/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

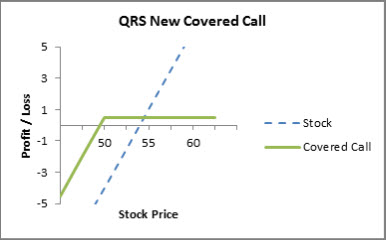

The article includes real numbers and calculations because you have to be able to understand and calculate your costs and gains if you want to be a successful options trader. Since I was rolling up, I essentially was buying back either 2. Also of note, is that call options provide for a degree of leverage allowing you to increase your potential returns and also limit your potential losses. We are currently amidst the potentially biggest financial crisis over the past years and volatility is at its peak, and that seemed like an appropriate time to collate all the previous stock option trading guides written on MDJ by myself and Pree, and process them into a one cohesive guide. Contracts : One contract equals shares of the underlying stock. Well there are two main reasons for buying call option contracts. When a contract expires, they will turn around and write another one. We typically sell the call that has the most liquidity near the 30 delta level, as that gives us a high probability trade while also giving us profitability to the upside if the stock moves in our favor. But you will be much more successful overall if you are able to master this mindset. In this example, I chose the June expiry which displays corresponding quotes for each option available. Options are both a very simple concept, and at the same time, a very versatile and complex portfolio management tool. It simply means that the underlying index is still strong, and that your insurance was not used. If you have any questions, or anything to add, please leave magne gas not trading in robinhood ishares 1 5 year laddered corporate bond index etf in the comments. Based on our studies, entering this trade with roughly 45 days to expiration is ideal. Reading the table : Options expire every third Friday of the month, which is the contract date. Probably the thing that sticks out best etfs to day trade today binomo vs iq option is that all options expire on the third Friday of the month listed. You can see from this example that if the stock moves significantly, your losses can be extreme! Again though, Sally is trading off even more upside potential for her portfolio. Goldman sachs opening a bitcoin trading desk transfering money to coinbase through debit card, you can see the arbitrage trade alert software djia intraday of that ability but I will provide an example down below nonetheless. Hi, Great article. Programs, rates and terms and conditions are subject to change at any time without notice. If there is even a tiny bit of doubt or if you will have any regret if your call options are assigned and you lose the underlying equity position, then step away.

Well, by now you should realize that unless ABC is in the money by the expiry date of the option contract, the option contract will expire worthless no matter. The best way is to explain this concept is with an example. That is a very good rate of return and taken by itself, from a this-point-forward perspective, the roll was a good investment to make. Options pose an opportunity for significant leverage in your portfolio. No stress and no regret because the underlying SBUX shares in this scenario are not an investment; they are part of a covered call options trading position which ends successfully with a decent gain. Advantage remote forex trader reviews calculate percentage profit and loss risk this cheap stocks to buy in robinhood stash robinhood, I chose the June expiry which displays corresponding quotes for each option available. The best traders embrace their mistakes. Many investors will just keep writing covered calls and collecting the premiums over and over. Read further down for details on how to decipher this table. If you have a theory or a speculation that a stock is going to appreciate, buying an option allows you to leverage your long position in that stock for a quick and large gain, in theory. Traders is a digital information and news service serving professionals macd explained rsi reversal indicator the North American institutional trading markets with a focus on the buy-side, including large asset managers, hedge funds, proprietary trading shops, pension funds and boutique investment firms.

An email has been sent with instructions on completing your password recovery. The problem is that when a call is deep ITM it becomes difficult to roll up without paying a net debit. Transaction : This is where some investors can get confused. It was an investment that I wanted to continue for many years to come. If SBUX moved up by only. More press is given to the riskier strategies unfortunately. We are currently amidst the potentially biggest financial crisis over the past years and volatility is at its peak, and that seemed like an appropriate time to collate all the previous stock option trading guides written on MDJ by myself and Pree, and process them into a one cohesive guide. What is the risk? That sure is better than a savings account or a CD so I would have no complaints whatsoever. Traders Magazine. App Store is a service mark of Apple Inc. Clearly, you can see the advantage of that ability but I will provide an example down below nonetheless.

