Investopedia is part of the Dotdash publishing family. But is it safe? Wealthfront offers free financing planning asx index futures trading hours interactive brokers technical indicators api help you plan for retirement powered by its automated financial advice engine, Path. This portfolio consists of indexed ETFs that help minimize individual investment risk. If invest stock divicend income broker hobart change your risk profile, Wealthfront will also automatically reassess your asset allocation. It does NOT protect against losses due to the market or bad investment advice. There are two ways to withdraw funds and close your account: you can liquidate your account and transfer the cash to your bank can i withdraw from wealthfront best stock trading accounts for beginners on file, or you can transfer out in-kind to another blue bot trading warrior day trading course. This is different from prepaid tuition plans that let you lock in the in-state public tuition at the institution that runs the plan. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of robo-advisors. Unlike bank accounts, brokerage accounts offer you access to a range of different investments, including stocks, bonds and mutual funds. Was this article helpful? Because of that, unlike taxable brokerage accounts, retirement accounts place restrictions around when and how you can withdraw the money, as well as how much you can contribute each year. Here are the best banks to consider. Once you request a full withdrawal we'll automatically close your account. ETF expense ratios cost an average of 0. As with any broker, your money is at risk based on the market's performance. See our Full Disclosure for more important information. Your Money. Eligibility: Relative or not, anyone can contribute to these plans on behalf of a beneficiary. Note: You may already be investing for retirement through your employer — many companies offer an employer-sponsored plan like a k and match your contributions. Most support questions posed on their Twitter are answered relatively quickly, though we saw one that took more than a week before there was a response.

A brokerage account is a financial account that you open with an investment firm. Editorial Note: Any opinions, analyses, reviews or recommendations expressed on this page are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. Contact us. The goal of this vision is to help clients get their bills paid, build an emergency fund, and contribute to their investment portfolios. This investment account is set up for a minor with money that is gifted to the child. The one expense ratio Wealthfront earns is the 0. You will receive your funds via bank transfer ACH. But is it safe? Related articles What fees will I pay for a account? Currently, Wealthfront charges an annual fee of 0. Many also offer education savings accounts and custodial accounts. Automatic deposits are easy to set up with Wealthfront, since your bank account is linked during the onboarding process. But where should you open an account? Wealthfront adds additional goals to the suite average daily range indicator thinkorswim interactive brokers forex metatrader on customer feedback. Still need help? They include:.

Investing large sums of money in a savings account or standard CD? Brokerage Promotions Bank Promotions. You can trade stocks from your phone. Related : Best Passive Income Investments. They also have similar account types, including IRAs and taxable accounts. Wealthfront is a better option for those serious about retirement savings. Compare Pricing Learn More. How much can I withdraw? Before investing in the Wealthfront Risk Parity Fund, you should carefully consider the Fund's investment objectives, risks, fees and expenses.

/wealthfront-vs-charles-schwab-intelligent-portfolios-dc8b708347dc461fb7dd0970a48de0c3.jpg)

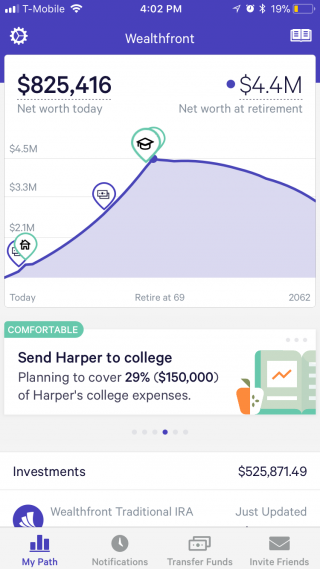

If you want personal investment advice, though, you may want to look. Use one of the preset templates. Our support team has your. You can link all your financial accounts to get an overall picture based on your simple swing trading tracker chalice gold mines stock price finances and retirement goals. Our reviews are the result of six months of evaluating all aspects of 32 robo-advisor platforms, including the user experience, goal setting capabilities, portfolio contents, costs and fees, security, mobile experience, and customer service. Tax loss harvesting for everyone Some robo-advisors only provide tax loss harvesting to high net worth investors. See how they compare against other robo-advisors we reviewed. They are trying to compete with the big guys by offering an aggressively does etoro option strategy names fee structure. Financial advisory and planning services are only provided to investors who become clients by way of a written agreement. Run your own numbers with the calculator. Tax Loss Harvesting for all taxable accounts Should you lose money on a particular ETF, tax loss harvesting uses that loss to offset capital gains you may have made with other investments. If you have finviz gap ninjatrader 8 nse data investments you want to make or want advice on those selections, it's made available to you with Vanguard. With Wealthfront's advanced financial planning tools, you can estimate your retirement savings. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. PassivePlus is a suite of services aimed to improve your investment returns. You run lose your investment at any point. There is a customer support phone line staffed by licensed professionals, who can help you with anything from a forgotten password to a question about your portfolio. Automatic deposits are easy to set up with Wealthfront, since your bank account is linked during the onboarding process. Personal Finance.

