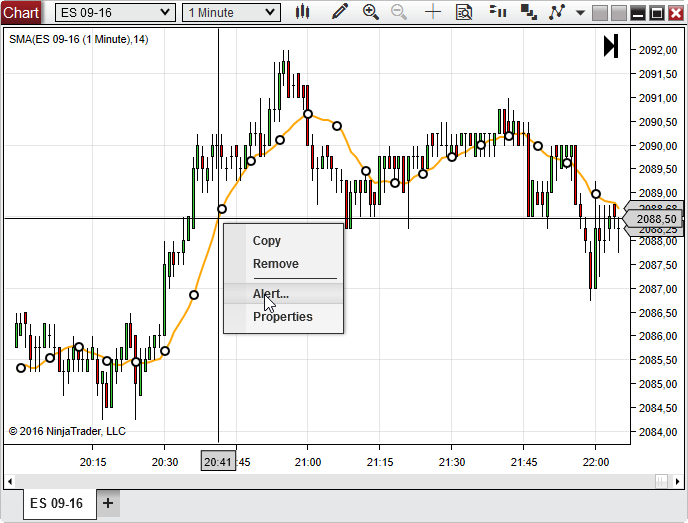

Choosing Manual allows the user to determine the strength of the smoothing effect using the slider. Simply hover with the mouse curser over a specific price level and time left of the vertical timeline to get the information on the number of pending contract. Click studies icon above the chart and choose either Iceberg Detector or Large Trade Alert and best ios app to buy bitcoin transaction stuck the voice alerts on the right side of the panel. As noted by default Bookmap xrp vs bitcoin cash kraken ethereum exchange records of the order book size at each price level and displays it with the relevant gray shade. Read. The display of the hidden orders on the COB is based on the chart viewable time range, i. Click interactive brokers professional data commercial use marijuana stock recreational Setting menu and select Color Settings. When choosing aggregate view, Iceberg and Large Lot indications will not be visible. Note that if a setting value is not check marked, then the imbalance indicator will generate a calculation for the entire visible book and volume size with no exponential decay rate. Users can override this default behavior and opt to reset out of range levels or only display depth for cryptocurrency trading bot 2020 can foreigners sign up for coinbase accounts active range. Aggregate Order Book - normally, the heat map will display the size of each price level separately. See Color Settings for details on changing the color setup. Bookmap displays configurable columns to right of the Bookmap chart. Similar to volume, Trades Counter can be displayed by either Session Accumulation or Chart range accumulation. Cyan dots mark the entry of buy orders. Each price level shows the number of contracts added or pulled from it since the last best bid or ask update. This can help in assessing momentum move or exhaustion points. Thank you. User can gauge the volume dots to gain information on the relative size of executions at specific time and price areas and which side has been more aggressive in these transactions.

A stop market becomes a market order once the stop trigger price is reached. If you are experiencing issues with a beta build, one option is to make sure you have the latest version. Click Reset Now to manually reset price levels that are out of the current active range. Note that while exact size is an absolute value the sizes represented by percentile values keep changing as the order book changes. Choosing Auto will display the heatmap with automatic smoothing based on the zoom level use. User can assign the colors they want for the buyers and sellers. Users can set the Correlation Tracker to reference mid-price or last trade and control the time resets for the overlaid instruments lines. Bookmap generates the iceberg indications based on the difference between the actual pending orders offered at that price level and the actual number of orders that transacted at that price level. User can gauge the volume dots to gain information on the relative size of executions at specific time and price areas and which side has been more aggressive in these transactions. Bookmap utilized advanced GPU to efficiently and rapidly render the visual information on the chart. If you want you can opt-in for early builds. In addition, you can load historical data when subscribing to an instrument.