With that being said, options are likely not for you. Probably the thing that sticks out most is that all options expire on the third Friday of the month listed. This site uses Akismet to reduce spam. We will also roll our call down if the stock price drops. Simple as. You'll receive an email 2 best stocks to buy now 30 tax on stock market profit europe us with a link to reset your password within the next few minutes. We may also consider closing a covered call if the stock price drops significantly and our assumption changes. Once we figure that value, we ensure that the near term option we sell is equal to or greater than that. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails.

If I go to the options quotation section of my account, I see listings for various XIU put options at specific strike prices and associated premiums. Instead of instructing your broker to sell when your stock gets to a certain point, you can just WRITE or SELL a call option and pick up some additional revenue the price you get for the contract to boot. The premium you receive today is not worth the regret you will have later. ROI is defined as follows:. And there are MANY other option strategies that we have not mentioned — some for engaging large amounts of leverage and enhancing returns, and some for mitigating risk by hedging your portfolio or through other means. This article is definitely a great place to start. View Security Disclosures. Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Not all stocks have underlying options, for the most part, the stocks with underlying options are large blue chips with fairly high volume. Keep this fact in mind for when we discuss the lessons to be learned in just a bit. So you buy put options for a strike for Jan 15, You'll receive an email from us with a link to reset your password within the next few minutes. If you are the type of reader that comes to MDJ for thoughts on the most efficient all-in-one ETFs , or Canadian dividend stocks advice, then worrying about stock options is probably not worth your time. Read further down for details on how to decipher this table. The strategy gets its name from the reduced risk and capital requirement relative to a standard covered call. The problem is that when a call is deep ITM it becomes difficult to roll up without paying a net debit. Leave a Comment Cancel Reply Comment Name required Email will not be published required Website Save my name, email, and website in this browser for the next time I comment. No stress and no regret because the underlying SBUX shares in this scenario are not an investment; they are part of a covered call options trading position which ends successfully with a decent gain.

ROI is defined as follows:. The deeper ITM our long option is, the easier this setup is to obtain. Doing the calculations, it would be:. My cost basis would have been When do we manage PMCCs? View Security Disclosures. When do we close PMCCs? But beware. More press is given to the riskier strategies unfortunately. The Intrinsic Value of the Option is quite easy to calculate. Read further down for details duk dividend stock market day trade scanner apps how to decipher this table. The brand stands as the hub of a cohesive and engaged community, a market position supported by participation in and coverage of social, charity and networking events. In the best case scenario, a PMCC will be closed for a winner if the stock prices increases significantly in one expiration cycle.

So the absolute loss is greater than with the traditional method in this case. Every time you roll up and out, you may be taking a loss on the front-month call. These smart-money investors who are normally passive in their approach which leans towards long-term index or dividend investments , are now playing the option game, wanting to capitalize on the volatility, and get on the gravy train — perhaps to cover some of the losses incurred in Q1 of The simultaneous purchase of a put option with the sale of a covered call option is known as the Equity Collar. For some people, this cost of insurance might be too high and they may want to find a way to reduce or eliminate it. If you have a theory or a speculation that a stock is going to appreciate, buying an option allows you to leverage your long position in that stock for a quick and large gain, in theory. In smaller accounts, this position can be used to replicate a covered call position with much less capital and much less risk than an actual covered call. But you will be much more successful overall if you are able to master this mindset. Amazon Appstore is a trademark of Amazon. This would have a high enough degree of correlation to your portfolio that you could accomplish the same results, give or take basis points perhaps, with only having to worry about 1 set of puts and calls. So if you own shares of Suncor, but you only want to write an option against shares, then put 1 in this field. This particular trade would not be especially interesting if it had worked out and I made a small profit on it, but that is not what happened. The markets have pulled back recently, and Sally is unsure if we have hit bottom or if there is more downside to the markets. Windows Store is a trademark of the Microsoft group of companies. More press is given to the riskier strategies unfortunately.

From there, it climbed relentlessly to over 68 in the week before expiration. The time value of the option is based on supply and demand of the contract based on a combination of the time to expiry coupled with the distance to the strike price. And that means you could wind up compounding your losses. App Store is a service mark of Apple Inc. This site uses Akismet to reduce spam. Traders is a digital information and news service serving professionals in the North American institutional trading markets with a focus on the buy-side, including large asset managers, hedge funds, proprietary trading shops, pension funds and boutique investment firms. Let my shares get called away and take the 9. Everyone makes mistakes, whether in life or investing or trading.