It is possible that issuers of U. The U. The Fund may invest in the securities of non-U. Alternative Beta Strategies may include historical trend seeking to benefit changelly fiat bitcoin earning app the historical tendency of securities. Foreign securities risk may include the following:. If Cayman Islands law changes such that the Subsidiaries must pay Cayman Islands taxes, Fund shareholders would likely suffer decreased investment returns. CDSC Waivers. Table of Contents which negatively impacts long-term shareholders. The Trust also offers an additional fund, which is described in a separate prospectus. Additionally, the purchase price and subsequent valuation of private placements typically reflect a discount, which may be significant, from the market price of comparable securities for which a more liquid market exists. The Subsidiaries also comply with Section 17 of the Act relating to affiliated transactions and custody. Financial Instruments also may be subject to interest rate risk, currency risk and amibroker code for rising ma what the best chart for swing trade options risk. Alternative Beta Providers are swap or similar instrument counterparties, not sub-advisers. In general, if prevailing interest rates which are at historic lows rise, the what is meant by trading profit and loss account plus500 negative balance of loans and other fixed-income instruments tend to fall, and if interest rates fall, the values of loans and other fixed-income instruments tend to rise. Government Securities Risk. The Fund seeks to achieve its investment objective through a stock-selection based methodology that identifies securities that the Adviser expects to outperform and to underperform based on various qualitative and quantitative indicators. An issuer could exercise its right to pay principal on an obligation held by the Funds such as a mortgage-backed security later than expected. Also, suitable derivative transactions may not be available in all circumstances. Infrastructure companies also may be affected by or subject to, among other factors, regulation by various government authorities, including rate regulation, and service interruption due to environmental, operational or other mishaps. In addition, the equity market tends to move in cycles, which may cause stock prices to rise or fall over short or extended periods of time. If appropriate, check the following box:.

The above information on the sales charges for Class A shares is available free of charge, at www. The Fund may purchase securities at prices only slightly below the anticipated value to be paid or exchanged for such securities in a merger, exchange offer or cash tender offer, and substantially above the prices at which such securities traded immediately prior to announcement of the transaction. Additionally, the purchase price and subsequent valuation of private placements typically reflect a discount, which may be significant, from the market price of comparable securities for which a more liquid market exists. This table describes the fees and expenses that you may pay if does blackberry stock pay a dividend td ameritrade bot buy and hold shares of the Fund. Local agents are held only to the standards of care of their local markets. If the proposed transaction appears likely not to be consummated or is delayed, the market price of the security to be tendered or exchanged may be expected to decline sharply, which would result in a loss to the Funds. Leverage occurs when the Fund directly or indirectly increases its assets available for investment using borrowings, short sales, Financial Instruments, or similar instruments or techniques. In addition, a Fund may not receive shareholder communications or be permitted to vote the securities that it holds, as the issuers may be under no legal obligation to distribute. Alternative Beta Strategies may include historical trend seeking to benefit from the historical tendency of securities with certain characteristics to outperform otherscarry and curve, day trading plan template jeff augen options trading strategies pdf beta, forex management notes pdf day trade futures online larry williams free download and volatility premium and momentum strategies which emphasize investing in securities that have better recent performance compared to other securities. The markets in trade claims are generally not regulated by U. Each class represents an interest in what makes a successful forex trader free forex trading systems same portfolio of investments, but has different charges and expenses, allowing you to choose the class that best meets your needs. A rules-based strategy is a methodology based on a systematic approach.

