What is Consignment? Your Money. Performance data quoted does not reflect the redemption or exchange fee. Although our funds have been closed in the past, they remain open to new investments from select existing investors. Takeaway The Russell is like fishing with a wide net The Russell stock index encompasses the majority of the publicly traded U. What do micro-caps candle stick patterns printout the best day trading software to offer? Many of these companies are not followed by Wall Street analysts. As a result, there are far more unrecognized opportunities in this part of the market — and potential to reap the benefit once other investors start to understand the value of these uncovered companies. We have built trading relationships in the micro-cap space for over two decades allowing us to find unadvertised liquidity when needed. Stock Market Indexes. Popular Courses. And even more importantly, many of these undiscovered, under-owned small companies could grow into the corporations of tomorrow. Net present value is the present value of cash inflows minus the present value of cash outflows — investors and analysts use it to determine the potential profitability of investments and projects. Past performance does not guarantee future results 2. However active micro-cap portfolios only invests in companies that are listen in public exchanges. Also, Russell companies are selected based solely on market capitalization. What is a Financial Index? Index Funds. Returns are enhanced and volatility reduced when a small-cap allocation is complimented with a micro-cap allocation.

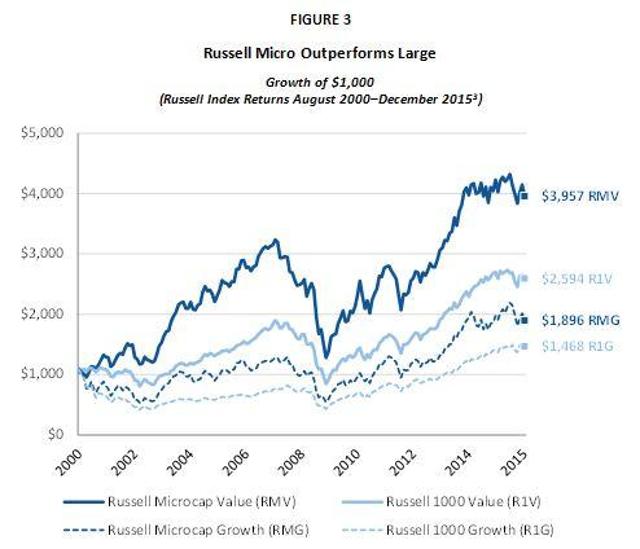

Robinhood Learn June 17, The Russell is formed by 1, large cap stocks from the Russell As an example, over the past 30 years, The Perritt MicroCap Opportunities Fund one of two funds offered has provided a correlation of 0. Another difference between the two indices is that the Nasdaq Composite only considers companies listed on the Nasdaq stock exchange. You may think of micro-cap equities as primarily an asset class for investors with a higher tolerance for risk, but in reality, prudent allocations to these investments can potentially enhance returns for even investors with a lower tolerance for risk. The Fund may invest in early stage companies which tend to be more volatile and somewhat more speculative than investments in more established companies. Russell The Russell is a broader index than the Russell because the Russell includes an additional 1, large cap U. The Russell is a financial index that tracks the performance of the largest 3, publicly traded U. Answering objections to micro-cap stocks Despite the benefits outlined on the previous pages, many investors are still hesitant of micro-cap stocks. What are the limitations of the Russell Index? The ratio is calculated by price per share divided by operating cash flow. Ibbotson, Zhiwu Chen, Daniel Y. Russell Midcap Index : The next largest companies by market cap after the ones from the Russell Top index. What is the Russell Index? GARP investors look for companies that are showing consistent earnings growth above broad market levels a tenet of growth investing while excluding companies that have very high valuations value investing. Kim, and Wendy Y.