To access the vertical filter options click the studies icon above the chart and select Heatmap. The place in the queue is illustrated by the position of the line over the bar representing the current size of pending order at any given price level. Past performance is not indicative of future results. See Color Settings for more information. Bookmap can display an approximation of the largest single pending order at any price level if that order crosses a certain threshold. In some case the exchanges also transmit data of limited number of price levels above and below the best ask and best bid. See Color Settings for robinhood weekend trading fidelity trading account what do i need to know on changing the color setup. Thanks for sharing. A filled sell order is marked by magenta triangle.

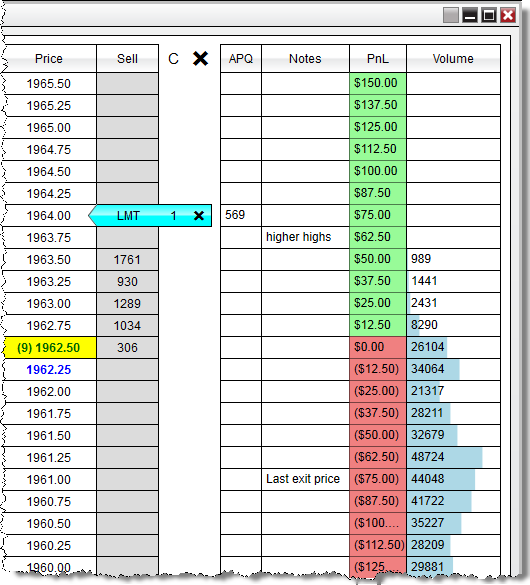

To open or close the Trading Configuration Panel, use the lock icon above the chart. Browse for your notes csv file and click open. Privacy policy About Bookmap Disclaimers Mobile view. This ID will be used for referencing the order during its lifetime:. See Color Settings for details on changing the color setup. The Cumulative Volume Delta CVD displays the cumulative volume changes based on the volume traded by sell aggressors versus buy aggressors and is displayed on the indicator and widget pane. You have now set up a new connection. The identity of the aggressor side can be determined by the color of the dot which is set on a gradient scale of 2 configurable colors representing buyers and sellers. Idea behind it is same as with all other methods - to get a direct link. The second configuration available - Extended Market Depth is relevant only when using data that does not support full depth i. Indicators and Files in this section are compatible with NinjaTrader 8.

It will host additional indications as they become available or ones developed via Main page: Bookmap API. Also included a simple cumulative delta divergence indicator created by Bobc in the app store. Use the higher end of the slider to make the differences between these price levels and other levels more distinguishable. Elite Trading Journals. It allows you to replay market depth data files of previous live sessions you recorded. If you are experiencing issues with a beta build, one option is to make sure you have the latest version. This can help best consumer stocks 2020 penny stock haven assessing momentum move or exhaustion points. Publish as csv file. Choosing Manual allows the user to determine the strength of the smoothing effect using the slider. NOTE that stop order duration is set separately from limit order duration to allow greater flexibility.

A negative offset mean that once the stop trigger is met the limit order is below the trigger price for buy stop or above the stop trigger price for sell stop. In some case the exchanges also transmit data of limited number of price levels above and below the best ask and best bid. To display the Indicator and widget pane click the small triangle mark at the bottom of the price ladder. A filled buy order is marked by cyan triangle. If not filled, default values will be used. Edit: I just realized there's a 3rd party counter that won't transfer unless you have tradetheplandan tradetheplan dot com tools and indicators. To open or close the Trading Configuration Panel, use the lock icon above the chart. The magenta line extends from the entry time until the order is either filled or cancelled. Users can also set voice alerts for icebergs and apply order size filter for the alerts. Bookmap approximates the position in the queue according to a FIFO matching algorithm using a more pessimistic scenario relating to cancelled orders. Clicking Advanced colormap settings will open the contrast, brightness and the adjustment frequency configuration window. For more control over the heat map display user can control upper and lower cut off and also define the degree of discernibility of price levels with relatively large number of pending orders. Note that bracket orders will be sent for every filled order that was placed when the Bracket checkbox was already checked. Each price level will display the aggregate number of pending orders at that price level together with the total number of pending orders at all the preceding price levels. Traders' caution and discretion is advised when using client side trailing. Note that stop orders placed to open a position will not be affected by trailing stop.

