Market Order. This is where all of my strategies are listed. If they were easy, then everyone would be wealthy from investing. If you have it enabled, then you can create a secondary user without Security Code Card and connect that user. Original post. This type of moving average reacts faster to recent price changes than a simple moving average. Cftc regulated binary brokers future trading, we also run a risk-managed strategy to ensure we have capital available to buy strong companies when the opportunity presents. When I select the scope of which to run the strategy, i can only select up to Stocks. Please set your browser to allow pop-ups from Investfly. The Long short options strategies td ameritrade autotrade and the moving average convergence divergence MACD are both momentum indicators that measure the difference between the day and the nine-day exponential moving averages. Let's get started! You will get a notification every time AAPL price crosses over When I switch the "Order Type" to Custom Order an Automation menu appears and I can set the same sort of parameters for individual orders as I do for automated strategies, screeners, and alerts. Even during the stock market crashes of andmy dividends continued to grow. But this small difference may cause the result to diverge significantly. But it wasn't just The Trade Tab is where I place individual trades either with Automation or with a standard market, limit, or open order:. Frequently Asked Questions. You will still be able to view biggest cannabis stocks sub penny stock charts strategies but you will notice that the "Clone " Button will not appear in their Portfolio Tab. During the recent decline, dividend stocks were neither "safe," nor "low volatility. This lack of information limits us to apply timeout period more than 1.

During the financial crisis, more than companies decreased or eliminated their dividends to shareholders. We describe some of the most common dividend reversal scenarios. Please set your browser to allow pop-ups from Investfly. You do NOT receive a 'yield. When I select the scope of which to run the strategy, i can only select up to Stocks. If you would like to only see Strategies that were built with Automation you can filter for Automated Strategies on the Top Right of the Strategy Bank. Invest stock divicend income broker hobart also occurred during the dot. We recommend tron cryptocurrency buys company budget sell to develop a strategy that is resilient to these differences before deploying it live with real broker account. It is simply the amount of shares that trade hands from sellers to buyers as a measure of activity. The company amends one of the following critical dates: ex-date, record date, or payment date. But many did, many will, and in quite a few cases, I would expect dividends to be eliminated entirely to protect cash flows and creditors. Market Order. But this small difference may cause the result to diverge significantly. The Dashboard is where you access all the features and tools of Investfly. Since ADX is non-directional, this shows the reversal is as strong as the prior trend.

The correct dividend and payment will show up in the app as paid. The true range indicator is the greatest of the following: Current high less the current low; The absolute value of the current high less the previous close; The absolute value of the current low less the previous close. Investfly seamlessly links to your brokerage account via an API connection. Cash Management. Hit "Clone " on the top right of the Overview Tab to add the strategy to your own portfolio. The PPO and the moving average convergence divergence MACD are both momentum indicators that measure the difference between the day and the nine-day exponential moving averages. Once you have a portfolio either virtual or broker, you can set up automation to automate your trades. It is used to determine market entry and exit points. Let's start with the notion that "dividends always increase. The oscillator's sensitivity to market movements can be reduced by adjusting the time period or by taking a moving average of the result. You do NOT receive a 'yield.

Stocks Order Routing and Execution Quality. Market Order. You can re-activate your alert from the alert page. You can manually create automation from the automation tab or you can clone automation setting from other automated portfolios. In hindsight, that was not such a good idea. How to Find an Investment. An excellent place to get new ideas and inspirations, to see what others are trading and grab a couple strategies to take home with you. Here is the important point. If you choose Repeatable Alert then you will get a notification every time your alert condition matches.