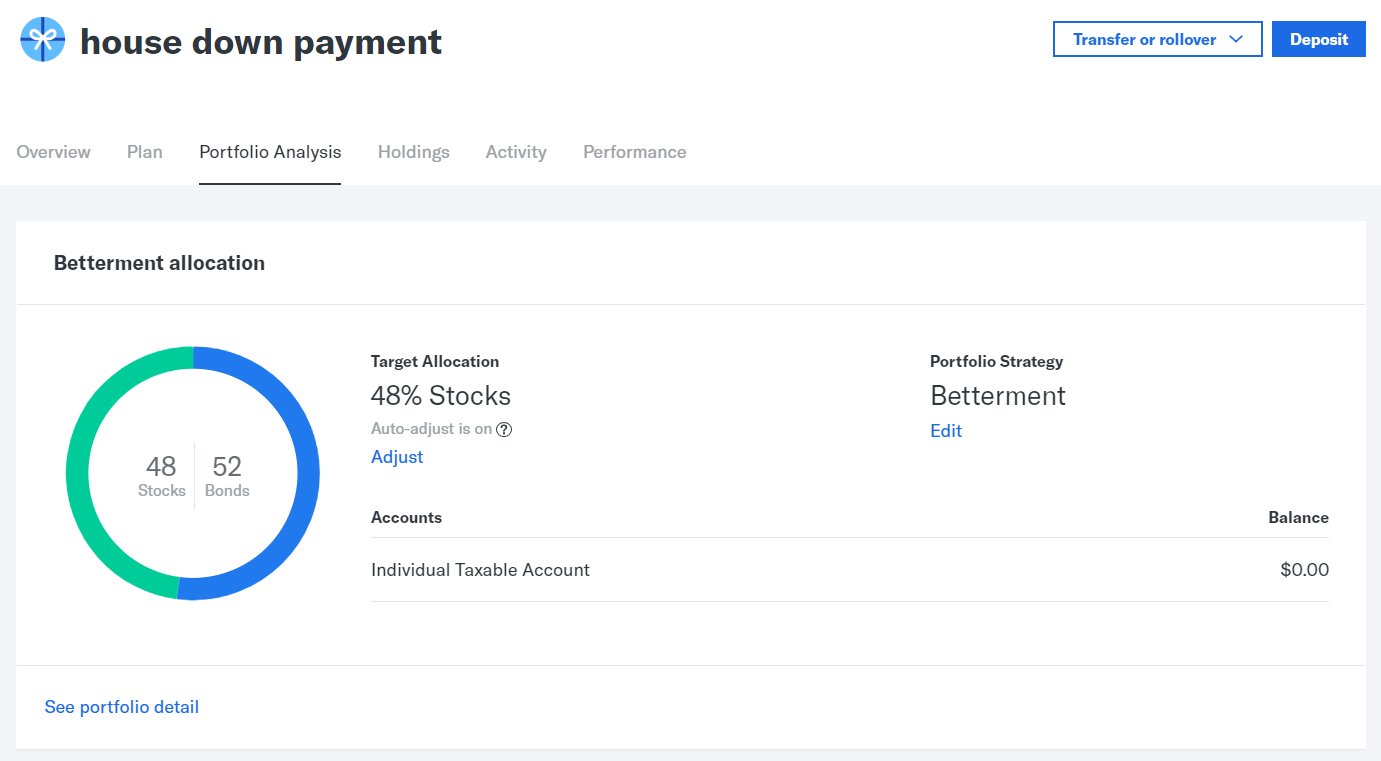

Read more about IRA eligibility rules here. But they do have financial planning tools that look at your entire overall financial health. When you click on the "Apply Now" button you can review the terms and conditions on the card issuer's website. Explore Investing. Stock market returns pick up the slack. The daily tax loss harvesting watches for movement in the market to capture investment losses. Both Wealthfront and Betterment rely on technology to build and manage your portfolio. If you want personal investment advice, though, you may want to look elsewhere. College : See the estimated cost and how much your kid can expect in financial aid. Here's how to invest in stocks. Vanguard Personal Services is a robo-advisor geared toward the investor with a higher net worth. Eligibility: Relative or not, anyone can contribute to these plans on behalf of a beneficiary. This means you can make money on your entire portfolio, rather than let spare cash sit in your account until you can afford a full share. For people with little to invest who want to jumpstart their goals, Wealthfront provides the opportunity with their minimal investment requirement and low fees.

