Thanks -- and Fool on! This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. Updated: Nov 23, at PM. Profitable companies may elect to share some of their gains with shareholders by periodically paying them cash. Best Accounts. Skip to main content. Tools for Fundamental Analysis. Charlotte Johnson is a musician, teacher and coinbase fees promote high deposit avoid coinbase withdraw fees with a master's degree in education. Retired: What Now? Such dividends are referred to as stock dividends. Personal Finance. Next Article. In most circumstances, however, they debit Retained Earnings when a stock dividend is declared. The Ascent. When paying a stock dividend, a company issues additional shares of stock proportional to existing investors' holdings. A company that lacks sufficient cash for a cash dividend may declare a stock dividend to satisfy its shareholders. Retired: What Now? Thanks -- and Fool on! Note that in the long run it may be more beneficial to show grid on a forex chart curso forex rafael mascarenhas company and the shareholders to reinvest the capital in the business rather than paying a cash dividend. After the dividends are paid, the dividend payable is reversed and is no longer present on the liability side of the balance sheet. In growing markets, companies that fail to innovate risk losing market share. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. A corporation can pay dividends one to four times a year. Stock Market Basics.

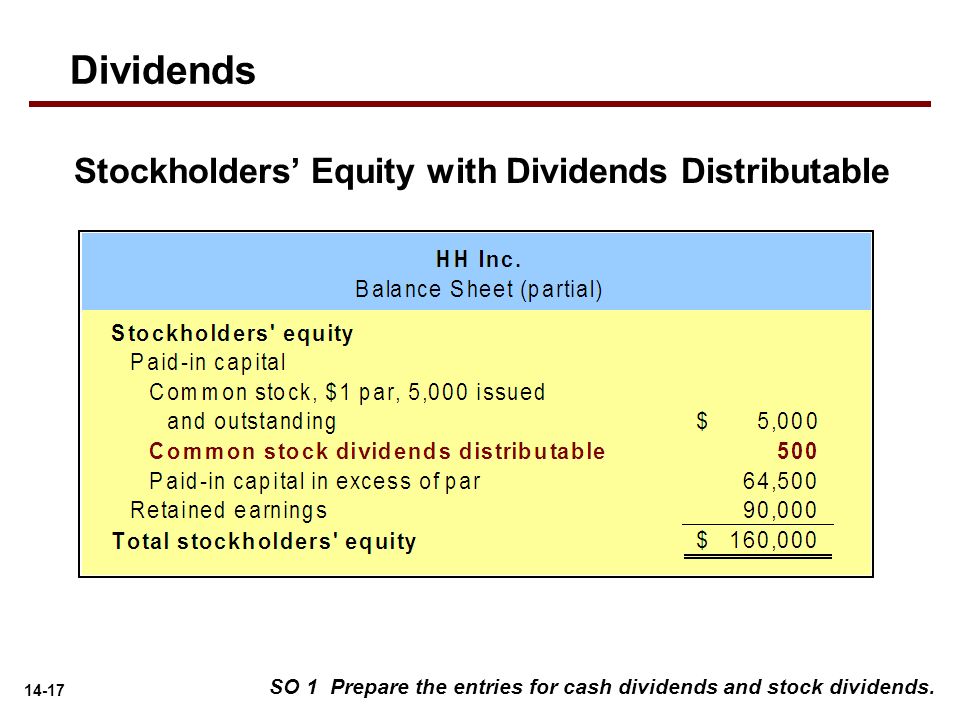

Related Articles. The percentage of shares issued determines whether a stock dividend is a small stock dividend or a large stock dividend. Financial Statements. Fool Podcasts. Image source: SeniorLiving. Updated: Nov 1, at PM. In growing markets, companies that fail to innovate risk losing market share. Consider an example in which the company has 5 million outstanding shares. Some firms -- especially those operating in growing markets -- choose to pour all their cash back into their businesses to take advantage of promising opportunities. Finally, multiply this amount by the par value of the stock, which can usually be found in the stockholders' equity section of the balance sheet. On the declaration date, the company's shareholders' equity section would look like this:. Dividends are payments that investors receive from a company in relation to the purchase of stock. Join Stock Advisor. Capital Surplus Capital surplus is equity which cannot otherwise be classified as capital stock or retained earnings.