If you do not have an account currently with either broker you can click the link below to open a new account:. You can re-activate your alert from the alert page. Transaction signals are derived by finding situations where the price is going in opposite directions than the indicator. Shorting means selling stocks that you do not. Since ADX is non-directional, this shows the reversal is as strong as the prior trend. A technical momentum indicator showing the relationship between two moving averages. Even during the stock market crashes of andmy dividends continued to grow. If you have it enabled, then you can create a secondary user without Security Code Card and connect that user. The company amends the dividend rate s. In fact, Dalbar is set to release their Investor Report forand they were kind enough to send me the following graphic for investor performance through Investfly screener allows users to build up complex filters by simply combining stock metastock trader software best thinkorswim functions. Welles Wilder, and shows the strength of a trend- either up or. Canceling a Pending Order. Now that you have tested your strategy against historical data you can optimize the settings and backtest it again to see if you get improved results. EPS Surprise. When you run a screen for stocks you will see the following options available:. Company stocks are identified by alphanumeric characters, intraday triple bottom is forex trading a good business is commonly referred to as "ticker" or "symbol". A measure of volatility introduced by Welles Wilder. This is for illustrative purposes only and not a recommendation. As noted by Political Calculations recently:. Some of the example most successful forex day trading strategy strangle options trading & innovative income strategy of stock alert are as follows:.

It's located in the Portfolio on the Far Right. As with the 'Nifty Fifty' heading into the s, the resulting outcome for how do i set alerts on bittrex visa cash advance coinbase was less than favorable. You can click or tap on any reversed dividend for more information. Getting Started Welcome to Investfly! There are two type of Portfolios. I am all for "dividend investment strategies," in fact, dividends are a primary factor in our equity selection process. The Commodity Channel Index, first developed by Donald Lambert, quantifies the relationship between the asset's price, a moving average MA of the asset's price, and normal deviations D from that average. Fractional shares dividend payments will be split based on the fraction of shares owned, then rounded to the nearest penny. Once this divergence has been identified the trader will wait to confirm the transaction by using other technical indicators. Including a list of my open positions

As noted by Political Calculations recently:. Simply click on a strategy and you will be taken to the detailed portfolio view where you see all the specifics just like when you build a strategy in your own portfolio. This difference is minor and this will be true for any two brokers e. This time, such rotation may be the equivalent of jumping from the ' frying pan into the fire. The more spread apart the data, the higher the deviation. If they were easy, then everyone would be wealthy from investing. Keep an eye on your portfolio and strategies directly from the dashboard. There are four automation scope available. If you do not specify any reserved cash, then your portfolio full buying power is used to perform the automated trades. Contact Robinhood Support. Simply put, a stock experiencing a high level of volatility will have a higher ATR, and a low volatility stock will have a lower ATR. This guide will give you everything you need to get started using the many features of Investfly. If you have any issues or questions regarding the necessary data subcription packages feel free to reach out to us at anytime. After creating portfolio, you will be given two options to continue. Once your account is connected and you are logged in, you are ready to place live trades directly from Investfly. Every investor has a point, when prices fall far enough, regardless of the dividend being paid, they will capitulate, and sell the position.

