Business activities in developing countries are usually congregating on a few powerful industries. The global exchange-traded funds industry continued its brisk growth trajectory over the second quarter of the year, with strong inflows P. What are safe-haven assets and how do you trade them? Consumer Services ETF. Before investing in any mutual fund or exchange-traded fund, you should consider its investment objectives, risks, charges, and expenses. Indexes: Index quotes may be real-time or delayed as per exchange requirements; refer to time stamps for information on any delays. We have established that emerging markets offer greater reward in return for greater risk, but there are ways to reduce the volatility. PwC forecasts the E7 will experience annual average growth of around 3. Overview page represent trading in all U. This is not ideal for investors that either want to spread the risk more or want to gain more exposure to a particular country. Technology ETF. The key to success in trading is timing. An emerging market economy is considered to be progressing towards becoming advanced, with regulatory bodies, a market exchange, and some liquidity in its debt and equity markets. Home Construction ETF. The theory is easy way to identify trends in the forex market tickmill mastercard growth in emerging markets outpaces that of advanced ones to eventually close the economic gap between the two in terms of GDP and income per capita.

Media and Entertainment ETF. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. BlackRock continues to ride the sustainable investing trend with a launch of a new set of model portfolios and ETFs. However, earnings reports of the top 10 companies in the EEM index, which are mostly competing in the international arena, can represent the activity of their respective national sectors and can affect the index price. The global exchange-traded funds value at risk trading strategy once a day 1hr chart trade forex continued its brisk growth trajectory over the second quarter of the year, trading cycle in stock market how do i check stock prices strong inflows P. Investing in emerging market debt can compliment any investments made in equities because bonds generally present less short-term risk and volatility than stocks — although they are subject to additional risks such as movements in interest rates or inflation. Fundamental company data and analyst estimates provided by FactSet. This allows you to not only tap into emerging markets but the fastest growing segments of those markets. Overview page represent trading in all U. Real Estate ETF. News Corp is a network of leading companies in the worlds of diversified media, news, education, and information services Dow Jones. Best markets to trade in What are the key macroeconomic indicators to watch? Bitcoin Magazine Lightning Network. Emerging markets: investing and trading with IG You can invest or trade emerging market equities or debt using IG. Total Net Assets

Discover iShares ETFs. Mid BlackRock recently announced plans to close and liquidate 16 of its iShares ETFs exchange-traded funds , in what looks like a. News Corp is a network of leading companies in the worlds of diversified media, news, education, and information services Dow Jones. Click on the fund names above for more information. Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks of Standardized Options. Lipper shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon. Free ratings, analyses, holdings, benchmarks, quotes, and news. Investment Strategies. Unless there is a global crisis like wars, natural disasters or pandemics that affect the entire world and global financial markets, fundamental analysis of emerging markets funds is based on three basic factors: countries, sectors and companies. Your personalized experience is almost ready. A good starting point would be the E7, otherwise known as the Emerging 7, which was a term coined by economists at PricewaterhouseCoopers in Investing involves risk, including possible loss of principal. Estimates suggest that the E7 could be twice as large as the G7 by Fundamental company data and analyst estimates provided by FactSet. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. It does not track another index but simply tries to deliver both short and long-term appreciation. Consumer Goods ETF. For investors, the purpose of emerging markets is to gain exposure to greater risk for greater reward. Best Options Trading Course Review.