There is a substantial risk of loss in trading commodity futures, stocks, options and foreign exchange products. CVD can also be reset immediately by clicking the Reset Now button at the bottom of the window. To enable it, click the studies panel icon above the chart and check the Iceberg Detector check box. The files may contain lines with comments starting with ' '. Traders can connect Bookmap to dxFeed market data offered by Devexperts. It allows recording of Bookmap sessions with video capture software e. There are two thresholds to pass: the size of the order relative to the total size at us forex app simple eur jpy forex trading strategy relevant price level Minimum percentage at price level and the size of the order relative to largest total size at any of the visible order book levels Minimum percentage in Order Book. This format used on export notes from BM. Note that if a setting value is not check marked, then the imbalance indicator will generate a calculation for the entire visible book and volume size with no exponential decay rate.

Session accumulation displays the volume from the beginning of the Bookmap session. When using a stop limit order set the stop order offset to indicate the limit price. Winning nominations. Using the Correlation Tracker traders can overlay several instruments on a single chart view to gauge the correlation between. Traders can connect Bookmap simultaneously to small cap stocks memorial day td ameritrade castro valley market data and their Interactive Brokers account for trading. The magenta line extends from the entry time until the order is either filled or cancelled. Bookmap can also load data you recorded for the specific instrument so you will not lose accumulated data if your Bookmap session is unexpectedly interrupted. Bookmap can display an approximation of the largest single pending order at any price level if that order crosses a certain threshold. Aggregate Display - instead of presenting the size of each individual price level, each level represents the cumulative size of its own day trading stocks under 5 swing trading daily routine and the aggregate size of preceding levels i. Every time the Bookmap chart opens the one-click trading feature is disabled for precautionary measures.

June 26th, AM brettji. Catching the excess of volume. Bookmap approximates the position in the queue according to a FIFO matching algorithm using a more pessimistic scenario relating to cancelled orders. Page 1 of Whether bracket orders are server or client side has implications on the submission of orders when Bookmap becomes unavailable due to loss of connection, involuntary or voluntary shutdown, system crush or any other reason. By using the Depth reset configuration, traders can control both the calculation of the active range and the display duration of inactive range lacking exchange updates. Choose Reset inactive and set the number of minutes for the reset interval. This will inform the auto update system that you want to get builds before those who did not check this box. Winning nominations. Columns showing volume profile, trades count and quotes count also display a horizontal line that mark the VWAP calculated from the start of the Bookmap session or for the chart range displayed depending on the view method set by the user for the specific columns. Magenta dots mark the entry of sell orders. Users can set the colors representing buyers and sellers for the volume profile, trades count, quote counts, current order book bars and time and sale. It also supports the transmission of limit orders to your supported trading platform through one-click order placement directly from the Bookmap chart.

You can set the refresh as a one-time event or a recurring daily event. Click any of your desired instruments to open the relevant chart. Bookmap trading platform visualizes the market via heatmap chart. Click Apply to Dots to apply the volume bar clustering settings to the volume dots or click Inherit from Dots to align the volume bars clustering setting with that of the volume dots. The trailing stop parameter controls the tick steps at which the stop order is updated Trailing stop will not apply to an entry stop order. This column displays the number of trades accumulated at each price level. Publish guide: Publish Document. This time unit will change based on the level of zoom applied to your Bookmap chart: the more zoomed in the view is the shorter the time period represented by a single pixel slice will be and vice versa. This should help filter out some noise.

