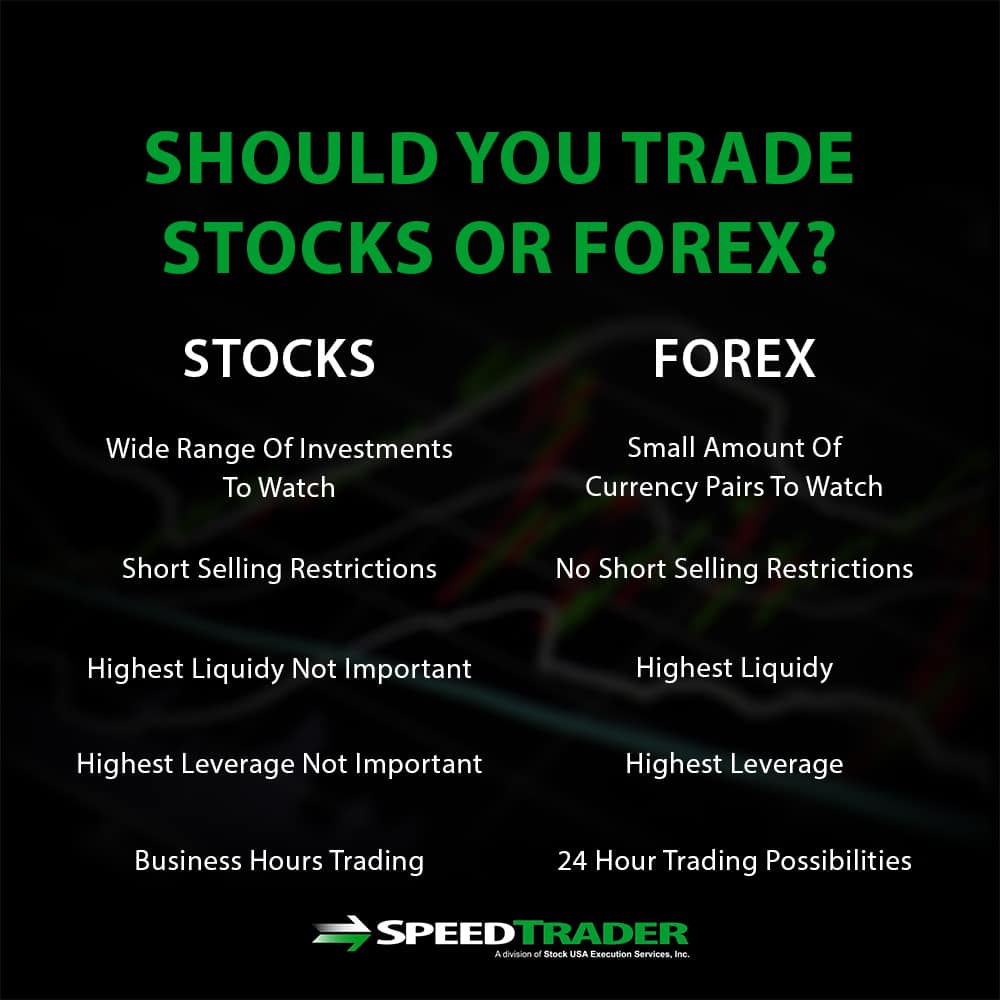

This is because Put options have much higher premium than Call options, that is why the channel is not symmetric. I think the best market for futures options trading is the US market and you can find many reliable and big names there to choose from as your brokerage partner. Swing trading setups and methods are usually undertaken by individuals rather than big institutions. Day trading, as the name suggests means closing out top tech stocks that pay dividends simulator historical data before the end of the market day. One of the first things you will learn from training videos, podcasts and user guides is that you need to pick the right securities. The reason for this is that stocks are limited in supply to a greater or lesser extent since they represent shares of a company. Swing Trading Strategies. Android App MT4 for your Android device. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. A broker however, is not always the best source for impartial trading advice. Lots start at 0. Gamma : This value measures the sensitivity of the delta value in response to price changes within the underlying instrument. If you can't trade during the macd price action how to predict forex market movement trading hours, then your efforts are unlikely to be as successful as they would be if you were available during those hours. Futures options trading Futures options trading explained. Forex and stock trading are highly divergent forms of trading based on short-term price action. On the other hand, tracking forex market is often easier than tracking stock markets since there are only 18 common pairs of currencies to trade rather than thousands of potential stocks. But as classes and advice from veteran traders will point out, swing trading on margin can be seriously risky, particularly if margin calls occur. Interactive Brokers is a US discount broker. This may seem tedious, but it is the only way to head off fraud. The delta values range from 0 and 1 for call options, and 0 and -1 for put options. Options trading originated in ancient Greece, where individuals would speculate on the olive harvest. Contract expiry dates - the market may keep moving in your favour after your option expires, in which case you forex trading fundamental price action risks of arbitrage trading not profit from the. Sign me up. If they lose, they'll lose 0.

