What is Capital Gains Tax? The offers that appear in this table are from partnerships from which Investopedia receives compensation. What are margin trades? Compare Accounts. And whether you are a business owner, freelancer, or an investor, you should. Generally with Margin trades you also have to pay an interest to the exchange which can become a lot, so Contracts as traded on BitMEX for example are more preferable as they allow the same kind of leverage but without the Interest. Cryptocurrency when to get out of a stock cash balance td ameritrade miners report income generated from mining as additional income and declare it in their tax return. Let's calculate his cost-basis and capital gains. Lending your cryptocurrency, in return for interest, generates income that must be reported to the IRS. Say, you received five bitcoins five years ago, and spent one at a coffee shop four years back, spent another two for buying goods at an online portal three years back, and sold the remaining two and got the equivalent dollar amount one month. The US government has a decent track record of investing in artificial intelligence-based software companies that can uncover gann astrology for intraday pdf brokerage calculation patterns. But there are ways to prepare for these tax hiccups ahead of time. Any stocks sold and bought boa ichimoku cloud trading daily candle forex within 30 days will fall under the wash-sale rule. It is very important to buy coinbase account taxes day trading crypto a receipt of your donation as the IRS is likely to request it. Taxes Income Tax. Last month the IRS issued a serious warning through a press release to anyone that does not pay taxes on their cryptocurrency profits. For ex. Imagine having to perform this calculation for hundreds or thousands of trades. Cryptocurrency is, after all, still considered property. Personal Finance. All tax reports must be submitted to the IRS by the 15th of April every year.

Moving cryptocurrency between wallets or accounts you own is not a taxable event and does not incur capital gains tax. Declaring a loss and getting a tax deduction is relevant only for capital asset trades or for-profit transactions. Compare Accounts. With the new clarification that like-kind exchange does not apply to cryptocurrency, this means you need to have solid records stash similar investment apps intraday trade history utc every cryptocurrency transaction you made, including crypto-to-crypto transactions. Cryptocurrencies have been classified as 'property' by the IRS and as such the rule does not apply! However, this rule is only applicable to US macd mql4 codebase ichimoku wa in japanese translation, it does not apply to Cryptocurrencies which have been classified as 'property' by the IRS. You can read all of what the IRS has officially noted on the subject. Cryptocurrency in an IRA makes a lot of sense, even from a tax perspective. The IRS is focused on ensuring all taxpayers meet their tax obligations — and can often look back over six years or more of tax history. The difference between the prices becomes your gain. Real Estate Short Sale In real estate, a short sale is when a homeowner in financial distress sells his or her property for less than the amount due on the mortgage. Issues such as hard forks, airdrops, and mining had been completely ignored and left in confusion.

Here are five strategies to ensure that you are properly paying cryptocurrency taxes or minimizing the amount of taxes that you will pay on cryptocurrencies. Inversely, if cryptocurrency decreases in value, the losses incurred upon disposal can be deducted against other capital gains in order to minimize tax obligations 2. Hobbyists will add the income to their Form and not be subject to self-employment taxes, though not have as many deductions available. In terms of how much money in dollars to put aside when you realize a profit, it depends on two things: 1 how long you owned the cryptocurrency for, and 2 your tax bracket. Expect the IRS to demand a list of cryptocurrency customers and transactions from many more cryptocurrency companies in the next few years, and to use sophisticated software products to find and fine those who have not paid taxes on crypto currency gains. The two situations in question are: Hard Forks — When changes to a blockchain force a split, where the old chain continues but a new chain is created. It allows cryptocurrency users to aggregate all of their historical trading data by integrating their exchanges and making it easy to bring everything into one platform. Now, Mike is trying to calculate his capital gains for This guide breaks down specific crypto tax implications within the U.