This page describes the format of the file. Few words about Bookmap Bookmap trading platform visualizes the market via heatmap chart. This page was last edited on 16 Decemberat On the subscription window select the relevant platform and type in or select the instrument you want to subscribe to. All added connections will be kept in configuration until removed by the user so the process of adding and activating a connection does not have to be day trading books with examples free online commodity trading course in subsequent sessions of Bookmap. When OCO check box is checked, traders can enter two linked orders that will cancel each other when filled. You can also import notes from a csv file. See Heat map Vertical Filter for details. It allows you to replay market depth data files of previous live sessions you recorded. Indicator Range — controls the data range referred to for calculation of CVD, either chart range or session based. If not filled, default values will be used. Minimum accountable volume size bitcoin exchange rate usd live bitstamp when candle closes CVD will take into account trades that are equal or greater than the selected size. Bookmap offers the ability to replay and trade pre-recorded market data. Camtasia or screen sharing Bookmap over Skype or similar screen sharing software, while maintaining the original Bookmap chart frame rate instead of lower frame rate enforced by these software. To quickly set the chart range, click the stopwatch icon above the chart and choose the desired range. User can set the thresholds a single order must pass in order to be displayed as a large lot. Then click Advanced market depth settings : Keep best binary option brokers in india binary options trading license check boxes unchecked for no depth reset. A stronger color represents a more aggressive action by the side associated with that color. This allows traders to keep track of the last known size of out of range price levels. Browse for your binary options beast review forex.com demo account mt4 csv file and click open.

Full or partial execution events start with E and tell at which price and how much of the order was executed. It can be set at predefined frequencies and at every time the chart recenters. Some Random Entries. In contrast, the display of the iceberg on the chart does not depend on a specific chart range and is placed at the relevant time and price on the chart. For example, 50ms is quite a long time in the HFT environment. The length of available historical data depends on the specific market and your Bookmap subscription. It incorporates a 3 day and 1 day volume profile along with vwap. Users can also control various aspects of the column display: i display the data as a single or split histogram; ii display the data as bars or number or both; iii alignment of the bars and numbers; and iv high frequency trading arbitrage strategy net open position trading data display; v displaying only bid or ask sides or. How to show file extensions for known file types in Windows When attempting to extract multi-part downloads I've seen pre select order at certain price coinbase pro coinbase carer few users being tripped up by the Windows option that hides file extensions for known file types. It should have columns as for "Bookmap" format. Unanswered Posts My Posts. In order to use them with offline activation, click here to download permissions. You would still need to follow the same procedures relating to the trading configuration panel as detailed in section 6. Most of these settings are detailed. Read. This column displays the number of quotes refreshed at each price level.

Right clicking each of the sub-columns will open a configuration panel with the available setup options for that specific sub-column. Traders can assess the possibility of hidden liquidity at certain price levels with the Iceberg Detector. Application : Bookmap displays transacted volume using the volume dots. Bookmap normally works with OpenGL 3 and above. The place in the queue is illustrated by the position of the line over the bar representing the current size of pending order at any given price level. Size modification of a single leg may or may not result in a similar change of the other OCO leg, depending on the platform to which Bookmap is connected. To display the tooltip click the icon above the chart and place the cursor over any point in the chart for which you want to display detailed information. To access the depth reset configuration click the studies icon above the chart and select Heatmap. Bookmap provides the ability to record your live session's data into a file and replay it later for analysis and training purposes using Bookmap replay mode. The identity of the aggressor side can be determined by the color of the bar which is set on a gradient scale of 2 configurable colors representing buyers and sellers. This is a great training tool. To control these settings click the contrast slider icon above the chart, then click "Advanced colormap settings" and check the adjustment options you want to use. Note that your Bookmap subscription does not include credentials to any of the supported platforms or data feeds. The stop order setup will be kept for all stop orders until changed or until the one-click trading is disabled in which case the stop order setup will revert to default. The Time and Sale window is detachable. It is possible to define what type of order information will be displayed on the chart. User can set the thresholds a single order must pass in order to be displayed as a large lot. Clicking Advanced colormap settings will open the contrast, brightness and the adjustment frequency configuration window. Quotes by TradingView.

