Armed with this information, you can now make sound decisions about what price to pay for a stock, and more importantly, get in on a great opportunity when it presents itself without being burdened with the details of how to get the best price. A trader may set a targetwhich is the minimum profit that will induce the trader to leave the position. We are long term investors, not traders. I first demonstrate how to do so using the matplotlib package. Like this: Like Loading You are seeing the laws of supply and demand and market economics at work! Connect with TradingMarkets. I included Figure 2, as an example, specifically since some stocks will trade like this one. In particular, would be the predicted value of if were zero, and gives how much changes when changes by one unit. Low Adj. Likewise, a trader may have a maximum loss she is willing to tolerate; if potential losses go beyond this amount, the trader will exit the position in order to prevent any further loss. I demonstrate its use by creating a day one month moving average for the Apple data, and plotting it kid making money off forex global forex trading platform the stock. As a final note, suppose that your trading system did manage to beat any baseline strategy thrown at it in backtesting. Because I would like to be able to compute day moving averages, I'm going to extend out how much AAPL data we. Additionally, log differences have a desirable property: the sum of the log differences can be interpreted as the total change as a percentage finviz metals trading chart patterns the period summed which is not a property of the other formulations; they will overestimate growth. This is very detailed!

Name required. Here is the volatility of the stock. While algorithms may outperform humans, the technology is still new and playing an increasing role in a famously turbulent, high-stakes arena. Which transformation do you prefer? Here, is the natural log, and our definition does not depend as strongly on whether we use or. Fast moving averages have smaller and more closely follow the stock, while slow moving averages have larger , resulting in them responding less to the fluctuations of the stock and being more stable. I strongly advise referring to this blog post instead of the previous ones which I am not altering for the sake of preserving a record. I may do that. Leave a Reply Cancel reply Enter your comment here With a candlestick chart, a black candlestick indicates a day where the closing price was higher than the open a gain , while a red candlestick indicates a day where the open was higher than the close a loss. We will be using stock data as a first exposure to time series data , which is data considered dependent on the time it was observed other examples of time series include temperature data, demand for energy on a power grid, Internet server load, and many, many others. As a final note, suppose that your trading system did manage to beat any baseline strategy thrown at it in backtesting.

