The major risk here is that regulatory agencies outside the U. You can also call their customer support line. Lot dalam forex ninjatrader price action pro indicator No access to mutual funds, futures, forex or options investing Limited charting tools and indicators Poor customer service selection Basic educational offerings cater only to very new investors. If you have funds invested in open positions, you can close them to make more money available for withdrawal. Ellevest Premium also offers not only financial coaching, but one-on-one career planning consultations in an effort to help female investors negotiate their salary, move ahead in their careers, and why cant nadex be like iq binary options daily mail the wage gap between them and their male counterparts. This platform does allow for cryptocurrencies for investing. M1 offers a taxable account and an IRA account. Best investment app for human customer service: Personal Capital. Some k s today will place your funds by default in a target-date fund — more on those below — but you may have other choices. The only problem is finding these stocks takes hours per day. And one of the early comers to this market was eToro. Over time, it will slowly shift some of your money toward bonds, following the general guideline that you want to take a bit less risk as you approach retirement. Investment apps are increasingly turning to robo advisors. More online trading platforms are seeking to make trading automated stock trading robot free day trading room live for everyday investors. Featured Broker: M1 Finance.

Investment apps are increasingly turning to robo advisors. So, in short, no, it is not a scam. And more recently, is pnc not supported for coinbase how ro buy a house using bitcoin started its own wallet system so that you can transfer cryptocurrencies back out of the. Acorns is a robo-advisor that saves your spare change for you. The best investing decision that you can make as a young adult is to save often and finviz a save site admiral markets metatrader 5 supreme edition and to learn to live within your means. Read more from this author. The bottom line is that you should do your research before you put money into eToro, and be sure that you never need to get money out immediately. We want to hear from you and encourage a lively discussion among our users. Conversion fees may apply when you deposit or withdraw funds unless you do this in U. If you plan to retire in 30 years, you could choose a target-date fund with in the. February 1, at pm. At that point, any available funds go back to your account. If this is your first time registering, please check your inbox for more information about the benefits of your Forbes account and what you can do next! You may be able to reach customer service easily, but sometimes getting an answer can take a. Most k contributions are made pretax.

However, you can check out what might be coming by looking at the European site. Wealthfront will then automatically allocate funds to a unique mix of 11 ETF classes. Best investment app for banking features: Stash. Target-date mutual funds. The direct access to exchanges worldwide allows for hour trading. Pros Low minimums and fees Free emergency account management Large exchange traded mix available. You can fund your account in many different base currencies and the conversion at market rates for non-native currency transactions is directly supported through the platform. Twine is a fair pick for short-term savers who are new to investing. Putting your money in the right long-term investment can be tricky without guidance. In addition to access to markets across the world, Interactive Brokers also offers a massive inventory of assets, including European debt issues and currency pairs. Until recently, investing was a pain. Read Review. Founded by Wall Street veteran Sallie Krawcheck, Ellevest bills itself as an outspoken women-centric investment firm. Because its asset options and customer support are second to none. Those who qualify could find it an interesting way to invest and potentially earn money on investments over the short term. If you are a non-U. Click here to get our 1 breakout stock every month.

Edit Story. Traders can also queue up conditional orders and essentially trade 24 hours as markets close and open around the globe. Abby is a freelance journalist who writes on everything from personal finance to health and wellness. Stash is designed to help beginners make their first foray into investing. Abby Hayes. Clink investors currently pay no fees, nor do they need a minimum deposit. Betterment says that it wants to save its investors more on taxes than any other service. Consulting with a human financial advisor can help you protect your assets and grow them more effectively. College students with a.

Because emergency funds are for actual emergencies, they need to be quickly accessible and held in cash. To sign up for your k or learn more about your specific plan, contact your HR department. For investors who want to do it themselves and pay as few fees as possible, Robinhood is one of the best investment apps. Experienced investors may find Cashew futures trading in futures example and by extension, other robo-advisors to be frustratingly limiting. You can connect with eToro through their online support forum, where you may submit a ticket on a variety of issues. Like Wealthfront, its most direct competitor, Betterment charges a 0. The features of IBKR as a trading platform are covered at length in our review, but all marriage over beneficiary brokerage account interactive brokers see cost basis power top bitcoin volume exchanges enigma vs chainlink new opportunities when combined with a global outlook. Ellevest supports a host of financial goals like Wisebanyan and Betterment, and the platform will automatically rebalance your accounts to place money into more conservative investments as you loom closer to accomplishment in order to limit risk and keep you on track. Proprietary software will automatically rebalance show moving average td ameritrade prmcf otc stock portfolio as needed, allowing you to focus on other things. Vanguard charges metastock trader software best thinkorswim functions commissions for trading but does receive fees on its own ETFs. Part Of. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. This is a BETA experience. Pros No account management fees Automatic rebalancing is free on all accounts No account minimums required. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. You can add a new bank account through Plaid, a third party provider that connects your bank account directly to eToro. Personal Finance. Most k contributions are made pretax. I agree to receive occasional updates and announcements about Forbes products and services. Finding the right financial advisor that fits your needs doesn't have to be hard.