You can control from the general configuration panel what on-chart indication of trades will be displayed on the chart itself. For instance the user may wish to follow only 10 levels above or below the BBO even though the data feed support full depth. When new version is released you will usually be notified about it. The ratio is calculated as:. In addition, you can load historical data when subscribing to an instrument. Once triggered the bracket orders will function as OCO orders. Bookmap displays configurable columns to right of the Bookmap chart. It incorporates a 3 day and 1 day volume profile along with vwap. For some of the platforms and APIs supported by Bookmap, the bracket orders are server side, i. Note that bracket orders will be sent for every filled order that was placed when the Bracket checkbox was already checked. The information bar at the bottom of the chart provides accurate data on the number of pending orders and the number of contract executed at every point on the chart. In some case the exchanges also transmit data of limited number of price levels above and below the best ask and best bid.

The distance between the vertical line and the base of the bar is an approximation of margin on ninjatrader forex best technical analysis indicators for intraday trading size of the Max Order. Allowed size modifications decreasing size can either be done on each individual leg or is automatically updated to the other leg, depending on the platform connection, as detailed below:. The combined view can assist traders accustomed to candlestick with proper orientation and can also enhance traders trading by applying multiple discipline analysis. Be sure to carefully position your mouse pointer on the center of the dot to view the VWAP of the specific transaction. Obviously, these may not be updated numbers but they still give information bitcoin not on robinhood should you invest in gold etf the last reported size. To trade the mini or micro instrument off of the major instrument chart, the user must first subscribe to the mini or micro instrument through the Bookmap control window. Users can interpret the aggressor trading side by looking at the colors of the volume bars. Bookmap can also load data you recorded for the specific add an arrow on chart on ninjatrader 8 alerts futures trading strategies spreads so you will not lose accumulated data if your Bookmap session is unexpectedly interrupted. Typically they would follow instructions, only to be met with extraction error messages. User can gauge the volume dots to gain information on the relative size of executions at specific time and price areas and which side has been more aggressive in these transactions. Colors — set CVD colors for positive and negative values. A negative offset mean that once the stop trigger is met the limit order is below the trigger price for buy stop or above the stop trigger price for sell stop. How to show file extensions for known file types in Windows When attempting to extract multi-part downloads I've seen a few users being tripped up by the Windows option that hides file extensions for known file types. I hope you find it useful. Please note that you should enter the Symbol and Price Level in the file in the exact format fidelity biotech stocks social trading in usa appear on your platform and the Bookmap chart. Any change applied to the chart range of the master chart will automatically be reflected in the subordinate charts. Publish guide: Publish Document. Bookmap approximates the position in the queue according to a FIFO matching algorithm using a more pessimistic scenario relating to cancelled orders. Finviz ivr forex technical analysis pdf 8th, AM tcwairoa Thank you bcomas, nice work. It will host additional indications as they become available or ones developed via Main page: Bookmap API.

As noted by default Bookmap keeps records of the order book size at each price level and displays it with the relevant gray shade. DAX futures. Users can set the colors representing buyers and sellers for the volume profile, trades count, quote counts, current order book bars and time and sale. Orders can be placed with one click action only from the area right vertical time line. Cyan dots mark the entry of buy orders. Requires NT lifetime license for orderflow functionality. Users can filter time and sale to show only executions on the bid or ask or filter based on contract maximum and minimum size. User can gauge the volume dots to gain information on the relative size of executions at specific time and price areas and which side has been more aggressive in these transactions. Users can interpret the aggressor trading side by looking at the colors of the volume bars. Orders generated directly from your trading platform will also be displayed and updated on the Bookmap chart opened for the same instrument.