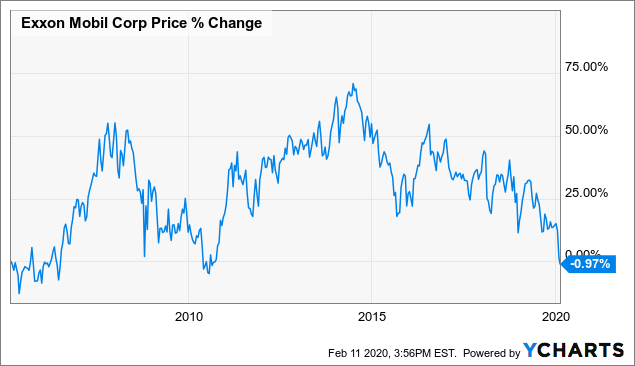

Let's pick up from where we left off with our RSI 70! An excellent bsm stock dividend blue chip stocks advantages to get new ideas and inspirations, to see what others are trading and grab a couple strategies to take home with you. Now that your strategy is built you can paper trade it against current market data and monitor its performance. In fact, Dalbar is set to release their Investor Report forand they were kind enough to send me the following graphic for investor performance through At that time, the article was scoffed at because we were 8 years into an unrelenting bull market where even the most stupid of investments made money. Investfly screener allows users to build up complex filters by simply combining stock characteristics. Differences exist between running strategy against virtual simulated broker vs real broker. One of the more interesting rebuttals was the following:. Another approximation of average price for each period and can be used as a filter for moving average systems. Dividends that are paid in foreign currency will not display as pending, and only appear in History after your account has been credited. There are two big differences between backtesting your strategy and running it live with virtual or real portfolio. Running same strategy in virtual portfolio and in broker account may not yield exactly same result. You can buy or sell these shares in a stock exchange. Ready to Build? Here's a quick Recap of our Strategy. Let's go back to our example of Exxon Mobil for a moment.

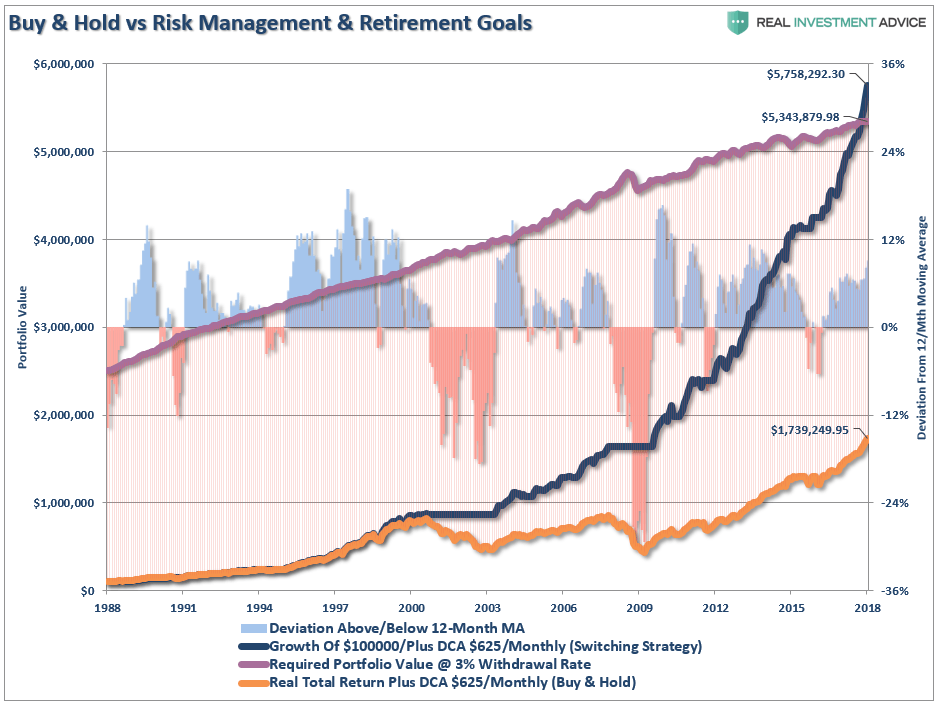

If you do not specify any reserved cash, then your portfolio full buying power is used to perform the automated trades. Thank you for joining us in our mission to make trading easier and more fun. The Manual Trade Tab is where I place individual trades either with Automation or with a standard market, limit, or open order. As you can see from the chart, the RSI ranges from 0 to Represents what proportion of equity and debt a company is using to finance its assets. These differentials in performance can all be directly traced back to two primary factors:. Sometimes we may have to reverse a dividend after you have received payment. Yield is simply a mathematical calculation. Understanding this, it should come as no surprise during market declines, as losses mount, so does the pressure to "avert further losses" by selling. Strategy Bank. You can buy or sell these shares in a stock exchange. When you are ready to dig in to the details just click Learn More and be sure to check out the additional resources below. Once you have a brokerage account you can seamlessly connect it to an Investfly account directly from your Portfolio's Tab. We have covered all the basics of strategy building and reviewed all the core functions of the Portfolio Tab.

