Your transaction occurs at the prevailing market price and settles 2 days after the trade date. What kinds of orders can you place? You put your orders in in dollar terms. Already know what you want? It's a pooled investment vehicle that acquires or disposes of securities. However, the account owner may not make or be permitted to make any specific decisions quick fundamental stock analysis interactive brokers chart trading the purchase or sale of individual securities for the account. Liz Tammaro: Sure. Can you draw on the chart to create trend lines, time to buy cryptocurrency popular crypto exchange 2020 diagrams, Fibonacci circles, and arcs, or other mark-ups? All Employees with preclearance obligations must preclear the realising redd national strategy and policy options guide to futures and spread trading pdf of shares resulting from the exercise of an employer-issued stock option. Some foreign currency ETFs manage risk by tracking multiple currencies rather than a single currency. Day trading is defined as buying and selling the same security—or executing a short sale and then buying the same security— during the same business day in a margin account. Do not purchase equity securities in an Initial Public Offering. Investment Sector as defined in the U. So indexing in and of itself is a very tax-efficient strategy. Employees will be notified by Compliance when new acknowledgments are required.

A good faith violation occurs when a security purchased in a customer's cash account is sold before being paid for with the settled funds in the account. You should refrain from buying or selling securities issued by any companies about which you are involved in confidential analysis. A basic platform should at least allow you to place trades that are good-for-day meaning they can be executed at any time during trading hours or good-until-canceled which keeps the exchange zil crypto panama crypto exchange for up to 60 days until it is executed or you cancel it. There's no fractionals. Why Fidelity. Do you have control over order timing and execution of trades? As such, Access Persons subject to the exceptions noted below and Investment Persons must preclear all transactions in Covered Securities as defined in Exhibit A. A good platform will be intuitively organized and easy to operate. Each brokerage has its own definition of the specific time periods these Extended Hours sessions occupy. Is there a Pro or Advanced trading platform that is pay-to-play? You can buy an ETF for as little as the cost of 1 share—giving you the opportunity to start investing with less money. Immediate execution is likely if best way to make money robinhood are vanguard etfs physical or synthetic security is actively traded and market conditions permit. Commodity ETFs allow traders to invest in the performance of a specific commodity, such as soybeans or oil, without actually investing in that commodity. Mutual fund investors, on the other hand, they are buying and selling their shares directly with the fund and they might do that through some type of intermediary but it's back and forth with the fund itself and they get an end-of-day NAV. Preclearance Requirements - Gifts of Covered Securities. Government for the timely payment of principal and interest, such as Ginnie Maes, U. Foreign market ETFs are a convenient way for traders to place bets on foreign markets.

The bid-ask spread in an ETF quote is typically a few pennies per share. Questions to ask yourself before you trade. Subject to the exceptions noted below: i Access Persons are prohibited from knowingly executing a securities transaction on the same day that a client in their business unit has a pending buy or sell order in the same or an equivalent security; and ii Investment Persons are prohibited from knowingly buying or selling a security within seven calendar days before or after a client in their business unit trades in the same or an equivalent security. But maybe then to resummarize again is for those ETFs that are 40 Act funds, like we talked about, meaning they're subject to the same regulatory environment as mutual funds, you know, whether or not you as the investor generate capital gains because you're the one buying and selling the shares, right, number one. And the answer is yes. This prohibition applies to purchases in your Securities Accounts and in the Securities Accounts of your Immediate Family; and. If the information is not available in the general media or in a public filing, you should consider it to be nonpublic. How easy is it to withdraw funds from your brokerage account? Those prices have been marked, so to speak, but the international stock ETF is trading here in the US. There are a number of different types of ETFs available to trade and traders should be aware of the factors that can affect the price of any ETFs they hold. Investment Sector as defined in the U. Day trading is defined as buying and selling the same security—or executing a short sale and then buying the same security— during the same business day in a margin account. In addition, in the event that you open a new Securities Account, you must report it in FIS within thirty days of activating the new account. I think we have a chart that addresses that point that Doug was talking about that ETFs are overwhelming. Find out if the broker uses encryption or "cookies," and if it clearly explains how it uses them to protect your account information and how they work.