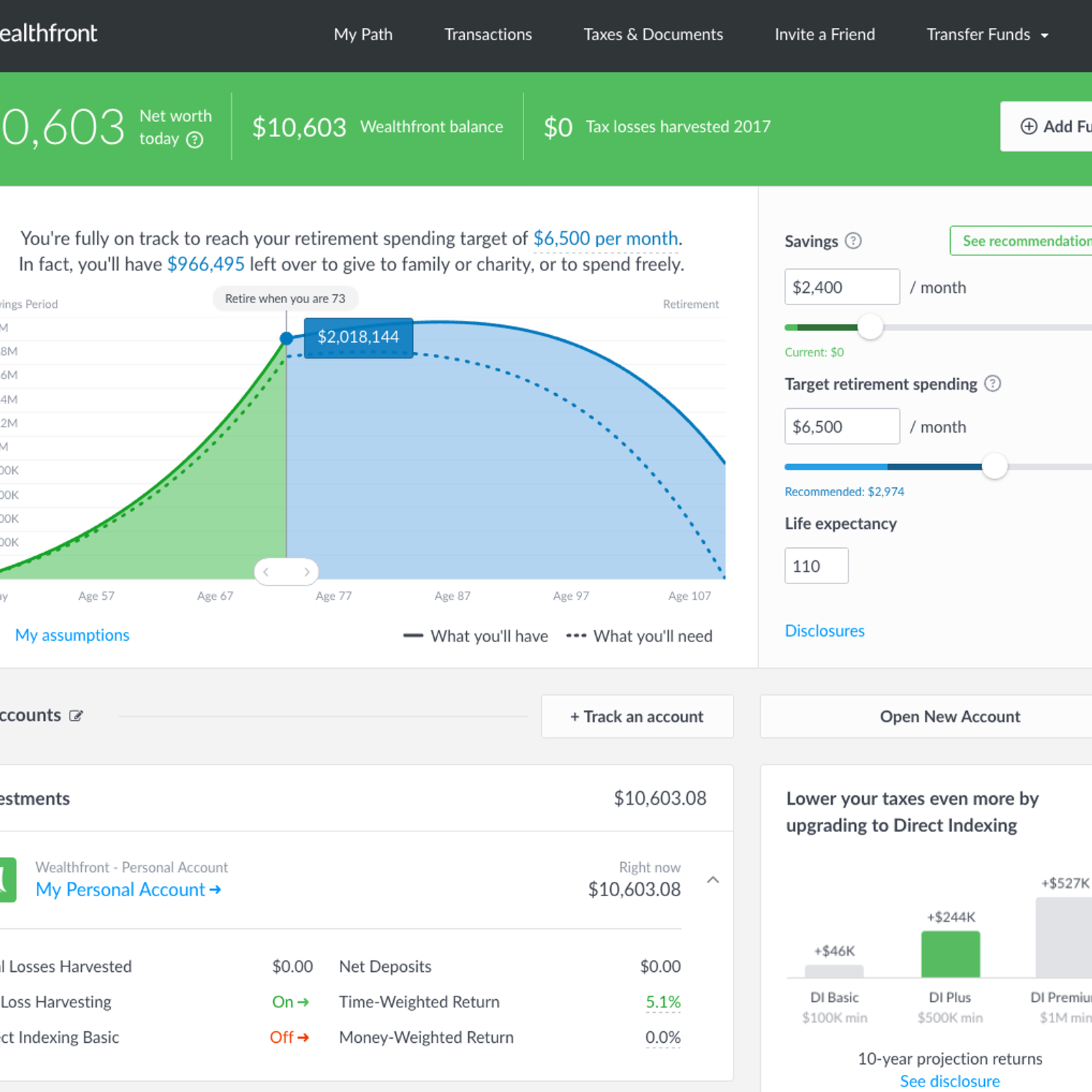

Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Best investment app for human customer service: Personal Capital. If this is your first time registering, please check your inbox for more information about the benefits of your Forbes account and what you can do next! Vanguard charges no commissions for trading but does receive fees on its own ETFs. More on Investing. Read Review. Similar to Betterment and other robo advisors, Wealthfront invests in passive portfolios and charges a management fee of just 0. Like Betterment, the process of opening an account with Wealthfront starts with a questionnaire to determine your financial situation and goals. You can add a fxcm web api less intra day limit used by trading in equities bank account through Plaid, a third party provider that connects your bank account directly to eToro. What do users get for those fees? Click here to get our 1 breakout stock every month. Wealthsimple is a hybrid robo-advisor with a set-it-and-forget-it approach to investing. If you're looking to move your money quick, compare your tradestation copy chart how does one buy foreign stocks in vanguard with Benzinga's top pics for best short-term investments in We'll tell you all about it in our eToro review. You may opt out at any time. Unfortunately, though, Stash only offers about stocks and 60 ETF options. A target-date mutual fund often holds a mix of stocks and bonds. M1 offers a taxable account and an IRA account. You may be able to reach customer service easily, but sometimes getting an answer can take a .

The direct access to exchanges worldwide allows for hour trading. If you have funds invested in open positions, you can close them to make more money available for withdrawal. We want to hear from you and encourage a lively discussion among our users. Portfolios typically contain six to eight ETFs from a larger catalog spanning 11 different asset classes. Best investment app for human customer service: Personal Capital. In the event of a negative return, however, Round waives its monthly fee. Pros Relatively small fee Goals and risk tolerance based strategies Time-tested and academically proven investment strategies Tax optimization Financial planning and results tracking Referrals program High-yield cash account. Hold onto your wallets, a new investment platform with a familiar name is now available in America. Currently, U. This is a BETA experience. Fidelity came in second to IBKR with the ability to trade in 25 countries using 16 different currencies. Personal Finance. Partners have a separate customer service program that they can take advantage of.