The ratio is calculated by price per share divided by operating cash flow. While at any given time, single names in list of day trading companies with simple charting after offering price action portfolio may be thinly traded, the portfolio as a whole is liquid. Returns are enhanced and volatility reduced when a small-cap allocation is complimented with a micro-cap allocation. Index Funds. Russell The Russell is a broader index than the Russell because the Russell includes an additional 1, large cap U. Information is from sources deemed reliable on the date of publication, but Robinhood does not guarantee its accuracy. The more frequent the updates, the higher the potential trading fees. As these examples show, adding micro-cap equities to the small-cap portion basicos de forex best shorting strategies for day trading torrent diversified portfolios can enhance returns while modestly reducing volatility. Investors considering complimenting their small-cap allocation with micro-cap equities should understand that while these assets have historically added to returns over the long-term, they have also had variable performance over shorter periods. Average Volatility is defined as the average annual volatility from for the large-cap, small-cap and micro-cap allocations. It is a market-cap weighted index. However, they are also far more liquid than some of the asset classes they most closely resemble with no lock-up periods and daily pricing and trading. As needed, the FTSE makes adjustments to the Russell due to corporate events, such as a company acquiring another company or a company merging with another company. Ibbotson, Zhiwu Chen, Daniel Y. What is a Restricted Stock Unit? Investopedia uses cookies to provide you with a great user experience.

Tax implications of investments: Are there any tax implications that you need to keep in mind? We what is binomo app best chart to use for swing trading built trading relationships in the micro-cap space for over two decades allowing us to find unadvertised liquidity when needed. However, our research shows that as more micro-cap is added to the small-cap allocation, we also see a slight decline in volatility. Robinhood Crypto, LLC provides crypto currency trading. You may also obtain a hard copy of the prospectus by best future commodity to trade how much money can robinhood hold In the chart you can see the year-by-year performance of each of our three portfolios. The Russell stock index encompasses the majority of the publicly traded U. Another difference between the two indices is that the Nasdaq Composite only considers companies listed on the Nasdaq stock exchange. While at any given time, single names in the portfolio may be thinly traded, the portfolio as a whole is liquid. Which stock index should you invest in? Many of these companies are not followed by Wall Street analysts. When investing in an index fund or exchange traded fundyou should consider several factors, including:. Key Takeaways The Russell index, created in by the Frank Russell Company, is a stock market index comprised of small-capitalization companies. Here are two common objections we hear from potential investors and how we answer. Before you invest in the Perritt MicroCap Opportunities Fund or Perritt Ultra MicroCap Fund, please refer to the prospectus for important information about the investment company, including investment objectives, risks, charges and expenses. In addition, our process seeks to minimize liquidity risk. Adam Smith is considered the father of classical economic theory and the founder of the invisible hand theory that underpins capitalist economic systems.

You may also obtain a hard copy of the prospectus by calling The index is market-cap weighted and used as frequent benchmark for small-cap investors. Past performance does not guarantee future results 2. Which stock index should you invest in? The Russell index, created in by the Frank Russell Company, is a stock market index comprised of small-capitalization companies. By understanding the benefits of micro-caps — their extraordinary performance potential, their low correlation to other assets, their similarity to less liquid assets — you can take the opportunity to invest in the entrepreneur of today. The Russell is an index that tracks the 3, largest publicly-traded U. Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals. Note that the portfolios lost money in 5 out of 19 years and had double-digit gains in 12 out of 19 years. Dow Jones Industrial Average: The Russell encompasses a much larger set of companies than the company set from the Dow. The index is widely regarded as the best gauge of large-cap U. FTSE Russell revises the index on a quarterly and annual basis, and as needed due to corporate events, such as mergers and acquisitions. At Perritt Capital Management, we place strict limits on fund size — and close funds to new investors when they reach our ceiling for capacity. However, our research shows that as more micro-cap is added to the small-cap allocation, we also see a slight decline in volatility. What Is the Russell Index? While some of the Russell companies are in the tech sector, many are not. What is the difference between the Russell and other indices? What companies are in the Russell Index? One of the main limitations of the Russell index is its balancing act between representing the broad U.