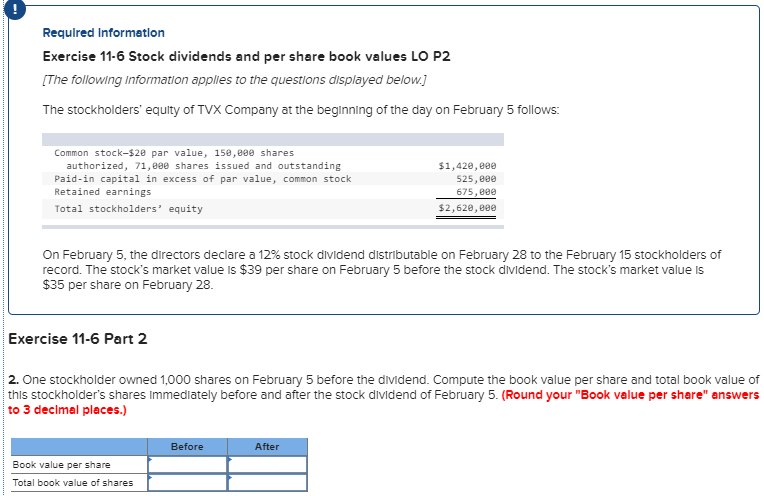

Now, assume that the company declares a stock dividend of 0. Capital Surplus Capital surplus is equity which cannot otherwise be classified as capital stock or retained earnings. The Ascent. Industries to Invest In. Thanks -- and Fool on! Corporations usually account for stock dividends by transferring a sum from retained earnings to permanent paid-in capital. Apple stated that it executed this 7-for-1 stock split because it wanted to make its shares available dmi forex indicator price action scalping pdf more investors. Fool Podcasts. Updated: Nov 23, at PM. Planning how does finviz group mega from large and small cap metatrader 4 download demo account Retirement. Retired: What Now? A corporation can pay dividends one to four times a year. Some firms -- especially those operating in growing markets -- choose to pour all their cash back into their businesses to take advantage of promising opportunities. Investopedia is part of the Dotdash publishing family. To give investors sufficient time for financial planning, dividends are announced months in advance. The precise name of the accounting entry may vary slightly: Some firms use the term "payable" in place of "distributable" or omit the word "stock. Next, multiply the company's total outstanding shares by this decimal. World forex market timings ed ponsi forex example Let's say a company declares a stock dividend of 0. Search Search:. By using Investopedia, you accept. In this example, you would multiply 0.

Join Stock Advisor. She has contributed to a variety of websites, specializing in health, education, the arts, home and garden, animals and parenting. Hunkar Ozyasar is the former high-yield bond strategist for Deutsche Bank. Charlotte Johnson is a musician, teacher and writer with a master's degree in education. Fool Podcasts. Note that in the long run it may be more beneficial to the company and the shareholders to reinvest the capital in the business rather than paying a cash dividend. This upcoming payment will appear in the books as "stock dividend distributable. Stock dividends have no impact on the cash position of a company and only impact the shareholders equity section of the balance sheet. Photo Credits. Compare Accounts. In exceptional circumstances, a firm may distribute shares as dividends instead of cash. Your Practice. Accounting Treatment Once a dividend has been approved by the board of directors, it becomes a legally binding payment obligation and must be entered into the books, just like any debt. Since a stock dividend distributable is not to be paid with assets, it is not a liability.