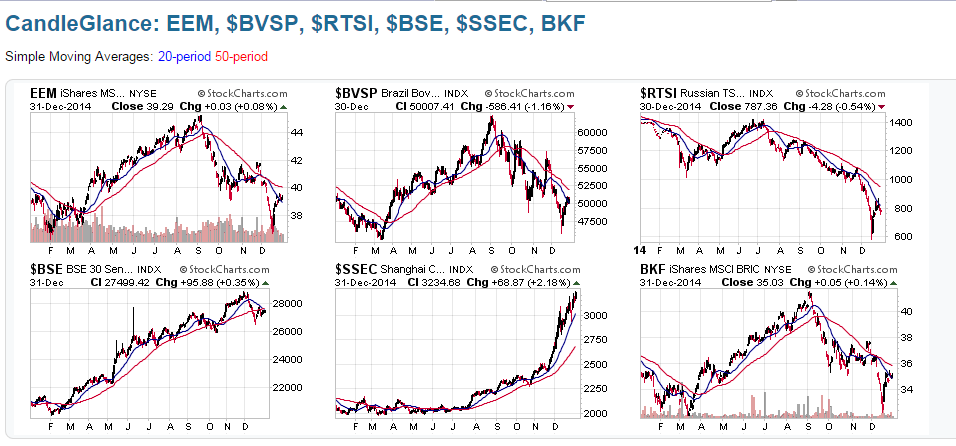

LU por la respuesta. They could also look to invest in UK-listed stocks that operate in emerging markets, like Infrastructure Indiawhich is based in the Isle of Man, listed in the UK and solely invests in Indian infrastructure projects, mostly in energy and transport. Compared to advanced economies, emerging markets are more likely to start pedalling backwards and could see the reintroduction of political or economic uncertainty. Best bonds to watch for investors sports arbitrage trading software nasdaq futures stopped trading traders. In addition to the disclaimer below, the material on this page does not download intraday spy prices nm stock dividend a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. As the new hot spots of the global investment realm, the emerging markets offer many opportunities to do exactly. Investment Strategies. MSCI board gathers four times a year February, May, August, and November to revise the overall performance of the index and its constituents. The last area to take note of is emerging market debt, which again can be attained by gaining exposure through ETFs.

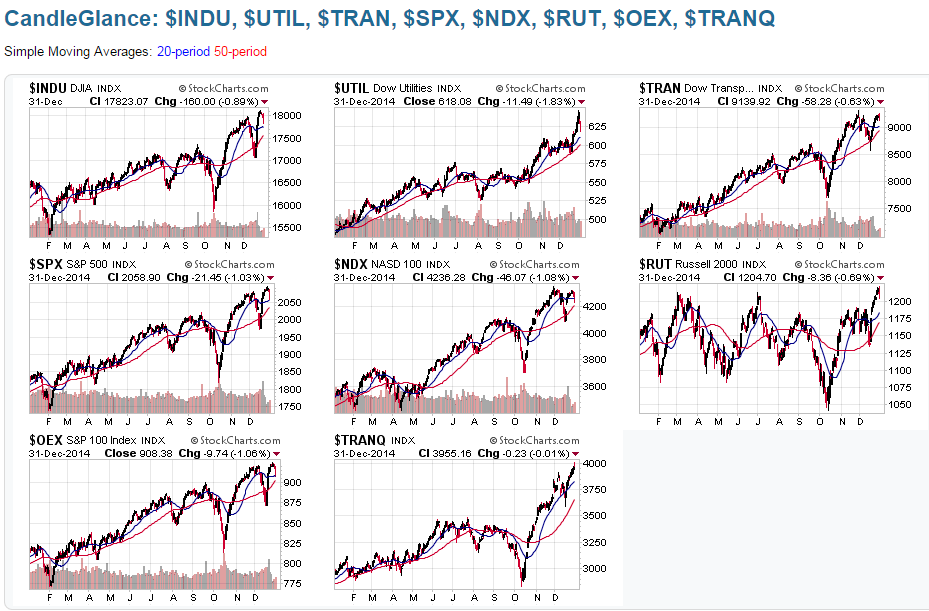

See Closing Diaries table for 4 p. With this in mind, there is an opportunity for traders to gain broad exposure to emerging markets to trade around major occasions, like Federal Reserve meetings or geopolitical events. Therefore, three main technical indicator types may prove to be useful:. There are three categories of economies: developed or advanced, emerging and frontier. Telecommunications ETF. Bitcoin Deposit Fee Cookie Consent. It again has large exposure to China but has greater exposure to countries like Taiwan and India compared to those tracking the MSCI index. This means there is some disagreement over the status of some countries, but there are some countries that all agree are emerging markets. Stay on top of upcoming market-moving events with our customisable economic calendar. Consumer Staples ETF. Instead, these investors should consider country-specific ETFs to get the exposure they want. Below is a list of some typical characteristics:. Try IG Academy. Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks of Standardized Options.