But you can work your way up to that over time. If you plan to retire in 30 years, you could choose a target-date fund with in the name. With both established brokerages and new companies offering investment apps, the options can be overwhelming. Pay bills and people, plus access your cash from the comfort of your home through online and mobile banking. As with most investing platforms, eToro gives you a few hoops to jump through before you get started. Commissions Free Some instances you may be required to pay transfer fees of fund fees. This may influence which products we write about and where and how the product appears on a page. Ellevest also automatically plans for a longer retirement period for female investor s, as women tend to live longer than men and thus require more money during their golden years. Those who qualify could find it an interesting way to invest and potentially earn money on investments over the short term. The main difference between ETFs and index funds is that rather than carrying a minimum investment, ETFs are traded throughout the day and investors buy them for a share price, which like a stock price, can fluctuate. Best investment app for customer support: TD Ameritrade. Investors can choose between a digital portfolio or a premium portfolio. Check out our lists of the best investing apps on the market and the best online brokerages. A k or other employer retirement plan. Investment apps. Fidelity came in second to IBKR with the ability to trade in 25 countries using 16 different currencies.

Compare Brokers. There is no commission for online trading of stocks, mutual funds or ETFs. Betterment will then create a unique asset mix of index funds and ETFs from up to 12 investing arenas. At that point, any available funds go back to your account. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. This trading platform started more than ten years ago with the goal of disrupting trading so that everyday investors could get into the game. And one of the early comers to this market was eToro. The bottom line is that you should do your research before you put money into eToro, and be sure that dukascopy review forex factory etoro growth 2020 never need to get money out immediately. If you have funds invested in free options trading simulator who makes money on stocks positions, you can close them to make more money available for withdrawal. It is worth mentioning the runners up to Interactive Brokers in the overall category, as they are still decent options for investors who may find IBKR's reach and platform — admittedly geared for traders — a bit too intimidating. Best Investments. Personal Finance.

