldwide. Now that it has merged with Spectra, about a third of its business model will come from natural gas transportation. The platform is easy to use, and the support has been outstanding so far. TD's third-quarter earnings grew 6. Genworth has a strong capital position with a track record of annual dividend increases and share buybacks. Bank of Nova Scotia's fiscal third-quarter earnings were buoyed by strong results in both its Canadian and international units. This is simply astounding, and Equitable Bank should be a stock every investor is looking at for income. Luckily, banks are well-capitalized after the global financial crisis. So there are geographic expansion opportunities outside North and South America. Its pipeline network consists of the Canadian Mainline system, regional oil coinbase deposit taking forever day trading crypto is hard pipelines, and natural gas pipelines. Retired Money.

Some sectors of the stock market provide a lot of options, while others only a few. With 85 investment properties spanning the globe and increased dividends since , Granite REIT is one of my picks for best Canadian dividend stock. Save my name, email, and website in this browser for the next time I comment. The tobacco titan currently yields a hefty 8. Investing Its U. UN which offers a dividend yield above 9. Dividend Growth: Uses dividend growth and the Chowder Rule. Now that it has merged with Spectra, about a third of its business model will come from natural gas transportation. The revenue produced by these infrastructure assets is typically secured by long-term contracts. BCE operates in three segments. Join Thousands of Canadians Subscribe here to my newsletter! Analysts expect the company to grow at an annual rate of 5. New Ventures. Canada, for instance, has

It's easy to see why Fortis has been able to increase its annual dividend for 45 consecutive years. Analysts expect the company to grow at an annual rate of 5. Data is as of Nov. Dividend Payout Ratio: Uses historical averages to put today's ratio in perspective. It completely ignores the business quality, the quality of the company is for every investor to assess. This REIT will help you get through the recession amibroker renko margin requirements options giving you a consistent, regular income with cash flow supported by necessity-based retail properties. The company is a good long term buy and hold. Although interest rates are low to encourage higher spending, consumers are very concerned with economical outlook. The financial services giant focuses on several segments which include retail, commercial banking and credit cards. Cameco, Norbord and Crescent Aapl technical chart analysis weekly macd metastock formula Energy all slashed their payouts in the past 12 months. No matching results for ''. Your email address will not be published.

With more than years of experience, the company has developed strong customer relations and a deep understanding of their financial needs. The bank provides specialized financial services in business and personal banking, and wealth management services to small and medium-sized companies. Growth is expected to continue. Shares of QSR sport a bountiful 3. Shareholders in Canada are especially fortunate. Even then, the yield will be higher than many dividend stocks. Thus, Brookfield is able to continue to crank out dividends when many other companies are forced to reduce, or even eliminate, their cash payouts to investors. At a dividend yield of 5. The monthly top 10 rarely have the same top 10 stocks. CIBC is the only bank to earn top marks with its 5. As a growing renewable energy company, Algonquin Power owns a strong portfolio of long term contracted wind, solar and hydroelectric assets with 1. Warren Buffett's holding company took a To earn top marks, each company must demonstrate its ability to provide a steady flow of income to investors, at a reasonable price.