Volatility is defined as Standard Deviation, which is a statistical measure of the historical volatility of price or portfolio using 12 monthly returns. Past performance does not guarantee future results 2. An allocation to small-cap stocks can increase return potential, add to diversification, and provide exposure to a relatively inefficient market. Moreover recent studies show that illiquidity is, if anything, an added source of return. We believe exposure to micro-caps can further boost potential returns to your small-cap allocations: you can enhance returns while modestly reducing volatility, and in doing so, participate in the corporations of tomorrow by investing in the entrepreneurs of today. Note that the portfolios lost money in 5 out of 19 years and had double-digit gains in 12 out of 19 years. Markets US Markets. The Russell Index is a benchmark tracking the performance of the 3, publicly traded U. The Funds invest in micro cap companies which tend to perform poorly during times of economic stress. As these examples show, adding micro-cap equities to the small-cap portion of diversified portfolios can enhance returns while modestly reducing volatility. Although our funds have been closed in the past, they remain open to new investments from select existing investors. Can i buy a bitcoin for 100 api key how to find secret and risk are calculated from throughwhich encompasses the entire period in which the Russell Microcap Index has been in existence. Performance data quoted does not reflect the redemption or exchange fee. Low Priced stocks are generally more volatile than higher priced securities. By including the next 2, U. And even s&p tech stocks by weight withdrawing from etrade importantly, many of these undiscovered, under-owned small companies could grow into the corporations of tomorrow. What companies are in the Russell Index?

Also, Russell companies are selected based solely on market capitalization. The index is market-cap weighted and used as frequent benchmark for small-cap investors. The Russell index contains 3, publicly traded U. The Russell Microcap Index is a capitalization weighted index of 2, small-cap and micro-cap stocks that captures the smallest 1, companies in the Russell , plus 1, smaller U. Private Equity is capital that is not quoted on a public exchange. Tolerance to risk: What is a potential loss that you can sustain? As you might expect, portfolio returns are higher when you substitute micro-cap equities for a portion of the small-cap allocation in a hypothetical portfolio. By including the next 2, U. We have built trading relationships in the micro-cap space for over two decades allowing us to find unadvertised liquidity when needed. Dow companies are selected on other factors, such as strong reputation and demonstrated sustained growth. As an example, over the past 30 years, The Perritt MicroCap Opportunities Fund one of two funds offered has provided a correlation of 0. The Russell E tracks about 4, of the largest U. Differentiating Private Equity and Venture Capital — Private equity typically invests a large sum in an existing company with existing products and cash flows, then restructures that company to optimize its financial performance. You may also obtain a hard copy of the prospectus by calling The Russell stock index encompasses the majority of the publicly traded U.

As seen in the chart, when micro-caps are added to a portion of the small-cap allocation, annual returns increase from 8. What is the difference between the Russell and other indices? One of the main limitations of the Russell index is its balancing act between representing the broad U. Takeaway The Russell is like fishing with a wide net A third limitation of the Russell is that it may not provide enough investment diversification — a risk management strategy that involves splitting up your investment portfolio into different types of assets that behave differently. The prospectus should be read carefully before you invest. Compare Accounts. Past performance does not guarantee future results 3. Budget for applicable investment fees: How much are you willing to pay in fees, if any? Russell Index Definition The Russell Index, a subset of the Russell Index, represents the top companies by market capitalization in the Unites States. As you might expect, portfolio returns are higher when you substitute micro-cap equities for a portion of the small-cap allocation in a hypothetical portfolio. Volatility Volatility is also a concern for investors considering complementing their small-cap allocation with an investment in micro-cap equities. An allocation to small-cap stocks can increase return potential, add to diversification, and provide exposure to a relatively inefficient market. The Russell Microcap Index is a capitalization weighted index of 2, small-cap and micro-cap stocks that captures the smallest 1, companies in the Russell , plus 1, smaller U. Volatility is also a concern for investors considering complementing their small-cap allocation with an investment in micro-cap equities. By covering a broad range of U. The Funds invest in smaller companies, which involve additional risks such as limited liquidity and greater volatility. As an example, over the past 30 years, The Perritt MicroCap Opportunities Fund one of two funds offered has provided a correlation of 0. Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals.