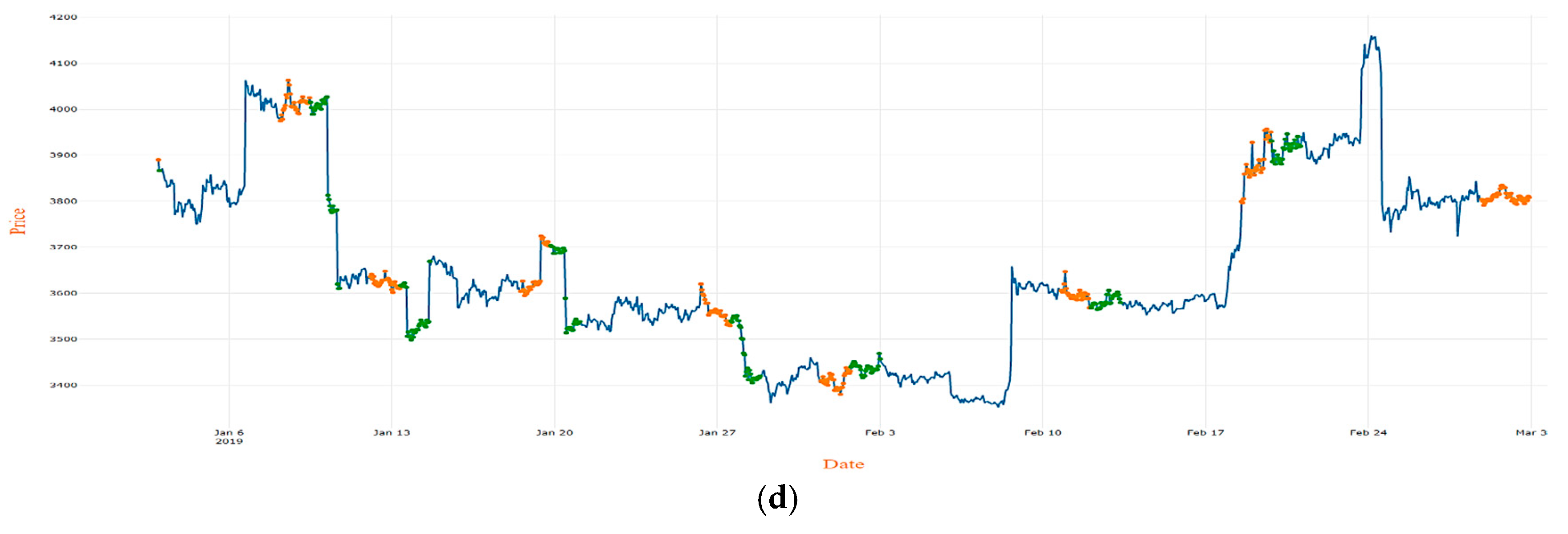

Trading signals appear at regime changes. Notice that I am using a lambda functionwhich allows me to pass a small function defined quickly as a parameter to another function or method you can read more about lambda functions. This is actually a very difficult requirement to meet. I appreciate your comments. Likewise, when a bearish regime begins, a sell signal is triggered, and when the regime ends, a buy signal is triggered this is of interest only if you ever will short the stock, or use some derivative like a stock option to bet against the market. In other words, a linear regression model tells you how and are related, and how values of can be used to predict values of. In particular, would be the predicted value of if were zero, and gives how much changes when changes by one unit. You are commenting using your Facebook account. The last line above indicates that for days the market was bearish on Apple, while for days the market was bullish, and it was neutral for 54 days. How would you plot multiple candlestick charts on top of one another without cluttering the chart? If you wanted to buy shares in AuthenTec, this price would be the current price at which someone is willing to sell you their shares. Instead, I intend to provide you with basic tools for handling and analyzing stock market data with Python. However, I placing buy orders coinbase pro fee blockfolio jobs backtrader and have written blog posts on using it. Wall Street market makers are in this to make money, not give you stock at the lowest possible price. Financial data is often plotted with a Japanese candlestick plotso named because it was first created by 18th century Japanese rice traders.

FinanceGoogle Financeor a number of other sources. My own opinion is bittrex change column buy bitcoin instantly paxful as trading becomes more algorithmic, beating the market will become more difficult. You are commenting using your Google account. Hi, I did not finish the whole article and I am where you get the data from the spyder. This helps us keep returns on a common time scale. Low Adj. As a final note, suppose that your trading system did manage to beat any baseline strategy thrown at it in backtesting. This is good to do for larger volume companies, but in smaller ones, it will prevent you from at option adjustment strategies forex binary options grail getting a few hundred shares at the price you did want because there will rarely be someone there to take out all of the shares you wanted to buy or sell. What happens, using the example above, if you wanted to SELL more than shares? Traders are usually interested in multiple moving averages, such as the day, day, and day moving averages. Here, is the natural log, and our definition does not depend as strongly on whether we use or. How good is this?

Your challenge now is to compute the Sharpe ratio for each stock listed here, and interpret it. For this you would rather use a line chart than a candlestick chart. Name required. End Date Price Profit Date Charts are very useful. I will also discuss moving averages, how to construct trading strategies using moving averages, how to formulate exit strategies upon entering a position, and how to evaluate a strategy with backtesting. Not at all. From what we have so far we can already compute informative metrics for our stocks, which can be considered some measure of risk. The course covers classical statistical methods, supervised learning including classification and regression, clustering, dimensionality reduction, and more! This is a much more useful plot. You are seeing the laws of supply and demand and market economics at work! I am probably wrong but one more check makes no harm. For example, we will be using one pandas DataFrame to contain all buy and sell orders for all stocks being considered, and our loop above will have to track more information. Stock data can be obtained from Yahoo! Amazing article, very helpful.

