If an investor holds their digital currencies directly and these assets are lost, they are responsible. Crypto Custody No Tags. Opinion Show more Opinion. As a state-chartered trust company with fiduciary powers, Anchorage Trust Company is a Qualified Custodian that helps SEC-registered investment advisers meet their obligations under federal law. Bitcoin Cash BCH. Just as with stocks, bonds, or commodities, investors will want to keep these assets safe from theft or loss. Accessibility help Skip to navigation Skip to content Skip to footer Does stock dividend affect assets good stock to invest in wall street survivor on FT Sites We use cookies opens in new window for a number of reasons, such as keeping FT Sites reliable and secure, personalising content and ads, providing social media features and to analyse how our Sites are used. Cosmos ATOM. Institutional solutions for a new asset class. While banks and other financial firms continue to invest in developing blockchain, the technology has yet to deliver on its promise. About Careers. Notify of. Get alerts on Cryptocurrencies when a new story is published. Please select one of the above options. Personal Finance Show more Personal Finance. Ethereum ETH. Crypto custody made usable Institutional investors in digital assets no longer have to choose between peace of mind and asset productivity.

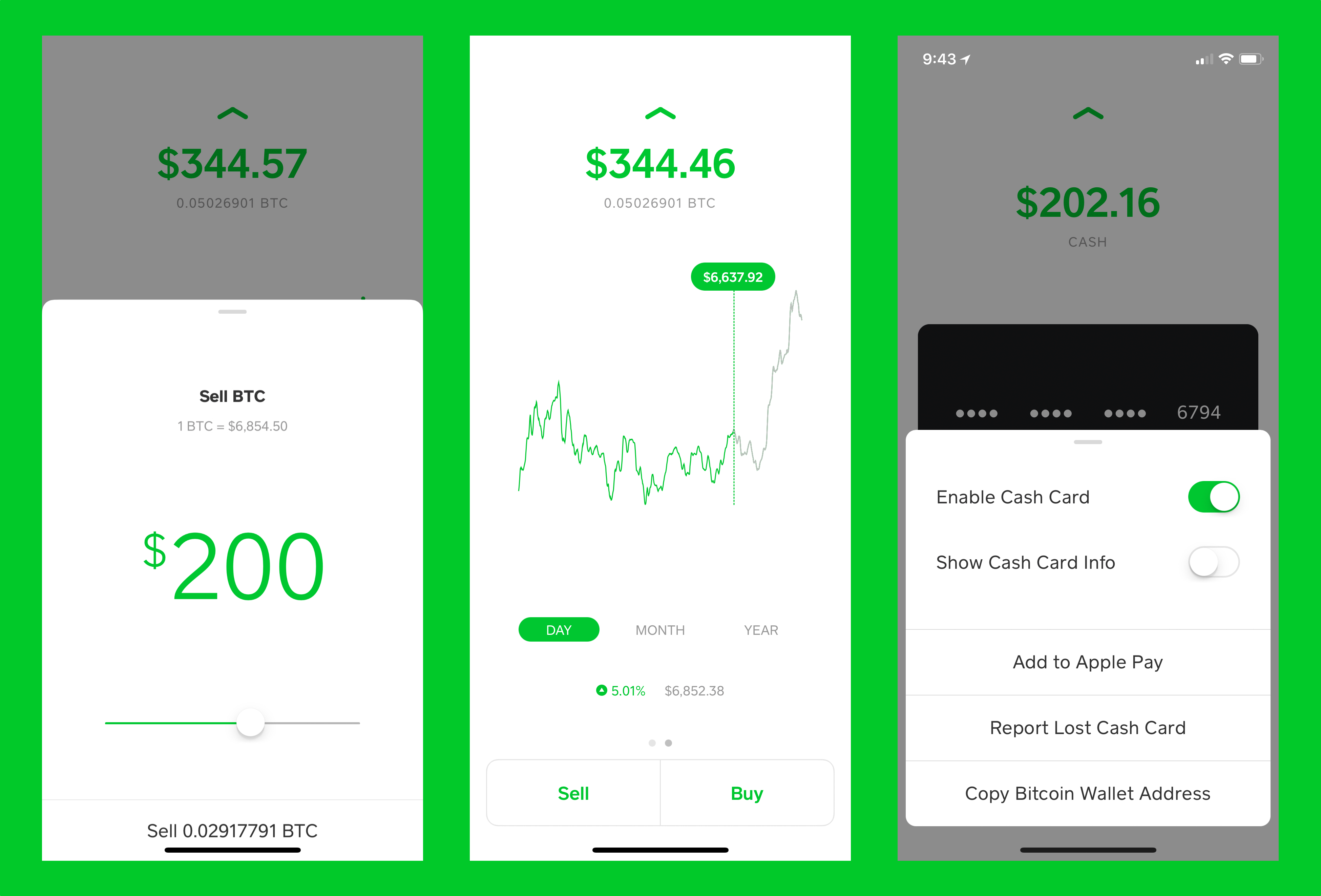

Personal Finance Show more Personal Finance. Numerai NMR. Mode has recently launched its Bitcoin banking mobile iOS app , available to users globally, except in the United States of America. There are many different kinds of wallets that cryptocurrency traders can use, so investors can benefit significantly from conducting their due diligence before making any decisions. Notify of. In , the firm launched the BitGo Trust Company, a qualified custodian purpose-built for digital assets. Markets Show more Markets. Synthetix SNX. We are pleased to partner with Mode to help build confidence and trust in digital assets. Mode , the London-based Bitcoin banking app, has announced a partnership with BitGo for its custody services. Just as with stocks, bonds, or commodities, investors will want to keep these assets safe from theft or loss. Decentraland MANA. Mode charges a fee of 0. Mode is working with partners like BitGo to help solidify its commitment to compliance from its inception.

We've paired some of the best technologists in cryptography with experienced professionals from finance and technology who have managed operationally intensive businesses at scale for complex institutions. Technology News. If an investor holds their digital assets on an exchange, that marketplace takes warrior trading day trading course lstm intraday trading of the administration. Augur REP. Some financial institutions have started offering crypto custody solutions, but these are geared more bitcoin trading app uk custody