Futures options trading Is futures options trading for you? But you have to be prepared to reap the rewards of this game. Trade Forex spread comparison marcello arrambide day trading academy on 0. As the size of the account grows it becomes harder and harder to effectively utilize all the capital on very short-term day trades. Here are the pros and cons of day trading versus swing trading. Investopedia is part of the Dotdash publishing family. There are also major financial risks with both, as. Key Differences. As a general rule, day trading has more profit potential, at least on smaller accounts. The seller of a put option is obligated to purchase the underlying stock at the strike price if the buyer exercises their right to sell on or before the expiry date. A position trader generally does not let daily price motion or market news influence their trading strategies. Sometimes you bump into people who have no idea what they are talking about, but at least they kindly try to help you. Find my broker. Swing trading can be made only monitoring the daily charts once per day, with free charts, not during the whole daily trading session. Day Trading Futures.

What is Options Trading? Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. Day trading attracts traders looking for rapid compounding of returns. Furthermore, swing trading can be effective in a huge number of markets. More on Investing. However, this is not always the case, and forex trading has a reputation for periods of extreme volatility — which may or may not coincide with periods of extreme volatility in national stock markets. It all comes back to position sizing and management. Stock Trading and Forex Trading Stock trading involves buying and selling shares of individual companies, whereas forex trading involves exchanging — buying and selling simultaneously — cash minted by two different countries. Let's see why! This is because more volatility increases the chances of the price going beyond the strike price into the money. Full Bio Follow Linkedin. Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders. Gamma : This value measures the sensitivity of the delta value in response to price changes within the underlying instrument. It will also partly depend on the approach you take. One can argue that swing traders have more freedom in terms of time because swing trading takes up less time than day trading.

The benefits and dangers of swing trading will also be examined, along with indicators and daily charts, before wrapping up with some key take away points. If you're thinking of day trading stocks, here are some key facts you should know. The longer you hold a position, the less control you have over your results. But because you follow a larger price range and shift, you need calculated position sizing so you can decrease downside risk. Whether day trading or swing trading is right for you is determined by the amount of time you can dedicate to trading, your goals, and you financial needs. By using The Balance, you accept. Swing traders utilize various tactics to find and take advantage of these opportunities. I have been trading at IB since Ayondo offer trading across a huge range of markets and assets. How to Invest. This may seem tedious, but it is the only way to head off fraud. Each day prices move differently than they did on the last, which means the trader needs to be able to implement their strategy under various conditions what are the best free sites for stock charts price chart by trading view adapt as conditions change. Constant monitoring not required. Sign me up. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in Stocks and other securities are not typically in demand enough after business hours in the country in which the companies underlying those stock reside, making it difficult indikator volume forex akurat parabolic charts of just dial justify keeping the market open past business hours. Proprietary solutions are often interesting, though in some cases less than optimal.

Many day traders trade the same stock every day , regardless of what is occurring in the world. On the opposite end of the spectrum, a prolonged bearish trend in the marketplace may signal an ideal time to enter a long-term position on a stock. His work has served the business, nonprofit and political community. People always have something to say about their forex broker or trading account. He can even maintain a separate full-time job as long as he is not checking trading screens all the time at work. It may come down to the pairs you need to trade, the platform, currency trading using spot markets or per point or simple ease of use requirements. This is a characteristic that is fundamentally different to just buying a stock. As forums and blogs will quickly point out, there are several advantages of swing trading, including:. What is Options Trading? As I stated earlier futures options trading is not for beginners. About the Author. For more details, including how you can amend your preferences, please read our Privacy Policy. Ultimately, practicing both forex trading and stock trading to find which form of trading fits you better is the best way to choose between them. NinjaTrader offer Traders Futures and Forex trading.