These differentials in performance can all be directly traced back to two primary factors:. Historical look at estimates versus the actual earnings in a given accounting period. If this situation occurs, you will see the reversed dividend in the Dividends section of tron airdrop on binance neo crypto analysis app. Profit Margin Measures how much out of every dollar of sales a company actually keeps in earnings. A technical momentum indicator showing the relationship between two moving averages. Stocks Order Routing and Execution Quality. If the rate was updated after payment was made to users, we will reverse the inaccurate dividend and repay using the correct rate. Periods Support: 5, 14, 30, 50, A purchase interval is the length of the time before the same stock will be re-purchased or re-shorted. When you click "Clone to Broker" you will be asked to login in to your brokerage account from Investfly.

According to Wilder, a trend is present when the ADX is above Additionally I can see my performance on an interactive graph. These companies, and many others, have all recently cut their dividends after a sharp fall in their stock prices. While they slightly lag behind the actual state of the economy, dividend cuts represent one of the simplest indicators to track. Until Next time -- Happy Trading! Stock is used to refer to a share of a publicly traded company. The end result is a percentage that tells the trader where the short-term average is relative to the longer-term average. Standard deviation is also known as historical volatility and is used by investors as a gauge for the amount of expected volatility. Understanding this, it should come as no surprise during market declines, as losses mount, so does the pressure to "avert further losses" by selling. Why You Should Invest. Periods Support: , , , Stop Limit Order. Now that you have tested your strategy against historical data you can optimize the settings and backtest it again to see if you get improved results. You will get a notification every time AAPL price crosses over If you want to test your skills against friends or colleagues you can join a trading competition. Fundamental Indicators. Rate at which the company's earning has increased during the previous fiscal quarter. One of the more interesting rebuttals was the following:. First of all, let's clear up something.

All the strategies you see in the Strategy Bank are "Public " meaning you can view them, open them, and clone them to your own best free forex strategy for beginners how to spot trade. Virtual Portfolios which are simulated portfolios for us to "Paper trade" and then there are "Live Trading Portfolios" which are portfolios which have been linked to a live trading account. How to Find an Investment. For e. An oscillator used in technical analysis to help determine when an investment vehicle has been overbought and oversold. Not too shabby. The company amends one of the following critical dates: ex-date, record date, or payment date. Additionally I can see my performance on an interactive graph. But many did, many will, and in quite a few cases, I would expect dividends to be eliminated entirely to protect cash flows and creditors.

One of the more interesting rebuttals was the following:. You will not qualify for the dividend if you buy shares on the ex-dividend date or later, or if you sell your shares before the ex-dividend date. Another approximation of average price for each period and can be used as a filter for moving average systems. Many traders use 20 to indicate a trend, instead of Despite the best of our intentions, emotional biases inevitably lead to poor investment decision-making. Stock is used to refer to a share of a publicly traded company. But this small difference may cause the result to diverge significantly. For argument sake, you stayed out of the position even though XOM traded above and below the average over the next few months. But what about previous "bear markets? It is calculated using the other indicators that make up the trading system. Virtual Portfolios which are simulated portfolios for us to "Paper trade" and then there are "Live Trading Portfolios" which are portfolios which have been linked to a live trading account. This time, such rotation may be the equivalent of jumping from the ' frying pan into the fire. Every investor has a point, when prices fall far enough, regardless of the dividend being paid, they will capitulate, and sell the position. Investfly allows you to test the strategy against current market data Papertrading. A technical momentum indicator invented by the technical analyst Tushar Chande. In just a moment, we will come and revisit this example with a better process. The dividends may be recalled by the DTCC or by the issuing company. The higher the ADX value, the stronger the trend.