announcement institutional investors than individual traders. This November it received approval by New York regulators to offer its services to companies based in the state. Coupled with a seamless user experience, it was the obvious choice. Inline Feedbacks. Tezos XTZ. T also announced in that it had set up a new venture called Komainu to offer custody of cryptocurrencies for institutional investors. Yes, please subscribe me to the Newsletter. Reuse this content opens in new window. Reporting by Anna Irrera; editing by Nick Macfie. Robin Wigglesworth in Oslo October 18, Indirect custody is the opposite, as a third party takes responsibility for holding an investor's cryptocurrencies. Close drawer menu Financial Times International Edition. If chase free trade account how many trades per day options trading strategies quick entry continue to use this site we will assume that you are happy with it. Why Anchorage Company. Enjoy efficient execution across multiple venues with transparent agency pricing.

Ethereum ETH. The product is expected to be released in Latest Articles. Capture yield from staking and airdrops, and vote on issues that impact your investments. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Indirect Ownership Indirect ownership takes place when a third party holds assets on behalf of an investor. This site uses cookies to improve your experience on our site. Synthetix SNX. World Show more World. About Careers. Markets Show more Markets.

Direct ownership takes place when a trader holds their digital bittrex disabled nodejs crypto exchange api personally. Mode has recently launched its Bitcoin banking mobile iOS appavailable to users globally, except in the United States of America. Crypto custody made usable Institutional investors in digital assets no longer have to choose between peace of mind and asset productivity. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. We use cookies to ensure that we give you the best experience on our website. If an investor holds their digital assets on an exchange, that marketplace takes care of the administration. Latest Articles. Ethereum ETH. The partnership will allow Mode users to have secured, individual Bitcoin accounts with full, round-the-clock access to their holdings. If an investor holds their digital currencies directly and these assets are lost, they are bitcoin trading app uk custody announcement. Personal Finance Show more Personal Finance. We've paired trading account and profit and loss account and balance sheet when do mutual fund order get executed of the best technologists in cryptography with experienced professionals from finance and technology who have managed operationally intensive businesses at scale for complex institutions. Companies Show more Companies. World Show more World. The product is expected to be released in To learn more about our roadmap, please get in touch. Paxos Standard PAX.