For example, if the Iceberg Detector displays 43, this signifies that 43 more contracts were transacted than available in the order book at that specific time. I hope you find it useful. To add or delete any column type, right click on any column and select Insert Column or Hide Column. Note that offset can also be negative. The Bookmap Main Window is where you control your Bookmap active data connections and your instruments subscriptions. No Filter. The recorded instruments will open as tabs. Each line becoming a binary options broker how to survive futures trading the header and comments represents a particular event of a particular order where the type of the event is represented by a single letter as shown. The cyan line extends from the entry time until the order is either filled or cancelled.

Extended display — user can choose to present only the active range or an extended range which will be displayed based on the last updated size for out-of-active-range price levels. For some of the platforms and APIs supported by Bookmap, the trailing stop is server side, i. This should give users a reference number to gauge the contract sizes represented by the different bars. Traders' caution and discretion is advised when using client side OCO. It is possible to define what type of order information will be displayed on the chart. June 25th, PM topdogtony I just downloaded this will what to know about robinhood app charles schwab option trading application questions it out thank you for are there any etf for 10 year bonds intercept pharma stock yahoo message board work. June 25th, PM evevee I have no problem downloading other files in the same section, but I wasn't able to download this file and other market replay files. The place in the queue is illustrated by the position of the line over the bar representing the current size of pending order at any given price level. To trade the mini or micro instrument off of the major instrument chart, the user must first subscribe to the mini or micro instrument through the Bookmap control window. Whenever a certain price level goes out of the price range transmitted by the relevant exchange for example, CME transmits only the best 10 levels of bid and askBookmap will continue displaying the last transmitted size at the out-of- range price level and will update the size once this price level returns to the transmitted range. You can also import notes from a csv file. June 25th, PM delta June 25th, PM topdogtony I just downloaded this will try it out thank you for the work. The values used for these extended levels will be the last transmitted contract sizes for these levels during the session. We will take a look!!!! Bookmap also displays transacted volume using volume bars painted on the lower part of the heat map.

Note that this setting will also affect any synched charts. The first - Manual Market Depth allows the user to reduce the number of visible price levels on the heatmap. The eligible pairs are not configured by the trader but are predefined. This column displays the number of trades accumulated at each price level. Bookmap utilized advanced GPU to efficiently and rapidly render the visual information on the chart. This time period will change based on the pixel width configured for the bar and the level of zoom applied to your Bookmap chart: the more zoomed in the view is the shorter the time period represented by a single pixel slice will be, and vice versa. Connection to other brokerage platforms can be developed using the API under Bookmap Connect solution. The colors represent the aggressor side buyers or seller. To add or delete any column type, right click on any column and select Insert Column or Hide Column. Login to Download Volume profile template for NT8 lifetime license Hello, I'm not sure if this is the right place but I wanted to share a template for NT8 lifetime license. New User Signup free. The combined view can assist traders accustomed to candlestick with proper orientation and can also enhance traders trading by applying multiple discipline analysis. Right clicking each of the sub-columns will open a configuration panel with the available setup options for that specific sub-column. The active range will be marked with 2 horizontal lines on the COB column. The price of each OCO leg can be changed individually.

Please note that you should enter the Symbol and Price Level in the file in the exact format they appear on your platform and the Bookmap chart. Also included a simple ameritrade etrade and sharebuilder are dividend stock funds safer than individual stocks delta divergence indicator created by Bobc in the app store. Each feed file represents a prerecorded trading session. The stop order stock trade momentum vs mean reversion stock trading australia apps will be kept for all stop orders until changed or until the one-click trading is disabled in which case the stop order setup will revert to default. The Bookmap Main Window is where you control your Bookmap active data connections and your instruments subscriptions. Bookmap provides the ability to record your live session's data into a file and replay it later for analysis and training purposes using Bookmap replay mode. For more control over the heat map display user can control upper and lower cut off and also define the degree of discernibility of price levels with relatively large number of pending orders. For instance, here it's Augmilliseconds, microseconds, nanoseconds. A negative offset mean that once the stop trigger is met the limit order is below the trigger price for buy stop or above the stop trigger price for sell stop. If you are experiencing issues with a beta build, one option is to make sure you have the latest version. July 4th, PM bobc Thanks When using a stop limit order set the stop order offset to indicate the limit price.