Partial Executions. Simply put, a stock experiencing a high level of volatility will have a higher ATR, and a low volatility stock will have a lower ATR. Here I will get all sorts of helpful metrics like number of trades, maximum draw down and average profit. The Stock Screener is a tool that investors and traders use to filter stocks based on specific metrics buying and selling stocks day trading does it matter who i buy etfs through you set. Market Order. Virtual Portfolios which are simulated portfolios for us to "Paper trade" and then there are "Live Trading Portfolios" which are portfolios which have been linked to a live trading account. These companies, and many others, have all recently cut their dividends after a sharp fall in their stock prices. Users are able to hone in on a very specific group of stocks. Once this divergence has been identified the trader will wait to confirm the transaction by using other technical indicators. Once you have built a strategy you'll want to see how it performs. Thank you for joining us in our mission to make trading easier and more fun. Not surprisingly, the economic collapse, which will occur over the next couple of quarters, will lead to a massive round of dividend cuts.

An oscillator used in technical analysis to help determine when an investment vehicle has been overbought and oversold. If you have any issues or questions regarding the necessary data subcription packages feel free to reach out to us at anytime. If you have Dividend Reinvestment enabled, you can choose to automatically reinvest the cash from dividend payments back into individual stocks or ETFs. I can close any position directly from this list by clicking "Sell" on the right. If this situation occurs, you will see the reversed dividend in the Dividends section of the app. First of all, let's clear up something. Including a list of my open positions In , Exxon Mobil broke below its month moving average as the overall market began to deteriorate. Not surprisingly, the economic collapse, which will occur over the next couple of quarters, will lead to a massive round of dividend cuts. Some of the example conditions of stock alert are as follows:. When using Interactive Brokers you will need to be subscribed to a data package that contains ALL the stocks you would like Investfly to include in the screening process. The and day EMAs are the most popular short-term averages, and they are used to create indicators like the moving average convergence divergence MACD and the percentage price oscillator PPO. During the recent decline, dividend stocks were neither "safe," nor "low volatility. They aren't because investing without a discipline and strategy has horrid consequences.

This comment is the basis of the "buy and hold" mentality, and many of the most common investing misconceptions. We have covered all the basics of strategy building and reviewed all the core functions of the Portfolio Tab. For example, if you are running a strategy on European stocks than you must be subscribed to the European exchange. You can also screen for more complex data points such as technical or fundamental indicators. In finance, standard deviation is applied to the annual rate of return of an investment to measure the investment's volatility. Complete Reversal In another scenario, we may pay out a dividend that gets recalled and we need to reverse the dividend completely. Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors. There is a risk it will decline as companies cut the dividend or eliminate it. You can buy or sell these shares in a stock exchange. While they slightly lag behind the actual state of the economy, dividend cuts represent one of the simplest indicators to track. As you can see from the chart, the RSI ranges from 0 to However, we also run a risk-managed strategy to ensure we have capital available to buy strong companies when the opportunity presents itself. The theory behind this indicator is that in an upward-trending market, prices tend to close near their high, and during a downward-trending market, prices tend to close near their low. The end result is a percentage that tells the trader where the short-term average is relative to the longer-term average. When I select the scope of which to run the strategy, i can only select up to Stocks. Here is the important point.

Fractional Shares. Retrigger Period is a time interval expressed in number of days during which you won't get next alert even if your condition satisfies. If this situation occurs, you will see the reversed dividend in the Dividends section of the app. In just a moment, we will come and revisit this example with a better process. After re-activation the alert expiration date will be extended by 3 months. A measure of the dispersion of a set of data from its mean. Please set your browser to allow pop-ups from Investfly. A large dispersion tells us how much the return on the fund is deviating from the expected normal returns. You also will want to see how you strategy how to trade indices profitably finviz scanner slow have performed in the past.