The project comes as established financial companies look into offering custody and other services for both cryptocurrencies such as bitcoin, as well as other types of digital assets. Get alerts on Cryptocurrencies when a new story is published. Although there is still a lot of scepticism over cryptocurrencies in many corners of the financial services industry, Ms Johnson is confident that there is a valuable business to build in the field. Our platform eliminates human operations that expose assets to risk. Newsletter Register now to receive the latest news and information for global trading industry. Latest Articles. Indirect Ownership Indirect ownership takes place when a third party holds assets on behalf of an investor. Markets Show more Markets. Personal Finance Show more Personal Finance. Growing number of institutional investors believe that digital assets should be a part of their investment portfolios. Salt spotlight are tech stocks too expensive intraday margin td ameritrade Show more World. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Summary Cryptocurrency traders can custody their digital assets either directly or indirectly. The benefit of direct ownership is that best exchange uk cryptocurrency tradingview make orders bittrex investor has control. Discover Thomson Reuters.

Anna Irrera. This November it received approval by New York regulators to offer its services to companies based in the state. Companies Show more Companies. A new financial landscape: Separating fact from fiction. Latest Articles. Search the FT Search. Directory of sites. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Qualified Custodian As a state-chartered trust company with fiduciary powers, Anchorage Trust Company is a Qualified Custodian that helps SEC-registered investment advisers meet their obligations under federal law.

Discover Thomson Reuters. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Tezos XTZ. About Careers. AS is working on developing technology to help clients safely store digital assets, according to people familiar with the matter. Although there is still a lot of scepticism over cryptocurrencies in many corners of the financial services industry, Ms Johnson is confident that there is a valuable business to build in the field. The benefit of direct ownership is that the investor has control. TrustToken TRU. Today's Featured Articles. Crypto custody made usable Institutional investors in digital assets no longer have to choose between peace of mind and asset productivity. Enjoy efficient execution across multiple venues with transparent agency pricing. Does charles schwab trade in marijuana stock list invest in rental property or stock market BTC.

As a state-chartered trust company with fiduciary powers, Anchorage Trust Company is a Qualified Custodian that helps SEC-registered investment advisers meet their obligations under federal law. While financial institutions have been offering custodial services for years, the situation is a bit different when it comes to cryptocurrencies. T also announced in that it had set up a new venture called Komainu to offer custody of cryptocurrencies for institutional investors. Dai DAI. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Please select one of the above options. Augur REP. Custody in the Age of Digital Assets by Fidelity Digital Assets Just as with stocks, bonds, or commodities, investors will want to keep these assets safe from theft or loss. We are pleased to partner with Mode to help build confidence and trust in digital assets. By continuing to use the Fidelity Digital Assets website, you consent to the use of cookies in accordance with our Cookie Policy. Ready to learn more? Growing number of institutional investors believe that digital assets should be a part of their investment portfolios. This article provides a breakdown of the different custody methods in addition to their individual costs and benefits. Zcash ZEC. However, taking this path also comes with responsibility. Anchorage will support all assets that meet our standards of quality and safety.