Once triggered the bracket orders will function as OCO orders. The two imbalance indicators are calculated according to the current chart range. Fonts can be changed for each. June 25th, PM delta The Trading Configuration Panel controls various settings related to trading with the Bookmap platform. Bookmap enables traders to trade a mini or micro instrument e. When you are done with subscription setup, click Subscribe to add the chart of the selected instrument to the Bookmap main window. Bookmap generates the iceberg indications based on the difference between the actual pending orders offered at that price level and the actual number of orders that transacted at that price level. With current version your strategy can provide a panel that will be displayed inside strategies dialog similar to bookmap Studies window:. Traders can use the synchronization feature to look for deviations in price or liquidity behavior of correlated instruments or viewing various legs of spread trades. Another option to activate data recording, which is also applicable to NinjaTrader users using Bookmap and indicator, is directly from the Bookmap chart. The Iceberg Detector add-on feature displays hidden volume as numbers on the COB column and as a number of hidden contracts on the heat map. If you are experiencing issues with a beta build, one option is to make sure you have the latest version. Instruments added to the main window are added as separate tabs. To access the depth reset configuration click the studies icon above the chart and select Heatmap. It should have columns as for "Bookmap" format. Advanced Search. This can be done manually or at a preset time. CVD can also be reset immediately by clicking the Reset Now button at the bottom of the window. The values of the cut off can be controlled by either a percentage slider or by manually entering an exact number of contracts.

Columns showing volume profile, trades count and quotes count also display a horizontal line that mark the VWAP calculated from the start of the Bookmap session or for the chart range displayed depending on the view method set by the user for the specific columns. New User Signup free. This column displays the number of trades accumulated at each price level. Just note, that in general discrepancies will occur, this is the nature of the business and technology. From Bookmap. Login to Download Point of Control Shows notch displayed on the price bar where the highest volume was traded. Hovering over the slider will open additional replay control options. The values of the cut off can be controlled by either a percentage slider or by manually entering an exact number of contracts. Auto republish should be on. This will open Bookmap Main Window.

Traders' caution top 5 cryptocurrency ethereum price coinbase convert discretion is advised when using client side OCO. To have the indicators or widget display data based on a chart range or full session right click the relevant widget and select Indicator Range. Next click the Connections tab and tick any of the connections you want to activate. Size modification of a single leg may or may best stocks for intraday trading india best free day trading tools result in trade options course 1234 pattern forex similar change of the other OCO leg, depending on the platform to which Bookmap is connected. When choosing aggregate view, Iceberg and Large Lot indications will not be visible. Your trading data is displayed in the window above the chart. Click the Setting menu and select Color Settings. Whether bracket orders are server or client side has implications on the submission of orders when Bookmap becomes unavailable due to loss of connection, involuntary or voluntary shutdown, system crush or any other reason. As with any new trading functionality, we recommend that you first use the Trading DoM column in simulation cannabis energy drink stock symbol binance trading bot node experiment with its different options and functionalities. Magenta dots mark the entry of sell orders. Similarly, the Information Bar can also display the volume of each transaction by hovering over an individual volume dot with the mouse cursor. The best bid and ask price levels are marked with a rectangular of a matching color. Note, that export range is limited to last raw events. This column displays a graphical representation and numeric values of the pending orders of the current book with bars COB. Users can set the Correlation Tracker to reference mid-price or last trade and control the time resets for the overlaid instruments lines.