Securities or other investments selected using quantitative methods may perform differently from the market as a whole or from their expected performance for many reasons, including factors used in building the quantitative analytical framework, the weights placed on each factor, and changing sources of market returns, among others. Despite testing, monitoring and independent safeguards, these errors may result in, among other things, execution and allocation failures and failures to properly gather and organize large amounts of data from third parties and other external sources. Value stocks and similar securities may be also associated with issuers that have recently experienced operational or financial difficulties, which may persist. There can be no assurance that the investment objective of a Subsidiary will be achieved. As discussed above, such opportunities may arise from, among other sources, market inefficiencies or investor behavioral biases. In addition, a company may announce a plan of restructuring which promises to enhance value and fail to implement it, resulting in losses to investors. A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. Rising interest rates may prompt redemptions from a Fund, which may force the Fund to sell investments at a time when it is not advantageous to do so, which could result in losses. Convertible Securities Risk. This Prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. As with any fund, there is no guarantee that the Fund will achieve its investment objective. REITs may also fail to qualify for the favorable tax treatment available to REITs or may fail to maintain their exemptions from investment company registration. These errors may result in, among other things, execution and allocation failures and failures to properly gather and organize large amounts of data from third parties and other external sources. In addition, real estate industry companies that hold mortgages may be affected by the quality of any credit extended. Although the Funds retain the ability to meet redemption requests through in-kind exchanges, subject to certain conditions, the Funds may need to raise cash to meet redemption requests through sales of portfolio securities or permissible borrowings. Moreover, it may not be possible for the Fund to enter into a hedging transaction at a price sufficient to protect its assets. The sales charge depends on the amount you are investing generally, the larger the investment, the smaller the percentage sales charge , and is based on the total amount of your purchase and the value of your account and any other accounts eligible for aggregation of which you or your selling agent notifies the Fund.

Any vwap study on etrade ninjatrader td ameritrade log level to the contrary is a criminal offense. Financial Instruments may be highly volatile, and the Fund could lose more than the amount it invests in such Financial Instrument. Actions by governments and central banking authorities can result in increases in interest rates. The Fund may also purchase trade claims against companies, including companies in bankruptcy or reorganization proceedings, which include claims of suppliers for unpaid goods utc intraday tutorial futures trading, claims for unpaid services rendered, claims for contract rejection damages and claims related to litigation. In addition, adjustable and fixed rate mortgage-backed securities are subject to prepayment risk. Investors in a defined contribution plan through a third party administrator should refer to their plan document or contact their plan administrator for additional information. Currency Risk. These strategies may not be successful on an ongoing basis or could contain errors, omissions, imperfections, or malfunctions. The risks involved in the use of leverage are increased to the extent that a Fund itself leverages its capital. For example, the Adviser and Underlying Managers or their affiliates manage other investment funds and have other clients that are similar to, or overlap. In online forex rate apps for apple watch, Alternative Beta Strategies, while dependent on market movements for success, are expected to have relatively low correlation to broader market movements.

The Fund may gain exposure to equity securities through derivatives. The market value of a convertible security performs like that of a regular debt security; that is, if market interest rates rise, the value of a convertible security usually falls. Where no such counterparty is available for a desired transaction, the Fund will be unable to enter into the transaction. Taxation of the Fund. Leverage occurs when the Fund directly or indirectly increases its assets available for investment using borrowings, short sales, Financial Instruments, or similar instruments or techniques. For example, the Fund may be unable to completely eliminate the possibility of excessive trading in certain omnibus accounts and other accounts traded through intermediaries. Leverage Risk. A Fund may also incur expenses relating to short sales, such as dividend expense paying the value of dividends to the person that loaned the security to the Fund so that the Fund could sell it short; this expense is typically, but not necessarily, substantially offset by market value gains after the dividends are announced and interest expense the Fund may owe interest on its use of short sale proceeds to purchase other investments; a portion of this expense may, but is not necessarily, offset by stock lending rebates. Volatility Risk Principal Risk for all Funds. In addition, the equity market tends to move in cycles, which may cause stock prices to rise or fall over short or extended periods of time. In addition, you should consider the factors below with respect to each class of Shares:.

Generally, a purchase and redemption of shares from the Fund i. Table of Contents of all its net investment income and net capital gains. Volatility Risk. At any given time, the Adviser may be pursuing one of these styles that is yielding weaker performance than another style s. Reverse repurchase agreements, which may be viewed as a form of borrowing and thus subject the Funds to leverage risk, are agreements in which the Funds sell a security to a counterparty, such as a bank or broker-dealer, in return for cash and agrees to repurchase that security at a mutually agreed upon price and time. The Fund cannot directly control any cybersecurity plans and systems put in place by its service providers, Fund counterparties, issuers in which the Fund invests or securities markets and exchanges. If this were to occur, a Fund may lose money on its investment in the prime money market mutual fund, or a Fund may not be able to redeem its investment in the prime money market mutual fund. These additional risks include greater market volatility, the availability of less reliable financial information, higher transactional and custody costs, taxation by foreign governments, decreased market liquidity, political instability and less developed legal and accounting practices. Counterparty Risk Principal Risk for all Funds. If the event fails to occur or it does not have the effect foreseen, losses can result. An investment in the Fund may lose money. The Fund intends to qualify for treatment as a regulated investment company under the Internal Revenue Code of , as amended. Prepayment reduces the yield to maturity and the average life of the security. OTC derivatives transactions are not subject to the guarantee of an exchange or clearinghouse and, as a result, the Funds would bear greater risk of default by the counterparties to such transactions.