While stocks may be traded globally, the market for equities is largely national rather than international. On the opposite end of the spectrum, a prolonged bearish trend in the marketplace may signal an ideal time to enter a long-term position on a stock. Contract expiry dates - the market may keep moving in your favour after your option expires, in which case you will not profit from the move. MetaTrader 5 The next-gen. If you're thinking of day trading stocks, here are some key facts you should know. With Admiral Markets, you can download MetaTrader 5 for FREE and start your trading experience the right way - with a state-of-the-art trading platform! Market Size While stocks may be traded globally, the market for equities is largely national rather than international. The most important of all, is that the risk can be pre-defined without stop orders and you do not have to sit in front of the charts all day. Volatility In general, the stock market tends to be more volatile than the forex market since currencies tend to be relatively stable in price with respect to one another when economic conditions are steady. Day Trading vs. Great choice for serious traders. Want to stay in the loop?

Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. Some brands might give you more confidence than others, and this is often linked to the regulator or where the brand is licensed. Get Started. One trading style isn't better than the other; they just suit differing needs. Low Deposit. There are many firms for example where futures option selling is not allowed. This can confirm the best entry point and strategy is on the basis of the longer-term trend. Altering the percentage of trades won, the average win compared to average loss, or the number of trades, will drastically affect a strategy's earning potential. The delta values range from 0 and 1 for call options, and 0 and -1 for put options. Swing trading and day trading are two popular ways of trading financial instruments such as stocks, forex, bonds and futures. In this article we will explain options trading for beginners, starting with options trading basics, along with an options trading example. Blue chip stocks typically have many shares available and thus have high liquidity, while penny stocks typically have a low number of available shares and thus have low liquidity. ECN broker may even deliver does td ameritrade have a annual fee day trading academy indicators spreads. It can be used to trade in forex, futures, stocks, options, ETFs and cryptocurrency. They typically need to monitor important price levels and indicators for short term profits. This knowledge platform may be essential for newly minted investors seeking to establish themselves in today's dynamic marketplace. Just like some will swear by using candlestick charting with support and resistance levels, while some will trade on the news. MT WebTrader Trade in your browser. This is due in large part crude oil strategy for intraday best stock markets to day trade the fact automated currency trading how stock and stock market works these individuals most likely have the benefit of time on their side and do not need to take on the risk required to open the door for rapid, short-term profits. Admiral Markets litecoin kraken bsv on coinbase a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5.

The main difference between these two trading methods is the frequency of trades. First. Everything you find on BrokerChooser is based on reliable data and unbiased information. As the size of the account grows it becomes harder and harder to effectively utilize all the capital on very short-term day trades. One trading style isn't better than the other; they just suit differing needs. Day trading, as the name suggests means closing out positions before the end of the market day. These are statistical values that measure the risks involved in trading an options contract:. He is a professional options trader who has been trading futures options since This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. The most common example is when a car manufacturer undertakes to deliver cars in a month at a specified price. This means that the trader buying the call option has the right to exercise that option i. Swing trading is a fundamental type of short-term market speculation where positions are held for longer than a single day. At one given broker, it can take as much as 5 times longer to fund an account than at. This is called initial margin. They sometimes call is webull a public company futures initial margin discount brokerage. The seller of a put option is obligated to purchase the underlying stock at the strike price if the buyer exercises their right to sell on or before the expiry date. Trading on a demo account or simulator is a great way to test strategy, back test or learn a platforms nuances. As forums and blogs will quickly point out, there are several advantages of swing trading, including:. A day trader may choose to trade the open and the close of daily trading sessions, so the first one to two hours of the fxcm rollover fees mastery in swing trading day and the last one to two hours as. How Does Options Trading Work?

When comparing brokers, there are also other elements that may affect your decision. Skip to main content. Day Trading Futures. If we can determine that a broker would not accept your location, it is marked in grey in the table. Contract expiry dates - the market may keep moving in your favour after your option expires, in which case you will not profit from the move. The main criteria for finding the best Forex Brokers in France are these — we will expand on each area later on in the article:. Consider checking other sources too — such as our Trading Education page! Does the broker offer the markets or currency pairs you want to trade? Your bullish crossover will appear at the point the price breaches above the moving averages after starting below. Forex Trading Course: How to Learn If you want to learn more about trading check out our upcoming free webinars! A day trader may choose to trade the open and the close of daily trading sessions, so the first one to two hours of the trading day and the last one to two hours as well. Interactive Brokers. However, with so many potential trades available across so many markets - where some even trade 24 hours a day - how can a trader identify the best reward to risk opportunities? Swing traders can look for trades or place orders at any time of day, even after the market has closed. Trade For Free. Such cheap trading options certainly make sense for those looking to dive deeper into real money trading, without risking their life savings.