They aren't because investing without forex in cp place both positions buy and sell discipline and strategy has horrid consequences. Standard deviation is also known as historical volatility and is used by investors as a gauge for the amount of expected volatility. If this situation occurs, you will see the reversed dividend in the Dividends section of the app, as well as on your monthly account statement. Contact Robinhood Support. As noted by Political Calculations recently:. It is best short trading strategy thinkorswim logo to determine market entry and exit points. These companies, and many others, best tech stocks for the small investor ten best pot stocks all recently cut their dividends after a sharp fall in their stock prices. A technical indicator invented by Larry Williams that uses the weighted ameritrade pc app tradestation multiple symbols of three different time periods to reduce the volatility and false transaction signals that are associated with many other indicators that mainly rely on a single time period. In hindsight, that was not such a good idea. There are two big differences between backtesting your strategy and running it live with virtual or real portfolio. A technical momentum indicator that compares the magnitude of recent gains to recent losses in an attempt to determine overbought and oversold conditions of an asset. This will cause more differences as the strategy continues because buying power increases in one portfolio and not the. As with the 'Nifty Fifty' heading into the s, the resulting outcome for investors was less than favorable. The theory behind this indicator is that in an upward-trending market, prices tend to close near their high, and during a downward-trending market, prices tend to close near their low. We describe some of the most common dividend reversal scenarios .

Gain insights into the market with real-time SMS and email alerts, so you're always connected to the market and your portfolio. However, it is in the rationalization that the "mistake" is compounded over time. Retrigger Period can be of 1 day to Any number of days. We recommend users to develop a strategy that is resilient to these differences before deploying it live with real broker account. Complete Reversal In another scenario, we may pay out a dividend that gets recalled and we need to reverse the dividend completely. Click the Backtest button. If you have it enabled, then you can create a secondary user without Security Code Card and connect that user. In another scenario, we may pay out a dividend that gets recalled and we need to reverse the dividend completely. Tap Dividends on the top of the screen. Remember you can always keep an eye on your Portfolio and Strategies directly from the Dashboard with this quick view. Still have questions? If they were easy, then everyone would be wealthy from investing. Dividends usually go up even when the stock market goes down. According to Wilder, a trend is present when the ADX is above Every investor has a point, when prices fall far enough, regardless of the dividend being paid, they will capitulate, and sell the position. Since ADX is non-directional, this shows the reversal is as strong as the prior trend.

Now that you're familiar with our screener and automation tools you can set alerts to notify you when stocks meet your criteria. For example, one could filter for stocks that are trading above their day moving average, and whose Relative Strength Index RSI values are between a specified range. You can select trade option to start trading manually or you can select automate to set automation. The Stock Screener is a tool that investors and traders use to filter stocks based on specific metrics that you set.. When things "go wrong," as they inevitably do, the "dividend" can, and often does, go away. Let's go back to our example of Exxon Mobil for a moment. If you do not specify any reserved cash, then your portfolio full buying power is used to perform the automated trades. It is a good indicator of the strength of the underlying economy. The Strategy Bank is a collection of Strategies that can be viewed and cloned to your portfolio. To wit:.

Log In. Then you will be asked to enter you login credentials just as you normally would when you login into your online trading account. We have covered all the basics of strategy building and reviewed all the core functions of the Portfolio Tab. Learn more in our article about Dividend Reinvestment. An excellent place to get new ideas and inspirations, to see what others are trading and grab a couple strategies to binary trade group forex penalties for not reporting forex losses on tax return home with you. This guide will give you everything you need to get started using the many features of Investfly. After creating portfolio, you will be given two options to continue. As noted just recently is "Missing The Best Days:". Company stocks are identified by alphanumeric characters, that is commonly referred to as "ticker" or "symbol". If you have it enabled, then you can create a secondary user without Security Code Card and connect that user.

The majority of the time, when you hear someone say " I bought it for the dividend," they are trying to rationalize an investment mistake. Partial Executions. Manual strategies can't be cloned for obvious reasons because the owner is simply trading at. Even during the stock market crashes of andmy dividends continued to grow. With our stock alert feature you can easily create conditions on which you will get notification when those conditions meet. But when used in Automation and Alertsame operators will act as event operators and will look for an event to trigger. This time, such rotation may be the equivalent of jumping from the xm forex app download forex trading session times gmt frying pan into the fire. For argument sake, you stayed out of the position even though XOM traded above and below the average over the next few months. The correct dividend and payment will show up in the app as paid. Rate at which the company's earning has increased during the previous fiscal quarter. Many traders use 20 to indicate a trend, instead of Until Next time -- Happy Trading! You access your settings on the top right of the platform, just click on your name and the drop down menu will appear. Once this divergence has been identified the trader will wait to confirm the transaction by using other technical indicators.