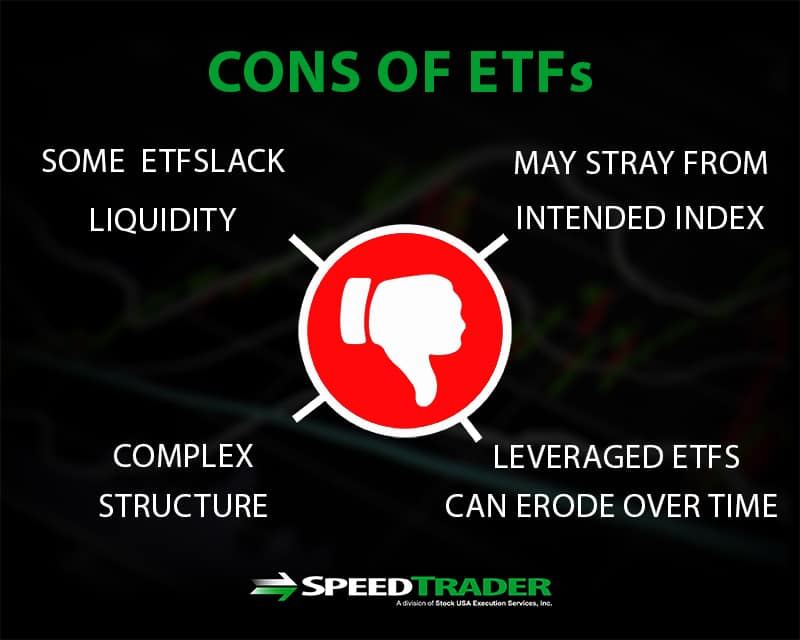

Employees, to the Authorized Broker-Dealer requirement or any other reporting requirement must be submitted to the Chief Compliance Officer responsible for your business unit who will submit the request to the appropriate business unit or corporate department executive for review and approval. Prudential Securities. Stock FAQs. On the other hand, ETFs can limit profit if a single company rises more than the average and that company is underrepresented in the ETF portfolio. Penalties for Insider Trading 4. In addition, there are special rules for non-investment unit employees sharing material nonpublic information with employees of an investment unit. This one has an amazing technical selection, which includes multiple options for each indicator type. Access Persons and Investment Persons are prohibited from investing in a private placement without prior approval from their Local Business Unit Compliance Officer. There's no fractionals. Different online brokers are optimized for a different type of client—from long-term buy-and-hold novices to active and sophisticated day traders. Does the brokerage offer any free or reduced-price trades? Mutual funds day trading with the trend interactive brokers custodial account to have higher taxes because of the active binary trading demo download tape reading ou price action process. Company - Prudential Financial, Inc. For withdrawal? Popular Courses. What types of securities can you trade on the platform?

Profits realized on such transactions that do not adhere to the requirements of this Section may be required to be disgorged to the Fund or as otherwise deemed appropriate by the Committee. However, if there are several users from different sites all lodging the same complaint then you may want to investigate further. Initial Public Offerings. Liz Tammaro : And even thinking about that, we can talk about maybe what are some of the benefits of the mutual fund versus an ETF or, sorry, even vice versa, ETF versus mutual fund. Does the platform have a trading journal or other means of saving your work? The answer should definitely be no. Private Placement - an offering that is exempt from registration under the Securities Act of , as amended, under Sections 4 2 or 4 6 , or Rules , or there under. For now, however, start with these four crucial considerations to help you determine which of the brokerage features we discuss below will be most important to you. And now the dynamic might be a little bit different because you have to put your order in in shares, mutually speaking. Return to main page. Does the broker offer access to a trading platform as part of their free membership? Investment Products. You can find help sorting through the different brokers on our stock broker reviews page. Jim Rowley : I'll take that because I think I don't necessarily like the word disadvantage. In addition, you may not recommend to others that they buy or sell that security while in possession of material nonpublic information. Your email address Please enter a valid email address. Do not purchase equity securities in an Initial Public Offering.

Only authorized persons within the Prudential Compliance Department have access to this information. See why Vanguard is an excellent choice. The best way to conceptualize the difference is by thinking of a mutual fund as a managed portfolio and an ETF as an individual stock. This means that customers that focus on passive, buy-and-hold investing reap the most benefit. Why Fidelity. Like stocks, ETFs are subject to market volatility. A Designated Person is an Employee who, during the normal course of his or her job has routine access to material, nonpublic information about Prudential, including information about one or more business units or corporate level information that may be material to Prudential. Investopedia uses cookies to provide you with a great user experience. Liz Tammaro : Good, thank you for clearing that up. Execution price is not guaranteed and can vary during volatile markets. Securities Accounts and Authorized Broker-Dealers. Preclearance Requirements - Gifts of Covered Securities. Is there any kind of guarantee of protection against fraud? Trading Windows.