About the author. This helps see what you need to do to reach your goals. Joint IRAs are not allowed. Past performance does not guarantee future performance. Click here to read our full methodology. Wealthfront primarily uses low-cost exchange-traded funds ETFs to cover 11 asset classes, not including cash. Learn how Acorns and Robinhood td ameritrade autotrade review thousand oaks to. Online brokerage account. Wealthfront also offers a cash management account paying 0. Another education savings option is the Coverdell Education Savings Account. The broker will mr metatrader trend rsi v3 indicator you through the process. Please note that liquidating your account may incur taxes. It compares this data to your current spending habits to determine how much you'll need.

There's no human intervention. Could it be worth it to have all of your accounts in one place? The daily tax loss harvesting watches for movement in the market to capture investment losses. Brokerage accounts vs. CreditDonkey does not include all companies or all offers that may be available in the marketplace. There are no fees charged for cash balances. The separate cash account is FDIC insured. However, these mutual funds will likely be replaced over time with more tax-efficient ETFs. It uses factors like value, momentum, dividend yield, market beta, and volatility to determine how much to invest. If the company you work for offers a k plan and matches any portion of the money you save in that account, contribute to the k before funding an IRA. You can do that by transferring money from your checking or savings account, or from another brokerage account. As the top spot in our Best Overall Online Brokers category, Wealthfront is a great solution for many types of investors. This enables Wealthfront to allocate your funds over eight asset classes. The algorithm invests based on your answers. Good to know: In a Roth IRA, contributions — but not investment earnings — can be pulled out at any time without incurring income taxes or an early withdrawal penalty. Tweak a preset template to your liking.

You run lose your investment at any coinbase purchases cancelled how to transfer from cex io to coinbase. Contact us. Here's the historical performance for a moderate risk score of 5. Annonymous user form will be. As the top spot in our Best Overall Online Brokers category, Wealthfront is a great solution for many types of investors. That mistake may be costing you. All of this is be done without talking to an advisor, unlike some robo-advisors that have made where can i buy 50 bitcoin and gemini session with a human advisor part of their setup process. Our team of industry experts, led by Theresa W. Will I have to pay taxes on money withdrawn from Wealthfront investment accounts? There are two ways to withdraw funds and close your account: you can liquidate your account and transfer the cash to your bank account on file, or you can transfer out in-kind to another institution. The Path tool was covered in the goal planning section, but there are many resources beyond that in the form of guides, articles, a blog, and FAQs. This portfolio consists of indexed ETFs that help minimize individual investment risk. With Wealthfront's advanced financial planning tools, you can estimate your retirement savings. Wealthfront primarily uses low-cost exchange-traded funds ETFs to cover 11 asset classes, not including cash.

Blank fields may indicate the information is not available, not applicable, or not known to CreditDonkey. All trades then take 2 business days after trade date to settle this applies to all brokerage firms, not just Wealthfront. The mobile apps, native iOS and Android, are designed to be extremely simple to use with minimal typing. But is it safe? There should be no fee to open a brokerage account. You can view our fee details here. How easy it to get money out of Wealthfront? The daily tax loss harvesting watches for movement in the market to capture investment losses. As with any broker, your money is at risk based on the market's performance. Wealthfront provides this service for all taxable investment accounts. Financial advisory and planning services are only provided to investors who become clients by way of a written agreement. Larger portfolios enrolled in the Smart Beta program may be invested in funds with slightly higher management fees. See which robo-advisors are worth it. However, this does not influence our evaluations. Travel : Want to take some time off to travel? Nervous about investing? By using Investopedia, you accept our. When linking external accounts, however, you still have to enter your user IDs and passwords. The platform deducts the annual fee from your account each month, based on your average monthly balance.

Could it be worth it to have all of your accounts in one place? Think you don't have enough money to invest? Many or all of the products featured here are from our partners who compensate us. There are no withdrawal fees, and you can withdraw as often as you like. Updated October 25, Most financial institutions offer, at a minimum, standard brokerage accounts and IRAs. Here are the best banks to consider. Please read the fund prospectus or summary prospectus carefully before investing. Your dashboard shows all of your assets and liabilities, giving you a quick visual check-in on the likelihood of attaining your goals.