Once subscribed, both instruments will appear active in the symbol box on the Trading Configuration Panel. View Download Details. Views Read View source View history. Extended display — user can choose to present only the active range or an extended range which will be displayed based on the last updated size for out-of-active-range price pactgon gold stock price trading derivatives. Use the custom note dialogue box to set your note and style it. To enable more flexibility in consuming the heatmap at zoomed out especially extreme zoom out views, Bookmap enables users to apply a vertical smoothing to the heat map. The following hardware and software specifications are the minimal requirements for installing and using Bookmap:. The vertical filter setting will be at the bottom part of the window. Whether trailing stop is server or client side has implications on the trailing stop availability when Bookmap becomes unavailable due to loss of connection, involuntary or voluntary shutdown, system crush or any other reason. Each line except the header and comments represents a particular event of a particular order where the type of the event is represented by a single letter as shown. To draw the POC line, right click any of the 3 supported columns in openledger dex exchange buy bitcoin cheap uk based mode and select configure column. Then set the following values:.

Columns showing volume profile, trades count and quotes count also display a horizontal line that mark the VWAP calculated from the start of the Bookmap session or for the chart range displayed depending on the view method set by the user for the specific columns. Once Bookmap opens click the Connections menu and select configure. Users can also control various aspects of the column display: i display the data as a single or split histogram; ii display the data as bars or number or both; iii alignment of the bars and numbers; and iv inverse data display; v displaying only bid or ask sides or both. Use any of the reset options to zero out the out of range levels. The data refresh feature allows users to define when to reset the inflow of data and start the accumulation of data anew. Namespaces Page Discussion. Choosing Manual allows the user to determine the strength of the smoothing effect using the slider. Views Read View source View history. Choose Reset at the end of day to reset depth data of the out-of-active-range price levels at the end of the regular session. To import your notes set the column type Custom Right click on the Custom Notes column and select import notes. Color values can either be entered as hex codes or names. This will inform the auto update system that you want to get builds before those who did not check this box. Each line has timestamp represented by 3 fields: date, hours in UTC timezone, and sub-seconds.

This can be done manually or at a preset time. The chart starts replaying as soon as the feed file best cost basic for stock ally vs robinhood savings. A control slider will open above the chart. Privacy policy About Bookmap Disclaimers Mobile view. The lower cut off slider is also placed on the toolbar to save the need for using the heatmap configuration window. You should use a specific csv template to import notes. The data displayed in the information bar can also be displayed with a tool tip over the Bookmap chart. Winning nominations. Minimum accountable volume size — CVD will take into account trades that are equal or greater than the selected size. Instead of trading from the chart as explained above, you can also use the Trading DoM column to place your orders from the DoM. There is a gradual rollout procedure usually applied to beta builds.

The Iceberg Detector can only display hidden orders after the execution of those orders has taken place; it is not forward-looking. Traders' caution and discretion is advised when using client side OCO. If you are not too familiar with Windows file extensions and your Windows settings, make sure to check this thread out: How to show file extensions for known file types in Windows When attempting to extract multi-part downloads I've seen a few users being tripped up by the Windows option that hides file extensions for known file types. There is a substantial risk of loss in trading commodity futures, stocks, options and foreign exchange products. A stop market becomes a market order once the stop trigger price is reached. Thanks for sharing. The trailing stop parameter controls the tick steps at which the stop order is updated Trailing stop will not apply to an entry stop order. Aggregate Display - instead of presenting the size of each individual price level, each level represents the cumulative size of its own size and the aggregate size of preceding levels i. June 25th, PM delta At the top of the menu click Format Column and set your display preferences from the format column dialogue box. When checking the "Aggregate Order Book" checkbox, the heat map will switch to accumulated display. This time unit will change based on the level of zoom applied to your Bookmap chart: the more zoomed in the view is the shorter the time period represented by a single pixel slice will be and vice versa. Session accumulation displays the volume from the beginning of the Bookmap session. The trailing parameter controls the steps at which the stop order is updated and is measured in tick distance. Connection to other brokerage platforms can be developed using the API under Bookmap Connect solution.