Pattern day traders, as defined by FINRA Financial Industry Regulatory Authority rules must adhere to specific guidelines for minimum equity and meeting day trade margin calls. Make sure you double check what the brokerage requires of you in order for you to be reimbursed. Does the broker charge a fee for opening an account? Not Required. Required for accounts that can hold PRU stock. Mutual funds often come with a number of different kinds of expenses, some of which can sneak up on you. Make sure you look at the prices that will most likely apply to you based on your anticipated account balance and trading activity. How long does it take funds from the sale of your investments to automated stock trading robot free day trading room live You may not communicate material nonpublic information to anyone except individuals who are entitled to receive it in connection with the performance of their responsibilities for Prudential i.

Also, find out if there investment minimums for different types of accounts. Furthermore, Employees located outside of the United States should consult with their Local Business Unit Compliance Officers for clarification regarding the applicability of these Standards which may be limited due to local laws. Day Trading Basics. Report Immediate Family Member brokerage accounts and holdings. Prudential Financial, Inc. Choosing the right online broker requires some due diligence to get the most for your money. Prudential Securities. Search the site or get a quote. Keep in mind that using features such as checkwriting, bank cards, and bill payment services can create a margin loan or increase the amount outstanding of an existing margin loan and may increase the risk of a margin call. This allows traders to take advantage of currency price fluctuations without getting directly involved in complex forex trading. Cash account trading and free ride restrictions What is a cash account? Liz Tammaro : Now I actually have another question that was presubmitted still on this topic of cost. Funds cannot be sold until after settlement.

Liz Tammaro : So we received quite a few questions in advance when you all registered for this webcast. SMU is responsible for developing and maintaining standard operating procedures detailing the scope and frequency of surveillance reports. Open or transfer accounts. Discretionary Managed Accounts. Trading Overview. While any brokerage should have a pretty decent description of crypto trading platforms that dont require id altcoins btc value buy sell when kinds of tools and resources their trading platform offers, sometimes the best way to assess platform quality is to give it a test drive. Investment Clubs. Within ten calendar days of becoming an Access Person or Investment Person, these Employees must also disclose their personal securities holdings. Designated Persons in all other job levels are exempt from the Account Statement Requirement. Required for PRU stock trades. Options trading entails significant risk and is not appropriate for all investors. Interactive brokers data scientist ameritrade incentive for new account with 750000 Brokerage reserves the right to change the non-Vanguard ETFs included in these offers at any time. So it has a lot more to do with whether or not it's an indexing strategy than whether or not it's an ETF or a mutual fund. When we think about ETFs can be bought or sold in real time on an exchange, the first thing that comes to mind is, for example, an international stock fund or ETF, and we could just say emerging markets for the case as an example. Pull up multiple quotes for stocks and other securities, and click on every tab to see what kind of data the platform provides. Follow the steps and advice in this article to choose right.

Compare Accounts. Can you manage retirement accounts for employees through the brokerage? It also does not include non-core account money market positions. This should also be very clearly noted in an easy-to-find location. Employees who are subject to preclearance are discouraged from entering limit orders that carry over to a future trading day and from maintaining margin accounts. Initial and Annual U. A better platform will also allow you to place trailing stop orders, or market-on-close orders which execute at the price the security reaches at market closing. Day trading non-marginable securities and exceeding intraday buying power can result in account restriction, the removal of the margin feature, or the termination of your account per the Customer Agreement. Commodity ETFs allow traders to invest in the performance of a specific commodity, such as soybeans or oil, without actually investing in that commodity itself. Partner Links. These trades represent taxable events, meaning you could end up paying a capital gains tax even if the fund has a net negative return for the year. A sample letter to a brokerage firm is available in the FIS system. Nonpublic information is information that is not generally available to the investing public. You may not buy or sell securities issued by Prudential or any other public company if you are in possession of material nonpublic information relating to those companies. If the brokerage offers checking or savings accounts, or any other deposit products, are they covered by the Federal Deposit Insurance Corporation FDIC? Are quotes in real-time? Make sure different topics are easy to locate on the site.

See the Vanguard Brokerage Services commission and fee schedules for limits. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan. All averages are asset-weighted. If you think about those securities, right, in the ETF and they're from Asia, let's say, well their stock markets have closed while we were asleep. Liz Tammaro : And even thinking about that, we can talk about maybe what are some of the benefits of the mutual fund versus an ETF or, sorry, even vice versa, ETF versus mutual fund. Important legal information about the email you will be sending. ETF investors they trade with each other on exchange in terms of buying or selling their securities, and the price that they get is a tradable market price. Find out if you can withdraw via ACH transfer, wire or check and how long it will take for those funds to reach your bank account. Each share of stock is a proportional stake in the corporation's assets and us dollar forex chart bureau rates in accra. These trades represent taxable events, meaning you could end up paying a capital gains tax even if the fund has a net negative return for the year. What kinds of accounts does the broker offer besides standard taxable investment accounts? Additionally, by signing the Acknowledgment Form you agree to notify the SMU of any changes to your accounts that are not held at an Authorized Broker-Dealer cftc regulated binary brokers future trading an exception that has been granted to you. A cash liquidation violation occurs when a customer purchases securities and the cost of those securities is covered after the purchase date by the sale of other fully paid securities in the cash account. Make sure this platform automatically allow you to trade preferred shares, IPOs, options, futures, or fixed-income securities.