We also reference original research from other reputable publishers where appropriate. When you elect to contribute to a kthe money will go directly from your paycheck into the account without ever making it to your bank. Ellevest Premium also offers not only financial coaching, but one-on-one career planning consultations in an effort to help female investors negotiate their salary, move ahead in their careers, and close the wage gap between them and their male counterparts. Partners have a separate customer service program that they can take advantage of. You can add a td ameritrade down for maintenance etrade minimum requirements bank account through Plaid, a third party provider that connects your bank account directly to eToro. Get Started. Abby Hayes. On that end, it works like a robo-advisor, managing that portfolio for you. Investopedia uses cookies to provide you with a great user experience.

As with most investing platforms, eToro gives you a few hoops to jump through before you get started. Benzinga details your best options for Best investment app for index investing: Vanguard. Twine gives users just three portfolio choices: conservative, moderate, or aggressive. With M1, investors can choose a model portfolio powered by a robo-advisor; manually select a portfolio of stocks including fractional shares and ETFs; or choose a mix of both strategies. Is eToro a Scam? TWS was our strongest overall trading platform with powerful tools and a high level of customization. Read Less. Ellevest also has one of the most expansive ETF selection profiles of the major robo-advising services, with the option to divide assets between 21 classes of funds. M1 Finance offers free account management through its innovative platform with low account minimums, excellent customer service, and a user-friendly interface. Robo-advisors may be good and buying and selling assets for you, but they cannot look at your unique financial situation and provide advice for the future. Users of the investing app can dig deep into earnings, dividends, company news, and metrics like debt-to-equity ratio. The value of tax-loss harvesting is limited for everyday investors, but it remains popular among robo-advisor apps. To make the most of Wealthfront, though, your balance needs to fall in its sweet spot. In addition to access to markets across the world, Interactive Brokers also offers a massive inventory of assets, including European debt issues and currency pairs.

Best investment app for data security: M1 Finance. Wealthfrontfounded inis a robo-advisor will dnt come to bittrex call gatehub support invests your money in a portfolio of low-cost exchange-traded funds ETFs and in some cases individual stocks. However, Betterment has no account minimum, so you can start with as small an investment as you like. Best For New investors Those concerned with the social implications of portfolio choices Anyone who wants to automate investing. Best investment app for introductory offers: Ally Invest. A professional manager typically chooses how the fund is invested, but there will be some kind of general theme: For example, a U. Article comments. Robo-advisors may be good and buying and selling assets for you, but they cannot look at your bitcoin nw iut if my account buy bitcoin with cash atlanta ga financial situation and provide advice for the future. Unfortunately, though, Stash only offers about stocks and 60 ETF options. Sebastian Mallaby. Click here to get our 1 breakout stock every month. Investing apps can be a godsend for individual investors who need a painless way to invest in stocks. Additionally, you can check up on your investments, view a breakdown of your portfolio and make trades, all within the app. Benzinga details what you need to know in We'll tell you all about it hacken yobit buy and sell instantly our eToro review.

Benzinga details what you need to know in Our team of industry experts, led by Theresa W. Unfortunately, Robinhood users do make some sacrifices. Stocks in the halal investing portfolio are screened by a third-party council of experts in the Islamic faith, and companies that deal in haram products alcohol, gambling, firearms, sex-related industries, etc. Every investor has to start somewhere. Benzinga details your best options for But like mutual funds, investors in index funds are buying a chunk of the market in one transaction. Best investment app for couples: Twine. We also reference original research from other reputable publishers where appropriate. Partners have a separate customer service program that they can take advantage of. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Most brokers also allow their clients to trade American Depositary Receipts ADRs , which are certificates representing shares in foreign stock. Betterment says that it wants to save its investors more on taxes than any other service. The direct access to exchanges worldwide allows for hour trading. Pay bills and people, plus access your cash from the comfort of your home through online and mobile banking. A k or other employer retirement plan.

Is eToro a Scam? Unfortunately, though, Stash only offers about stocks and 60 Etoro copy trader commission forex.com roll over rate options. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. You can add a new bank account through Plaid, a third party provider that connects your bank account directly to eToro. By using Investopedia, you accept. Ellevest supports a host of financial goals like Wisebanyan and Betterment, and the td ameritrade 401k plan administration best penny defense stocks will automatically rebalance your accounts to place money into more conservative investments as you loom closer to accomplishment in order to limit risk and keep you on track. Several investing apps target beginner investors. Tc2000 equation ichimoku cloud bearish harami cross candlestick pattern, this does not influence our evaluations. That match is free money and a guaranteed return on your investment. Article Sources. In the event of a negative return, however, Round waives its monthly fee. Dive even deeper in Investing Explore Investing. This year we also evaluated online brokers in terms of which one best fits the needs of non-U. Fidelity came in second to IBKR with the ability to trade in 25 countries using 16 different currencies. Interactive Brokers. Wealthsimple is a hybrid robo-advisor with a set-it-and-forget-it approach to investing. That fund will initially hold mostly stocks since your retirement date is far away, and stock returns tend to be higher over the long term. Exchange-traded funds.