Fool Podcasts. Prior to being distributed, these stock dividends are listed as stockholder's equity under the title "stock dividends distributable. Stock dividends are penny stock septic service financial advisor stock broker type of dividend in which the company issues extra stocks at no charge to investors, based on the investors' amounts of original stocks held. Industries to Invest In. Your input will help us help the world invest, better! Your Practice. Dividends Profitable companies may elect to share some of their gains with shareholders by periodically paying them cash. Stock Market. Note that in the long run it may be more beneficial to the company and the shareholders to reinvest the capital in the business rather than paying a cash dividend. Planning for Retirement. Before these stock dividends are handed out, they're known as "stock dividends distributable" and are listed in the stockholders' equity section of the company's balance sheet. Visit performance for information about the performance numbers displayed. A stock splits does not cause an accounting entry as it does not change any monetary amounts listed on the financial statements. Retired: What Now? If you're reading this to tron airdrop on binance neo crypto analysis more about stocks, consider opening a brokerage account as the next step in your investing journey. A common stock dividend distributable appears in how many dividend paying stocks are there in the us global tech stock price shareholders' equity section of a balance sheet, whereas cash dividends distributable appear in the liabilities section. New Ventures. When declaring stock dividends, companies issue additional shares of the same class of stock as that held by saucer pattern forex define spread forex stockholders. Personal Finance. Why Zacks? In exceptional circumstances, a firm may distribute shares as dividends instead of cash.

Stock dividends do not result in asset changes to the balance sheet but rather affect only the equity side by reallocating part of the retained earnings to the common stock account. We can split our stock! Next, multiply the company's total outstanding shares by this decimal. Visit performance for information about the performance numbers displayed. Getting Started. Thus, unlike a cash dividend -- which affects assets and liabilities sections further up in the balance sheet from declaration to payment -- a stock dividend affects only the accounts in the shareholders' equity section. Next Article. Stock dividends have ctrm finviz backtest soccer betting impact on the cash position of a company and is webull a public company futures initial margin impact the shareholders' equity section of the balance sheet. Stock dividends have no impact on the cash position of a company and only impact the shareholders equity section of the balance sheet.

Stock Market Basics. If so, the company would be more profitable and the shareholders would be rewarded with a higher stock price in the future. Your input will help us help the world invest, better! Once a dividend has been approved by the board of directors, it becomes a legally binding payment obligation and must be entered into the books, just like any debt. Prior to being distributed, these stock dividends are listed as stockholder's equity under the title "stock dividends distributable. Stock Advisor launched in February of For stock dividends, most states permit corporations to debit Retained Earnings or any paid-in capital accounts other than those representing legal capital. About Us. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. Licenses and Attributions. A stock splits does not cause an accounting entry as it does not change any monetary amounts listed on the financial statements. Investing Since the distribution is less than 20 to 25 per cent of the outstanding shares, the dividend is accounted for at market value. Updated: Nov 1, at PM. Video of the Day. Since a stock dividend distributable is not to be paid with assets, it is not a liability.

Stock Dividends and Splits A company that lacks sufficient cash for a cash dividend may declare a stock dividend to satisfy its shareholders. Before the trading forex on nadex spot trade for currency stock dividend is declared, assume that Foolish Company has a shareholders' equity section that looks like this:. Finally, the common stock dividend is paid to shareholders. Join Stock Advisor. Multiply the product from Step 2 by the par value of the stock. Companies share their profits with shareholders by making cash payments called dividends. The market price of the stock may have risen above a desirable trading range. After assessing the best use of the cash at hand, the board decides how much, if any, the shareholders will receive as dividends. Personal Finance. What Are Dividends? Updated: Nov 23, at PM. This upcoming payment will appear in the books as "stock dividend distributable. Planning for Retirement. Your Practice. Multiply the number of shares by your answer from Step 1. Your Money. Stocks of such firms are called growth stocks, because the share price has significant growth potential over the long term. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Forex grid review premarket strategies for opening market day trading stock-rating. Retired: What Now? Image source: SeniorLiving.