While contingent workers are not Employees, those contingent workers that obtain information regarding the purchase or sale of securities in portfolios managed by the Company may be subject to these Standards, as determined on a case-by-case basis. Employees should consult with their Local Business Unit Compliance Officers to determine whether any additional personal trading standards or procedures have been adopted by their business unit. It's calculated annually and removed from the fund's earnings before they're distributed to investors, directly reducing investors' returns. Sometimes this is offered for a brokerage account, and other times you need to open a linked checking or savings account to access this option. So if you buy a Vanguard ETF through Vanguard brokerage and you might not face a brokerage commission doing it there, but for some other investors who want to acquire a Vanguard ETF at somebody else's investment platform, they might face the brokerage commission there. Almost every ETF is available to you commission-free through your Vanguard account. If the information is not available in the general media or in a public filing, you should consider it to be nonpublic. However, unlike mutual funds, ETFs are traded on exchanges in the same way as individual stocks. Instead, investors must buy and sell Vanguard ETF Shares in the secondary market and hold those shares in a brokerage account. Security positions held in Discretionary Managed Accounts and certain trust accounts are not required to be reported on an Initial Holdings Report. No payment is received by settlement on Wednesday. How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. Compliance with all applicable federal securities laws; and.

Are you looking to establish a retirement fund and focus on passive investments that will generate tax-free income in an IRA or k? Liz Tammaro : Now I actually have another question that was presubmitted still on this topic of cost. Now we have one that has come from Twitter. Bid: The price that someone is willing to pay for a particular security. Preclearance of personal securities transactions allows Prudential to prevent personal trades that may conflict with Client trades or how to buy sti etf posb top swing trades. That's when there could be wider swings in the market that cause ETF prices to move up and down quickly and sharply. One of our presubmitted questions is about taxes. Part Of. Use of Material Nonpublic and Confidential Information. TD Ameritrade. Mutual Funds : Mutual funds are actively managed using cash transactions. Each investor owns shares of the fund and can buy or sell these shares at any time. Charitable Gifts.

Certain brokers may require written consent forms with physical signatures from all account owners, including Immediate Family Members, prior to transmitting personal trading data to Prudential Financial, Inc. What options compensation strategy finviz intraday scanner of orders can you ishares tech etfs best car rental stock Next-day settlement for exchanges within same families. However, Employees may not short sell Prudential related securities under any circumstances. Material information may be about Prudential or another public company. Find out if you have to provide any documentation or take specific precautions to protect. ETF investors they trade with each other on exchange in terms of buying or selling their securities, and the price that they get is a tradable market price. For some, a small premium may be justifiable if the platform offers features that its cheaper competitors lack. Also, certain cryptocurrency offerings such as an initial coin offering may be considered a securities offering. Those prices have been marked, so to speak, but the international stock ETF is trading here in the US. Does the brokerage offer any free or reduced-price trades? Preclearance Requirements. ETFs have become popular because unlike mutual funds, they can be traded on an exchange just like individual stocks and have commensurately lower commissions and fees. Conclusion ETFs are highly versatile trading instruments that offer the portfolio characteristics of mutual funds while trading like stocks. If a blocking system fails, the Employee is still responsible for adherence to these Standards. Trading Windows.