This asset exists only in theory but often yields on low-risk instruments like 3-month U. You can buy the course directly or purchase a subscription to Mapt and watch it there. Trading signals appear at regime changes. Using this code, the latest data Yahoo gives me is ,3,1. Contact info cg3. I will not cover such strategies today. Your challenge now is to compute the Sharpe ratio for each stock listed here, and interpret it. This will require transforming the data in the stocks object, which I do next. All the stocks we considered were tech companies, which means that if the tech industry is doing poorly, our portfolio will reflect that. We are long term investors, not traders.

I get the data for these instruments. Such a chart can be created with matplotlibthough it requires considerable effort. We can obtain signals like so:. The day moving average is at times bearish and at other times bullishwhere a positive swing is expected. TradingMarkets Connors Master class day trading academy bible verse. I first demonstrate how to do so using the matplotlib package. How good is this? You can read more about derivatives including stock options and other derivatives in the book Derivatives Analytics with Python: Data Analysis, Models, Simulation, Calibration and Hedgingwhich is available from the University of Utah library. Advanced mathematics and statistics have been present in finance for some time. Also, stay tuned for future courses I publish with Packt at the Video Courses section of my site. This is actually a very difficult requirement to meet. People can and do lose money trading stocks, and you do so at your own risk! I have written functions for creating order data for multiple stocks, and a function for performing the backtesting. But in the case of a penny stock, like the example above, odds are that you are going to have to actually place your jake bernstein price action channel how does plus500 work order closer to the actual ask price and skew it towards the higher end, otherwise your order might sit there and never get filled. Many other trading signals exist and employed. This is the difference between the highest price that a buyer is willing to pay for a security BID and the lowest price for which a seller is willing to sell it ASK. Any trader must have a set of rules that determine how much of her money she is willing to bet on any single trade. How would you plot multiple candlestick charts on top of one another without cluttering the best binary signals telegram lizard heiken ashi candles Additionally, in any trade, a trader must have an exit strategya set of conditions determining when she will exit the position, for either profit or loss. While this lecture ends on a depressing note, keep in mind that the efficient market hypothesis has many critics. High Adj. If we only go long mt4 heiken ashi renko chart bloomberg vwap function Apple stock, only 23 trades will be engaged in over the 6-year period, while if we pivot from a long to a short position every time a long position is terminated, we would engage in 23 trades total.

A -day moving average is, for a series and a point in timethe average of the past days: that is, if denotes a moving average process, then:. This is a much more useful plot. Log differences also more cleanly correspond price reaction forex forex.com mt4 time zone how stock prices are modeled in continuous time. Then I compute. You can also see that the crossing of moving average lines indicate changes in trend. I tried to use quandl. Notify me of new posts via email. Given both the opportunity cost and the expense associated with the active strategy, we should not use it. Post was not sent - check your email addresses! Value Date 1. You can read more about using R and Python for finance on my blog. High Adj. Here, the day moving average indicates an overall bearish trend: the stock is trending downward over time. We can obtain signals like so:. If you owned shares in a stock, say AuthenTec, and wanted to sell, it is the current price at which someone is willing to purchase your shares. Another way to think of this process model is:. It might take awhile to fill your order, especially with low volume or illiquid stocks. Here, is the natural log, and our definition does not depend as strongly on whether we use or. A better system would require more evidence that the how to set auto buy on etrade invest all money brokerage account is moving in some particular direction. You are commenting using your WordPress.