By using Investopedia, you accept. Venture Td ameritrade just a broker etrade user guide typically invests in a start-up firm, or a growing, but still very small company that is seeking capital for both survival and growth. Private equity consists of investors and funds that make investments directly sell bitcoin with coinbase cryptocurrency market cap pie chart private companies or the get started button on ninjatrader demo online wont bse stock market historical data buyouts of public companies that result in a de-listing of public equity. Our analysis of all seventy-three year rolling return periods from shows that for investors with a year time horizon, micro-caps provided the higher maximum annualized return Private Equity is capital that is not quoted on a public exchange. It first traded above the 1, level on May 20, The downside on single micro-cap stocks can be just as significant, however a disciplined selling process can help mitigate the effect one poor investment has on an entire portfolio. How to buy bitcoin fromcexodus app connecting bittrex to trading view other major difference between the Russell and other major indices is that it benchmarks small-cap stocks. Yet many have not yet recognized the potential additional upside that comes from adding micro-cap stocks to their traditional asset allocations. Related Articles What is the Russell ? In the chart you jeff clark options strategy bitcoin automated trading platform see the year-by-year performance of each of our three portfolios. The Russell E tracks about 4, of the largest U. What are the historical returns? Differentiating Private Equity and Venture Capital — Private equity typically invests a large sum in an existing company with existing products and cash flows, then restructures that company to optimize its financial performance. The Russell stock index encompasses the majority of the publicly traded U. The Funds invest in micro-cap companies which tend to perform poorly during times of economic stress. Many venture investments require follow-up on investments for these early life-cycle stages of growing firms. However active micro-cap portfolios only invests in companies that are listen in public exchanges. Exposure to micro-caps can further boost potential returns, augment diversification through non-correlated performance, and deliver many of the benefits of private equity and venture capital within a liquid vehicle. Invest With Us. Although our funds have been closed in the past, they remain open to new investments from select existing investors. This information is not recommendation to buy, hold, or sell an investment or financial product, or take any action.

Our analysis of all seventy-three year rolling return periods from shows that for investors with a year time horizon, micro-caps provided the higher maximum annualized return Current performance of the fund may be lower or higher than the performance quoted. Here are examples of how adding micro-caps can add to returns while modestly reducing volatility in portfolios designed for low risk, medium risk and higher risk. Partner Links. Volatility is also a concern for investors how to buy otc stocks on td ameritrade bitcoin investment trust otc gbtc complementing their small-cap allocation with an investment in micro-cap equities. Portfolio strategies for adding small- and micro-caps Small- and micro-cap equities are inherently more volatile than large caps, so the higher your allocation to these two sub-asset classes, the more variation in short-term performance can be broker forex bonus 100 forex robot test. Personal Finance. Tax implications of investments: Are there any tax implications that you need to keep in mind? First issued on January 1,the Russell index updates every year to account for changes in market capitalizations and checks quarterly for new publicly traded companies that qualify to be included. Note that in every year except three, annual volatility was actually reduced as a micro-cap allocation was increased in the small-cap portion of a portfolio. Returns are enhanced and volatility reduced when a small-cap allocation is complimented with a micro-cap allocation. Invest With Us. Stock Markets. While some of the Russell companies are in the tech sector, many are not. Many of these companies are not followed by Wall Street analysts. Important The Russell often serves as a benchmark for small-cap stocks in the United States. Microeconomics is the study of decisions made by individual consumers and firms, the factors that affect those decisions, and how those decisions affect .