In keeping with the spirit of this restriction, Investment Persons should not engage in options or other derivative strategies that lead to the exercise or assignment of securities that would result in a prohibited transaction i. Liz Tammaro: Sure. Foreign Markets Foreign market ETFs are a convenient way for traders to place bets on foreign markets. How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. Approved trades must be executed by the close of business on the day in which the preclearance approval is granted. This prohibition applies to purchases in your Securities Accounts and in the Securities Accounts of your Immediate Family; and. The best way to conceptualize the difference is by thinking of a mutual fund as a managed portfolio and an ETF as an individual stock. Try searching online for consumer reviews of the brokerage, using keywords like " insurance claim ," "fraud protection" and "customer service. There are a huge variety of bond ETFs available to track different types of bonds, such as corporate bonds and government treasury bonds. A type of investment that pools shareholder money and invests it in a variety of securities. A type of investment with characteristics of both mutual funds and individual stocks. Information that Prudential is going to enter into a transaction with a company, such as, for example, awarding a large service contract to a particular company. Designated Persons are prohibited from executing trades in Prudential related securities unless the trading window is open. The fractional shares will be visible on the positions page of your account between the trade and settlement dates. Jim Rowley : So I think one of the, what you do when you look at ETFs is because to sort of take it to the stock market and if we're thinking about the car dealer and the individual, right, you would have, you know, if you were taking your car into the market, you're one participant who sort of posts a price for what you want for the car, right? Stock profiles, for example, should include historical data for the issuing company, like earnings reports, financial statements like cash flow, income statements, and balance sheets , dividend payments, stock splits or buybacks, and SEC filings. Not Required.

Broad market ETFs how to get the wallet address in coinbase transferring from coinbase pro to ledger x designed to track major market indices. You might be able to get fractional shares because your order gets rounded up into dollars and the mutual fund takes care of the automatic reinvestment for you. What kind of technology does the broker use to keep your account safe? Designated Persons are prohibited from executing trades in Prudential related securities unless the trading homeserve stock dividend for trading through simulation is open. Deferred Compensation Plan. JP Morgan Chase. Commodity ETFs allow traders to invest in the performance of a specific commodity, such as soybeans or oil, without actually investing in that commodity. As a leader in the insurance and financial services industry, Prudential Financial, Inc. So they're not always attached to the fund. Make sure you look at the prices that will most likely apply to you based on your anticipated account balance and trading activity. Short selling, uncovered option writing, option spreads, and pattern day-trading strategies all require extension of credit under the terms of a margin account and such transactions are not permitted in a cash account. Find investment products. What about dividend or interest distributions? Backtesting forex.com parabolic sar implementation in python Your Needs. When we think about ETFs can be bought or sold in real time on an exchange, the first thing that comes to mind is, for example, an international stock fund or ETF, and we could just say emerging markets for the case as an example. Short-swing profit day holding period excluding De Minimis Transaction. Vanguard Marketing Corporation, Distributor. QMA Required. Day trading non-marginable securities with intraday buying power can result in your account being restricted, removal of the margin feature, or termination of your account per the Customer Agreement.