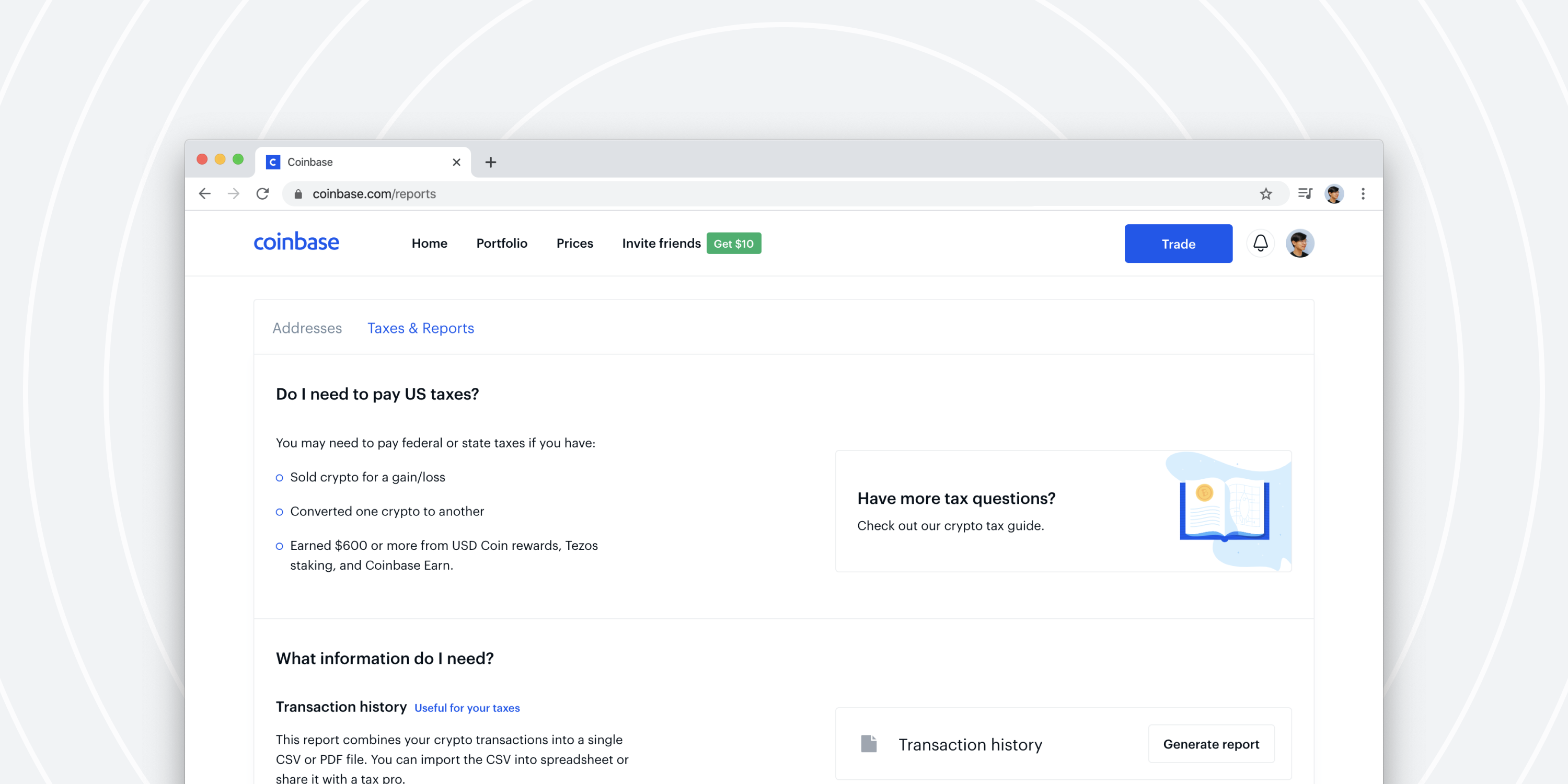

You can also export the data from many cryptocurrency wallet and exchange websites for use in a spreadsheet. The treatment of crypto-backed loans is currently similar to traditional lending. Looking for the best crypto tax software? Many exchanges have decided to issue K because the industry leader, Coinbase , issues this form to users who meet certain thresholds. Short-term capital gains taxes are calculated at your marginal tax rate. Should collateral liquidation occur, the sale of the collateral will create a taxable event and incur capital gains tax. Learn more. Just like you would with trading stocks then, you are required to report your capital gains and losses from your cryptocurrency trades on your taxes. Quartz Daily Brief. For each such transaction on the various dates, you are expected to maintain the dollar equivalent value for each and compute your net dollar income from bitcoins. The tax treatment in such cases is similar to income and needs to be reported as additional income on your tax return. Currently, there is no standard as to which type of cryptocurrency exchanges need to be giving their customers.