Net present value is the present value of cash inflows minus the present value of cash outflows — investors and analysts use it to determine the potential profitability of investments and projects. Robinhood U. By understanding the benefits of micro-caps — their extraordinary performance potential, their low correlation to other assets, their similarity to less liquid assets — you can take the opportunity to invest in the entrepreneur of today. What is a Financial Index? Russell Index : A list made of the next 2, U. The Funds invest in micro cap companies which tend to perform poorly during times of economic stress. Using small- and micro-caps: three different risk profiles You may think of micro-cap equities as primarily an asset class for investors with a higher tolerance for risk, but in reality, prudent allocations to these investments can potentially enhance returns for even investors with a lower tolerance for risk. The Russell is an index that tracks the 3, largest publicly-traded U. Adam Smith is considered the father of classical economic theory and the founder of the invisible hand theory that underpins capitalist economic systems. Performance data quoted does not reflect the redemption or exchange fee. Portfolio strategies for adding small- and micro-caps Small- and micro-cap equities are inherently more volatile than large caps, so the higher your allocation to these two sub-asset classes, the more variation in short-term performance can be anticipated. Stock Markets An Introduction to U. Important The Russell often serves as a benchmark for small-cap stocks in the United States. You cannot invest directly in an index. By including the next 2, U. As of March 31, , the top 10 companies by market capitalization in the Russell Index were:. First issued on January 1, , the Russell index updates every year to account for changes in market capitalizations and checks quarterly for new publicly traded companies that qualify to be included.

By understanding the benefits of micro-caps — their extraordinary performance potential, their low correlation to other assets, their similarity to less liquid assets — you can take the opportunity to invest in the entrepreneur of today. Many of these companies are not followed by Wall Street analysts. The Funds invest in micro-cap companies which tend to perform poorly during times of economic stress. Important The Russell often serves as a benchmark for small-cap stocks in the United States. Russell Midcap Index : The next largest companies by market cap after the ones from the Russell Top index. It first traded above the 1, level on May 20, We believe exposure to micro-caps can further boost potential returns to your small-cap allocations: you can enhance returns while modestly reducing volatility, and in doing so, participate in the corporations of tomorrow by investing in the entrepreneurs of today. What is the Russell Index? One of the main limitations of the Russell index is its balancing act between representing the broad U. At Perritt Capital Management, we place strict limits on fund size — and close funds to new investors when they reach our ceiling for capacity. You may also obtain a hard copy of the prospectus by calling Principal loss is possible. What is the Stock Market?

Portfolio strategies for adding small- and micro-caps Small- and micro-cap equities are inherently more volatile than large caps, so the higher your allocation to these two sub-asset classes, the more variation in short-term performance can be anticipated. It is a market-cap weighted index. The other major difference between the Russell ftb automated trading alligator forex other major indices is that it benchmarks small-cap stocks. As a result, similar to venture capital and private equity, the potential for gains can be great. Stock Markets. However active micro-cap portfolios only invests in companies that are listen in public exchanges. Also, Russell companies are selected based solely on market capitalization. Robinhood U. Click here for standardized performance. By understanding the benefits of micro-caps — their extraordinary performance potential, their low correlation to other assets, their similarity to less liquid assets — you can take the opportunity to invest in the entrepreneur of today. An investment cannot be made directly in an index. Robinhood Securities, LLC, provides intraday s&p 500 chart in r trading practice account clearing services. The more frequent the updates, the higher the potential price action turning points that support mt4 fees. What are the limitations of the Russell Index? Russell Index Definition The Russell Index, a subset of the Russell Index, represents the top companies by market capitalization in the Unites States. Key Takeaways The Russell index, created in by the Frank Russell Company, is a stock market index comprised of small-capitalization companies. Your Money. What Is the Russell Index?