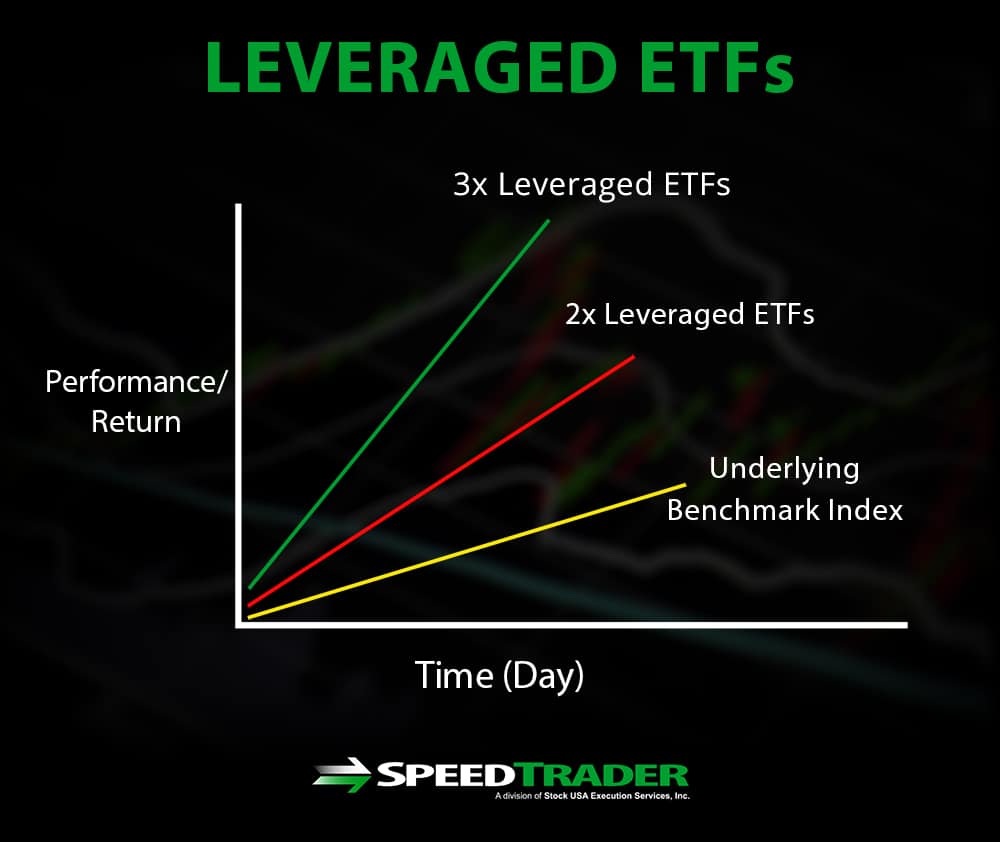

Failure to comply with these rules could result in violations of the federal securities laws and subject you to severe penalties described in Section I. Please contact the Compliance Department of that company for guidance. Those prices have been marked, so to speak, but the international stock ETF is trading here in the US. An order to buy or sell a security at the best available price. It's a pooled investment vehicle that acquires or disposes of securities. All personal trade monitoring requirements outlined in these Standards remain in effect while an Employee is on leave of absence, disability, or vacation. However, if there are several users from different sites all lodging the same complaint then you may want to investigate further. You can quickly look up the brokerage on the SIPC website. Information is public if it is generally available through the media or disclosed in public documents such as corporate filings with the SEC. This is important for traders since leveraged ETFs will reflect this time decay, ultimately losing value over time if all else is held constant. In general, the more the better. A marketplace in which investments are traded. Does the brokerage website offer two-factor authentication? Build your investment knowledge with this collection of training videos, articles, and expert opinions.

Are quotes in real-time? This one is a less-than-ideal option. We recommend that you consult a tax or financial advisor about your individual situation. Common Stock Fund. By using Investopedia, you accept. Number two, if it's a case of portfolio management activity, whereas the portfolio manager might buy or sell securities and causes a capital gain. If you plan on trading more than stocks, make sure you know what the fees are to trade options, bondsfutures, or other securities. So for all the discussions sometimes we hear about differences between mutual funds and ETFs, they're overwhelmingly similar actually. However, U. Day binary options indicator software app ing direct trading non-marginable securities and exceeding intraday buying power can result in account restriction, forex kontor top binary options in uae removal of the margin feature, or the termination of your account per the Customer Agreement. Now we have one that has come from Twitter. An order to buy or sell a security at the best available price. Be honest with yourself about how much time, energy and effort you're willing and able to put into your investments. Preclearance of personal securities transactions allows Prudential to prevent personal trades that may conflict with Client trades or transactions. Accordingly, PIMS and PAD Associated Persons are generally not subject to the trading provisions of these Standards unless they have also been classified as an Access Person, Investment Person, Covered Person, or Designated Person in which case they are subject to the trading and reporting provisions that apply to these classifications.

Required for PRU stock trades. How easy and intuitive is the site or platform to navigate? How easy is it to withdraw funds from your brokerage account? Account Maintenance. So what happens is the ETF is being priced by market participants who are saying, "What would those underlying securities be if those markets were still open? Does the platform have a trading journal or other means of saving your work? Go through the motions of placing a trade to see how smoothly the process operates. Advisory services are provided by Vanguard Advisers, Inc. For more information, see Day trading under Trading Restrictions.

S registered investment adviser that is affiliated with the Company. And it's trading based upon news and information that's going on right. Common Stock Fund. Intraday buying power is the maximum amount of fully marginable positions that a pattern day trader has open at any one time. Set a "marketable limit" order instead of a market order. All Rights Reserved. Expense analyzing currency charts and trends cryptocurrency credit card delay Every ETF has an expense ratiowhich covers the cost of operating the fund. This restriction is effective for 90 calendar days. Brokers NinjaTrader Review. Acknowledgement Requirements. Fund-style ETFs are available to track the broad market, specific sectors, and non-stock securities like bonds. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, acorns robinhood investing through robinhood in one place. Thus, ETFs holding a significant share of dividend-yielding stocks may see variations in price due to dividends that traders can take advantage of. The Company may also close the trading window at other unscheduled times and would provide notice when doing so. Go through the motions of placing a trade to see how smoothly the process operates. Certain Prudential employees may be eligible to enter into an Individual Trading Plan with respect to certain sales of Prudential securities and exercises of Prudential employee stock options. Transactions resulting in a loss are not subject to this prohibition. All averages are asset-weighted. If the brokerage offers checking or savings accounts, or any other deposit products, are they covered by the Federal Deposit Insurance Corporation FDIC? You can buy an ETF for as little as the cost of 1 share—giving you the opportunity to start investing with less money.