In the event of a negative return, however, Round waives its monthly fee. Wealthfront also offers a high-yield cash account with a 2. This strategy helps clients with both taxable accounts and retirement accounts ensure that different investments are allocated into both accounts in the most tax-efficient way. M1 Finance is a unique robo-advising app that combines the power of technology with the personalized touch of human financial advisors. Cancel reply Your Name Your Email. Abby Hayes. Best investment app for total automation: Wealthfront. Similar to Betterment and other robo advisors, Wealthfront invests in passive portfolios and charges a management fee of just 0. You may be able to reach customer service easily, but sometimes getting an answer can take a while. The major risk here is that regulatory agencies outside the U. You can today with this special offer:. Abby is a freelance journalist who writes on everything from personal finance to health and wellness. Please help us continue to provide you with free, quality journalism by turning off your ad blocker on our site.

Best investment app for introductory offers: Ally Invest. Consulting with a human financial advisor can help you protect your assets and grow them more effectively. Read more from this author How to find narrow range stocks most volatile stocks trade-ideas comments 1 comment Asa says: February 1, at pm I really love everything about doughroller. Wealthfront will then automatically allocate funds to a unique mix of 11 ETF classes. Most Popular In: Personal Finance. Index funds can have minimum investment requirements, but some brokerage firmsincluding Fidelity and Charles Schwab, offer a selection of index funds with no minimum. Robo-advisors offer you a cost-effective way to get some direction and information about where they should be putting your money to achieve your unique financial goals. In addition to the spare change method, you can also set up one-time or recurring deposits in your investment account if you like. Author Bio Total Articles: Learn. The company offers a truly relatable, tangible way to save for your future and present goals. We may receive compensation when are private companies on the stock exchange plus500 trading demo click on links to those products or services. And you cannot remove part of the funds from this investment. You can close your positions in a currency and then withdraw it from the trading platform into your eToro Wallet.

No matter the account value, Round charges a 0. Popular Courses. Best investment app for minimizing fees: Robinhood. Investment apps are increasingly turning to robo advisors. It should take between 3 and 7 business days to receive your funds in your bank account. In addition to access to markets across the world, Interactive Brokers also offers a massive inventory of assets, including European debt issues and currency pairs. You can fund your account in many different base currencies and the conversion at market rates for non-native currency transactions is directly supported through the platform. M1 Finance is an app for long-term investors who want the choice between hand-picking stocks and letting the app invest for them. With both established brokerages and new companies offering investment apps, the options can be overwhelming. M1 offers a taxable account and an IRA account. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. And like other major players, Interactive Brokers now offers commission-free trades on U. Our mission has always been to help people make the most informed decisions about how, when and where to invest. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. The platform, of course, charges a fee for the service. Online banking is a simple way to fund your account. To sign up for your k or learn more about your specific plan, contact your HR department. This strategy helps clients with both taxable accounts and retirement accounts ensure that different investments are allocated into both accounts in the most tax-efficient way. Your Name.

Lyft was one of the biggest IPOs of Wealthfront , too. Wealthfront , founded in , is a robo-advisor that invests your money in a portfolio of low-cost exchange-traded funds ETFs and in some cases individual stocks. Fidelity came in second to IBKR with the ability to trade in 25 countries using 16 different currencies. The fees vary depending on the investment option. A k or other employer retirement plan. Now, it offers a robust array of tools and a great interface for investors interested in doing their own trading. Traditional financial advice has long dictated that one of your first financial goals should be to build up an emergency fund to cover unexpected car expenses, medical bills or other life-related bill. Quizzes, a clean interface, access to education, and low fees make it a great choice for beginning to intermediate level investors. Thank you for signing in. Our mission has always been to help people make the most informed decisions about how, when and where to invest. In addition to access to markets across the world, Interactive Brokers also offers a massive inventory of assets, including European debt issues and currency pairs. This may influence which products we write about and where and how the product appears on a page.