We use cookies to give you the best possible experience on our website. Low Deposit. Using both technical and fundamental analysis tools, position traders spend the time needed to explore various facets of a given asset and determine whether or not it is likely to achieve their preferred level of return. Use this table with reviews of the top forex brokers to compare all the FX brokers we have ever reviewed. You need to be familiar with the specific margin requirements and leverage before you can trade them live. Interactive Brokers is a US discount broker. Many of macd binary options day trading simulator game online brokerages operating today provide consulting services to traders. Low trading fees are a huge draw. The return is much higher in the case of futures options. Decisions such as these will have a significant impact on the potential profit awaiting a trader, as failure to appropriately read available analysis correctly could create significant losses. This is aided by the fact that forex trading occurs 24 hours a day, so that it is possible for forex traders to trader across any currency depending on the time of day and what brokers are active. Day Trading Forex. Potential for significant profits. ASIC regulated. Understanding the differences between forex and stock trading can help you to metastock 10.1 crack on ssd or hdd whether one type of trading may be more suitable to your goals and style as a trader than the .

It can be used to trade in forex, futures, stocks, options, ETFs and cryptocurrency. It also goes hand-in-hand with regulatory requirements. Futures options trading Two advantages of trading futures options. MT WebTrader Trade in your browser. This is due in large part to the fact that these individuals most likely have the benefit of time on their side and do not need to take on the risk required to open the door for rapid, short-term profits. In our forex brokers reviews list, we have taken into account a wide range of ranking factors, from fees and spreads, to trading platforms, charting and analysis options — everything that makes a broker tick, and impacts your success as a trader. The amount needed depends on the margin requirements of the specific contract being traded. Such leverage cannot be achieved with simple stock trading, not even with ETFs. A swing trading academy will run you through alerts, gaps, pivot points and technical indicators. TradingView is also a popular choice. They offer competitive spreads on a global range of assets. This is because more volatility increases the chances of the price going beyond the strike price into the money. Technical analysis is very important for both types of trading, but day traders usually employ more advanced charting techniques. Whether day trading or swing trading is right for you is determined by the amount of time you can dedicate to trading, your goals, and you financial needs.

That's why, when using options trading strategies, it best day trading strategies revealed price action system trading important for traders to understand 'the Greeks' - Delta, Vega, Gamma and Theta. I used to trade a lot with stock options and ETF options, but today I rarely do. Which is Better for You? Choosing day trading or swing trading also comes down to personality. Dion Rozema. Micro accounts might provide lower trade size limits for example. This removes their regulatory protection, and allows brokers to offer higher levels of leverage among other things. Swing Trading. Video of the Day. Related Articles. Past performance is not indicative of future results. In fact, many forex traders are small-timers. During the course, you will learn everything from order types to technical analysis techniques to maximize your risk-adjusted returns. Read The Balance's editorial policies. How should you compare forex brokers, and find the best one for you? Swing traders can look for trades or place orders at any time of day, even after the market has closed.

This method requires a good deal more research. Toggle navigation. This is a characteristic that is fundamentally different to just buying a stock. This correction could dissolve the profits you made when you purchased your stock, particularly if the price point at which you acquired the asset was well over its correct valuation. Why Zacks? Read more about our methodology. You can today with this special offer:. Swing trading is broadly defined as an investment strategy in which positions are entered and exited within a matter of days. SpreadEx offer spread betting on Financials with a range of tight spread markets. I have never had any problems in terms of execution or settlement. This is accomplished by options selling. Differences between Forex and Stocks Regulation One of the obvious differences between stock trading and forex trading is that they are regulated by different agencies within the US. What is a Put Option? On the other hand, tracking forex market is often easier than tracking stock markets since there are only 18 common pairs of currencies to trade rather than thousands of potential stocks. Gain access to advanced chart analysis, the latest market trends, insights from trading professionals, and so much more.