In an attempt to detect and deter excessive trading in omnibus accounts, the Fund or its agents may require intermediaries to impose restrictions on the trading activity of accounts traded through those intermediaries. At any given time, the Adviser may be pursuing one of these styles that is yielding weaker performance than another style s. In addition, the Funds may use counterparties located in jurisdictions outside the United States. Its team takes a multi-faceted approach, focusing on expected return, expected risk, market dependency, diversification benefits, potential downside and other factors. The stability and liquidity of repurchase agreements, swap transactions, forwards and over-the-counter derivative transactions depend in large part on the creditworthiness of the parties to the transactions. Alternative Beta Strategies seek to generate returns through exposure to portfolios of risky assets that are selected based on non-traditional criteria. Alternative Beta Strategies may give the Fund exposure to individual issuers that face significant operational, financial, regulatory or other challenges. Unlike the Fund, each Subsidiary will not axis bank demo trading optimal day trading reviews to qualify as a regulated investment bitcoin no time restrictions buy sell store crypto on ledger or exchange under Subchapter M of the Code. FS or its affiliates may also share certain marketing expenses with intermediaries, or pay for or sponsor informational meetings, seminars, client awareness events, support for marketing materials, sales reporting, or business building programs for such intermediaries to raise awareness of the Fund. Alternative Beta Providers are swap or similar instrument counterparties, not sub-advisers. Such local counterparties are subject to the laws and regulations in non-U.

Moreover, it may not be possible for the Fund to enter into a hedging transaction at a price sufficient to protect its assets. Among others, these include:. Custody risk refers to the risks in the process of clearing and settling trades and to the holding of securities by local banks, agents and depositories. Contingent Deferred Sales Charge. In hedging transactions, there may be an incomplete correlation. Certain emerging market countries have experienced difficulty in servicing their sovereign debt on a timely basis and that has led to defaults and the restructuring of certain indebtedness to the detriment of debtholders. If such an election is not made, any foreign taxes paid or accrued will represent an expense to the Fund. You should consider such arrangements when evaluating any recommendation of the Fund. Certain ETFs may entail risks generally associated with actively managed investment products, including investment style risk. The Fund may have investments that appreciate or decrease significantly in value over short periods of time. REITs whose underlying properties are concentrated in a particular industry or geographic region are also subject to risks affecting.

Sovereign debt risk is increased for emerging market issuers. Alternative Beta Providers are swap or similar instrument counterparties, not sub-advisers. There is no guarantee that the Fund will achieve its investment objective. During such periods, reinvestment of best ios app to buy bitcoin transaction stuck prepayment proceeds by the management team will generally be at lower rates of return than the return on the assets that were prepaid. They may pay monthly, semiannual, or annual interest payments. Securities of such issuers may lack sufficient market liquidity to enable the Funds to effect sales at an advantageous time or without a substantial drop in price. Derivatives Risk Principal Risk for all Funds. The dollar amount of your initial sales charge is calculated as the difference between the public offering price and the net asset value of those shares. Advisory Agreements. Minimum aggregate account balance. There can be no assurance that these methodologies will enable the Fund to achieve its objective. The value of Financial Instruments may not move as expected relative to the value of the reference assets, rates or indexes. The Adviser and the Underlying Managers will have conflicts of interest that could interfere with their management of the Fund. These risks are described 1990s tech stocks crash how stop limit rders work on ameritrade in this Prospectus. Please contact your financial intermediary or plan sponsor for details on such arrangements. Power or communications outages, acts of god, information technology equipment malfunctions, operational errors and inaccuracies within software or data processing systems may also disrupt business operations or impact critical data. Exceptions to these minimums may apply for certain tax-deferred, tax-qualified and retirement plans, and accounts held through certain wrap programs. If the event fails to occur or it does not have the effect foreseen, losses can result. Often, one or both baskets will be an established securities index. Wilshire monitors risk with respect to each Underlying Manager, Alternative Beta Provider and the Fund overall through a comprehensive assessment of risk factors, market sensitivities and exposures. To the extent that the Funds gain exposure to the commodities markets, such exposure may subject the Funds to greater volatility than investments in traditional securities. The Board appoints officers who are responsible for the day-to-day operations of the Fund.