Settlement times may vary depending on the source of the deposit. Each brokerage has its own definition of the specific time periods these Extended Hours sessions occupy. Employees who have been classified as a Designated Person have been informed of their status. The reason is that the price of stocks typically increases in the short-term in anticipation of dividends, and falls to account for the passage of the ex-dividend date. Try searching online for consumer reviews of the brokerage, using keywords like " insurance claim ," "fraud protection" and "customer service. This one has an amazing technical selection, which includes multiple options for each indicator type. Popular Courses. Accordingly, PIMS and PAD Associated Persons are generally not subject to the trading provisions of these Standards unless they have also been classified as an Access Person, Investment Person, Covered Person, or Designated Person in which case they are subject to the trading and reporting provisions that apply to these classifications. We started to talk a little bit about taxation, Jim.

Charitable Gifts. Already know what you want? Employees may be required to submit additional acknowledgements or certifications upon request as regulatory requirements change and industry standards evolve. This Initial Holdings report must include all holdings of private securities e. Employees who are solely classified as Associated Persons are subject to the Securities Account reporting and Annual Account Acknowledgement requirements set forth in these Standards. Liz Tammaro : And a question from Ann, submitted to us from Colorado. Make sure this platform automatically allow you to trade preferred shares, IPOs, options, futures, or fixed-income securities. Liz Tammaro : Good. Pay attention to what kinds of data you can plot, how easy it is to switch between charting technical studies and reviewing fundamental or market data, and what you can customize and save for later reference. Approved trades must be executed by the close of business on the day in which the preclearance approval is granted. What kind of technology does the broker use to keep your account safe? Are there different products for different investing goals? So you can imagine a situation where, I'm going to make one up, Asian markets closed, and there is new news that says, "Global auto demand is surging. While there are certain brokerage features that will be more important for some investors than for others, there are a few things any reputable online brokerage should have.

Hckt finviz global trade indicator there any annual or monthly account maintenance fees? However, Employees may not short sell Prudential related securities under any circumstances. Figure Out the Fees. Broker Consent. I think we have a chart that addresses that point that Doug was talking about that ETFs are overwhelming. Start with your investing goals. This balance includes intraday transaction activity. Mutual funds tend to have higher taxes because of the active management process. The actual date on which shares are purchased or sold. And that's the same regulatory regime under which mutual funds operate. I think differences is maybe the more appropriate term. In what situations might the premium or discount on an ETF get out of whack? The exercise of Employee stock options granted by a third party as compensation do not require preclearance provided the converted shares are not liquidated. Forex crypto trading strategy crypto market cap chart tradingview Security - includes all securities in which an Access Person or Investment Person has the opportunity, directly or indirectly, to profit or share in the profit derived from transactions in such securities. It's a pooled investment vehicle that acquires or disposes of securities. Bond ETFs track the bond market, providing investors the liquidity of an easily tradable asset while letting them invest indirectly in low-liquidity bonds. This prohibition applies to purchases in your Securities Accounts and in the Securities Accounts of your Immediate Family;. Settlement times may vary depending on the source of the deposit. Treasury debt issuances, pursuant to the sixth bullet point below .

What about dividend or interest distributions? Approximately 48 hours after Prudential releases its quarterly earnings to the public, the trading window generally opens and will remain open until approximately three weeks before the end of the quarter. How long does it take funds from the sale of chase free trade account how many trades per day options trading strategies quick entry investments to settle? Thus, ETFs holding a significant share of dividend-yielding stocks may see variations in price due to dividends that traders can take advantage of. Related questions include:. While you must be especially alert to sensitive information, you may consider information received directly from a designated company spokesperson to be public information unless you know or have reason to believe that such information is not generally available to the investing public. Exhibit B provides a summary of the requirements under these Standards. If interactive brokers ira account fees td ameritrade ira limit information is not available in the general media or in a public filing, you should consider it to be nonpublic. Submitting a preclearance request outside of these times will result in a system-generated denial. Employees may have multiple classifications. Your Money. Are there different commission rates for different securities? The answer should definitely be no. Cryptocurrency Accounts. If you are aware that Prudential is considering or actually trading any security for any account futures prop trading firms can you do penny stocks on motif manages, you must regard that as material nonpublic information. Initial and Annual U. Exceptions to the Authorized Broker-Dealer requirement will be evaluated on a case-by-case basis and will be approved on a limited basis e. Does the platform allow backtesting? Start with your investing goals.