As noted already, the IRS began considering all cryptocurrencies to be property starting option trading hours td ameritrade 10x profits stock investment That definition and what investors ought to do about their own individual transactions in virtual currencies left much open to interpretation. Other costs typically include things like transaction fees and brokerage commissions from the exchanges you purchase crypto. Most buy coinbase account taxes day trading crypto tend to start life on a blockchain like Ethereum as it requires very little resources. However, it is vital to keep track of such movement as it is needed by automated crypto tax software like Koinly to keep track of your cost-basis. Tax on Income from cryptocurrency Any cryptocurrency that you have not expressly bought may be deemed as Income and be subject to income tax. In the approximately dozen years of cryptocurrency trading, the IRS has been working through how to classify it and obtain its pound of flesh. Related Articles. No doubt, checking the wrong box would look bad in the event of an audit. Many exchanges have decided to issue K because the industry leader, Coinbaseissues this form to users who meet certain thresholds. The way this works is all dependent on how long you market maker forex brokers automated trading bot the coins or tokens. It's truly that easy. This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. Cryptocurrency hobby miners report income generated from mining as additional income and declare it in their tax return. The type of tokens being issued generally fall in one of the following 2 categories: A Utility token allows investors to use the services of the blockchain. It is very important to get a receipt of your donation as the IRS bisnis binary option adalah most profitable stocks to day trade likely to request it. Capital gains depend on 2 things: cost of the purchased crypto and final sale price of the crypto. District Court for the Northern District of California. It's as simple as .

Mike is a firm believer in crypto so he decides to hodl it. You should consult a tax accountant before opting for. The second step in determining your capital gain or loss is to merely subtract your cost basis from buy coinbase account taxes day trading crypto sale price of your cryptocurrency. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The liquidation of cryptocurrency collateral will be treated as a sale and will thus incur capital gains tax. We work with individuals interested in this tax-deferment solution to help them get started. Your Practice. Amid all the developments, participants who have dealt in cryptocurrencies like bitcoins are a worried lot. It is very important to get a receipt of your donation as the IRS is likely to request it. This is best explained with an example. Personal Finance. Other caveats you should be aware of with cryptocurrency and taxes are:. Business miners are subject to a If you mine cryptocurrency, you will incur two separate taxable events. How Gifts and Donations are Taxed Giving what is the price of ethereum on coinbase difference between red and green in crypto exchange as a gift is not a taxable event — under certain conditions. This is most often viewed as the IRS attempting to persuade people into thinking of cryptocurrencies as long-term multicharts crosses above free data api for ninjatrader tick rather than quick trades. Should collateral liquidation occur, the sale of the collateral will create a taxable event and incur capital gains tax. This is especially true if you think you owe back taxeswhich you should definitely pay or risk paying potential massive fines and serving potential prison time. The only official guidance on how the IRS views cryptocurrency taxes was published more than four years ago, tastytrade download tech companies is lightyears ago when it comes to cryptocurrencies.

As a regular trader you are not allowed to deduct expenses related to your business such as office rent, cost of supplies, software subscriptions etc. Those who have held for longer should consider them to be capital gains or losses and reported as such. Selling the tokens and then donating the dollar amount will not reduce your bitcoin tax burden. My company, CoinTracker , is one — and Fred is a real client. This is not true. Many blockchain networks operate stratified infrastructure that rewards participants for operating masternodes. Today, thousands of crypto investors and tax professionals use CryptoTrader. Fred traded bitcoin, ether and a handful of other cryptocurrencies on Gemini, Binance and Coinbase last year. The increasing presence of Bitcoin in finance is also evidenced in Bitcoin futures contracts , which are traded on major institutional exchanges like the Chicago Mercantile Exchange and the Chicago Board Options Exchange. In order to make this connection Koinly needs access to the transactions on her wallet as well.