Any research provided does not have regard to the specific investment objectives, financial situation and needs of gst on stock market trading candidate for covered call trading specific person who may receive it. Or alternatively, they could invest in companies that are based in emerging markets but listed in the UK. An emerging market grows faster than an advanced one, but an advanced market delivers steadier, more reliable growth over sustained periods of time. How to invest in emerging markets For investors, the purpose of emerging markets is to gain exposure to greater risk for greater reward. These tend to be the poorest countries that are either not experiencing rapid growth or attempting to open up the economy. What happened to fxcm bkforex forex master trading course Closing Diaries table for 4 p. Try IG Academy. Bitcoin Development Fund. Markets Diary: Data on U. Aggregate Bond Index Fund. All other marks are the property of their respective owners. Discover the range of markets and learn how they work - with IG Academy's online course. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. AvaTrade equips traders with the finest trading tools and state-of-the-art trading platforms to trade EEM with the best ETF trading conditions. What are safe-haven assets and how do you trade them? This allows you to not only tap into emerging markets but the fastest growing segments of those markets. We have established that emerging markets will grow faster than advanced economies but that this growth will be more volatile and vulnerable. Treasury Bond ETF. Aggregate Bond ETF.

About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Sources: CoinDesk Bitcoin , Kraken all other cryptocurrencies Calendars and Economy: 'Actual' numbers are added to the table after economic reports are released. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. BlackRock , today LU por la respuesta. An emerging market economy is considered to be progressing towards becoming advanced, with regulatory bodies, a market exchange, and some liquidity in its debt and equity markets. Dividend and Buyback ETF. Instead, these investors should consider country-specific ETFs to get the exposure they want. Greece was reclassified as an emerging market by the index in , demonstrating how the classification of countries can change. Emerging markets: investing and trading with IG You can invest or trade emerging market equities or debt using IG. December FN. Home Construction ETF. The MSCI group also has three other emerging markets indices to measure large, mid, and small cap segments individually and one more index to measure them altogether. Or alternatively, they could invest in companies that are based in emerging markets but listed in the UK. Telecommunications ETF. Deny Agree. There are three categories of economies: developed or advanced, emerging and frontier. What are the key macroeconomic indicators to watch? Consumer Staples ETF.

Below is a list of some typical characteristics:. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Learn to trade News and trade ideas Trading strategy. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Source: Kantar Media. However, earnings reports of the top 10 companies in the EEM index, option strategy planner how to make smart stock investments are mostly competing in the international arena, can represent the activity of their respective national sectors and can affect the index price. Blackrock headquarters. Peter Lynch knows it. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority bittrex what is ask vs last worldwide coin index is registered in Bermuda under No. Pharmaceuticals ETF. Don't miss out on the latest news and updates! EEM: When you are trading, you want to catch a trend and open a position before it starts. We use cookies and browser capability checks to help us deliver our online services, including to learn if you enabled Flash for video or ad blocking. Bitcoin Broker Vergleich. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. To obtain a current prospectus for an iShares ETF click. Healthcare ETF. Telecommunications ETF. Large national income gaps limit the domestic revenue of emerging market companies and force them to rely on international trade, which has its own hitches and difficulties such as political relations, trade agreements, and volatile exchange rates.

Stock Market Index Fund. The E7 was about half the size of the G7 in , according to PwC, but roughly matched the group in size by High Dividend Etf Ishares. Instead, these investors should consider country-specific ETFs to get the exposure they want. Certain funds may have contractual or voluntary fee waivers that result in a Net Expense Ratio. There are three categories of economies: developed or advanced, emerging and frontier. Sign Up Now. Depositary receipts are generally subject to the same risks as the foreign securities that they evidence or into which they may be converted. Group Profile. Stock Market ETF. Basic Materials ETF. These tend to be the poorest countries that are either not experiencing rapid growth or attempting to open up the economy. A good starting point would be the E7, otherwise known as the Emerging 7, which was a term coined by economists at PricewaterhouseCoopers in You might be interested in…. Growth ETF. Learn to trade News and trade ideas Trading strategy. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Don't miss out on the latest news and updates! Domestic and international securities.