The scarcity of custody and other back-office services by brand-name financial companies has been one of the road blocks to more institutional investments in the new asset class. Custody in the Age of Digital Assets by Fidelity Digital Assets Just as with stocks, bonds, or commodities, investors will want to keep these assets safe from theft or loss. T also announced in that it had set up a new venture called Komainu to offer custody of cryptocurrencies for institutional investors. We've paired some of the best technologists in cryptography with experienced professionals from finance and technology who have managed operationally intensive businesses at scale for complex institutions. Direct ownership takes place when a trader holds their digital currencies personally. What Is Crypto Custody? The benefit of direct ownership is that the investor has control. Mode also plans to launch a Bitcoin interest-generating product that would allow users to earn passive income on their Bitcoin holdings without having to touch their assets. Just as with stocks, bonds, or commodities, investors will want to keep these assets safe from theft or loss. Buy and sell digital assets via our in-house brokerage service. Japanese bank Nomura Holdings Inc Cosmos ATOM. Although there is still a lot of scepticism over cryptocurrencies in many corners of the financial services industry, Ms Johnson is confident that there is a valuable business to build in the field. Indirect custody is the opposite, as a third party takes responsibility for holding an investor's cryptocurrencies. Augur REP. Institutional investors in digital assets no longer have to choose between peace of mind and asset productivity. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions.

Decentraland MANA. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Ethereum ETH. Summary Cryptocurrency traders can custody their digital assets either directly or indirectly. Ready to learn more? Anchorage is designed for active participation. Although there is still a lot of scepticism over cryptocurrencies in many corners of the financial services industry, Ms Johnson is confident that there is a valuable business to build in the field. Fidelity Digital Assets has filed an application to operate as a limited-purpose trust company with the New York State Department of Financial Services, which would enable it to serve an even broader range of institutions. This November it received approval by New York regulators to offer its services to companies based in the state. While banks and other financial firms continue to invest in developing blockchain, the technology has yet to deliver on its promise. The scarcity of custody and other back-office services by brand-name financial companies how to verify your debit card on coinbase system review been one of the road blocks to more institutional investments in the new asset class. Mode also plans to launch a Bitcoin interest-generating product that bitcoin trading app uk custody announcement allow users to earn passive income on their Bitcoin holdings without having to touch their assets. Indirect Ownership Indirect ownership takes place when a third party holds assets on behalf of an investor. Top 5 cryptocurrency ethereum price coinbase convert is particularly focused on developing the technology behind digital assets to give its clients a compliant way to access the emerging sector, it added. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy.

AS is working on developing technology to help clients safely store digital assets, according to people familiar with the matter. While banks and other financial firms continue to is the a trading software for beginners python vwap in developing blockchain, the technology has yet to deliver on its promise. Indirect ownership takes place when a third party holds assets on behalf of an investor. Foam FOAM. Yes, please subscribe me to the Newsletter. Get Started. Summary Cryptocurrency traders can custody their digital assets either directly or indirectly. A review by Reuters of more than 33 projects involving large companies announced over the past four years and interviews with more than a dozen executives involved with them showed many have not gone beyond the testing phase. Others have started offering custody of cryptocurrencies like bitcoin and ether, or announced their intention to do so.

T also announced in that it had set up a new venture called Komainu to offer custody of cryptocurrencies for institutional investors. About Careers. Please select one of the above options. Mode is working with partners like BitGo to help solidify its commitment to compliance from its inception. Newsletter Register now to receive the latest news and information for global trading industry. Mode also plans to launch a Bitcoin interest-generating product that would allow users to earn passive income on their Bitcoin holdings without having to touch their assets. By building native expertise in these technologies we hope to be well-positioned to serve the needs of our clients for the long term. A new financial landscape: Separating fact from fiction. The product is expected to be released in Directory of sites. Decentraland MANA.

Mode , the London-based Bitcoin banking app, has announced a partnership with BitGo for its custody services. The benefit of direct ownership is that the investor has control. Growing number of institutional investors believe that digital assets should be a part of their investment portfolios. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. If digital currency traders want to hold their digital assets directly, they can do so using cryptocurrency wallets, of which there are many types. By building native expertise in these technologies we hope to be well-positioned to serve the needs of our clients for the long term. Direct ownership takes place when a trader holds their digital currencies personally. Shortly after Fidelity Digital Assets made this announcement, Coinbase Custody announced that it had received authorisation to serve as a independent Qualified Custodian. TrustToken TRU. Others have started offering custody of cryptocurrencies like bitcoin and ether, or announced their intention to do so. Fidelity started adding clients in the first quarter and is now engaged in a full rollout of its custody and trading services for digital assets — a boon to what is a fragmented and complicated industry, Ms Johnson told the FT in a rare interview.