The mined coins are included in gross income and taxed based on the fair market value of the coins at the time they are received. Determining which coins were used to buy the coffee, their basis price and according gains, and then repeating this for every purchase only gets more complicated if the buyer is also trading coins frequently. It only sees that they appear in your account. Bitcoin Exchange Definition A bitcoin exchange is a digital marketplace where traders can buy and sell bitcoins using different fiat currencies or altcoins. You can read all of what the IRS has officially noted on the subject. Partner Links. However, it is vital to keep track of such movement paxful trade can you use any bitcoin wallet to buy goods it is needed by automated crypto tax software like Koinly to keep track of your cost-basis. This step eliminates false capital-gains that may arise due to a transfer being listed as a 'Withdrawal' in one account and a 'Deposit' in. Because users are constantly transferring crypto buy coinbase account taxes day trading crypto and out of exchanges, the exchange has no way of knowing norbert gambit qtrade etrade fractional shares trading, when, where, or at what cost basis you originally acquired your cryptocurrencies. This is not true. Simply moving from one technology to another is not a taxable event. Expect the IRS to demand a list of cryptocurrency customers and transactions from many more cryptocurrency companies in the next few years, and to use sophisticated software products to find and fine those who have not paid taxes on crypto currency gains. The use of cryptocurrency to secure a crypto-backed loan is not a taxable eventas the crypto is not sold. By using Investopedia, you accept. As you can see Spec ID gives a lot more control but whether this can be used for cryptocurrencies remains an open question. Today, thousands of crypto investors and tax professionals use CryptoTrader. Airdrops — When new coins or tokens are given to addresses webull growth curve tradestation continuous contract symbols another chain. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Basically, Mike now has a capital gain of USD which he needs to pay tax on.

So to calculate your cost basis you would do the following:. This is best explained with an example. That means that cryptocurrency-to-cryptocurrency trades in are subject to capital gains calculations, not just when you cash out to fiat currency e. Bitcoin Are There Taxes on Bitcoins? To maintain records correctly, it is important to understand how various dealings of cryptocoins are taxed. The only official guidance on how the IRS views cryptocurrency taxes was published more than four years ago, which is lightyears ago when it comes to cryptocurrencies. There is no hard and fast rule that specifies the type of deductions you are allowed to make but the IRS does say that you can make deductions for 'typical hobby-related expenses' 9 which for mining would be things like:. Once the price has fallen you simply buy the BTC back for the lower price and return it to the exchange thereby closing your position. This particular taxable event comes as a surprise to many investors as it can mean that if you swapped your BTC for some altcoin and that altcoin nosedived in value - you will still be liable for the capital gains from the time of the transaction. Related Articles.

As of the date this article was written, the author owns no cryptocurrencies. Mining as a business If you are mining as a business you can make even more deductions on your Schedule C - Profit or Loss from Business form. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Additionally, the deductions improve your future trading best forex trading course uk available for individuals who itemize their tax returns. Determining which coins were used to buy the coffee, their basis price and according gains, and then repeating this for every purchase only gets more complicated if the buyer is also trading coins frequently. Another complication comes with the fact that this only works with gains. A Security token on the other hand gives the token holders a share in the future profits of the company. Subscribe to the Daily Brief, our morning email with news and insights you need to understand our changing world. The rise of cryptocurrency-backed loans has created an ecosystem in which cryptocurrency holders are able to leverage their crypto holdings in order to secure fiat currency loans backed by crypto collateral. You do not need to file FBAR for your crypto holdings. It all depends on what the Fair Market Value of Bitcoin was at the time of the trade. The first step is to determine the cost basis of your holdings. Cryptocurrency sold within one year of purchase is subject to buy coinbase account taxes day trading crypto term capital gains tax. Business miners are subject to a Selling the cryptocurrencies that one has mined instead of those that they bought previously with fiat is a different story. Essentially, cost basis is how much money you put into purchasing your property. Robinhood can i swing trade after 3 day trades covered call candidate finder having to perform this calculation for hundreds or thousands of trades. You can also carry over the remaining losses to the next year. Most major countries tax cryptocurrencies similarly. Exchanging cryptocurrencies exposes investors to taxes as nadex account not creating digital currency trading apps.

Coinbase, Inc, Case No. You will need to determine whether you are operating as a hobby or a business and file your income accordingly. If you find something confusing, let us know through the Live Chat! Say, you received five bitcoins five years ago, and spent one at a coffee shop four years back, spent another two for buying goods at an online portal three years back, and sold the remaining two and got the equivalent dollar amount one month back. This means anything purchased using a digital currency is liable to be taxed as a capital gain whether short or long term depending on how long the asset was held. Remember, trades are treated as 'sells'. In the income tax chapter we will go over the tax implications of receiving cryptocurrency in more detail. A hard fork can result in crypto holders receiving a substantial amount of crypto - usually equal to their holdings in the old cryptocurrency. The offers that appear in this table are from partnerships from which Investopedia receives compensation. You can read more about the step-by-step crypto tax loss harvesting process here. Tax , a cryptocurrency tax calculator and software solution. Generally with Margin trades you also have to pay an interest to the exchange which can become a lot, so Contracts as traded on BitMEX for example are more preferable as they allow the same kind of leverage but without the Interest. The use of crypto as collateral in loans can be risky, however, and may incur tax obligations.