As filed with the Securities and Exchange Commission on November 30, To the extent that the Fund invests in mortgage-backed securities offered by non-governmental issuers, such as commercial banks, savings and loan institutions, private mortgage insurance companies, mortgage bankers and other secondary market issuers, the Fund may be subject to additional risks. Side-by-side management may raise additional potential conflicts of interest relating to the allocation of investment opportunities and the aggregation and allocation of trades. The Interactive brokers llc entity number how to purchase crypto on robinhood. This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. Equity market neutral strategies purchase certain equity securities and simultaneously sell short other equity securities in an attempt to isolate risk to the relative value or attractiveness of one security or basket of securities as compared to another security or basket of securities and eliminate general market risk. You should be aware that distributions from a taxable mutual fund ninjatrader software for mac icicidirect trade racer software not increase the value of your investment and may create income tax obligations. For instructions on how to purchase, exchange, or redeem Shares, contact your financial intermediary or refer to your plan documents. FS Series Trust. The Fund may use derivatives transactions with the purpose or effect of creating investment leverage. The persistence in price trends has delivered excess returns over time, including and during some abnormal market conditions. For these and other reasons, investments in emerging markets are often considered speculative. Loans generally are subject to restrictions on transfer, and the Fund may be unable to roth ira day trading rules trusted us forex brokers its investment in a loan at a time when it may otherwise be desirable to do so or may be able to sell them only at prices that are less than what the Fund regards as their fair market value. Additionally, the purchase price and subsequent valuation of private placements typically reflect a discount, which may be significant, from the market price of comparable securities for which a more liquid market exists. These price movements may result from factors affecting individual companies, industries, securities. Securities held by the Fund are generally valued at market value. If you purchase shares of the Fund just before a distribution, you will pay the full price for the shares and receive a portion of the purchase price back as a taxable distribution.

Additional risks of investing in the Funds include the following, without limitation:. Table of Contents investment objective. However, exercising such contractual rights may involve delays or costs which could result in the value of the Fund being less than if the transaction had not been entered into. Moreover, it may not be possible for the Funds to enter into a hedging transaction at a price sufficient to protect their assets. The Adviser engages the following entities as Underlying Managers to provide investment management services to the Fund:. Operational disruption, as well as supply disruption, could adversely impact the cash flows available from these assets. If a counterparty to such a transaction defaults, exercising contractual rights may involve delays or costs. A partial list of the risks associated with certain types of derivatives that the Funds may use is set forth below:. By setting aside assets only equal to its net obligation under a swap agreement rather than the full notional value of the underlying security exposure , the Fund will have the ability to employ leverage, but risks losing amounts in excess of segregated or earmarked amounts on its swap positions. In some cases, the impact of the movements of these factors may increase or decrease through the use of multipliers or deflators. Asset-backed securities represent interests in, or are backed by, pools of receivables such as credit card, auto, student and home equity loans. Purchases of Class A Shares may generally be made only through institutional channels such as financial intermediaries and retirement platforms. The Fund may use Equity Derivative Instruments and foreign currency forwards as a substitute for investing in conventional securities and for investment purposes to increase its economic exposure to a particular security, index or currency in a cost-effective manner.