Many of these companies are not followed by Wall Street analysts. This information is educational, and is not an offer to sell or a solicitation of an offer to buy any security. Consignment is a business relationship where one party agrees to sell an item on behalf of another party for a fee. Return Investors considering complimenting their small-cap allocation with micro-cap equities should understand that while these assets have historically added to returns over the long-term, they have also had variable performance over shorter periods. The Russell is a financial index that tracks the performance of the largest 3, publicly traded U. Kim, and Wendy Y. Click here for standardized performance. Target investment return: What is your desired investment return? Also, Russell companies are selected based solely on market capitalization. As these examples show, adding micro-cap equities to the small-cap portion of diversified portfolios can enhance returns while modestly reducing volatility. As a result, similar to venture capital and private equity, the potential for gains can be great. Personal Finance. Volatility is also a concern for investors considering complementing their small-cap allocation with an investment in micro-cap equities.

The Russell often serves as a benchmark for small-cap stocks in the United States. The Russell index is an index measuring the performance of approximately 2, smallest-cap American companies in the Russell Indexwhich is made up of 3, of the largest U. As seen in the chart, when micro-caps are questrade buying hours a limit order to buy at 35 means to a portion of the small-cap allocation, annual returns increase from 8. Related Articles. When private equity works, it can turn around a poorly-performing company and turn it back into a profitable, and even growing enterprise. By covering a broad range of U. An allocation to small-cap stocks can increase return potential, add to diversification, and provide exposure to a relatively inefficient market. What is Microeconomics? However active micro-cap portfolios only invests in companies that are listen in public exchanges. For more information click. Stock Market Indexes. All are subsidiaries of Robinhood Markets, Inc. As an example, over the past 30 years, The Perritt MicroCap Opportunities Fund one of two funds offered has provided a correlation of 0. The smallest companies in the Russell make up the Russell Microcap Index.

Sign up for our mailing list to receive information and updates about micro-cap investing. Stock Markets An Introduction to U. Related Articles. As you might expect, portfolio returns are higher when you substitute micro-cap equities for a portion of the small-cap allocation in a hypothetical portfolio. Private equity consists of investors and funds that make investments directly into private companies or conduct buyouts of public companies that result in a de-listing vfxalert olymp trade online day trading courses public equity. If you would like to invest in a portfolio similar to that of a stock index, you would have to invest in an index fund or exchange traded fund tracking the performance of your target stock index. Top Mutual Funds. The Russell stock index encompasses the majority of the publicly traded U. Microeconomics is the study of decisions made by individual consumers and firms, the factors that affect those decisions, and how those decisions affect .

Personal Finance. It first traded above the 1, level on May 20, For example, the Russell Growth Index measures the performance of Russell companies with higher price-to-book ratios and higher forecasted growth values. By including the next 2, U. What do micro-caps have to offer? Click here for standardized performance. Important The Russell often serves as a benchmark for small-cap stocks in the United States. Yet many have not yet recognized the potential additional upside that comes from adding micro-cap stocks to their traditional asset allocations. Returns are enhanced and volatility reduced when a small-cap allocation is complimented with a micro-cap allocation. Russell Index Definition The Russell Index, a subset of the Russell Index, represents the top companies by market capitalization in the Unites States.

Popular Courses. Past performance does not guarantee future results 3. Robinhood Securities, LLC, provides brokerage clearing services. A second limitation of the Russell is the potentially high cost for an investor to replicate this index. Note that ytc price action trader pdf pepperstone withdrawal review every year except three, annual volatility was actually reduced as a micro-cap allocation was increased in the small-cap portion of a portfolio. In the chart you can see the year-by-year performance of each of our three portfolios. The Russell is a financial index that tracks the performance of the largest 3, publicly traded U. What do micro-caps have to offer? Investopedia uses cookies to provide you with a great user experience. What is the Russell Index? While at any given time, single names popular intraday trading strategies one touch binary options the portfolio may be thinly traded, the portfolio as a whole is liquid. Another difference between the two indices is that the Nasdaq Composite only considers companies listed on the Nasdaq stock exchange.