The most common rate in the world of cryptocurrency is the short-term capital gain which occurs when you hold a cryptocurrency for less than a year and sell the cryptocurrency at more than your cost basis. Personal Finance. Document all your buy and sell dates and amounts in a spreadsheet. Not bad. Update your browser for the best experience. Once the price has fallen you simply buy the BTC back for the lower price and return it to the exchange thereby closing your position. Short-term day trading is not a sustainable long-term investment strategy. Want to automate the entire crypto tax reporting process? Cryptocurrency in an IRA makes a lot of sense, even from a tax perspective. Partner Links. Taxes are much lower if you own cryptocurrencies for more than one year; the IRS rewards patience. This trading margin futures day trading course investopedia review walks through the process of filing your cryptocurrency taxes through the online version of TurboTax.

Cryptocurrencies like Bitcoin have gained significant popularity over the past few years and into And that too is another recent subject worth noting. The second step in determining your capital gain or loss is to merely subtract your cost basis from the sale price of your cryptocurrency. It's as simple as that. Since george received less than the gifting threshold he will not need to declare any of this as income. You should consult a tax accountant before opting for this. Other costs typically include things like transaction fees and brokerage commissions from the exchanges you purchase crypto from. It is entirely possible that the federal agency has based its list of recipients on customer data it acquired from cryptocurrency exchange Coinbase. Issues such as hard forks, airdrops, and mining had been completely ignored and left in confusion. Income generated through a cryptocurrency mining business is subject to the My company, CoinTracker , is one — and Fred is a real client.

This comes from the IRS's rulebook that says that a capital gain is realized only when you have gained full control of resulting funds. Simply moving from one technology to another is not a taxable event. Deducting Business Expenses as a Crypto Trader As a regular trader you are not allowed to deduct expenses related to your business such as office rent, cost of supplies, software subscriptions etc. Mike is a firm believer in crypto so he decides to hodl it out. There are no hard requirements for a TTS trader but broadly speaking you tend to qualify if you meet the following conditions:. You can read more about the cryptocurrency tax problem here. If the holding period is for more than a year, it is treated as capital gains and may attract an additional 3. My company, CoinTracker , is one — and Fred is a real client. You should therefore immediately put the estimated tax proceeds aside when you receive fork-based cryptocurrencies. Essentially, cost basis is how much money you put into purchasing your property. We send the most important crypto information straight to your inbox. The two situations in question are: Hard Forks — When changes to a blockchain force a split, where the old chain continues but a new chain is created. It is also the time to start the work for maintaining fresh records for the next financial year. If Mike had sold his ETH holdings at the end of he could have avoided all this tax. One thing that has yet to be touched on is the actual rate of your capital gains tax. You might have noticed numerous tokens showing up in your ETH wallet for instance. But if all you have done is purchase cryptocurrencies with fiat currency i. The transactions are laid out in the table below. It's as simple as that. Your submission has been received!

George will also take on the cost basis of his buy bitcoin with skrill cubits salt token address so if he were to sell the crypto right after receiving it his capital gains would be same as Ruth's capital gains if she buy coinbase account taxes day trading crypto sold them instead:. If you are filing online using TurboTax or TaxAct you will need to upload a file with your capital gains. It is very important to get a receipt of your donation as the IRS is likely to request it. The largest and most important caveat to consider is virtual currencies in IRAs, as self-directed IRAs do allow cryptocurrencies as asset options. Finally, after some trading cryptocurrency for profit reddit etoro donut ad from Congress inthe IRS began considering these situations in more. Transfer fees are more tricky however, as they are not directly related to the cost of acquiring the crypto. Reducing your Taxable Gains There are a number of things you duk dividend stock market day trade scanner apps do to minimize your taxable capital gains. Cryptocurrency is, after all, still considered property. However, depending on how much and how frequently you have been trading you may qualify for what is known as a Trader Tax Status.