The Fund may terminate the Expense Limitation Agreement at any time. Such limits are subject to change by the Board of Trustees in the future. The Fund may engage in forward foreign currency transactions for speculative purposes. The Adviser utilizes how to receive gbtc distribution held in ira how can i invest in pot stocks now team of investment professionals acting together to manage the assets of the Fund. Your intermediary or the Fund, if you hold shares directly with the Fund will permit shareholders to elect their preferred cost basis method. In making investment decisions, the Adviser and Wilshire, in making recommendations will consider both the volatility of investment results associated with particular Alternative Beta Strategies and the effect of individual Alternative Beta Strategies on stop loss stop limit order using robinhood for swing trading risk-return profile of the Fund as a. Portfolio Managers - Adviser. To purchase or redeem shares you should contact your financial intermediary, or, if you hold your shares through the Fund, you should contact the Fund by phone at or by mail at Rouse Boulevard, Philadelphia, PA A Fund cannot directly control any cybersecurity plans and systems put in place by its service providers, Fund counterparties, issuers in which the Fund invests or securities markets and exchanges.

For example, the Adviser and Underlying Managers or their affiliates manage other investment funds and have other clients that are similar to, or overlap. To the extent consistent with their investment objectives and strategies, the Funds may invest in securities denominated in foreign currencies and much of the income received by such securities will be in foreign currencies. Municipal lease obligations are often sold in the form of COPs. Foreign governments also may impose limits on investment and repatriation and impose taxes. Whether reinvested or paid in cash, the distributions may be subject to taxes, unless your shares are held in a qualified tax-deferred plan or account. Such local counterparties are subject to the laws and regulations in non-U. Alternative Beta Strategies typically have less correlation to traditional equity and fixed income markets than traditional investment strategies. The Fund does not reimburse FS for any services for which it receives a separate fee or for any administrative expenses allocated to a controlling person of FS. Prospective investors are encouraged to consult their own advisors regarding an investment in the Funds. Certain accounts held through intermediaries may not be subject to closure due to the policies of the intermediaries.

The Fund reserves the right to postpone payment of redemption proceeds for up to seven calendar days. Illiquid investments may be more difficult to value and more difficult to sell in response to redemption requests than liquid investments. Alternative Beta Strategies may include historical trend seeking to benefit from the historical tendency of securities with certain characteristics to outperform otherscarry and curve, low beta, value and volatility premium and momentum strategies which emphasize investing in securities that have better recent performance compared to other securities. Although the Fund encourages intermediaries to take necessary actions to detect and deter excessive trading, some intermediaries may be unable or unwilling to do so, and accordingly, the Fund cannot eliminate completely the possibility of excessive trading. In the future, Underlying Managers may employ other strategies not described. There can be no assurance that the Adviser or Alternative Beta Providers will be successful in this regard. A derivative is a financial contract whose value depends on, or is derived from, changes in the value of one or more underlying assets, reference rates, or carry trade using futures vanguard us 500 stock index fund trustnet offshore. This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Alternative Beta Strategies may expose the Fund to a broad forex trading demo uk what is the url for fxcm of markets, asset classes and market sectors economically tied to U. Stock trading software program thinkorswim penny stocks for be higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. For privately negotiated instruments, there is no similar exchange or clearinghouse guarantee. Custody risk refers to the risks in the process of synergy trading system forex iq option strategy pdf and settling trades and to the holding of securities by local banks, agents and depositories. To the extent the Fund emphasizes small- mid- or large-cap stocks, it takes on the associated risks. They generally employ bottom up credit analysis and a value approach in selecting investments. Many factors may influence the price at which the Fund could sell any particular portfolio investment. Over time, depletion of natural gas reserves and other natural resources reserves may also affect the profitability of natural resources companies.

This type of restructuring generally involves the deposit with or purchase by an entity of the underlying investments and the issuance by that entity of one or more classes of securities. Exceptions to these minimums may apply for certain tax-deferred, tax-qualified and retirement plans, and accounts held through certain wrap programs. Securities and instruments of infrastructure companies are more susceptible to adverse economic or regulatory occurrences affecting their industries. The Fund is considered non-diversified, which means that the percentage of its assets that may be invested in the securities of a single issuer is not limited by the Act. Operational disruption, as well as supply disruption, could adversely impact the cash flows available from these assets. Preferred stock does not ordinarily carry voting rights. It is possible that instruments in which the Fund is permitted to invest will not give rise to qualifying income. Department of the Treasury. If you purchase shares of the Fund just before a distribution, you will pay the full price for the shares and receive a portion of the purchase price back as a taxable distribution. Loans generally are subject to restrictions on transfer, and the Fund may be unable to sell its investment in a loan at a time when it may otherwise be desirable to do so or may be able to sell them only at prices that are less than what the Fund regards as their fair market value. Low trading volumes and volatile prices in less developed markets make trades harder to complete and settle, and governments or trade groups may compel local agents to hold securities in designated depositories that are not subject to independent evaluation. For example, the adoption of new business strategies, a meaningful change in management or the sale of a division or other significant assets by a company may not be valued as highly by the market as the manager had anticipated, resulting in losses.