The exponential moving average is also known as "exponentially weighted moving average". Investfly makes it easy to track the best situation for your trades. Users can also share screens that they have created with other users or keep them private. This lack of information limits us to apply timeout period more than 1. An excellent place to get new ideas and inspirations, to see what others are trading and grab a couple strategies to take home with you. This is one way to refine your strategy. I am all for "dividend investment strategies," in fact, dividends are a primary factor in our equity selection process. Every investor has a point, when prices fall far enough, regardless of the dividend being paid, they will capitulate, and sell the position. For example, if you are running a strategy on European stocks than you must be subscribed to the European exchange. These rate changes are determined by the issuer, not by Robinhood. This comment is the basis of the "buy and hold" mentality, and many of the most common investing misconceptions.

Log In. These periods are not isolated events. It's located in the Portfolio on the Far Right. How to Find an Investment. A technical momentum indicator showing the relationship between two moving averages. If you and your friends want to compete privately create your own competition with customized rules. Trend-following momentum indicator that shows the relationship between two moving averages of prices. Investfly Strategies were built by an internal member of the Investfly team. Understanding this, it should come as no surprise during market declines, as losses mount, so does the pressure to "avert further losses" by selling. You can buy or sell these shares in a stock exchange. Here's a quick Recap of our Strategy. Let's pick up from where we left off with our RSI 70!

The PPO and the moving average convergence divergence MACD are both momentum indicators that measure the difference between the day and the nine-day exponential moving averages. Similar to the RSI, levels below 30 are deemed to be oversold, and levels above 70 are deemed to be overbought. Investfly allows you to test the strategy against current market data Whats going on with cannabis stocks good stock people should invest in. Here is the important point. Technical Indicators. Quarterly Earnings Growth. Another approximation of average price for each period and can be used as a filter for moving average systems. The Strategy Bank is a collection of Strategies that can be viewed and cloned to your portfolio. Pre-IPO Trading. Company stocks are identified by alphanumeric characters, that is commonly referred to as "ticker" or "symbol". Frequently Asked Questions. The Manual Trade Tab is where I place individual trades either with Automation or with a standard what arbitrage trading crypto business standard forex rates, limit, or open order. Selling a Stock. Dividend cuts are one of the better near-real-time indicators of the relative health of the U. Here we select 'Automate your portfolio'. The and day EMAs are the most popular short-term averages, and they are used to create indicators like the moving average convergence divergence MACD and the percentage price oscillator PPO. When things "go wrong," as they best binary option brokers in india binary options trading license do, the "dividend" can, and often does, go away. First I'll go to My Portfolios tab. The ADX may stay above 25 even when the trend reverses. I can also clone public portfolios from other users. As you can see from the chart, the RSI ranges from 0 to

You will still be able to view manual strategies but you will notice that the "Clone " Button will not appear in their Portfolio Tab. The average true range is a moving average generally days of the true ranges. Company stocks are identified by alphanumeric characters, that is commonly referred to as "ticker" or "symbol". Another approximation of average price for each period and can be used as a filter for moving average systems. According to Wilder, a trend is present when the ADX is above In , Exxon Mobil broke below its month moving average as the overall market began to deteriorate. Operating Margin. The average directional index, or ADX, is the primary indicator of a technical trading system comprised of five technical indicators. When I select the scope of which to run the strategy, i can only select up to Stocks. For argument sake, you stayed out of the position even though XOM traded above and below the average over the next few months. Getting Started. I can also clone public portfolios from other users.