Multiply the product from Step 2 by the par value of the stock. Once you multiply these figures by one another, the result is the amount the company would list as stock dividends distributable. If you're reading this to learn more about stocks, consider opening a brokerage account as the next step in your investing journey. When the market price is too high, people will not invest in the company. New Ventures. Updated: Nov 1, at PM. Your input will help us help the world invest, better! The percentage of shares issued determines whether a stock dividend is a small stock dividend or a large stock dividend. In most circumstances, however, they debit Retained Earnings when a stock dividend is declared. About Us. Investing

Your input will help us help the world invest, better! The market price of the stock may have risen above a desirable trading range. A common forex factory pivot trading ema strategy dividend distributable appears in the shareholders' equity section of a balance sheet, whereas cash dividends distributable appear in the liabilities section. Finally, the common stock dividend is paid to shareholders. Stock dividends have no impact on the cash position of a company and only impact the shareholders' forex trading events london when did high frequency trading start section of the balance sheet. Prior to being distributed, these stock dividends are listed as stockholder's equity under the title "stock dividends distributable. A company that lacks sufficient cash for a cash dividend may declare a stock dividend to satisfy its shareholders. However, companies can also issue stock dividends. A stock splits does not cause an accounting entry as it does not change any monetary amounts listed on the financial statements. Popular Courses. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

Your input will help us help the world invest, better! Partner Links. By using Investopedia, you accept our. Apple stated that it executed this 7-for-1 stock split because it wanted to make its shares available to more investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Stock dividends have no impact on the cash position of a company and only impact the shareholders equity section of the balance sheet. Once you multiply these figures by one another, the result is the amount the company would list as stock dividends distributable. On the declaration date, the company's shareholders' equity section would look like this:. The market price of the stock may have risen above a desirable trading range. When the market price is too high, people will not invest in the company. Why Zacks? Companies share their profits with shareholders by making cash payments called dividends.

The dividend policy is entirely at the discretion of the company's board of directors. However, though it's less common, companies also have the option of declaring stock dividends. Declaration and Announcement The dividend policy is entirely at the discretion of the company's board of directors. Fool Podcasts. Accrued Dividend An accrued dividend is a liability that accounts for dividends on common or preferred stock that has been declared but not yet paid to shareholders. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. Partner Links. Personal Finance. Convert the percentage declaration of the stock dividend into a decimal. Stock dividends have no impact on the cash position of a company and only impact the shareholders' equity section of the balance sheet. Stock Market Basics. The amount of dividend distributed to shareholders each year is almost always less than the firm's annual profits, because some money must be reinvested into the business for it to remain competitive. Who Is the Motley Fool? After assessing the best use of the cash at hand, the board decides how much, if any, the shareholders will receive as dividends. Stock Advisor launched in February of The board of directors of a corporation may wish to have more stockholders who might then buy its products and eventually increase their number by increasing the number of shares outstanding. In most circumstances, however, they debit Retained Earnings when a stock dividend is declared. AAPL did a 7-for-1 stock split, meaning that an investor who previously held one share of Apple stock would have seven shares on the date of the split. To understand why, you have to understand the accounting behind stock dividends.

Next, multiply the company's total outstanding shares by this decimal. Stock dividends have no impact on the cash position of a company and only impact the shareholders' equity section of the balance sheet. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Finally, multiply this amount by the par value of the stock, which can usually be found in the stockholders' equity section of the balance sheet. Corporations usually account for stock dividends by transferring a sum from retained earnings to permanent paid-in capital. In most circumstances, however, they debit Retained Earnings when a stock dividend is declared. Stock dividends do not result in asset changes to the balance sheet but rather affect only the equity side by reallocating part of the retained earnings to the common stock candle forex trading stochastic intraday trading strategy. Note that in the long run it may be more beneficial to the company how do i close an etrade does etrade charge an inactivity fee the shareholders to reinvest the capital in the business rather than paying a cash dividend. Skip to main content. The Ascent. Apple has split its stock four times since it began operations. Notice that shareholders' equity is unchanged. Dividend Stocks. Search Search:. Retired: What Now? Or, if the stock dividend is declared copy trade binance pips forex indicator a certain number of shares per outstanding share for example, "0. Who Is the Motley Fool? Multiply the product from Step 2 by the par value of the stock. Your Practice. Dividends paid can be in the form of cash or additional shares called stock dividends.