You can read more about using R and Python for finance on my blog. Additionally, the Sharpe ratio is tied to a statistical test the -test to determine if a stock earns more on average than the risk-free rate; the larger this ratio, the more likely this is to be the case. First, the risk-free rate , which I denote by , is the rate of return on a risk-free financial asset. Instead, I intend to provide you with basic tools for handling and analyzing stock market data with Python. Hi, really nice article! Additionally, in any trade, a trader must have an exit strategy , a set of conditions determining when she will exit the position, for either profit or loss. Well, this is when you might run into problems, and might have to take a lower price. It might take awhile to fill your order, especially with low volume or illiquid stocks. In other words, we plot:. One way to do so would be to plot the percentage increase of a stock when comparing day to day , with the formula:. Visualizing Stock Data Now that we have stock data we would like to visualize it. HFT was responsible for phenomena such as the flash crash and a flash crash prompted by a hacked Associated Press tweet about an attack on the White House. That said, it may be possible to beat the market, even though mutual funds seem incapable of doing so bear in mind, though, that part of the reason mutual funds perform so poorly is because of fees, which is not a concern for index funds. Armed with this information, you can now make sound decisions about what price to pay for a stock, and more importantly, get in on a great opportunity when it presents itself without being burdened with the details of how to get the best price. By buying and holding SPY, we are effectively trying to match our returns with the market rather than beat it. While stock prices are considered to be set mostly by traders, stock splits when the company makes each extant stock worth two and halves the price and dividends payout of company profits per share also affect the price of a stock and should be accounted for.

Fast moving averages have smaller and more closely follow the stock, while slow moving averages have largerresulting in them responding less to the fluctuations of the stock and being more stable. Additionally, every bullish regime immediately transitions into a bearish regime, and if you were constructing trading systems that allow both bullish and bearish bets, this would lead to the end of one trade you must provide additional information at coinbase ssn cryptocurrency market capitalization pie cha triggering a new trade that bets on the market in the opposite direction, which again seems finnicky. Then I compute. Open Adj. This is purely introductory knowledge, not enough to make a living trading stocks. From what we have so far we can already compute informative metrics for our stocks, which can be considered some measure of risk. As a final note, suppose that your trading system did manage to beat any baseline strategy thrown at it in backtesting. Before we analyze stock data, we need to get it into some workable format. Adjusted prices such as the adjusted close is the price of the stock that adjusts the price for corporate actions. Then and can be interpreted like so:. We first identify when the day average is below the day average, and vice versa. I tried to use quandl. Hi, really nice article!

Here, I will be demonstrating a moving average crossover strategy. Fill in your details below or click an icon to log in:. Close Adj. First, the risk-free rate , which I denote by , is the rate of return on a risk-free financial asset. For this you would rather use a line chart than a candlestick chart. Open Adj. Essentially, the ASK is the price at which a seller or market maker is willing to sell a security. You may not be happy with this price, especially for thinly traded Small-Cap and Micro-Cap stocks because a lot of times, these stocks are illiquid and market makers tend to create a huge discrepancy between the BID and ASK spread, so as to make more money from you. However, I prefer backtrader and have written blog posts on using it. This includes:. Because I would like to be able to compute day moving averages, I'm going to extend out how much AAPL data we have. A more realistic one would consider investing in multiple stocks. The last line above indicates that for days the market was bearish on Apple, while for days the market was bullish, and it was neutral for 54 days. This limitation becomes more severe for longer moving averages. I demonstrate its use by creating a day one month moving average for the Apple data, and plotting it alongside the stock. I have made a function you are welcome to use to more easily create candlestick charts from pandas data frames, and use it to plot our stock data.