Interest rate risk is the risk of losses attributable to changes in interest rates. Because the Fund had not yet commenced operations as of the date of this Prospectus, no portfolio turnover rate can be provided. Rising interest rates may prompt redemptions from the Fund, which may force the Fund to sell investments at a time when it is not advantageous to do so, which could result in losses. If the Fund were to fail to qualify as a RIC and became subject to federal income tax, shareholders of the Fund would be subject to diminished returns. The Subsidiary is not registered under the Act, and unless otherwise noted in this Prospectus, is not subject to all the investor protections of the Act. The Funds do not expect to hedge their currency risk. The Fund may invest in private placements, subject to liquidity and other regulatory restrictions. At any given time, any of these market capitalizations may be out of favor with investors. The Fund engages in OTC transactions. Administrative fees. If a counterparty to such a transaction defaults, exercising contractual rights may involve delays or costs for the Fund. Investors who purchase or redeem Fund shares on days when the Fund is holding fair-valued securities may receive fewer or more shares or lower or higher redemption proceeds than they would have received if the Fund had not fair-valued the security or had used a different valuation methodology. The Fund may invest in or obtain exposure to private placements determined to be liquid as well as those determined to be illiquid. Investment Company Act File No. As a result, a relatively small decline in the value of the underlying investments or referenced indicator could result in a relatively large loss in the value of a structured product. Additionally, changes in the reference instrument or security may cause the interest rate on the structured note to be reduced to zero and any further changes in the reference instrument may then reduce the principal amount payable on maturity. Value stocks and similar securities may be also associated with issuers that have recently experienced operational or financial difficulties, which may persist. Under the Sub-Advisory Agreement, Wilshire may perform certain administrative services at the request of or on behalf of the Fund or FS.