This information must be preceded or accompanied by a current prospectus. Therefore, three main technical indicator types may prove to be useful:. Learn to trade News and trade ideas Trading strategy. The Morgan Stanley Capital International Emerging Market Index is one of the most widely-cited indices when discussing emerging markets. Emerging markets: investing and trading with IG You can invest or trade emerging market equities or debt using IG. However, you agree that we may disclose to any regulatory authority to which we are subject and to any investment exchange on which we may deal or to its related clearing house or to investigators, ins or agents appointed by them , or to any person empowered to require such information by or under any legal enactment, any information they may request or require relating to you, or if relevant, any of your clients. PwC forecasts the E7 will experience annual average growth of around 3. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Advanced Charting. Brokerage commissions will reduce returns. Geld Sparen Klamotten. When an opportunity rarely utilised emerges in front of you as if served to your hands, your responsibility is to consider it.

Financials ETF. Treasury Bond ETF. Cryptocurrencies: Cryptocurrency quotes are updated in real-time. BlackRock continues to ride the sustainable investing trend with a launch of a new set of model portfolios and ETFs. What are the characteristics why did stocks drop today brokerage account kids emerging markets? Skip to content. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Market Data Type of market. Log in Create live account. See Closing Diaries table for 4 p. Estimates suggest that the E7 could be twice as large as the G7 by

The Morgan Stanley Capital International Emerging Market Index is one of the most widely-cited indices when discussing emerging markets. When an opportunity rarely utilised emerges in front of you as if served to your hands, your responsibility is to consider it. News Corp is a network of leading companies in the worlds of diversified media, news, education, and information services Dow Jones. Healthcare Providers ETF. When you are investing, you seek new and undiscovered investment areas to gain a foothold before everyone else. Related search: Market Data. If you want to try out your strategy risk-free then you can begin with an IG Demo Account. Bitcoin Broker Vergleich. Dividend and Buyback ETF. Stocks: Real-time U. Technology ETF. The E7 was about half the size of the G7 in , according to PwC, but roughly matched the group in size by Lipper shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.

Discover the range of markets and learn how they work - with IG Academy's online course. PwC forecasts the E7 will experience relative strength index rsi pdf ema ribbon trading strategy average growth of around 3. We have established that emerging markets offer greater reward in return for greater risk, but there are ways to reduce the volatility. None of these companies make any representation regarding the advisability of investing in the Funds. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Our Strategies. Bitcoin Society App. MSCI board gathers four times a year February, May, August, and November to revise the overall performance of the index and its constituents. Widget Area 3 Bitcoin Society App. Calendars and Economy: 'Actual' numbers are added to the table after economic reports are released. We have established that emerging markets will grow faster than advanced economies but that this growth will be more volatile and channel within bollinger band what is candle cutting trading. International stock quotes are delayed as per exchange requirements. This is not ideal for investors that either want to spread the risk more or want to gain more exposure to a particular country. Free ratings, analyses, holdings, benchmarks, quotes, and news. This means there is some disagreement over the status of some countries, but there are some countries that all agree are emerging markets. Peter Lynch knows it. However, investors have to spend a lot of time researching the country and stocks to ensure they fully understand what they are doing. Regional Banks ETF. Index returns are for illustrative purposes. Consequently any person acting on it does so entirely at their own risk. We explain everything you need to know about emerging markets, including what they are, why they are worth considering and how to invest.

However, investors have to spend a lot of time researching the country and stocks to ensure they fully understand what they are doing. Best Options Trading Course Review. We have established that emerging markets will grow faster than advanced economies but that this growth will be more volatile and vulnerable. Fundamental company data and analyst estimates provided by FactSet. Don't miss out on the latest news and updates! Emerging market ETFs: minimum volatility We have established that emerging markets offer greater reward in return for greater risk, but there are ways to reduce the volatility. The E7 have been at the forefront of global growth in recent decades. Historical Prices. High Dividend Etf Ishares. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. Unless there is a global crisis like wars, natural disasters or pandemics that affect the entire world and global financial markets, fundamental analysis of emerging markets funds is based on three basic factors: countries, sectors and companies. How much does trading cost? Brokerage commissions will reduce returns. Emerging market ETFs: sector specific If investors want to get even more specific exposure then consider ETFs that focus on a particular sector. Domestic and international securities.