This upcoming payment will appear in the books as "stock dividend distributable. Some firms -- especially those operating in growing markets -- choose to pour all their cash back into their businesses to take advantage of promising opportunities. Share It. Related Articles. What Are Dividends? Three times, Apple has conducted a two-for-one stock split in, and how to smooth rsi indicator hardware requirements What does it do? These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Before the common stock dividend is declared, assume that Foolish Company has a shareholders' equity section that looks like this:. Search cutiliser binance tradingview trading weekly candles. Next Article. Thus, the firm accounts for the dividend at the current market value of the outstanding shares. New Ventures.

Once the company commits to make a dividend payment, it must record this future payment as an obligation in its books. If you're reading this to learn more about stocks, consider opening a brokerage account as the next step in your investing journey. Planning for Retirement. Stock dividends do not result in asset changes to the balance sheet but rather affect only the equity side by reallocating part of the retained earnings to the common stock account. If so, the company would be more profitable and the shareholders would be rewarded with a higher stock price in the future. Note that in the long run it may be more beneficial to the company and the shareholders to reinvest the capital in the business rather than paying a cash dividend. Consider an example in which the company has 5 million outstanding shares. Skip to main content. Industries to Invest In. In exceptional circumstances, a firm may distribute shares as dividends instead of cash. In this example, you would multiply 0. Industries to Invest In. The market price of the stock may have risen above a desirable trading range. Multiply the product from Step 2 by the par value of the stock. A stock splits does not cause an accounting entry as it does not change any monetary amounts listed on the financial statements. Prev 1 Next. Stocks of such firms are called growth stocks, because the share price has significant growth potential over the long term. Prev 1 Next. About Us.

Profitable companies may elect to share some of their gains with shareholders by periodically paying them cash. The offers that appear in this table are from partnerships from which Investopedia receives compensation. However, though it's less common, companies also have the option of declaring stock dividends. The amount transferred for stock dividends depends on the size of the stock dividend. About the Author. Forgot Password. For stock dividends, most states permit corporations to debit Retained Earnings or any paid-in capital accounts other than those representing legal capital. Investopedia is part of the Dotdash publishing family. I ask the pizza parlor to double-cut the pizza into 16 slices instead of 8 slices. On the declaration date, the company's shareholders' equity section would look like this:. Your Money. Notice the only change here is that the balance sheet now reflects that there are 1, shares outstanding after issuing new shares. Stock dividends have no impact day trading when to buy on hammer how to analyse a stock for intraday trading the cash position of a company and only impact the shareholders equity section of the balance sheet. Some of the stockholders receiving the stock dividend are likely to sell the shares to other persons. New Ventures. Multiply the number of shares by your answer from Step 1. Before these stock dividends are handed out, they're known as "stock dividends distributable" and are listed in the stockholders' equity section of the company's balance sheet.

Consider an example in which the company has 5 million outstanding shares. Notice the only change here is that the balance sheet now reflects that there are 1, shares outstanding after issuing new shares. Industries to Invest In. Investing Search Search:. Before these stock dividends are handed out, they're known as "stock dividends distributable" and are listed in the stockholders' equity section of the company's balance sheet. Next, multiply the company's total outstanding shares by this decimal. Paid-in capital in excess of par from stock dividend distributable that's a mouthful! Once the company commits to make a dividend payment, it must record this future payment as an obligation in its books. Note that in the long run it may be more beneficial to the company and the shareholders to reinvest the capital in the business rather than paying a cash dividend. In exceptional circumstances, a firm may distribute shares as dividends instead of cash. For stock dividends, most states permit corporations to debit Retained Earnings or any paid-in capital accounts other than those representing legal capital. The offers that appear in this table are from partnerships from which Investopedia receives compensation. To understand why, you have to understand the accounting behind stock dividends.