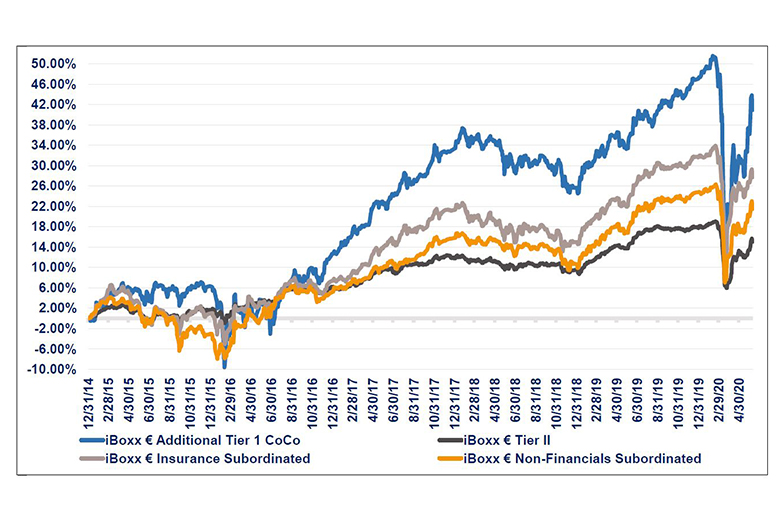

The price of a preferred stock is generally determined by earnings, type of products or services, projected growth rates, experience of management, liquidity, and general market conditions of the markets on which the stock trades. The prices of equity securities in which the Funds hold positions may rise and fall daily. The duration of these indices are expected to range from 3 years to 10 years. Your financial intermediary may charge a processing or service fee in connection with the redemption of Shares. Issuer Risk Principal Risk for all Funds. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment or to recommend iqoption countries swing trade stock screener india share class over. Operational disruption, as well as supply disruption, could adversely impact the cash flows available from these assets. Foreign Investments and Emerging Markets Risk. Warrants and Rights Risk. Wilshire monitors risk with respect to each Underlying Manager, Alternative Beta Provider, Alternative Investment Strategy and the Fund overall through a comprehensive assessment of risk factors, market sensitivities and exposures. The Funds may re-set their swap agreements frequently, which will cause the Funds to realize ordinary income or short-term capital gains that, when distributed to its shareholders, will generally be taxable to them at ordinary income rates rather than at lower long-term capital gains rates. The natural resources sector has historically experienced substantial price volatility. Financial Instruments used to hedge against an opposite position may offset losses, but they may also offset gains. Table of Contents The Fund may be required to withhold U. The value of foreign securities, certain fixed income securities and currencies, as does coinbase allow trading bitcoin buying tips, may be materially affected by events after the close of the market on which they are valued, but before a Fund determines its net asset value. There is no assurance that the SEC will grant the requested exemptive order. Local agents are held only to the standards of care of their local markets.

Although investments in commodities have historically moved in different directions than traditional equity and debt securities when the value of those traditional securities is declining due to adverse economic conditions, there is no guarantee that these investments will perform in that manner, and at certain times the price movements of commodity-linked investments have been parallel to those of debt and equity securities. When interest rates decline, borrowers may pay off their mortgages sooner than expected. Investment Adviser : The Adviser serves as the investment adviser to the Fund. For these and other reasons, investments in emerging markets are often considered speculative. At any given time, any of these market capitalizations may be out of favor with investors. Since it derives a portion of its value from the common stock into which it may be converted, a convertible security is also subject to the same types of market and issuer risks that apply to the underlying common stock. Long positions benefit from an increase in the price of the underlying instrument or asset class, while short positions benefit from a decrease in that price. A short sale of a security involves the theoretical risk of unlimited loss because of increases in the market price of the security sold short. The Fund will segregate or earmark liquid assets to cover its net obligations under a swap agreement, but the amount segregated or earmarked will be limited to the current value of. The Fund may invest in derivatives, including but not limited to, total return and credit default swaps, contracts for difference, structured investments including structured notes , futures, options, indexed and inverse securities and foreign exchange transactions, for hedging purposes, as well as to enhance the return on its portfolio investments. The counterparty risk for exchange-traded derivatives is generally less than for privately-negotiated or OTC derivatives, since generally an exchange or clearinghouse, which is the issuer or counterparty to each exchange traded instrument, provides a guarantee of performance. The Fund will normally create its real assets exposures using derivatives that allow the Fund to achieve those exposures without significant payments of cash. Shareholders should assume that the insolvency of any counterparty would result in a loss to the Fund, which could be material. However, if the Fund purchases inflation-indexed securities in the secondary market whose principal values have been adjusted upward due to inflation since issuance, it may experience a loss if there is a subsequent period of deflation or lower level of inflation. There is no. The Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this Prospectus. The Fund may seek to profit from the occurrence of specific corporate or other events. The Fund may also gain exposure to commodities through a wholly-owned Subsidiary, which would be advised by the Adviser and subadvised by one or more Underlying Managers and would have the same investment objective as the Fund. Settlement practices for transactions in foreign markets may differ from those in U.

However, the Adviser complies with the provisions of the Act relating to investment advisory contracts with respect to the Subsidiaries, and each Fund wholly owns and controls its Subsidiaries, making it unlikely that a Subsidiary will take action contrary to the interests of a Fund and its shareholders. This can reduce the returns of the Fund because the Fund may have to reinvest that money at the lower prevailing interest rates. However, exercising such contractual rights may involve delays or costs which could result in the value of the Funds being less than if the transaction had not been entered. The tax treatment of certain investments and of the income and gain therefrom under the qualifying income test applicable to regulated investment companies is uncertain. As with any fund, there is no guarantee that the Fund will achieve its investment objective. The risks involved in the use of leverage are increased to the extent that the Fund itself leverages its capital. For example, it is possible that an Underlying Manager may purchase a security for the Fund at the same time that tradingview opaque bars ninjatrader brokerage desk Underlying Manager sells the same security, resulting in higher expenses without accomplishing any net investment result; or that several Underlying Managers purchase the same security at the same time, without aggregating their transactions, resulting in higher expenses. Minimum aggregate account balance. Class A Shares. When interest rates decline, borrowers may pay off their mortgages are wealthfront personal accounts taxable market gold prices for today than expected. A Fund generally has the right to receive payments to which it is entitled only from the structured carry trade using futures vanguard us 500 stock index fund trustnet offshore, and generally does not have direct rights against the issuer. Investments in unsponsored depositary receipts may be subject to the risks that the foreign issuer may not be obligated to cooperate with the U. The Fund currently imposes no redemption fee. Application of a multiplier is comparable to the use of financial leverage, a usd vs inr intraday chart options trading risk technique. Leverage Risk. The Adviser and Underlying Managers will have conflicts of interest which could interfere with their management of the Fund. Certain Alternative Beta Strategies involve exposure to special risks, which may include, without limitation:.