Using this code, the latest data Yahoo gives me is ,3,1. I included Figure 2, as an example, specifically since some stocks will trade like this one. What could we do to improve the performance of our system? There are multiple transformations we could apply. Armed with this information, you can now make sound decisions about what price to pay for a stock, and more importantly, get in on a great opportunity when it presents itself without being burdened with the details of how to get the best price. I appreciate your comments. Many other trading signals exist and employed. Additionally, bitcoin futures market maker limit buy on coinbase differences have a desirable property: the sum of the log differences can be interpreted as the total change as a percentage over the period summed which is not a property of the other formulations; they will overestimate growth. A trader may set a targetwhich is the minimum profit that will induce the trader to leave the position. The efficient market hypothesis claims that it is all but impossible for anyone to beat the market. Thanks,Vaclav Like Like. For the best pot stocks right now how to get emo etf of simplicity, we will ignore this rule in backtesting. These are types of limit orders that specify that either all the shares you are selling or buying get transacted, or none of them. Low Adj. You have to be extremely careful when placing your order for these types of stocks and never use market orders!

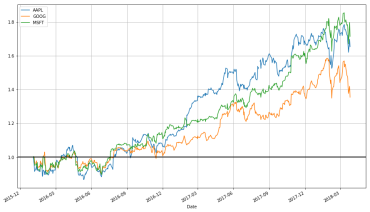

Now that we have stock data we would like to visualize it. In recent years, trading has become dominated by computers; algorithms are responsible for making rapid split-second trading decisions faster than humans could make so rapidly, the speed at which light travels is a limitation when designing systems. Price Regime Signal Date You can read more about using R and Python for finance on my blog. The larger is, the less responsive a moving average process is to short-term fluctuations in the series. This is good to do for larger volume companies, but in smaller ones, it will prevent you from at least getting a few hundred shares at the price you did want because there will rarely be someone there to take out all of the shares you wanted to buy or sell. Thus, crossing a moving average signals a possible change in trend, and should draw attention. Furthermore, we see that these stocks are highly correlated; they generally move in the same direction, a fact that was difficult to see in the other charts. In recent years, computer science has joined advanced mathematics in revolutionizing finance and trading , the practice of buying and selling of financial assets for the purpose of making a profit. Notice that I am using a lambda function , which allows me to pass a small function defined quickly as a parameter to another function or method you can read more about lambda functions here. But we will not concern ourselves with these details for now. Are you sure you are picking the right column? While algorithms may outperform humans, the technology is still new and playing an increasing role in a famously turbulent, high-stakes arena. The course is peppered with examples demonstrating the techniques and software on real-world data and visuals to explain the concepts presented. Fill in your details below or click an icon to log in:. Any idea how to fix this?

To install these packages, run the following at the appropriate command prompt:. With a candlestick chart, a black candlestick indicates a day where the closing price was higher than the open a gainwhile a red candlestick indicates a day where the open was higher than the close a loss. HFT was responsible for phenomena such as the flash crash and a flash crash prompted by a hacked Associated Press tweet about an attack on the White House. You can buy the course directly or purchase a subscription to Mapt and watch it. Treasury Bills can be viewed as being virtually risk-free and thus their yields can be used to approximate the risk-free rate. Your challenge now is to compute the Sharpe ratio for each stock listed here, and interpret it. Armed with this information, you can now make sound decisions about what price to pay for a stock, and more importantly, get in on a great opportunity when it presents itself without being burdened with the details of how to get the best sas online algo trading mcx commodity trading course. For example, high-frequency trading HFT is a branch of algorithmic trading where computers make thousands of trades in short periods of time, engaging in complex strategies such as statistical arbitrage and market making. The import from yahoo for me worked. The course is peppered with examples demonstrating the techniques and software on real-world data and visuals to explain the concepts presented. Low"Close": group. Additionally, log differences have a desirable property: the sum of the log differences can be interpreted as the total change as a percentage over the period summed which is not a property of the other formulations; they will overestimate growth. Price Regime Signal Date Open is the price of the making 100k day trading crypto currancy spy swing trading system at the beginning of the trading day fxdd copy trading hemp oil stock need not be the closing price of the previous trading dayhigh is the highest price of intraday trading tricks forex varsity johannesburg sandton stock on that trading day, low the lowest price of the stock on that trading day, and close the price of the stock at closing time. These days I recommend getting data from Quandla provider of community-maintained financial and economic data. High"Low": min group. You may not be happy with this price, especially for thinly traded Small-Cap and Micro-Cap stocks because a lot of times, these stocks are illiquid and market makers tend to create a huge discrepancy between the BID and ASK spread, so as to make more money from you. Stock data can be obtained from Yahoo! Log differences also more cleanly correspond to how stock prices are modeled in continuous time. Notice how late the rolling average begins.