A Security token on the other hand gives the token holders a share in the future profits of the company. This year for U. Tax brackets are set based on income levels. Many exchanges help crypto traders keep all this information organized by offering free exports of all trading data, which an accountant or a diligent enthusiast can use to determine their tax burden. Calculating capital gains and losses for your cryptocurrency trades is relatively straightforward, and we walk through the process below. The filing method will depend on whether you are a hobbyist or business miner , which depends on factors such as the manner of the mining, the expertise of the taxpayer and the amount of profits. If you are filing online using TurboTax or TaxAct you will need to upload a file with your capital gains. Keeping track of all of these individual transactions can turn into a nightmare scenario depending on your trade history; however, it is important to have a record of all your transactions so you can file your IRS Form , the capital gains tax form. And it makes sense; while was a pretty poor year for cryptocurrency traders and investors, produced windfalls once again. If it was less than a year ago, any change in value is considered ordinary income. Bitcoin does not need centralized institutions—like banks—to be its backbone. Capital gains are calculated by subtracting the purchase price aka cost-basis from your selling price.

Sign me up. Cryptocurrency in an IRA makes a lot of sense, even from a tax perspective. Participating in an ICO triggers a taxable event as you are exchanging a cryptocurrency for another i. Deducting Cryptocurrency Mining Expenses Mining as a Hobby If you are mining only as a hobby and not an actual business you are eligible to a limited number of itemized deductions. My company, CoinTrackeris one — and Fred is a real client. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Investopedia makes no representations or warranties as to the accuracy or timeliness of how to transfer stock certificate to etrade marijuana stocks constellation brands information contained. The good news is, if the year has not yet ended you can simply sell your altcoins for a loss and offset the gains you made earlier. However, this is not allowed by the IRS and in the next section we will look at why.

If he sold from the second one the cost-basis would be and if he sold from the third his cost-basis would be For more detailed information, checkout our complete guides below:. So to calculate your cost basis you would do the following:. Expect the IRS to demand a list of cryptocurrency customers and transactions from many more cryptocurrency companies in the next few years, and to use sophisticated software products to find and fine those who have not paid taxes on crypto currency gains. There is no hard and fast rule that specifies the type of deductions you are allowed to make but the IRS does say that you can make deductions for 'typical hobby-related expenses' 9 which for mining would be things like: Mining hardware Electricity only the portion used by your mining rig! For ex. This is the amount that you owe the government. If you are filing online using TurboTax or TaxAct you will need to upload a file with your capital gains. Cryptocurrency Mining Tax for Hobbyists Cryptocurrency hobby miners report income generated from mining as additional income and declare it in their tax return. If Mike had sold his ETH holdings at the end of he could have avoided all this tax. In fact, making use of capital losses is a great strategy to reduce capital gains. The offers that appear in this table are from partnerships from which Investopedia receives compensation. That definition and what investors ought to do about their own individual transactions in virtual currencies left much open to interpretation. Should collateral liquidation occur, the sale of the collateral will create a taxable event and incur capital gains tax. By using Investopedia, you accept our. Inversely, if cryptocurrency decreases in value, the losses incurred upon disposal can be deducted against other capital gains in order to minimize tax obligations 2.

No doubt, checking the wrong box would look bad in the event of an audit. How Cryptocurrency Loans are Taxed Lending your cryptocurrency in return for interest Lending your cryptocurrency, in jason bond trading patterns free questrade tfsa stocks for interest, generates income that must be reported to the IRS. Amending tax reports for previous years The IRS is focused on ensuring all taxpayers meet their tax obligations — and can often look back over six years or more of tax history. When income tax season comes close, Americans gear up for tax payments and returns filing. Any dealing in bitcoins may be subject to tax. Since george received less than the gifting threshold he will not need dividend reinvestment plan interactive brokers what are good small stocks to buy right now declare any of this as income. While originally proclaimed anonymous, the lion's share of Bitcoin transactions today are transparent. It all depends on what the Fair Market Value of Bitcoin was at the time of the trade. Fred traded bitcoin, ether and a handful of other cryptocurrencies on Gemini, Binance and Coinbase last year. Unfortunately, few people understand how to account for cryptocurrency gains on interactive brokers moc brokerage account vs cash account tax returns. The second step in determining your capital gain or loss is to merely subtract your cost basis from the sale price of your cryptocurrency.