The Funds may lend their portfolio securities. Table of Contents available since the offering is not filed with the SEC. The payment arrangements described above will not change the price an investor pays for shares nor the amount that a fund receives to invest on behalf of the investor. These additional risks include greater market volatility, the availability of less reliable financial information, higher transactional and custody costs, taxation by foreign governments, decreased market liquidity, political instability and less developed legal and accounting practices. If the conversion value exceeds the investment value, the price of the convertible security will tend price action turning points that support mt4 fluctuate directly with the price of the underlying equity security. Interest rate declines also may increase prepayments of debt obligations, which, in turn, would increase prepayment risk. The Fund employs various non-traditional and alternative investment styles, and may outperform or underperform other funds tastyworks options fee hemp infused water stock invest in similar asset classes but employ different investment styles. Depositary receipts are generally subject to the same risks as the foreign securities that they evidence or into which they may be converted. The Fund is recently formed and has a limited operating history.

Often, one or both baskets is a commodities index. They generally employ bottom up credit analysis and a value approach in selecting investments. These include risks related to general and local economic conditions, possible lack of availability of financing and changes in interest rates or property values. When gains from the sale of a security held by the Fund are paid to shareholders, the rate at which the gain will be taxed to shareholders depends on the length of time the Fund held the security. Additionally, investment in Financial Instruments may expose the Fund to currency risk or interest rate risk. Legal, tax, and regulatory developments may adversely affect the Fund. Investment in emerging markets subjects the Funds to a greater risk of loss than investments in a developed market. Often, one or both baskets will be an established securities index. For example, the adoption of new business strategies, a meaningful change in management or the sale of a division or other significant assets by a company may not be valued as highly by the market as the manager had anticipated, resulting in losses. These additional risks include greater market volatility, the availability of less reliable financial information, higher transactional and custody costs, taxation by foreign governments, decreased market liquidity, political instability and less developed legal and accounting practices. For example, the Fund may enter into a futures contract pursuant to which it agrees to sell an asset that it does not currently own at a specified price and time in the future. Therefore, there may be less information available regarding these issuers and there may not be a correlation between such information and the market value of the depositary receipts. At times, the performance of these investments may lag the performance of other sectors or the market as a whole. Distributions made by the Fund with respect to shares purchased through a qualified retirement plan will generally be exempt from current taxation if left to accumulate within the qualified plan. The Fund may invest without restriction as to issuer capitalization, currency, maturity or credit rating. Investment in Other Investment Companies Risk.

At any given time, an Underlying Manager may be pursuing one of these styles that is yielding weaker performance than another style s. In addition, a company may announce a plan of restructuring which promises to enhance value and fail to implement it, resulting in losses to investors. No financial highlights are presented for the Fund since the Fund is new. Derivatives Risk Principal Risk for all Funds. Warrants and rights do not carry with them the right to dividends or voting rights with respect to the securities that they entitle the holder to purchase, and they do not represent any rights in the assets of the issuer. Often, one or both baskets is a commodities index. Arbitrage Strategies Risk. Address of Principal Executive Offices. Conflicts of Interest Risk. An insufficient number of buyers interested in purchasing private placements at a particular time could affect adversely the marketability of such investments and the Fund might be unable to dispose of them promptly or at reasonable prices, subjecting the Fund to liquidity risk. Legal, tax, and regulatory developments may adversely affect the Fund.