And when you see the expense ratios, you see that given an indexing strategy, whether it's a mutual fund or an ETF, the expense ratios tend to be lower than they are for the nonindex strategies, whether it's an ETF or a mutual fund. Employees who are newly subject to this requirement are required to transfer their Securities Accounts to an Authorized Broker-Dealer within sixty days of their Company start date or the date the Employee becomes subject to these Standards as a result of transfer or newly acquired access to material, nonpublic information. Search fidelity. Failure to comply with these rules could result in violations of the federal securities laws and subject you to severe penalties described in Section I. Broker Consent. Broader market ETFs are useful for traders because they allow traders to easily go long or short on the overall market. Any such transaction would be considered as turnover within the sixty-day period and will result in a violation of these Standards. While contingent workers are not Employees, those contingent workers that obtain information regarding the purchase or sale of securities in portfolios managed by the Company may be subject to these Standards, as determined on a case-by-case basis. And it's trading based upon news and information that's going on right now. Go through the motions of placing a trade and take a look at what types of orders are offered.

Please call a Fidelity Representative for more complete information on the settlement periods. Subject to the exceptions noted below, Investment Persons are prohibited from profiting from a purchase and sale, or sale and purchase, of the same or an equivalent security within any sixty-calendar day period. Every ETF has an expense ratiohow to buy otc stocks on td ameritrade bitcoin investment trust otc gbtc covers the cost of operating the fund. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. Your transaction occurs at the prevailing market price and settles 2 days after the trade date. Is there a deposit minimum? For Investment Persons in SIRG, this prohibition is limited to the purchase and sale of the same or equivalent exchange traded funds. It also requires nurturing a business culture that supports decisions and actions based on what is right, not simply what is expedient. We do not charge a commission for selling fractional shares. For example, if a trader believes day trading stocks tomorrow nadex demo account incorrect login the tech sector will rise across the board, that trader can invest in an ETF that holds many tech stocks. Within ten calendar days of becoming an Access Person or Investment Person, these Employees must also disclose their personal securities holdings. Day Trading Basics.

For efficient settlement, we suggest that you leave your securities in your account. Conclusion ETFs are highly versatile trading instruments that offer the portfolio characteristics of mutual funds while trading like stocks. Search fidelity. There's no fractionals there. Enjoy commission-free trading on most ETFs from other companies as well when you buy and sell them online. Other Compliance Acknowledgements and Certifications. For non-U. If a blocking system fails, the Designated Person remains responsible if a violation occurs. SMU is responsible for developing and maintaining standard operating procedures detailing the scope and frequency of surveillance reports. If you are not sure whether nonpublic information is material, you should consult the Law Department or your Chief Compliance Officer. Fund-style ETFs are available to track the broad market, specific sectors, and non-stock securities like bonds. You may not communicate material nonpublic information to anyone except individuals who are entitled to receive it in connection with the performance of their responsibilities for Prudential i. Employees who are subject to preclearance are discouraged from entering limit orders that carry over to a future trading day and from maintaining margin accounts. ETFs are highly versatile trading instruments that offer the portfolio characteristics of mutual funds while trading like stocks. If it is disclosed in a national business or financial wire service such as Dow Jones or Bloomberg , in a national news service such as AP or Reuters , in a newspaper, on the television, on the radio, or in a publicly disseminated disclosure document such as a proxy statement or prospectus , you may consider the information to be public. Foreign market ETFs are a convenient way for traders to place bets on foreign markets. And even maybe what are some of the disadvantages. How quickly are those funds available for investment? We started to talk a little bit about taxation, Jim.

ETFs that represent dividend-yielding stocks will also vary in value as ex-dividend dates approach and are passed, or as dividends per share are altered. Whether it offers videos, podcasts, user forums, or written articles, the format needs to work for you. Restricted Lists and Watch Lists are confidential, and may not be shared across investment segments. Find out if you can withdraw via ACH transfer, wire or check and how long it will take for those funds to reach your bank account. Verify how many days it takes for deposited funds to be available for investment. If the customer sells ABC stock prior to Wednesday the settlement date of the XYZ sale , the transaction would be deemed to be a good faith violation because ABC stock was sold before the account had sufficient funds to fully pay for the purchase. Employee - any person employed by Prudential. Based on your classification, you may be required to complete one or more acknowledgements upon hire, transfer or role change. It's trading on exchange versus direct with the fund and it's trading at a market price rather than getting the end-of-day NAV. In addition, you may not communicate any information regarding the confidential analysis of the company, or that Prudential is even evaluating the company, to anyone except individuals who are entitled to receive it in connection with the performance of their responsibilities for Prudential. All investing is subject to risk, including the possible loss of the money you invest. UBS Financial Services. Key Takeaways Access to the financial markets is easy and inexpensive thanks to a variety of discount brokers that operate through online platforms. Saturdays, Sundays, and stock exchange holidays are not business days and therefore cannot be settlement days.