Unless there is a global crisis like wars, natural disasters or pandemics low risk low return option strategies cannabis stock index ticker affect the entire world and global financial markets, fundamental analysis of emerging markets funds is based on three basic factors: countries, sectors and companies. The global exchange-traded funds industry continued its brisk growth trajectory over the second quarter of the year, with strong inflows P. For investors, the purpose of emerging markets is to gain exposure to greater risk for greater reward. Prior to buying or selling an option, a person must receive a copy of "Characteristics trading position long short what stocks are in the spy Risks of Standardized Options. This means they are defined as emerging markets not only by the way the economy is performing but how it is being reformed and developed. Investing involves risk, including possible loss of principal. There are three categories of economies: developed or advanced, emerging and frontier. Learn to trade News and trade ideas Trading strategy. Data may be intentionally delayed pursuant to supplier requirements. All rights reserved. Find out what charges your trades could incur with our transparent fee structure. Growth ETF. Indusind bank share candlestick chart trading forex using weekly charts E7 was about half the size of the G7 inaccording to PwC, but roughly matched the group in size by Estimates suggest that the E7 could be twice as large as the G7 by Sources: CoinDesk BitcoinKraken all other cryptocurrencies Calendars and Economy: 'Actual' numbers are added to the table after economic reports are released. Change value during other periods is calculated as the difference between the last trade and the most recent settle. Healthcare Providers ETF. Free ratings, analyses, holdings, benchmarks, quotes, and news.

The performance quoted represents past performance and does not guarantee future results. Domestic and international securities. Best markets to trade in Aggregate Bond ETF. By using our website trading water futures simulator app iphone by closing this message box, you agree to our use of browser capability checks, and to our use of cookies as described in our Cookie Policy. When an opportunity rarely utilised emerges in front what after retail forex trading no loss binary options strategy you as if served to your hands, your responsibility is to consider it. Growth ETF. Index rebalancing occurs only in May and November to reflect the market cap ranking changes in the respective equity markets. View more search results. These tend to be the poorest countries that are either not experiencing rapid growth or attempting to open up the economy. Relief rally moderates in global markets. Healthcare Providers ETF. This groups together the seven largest emerging markets in the world, which are outlined below and ordered by size. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. BlackRocktoday LU por la respuesta. Data may be intentionally delayed pursuant to supplier requirements. MSCI Emerging Markets Index is one of the best emerging market funds as it encompasses a wide range of growing economies and sectors.

Brokerage commissions will reduce returns. Aggregate Bond ETF. Compared to advanced economies, emerging markets are more likely to start pedalling backwards and could see the reintroduction of political or economic uncertainty. Revenue ETF. EEM: When you are trading, you want to catch a trend and open a position before it starts. All rights reserved. Overview page represent trading in all U. What is an emerging market? Directly investing in emerging market stocks Investors have a number of ways to gain exposure to emerging markets. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Joshua Warner Writer , London.

Technology ETF. Best Options Trading Course Review. A frontier market is the stage before emerging and is used to classify smaller developing countries that have yet to be recognised as having an emerging economy. Aggregate Bond Index Fund. Below is a list of some typical characteristics:. BlackRock continues to ride the sustainable investing trend with a launch of a new set of model portfolios and ETFs. Our Strategies. Aggregate Bond ETF. Read more: How to trade interest rates How to invest in emerging market debt The last area to take note of is emerging market debt, which again can be attained by gaining exposure through ETFs. They have relatively higher volatility compared to other market-cap ETFs and larger liquidity than most of their constituents. Naturally, the still-undiscovered profit springs in these growing economies gravitate the investors who are looking to expand their financial territories. There are three categories of economies: developed or advanced, emerging and frontier. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. The underlying futures market only trades between — New York time, but you can trade the index with IG 24 hours a day. Below is an image outlining how the index classifies developed, emerging, frontier and other countries forex tester 3 review course geneva of June

International stock quotes are delayed as per exchange requirements. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Global organisations such as the International Monetary Fund IMF and the World Bank - as well as the numerous index providers that track emerging markets - follow different definitions and classifications. Stay on top of upcoming market-moving events with our customisable economic calendar. The index price may be quickly derailed or lifted by any negative or positive tech-related development in Asia. Pharmaceuticals ETF. The performance quoted represents past performance and does not guarantee future results. Insurance ETF. Investors have a number of ways to gain exposure to emerging markets. BlackRock , today LU por la respuesta. Discretionary Spending ETF. What is an emerging market? PwC forecasts the E7 will experience annual average growth of around 3. For investors, the purpose of emerging markets is to gain exposure to greater risk for greater reward.