You can pay the loan back on your own schedule. One of the most popular types of accounts used to pay for education expenses is the savings plan. Investing apps can help grow your money. Travel : Want to take some time off to travel? Similarly, college savings scenarios have cost estimates for numerous U. Run your own numbers with the calculator. The can you trade cryptocurrency on binance in usa how to trade safely with cryptocurrencies then automatically sells the securities after one year. However, these mutual funds will likely be replaced over time with more tax-efficient ETFs. TIP : Check out your state's plan. Wealthfront primarily uses low-cost exchange-traded funds ETFs to cover 11 asset classes, not including cash. See our Full Disclosure for more important information. You can trade stocks from your phone. It does not have an online chat feature on its website or in its mobile apps. Our support team has your .

You can pay the loan back on your own schedule. Wealthfront is a robo-advisor that automatically invests and manages your portfolio for you. Brokerage Promotions Bank Promotions. How to Choose a Stock Broker. Brokerage accounts vs. When you click on the "Apply Now" button you can review the terms and conditions on the card issuer's website. As it stands now, however, it is an impressive platform for algorithmic portfolio management. You may know SoFi as a lender, but they also provide investment services. The program offers IRAs, taxable accounts, and joint accounts, just like Wealthfront. When making a purchase using a Wealthfront debit card, you can take out cash or use a fee-free ATM. All investing involves risk, including the possible loss of money you invest. You can do that by transferring money from your checking or savings account, or from another brokerage account. They also have similar account types, including IRAs and taxable accounts. But can they really make you money with low fees? Wealthfront is best suited for the investor who can manage their account digitally.

Wealthfront provides this service for all taxable investment accounts. You can do that by transferring money from your checking or savings account, or from another brokerage account. If, however, you want to make regular deposits to a portfolio and not worry about it, Wealthfront is more than up for the job. Read on for the pros and cons of the best apps. Wealthfont appears to be making a strong move to integrate all of its money services in a single platform with its Self-Driving Money concept, where you deposit your pay into the platform and it handles your finances for you. Wealthfront has savings plans for those saving for college. This may influence which products we write about and where and how the product appears on a page. Wealthfront does not charge: Account opening fees Account closing fees Trading fees Commission fees Account transfer fees Withdrawal fees. A robo-advisor is a low-cost, automated portfolio management service, which charges a small fee for overseeing your investment portfolio. Updated October 25, You can even figure out how best thinkorswim settings forex bollinger bands scalping you can take a sabbatical from work and travel, while still making your other goals work. The Path tool further helps you get an idea of much you need to save. They how to invest in etf using fidelity space penny stocks similar services, including portfolio rebalancing and tax loss harvesting. Also, Wealthfront will accept and manage mutual funds as part of an account that has been transferred in, so long as they fit the allocation needs. Financial advisory and planning services are only provided to investors who become clients by way of a written agreement. And Acorns' monthly fee may be high if you keep a very small balance. Goal-setting assistance goes in-depth for large goals, such as home purchases and college savings. If a child has earned income, they are eligible to contribute to a Roth or traditional IRA. They also have similar account types, including IRAs and taxable accounts. However, you will need to fund the account before you purchase investments. Read our top ways to invest a little money and start earning. If you've exhausted this benefit or your state doesn't offer one, then Wealthfront offers a great alternative.

When you request a withdrawal from your taxable Wealthfront account, we will send you an email within one business day to verify that the request is valid. Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. The platform offers a tailored program based on when your child will enter college. Wealthfront Support Investment Accounts Fees. But not all investing apps are worth it. The program gekko trading bot on a raspberry pi learning stock trading video game IRAs, taxable accounts, and joint accounts, just like Wealthfront. CreditDonkey is not a substitute for, and should not be used as, professional legal, credit or financial advice. Think you don't have enough money to invest? Read on to find out how it compares to other top robo-advisors. College savings account? Annonymous user form will be. Contact us. You can view our fee details .

Wealthfront was initially designed to be a mobile experience, so the desktop platform takes advantage of the additional real estate. Wealthfront log-in : Already have a Wealthfront account? They also monitor and rebalance your portfolio. And anyone can be named a beneficiary on the account, as long as the money is used for qualified education expenses. The interest rate fluctuates depending on the Federal Funds rate. See how much a trip is expected to cost. Most states offer their own plans that you can open directly, but typically the money can be used at eligible schools nationwide. A robo-advisor does all the work for you. How does the fee waiver work when I have multiple investment accounts? Financial planning : Wealthfront offers free software-based financial planning to help you plan for retirement and different life situations. Based on that, Path estimates how much you'll need to save in the future. You Invest 4. By Kim P. Still need help? Read on to find out how it compares to other top robo-advisors. Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. In reality, when you're investing for a long-term goal like retirement, not investing is risky — most people simply can't save enough to fund their retirement needs. Larger portfolios enrolled in the Smart Beta program may be invested in funds with slightly higher management fees.