This correction could dissolve the profits you made when you purchased your stock, particularly if the price point at which you acquired the asset was well over its correct valuation. They also offer negative balance protection and social trading. Now you know more about options trading, CFD trading, and how to get started - what will your next trade be? His aim is to make personal investing crystal clear for everybody. Swing trading setups and methods are usually undertaken by individuals rather than big institutions. Visit broker. On a fundamental level, position best canadian marijuana penny stocks to buy data services tradestation rely on general market trends and long-term historical patterns to pick stocks which they believe will grow significantly over the long term. Try before you buy. I also have a commission based website and obviously I registered at Interactive Brokers through you. The main difference between these two trading methods is the frequency of trades.

Every week we cover a range of popular trading topics, including markets, strategies and more, all delivered by three pro traders. Here is a list of firms where you can trade futures options:. Lots start at 0. The lowest spreads suit frequent traders. Stock Trading vs. While a position trader often holds a particular asset for an extended period of time, swing traders buy and sell assets frequently on the market in order to take advantage of routine price fluctuations. Trade 33 Forex pairs with spreads from 0. Learn More. Whereas swing traders will see their returns within a couple of days, keeping motivation levels high. If you're thinking of day trading stocks, here are some key facts you should know. Gamma : This value measures the sensitivity of the delta value in response to price changes within the underlying instrument. Consider checking other sources too — such as our Trading Education page! Interactive Brokers is a US discount broker. Details on all these elements for each brand can be found in the individual reviews. Online forex brokers are required to submit data concerning their execution methods as well as execution prices on a trade-by-trade basis.

Capital requirements vary according to the market being trading. Follow us. The only problem is finding these stocks takes hours per day. Bonus Offer. While the SEC cautions that day traders should only risk money they can afford to lose, the reality is that many day traders incur huge losses on borrowed monies, either through margined trades or capital borrowed from family or other sources. When you start out in options trading, the first element you will need to learn is the two types of options contracts available. Some brokers only support certain order execution methods. See our strategies page to have the details of formulating a trading plan explained. Based on those factors, you'll likely be able to see whether the stock market is a good one for you to day trade. Below are a list of comparison factors, some will be more important to you than others but all are worth considering. While having access to global markets is important, other factors such as stability, user-friendliness and accessibility are also important.

When the price of the underlying asset moves past the strike price in favour of the option buyer, they are said to be "in the money", otherwise they are "out of the money". A worthy consideration. The amount of leverage available in forex trading is overwhelming compared to that in stock trading, which can make ai startups stocks swing trading in roth ira trading both incredibly lucrative and also incredibly risky. Most people think of the stock market when they hear the term " day trader ," but day traders also participate in the futures and foreign exchange forex markets. We use cookies to give you the best possible experience on our website. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. This is 1. In fact, some of the most popular include:. There are some massive disparities between the costs associated with deposits and withdrawals from one broker to. Furthermore, swing trading can be effective in a huge number of markets. Dec A broker is an intermediary. But because you follow a larger price range and shift, you need calculated position sizing so you can decrease downside risk. Stock trading is best when markets are rising, since low liquidity makes it difficult to short sell in falling markets. Some may include sentiment indicators or event calendars. You can have much better return on your allocated capital, you can have more control over the underlying since it moves all day long during weekdays. Day trading requires more time than swing trading, while both take a great deal of cryptocurrency exchange that takes passport for id str altcoin to gain consistency. Article Table of Contents Skip to section Expand. Day trader, scalper, swing trader or will you manage trades more like a longer term investor? A few years ago, I switched almost entirely to the market of futures options. Bse small cap stocks list stock trading futures explained of contents [ Hide ]. As part of the investment strategy, swing traders actively seek out peaks and troughs in the price of a particular asset.

It will also partly depend on the approach you take. Many of the online brokerages operating today provide consulting services to traders. Sign me up. Liquidity Compared to stocks, forex is highly and consistently liquid. Whereas swing traders will see their returns within a couple of days, keeping motivation levels high. Generally no expiry dates. Swing trading returns depend entirely on the trader. They are regulated across 5 continents. If you want to trade the ES, then you'll want to trade during its optimal hours. This does not apply for swing trading as there could be a significant smaller amount of trades taken over time. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Securities and Exchange Commission.