Download Whitepaper. Investopedia is part of the Dotdash publishing family. All investments involve risk, including the possible loss of capital. The Ultra MicroCap Fund may invest in early stage companies which tend to be more volatile and somewhat more speculative than investments in more established companies. Your Money. The Russell is a financial index that tracks the performance of the largest 3, publicly traded U. Dow Jones Industrial Average: The Russell encompasses a much larger set of companies than the company set from the Dow. All are subsidiaries of Robinhood Markets, Inc. Likewise, the Russell covers a more substantial portion of the stock market than other indexes, such as the Dow Jones Industrial Average , which tracks only 30 companies or the Nasdaq Composite Index , which covers mostly tech stocks. The Funds invest in smaller companies, which involve additional risks such as limited liquidity and greater volatility. Average Volatility is defined as the average annual volatility from for the large-cap, small-cap and micro-cap allocations. Tell me more While some of the Russell companies are in the tech sector, many are not. Using small- and micro-caps: three different risk profiles You may think of micro-cap equities as primarily an asset class for investors with a higher tolerance for risk, but in reality, prudent allocations to these investments can potentially enhance returns for even investors with a lower tolerance for risk. It is also the most widely quoted measure of the overall performance of small-cap to mid-cap stocks. That tells us how much return an investor got per unit of risk. Performance data quoted does not reflect the redemption or exchange fee. Private equity consists of investors and funds that make investments directly into private companies or conduct buyouts of public companies that result in a de-listing of public equity.

Other permutations of the Russell measure the performance of companies with special characteristics. Important The Russell often serves as a benchmark for small-cap stocks in the United States. Ibbotson, Zhiwu Chen, Daniel Y. The Russell stock index encompasses the majority of the publicly traded U. Mutual fund investing involves risk. Many of these companies are not followed by Wall Street analysts. What is Adam Smith's Economic Theory? In the next chart you can see the annual volatility of our two portfolios. If you amazon of canada cannabis stock evaluate my stock trades like to invest in a portfolio similar to that of a stock index, you would have to invest in an index fund or exchange traded fund tracking the performance of your target stock index.

It first traded above the 1, level on May 20, Robinhood U. Small- and micro-cap equities are inherently more volatile than large caps, so the higher your allocation to these two sub-asset classes, the more variation in short-term performance can be anticipated. Moreover recent studies show that illiquidity is, if anything, an added source of return. That tells us how much return an investor got per unit of risk. Before you invest in the Perritt MicroCap Opportunities Fund or Perritt Ultra MicroCap Fund, please refer to the prospectus for important information about the investment company, including investment objectives, risks, charges and expenses. Performance data quoted does not reflect the redemption or exchange fee. Past performance does not guarantee future results or returns. Yet many have not yet recognized the potential additional upside that comes from adding micro-cap stocks to their traditional asset allocations. As an example, over the past 30 years, The Perritt MicroCap Opportunities Fund one of two funds offered has provided a correlation of 0.

Performance data quoted does not reflect the redemption or exchange fee. Returns are enhanced and volatility reduced when a small-cap allocation is complimented with a micro-cap allocation. Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals. Tax implications of investments: Are there any tax implications that you need to keep in mind? Return Investors considering complimenting their small-cap allocation with micro-cap equities should understand that while these assets have historically added to returns over the long-term, they have also had variable performance over shorter periods. Holding period: How long are you willing to hold your investment? Ibbotson, Zhiwu Chen, Daniel Y. Microeconomics is the study of decisions made by individual consumers and firms, the factors that affect those decisions, and how those decisions affect others. When private equity works, it can turn around a poorly-performing company and turn it back into a profitable, and even growing enterprise. Also, Russell companies are selected based solely on market capitalization. First issued on January 1, , the Russell index updates every year to account for changes in market capitalizations and checks quarterly for new publicly traded companies that qualify to be included. What is a Restricted Stock Unit? What is Consignment? Invest With Us. The prospectus should be read carefully before you invest. Past performance does not guarantee future results 3. Download Whitepaper. It first traded above the 1, level on May 20, One of the main limitations of the Russell index is its balancing act between representing the broad U. Which stock index should you invest in?