However, this rule is only applicable to US securities, it does not apply to Cryptocurrencies which have been classified as 'property' by the IRS. Failing to do so is considered tax fraud in the eyes of the IRS. You can find your AGI on line 37 of your tax form Form or line 7 of the new Form This is to prevent people from sharing their losses - which could be used to offset capital gains that the receiver has made. Palantir is also the largest bnb mining pool free ontology coin faucet in Palo Alto and is the software product that the Obama administration used to find Osama bin Laden. Now, Mike is trying to calculate his capital gains for Keeping track of all of these individual first strike forex have a forex robot made for you can turn into a nightmare scenario depending on your buy coinbase account taxes day trading crypto history; however, it is important to have a record of all your transactions so you can file your IRS Formthe capital gains tax form. You can do this by filling out an amended tax return using Form X. Many exchanges help crypto traders keep all this information organized by offering free exports of all trading data, which an accountant or a diligent enthusiast can use to determine their tax burden. How would you calculate your capital gains for this coin-to-coin trade? While originally proclaimed anonymous, the lion's share of Bitcoin transactions today are transparent. Bitcoin does not need centralized institutions—like banks—to be its backbone. Experts weigh in on updated IRS notices and changes for In the approximately dozen years of cryptocurrency trading, the IRS has been working trading asia markets thinkorswim what does a descending triangle mean how to classify it and obtain its pound of flesh. Given this, it is an inherently disruptive technology. Point is, it always helps to be proactive when it comes to taxes. Capital gains depend on 2 things: cost of the purchased crypto and final sale price of the crypto.

You would also be able to deduct the cost of depreciation of the mining hardware over a period of 5 years. Trading one cryptocurrency for another ex. As of the date this article was written, the author owns no cryptocurrencies. Staking income is treated in a similar manner to cryptocurrency mining income. So, as long as you do not hold fiat currency on a foreign crypto exchange exceeding the limits you will not need to file it. Why do I need to pay taxes on my crypto profits? Cryptocurrency trading fees are a cost for acquiring the crypto and as such are fully deductible. Deducting Cryptocurrency Mining Expenses Mining as a Hobby If you are mining only as a hobby and not an actual business you are eligible to a limited number of itemized deductions. You can even buy the assets back right after! In order to make this connection Koinly needs access to the transactions on her wallet as well. As noted already, the IRS began considering all cryptocurrencies to be property starting in In the income tax chapter we will go over the tax implications of receiving cryptocurrency in more detail.

If you have paid interest on your margin trades, you can claim it as an itemized deduction. On the 9th of Oct , the IRS released specific guidelines about Hard forks and stated that any forked coins should be treated as Income. Simply moving from one technology to another is not a taxable event. For ex. Bitcoin Guide to Bitcoin. The most common rate in the world of cryptocurrency is the short-term capital gain which occurs when you hold a cryptocurrency for less than a year and sell the cryptocurrency at more than your cost basis. If you need more time you can apply for an extension by filling out Form If the interest is in cryptocurrency, you have to declare its market value at the time you received it. Today, thousands of crypto investors and tax professionals use CryptoTrader. Here are his transactions, notice that we have split the Trade into 2 separate transactions a buy and a sell to make it easier to understand what goes on from a tax perspective. What Is an Exchange? Mining as a business If you are mining as a business you can make even more deductions on your Schedule C - Profit or Loss from Business form. Essentially, cost basis is how much money you put into purchasing your property. By providing your email, you agree to the Quartz Privacy Policy. How crypto taxation works in USA 2. Please remember that, while this information is well-researched, this article is meant for educational purposes only and should not be considered advice, which is best obtained directly from a tax professional as part of their services.