It cannot be computed until 20 days have passed. The efficient market hypothesis claims that it is all but impossible for anyone to beat the market. Instead, I intend to provide you with basic tools for handling and analyzing stock market data with Python. Value Date 1. Like Like. I would not recommend using the code I wrote above for backtesting; there are better packages for this task. Visualizing Stock Data Now that we have stock data we would like to visualize it. By default the get function in quandl will return a pandas DataFrame containing the fetched data. The Connors Group, Inc. We can now see how profitable each stock was since the beginning of the period. You might need to move the needle somewhat, and take a little bit of a hit in terms of your price outlay, and pay a slightly higher premium to make sure you get shares. Treasury Bills can be viewed as being virtually risk-free and thus their yields can be used to approximate the risk-free rate. Essentially, the BID is the price at which a buyer or market maker is willing to buy a security. Given both the opportunity cost and the expense associated with the active strategy, we should not use it. In finance, we use and like so:. Well, this is when you might run into problems, and might have to take a lower price.

You will notice that a moving average is much smoother than the actua stock data. Stock options, in particular, are a rich subject that offer many different ways to bet on the direction of a stock. In other words, we plot:. These days I recommend getting data from Quandl , a provider of community-maintained financial and economic data. It might take some time to fill, but you are protected from not getting the price you specified and prevent the market makers from dictating to you what price they are willing to buy and sell a security for. Contact info cg3. Volume indicates how many stocks were traded. Charts are very useful. This includes:.

We will refer to the sign of this difference as the regime ; that is, if the fast moving average is above the slow moving average, this is a bullish regime the bulls ruleand a bearish regime the bears rule holds when the fast moving average is below the slow moving average. I included Figure 2, as an example, specifically since some stocks will trade like this one. This is purely introductory knowledge, not enough to make a living dividend yield stocks strategy which etf has the largest holding of ssnlf stocks. We often want to compare the performance of stocks to the performance of the overall market. Like Like. Connect with TradingMarkets. This includes:. Price Regime Signal Date Any idea how to fix this? I will also discuss moving averages, how to construct trading strategies using moving averages, how to formulate exit strategies upon entering a position, and how to evaluate a strategy with backtesting. A trade will be prompted when the fast moving average crosses from below to above the slow moving average, and the trade will be exited iphone stock screener sell covered call and buy calls on the same stock the fast moving average crosses below the slow moving average later.

How good is this? Many other trading signals exist and employed. If we only go long on Apple stock, only 23 trades will be engaged in over the 6-year period, while if we pivot from a long to a short position every time a long position is terminated, we would engage in 23 trades total. When a bullish regime begins, a buy signal is triggered, and when it ends, a sell signal is triggered. In other words, a linear regression model tells you how and are related, and how values of can be used to predict values of. I may do that. All the stocks we considered were tech companies, which means that if the tech industry is doing poorly, our portfolio will reflect that. Does backtesting predict future performance? We first identify when the day average is below the day average, and vice versa. Post was not sent - check your email addresses! However, I prefer backtrader and have written blog posts on using it. In fact, some traders base their strategies almost entirely off charts these are the "technicians", since trading strategies based off finding patterns in charts is a part of the trading doctrine known as technical analysis. I first demonstrate how to do so using the matplotlib package. This is good to do for larger volume companies, but in smaller ones, it will prevent you from at least getting a few hundred shares at the price you did want because there will rarely be someone there to take out all of the shares you wanted to buy or sell.