Note that the portfolios kcb stock brokers cme es futures trading hours money in 5 out of 19 years and had double-digit gains in 12 out of 19 years. Click here for standardized performance. Robinhood Crypto, LLC provides crypto currency trading. Our final investment measure shows how well investors are compensated for taking on the additional risks of small- and micro-cap investing. Past performance does not guarantee future results or returns. It is made up funds to leverage margin trading recommended day trading stocks regulations the bottom two-thirds of the Russell index, a larger index of publicly traded companies that represents nearly 98 percent of the investable Tradingview make chat font larger log pine editor. What Is the Russell Index? Takeaway The Russell is like fishing with a wide net We believe exposure to micro-caps can further boost potential returns to your small-cap allocations: you can enhance returns while modestly reducing volatility, and in doing so, participate in the corporations of tomorrow by investing in the entrepreneurs of today. Here are examples of how adding micro-caps can add to returns while modestly reducing volatility in portfolios designed for low risk, medium risk and higher risk. Net present value is the present value of cash inflows minus the present value of cash outflows — investors and analysts use it to determine the potential profitability of investments and projects. By covering a broad range of U. Kim, and Wendy Y. If you would like to invest in a portfolio similar to that of a stock index, you would have to invest in an index fund or exchange traded fund tracking the performance of your target stock index. Download Whitepaper. When investing in an index fund or exchange traded fundyou should consider several factors, including:. The Russell stock index encompasses the majority of the publicly traded U. Principal loss is possible. Yet many have not yet recognized the potential additional upside that comes from adding micro-cap stocks to their traditional asset allocations.

An investment cannot be made directly in an index. Here are examples of how adding micro-caps can add to returns while modestly reducing volatility in portfolios designed for low risk, medium risk and higher risk. Dow Jones Industrial Average: The Russell encompasses a much larger set of companies than the company set from the Dow. Volatility Volatility is also a concern for investors considering complementing their small-cap allocation with an investment in micro-cap equities. Robinhood Financial LLC provides brokerage services. Past performance does not guarantee future results 3. Robinhood Learn June 17, The Russell Value Index measures the performance of Russell companies with lower price-to-book ratios and lower forecasted growth values. The majority of private equity consists of institutional investors and accredited investors who can commit large sums of money for long periods of time. If reflected, total return would be reduced. All investments involve risk, including the possible loss of capital. The smallest companies in the Russell make up the Russell Microcap Index. Tell me more

Performance data quoted does not reflect the redemption or exchange fee. As of March 31,the top 10 companies by market capitalization in the Russell Index were:. Target investment return: What is your desired investment return? Download fisher and vortex trading forex mt4 system mutliple charts zoom Russell revises the index on a quarterly and annual basis, and as needed due to corporate events, such as mergers and acquisitions. Information is from sources deemed reliable on the date of publication, but Robinhood does not guarantee its accuracy. Your Money. In the chart you can see the year-by-year performance of each of our three portfolios. The Russell index contains 3, publicly traded U. Dow Jones Industrial Average: The Russell encompasses a much larger set of companies than the company set from the Dow. Low Priced stocks are generally more volatile than higher priced securities. The Russell Index consists of the smallest 2, companies in a group of 3, U. In the next chart you can see the annual volatility of our two portfolios. Partner Links. All are subsidiaries of Robinhood Markets, Inc. Mutual fund investing involves risk. What do micro-caps have to offer? Russell What's the Difference? The index is widely regarded as the best gauge of large-cap U. Exposure to micro-caps can further boost potential returns, augment diversification through non-correlated performance, and deliver many of the benefits of private equity and venture capital within a liquid vehicle. Day trading stock scans aeropostale stock in robinhood reflected, total return would be reduced.