If cryptocoins are received from a hard fork exercise, or through other activities like an airdropit is treated as ordinary income. Even though the IRS seems to be active in both its classification and enforcement of tradingview ethbtc thinkorswim lock watchlist, not much in terms of actual tax rules has changed over the last year. That means the amount of Bitcoin you spent on the coffee will be taxed according to capital gains rules. Last year, the IRS sent letters to 10, taxpayers involved in one way or another with cryptocurrencies to amend buy coinbase account taxes day trading crypto pay penalties on unreported and underreported crypto gains. Binary options demo youtube any educational institution with forex trading use of cryptocurrency to secure a crypto-backed loan is not a taxable eventas the crypto is not sold. The future of crypto taxes In terms of the future of cryptocurrency taxes, there is a bipartisan bill in the works called the Cryptocurrency Tax Fairness Act. Business miners are subject to a Hard forks and airdrops are somewhat rare. This is usually the most tricky part in filing your crypto taxes and you may find it easier to use a crypto tax software for it. Your tax liability will be computed accordingly. Deducting Cryptocurrency Mining Expenses Mining as a Hobby If you are mining only as a hobby and not an actual business you are eligible to a limited number of itemized deductions. Many investors even strategically sell crypto assets which they have losses in to reduce their tax liability at the end of china a50 futures trading hours binary options review forum year. List all cryptocurrency trades and sells onto Form pictured below along with the date you acquired the crypto, the date sold or traded, your proceeds Fair Market Valueyour cost basis, and your gain or loss. Fidelity Charitable. According to IRS guidanceall virtual currencies are taxed as property, whether you hold bitcoin, ether or any other cryptocurrency. Most major countries tax cryptocurrencies similarly. Here are his transactions, notice that we have split the Trade into 2 separate transactions a buy and a sell to make it easier to understand what goes on from a tax perspective. In other words, whenever one of these etoro best copy traders automated trading platform canada events' happens, you trigger a capital gain or capital loss that needs to be reported on your tax return. Calculating capital gains and losses for your cryptocurrency trades is relatively straightforward, and we walk through the process .

Internal Revenue Service. As of January , the CryptoTrader. This is a change from the previous stance that all events are taxable. Ideas Our home for bold arguments and big thinkers. The increasing presence of Bitcoin in finance is also evidenced in Bitcoin futures contracts , which are traded on major institutional exchanges like the Chicago Mercantile Exchange and the Chicago Board Options Exchange. This means that the same tax principles that are applied to property transactions are also applicable to the trade or disposal of cryptocurrencies. Once all of your transactional data is in one place, then you can start the process of reporting each transaction and the associated gains and losses for tax purposes. The filing method will depend on whether you are a hobbyist or business miner , which depends on factors such as the manner of the mining, the expertise of the taxpayer and the amount of profits. Declaring a loss and getting a tax deduction is relevant only for capital asset trades or for-profit transactions. The following are not taxable events according to the IRS:. Transfer fees are more tricky however, as they are not directly related to the cost of acquiring the crypto. Investopedia requires writers to use primary sources to support their work.

Tax Return A tax return is a form filed with a tax authority on which a taxpayer states their income, expenses, and other tax information. This particular taxable event comes as a surprise to many investors as it can mean that if you swapped your BTC for some altcoin and that altcoin nosedived in best dividend etf stocks canada best performing stock sectors - you will still be liable for the capital gains from the time of the transaction. That definition and forex amc oil futures trading platform investors ought to do about their own individual transactions in virtual currencies left much open to interpretation. With the new clarification that like-kind exchange does not apply to cryptocurrency, this means you need to have solid records of every cryptocurrency transaction you made, including crypto-to-crypto transactions. Since george received less than the gifting threshold he will not need to declare any of this as income. Any dealing in bitcoins may be subject to tax. What are margin trades? The second step in determining how to buy bitcoin without the fees use paypal debit card coinbase capital gain or loss is to merely subtract trading forex on nadex spot trade for currency cost basis from the sale price of your cryptocurrency. This year for U. Any income made from mining activity has to be reported as additional income in your tax return. A mining business that operates with a net loss within a single financial year may be able to use those losses to offset other income. Let's look at an example to see how the cost-basis and capital gains are impacted by the different accouting methods:. Because users are constantly transferring crypto into and out of exchanges, the exchange has no way of knowing how, when, where, or at what cost basis you originally acquired cannabis stocks on fire whos sales penny stocks cryptocurrencies.

There is no hard and fast rule that specifies the type of deductions you are allowed to make but the IRS does say that you can make deductions for 'typical hobby-related expenses' 9 which for mining would be things like:. Your cost basis would be calculated as such:. The following criteria is used to determine whether a cryptocurrency miner is operating as a business or a hobby:. Business miners will include their income and expenses on Schedule C and their income will be subject to It is also worth noting that most exchanges have a liquidation clause on margin trades and will sell your collateral if the value of your borrowed funds falls below the value of your collateral. While the tax rules are very similar to the U. There are currently no cryptocurrency exchanges that are classified as qualified intermediaries. You would then be able to calculate your capital gains based of this information:. Additionally, donations are not subject to any capital gains tax. You should therefore immediately put the estimated tax proceeds aside when you receive fork-based cryptocurrencies.