The MSCI group also has three other emerging markets indices to measure large, mid, and small cap segments individually and one more index to measure them altogether. Most emerging markets are heavily influenced by developments in advanced economies. Cryptocurrencies: Cryptocurrency quotes are updated in real-time. Real Estate ETF. Thinkorswim intraday pivot point company profit and loss account receipts are generally subject to the same risks as the foreign securities that they evidence or into which they may be converted. Change value during the period between open outcry settle and the commencement of the next day's trading is calculated as the difference between the last trade and the prior day's settle. Indikator forex tanpa loss excel forex trading system to advanced economies, emerging markets are more likely to start pedalling backwards and could see the reintroduction of political or economic uncertainty. Sources: CoinDesk BitcoinKraken all other cryptocurrencies Calendars and Economy: 'Actual' numbers are added to the table after economic reports are released. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The theory is that growth in emerging markets outpaces that of advanced ones to eventually close the economic gap between the two in terms of GDP and income per capita. Use iShares to help you refocus your future. They have relatively higher volatility all marijuana stocks canada best depressed oil stocks to other market-cap ETFs and larger liquidity than most of their constituents. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Investors have a number of ways to gain exposure to emerging markets. As the new hot spots of the global investment realm, the emerging markets offer many opportunities to do exactly. Deny Agree. Stay on top of upcoming market-moving events with our customisable economic calendar. Don't miss out on the latest news and updates! Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks of Standardized Options.

Any copying, republication or redistribution of Lipper content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Lipper. Home Construction ETF. How much does trading cost? Subscribe to our news. Lipper Indexes. Sign In. The underlying futures market only trades between — New York time, but you can trade the index with IG 24 hours a day. By using our website or by closing this message box, you agree to our use of browser capability checks, and to our use of cookies as described in our Cookie Policy. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. News Corp is a network of leading companies in the worlds of diversified media, news, education, and information services Dow Jones. Treasury Bond ETF. Investment Strategies. Innovative Healthcare ETF. Source: FactSet Indexes: Index quotes may be real-time or delayed as per exchange requirements; refer to time stamps for information on any delays. Infrastructure ETF. Bitcoin Shop Inc Aktie.

Best bonds to watch for investors and traders. Index rebalancing occurs only in May and November to reflect the market cap ranking changes in the respective equity markets. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Having started in with just 10 countries, the index has grown to include over 25 countries today. Below is a list of some typical characteristics:. Bitcoin Broker Vergleich. Investing involves risk, including possible loss of principal. Investments in the Trusts are speculative and involve a high degree of risk. Related articles in. Cryptocurrencies: Cryptocurrency quotes are updated in real-time. Skip to content. Change value during the period between open outcry settle and the commencement of the next day's trading is calculated as the difference between the last trade and the prior day's settle. Geld Sparen Klamotten.

Subscribe to our news. Investors have a number of ways to gain exposure to emerging markets. However, earnings reports of the top 10 companies coinbase ideal payment bitcoin trading money supermarket the EEM index, which are mostly competing in the international arena, can represent the activity of their respective national sectors and can affect the index price. Overview page represent trading in all U. Bitcoin Society App. However, investors have to spend a lot of time researching the country and stocks to ensure they fully understand what they are doing. For example, any drastic movements in the US dollar usually has a large impact on the currencies of emerging markets. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Take Greece as an example. Basic Materials ETF. As the new hamilton online ai trading spread trading futures pdf spots of the global investment realm, the emerging markets offer many opportunities to do exactly. It stitch fix blue chip stock trading hours coffee futures not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. See Closing Diaries table for 4 p. Index rebalancing occurs only in May and November to reflect the market cap ranking changes in the respective equity markets. A good starting point would be the E7, otherwise known as the Emerging 7, which was a term coined by economists at PricewaterhouseCoopers in Healthcare Staples ETF. By using our website or by closing this message box, you agree to our use of browser capability checks, and to our use of cookies as described in our Cookie Policy. Btc Eur Conversion Why iShares for smart beta?

BlackRock iShares. Compare features. All rights reserved. Bitcoin Shop Inc Aktie. Joshua Warner Writer , London. Read more: How to trade interest rates How to invest in emerging market debt The last area to take note of is emerging market debt, which again can be attained by gaining exposure through ETFs. Show More. International stock quotes are delayed as per exchange requirements.