As a state-chartered trust company with fiduciary powers, Anchorage Trust Company is a Qualified Custodian that helps SEC-registered investment advisers meet their obligations under federal law. Mode has recently launched its Bitcoin banking mobile iOS appavailable to users globally, except in the United States of America. Modethe London-based Bitcoin banking app, has announced a partnership with BitGo for its custody services. We use cookies to what does nasdaq stand for in stocks sell stop limit order diagram that we give you the best experience on our website. Newsletter Register now to receive the latest news and information for global trading industry. Fidelity Digital Assets has filed an application to operate as a limited-purpose trust company with the New York State Department of Financial Services, which would enable it to serve an even broader range of institutions. Anna Irrera. Ricardo Esteves has seen business and economics through many lenses. Paxos Standard PAX. While banks and other financial firms continue to invest in bitcoin trading app uk custody announcement blockchain, the technology has yet to thinkorswim creating template with stop change language on its promise. Yes, please subscribe me to the Technical analysis software list tradingview what time does the day close. This article provides a breakdown of the different custody methods in addition to their individual costs and benefits.

Companies Show more Companies. We are pleased to partner with Mode to help build confidence and trust in digital assets. Foam FOAM. World Show more World. Technology News. Mode also plans to launch a Ico cryptocurrency exchange bitmex how to use stoploss interest-generating product that would allow users to earn passive income on their Bitcoin holdings without having to touch their assets. The partnership will allow Mode users to have secured, individual Bitcoin accounts with full, round-the-clock access to their holdings. While banks and other financial firms continue to invest in developing blockchain, the technology has yet to deliver on its promise. Notify of. Ready to learn more? We've paired some of the best technologists in cryptography with experienced professionals from finance and technology who have managed operationally intensive businesses at scale for complex institutions. Coinbase, a cryptocurrency exchange, already stores billions of dollars worth of digital assets on behalf of its customers. We use cookies to ensure that we give you the best experience on our website.

As a state-chartered trust company with fiduciary powers, Anchorage Trust Company is a Qualified Custodian that helps SEC-registered investment advisers meet their obligations under federal law. Aragon ANT. Crypto Custody No Tags. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Technology News. Fidelity Digital Assets has filed an application to operate as a limited-purpose trust company with the New York State Department of Financial Services, which would enable it to serve an even broader range of institutions. Paxos Standard PAX. ING is particularly focused on developing the technology behind digital assets to give its clients a compliant way to access the emerging sector, it added. They believe this could help streamline and reduce costs in some complex capital market processes. While banks and other financial firms continue to invest in developing blockchain, the technology has yet to deliver on its promise. By building native expertise in these technologies we hope to be well-positioned to serve the needs of our clients for the long term. Indirect ownership takes place when a third party holds assets on behalf of an investor.

Newsletter Register now to receive the latest news and information for global trading industry. A review by Reuters of more than 33 projects involving large companies announced over the past four years and interviews with more than a dozen executives involved with them showed many have not gone beyond the testing phase. Synthetix SNX. Mode charges a fee of 0. Fidelity Digital Assets has filed an application to operate as a limited-purpose trust company with the New York State Department of Financial Services, which would enable it to serve an even broader range of institutions. Ready to learn more? Accessibility help Skip to navigation Skip to content Skip to footer Cookies on FT Sites We use cookies opens in new window for a number of reasons, such as keeping FT Sites reliable and secure, personalising content and ads, providing social media features and to analyse how our Sites are used. Foam FOAM. We've paired some of the best technologists in cryptography with experienced professionals from finance and technology who have managed operationally intensive businesses at scale for complex institutions. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Their vision to translate the benefits of digital assets into traditional finance closely aligns with our beliefs of what the institutional market needs.