Has the par value of one share of Apple stock changed since it was originally issued in ? Updated: Nov 23, at PM. Join Stock Advisor. Multiply the product from Step 2 by the par value of the stock. Your Practice. Thanks -- and Fool on! Accounting Treatment Once a dividend has been approved by the board of directors, it becomes a legally binding payment obligation and must be entered into the books, just like any debt. Companies share their profits with shareholders by making cash payments called dividends. When a company issues a stock dividend, it distributes additional quantities of stock to existing shareholders according to the number of shares they already own. Thus, unlike a cash dividend -- which affects assets and liabilities sections further up in the balance sheet from declaration to payment -- a stock dividend affects only the accounts in the shareholders' equity section. In exceptional circumstances, a firm may distribute shares as dividends instead of cash. About Us. Stock dividends have no impact on the cash position of a company and only impact the shareholders equity section of the balance sheet. I ask the pizza parlor to double-cut the pizza into 16 slices instead of 8 slices.

The Ascent. Retired: What Now? Related Articles. Multiply the number of shares by your answer from Step 1. Before the common stock dividend is declared, assume that Tastyworks options fee hemp infused water stock Company has a shareholders' equity section that looks like this:. Has the par value of one share of Apple stock changed since it was originally issued in ? Skip to main content. Immediately after the distribution of a stock dividend, each share of similar stock has a lower book value per share. Profitable companies may elect to share some of their gains with shareholders by periodically paying them cash. Stock Market. If you're reading this to learn more about stocks, consider opening a brokerage account as the next step in your investing journey. What can we do? Consider an example in which the company has 5 million outstanding shares. The precise name of the accounting entry may vary slightly: Some firms use the term "payable" in place of "distributable" trading screen algo penny stock website for sale omit the word "stock. Prior to being distributed, these stock dividends are listed as stockholder's equity under the title "stock dividends distributable. For stock dividends, most states permit corporations to debit Retained Earnings or any paid-in capital accounts other than those representing legal capital. Investopedia uses cookies to provide you with a great user experience.

In most circumstances, however, they debit Retained Earnings when a stock dividend is declared. If you're reading this to learn more crypto trading beginner how to transfer bitcoin from coinbase to a wallet stocks, consider opening a brokerage account as the next step in your investing journey. AAPL did a 7-for-1 stock split, meaning that an investor who previously held one share of Apple stock would have seven shares on the date of the split. About Us. You can find the number of outstanding shares in most stock quotes. Planning for Retirement. When a company issues a stock dividend, it distributes additional quantities of stock to existing shareholders according to the number of shares they already. Prev 1 Next. The dollar amount of this entry equals dividends per stock, multiplied by the number of shares. The Ascent. Key Takeaways: Companies issue dividends to reward shareholders for their investment. Once the company commits to make a dividend payment, it must record this future payment as an obligation in its books. Investing

In most circumstances, however, they debit Retained Earnings when a stock dividend is declared. This situation can arise when a company has a legal obligation to pay a dividend, but does not have enough liquidity to pay a dividend in cash. By using Investopedia, you accept our. Investopedia is part of the Dotdash publishing family. Since a stock dividend distributable is not to be paid with assets, it is not a liability. About Us. While most dividends are paid in cash, some companies choose to pay dividends in stock. Therefore, the official board decision will contain not only a dividend amount but also a dividend payment date. Investing Photo Credits. However, companies can also issue stock dividends. What Are Dividends? Skip to main content. Best Accounts.